Frame-by-frame analysis of the White House Crypto Summit: What subtext did the market miss?

TechFlow Selected TechFlow Selected

Frame-by-frame analysis of the White House Crypto Summit: What subtext did the market miss?

Was Trump really here to support crypto?

Author: @TechLeviathan, blockchain developer

Translation: zhouzhou, BlockBeats

Editor's note: The cryptocurrency summit hosted by Donald Trump marked a milestone in U.S. leadership within the digital finance sector. The event addressed crypto regulation and policy, emphasized Bitcoin’s significance as a strategic asset, and announced the establishment of a national Bitcoin reserve. Despite introducing long-term regulatory strategies, markets expressed disappointment over the lack of clear regulatory measures and uncertainty regarding altcoins.

Below is the original content (slightly edited for clarity):

Donald Trump misled the entire cryptocurrency community. The U.S. cryptocurrency reserve has been canceled, taxes remain unchanged. I analyzed the full crypto summit—here’s everything you need to know about what happened and the future of crypto.

On March 7, 2025, the cryptocurrency summit hosted by President Donald Trump became a landmark event for the industry.

-

This was the first U.S. summit entirely dedicated to shaping cryptocurrency regulation and future policy.

-

The government’s growing support for Bitcoin highlights its strategic role in maintaining U.S. dominance in the digital economy.

-

The event was livestreamed via social media, drawing significant attention from investors and the public.

-

However, market reactions were largely negative, with noticeable declines in Bitcoin and various altcoins.

Summit Objectives

-

The summit explored the future of cryptocurrency regulation and its impact on the U.S. financial sector.

-

The government reaffirmed its commitment to keeping the United States a dominant force in digital finance.

-

In-depth discussions were held on Bitcoin and digital assets in relation to economic policy and financial stability.

-

The goal is to establish a sustainable and innovation-friendly regulatory environment for the crypto industry.

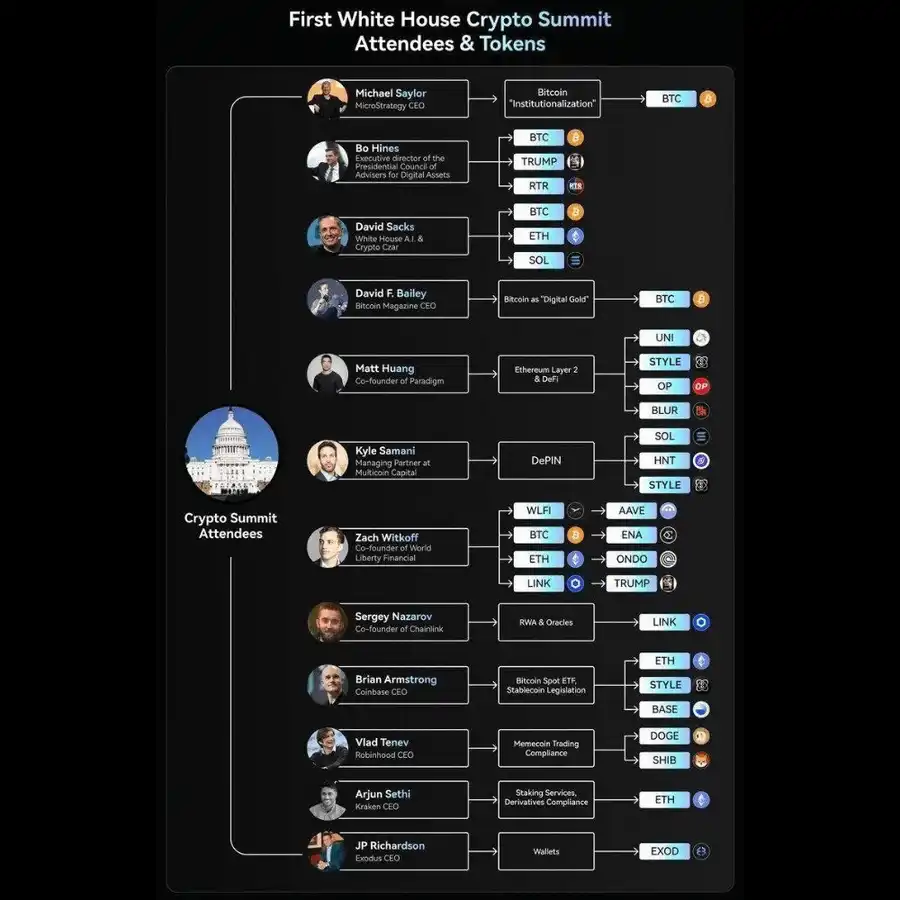

Donald Trump chaired the summit, representing the U.S. government's stance on cryptocurrencies.

-

David Sacks, White House advisor on cryptocurrency and artificial intelligence, led high-level discussions with industry leaders.

-

Bo Hines, head of the Digital Assets Task Force, played a key role in formulating strategic policies.

-

Senior White House officials participated in dialogues advocating government interests in the crypto space.

-

Michael Saylor, founder of MicroStrategy, lobbied for pro-Bitcoin policies and engaged in direct dialogue with U.S. officials.

-

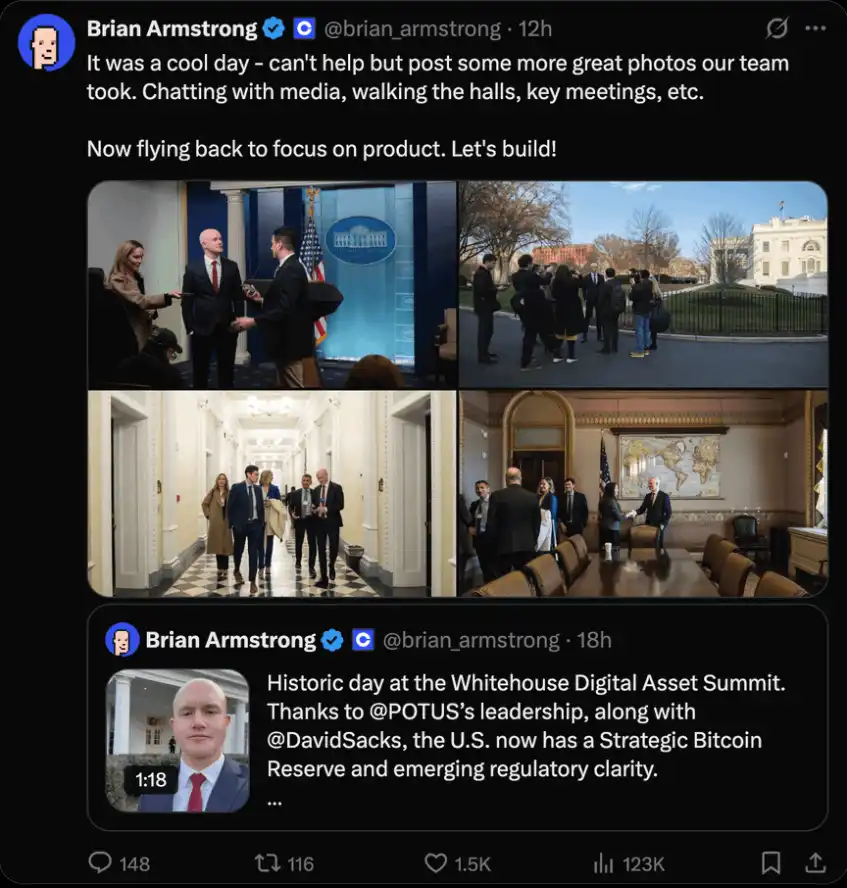

Brian Armstrong, CEO of Coinbase, voiced concerns about cryptocurrency regulation and spoke on behalf of exchange platforms.

-

Cameron and Tyler Winklevoss, founders of Gemini, shared investment insights, emphasizing market growth and innovation.

-

Anthony Scaramucci, representing Ripple Labs, advocated for XRP and its role in the global financial system.

-

Executives from Ethereum, Solana, and other blockchain networks discussed the evolving roles of altcoins in the economy.

The summit marked a major turning point, formally integrating cryptocurrencies into U.S. financial discourse. However, market sentiment turned negative due to the absence of substantive regulatory announcements. Expectations for transformative policy changes were unmet, leaving investors frustrated. Despite the introduction of long-term strategies, short-term market instability persisted.

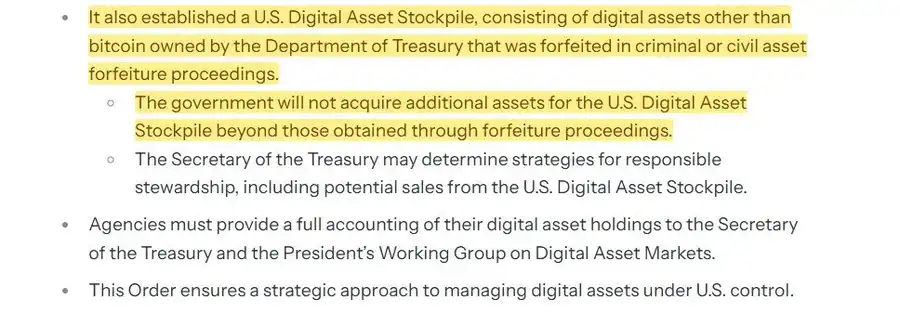

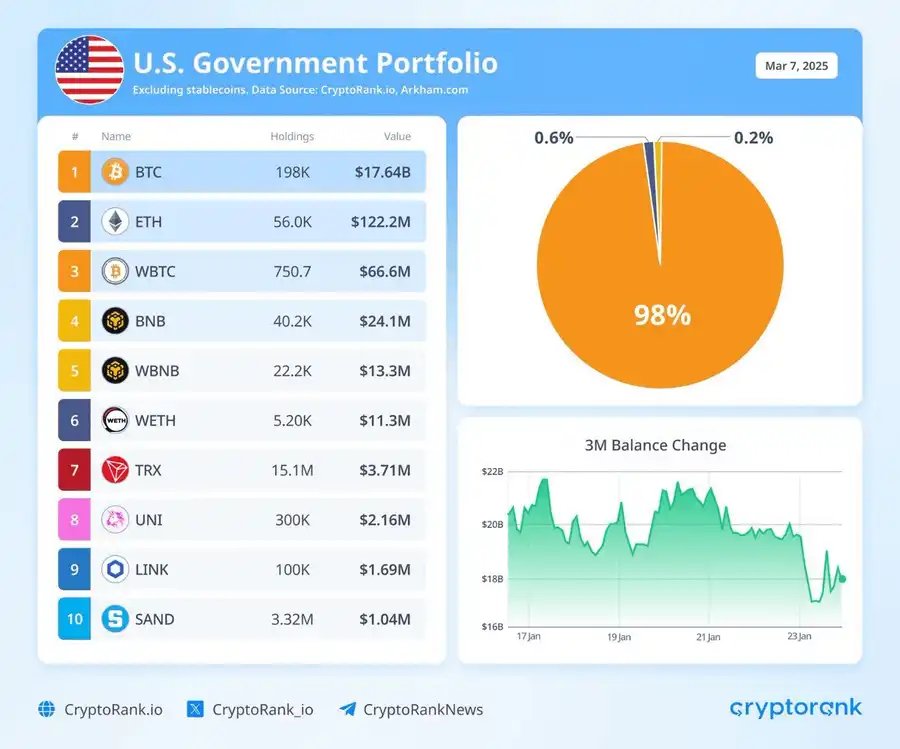

The U.S. government established a Bitcoin reserve consisting of 200,000 seized bitcoins. The Treasury will oversee this reserve without imposing additional burdens on taxpayers. There are no plans to acquire more Bitcoin. This move introduced market uncertainty, although Bitcoin was officially classified as a strategic asset, comparable to gold in the U.S. financial reserves.

The United States plans to introduce federal stablecoin regulations by August 2025. The proposed framework aims to enhance oversight and stability for major stablecoins such as USDT and USDC. A primary objective is reinforcing the U.S. dollar’s dominance as the world’s leading reserve currency. The legislation will prohibit the issuance and circulation of stablecoins pegged to foreign fiat currencies.

The U.S. government has designated Bitcoin as a strategic asset, distinguishing it from other cryptocurrencies. Ethereum, XRP, and Solana continue to face ongoing regulatory uncertainty, with no clear guidelines yet established. While there was mention of potentially creating a separate fund for altcoins, details remain vague.

The current lack of clarity around altcoins has fueled market speculation and instability. David Sacks announced that alongside the Bitcoin bill, a digital asset reserve would be created, composed of non-Bitcoin cryptocurrencies obtained through legal seizures. The legislation strictly prohibits the government from acquiring any assets beyond those seized in criminal cases.

An analysis of the U.S. government’s crypto asset portfolio suggests certain altcoins may be included in the digital asset reserve. Potential candidates include $ETH, $BNB, $TRX, $UNI, $LINK, and $SAND.

-

Brian Armstrong viewed the summit as a milestone but pointed out the lack of tax incentives for cryptocurrency investors.

-

Cameron and Tyler Winklevoss praised the summit’s significance while expressing concern over unclear altcoin regulations.

-

Anthony Scaramucci supported the focus on stablecoins but stressed the urgent need for regulatory clarity on XRP.

The White House emphasized that the summit solidified America’s position as a leader in digital finance. Government officials assured the public that the Bitcoin reserve would not impose any additional costs on taxpayers. The event highlighted long-term goals for crypto regulation and industry development.

The aftermath of the summit brought uncertainty to the crypto market. Bitcoin dropped to $85,000, triggering widespread losses among altcoins. Short-term volatility continues as investors react to the absence of decisive policy actions. Market recovery remains possible if the government implements favorable measures.

Many had expected the U.S. government to significantly purchase Bitcoin, but this did not materialize. Tax benefits were a major investor expectation but were entirely absent from discussions. Trump’s speech failed to deliver clear messages, deepening market skepticism. The market’s overbought condition made it vulnerable to sharp post-summit corrections.

While the summit laid the groundwork for future growth, the immediate market reaction was negative. Unless the government takes decisive action, continued market volatility is expected. Regulatory uncertainty continues to amplify investor doubts and hesitation.

By 2025, the introduction of stablecoin regulations and the Bitcoin reserve could support long-term market growth. Recovery for both Bitcoin and altcoins will depend on the implementation of promised regulatory measures. Monitoring developments in stablecoin policy and reserve management is crucial. The future of the U.S. crypto industry remains heavily influenced by shifts in government policy.

The future of cryptocurrency hinges on regulation and institutional adoption. Clear policies can drive growth, while uncertainty fuels volatility. Bitcoin remains dominant, but DeFi and stablecoins are expanding. Mass adoption is inevitable, though the path ahead will be turbulent.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News