Data Analysis: Is It Time to Buy the Bitcoin Dip?

TechFlow Selected TechFlow Selected

Data Analysis: Is It Time to Buy the Bitcoin Dip?

The remaining bearish factors are now few, so attention can be shifted to the potential positive news expected on March 7.

Author: Crypto Stream

Translation: Tim, PANews

Is now the best time to buy the Bitcoin dip?

The market plunged 10% overnight, completely erasing the gains driven by the U.S. cryptocurrency strategic reserve announcement. Retail investors are panic-selling, and market sentiment has hit rock bottom. However, the actual situation may be better than it appears on the surface. Below is my market outlook:

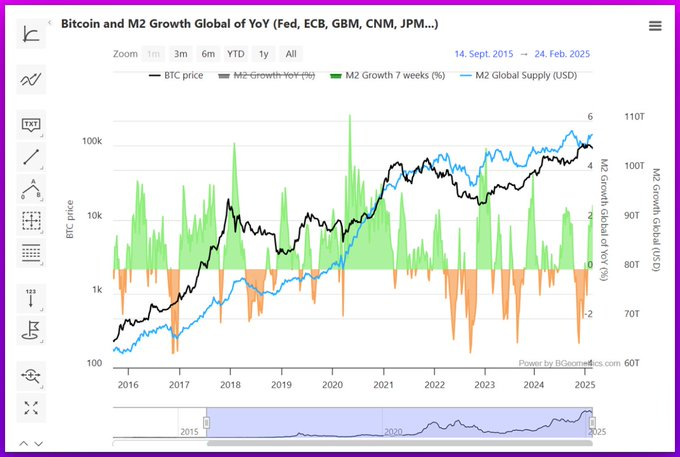

Why Can Global M2 Money Supply Drive Bitcoin Higher?

Bitcoin is extremely sensitive to changes in global money supply. As the "most sensitive asset" to liquidity shifts—a term coined by global liquidity research firm CrossBorder Capital—experts estimate its correlation with money supply reaches as high as 40%.

Analysis of current M2 money supply trends:

Global M2 supply likely bottomed around January this year. Historical data shows a lag of 40–70 days between M2 movements and Bitcoin price reactions. This suggests that the rebound in liquidity will likely drive Bitcoin higher over the medium term, with the transmission mechanism potentially taking effect as soon as 20 days from now.

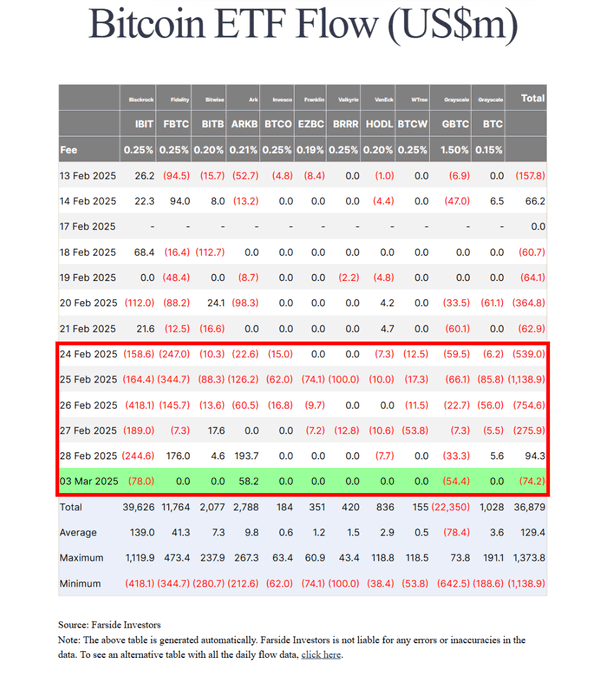

Analysis of Tariff Policy Impact on the Market

Trade war fears are shaking the markets, and declining U.S. risk appetite is clearly negative for risk assets. However, I believe the impact of tariffs has already been largely priced in, with ETF fund flows serving as the key indicator:

ETF Fund Flows vs. Market Expectations

Outflows from ETFs have significantly slowed. Institutional investors have mostly finished pricing in tariff-related risks last week, and no large-scale capital withdrawals are expected this week. Notably, there are early signs of inflows from investors buying the dip.

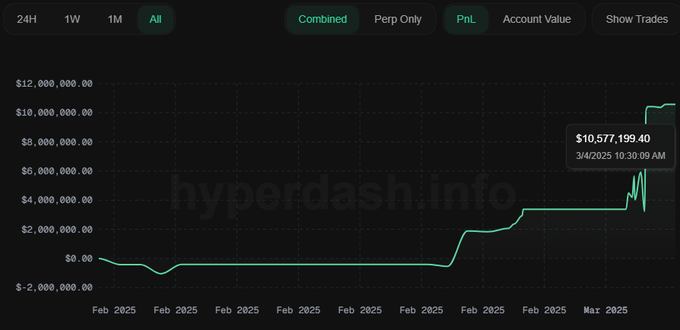

Sell-Off Demographics Analysis

Current selling pressure mainly comes from two groups: retail investors engaging in panic selling, and well-prepared institutional players. It’s worth noting that retail investors may have misjudged policy timing due to delayed reactions.

Technical Analysis of the CME Futures Gap

Another potential bearish factor was the CME Bitcoin futures gap. This refers to the price gap that forms when the CME exchange reopens after weekends, where spot Bitcoin prices diverge from futures opening levels. While such gaps don’t necessarily trigger immediate sell-offs, traders’ widespread belief that “gaps must be filled” can intensify short-term selling pressure. Importantly, this technical gap was fully closed on March 4, removing this factor from the current price equation.

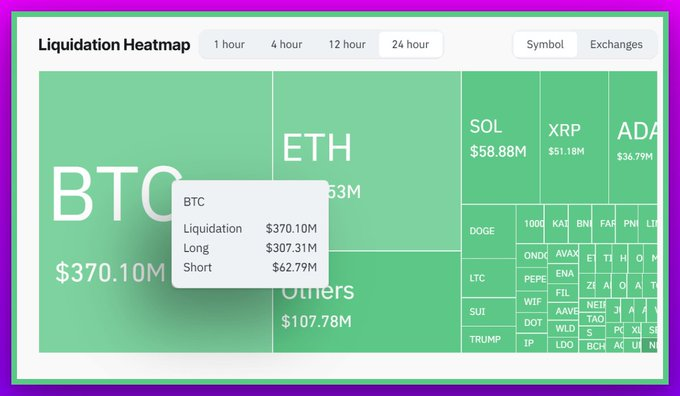

Based on the above analysis, we can summarize three core drivers behind yesterday’s price movement:

• Insiders shorting after the announcement

• Long positions being liquidated

• A surge in newly opened short positions

Finally, I believe remaining bearish factors are now limited. We can shift our focus to the potentially positive news expected around March 7.

Bitcoin has retraced to pre-announcement levels. In my view, current prices offer an excellent risk-reward ratio for entering long positions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News