Opinion: Base up, BSC down

TechFlow Selected TechFlow Selected

Opinion: Base up, BSC down

Aerdrome incentivizes ecosystem projects by bribing miners, creating a flywheel effect. In contrast, similar products on BSC have not achieved comparable results.

Author: CapitalismLab

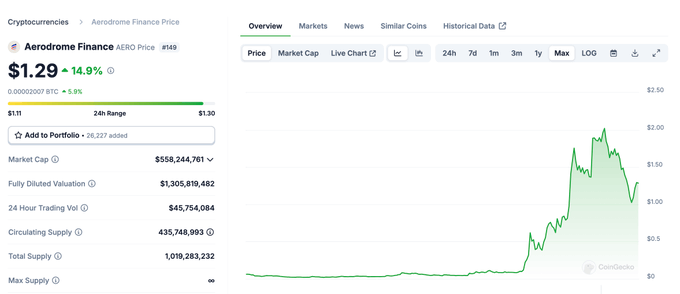

Aerdrome has completed a full price cycle. A single project on Base drove the ecosystem to peak valuations of $1B market cap and $2B FDV—delivering 100x returns—and flexed its muscle, generating positive externalities that further energized the Base ecosystem.

In contrast, BSC this cycle remained silent even after major catalysts were confirmed. Where lies the gap? This thread uses this as an entry point to analyze and critique the differences between two CEXs reflected on-chain.

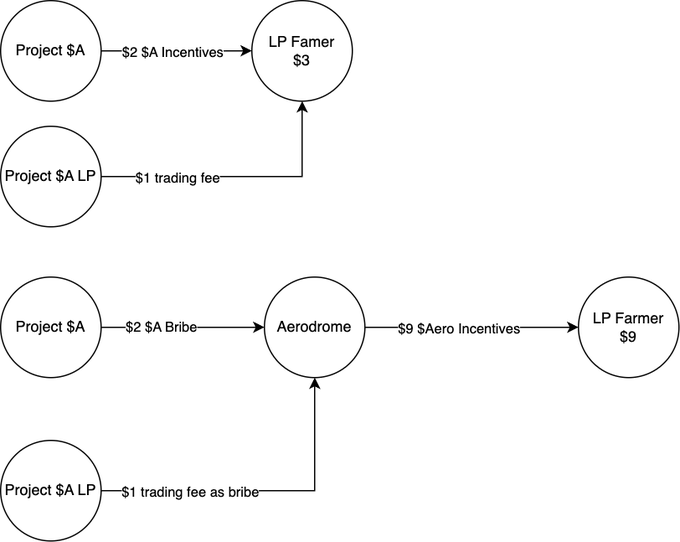

Coinbase’s support for Aero is very straightforward. As shown in the image below, previously projects incentivized DeFi farmers directly—for example, a $2 worth of project tokens, plus an additional $1 from DEX trading fees, totaling $3 for the farmer.

Under Aero's ve(3,3) DEX model, that same $3 is instead used to bribe veAero holders. In return, veAERO voters allocate higher-value $Aero tokens (e.g., worth $9) to liquidity providers.

Ultimately, the project still pays $3. The veAero stakers (long-term lockers) receive real yield of $3, while farmers get $9 in incentives—effectively tripling the incentive efficiency.

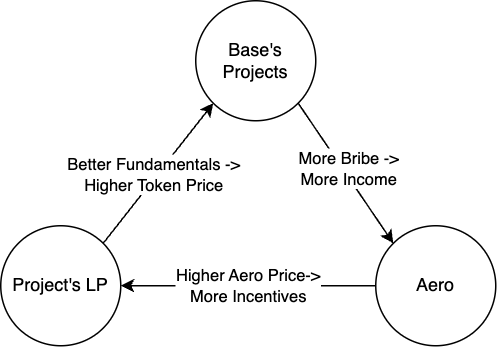

The higher the Aero price, the greater the value of distributed incentives, which boosts fundamental strength across Base-native projects. Stronger projects can then offer more valuable token bribes back to veAero, increasing revenue and driving up Aero’s price—creating a powerful flywheel effect.

Moreover, if Base directly funded on-chain projects, it would risk favoritism and off-chain politics, and couldn’t easily support grassroots or meme projects publicly. These types of projects bring traffic. By backing Aero, Base enables permissionless incentives across the ecosystem—any project can amplify its rewards through the Aero system. The benefits to ordinary developers far surpass what official grants could achieve.

Now looking at BSC—does it have similar products? Not only does it, but at both developer and product levels, they arguably outperform Base.

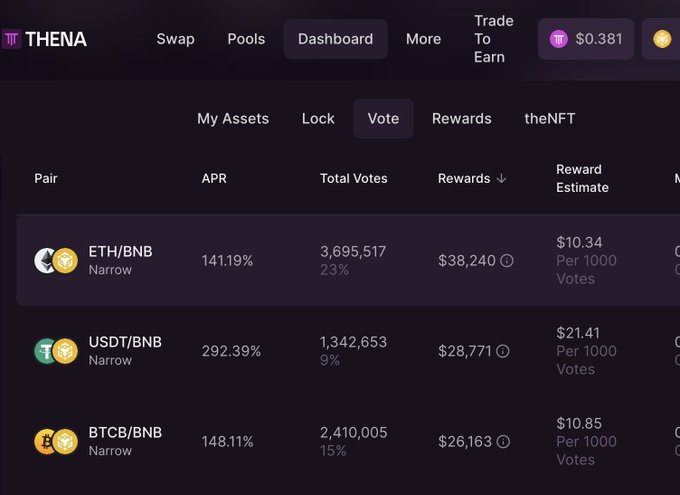

Thena is essentially an enhanced version of Aerodrome, supporting V3 concentrated liquidity.

PancakeSwap combined with Cakepie creates an even stronger dual-flywheel mechanism with higher ceilings.

Although we previously criticized the Cake Wars for falling short compared to Pendle War (borderline self-promotion), and PancakeSwap's iterations were slow, preventing the flywheel from fully forming, compounded by their refusal to adopt advanced ve(3,3) models where trading fees go to voters—instead reserving nearly half the voting power for manual control by the team (power is addictive, who would willingly let go?).

Still, when compared horizontally, BSC may fall short of leaders but clearly exceeds many others—for instance, ARB’s flagship Camelot has been waiting over a year without getting voting gauge allocation.

The Cakepie/Magpie team is exceptionally capable—an anomaly on BSC—and has achieved success with subDAOs on other chains. Thena hasn't yet proven itself cross-chain, but product-wise, it's faster and better than Velo/Aero variants.

Given that BSC has stronger foundational products and developers, why hasn't it achieved results comparable to Base? Why did Mantle’s ve(3,3) DEX Moe generate more buzz this cycle than anything on BSC?

A closer look reveals a shocking truth: Binance’s support isn’t zero—it’s negative… actually negative…

Yes, not only do the above-mentioned projects lack investment or listing support like Aero received, but as shown in the figure, addresses explicitly marked as Binance—and another suspected Binance address (inferred by the Cake community)—have collectively locked 26% of veCAKE, directly competing with ecosystem projects for rewards. Since each round of dividends and incentives is fixed, more held by Binance means less left for actual ecosystem participants.

Half the voting power is retained by the Pancake team, and now Binance takes another large chunk—severely undermining the system. Normally these tokens would be injected into ecosystem projects for support. Here, instead of nurturing the ecosystem, Binance actively competes against it. Surely Binance doesn’t need this small slice of Pancake’s income distribution…

Is ve(3,3) hard to understand? Last cycle, both the Curve War between Yearn (by AC) and Convex, and Terra/Luna’s purchase of CVX to control Curve governance in order to boost UST adoption, were major focal points. For seasoned Web3 players, this is basic knowledge.

This cycle’s 100x gems Pendle and Aero both adopted this model—even Cake stabilized and rebounded thanks to it.

Did Binance allocate resources on BSC toward superior projects? How do NFP, Cyber, ID, Hook—projects receiving investments and listings on Binance—compare to Aero?

Setting aside widespread criticism about poor project quality, these initiatives lack positive externalities and operate in isolation. Coinbase turns one dollar into three dollars of ecosystem incentives via Aero; Binance burns ten cents with no return, creating adverse selection for developers.

In fact, this adverse selection is already in motion—developers are jumping ship.

The Thena team is focusing on IntentX, a new project on Base. Magpie’s latest subDAO is also prioritizing ETH-based ecosystems. While most earnings will eventually flow back to MGP on BSC, how sustainable is it for the main DAO to remain long-term on a chain that lacks synergy with its newer subDAOs?

In summary, the key difference lies here:

Coinbase strategically allocates resources to projects with positive externalities for the Base ecosystem—turning every dollar into triple impact—and investing in top-tier developers to attract more high-quality builders.

Binance funnels funds into BSC projects lacking positive externalities, wasting capital, while actively undermining those few projects that do benefit the ecosystem—appearing clueless about Web3 principles—and driving away elite developers.

This thread uses ve(3,3) DEXs as just one narrow example, but it reflects broader systemic issues—a microcosm of deeper problems.

Base hasn’t launched a separate token, and BNB has recently outperformed the market due to frequent new listings. But token price growth ultimately depends on imagination and narrative. If BSC could become more flexible and supportive of on-chain innovation, BNB’s upside potential could expand significantly. We’ll continue monitoring future developments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News