The trenches have collapsed, the Meme cycle is gone forever

TechFlow Selected TechFlow Selected

The trenches have collapsed, the Meme cycle is gone forever

Survival, survival, continue to survive.

Author: Loopify

Compiled by: TechFlow

I'm not the first to say this, nor am I someone commenting after the dust has settled—someone who'd be dismissed as "hindsight smart." But I still want to make a bold call: I believe the memecoin hype is over.

The current wave of memecoin mania has essentially run its course. Existing tokens might still have a chance to return to all-time highs, but it's unlikely any new token will surge to a multi-billion dollar market cap and sustain it. For mid- and low-market-cap tokens, the odds of recovery are nearly 0.1%.

You can pinpoint on the chart the key moments signaling the collapse of the meme market: $TRUMP was the first to trigger the shift, followed by $MELANIA, then a series of other rug pulls, with $LIBRA being the final straw that broke the market.

Massive scams and exit schemes were inevitable, just as platforms like pump.fun were bound to emerge in some form.

The market has become excessively volatile, swinging from extreme pumps (PvE memecoins climbing to billion-dollar valuations) to extreme frauds (nation-state-level rug operations). Most people either made money or lost heavily during this cycle.

No Real Holders

One crucial point about the Solana trenches: they were entirely driven by market momentum. The vast majority of people buying these tokens did so purely for profit, as the "narrative" appeal seen in traditional crypto projects has vanished. This also means these tokens collapse faster in price than others.

Albert Murad Einstein promoting memecoins

The memecoin frenzy was hailed as the purest form of trading because it had no constraints. That’s precisely why they could go so crazy. Yet this very "purity" brings massive downsides.

Once the thrill of making money fades, holders quickly exit—and the same crowd completely abandons the space. This differs from other cryptocurrencies, where holders often maintain belief in the project due to some underlying value. Memecoins, however, rely entirely on market sentiment and have almost no substance.

This partially applies to NFTs too, but there's a distinction. Memecoins have fully abandoned any notion of "utility," with only rare exceptions breaking through the noise and being regarded as "classic" or "evergreen," such as $PEPE.

This memecoin cycle also gave rise to relatively new phenomena like copy-trading. While people have always tracked wallet activity on-chain, the sheer volume of new tokens this time was unprecedented. Improvements in Solana's trading UX and liquidity have further fueled this trend.

Now, some individuals have already earned hundreds of thousands of dollars through this model—by attracting followers to copy their trades. (This isn't about any one person, but a widespread pattern: those who gain fame for "making big money" in public wallets often attract massive follower bases, and some may even exploit this intentionally.)

DEXs have had copy-trading features for a while, but previously you couldn’t buy a tiny token with a $10K market cap for 5 SOL and sell it for 10 SOL just 15 seconds later.

This dynamic leads more people to follow so-called KOLs into the "incinerator" (i.e., losses), but unlike before, there's little backlash on social media, since these traders aren’t explicitly promoting specific tokens.

Comparison with NFTs

Remember when NFTs were at their peak? I draw this comparison because NFTs were the previous cycle’s craze, just as ICOs were the trend in 2017.

Almost everyone had heard of NFTs. The trend spread widely across the internet and attracted countless A-list celebrities launching their own projects (most of which ended in rug pulls). NFT market trading volumes reached tens of billions of dollars, with floor prices of top collections hitting six figures.

During that wave, OpenSea emerged as the biggest winner, earning over $1 billion in fees alone—compared to pumpfun’s total revenue of around $500 million.

However, one major difference between this memecoin wave and the NFT era is that many protocols have profited massively this time.

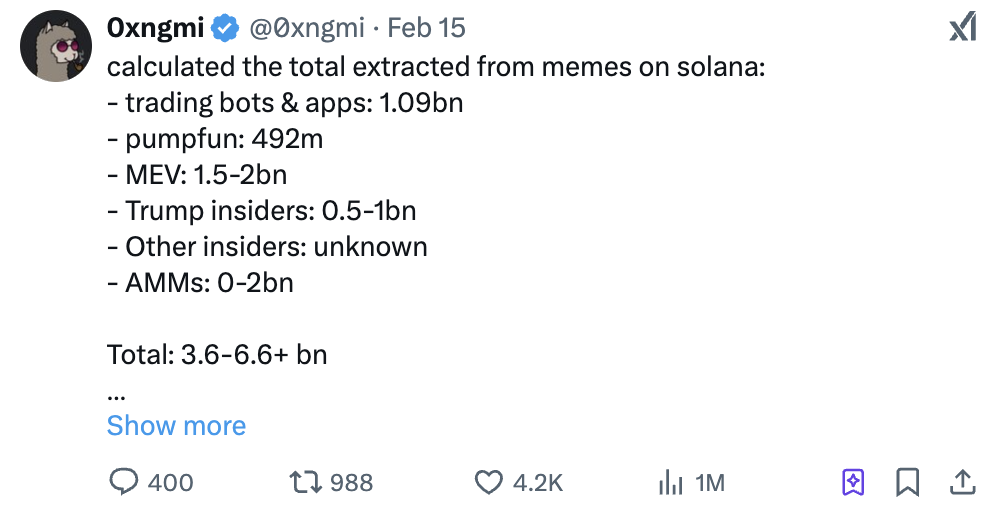

@0xngmi: Total "extracted" gains from the Solana memecoin boom:

-

Trading bots and apps: $1.09 billion

-

pumpfun: $492 million

-

Maximum extractable value (MEV): $1.5–2 billion

-

Trump insiders: $500 million–1 billion

-

Other insiders: Unknown

-

Automated market makers (AMMs): $0–2 billion

Total: Over $3.6–6.6 billion

Even at the lowest estimate, roughly $4 billion was "extracted" during this cycle—an enormous sum. (After all, one of the most powerful people in the world launched a token that hit a $70 billion market cap in two days—that’s hardly "early" anymore.)

In contrast, my rough estimate suggests that if we include marketplace trading, royalties, and minting revenue, the total scale of NFTs was slightly lower than this.

This indicates that the memecoin craze has surpassed the last cycle’s trend, and the high liquidity enabled much faster market adjustments.

Many members of the Solana community are sensitive to the term "extraction" (hence the quotes) and compare it to traditional business models. But I think that comparison is flawed.

In traditional business, when I buy a game, I receive entertainment value while the company earns revenue—it’s a positive-sum game.

You could argue that much of crypto operates as zero-sum, but many projects were originally designed to deliver real utility.

Yet pumpfun functions as a negative-sum game, operating via value extraction mechanisms akin to a casino—its primary function is creating tokens with no intrinsic value, whose sole purpose is speculation or gambling for higher returns. (Of course, this doesn’t apply to projects not specifically built for memecoins, like Jup or Phantom, even though they benefited the most from the memecoin surge.)

What Comes Next?

Nobody truly knows when this cycle will end, and that will determine the short-term market direction.

Each cycle spawns a new trend, or perhaps an evolved version of the last one—or a revival (or complete death)—because people are always chasing the next 100x opportunity.

Returning to my earlier point, I believe memecoins have a lower chance of resurgence compared to other trends because they lack real holders and believers.

Essentially, only the largest tokens will survive; everything else will die. If the market rebounds, new tokens will likely outperform everything existing.

You must prepare for this scenario: Survive, survive, keep surviving.

If you exit the market before the next trend arrives or run out of capital, adaptation will be extremely difficult. In this space, adaptability is critical. Anyone can make money in a bull market, but making money in a bear market is true skill—and adapting to the next bull market is yet another skill altogether. (Each cycle demands a different mindset.)

Finally, I recommend an article that deeply explores why "getting rich" is only half the journey—the other half is "staying rich"—and offers actionable advice:

*PS: If you think an asset has already dropped 90%, so these suggestions don’t apply, remember—it could easily drop another 90%.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News