Reflecting on the cycle changes of this crypto bull market, how to formulate an effective selling strategy?

TechFlow Selected TechFlow Selected

Reflecting on the cycle changes of this crypto bull market, how to formulate an effective selling strategy?

A specific exit strategy must be established before entering into a trade.

Author: Finish, crypto KOL

Translation: Felix, PANews

This cycle has been extremely difficult, worse than any previous one. Many have even called it a "crime cycle" due to the growing number of scammy rugs and fraudulent projects.

The purpose of this article is to reflect on the past and attempt to predict what comes next.

Pump.Fun is Born

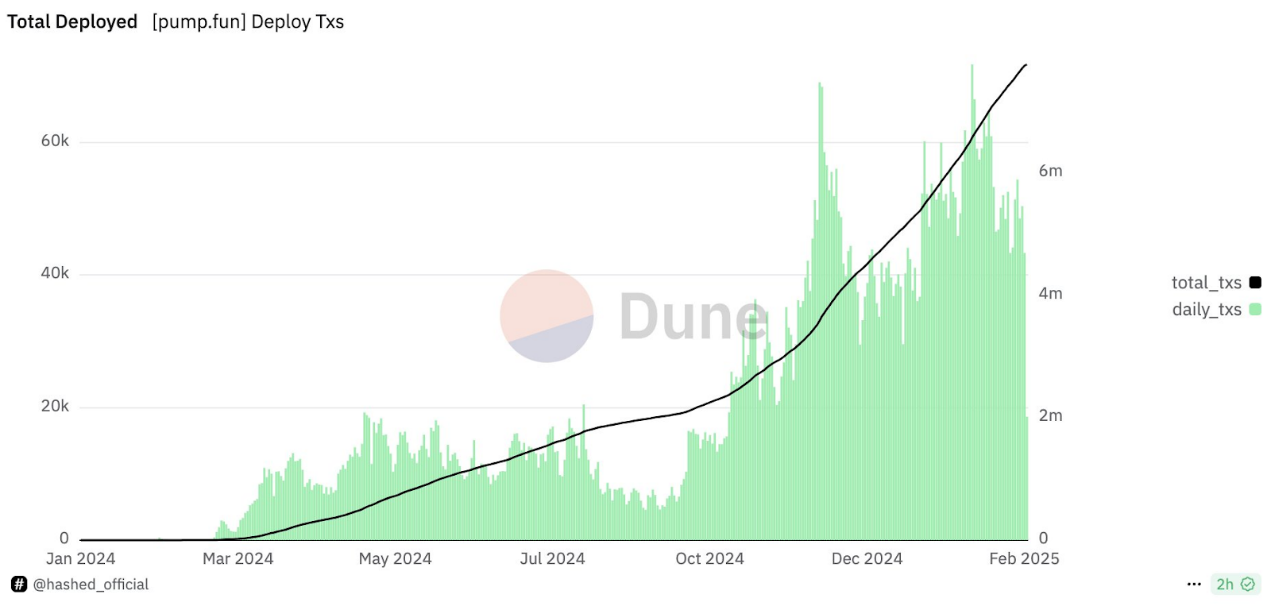

On January 19, 2024, Pump.fun launched, forever changing the landscape of meme tokens. Regardless of age, profession, or nationality, anyone now had the opportunity to launch a token.

The initial hype was modest, but by last March, with the emergence of tokens like MICHI and FWOG, Pump.fun began its rise. The ability for nearly anyone to launch a meme in seconds transformed the entire crypto space.

Pump.fun offered a fair launch model bundled with numerous tokens, eliminating insider dumps. While this seemed positive, it also extracted massive fees.

Since its launch, Pump.fun has earned over 2.86 million SOL, approximately $577 million. It may be one of the most successful startups ever.

This liquidity has been permanently withdrawn and captured by Pump.fun developers, one of the key factors that makes this cycle unique.

Bitcoin Halving

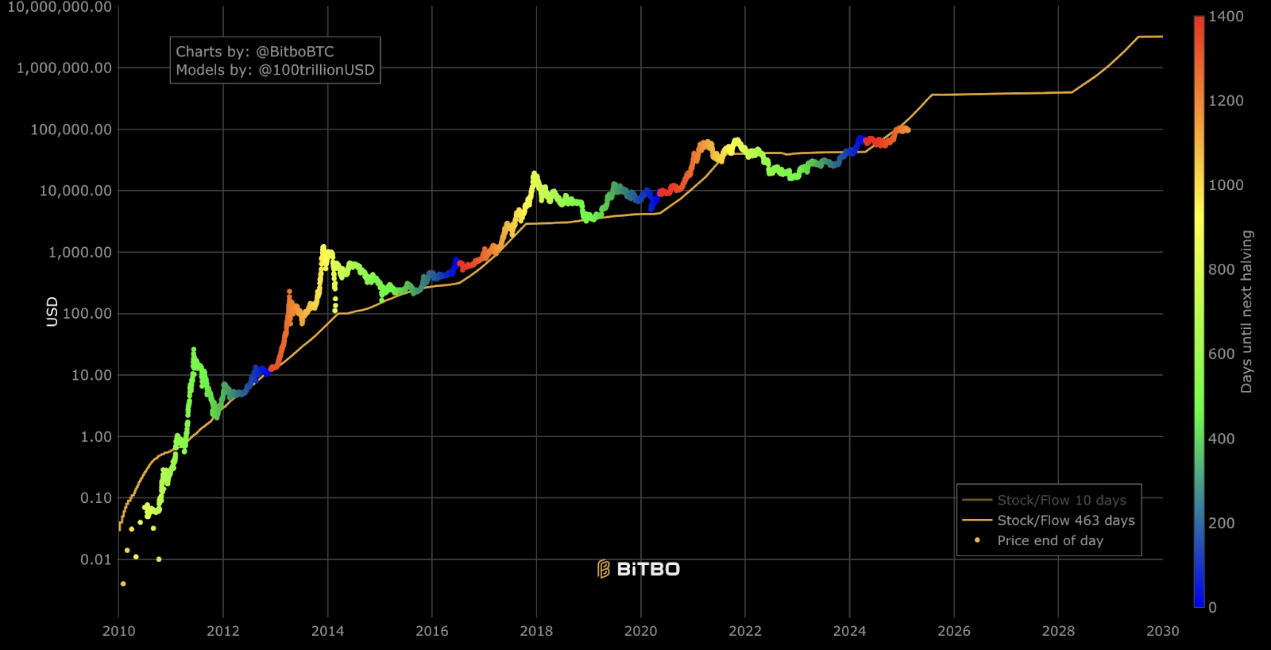

Next came one of the most critical moments in this cycle. On April 20 last year, the BTC block mining reward decreased from 6.25 to 3.125 coins. With the first ETF approved on January 10, many anticipated the halving would be a "sell the news" event—but instead, a new all-time high followed.

The combination of ETF approval and the Bitcoin halving created the most bullish setup imaginable, as many had been waiting for institutional liquidity to begin flowing in—and that's exactly what happened. Fidelity, BlackRock, and MicroStrategy have been buying daily, injecting increasing amounts of liquidity.

This gave traders hope. Many assumed this cycle would mirror the last, but this time, everything was different. The market consistently moved against the "crowd."

What You Expect Is Your Problem

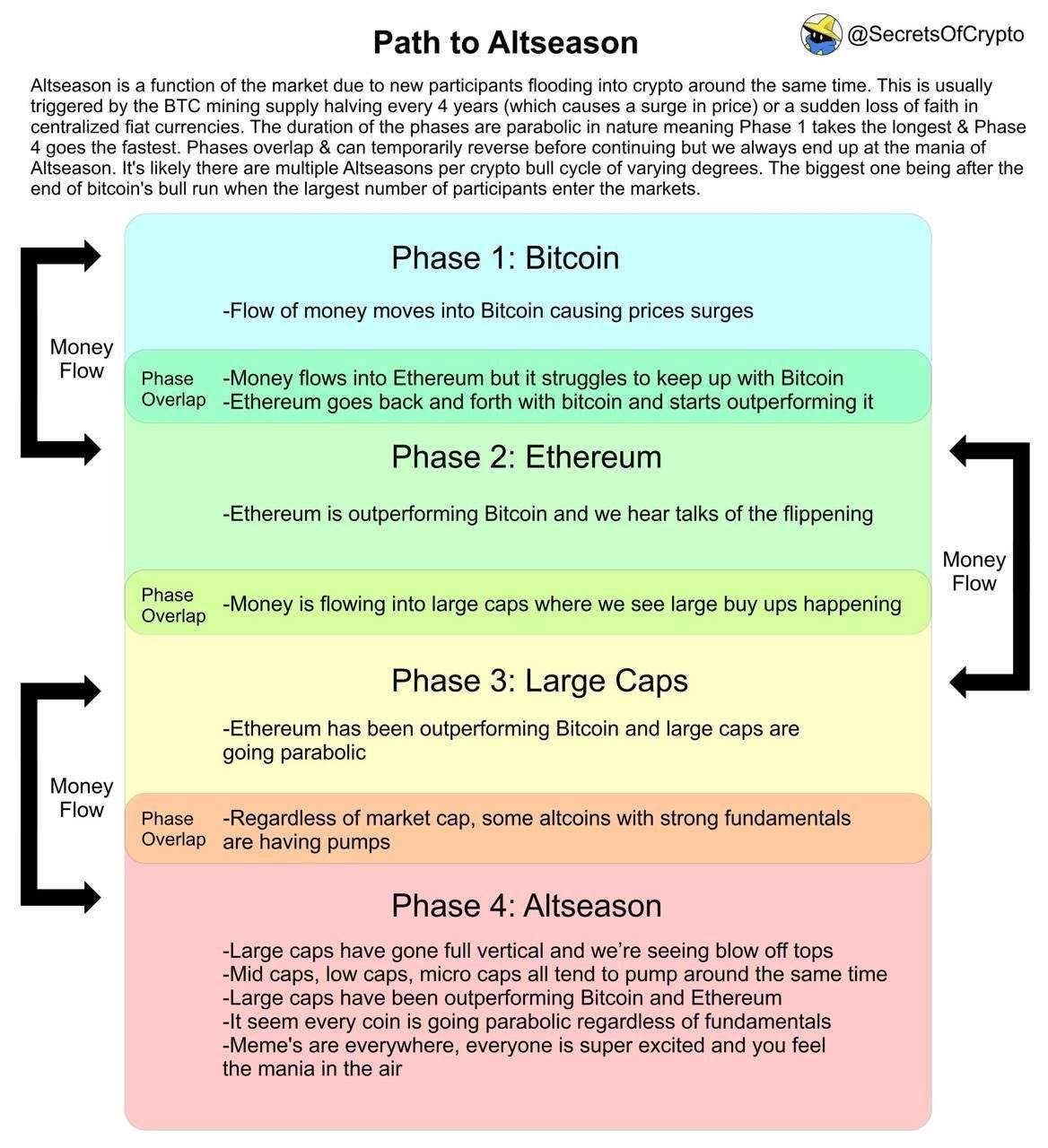

Looking back at the 2017 and 2021 cycles, they were actually very similar. Making money wasn't hard and didn't require special knowledge. Back then, there were only 10-20 altcoins everyone knew about, which people simply accumulated.

BTC would rise first, followed by ETH as the beta play of the cycle, often delivering higher returns. Then momentum would shift from ETH to altcoins, moving from high-market-cap to low-market-cap assets.

This led many to decide in 2024 to skip the BTC phase entirely, jumping straight into ETH or altcoins. If ETH could return 5x and major altcoins even 10x, why wait for BTC’s 2-3x?

The logic was simple, yet the "crowd" failed to consider that this cycle might be different. The number of projects, tokens, and memes is now hundreds of times greater than before. People bought familiar tokens like DOT, ATOM, and ADA, expecting 10x returns.

It turned out that when liquidity shifted to altcoins, the sheer volume—especially of new altcoins—left older ones behind.

Frauds Are Different Compared to 2021

Crypto KOL OverDose made a valid point: in 2021, scammers needed creativity to pull off a "rug," and users who weren’t overly greedy could often exit in time.

-

Do Kwon’s Terra $LUNA

-

Sam Fried’s FTX

-

3AC had long-term investments before collapsing

-

Alameda pushed narratives and manipulated markets

Back then, fraud required intelligence. Today, it's simply about leveraging big names, celebrities, and even presidents to promote garbage projects.

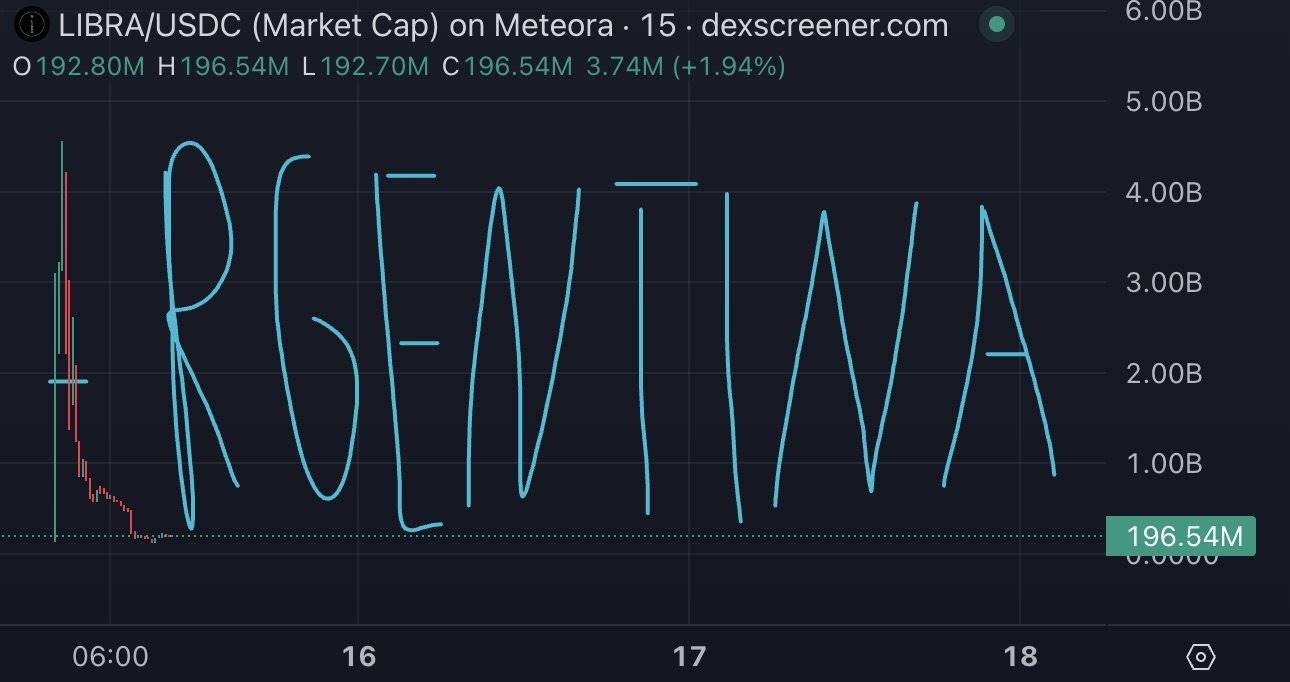

Players have grown accustomed to gambling, experiencing FOMO on TRUMP and MELANIA, trying to profit on CAR or LIBRA—only to suffer heavy losses.

I personally know 10-15 skilled traders who heavily invested in LIBRA (up to $1 million), while insiders dumped over $100 million onto them.

Time for a Change

It's time to realize cycles will never repeat the same way. Altcoins are no longer just "beta plays" to BTC or ETH—they represent a completely different niche with more risks and opportunities.

You can't expect DOT or ATOM to rally just because BTC broke ATH in 2021 and dragged altcoins up.

Undoubtedly, individuals remain bullish on BTC and believe it will continue to be one of the best compounding assets over the next 10-20 years, but returns will resemble those of stocks—no more easy 200% annual growth.

Key lessons to take from this cycle:

-

Holding without a plan is cowardly. If you don't sell at the right time, you risk losses. Murad kept advocating holding; since ATH, nearly all his memes have dropped 80-90%.

-

You need a clear exit strategy. This may sound harsh, but the market demands predefined selling rules before entering any trade.

-

Narrative rotation. We've seen wild shifts—from memes to AI agents to TRUMP. Falling behind at any point can erase most gains. Always follow the narrative and remember liquidity is finite.

-

Being timely beats being early. Don’t overthink—rotate when the timing is right.

-

No matter how much you believe in a protocol, secure steady profits and keep accumulating Bitcoin. Bitcoin still outperforms most stock or real estate opportunities.

Hopefully, this cycle isn’t over yet. The current BTC consolidation will determine what happens in the next 2-3 months.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News