@Trump, how did Wall Street tycoon Ackman use Twitter to "remotely control" the White House?

TechFlow Selected TechFlow Selected

@Trump, how did Wall Street tycoon Ackman use Twitter to "remotely control" the White House?

Justice or利益? This is the key question to understanding Ackerman.

By David, Yanz, TechFlow

Sunday, April 7, 2025.

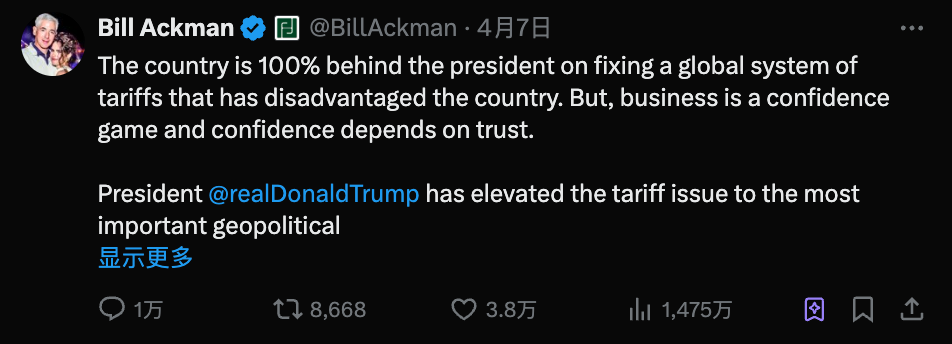

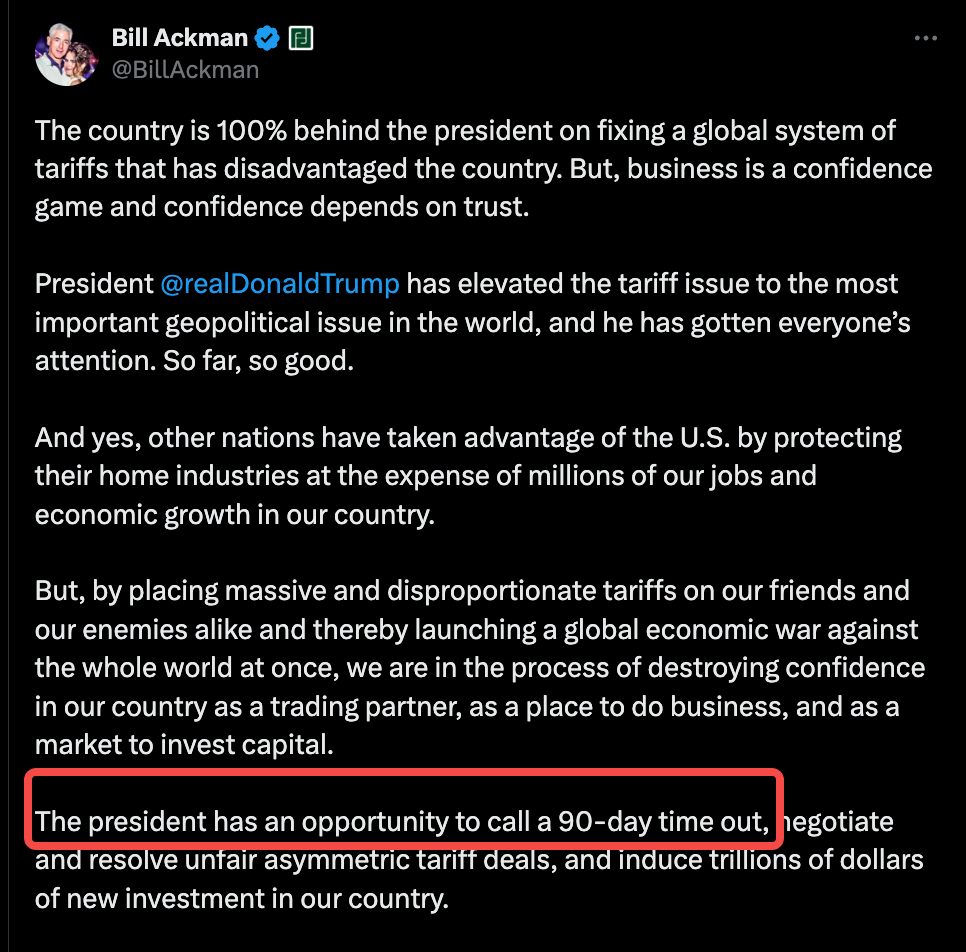

Bill Ackman posted a tweet calling for a 90-day pause on the tariff plan and directly @-ed Trump. Naming the president explicitly is taboo on Wall Street. But Ackman didn’t care.

Seventy-two hours earlier, Trump had announced "reciprocal tariffs" on nearly all trading partners; global stock markets plunged immediately, panic spreading.

Then, a miracle happened.

On Wednesday morning, Trump announced an unexpected decision: a 90-day suspension of the tariff plan to allow room for negotiations. This idea of a "90-day pause" came straight from Ackman’s tweet three days prior.

The coincidence sparked speculation across social media: Did a White House aide see the tweet and bring it to the president?

This isn’t the first time Ackman has successfully "remotely controlled" the White House. In fact, during the Trump era, this hedge fund manager with 1.8 million Twitter followers is pioneering a new model of political-business relations—no formal position, no secret meetings, just enough followers and well-timed public statements.

From being a longtime Democratic donor to becoming Trump’s "Twitter advisor," this is a story about social media, money, and power.

Tariff Turmoil: A Key Backer Steps In

Before it actually happened, no one could have imagined that a single tweet could shift tariff policy.

When Ackman issued his warning that Trump’s tariff policy might trigger an "economic nuclear winter," he was making a dangerous gamble—as a major donor who once publicly listed 33 reasons supporting Trump, now openly opposing his tariff stance.

Is this betrayal or clarity?

Just three months earlier, he had praised Trump’s economic vision on Twitter. Now, by publicly opposing him and tweeting in favor of a 90-day tariff delay, the risks were obvious—his goodwill and influence within the White House could vanish overnight.

But Ackman bet right.

He accurately gauged Trump’s psychology—the president cares more about stock market performance and public sentiment than anything else. Trump simply needed a dignified way to pivot, without appearing to yield under pressure.

The brilliance of the "90-day pause" idea lies in its dual benefit: it gives Trump an exit ramp—he can frame it as enabling "better negotiations"—and reassures markets that at least for three months, there will be no tariff shocks.

On that day, when Trump announced the 90-day tariff suspension, U.S. stocks recorded their biggest single-day gain in 16 years. The S&P 500 rose 4.2%, and the Dow Jones Industrial Average surged over 1,200 points.

Ackman remained low-key about his victory. He merely tweeted: "A wise decision. America needs trade, but it must be fair trade."

The tariff turmoil lasted only a week, but what it revealed will endure much longer.

In the Trump era, financial backers are no longer silent check-writers. They are vocal partners—and when necessary, even critics. And when criticism is loud and unified enough, even Trump must listen.

Governing via Tweet: A New Model of Political-Business Relations

Bill Ackman is handling political-business relations in a simpler, more direct way: tweeting and @-ing the president.

Traditional political-business ties operate behind closed doors—private club dinners, golf course deals, messages passed through intermediaries. The public never knows how policies are shaped, who influenced whom, or at what cost.

Ackman’s approach is the opposite—no lobbyists hired, no private dinners arranged, not even formal meeting requests. He just tweets, letting his 1.8 million followers amplify his voice to the White House.

This is no accident, but a calculated strategy rooted in Ackman’s deep understanding of Trump’s media habits.

According to several former White House officials, Trump’s first daily ritual is scrolling through X (formerly Twitter), checking who’s talking about him and what they’re saying. He pays special attention to high-follower accounts, especially those who’ve supported him. When such figures publicly criticize a policy, Trump takes notice.

Ackman’s Twitter strategy appears meticulously crafted—typically posted late at night or on weekends, worded sharply but not confrontational, always tagged with presidential-related keywords.

Every lobbying effort is public, every argument open to public scrutiny.

This is an unconventional honesty, yet highly rational:

Instead of hiding interests, he makes them part of his argument—I have skin in the game, so I care more than anyone about this policy’s consequences.

Yet when billionaires can amplify their voices through follower counts, what does transparency really mean for underlying interests?

A $9 Billion “Activist”

If three numbers define Bill Ackman, they would be:

58 years old, $9 billion net worth, 1.8 million X platform followers. These figures paint the portrait of a classic Wall Street success story. Yet Ackman is anything but typical.

In 2014, during an investor presentation on Herbalife, he passionately argued that the supplement company survived only because salespeople were forced to buy its mediocre protein shakes—shakes they often couldn’t resell to real customers.

He accused the company of running a pyramid scheme preying on America’s lower-income population. Yet in the days following the speech, Herbalife’s stock rose 25%. He ultimately lost $1 billion on the short bet.

Justice or profit? This is the key question in understanding Ackman.

In March 2020, while the world debated whether COVID-19 would become a pandemic, Ackman spent $27 million buying credit protection to hedge against market collapse. One month later, that investment turned into $2.6 billion.

At the same time, he tearfully urged CNBC viewers to “shut down the U.S. for 30 days,” warning hotel stocks would go “to zero.”

Critics claimed he was deliberately stoking fear to profit from his short positions. Supporters said he was sounding the alarm and fulfilling civic duty. The truth? Probably both.

But unquestionably, he’s brilliant. While other hedge fund managers work quietly, he realized early that the social media age demands a new playbook.

He transformed himself into finance’s “influencer”—posting frequently on Twitter, engaging in online arguments, even competing in professional tennis matches at age 59 (though eliminated in the first round).

Some say he wants to be the “next Buffett.” But Buffett never @-ed presidents on Twitter, nor publicly clashed with Harvard’s president over politics. Ackman seems more like someone who’ll do whatever it takes to win—yet genuinely believes he’s doing the right thing.

This contradiction is precisely his secret weapon in influencing Trump.

An Italian Dinner That Changed Politics

Before May 2024, Bill Ackman’s political history read like a standard Wall Street liberal’s resume. At charity galas in Manhattan’s Upper East Side, he was a regular at Democratic fundraising events.

That changed in Los Angeles the same month.

During the Milken Institute Global Conference, Ackman met Elon Musk. Two billionaires equally active on X found common ground.

Days later back in New York, Ackman had dinner with Trump. According to Bloomberg, the main course was ravioli. While the exact conversation remains unknown, the meal clearly left a strong impression on Ackman.

Prior to that dinner, Ackman had supported multiple anti-Trump candidates in the 2024 presidential race. Afterward, everything changed.

In October 2024, he posted a tweet on X featuring an interview video listing “33 actions that led me to support Trump over Harris.”

There were many reasons, but insiders noticed one detail: Ackman has held positions in Fannie Mae and Freddie Mac for over ten years. During his first term, Trump pushed for privatizing the two government-sponsored enterprises, though he said “there wasn’t enough time.”

Ackman later wrote on Twitter, “I believe the Trump team will get this done.”

On July 14, after Trump survived an assassination attempt, Ackman publicly expressed support. By January 2025, he declared he “no longer wanted any association with the Democratic Party.”

From Democratic donor to MAGA supporter, Ackman’s shift seemed sudden—but was actually predictable. Like most on Wall Street, driven by interests, perhaps Ackman has always been a trader. He may have simply made a political trade.

That plate of ravioli might have marked the start of the deal.

Privatizing the GSEs: A Decade-Long Bet

Ackman’s experiment in Twitter-driven political influence began a year earlier with his push for GSE privatization—a move tied to a carefully orchestrated high-stakes gamble.

Fannie Mae and Freddie Mac, two government-sponsored enterprises, control nearly half of the U.S. residential mortgage market. During the 2008 financial crisis, they received federal bailouts and have remained under government conservatorship ever since.

To most people, this is just a footnote in financial history. To Ackman, it’s the biggest bet of his life.

Starting in 2013, Ackman’s Pershing Square fund began accumulating shares in the two GSEs, when prices were below $2 per share. His logic was simple: these companies are fundamentally profitable; government oversight is temporary; full privatization will eventually happen. When it does, share prices will skyrocket.

He waited ten years for that “eventually.”

During that time, the stocks traded sideways. Other investors exited. Ackman doubled down. By 2024, he held over 115 million shares, becoming one of the largest outside shareholders.

On December 30, 2024, after Trump won the election but before taking office, Ackman launched his Twitter blitz.

In a tweet @-ing Trump, he wrote: “There is a credible path to end federal oversight of Fannie and Freddie within two years.”

He carefully framed the message—avoiding personal interest, focusing solely on national benefit: “This could generate over $300 billion in additional revenue for the federal government,” “Remove $8 trillion in liabilities from the government balance sheet.”

The key line: “Trump loves big deals—this would be the biggest deal in history. I believe he will deliver it.” The tweet reached nearly 3 million views. Wall Street analysts began reevaluating GSE stocks.

In February 2025, signals emerged.

Newly confirmed Housing and Urban Development Secretary Scott Turner stated that facilitating GSE privatization was his “top priority.” News spread, and GSE shares jumped. Over the past 12 months, both companies’ stocks have risen more than sixfold.

Ackman believes his decade-long wait is finally ending.

“You don’t need to be old to be proven right,” he wrote in a recent tweet, “The most inspiring words I’ve ever heard—when I was 25.”

The Trump era has rewritten the rules of donor politics. In this new game, Bill Ackman has already scored twice—and is patiently waiting for more.

“Coincidentally,” I Care About Crypto Too

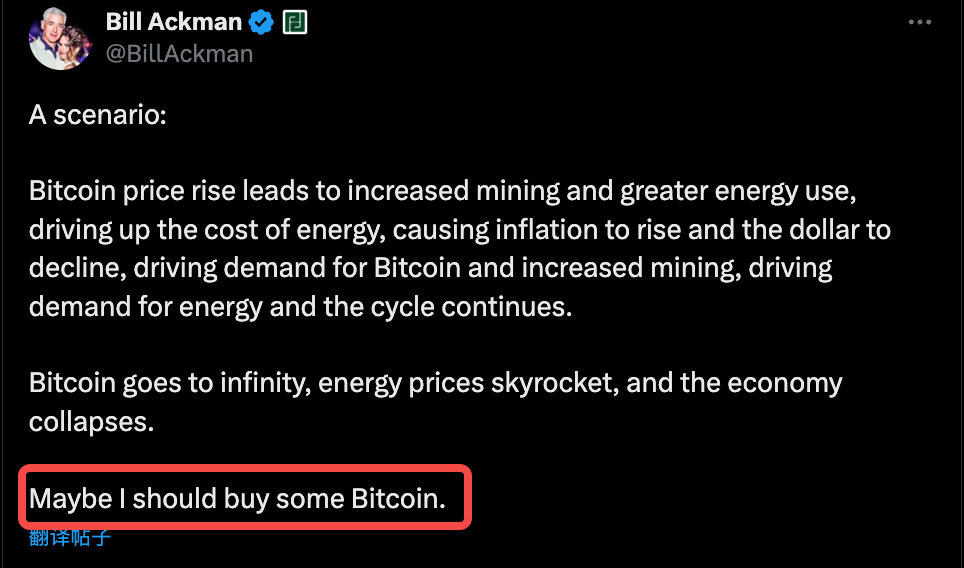

On March 9, 2024, Bitcoin was approaching an all-time high near $70,000. Ackman tweeted: Maybe I should buy some.

In fact, Ackman’s stance on cryptocurrency has always been subtle. In 2022, after FTX collapsed, he revealed he had “small investments” in several crypto projects and seven crypto venture funds, amounting to less than 2% of his portfolio. He described them as “more like hobbies, ways to learn.”

More telling is the timing.

Ackman’s Bitcoin tweet came shortly after Trump clearly voiced support for crypto. Trump promised to make the U.S. the “global crypto capital,” opposed central bank digital currencies—positions aligning perfectly with Ackman’s free-market ideology.

Beyond Bitcoin, Ackman has recently spoken frequently about artificial intelligence. He’s invested in several AI startups—though the names remain confidential. Interestingly, these emerging fields “coincidentally” align with the Trump administration’s priorities—Vice President Vance is a known tech advocate, and multiple Silicon Valley elites have entered government.

Ackman’s moves appear to be both business decisions and political positioning.

In hindsight, he consistently finds the intersection of money and power. Where’s the next battlefield? Perhaps crypto regulation, perhaps AI.

But one thing is certain: when that moment arrives, Bill Ackman will be there in a suit, waiting calmly, ready to say: Hey, you’re here.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News