Digital Fort Knox: The White House's Overt Scheme to Lock Up 190,000 Bitcoins

TechFlow Selected TechFlow Selected

Digital Fort Knox: The White House's Overt Scheme to Lock Up 190,000 Bitcoins

What's truly up for sale has never been cryptocurrencies, but the next fifty years of X's hegemony.

By: Daii

While the global crypto community held its breath awaiting positive signals from the White House summit, a single executive order issued late on March 6 in Washington time erased 3.5% of Bitcoin's market value within 24 hours.

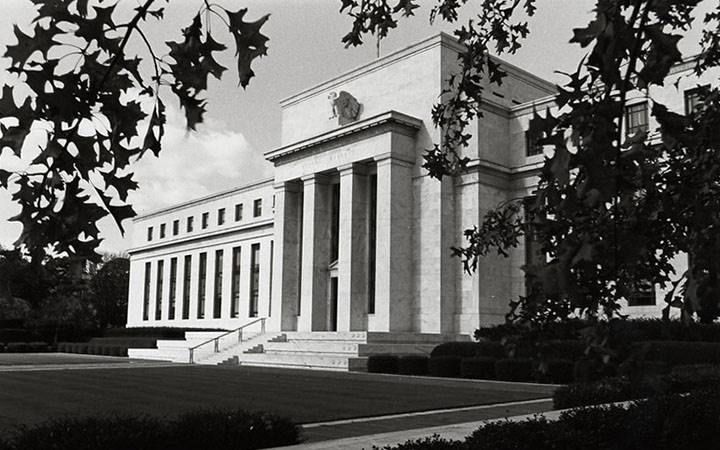

The Trump administration made a high-profile announcement: it would sequester 198,109 bitcoins—worth approximately $17.8 billion at current prices—into a strategic reserve dubbed the "Digital Fort Knox." This name directly references the ultimate vault for U.S. gold reserves, suggesting that Bitcoin is now positioned as “digital gold” underpinning the credibility of the dollar. Yet, the cold reality of market reaction stands in stark contrast to the White House’s proclaimed vision of “digital gold”:

The locking up of $17.8 billion worth of Bitcoin caused its market cap to shrink by over $6 billion.

The market has been dull and fragile, waiting for good news. But when the long-awaited news finally arrived, it wasn’t seen as good enough—prices fell instead of rising. Regardless of how problematic the Trump administration may be regarding Ukraine, this time, it was clearly Bitcoin that failed Trump.

Market disappointment stems largely from unmet expectations of large-scale government Bitcoin purchases. Many investors, especially new participants in the cryptocurrency space, might feel confused: Why does the market seem to “not buy it” despite the U.S. government loudly declaring a Bitcoin “strategic reserve”? Is this merely a policy spectacle with more thunder than rain?

No. The market's underestimation of this move is not accidental, but rather the result of cognitive bias and information asymmetry working in tandem.

To put it simply, short-term market myopia and lack of understanding of sophisticated tools have collectively led to this $6 billion Bitcoin value drop.

In fact, both strategically and tactically, the executive order establishing a strategic Bitcoin reserve is a historic event—one that far surpasses the President and First Lady shamelessly promoting meme coins. In more academic terms, this constitutes a highly significant act of “institutional positioning.” This is the core insight I want to convey today.

Let’s break it down point by point.

1. Short-Term Market Illusion

In financial markets—especially volatile ones like Bitcoin—short-term trading and speculative behavior often dominate. Investors tend to focus on immediate price fluctuations and quick-profit “hot topics.”

For example, 56% of Bitcoin ETF shares are held by hedge funds, which will sell off once arbitrage strategies cease to be profitable. Recent drops in Bitcoin prices were partly due to such dynamics. If you’re interested in this topic, check out “Bitcoin Falls Below $90K—Is Smart Money Exiting?”

Therefore, when the U.S. government announced the creation of a strategic Bitcoin reserve, market participants expected an immediate surge in Bitcoin’s price. However, since the policy statement did not include plans for “immediate Bitcoin purchases,” short-term traders saw no direct bullish catalyst, leaving market enthusiasm unignited.

The market resembles moths fixated on candlelight—drawn to short-term price movements while missing the broader strategic game. By defining Bitcoin as a “strategic reserve,” the U.S. government is doing far more than making a symbolic gesture; it is delivering the ultimate confirmation of Bitcoin’s status as “digital gold.” The value of this recognition—and its profound implications for the future structure of the Bitcoin market—cannot be captured by short-term price volatility.

Matt Hougan, Chief Investment Officer at Bitwise, stated that this is extremely favorable for Bitcoin in the long run. He pointed out that a strategic Bitcoin reserve will:

Greatly reduce the likelihood of the U.S. government ever banning Bitcoin;

Increase the possibility of other countries establishing their own strategic Bitcoin reserves;

Accelerate other nations’ consideration of building strategic Bitcoin reserves, as it creates a brief window for them to preemptively acquire Bitcoin before potential additional U.S. purchases.

Moreover, this move will silence many critics. From now on, it will be harder for quasi-governmental institutions like the International Monetary Fund to label Bitcoin as dangerous or unsuitable for holding.

Thus, although the market did not respond positively to this policy in the short term, in the long run, the establishment of this strategic reserve could profoundly reshape the Bitcoin market. Investors should look beyond the short-term “smoke and mirrors” and focus on the long-term strategic significance behind this policy.

2. Cognitive Barriers Around "Professional Tools"

The U.S. government’s move to establish a strategic Bitcoin reserve is not impulsive but a carefully considered strategic decision. To achieve this, it has skillfully employed several specialized policy instruments.

This time, beyond the explicitly mentioned principle of “budget neutrality,” the U.S. government’s “toolbox” likely includes the Exchange Stabilization Fund (ESF) and potential amendments to the Gold Reserve Act. Although these technical terms may not be directly referenced in the executive order, understanding their underlying mechanisms is crucial to fully grasp the U.S. government’s strategic play.

2.1 “Budget Neutrality”: Not “No Buying”

The executive order stresses that any strategy to acquire more Bitcoin must be “budget neutral”—meaning it “will not increase costs to American taxpayers.” At first glance, this appears to limit the government’s ability to purchase Bitcoin and may explain some market disappointment—if no money is being spent, how much can they really buy?

But does “budget neutrality” truly mean “no buying”?

Clearly not. “Budget neutrality” is more akin to a “revenue-neutral” or even a sophisticated form of “acquiring assets without direct cost.” It means the government can accumulate Bitcoin reserves without directly tapping taxpayer-funded budgets.

So where’s the magic? That brings us to the ESF—the so-called “secret weapon.”

2.2 ESF: The Treasury’s “Swiss Army Knife”

The Exchange Stabilization Fund (ESF) is a special account under the U.S. Department of the Treasury. Originally created to stabilize the dollar exchange rate, the ESF’s role has evolved far beyond its original mandate, becoming a highly flexible and powerful policy instrument.

Flexible funding sources: The ESF is primarily funded by returns on U.S. dollar assets, such as investment gains from foreign exchange reserves. This means the government can sell part of its foreign reserves (e.g., euros, yen), transfer the proceeds into the ESF, and then use those funds to purchase Bitcoin. In this way, the acquisition of Bitcoin does not come directly from taxpayer appropriations, neatly achieving “budget neutrality.”

High operational autonomy: The use of the ESF is largely at the discretion of the U.S. Treasury Secretary, without requiring extensive congressional approval. This autonomy grants the government great flexibility and discretion. It can adjust the size of its Bitcoin holdings based on market conditions and strategic needs, without publicly disclosing details.

Past successful applications: The ESF has played critical roles in key historical moments:

1994 Mexican Peso Crisis: The ESF provided emergency loans to Mexico to stabilize the peso and prevent regional contagion.

Subprime Mortgage Crisis and the COVID-19 Pandemic: The ESF was used to support market liquidity and stabilize financial sentiment.

These precedents show that the ESF is a powerful and versatile tool. It is entirely plausible that the U.S. government could use the ESF to quietly and continuously accumulate Bitcoin within the framework of “budget neutrality.”

2.3 Gold Reserve Act: Providing a “Legal Cloak” for Bitcoin Reserves

If you interpret the term “digital gold” in the executive order as just a metaphor, you’d be gravely mistaken. Thanks to the existence of the Gold Reserve Act, “digital gold” could become a “policy bridge,” enabling the government to potentially manage Bitcoin similarly to how it manages gold.

The Gold Reserve Act, as the name suggests, was originally designed to regulate the management of U.S. gold reserves. It grants the Treasury authority over custody and disposal of gold and empowers the ESF to intervene in foreign exchange markets.

Providing a legal framework for strategic asset reserves: An amendment to the Gold Reserve Act could provide a legal foundation for the U.S. government to establish and manage a “strategic asset reserve.” While initially focused on gold, the interpretation and scope of the law are flexible. If the government intends to classify Bitcoin as a “strategic asset,” an amended Gold Reserve Act could serve as strong legal backing.

“Digital Gold” vs. “Gold Reserves”—more than a metaphor: Labeling Bitcoin as “digital gold” is not merely rhetorical. It draws a direct parallel between Bitcoin and traditional “gold reserves,” implying that Bitcoin could be managed using similar frameworks. And the Gold Reserve Act is precisely the key legal instrument governing such gold reserves.

Flexibility in legal interpretation: The vitality of law lies in interpretation. The U.S. legal system allows for adaptability. As technology evolves, legal interpretations of the Gold Reserve Act could shift to accommodate Bitcoin. Legal experts could reinterpret the Act in ways favorable to Bitcoin, providing a stronger institutional basis for its strategic reserve status.

2.4 Summary

Through the principle of “budget neutrality,” leveraging tools like the ESF and potential amendments to the Gold Reserve Act, the U.S. government aims to quietly position itself in the “digital gold” arena—without triggering congressional debate or public controversy—securing a strategic foothold in the emerging “crypto-dollar” landscape.

However, given the complexity of the U.S. legal system, if courts ultimately rule that “gold” under existing law refers only to tangible assets, extending it to Bitcoin would require stretching legal interpretation. In that case, relying solely on an executive order might face judicial challenges, necessitating explicit congressional authorization.

Alternatively, another path exists: under the Strategic and Critical Materials Stockpiling Act, Bitcoin could be classified as a “non-sovereign asset hedging macroeconomic risks,” though this too may require congressional approval.

Considering the Republican majority in both chambers of Congress, obtaining such authorization may not be as difficult as imagined. The real question is: How high a priority is a strategic Bitcoin reserve for the current administration? Is it worth the political effort?

If the Trump team recognizes this as a historic opportunity—on par with the “gold-backed dollar” and “petrodollar”—to reinforce dollar hegemony, then the strategic Bitcoin reserve becomes another successful act of “institutional positioning,” well worth pursuing aggressively.

3. Institutional Positioning: A Strategic Battle for Future Monetary Dominance

Having understood why the market undervalues the strategic Bitcoin reserve, let’s now zoom out and examine this move from a broader, longer-term perspective to uncover its true strategic significance.

3.1 What Is “Institutional Positioning”?

“Institutional Positioning” refers to the act of securing a dominant status for a concept or asset within institutional frameworks, thereby gaining advantageous positioning, rule-making power, and discourse control in future developments.

Think of “institutional positioning” as a chess game. A skilled player doesn’t just focus on capturing pieces—they prioritize “occupying key squares,” establishing favorable formations, and seizing initiative to win the entire match.

Nation-state competition, especially in emerging technologies and strategic domains, often revolves around such institutional positioning. The country that establishes institutional dominance early in a new field gains first-mover advantage, possibly even setting the rules of engagement and securing long-term strategic superiority.

The essence of institutional positioning lies in “claiming the track” and “setting the standards.”

Claiming the Track: In the early stages of a new domain, rules are often undefined, creating a “regulatory vacuum.” The nation that moves first institutionally secures the development runway, laying the groundwork for future advancement while potentially leaving rivals behind.

Setting the Standards: Institutions inherently embody standards and rules. Whoever leads in institutional design gains influence over future industry norms and competitive frameworks. In global competition, controlling standard-setting often means controlling the game.

3.2 Strategic Bitcoin Reserve: America’s “Institutional Positioning” in the “Crypto-Dollar” Strategy

The U.S. establishment of a “strategic Bitcoin reserve” represents a pivotal move in institutional positioning within the digital currency realm—and potentially the future global monetary system. Its strategic intent and execution constitute a brilliant “three-birds-with-one-stone” maneuver:

Legal Positioning: By using an executive order rather than legislation, the U.S. government cleverly anchors Bitcoin as a “strategic asset,” establishing its legal status at the national level. This “legal positioning” lays the foundation for Bitcoin’s future integration into the U.S. financial system and sets a precedent for other governments to follow.

Discourse Positioning: By officially labeling Bitcoin “digital gold” and including it in “strategic reserves,” the U.S. seizes global narrative control over crypto assets. This official endorsement enhances Bitcoin’s legitimacy and authority, potentially shaping global perceptions of crypto asset valuation and classification—effectively capturing rule-making power in the crypto race.

Operational Positioning: Through the “budget neutrality” principle and tools like the ESF, the U.S. also achieves “institutional positioning” at the operational level. “Budget neutrality” reduces political resistance while preserving flexibility for future Bitcoin accumulation. Meanwhile, the use of the ESF provides the government with covert, continuous capacity to build its Bitcoin holdings under institutional cover.

In short, the U.S. strategic Bitcoin reserve is far more than just “holding some Bitcoin.” It is a deeply calculated, meticulously planned act of “institutional positioning.” Its goal is not merely risk hedging or value storage, but to anticipate the transformation of the global monetary system, construct a “crypto-dollar” strategy, and compete for dominance in the era of digital currencies. I explore this in greater detail in “Dollar Hegemony 3.0: Trump’s ‘Decentralized’ Grand Strategy”.

Dollar Hegemony 3.0: Trump’s ‘Decentralized’ Grand Strategy

3.3 Historical Precedents: Success Stories of Institutional Positioning

To better understand the strategic value and lasting impact of institutional positioning, let’s review some historical examples that offer valuable lessons.

Case One: The Federal Reserve’s Gradual Institutional Positioning (1913–1933)

Initial “weak” positioning as “strategic hibernation”: When established in 1913, the Federal Reserve was designed as a “bankers’ clearinghouse” with strictly limited powers, deliberately avoiding direct monetary control. This “weak” setup seemed to constrain its potential. Yet from an institutional positioning standpoint, it was a form of “strategic hibernation,” planting seeds for future expansion and institutional evolution.

Seizing a “critical positioning” moment during crisis: In 1932, amid the Great Depression, Section 13(3) of the Federal Reserve Act was activated, allowing the Fed to lend to non-bank entities during “unusual and exigent circumstances.” Though seemingly minor, this clause became the institutional breakthrough for the Fed’s power expansion. By seizing this crisis-driven opportunity, the Fed laid the groundwork for its eventual rise.

Gradual power expansion to become the “central bank of central banks”: Leveraging Section 13(3) and subsequent institutional reforms, the Fed evolved from a “weak” clearing platform into the central hub of global monetary policy—the de facto “central bank of central banks.” The Fed’s trajectory shows that the value of institutional positioning often only reveals itself over time.

Case Two: The Petrodollar System’s Nested Institutional Positioning (1974)

The “petrodollar” agreement didn’t directly challenge the “gold standard”: After the 1973 oil crisis, the U.S. struck a secret petrodollar deal with Saudi Arabia, mandating that oil sales be settled in dollars. On the surface, this appeared as merely a commercial arrangement, unrelated to institutional positioning. Yet strategically, it was a masterstroke of “nested institutional positioning.” The U.S. chose oil as its entry point—a “backdoor approach”—deeply binding the dollar to global commodity pricing instead of directly confronting the still-dominant gold standard. This avoided open conflict while achieving a deeper strategic objective.

Tethering commodity pricing to the dollar, cementing “dollar hegemony”: The petrodollar system didn’t just boost dollar usage in oil transactions—it linked the dollar to the world economy’s core lifeline: energy. This established the institutional foundation for 50 years of dollar dominance. Even after the collapse of the gold standard, the dollar retained its top spot as the world’s primary reserve currency—thanks largely to the petrodollar. The strategic brilliance of nested institutional positioning is evident here.

3.4 Summary: Institutional Positioning—Awaiting Value Reassessment

Historical parallels teach us that the value of institutional positioning often requires time to materialize. It demands strategic patience and a long-term perspective to fully appreciate. The U.S. strategic Bitcoin reserve may currently be in the “hibernation phase” of institutional positioning, with its true strategic worth not yet recognized or priced in by the market.

Yet it’s foreseeable that once the market widely grasps the strategic intent behind this institutional positioning, and as the “institutional dividend” begins to unfold, Bitcoin’s value reassessment could explode upward.

Conclusion: Algorithms Challenge the Printing Press, Code Rewrites Bretton Woods

The establishment of a U.S. strategic Bitcoin reserve is far more than a simple asset allocation exercise—it’s a “dimensional strike” by digital civilization against the traditional monetary order. When Trump signed the order, we didn’t just witness the locking up of 200,000 Bitcoins; we observed a silent financial coup—algorithms now vying with printing presses for control over the definition of global money.

History rhymes: In 1971, Nixon closed the gold window, freeing the dollar from the gold standard and ushering in the era of fiat dominance. In 2025, Trump enshrines Bitcoin into national reserves—not to dismantle dollar hegemony, but to implant a “digital gene” into it, attempting to replicate the petrodollar’s logic within the code-based world. The brilliance of this “crypto-dollar” strategy lies in acknowledging the twilight of centralized monetary systems while simultaneously using decentralized technology to prolong that twilight.

The market’s shortsighted reaction resembles the bankers at the 1944 Bretton Woods Conference who doubted Special Drawing Rights (SDRs)—focused only on gold-to-dollar conversion rates, blind to how institutional positioning would reshape financial rules for half a century. Today, Bitcoin’s algorithmic code is drafting a new monetary constitution: When the state begins stockpiling censorship-resistant assets, it’s pre-installing an “escape pod” for sovereign currency’s ultimate crisis. If you want your own escape pod, I’ve prepared two beginner-friendly guides—one on how to buy Bitcoin, the other on sending Bitcoin to a cold wallet. That should get you started.

The future currency wars may not be won by whose central bank balance sheet is largest, but by who can most intricately embed “digital gold” into strategic architecture. Just as the petrodollar turned black gold into a credit medium, the crypto-dollar seeks to transform hash values into levers of power. The endgame of this contest may validate Hayek’s prophecy: “The denationalization of money will ultimately bury the ghost of Keynesianism”—except this time, it’s not just free markets wielding the pickaxe, but awakened nation-states.

When the White House deposits Bitcoin into the “Digital Fort Knox,” it’s not just the quiet click of encrypted cold storage—it’s the sound of old financial foundations cracking. Algorithms are now competing with printing presses for monetary definition. The “greenback” of tomorrow may be forged in code and hash values.

Who Will Be the Next “Greenback”?

The answer may lie in Yellen’s statement: “We won’t sell these Bitcoins”—because what’s truly for sale has never been cryptocurrencies, but the next fifty years of X-currency hegemony.

Right now, “the dollar” just has slightly better odds.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News