U card热度 surges, but beware of potential tax and legal risks

TechFlow Selected TechFlow Selected

U card热度 surges, but beware of potential tax and legal risks

U Card offers cryptocurrency investors an excellent off-chain payment solution with its strong privacy, convenient payments, and low transaction fees.

Author: FinTax

Introduction

In recent years, with the rapid development of cryptocurrency markets and digital payment technologies, exchanges, wallet service providers, and others have successively launched their own U cards. U cards have become tools for an increasing number of Web3 users to conduct cross-border payments and daily spending. At the same time, discussions about U cards on various social media platforms have grown explosively, making U cards a hot topic. Some view them as a key solution to OTC cryptocurrency challenges, while others remain cautious or even skeptical. This article by FinTax will introduce you to the basics of U cards and specifically highlight the tax and other risks associated with U cards that should not be overlooked.

1. Concept of U Cards

1.1 U Card

A U card is a financial tool designed for cryptocurrency investors. Its usage resembles that of a traditional bank card—holders can directly spend or withdraw cash via the U card without first manually converting cryptocurrencies into fiat currency.

U cards are divided into two main categories: physical and virtual. Physical U cards, such as Mastercard U cards or UnionPay U cards, enjoy broader acceptance. Virtual U cards like Dupay are primarily used for e-commerce or international payments, offering greater convenience and flexibility, though they cannot be used to withdraw cash at ATMs.

Common U card issuance models include the following:

-

Direct issuance by banks. Banks leverage their own payment networks and compliance frameworks to offer users stable cryptocurrency payment solutions.

-

Joint issuance by banks and cryptocurrency companies. In this model, banks provide traditional financial infrastructure, while third-party companies manage cryptocurrency handling and conversion.

-

Independent issuance by specialized crypto payment firms. Some companies focused on cryptocurrency payments independently issue U cards through partnerships with payment networks such as Visa or MasterCard.

-

Co-issuance via SaaS model. This refers to third-party payment companies offering U card issuance platforms to distributors or other financial service providers via a SaaS (Software-as-a-Service) model.

1.2 How U Cards Work

The ease of use is one of the main reasons why U cards have gained widespread adoption. We can understand their mechanism in two steps:

-

Funding: Users deposit USDT into a wallet, then transfer USDT from the wallet address to the U card address. The U card provider then settles the USDT into the corresponding foreign currency.

-

Withdrawal or Spending: Users can withdraw cash from ATMs worldwide using the U card, or make direct purchases. At the point of payment, the transaction is conducted in converted fiat currency, not USDT.

2. Why U Cards Are Popular

2.1 Privacy Protection

Web3 users often place high importance on personal privacy, including transaction anonymity, and prefer to remain anonymous during payments or transfers. U cards offer strong privacy protection mechanisms. On one hand, virtual U cards typically do not require real-name registration, allowing users to purchase or top up anonymously. On the other hand, although physical U cards may require some level of KYC verification, they still significantly reduce the risk of exposing personal information compared to traditional banking transactions, which demand extensive personal data.

2.2 Simplified Payment Process

U cards typically enable real-time payment and settlement, eliminating potential delays associated with traditional bank transfers and removing the need to manually convert USDT into fiat before use, thus offering significant convenience. Additionally, beyond traditional POS payments, U cards support digital wallets and QR code payments, making them compatible with various mainstream payment channels and highly flexible.

2.3 Lower Cross-Border Payment Costs

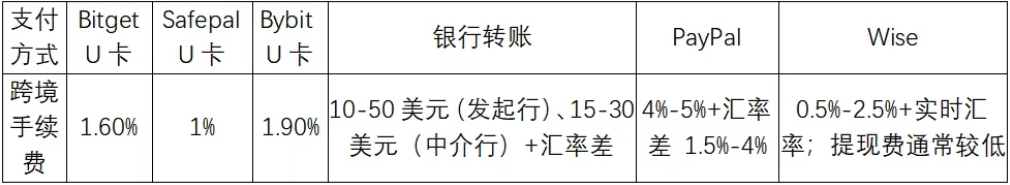

U card fees are often significantly lower than those of traditional payment channels, especially evident in cross-border transactions. The following chart compares cross-border fees across multiple payment methods:

3. Potential Risks of U Cards

3.1 Tax Risks

Due to their support for anonymity or minimal real-name requirements, some users attempt to use U cards for tax avoidance—for example, concealing income sources to reduce taxable amounts. However, such tax avoidance via U cards is actually unfeasible. First, although U cards offer some degree of anonymity, most still rely on international payment networks (such as Visa or Mastercard), which meticulously record every transaction—including amount, merchant details, and timestamp. Therefore, tax authorities can still trace fund flows through these records. Second, for cross-border transactions, tax authorities can also monitor capital movements via foreign exchange surveillance systems and interbank information sharing. Many countries have signed agreements on automatic exchange of tax information (CRS, Common Reporting Standard), making cross-border fund flows relatively transparent. Through these means, tax authorities can obtain transaction data related to U cards. Finally, in practice, payment platforms may conduct strict real-name reviews on large transactions. If a user engages in frequent high-value fund movements, the platform may require additional documentation proving the legitimacy of fund sources. Thus, attempting tax avoidance via U cards is not only ineffective but may also trigger tax audits and penalties.

3.2 Legal Risks

Several legal risks must also be considered when using U cards. For instance, in countries with strict foreign exchange controls, although U cards may not impose individual limits on holding or withdrawing USD, transferring funds abroad exceeding foreign exchange quotas may violate foreign exchange regulations. If detected by foreign exchange authorities, individuals may face administrative fines or even criminal charges. Additionally, in some countries where the legal status of cryptocurrency remains unclear—or where its use is outright banned—using cryptocurrency-based U cards for transactions could be deemed illegal. Therefore, users should understand the basic compliance requirements of their respective jurisdictions before using U cards. Moreover, users must never use U cards as tools for illegal activities. For example, conducting high-frequency, large-value transactions or assisting others in cashing out funds may be classified as illegal business operations or money laundering, potentially leading to criminal liability.

4. Conclusion

In summary, U cards have earned wide acclaim by offering strong privacy, convenient payments, and low fees, providing cryptocurrency investors with an excellent off-chain payment solution. However, U cards are not without flaws. Users still face potential issues such as tax and legal risks, which must be approached with caution—otherwise, the consequences may outweigh the benefits.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News