Behind customer service disputes, who will fill the BSC product debt black hole?

TechFlow Selected TechFlow Selected

Behind customer service disputes, who will fill the BSC product debt black hole?

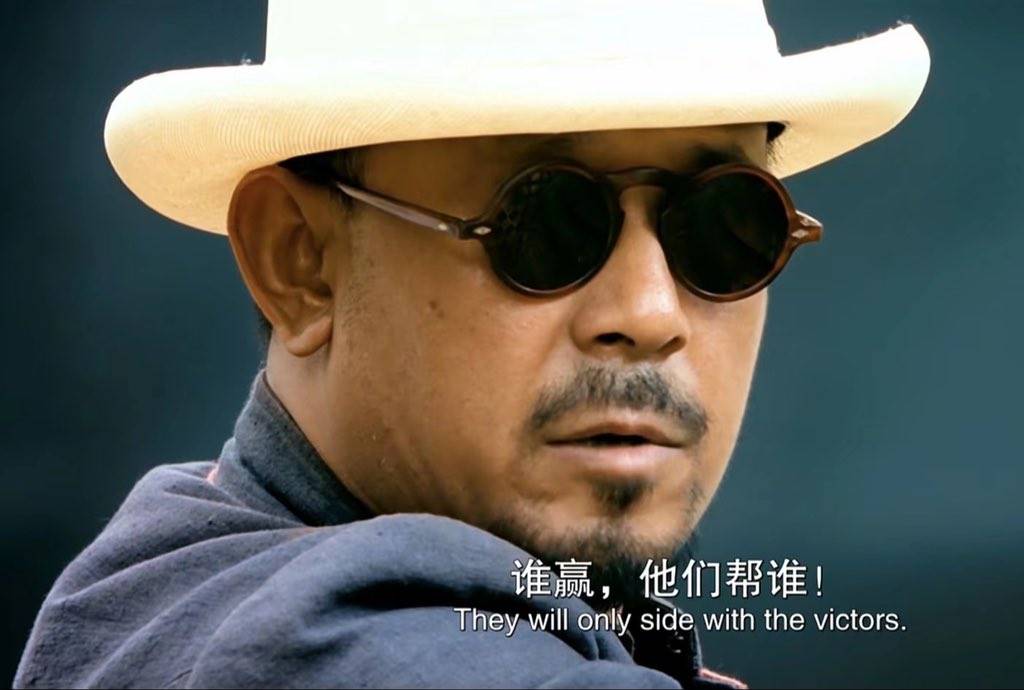

Whoever wins, users will follow.

By: TechFlow

BSC has been buzzing lately.

As the wealth effect of TST reignites attention toward the BSC ecosystem, MyShell launches its IDO at a "welfare-level" valuation of $20 million, and CZ’s dog-themed tokens fuel degens’ enthusiasm;

The on-chain狂欢 is always paid for by someone else.

A traffic surge specifically targeting BSC unexpectedly turned into a Waterloo for Binance's Web3 infrastructure.

If you've browsed social media these days, you must have seen complaints about Binance wallet’s poor user experience and weak infrastructure. The eruption of long-standing community grievances first hit BSC's community management and marketing teams.

The Technical Debt Behind Customer Service Controversy

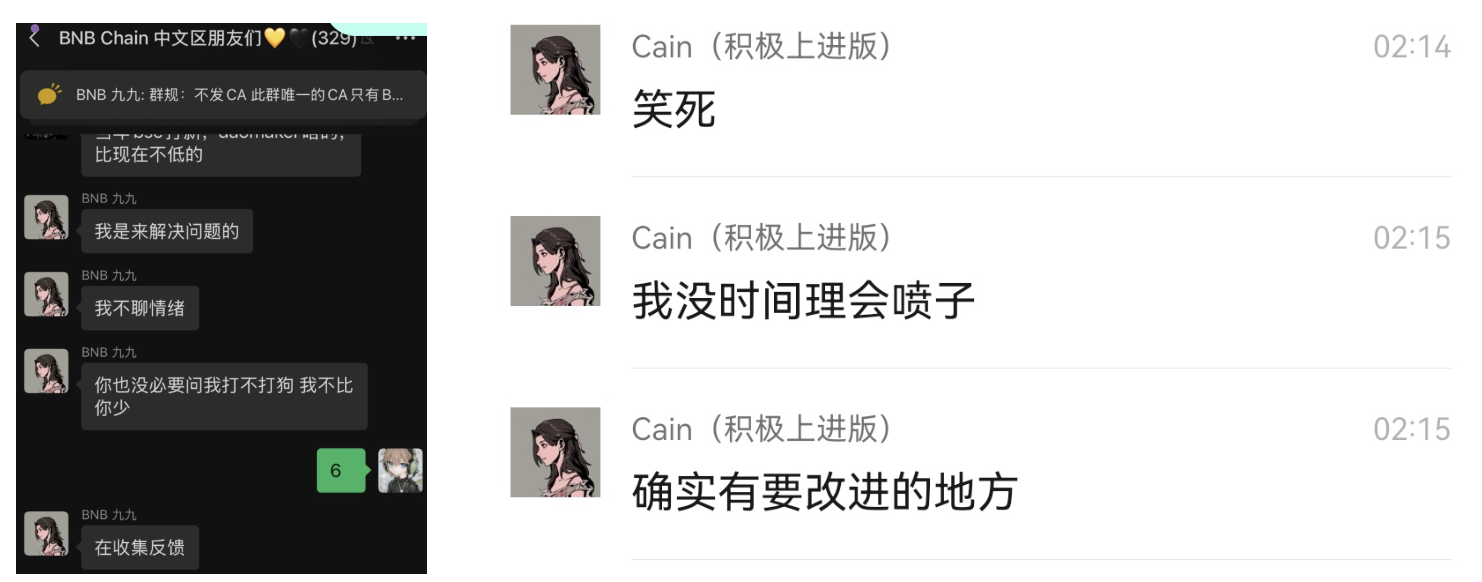

Well-known crypto KOL yuyue (@yuyue_chris) posted this morning an open complaint titled "Urgent Public Complaint Regarding Severe Negligence and Brand Damage by BNBChain Marketing Staff," pointing fingers at Jiujiu, customer service and manager of the BSC Chinese community.

From the conversation snippets shared by yuyue, it's clear that the marketing team representative failed to deliver adequate emotional support when responding to user feedback on BSC's performance—coming off as blunt and cold instead.

Responses like “I don’t have time to deal with trolls” and “I hunt scammers no less than you do” easily escalate tensions when users are already anxious due to technical issues.

And when users complain about repeatedly failing to make purchases, a sarcastic retort such as “Sol never goes down?” unintentionally pours oil on the fire—doing nothing to calm emotions and potentially worsening conflict.

To be fair, customer service and marketing reps are human too. Facing technical limitations, they bear both public pressure and internal responsibility to find solutions—often caught in the middle and unappreciated. Some frustration is understandable.

Some Twitter users commented that the accumulated anger shouldn't fall solely on Jiujiu—"battling public criticism, running around nonstop, opening Twitter only to be attacked"—this kind of stress takes a mental toll. The real targets should be the product managers behind the chain and wallet...

This seemingly ordinary customer complaint is actually the inevitable explosion of accumulated technical debt.

There's naturally a gap between users' smooth transaction expectations from migrating from the SOL ecosystem and their actual BSC experience. If you search keywords like “BSC chain” or “Binance Wallet” on Twitter, you'll find existing complaints about product flaws.

BSC marketing staff may need to simultaneously play three roles: technical interpreter (explaining chain characteristics), emotional therapist (soothing user anxiety), and brand ambassador.

Under such multiple pressures, poor communication from a community manager triggers PR crises. But when usability problems become deeply entrenched, what we really need to examine is the misalignment between technical infrastructure capabilities and market expectations.

This isn't just one person's problem—the underlying resentment involves technology, user experience, listing processes, even organizational structure. It resembles more a crisis of brand trust and anxiety sparked by customer complaints.

The Unsellable Pork Chop Rice

If yuyue’s mention of “poor communication attitude among marketing personnel” still falls under individual issues, yesterday’s MyShell IDO exposed broader technical flaws.

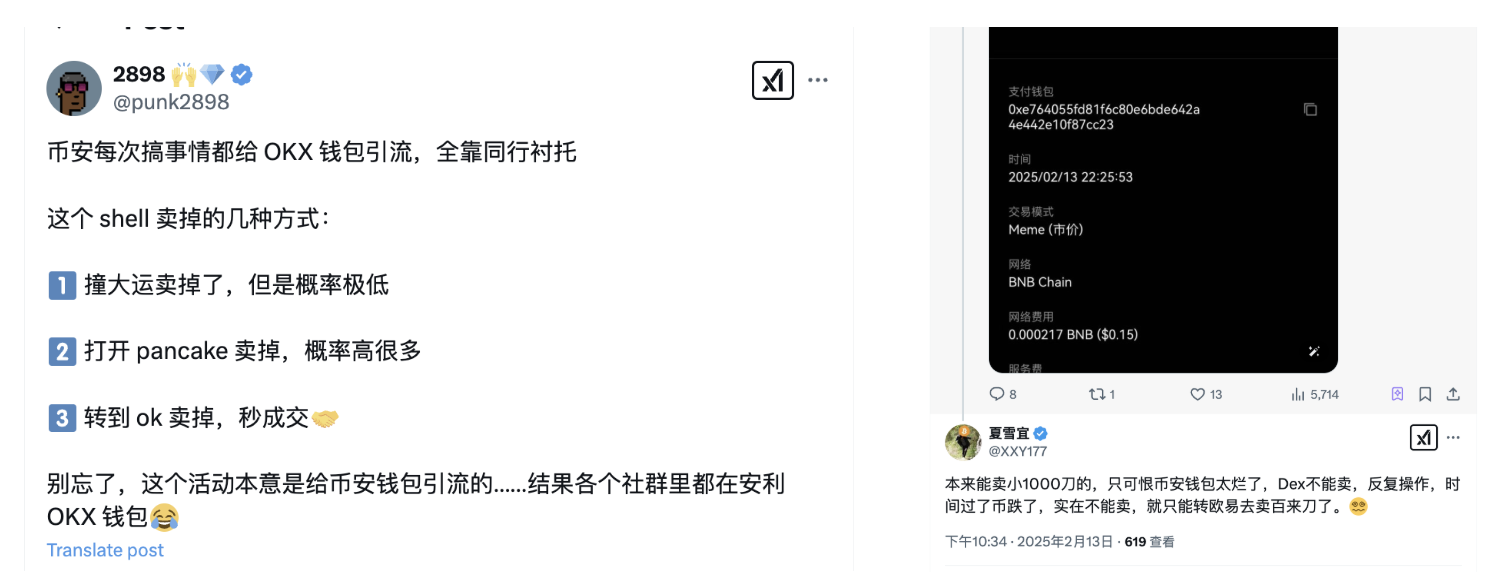

The $SHELL token IDO, conducted simultaneously on Binance Wallet and PancakeSwap, attracted significant attention and real capital. With its low initial valuation, oversubscription briefly exceeded 100x.

Yet in stark contrast, after the IDO ended, users eager to claim and trade their tokens were met with repeated roadblocks.

For example, some users pointed out that the Binance Wallet is an MPC wallet tied to CEX KYC identity. If you choose to export private keys, the original wallet becomes invalid. Meanwhile,

Purchased $SHELL cannot be directly sold within the Binance Wallet due to the small pool size.

Even more confusingly, using the same wallet to connect to PancakeSwap shows no assets, nor can users see corresponding BEP-20 holdings on BscScan...

In today’s hyper-competitive PVP market, racing against time is critical.

Due to poor wallet experience, users often watch new token prices drop helplessly, unable to sell—causing the returns from their “pork chop rice” to shrink continuously. After accounting for time cost and asset transfer fees, the outcome might even be a net loss.

Previously, some argued that MyShell’s TGE served as a stress test for Binance Wallet—handing out benefits while evaluating how much load the performance and experience could handle.

But judging from current results, the pressure clearly backfired onto Binance itself.

Then in the early hours today, CZ’s dog-themed tokens appeared, further igniting degens’ rush—but also further exposing the fragility of BSC, Binance Wallet, and related ecosystem technologies, causing noticeable network lag that impacted trading experience.

One degen joked: "Only after experiencing Binance’s Web3 wallet do you realize how robust the SOL chain truly is."

The author has no intention to fuel rivalry between blockchains or take sides. But amid the flood of Twitter posts right now, the issues users raise about BSC and Binance Wallet cannot be ignored.

Competitors Become Lifeguards—A Dark Comedy

More ironically, the inability to claim and sell SHELL tokens gave OKX Wallet a surprising traffic boost.

After SHELL’s TGE, users who couldn’t immediately sell via Binance Wallet—including the author—chose to withdraw SHELL to OKX Wallet for sale.

This has a darkly humorous twist... A marketing event and ecosystem project from one platform ultimately relies on a competitor’s wallet to solve the last-mile selling problem.

From a user perspective, loyalty is actually a rather abstract concept.

Especially when watching token prices fall but being unable to sell—it feels exactly like a car sinking into water with the water level slowly rising. At that moment, you won’t care which brand the window-breaking hammer is from.

As long as it breaks the glass and lets you escape liquidity, who cares which wallet you’re actually using? And unless necessary, why would anyone switch hammers?

When on-chain tokens have liquidity but your own wallet fails to display or enable trading, the trend of voting with feet becomes obvious—after all, your drawdown is real money.

It’s unfortunate and ironic that BSC generated targeted traffic and attention for itself but failed to capture it, instead gifting a windfall to rival wallets.

This isn’t limited to MyShell’s token selling phase—it happened again during last night’s dog-token rush.

When their native wallet couldn’t handle the traffic and excitement, many prepared an OKX wallet or third-party bot wallet alongside, ready to charge in as soon as CZ announced the dog names.

When too many people rushing caused network congestion or failed transactions, bot-linked wallets could speed up purchases by increasing gas fees, while OKX Wallet offered similar meme trading modes designed for rapid execution on trending assets.

So What Now?

Looking back, massive traffic and opportunities require robust, functional infrastructure to support them. Without it, users will naturally flock to better alternatives.

Position doesn’t matter—interests do. What can we learn from this incident?

First, competition between chains and exchanges has now genuinely entered the stage of user experience warfare.

The prosperity of an ecosystem no longer depends merely on TPS or gas fee metrics, but on the sum of tool smoothness, exception handling mechanisms, and loss recovery pathways.

Do it well, and you achieve twice the result with half the effort; do it poorly, and you risk losing both brand reputation and users.

Second, on-chain wallets have become de facto traffic distributors. The entry experience when users first interact with a DApp determines their sense of belonging and future habits within the ecosystem.

Third, when users have already developed self-help strategies (switching to other wallets), compensation measures—or sincerity—must directly address the experiential gaps left by competitors, not just another AMA or slogan-chanting session.

Talk is cheap, show us products.

This absurd stress test felt eerily reminiscent of Zhang Mazi’s metaphor in *Let the Bullets Fly*: “Whoever wins, the users follow.”

When once-in-a-lifetime fortune arrives, it’s never grand statements on Twitter that secure it—but the smooth click of the “confirm” button inside a wallet—because in the era of on-chain MEMEs, every second of lag is hand-carving a moat for your competitors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News