Crypto Morning Brief: NVIDIA's Q4 Revenue of $39.3 Billion Beats Expectations, Safe Developer's Machine Hacked Leading to Bybit Theft

TechFlow Selected TechFlow Selected

Crypto Morning Brief: NVIDIA's Q4 Revenue of $39.3 Billion Beats Expectations, Safe Developer's Machine Hacked Leading to Bybit Theft

Global risk aversion has led to a decline in Bitcoin prices, and the Federal Reserve may maintain current interest rates.

Author: TechFlow

Yesterday's Market Dynamics

Safe claims developer machines were compromised, but contracts, front-end and service source code remain secure

According to Bybit's interim report on the $1.5 billion theft incident, the breach was caused by a vulnerability in Safe's infrastructure, while Bybit's related systems showed no abnormalities.

The Safe team responded, stating, "Forensic review of Lazarus Group’s targeted attack on Bybit concluded that the attack on Bybit’s Safe was executed via compromise of a Safe developer machine, resulting in a disguised malicious transaction.

External security researchers’ forensic analysis found no vulnerabilities in Safe’s smart contracts, front-end, or service source code. Following the recent incident, the Safe team has conducted a thorough investigation and has now restored Safe on the Ethereum mainnet through a phased rollout. The Safe team has fully rebuilt and reconfigured all infrastructure, rotated all credentials, and ensured the attack vector has been completely eliminated.

After the final investigation results are available, the Safe team will release a complete post-mortem report."

QCP: Global risk-off sentiment drives Bitcoin lower; Fed likely to hold rates steady

QCP Asia's market watch for February 26 noted that global risk-aversion sentiment led to declines in equities, gold, and Bitcoin. Bitcoin continues trading in sync with risk assets, and ETF outflows confirm weak market confidence. In volatile markets, cryptocurrencies remain the first assets traders rush to sell when reducing exposure.

Concerns over stagflation are rising. The U.S. decision to impose 25% tariffs on Canada and Mexico (effective March 3) further dampened market sentiment.

In the coming weeks, consumer and retail confidence surveys will be key. These indicators typically lead actual economic data and may provide early warning signals of stagflation.

Greeks.live: Overall market sentiment bearish, BTC could fall below $80,000

Adam, macro researcher at Greeks.live, published a Chinese community briefing on X, noting widespread bearish sentiment and weak rebound strength, suggesting BTC could decline further below $80,000. Some believe it may follow last year’s choppy trend. Multiple traders pointed out that the recent breakdown below the M-top formation poses medium-term downside risks. Record net outflows from Bitcoin ETFs have further intensified bearish sentiment.

Options traders discussed abnormal volatility behavior—despite sharp price drops, medium- and long-dated options volatility failed to rise meaningfully, possibly indicating market expectations of a one-off correction rather than a trend reversal.

Regarding DVOL (volatility index), professionals highlighted insufficient liquidity as the main issue. Suggestions include launching perpetual DVOL to boost liquidity, though this faces technical challenges in index design and risk management.

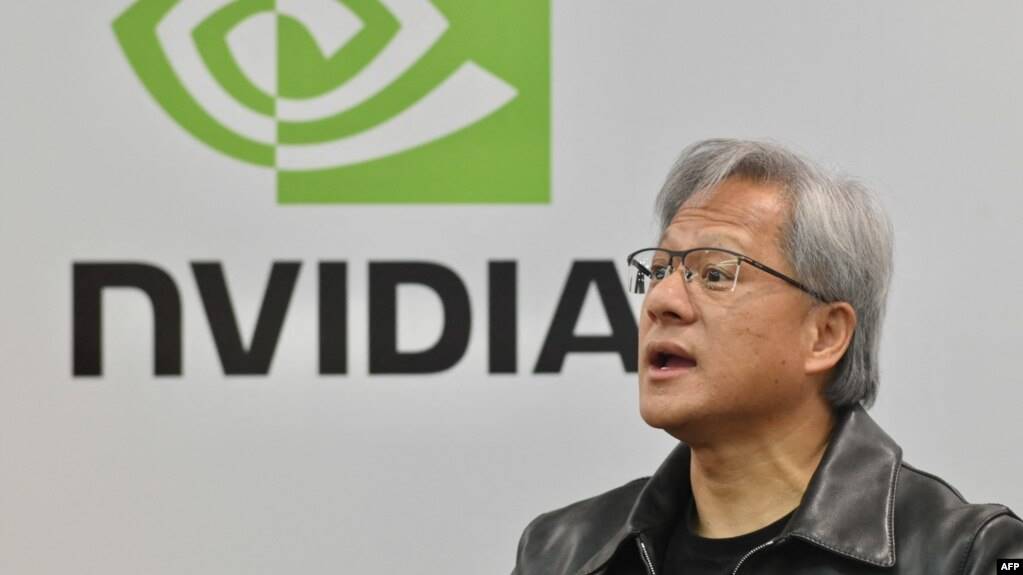

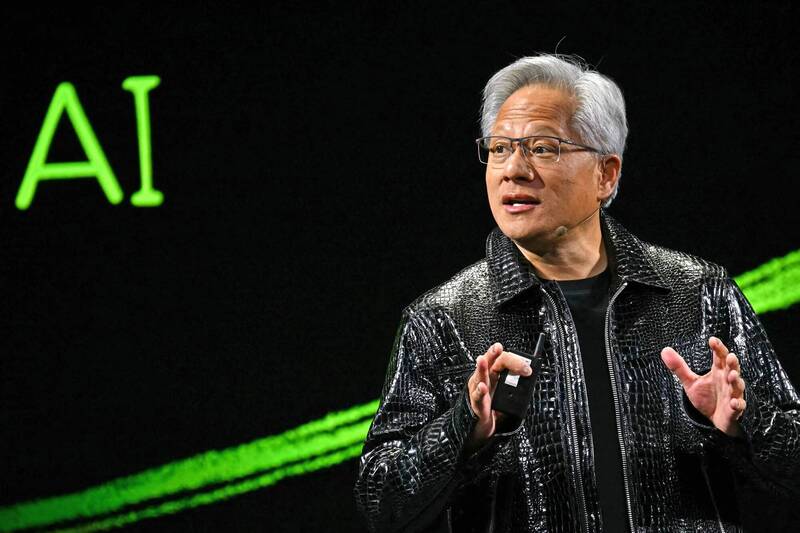

NVIDIA Q4 revenue hits $39.3B, exceeding expectations; Jensen Huang says Blackwell chip demand is astonishing

According to Jinshi News, NVIDIA reported Q4 FY2025 earnings significantly above market expectations, with revenue rising 78% year-on-year to $39.3 billion, surpassing analysts' forecast of $38 billion. Data center revenue reached $35.6 billion, up 93.5% year-on-year, while net profit surged 80% to $22.091 billion.

For Q1 FY2026 guidance, NVIDIA expects revenue of $43 billion, above analysts’ $42 billion estimate, signaling continued strong AI chip demand. Although recent concerns emerged over chip demand due to the DeepSeek model, the report showed over 40% of data center revenue came from inference, alleviating investor worries.

NVIDIA shares rose over 3.5% in after-hours trading following the report. The company plans to reveal more details about future chips at its annual event next month in California, including the next-generation AI chip codenamed "Rubin," expected to begin production in 2026.

pump.fun co-founder: pump.fun X account compromised, do not interact

Alon, co-founder of pump.fun, announced that the official pump.fun X account has been hacked and urged users not to interact with it.

Circle CEO: USD-pegged stablecoin issuers should be required to register and operate in the U.S.

According to CoinDesk, Circle CEO Jeremy Allaire said in a Bloomberg interview that issuers of dollar-pegged digital tokens should be mandated to register and operate within the United States.

Allaire believes non-U.S. stablecoin providers should not be allowed to circumvent U.S. regulations while still serving American customers.

21 staff members of U.S. Department of Government Efficiency resign collectively, refusing to use technical expertise to “dismantle critical public services”

According to Dongnan Zaobao, 21 staff members of Elon Musk-led "Department of Government Efficiency" (DOGE) resigned en masse on February 25 local time. In their joint resignation letter, they refused to use their technical expertise to "dismantle critical public services" and criticized many of Musk’s recruits as "political fantasists" lacking the skills or experience needed to fulfill their duties.

Meanwhile, New York Governor Kathy Hochul stated on February 25 that she welcomes recently laid-off federal workers to apply for state government positions via an online portal. DOGE is currently coordinating federal workforce reductions with the stated goal of downsizing the federal bureaucracy, though no official total number of layoffs has been released.

Strive CEO writes to GameStop proposing Bitcoin treasury strategy to become “top Bitcoin corporate treasury in gaming industry”

According to Nate Geraci, president of The ETF Store, Strive CEO Matt Cole sent a letter on February 24 to GameStop Chairman and CEO Ryan Cohen, recommending GameStop allocate its nearly $5 billion cash reserves into Bitcoin to transform the company into the "top Bitcoin corporate treasury in the gaming industry." Cole noted that GameStop has significantly reduced operating losses over the past two years and generated interest income from equity financing proceeds to offset deficits, but core challenges remain: physical retail is declining, and consumer preferences are shifting toward digital game downloads.

As an asset manager holding GameStop shares through ETFs, Strive believes GameStop has an "incredible opportunity" to reshape its financial future by becoming a Bitcoin corporate treasury in the gaming sector. The letter acknowledged GameStop is already considering purchasing Bitcoin and other cryptocurrencies to address business challenges, but emphasized execution strategy is critical to success and offered specific recommendations.

Hong Kong to release second virtual asset policy statement

According to Hong Kong Economic Times, Financial Secretary Paul Chan announced in the 2025–26 Budget Speech that the Hong Kong government will soon publish its second virtual asset development policy statement, exploring ways to integrate traditional financial services strengths with technological innovation in the virtual asset space to enhance security and flexibility in real economic activities, and encouraging local and international firms to explore innovative applications of virtual asset technologies.

Chan reiterated that the government will consult on licensing frameworks for OTC and custody services for virtual assets within the year. On stablecoin regulation, the Hong Kong government has already submitted a bill to the Legislative Council, and upon passage, the HKMA will begin processing license applications promptly.

SlowMist CISO warns of sophisticated SMS phishing attacks appearing within Binance’s official message threads

@im23pds, Chief Information Security Officer at SlowMist, warned on social media about advanced SMS phishing attacks targeting Binance users. Unlike typical phishing messages, these fraudulent texts appear within Binance’s official SMS conversation threads, sharing the same channel as legitimate messages and spanning extended periods, accurately mimicking the official environment.

@im23pds analyzed two possible technical mechanisms: first, attackers using SMS spoofing to forge sender numbers, blending phishing messages into official threads; second, attackers exploiting SMS gateway vulnerabilities or supply chain compromises, successfully infiltrating SMS channels or colluding with rogue SMS providers.

FBI confirms North Korean hacking group responsible for ~$1.5B in stolen assets from Bybit

According to an FBI announcement, the U.S. Federal Bureau of Investigation issued a PSA confirming that a North Korean hacking group is responsible for the theft of approximately $1.5 billion in digital assets from the Bybit exchange. The FBI stated the hackers acted swiftly, converting portions of the stolen funds into Bitcoin and other digital assets and distributing them across thousands of addresses on multiple blockchains. These assets are expected to undergo further money laundering before ultimately being converted into fiat currency.

To prevent circulation of the stolen assets, the FBI specifically urged participants across the cryptocurrency ecosystem—including RPC node operators, exchange platforms, cross-chain bridge services, blockchain analytics firms, DeFi services, and other VASPs—to block all transactions associated with or originating from addresses used by the hackers for money laundering.

Market Movements

Suggested Reading

Podcast Notes | Bull and Bear Markets Intertwined, Can Bitcoin Reach $150K?

This article analyzes current trends in the cryptocurrency market, performance of Bitcoin and altcoins, macroeconomic policy impacts, and potential future directions. It also explores the potential influence of Trump-related policies, along with dynamics and investment strategies for major coins like Ethereum and Solana.

SEC Abandons Pursuit of Crypto Firms – What Shifts in Regulatory Stance?

This article discusses the SEC’s recent shift in regulatory approach toward the cryptocurrency sector, including dropping investigations into multiple crypto firms and establishing a crypto task force to promote a clearer regulatory framework. The task force aims to resolve legal uncertainties around crypto assets, clarify their classification as securities, and support compliant projects. This marks a significant transformation in U.S. crypto regulation, potentially reducing unnecessary litigation and accelerating industry growth.

Understanding Solana’s New Launch Platforms: Time.fun and Super.exchange

This article introduces two new asset launch platforms—Time.fun and Super.exchange—launched by the Solana ecosystem during a market downturn, analyzing their innovative models, potential, and risks. Time.fun is a social finance platform based on time tokens, allowing users to purchase celebrities’ time tokens for interaction, while creators maximize time value through transaction fees.

From High School Teacher to Ethereum Foundation President: Aya and Her Infinite Garden

This article traces Aya Miyaguchi’s journey from high school teacher to President of the Ethereum Foundation, highlighting her values and vision in advancing Ethereum’s development. Aya emphasizes Ethereum as an “infinite garden,” rooted in decentralization ideals rather than short-term gains. The piece also covers her leadership style, criticisms faced, and contributions to the Ethereum ecosystem.

Meme Coin Battle on Bear Chain: THJ Incubates Henlo to Become Traffic Gateway and Core Revenue Tool?

This article focuses on the meme project Henlo within the Berachain ecosystem, detailing its unique positioning as a community cultural representative, growth potential, and deep integration with the ecosystem. Incubated by The Honey Jar, Henlo aims to become Berachain’s primary traffic gateway and core revenue instrument, leveraging innovative token mechanics and community-driven models to drive broad participation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News