The bull market hasn't ended yet, and the market hasn't reached a frenzied stage.

TechFlow Selected TechFlow Selected

The bull market hasn't ended yet, and the market hasn't reached a frenzied stage.

Bottoms up! I'll take my sip—cheers, you do as you like!

Author: Lao Mao

Offering a dose of optimism under the heavy hammer of a massive weekly bearish candle is a dangerous thing to do.

Although 99% of my content over the past decade has emphasized investing in Bitcoin, there are always those who cherry-pick that remaining 1% to justify using leverage, blow themselves up, and then come into the comments saying they didn’t get rich because they listened to me.

So let me be absolutely clear: I talk about Bitcoin—only Bitcoin—and specifically Bitcoin held securely in one’s own cold wallet, scientifically and safely stored. This does not include any Bitcoin on exchanges, Bitcoin futures positions, Bitcoin-related stocks, or any Bitcoin-related ETFs. It includes no altcoins whatsoever—no Sol, no Eth, no XRP, no ADA. I don’t touch these, and I cannot offer any advice on them. Is that clear enough?

Additionally, this bit of encouragement is only intended for true Hodlers—people who, frankly, don’t even need my reassurance. I’m offering it merely as moral support during tough times, like a warm hug. It is absolutely not investment advice. If you’re skilled enough to profit from trading ranges or even bear markets, this encouragement isn’t for you—please just pass by.

The last time I wrote about Bitcoin was when it dropped from over $60,000 down to around $18,888. Some of you might still remember what I said back then.

Let me share my subjective view: despite rumors that several legendary whales and top traders have already dumped all their Bitcoin, that has nothing to do with me. I firmly believe this bull market hasn’t ended. Here are my reasons—though they may seem more like feelings than logic:

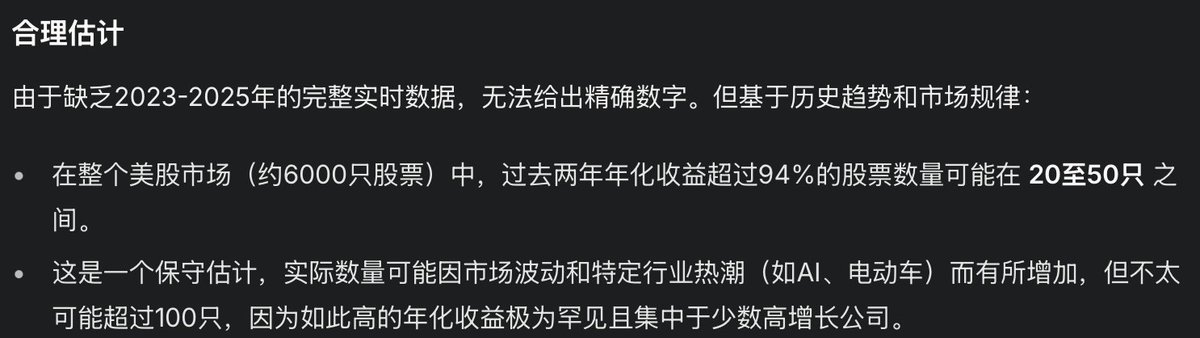

1. If this is a bull market, it’s been way too rational and restrained. Today’s price, while delivering an astonishing 94% annualized return over the past two years, still places Bitcoin’s performance on par with several strong U.S. stocks according to Grok’s analysis (see chart below). For such a high-risk asset, that’s barely impressive. As for other assets, do you even dare call this a “bull market”? Bitcoin has become the well-behaved version of a U.S. stock. I’m not saying how high it can go, but at the very least, its downside should be limited. If you’re looking for a gentle sip of optimism, avoiding a brutal drop counts as flavor too.

2. Even though Wall Street has stepped in and ETFs are live, the full power of monetary easing hasn’t kicked in yet. At best, we’ve seen a lackluster, half-hearted bull run so far. The real floodgates will open when global fiscal policies fully embrace stimulus mode. After enduring the drought, we’ll see a roaring bull market—that’s what true Hodlers deserve.

3. You must deeply understand the meaning behind the Trump administration’s idea of a cryptocurrency “reserve.” If you don’t get it, you really don’t. The U.S. reportedly hasn’t touched its gold reserves in decades. If a significant amount of Bitcoin is similarly locked away and held long-term, that’s a major deal given the current supply available for trading. Just this alone could relegate recent volatility to mere wrinkles on a long-term flat line. Once the U.S. government starts reserving Bitcoin, others won’t stay behind—adoption will follow almost inevitably. Reserve status is binary: either you have it or you don’t. There’s no “small” reserve. Once it begins, it becomes an arms race—a long, endless competition. Bitcoin, now being considered an asset worthy of legal reserve status by the U.S. government, currently has a market cap comparable to a single U.S. stock. If its future value were truly expected to remain at this level, no national government would bother reserving it. The sole reason for holding it is clear: to avoid losing influence if the asset surges. This is a reserve of power. You can call Trump reckless or foolish, but to assume the world’s most powerful nation is just clowning around without serious intent—that’s dangerously naive.

4. Lastly, I’ve spent years tracking various bull market indicators based on cyclical patterns. I won’t deny some of this could be "cutting the boat to find the sword"—clinging to outdated logic—but I actively filter out irrelevant parts. Even after doing so, this current weak bull market has only reached about 30% of the fair value zone suggested by my composite indicators. At this price level, I don’t know if it’s just me, but it doesn’t feel worth selling. Even if forced to sell, it’d feel like a fire sale—and I have no confidence I could buy back cheaper later. So I can only Hodl. From here, price movements are free to do as they please.

Ten years as a professional elevator operator, dressed in fine clothes, standing with you, without regret.

Once again: none of the above constitutes investment advice. You alone bear responsibility for any losses. If you profit, feel free to Venmo me $50 :)

I promise no one financial freedom. That’s always your own journey. Relying on anyone else’s opinions for investment decisions rarely ends well.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News