January Market Review: $TRUMP Captures Market Attention, DeepSeek Ignites Market Buzz (With List of Tokens to Watch)

TechFlow Selected TechFlow Selected

January Market Review: $TRUMP Captures Market Attention, DeepSeek Ignites Market Buzz (With List of Tokens to Watch)

The entire Memecoin market has almost been eliminated by the market.

Author: Viktor

Translation: TechFlow

Key Events in January:

-

The main focus this month was the launch of the $TRUMP token, followed by the introduction of the $MELANIA token and related inauguration events. However, I will discuss these topics in detail in the following sections.

-

In January, three major centralized exchange (CEX) tokens were launched on Binance: $BIO (core protocol for decentralized science, DeSci), $SONIC (possibly a Solana-based gaming Layer 2), and $ANIME (token of the Azuki ecosystem). However, since their token generation events (TGEs), these tokens have generally seen downward price trends. The same applies to $VVV, an AI project launched by Erik Voorhees, which has dropped -65% since its listing on Coinbase.

-

On December 31, Elon changed his Twitter name and profile picture to "Kekius Maximus," causing the market cap of the memecoin $KEKIUS to surge from $1M to $400M. However, after reverting his name and avatar on January 1, $KEKIUS quickly fell back to $80M and closed the month at $40M.

-

The Base-based memecoin $TOSHI launched on January 14, doubling in price within a short time. In the following days, prices went into overdrive, surging nearly 8x within three days despite extremely negative funding rates, before eventually falling -40% from its peak. This rally also boosted other Base-based memecoins such as MIGGLES, MIGGLES, BENJI, $KEYCAT, $DOGINME, and $MOCHI.

-

Abstract, a Layer 2 developed by the Pudgy Penguins team, officially launched on January 28. However, the announcement triggered a classic "sell-the-news" reaction, causing $PENGU to plummet 44% over two days.

-

CME announced on January 22 that it would launch futures for $XRP and $SOL on February 10, signaling progress toward potential ETF approvals for both tokens. Although the news initially sparked a price increase, gains were quickly erased, reflecting weak market sentiment.

-

Bitwise filed applications for ETFs (exchange-traded funds) of $DOGE and $LTC on January 21 and January 24, respectively. While $DOGE saw a muted market response, $LTC showed strong performance immediately after the filing announcement.

-

Over the weekend of January 26, the entire tech industry was shaken by a Chinese AI startup named DeepSeek. The company unveiled a highly cost-effective AI model capable of matching industry giants with significantly reduced resource consumption. This news caused panic-driven sell-offs in traditional financial markets before opening hours, leading to sharp declines in $BTC and other altcoins when CME opened. On Monday, January 27, $NVDA stock dropped -17%, while $BTC fell from $105k to $98k within hours.

-

Thorchain ($RUNE) faced technical insolvency, with liabilities exceeding $200 million on BTC and ETH, forcing it to suspend all lending and savings services. As a result, $RUNE's price dropped -52% during January. The community is currently actively seeking recovery solutions.

Main Narratives in January:

Inauguration and News-Driven Price Movements of $BTC

In January, $BTC’s price movements were primarily driven by news. Prices rose strongly at the beginning of the month, reaching $102k on the first trading day of the year (January 6). However, positive employment data released on January 7 suggested lower chances of rate cuts, directly pushing $BTC below $100k and down to $92k by January 10. On January 13 (Monday), prices briefly dipped below $90k before bottoming out and rebounding rapidly, recovering to $100k within two days and climbing to $106k by January 19 (the day before the inauguration).

However, on inauguration day, the launch of the $MELANIA token pushed $BTC below $90k again. Yet, just hours before the ceremony, we witnessed $BTC reach a new all-time high (ATH) of $109k. The market pattern during this period remained consistent: prices rose ahead of events due to investor speculation about a possible Bitcoin Strategic Reserve (BSR) announcement, but declined once no such announcement materialized.

Finally, on January 23, the U.S. issued an Executive Order (EO) regarding cryptocurrency. It established a digital asset task force responsible for “recommending regulatory and legislative proposals related to digital assets.” One recommendation specifically mentioned “the potential creation and maintenance of a national digital asset reserve.”

The market initially reacted positively, especially altcoins, which could potentially be included in such a reserve. However, as it became clear that this was far from an actual SBR, prices stagnated. Substantial progress in this area is expected to take months.

As previously mentioned, $BTC crashed on January 27 due to the DeepSeek news but later recovered to $106k and ultimately closed at $102k, recording a +10% monthly gain (in contrast to most altcoins posting red candles, $BTC’s market dominance continued to rise).

Launch of TRUMP and MELANIA Tokens

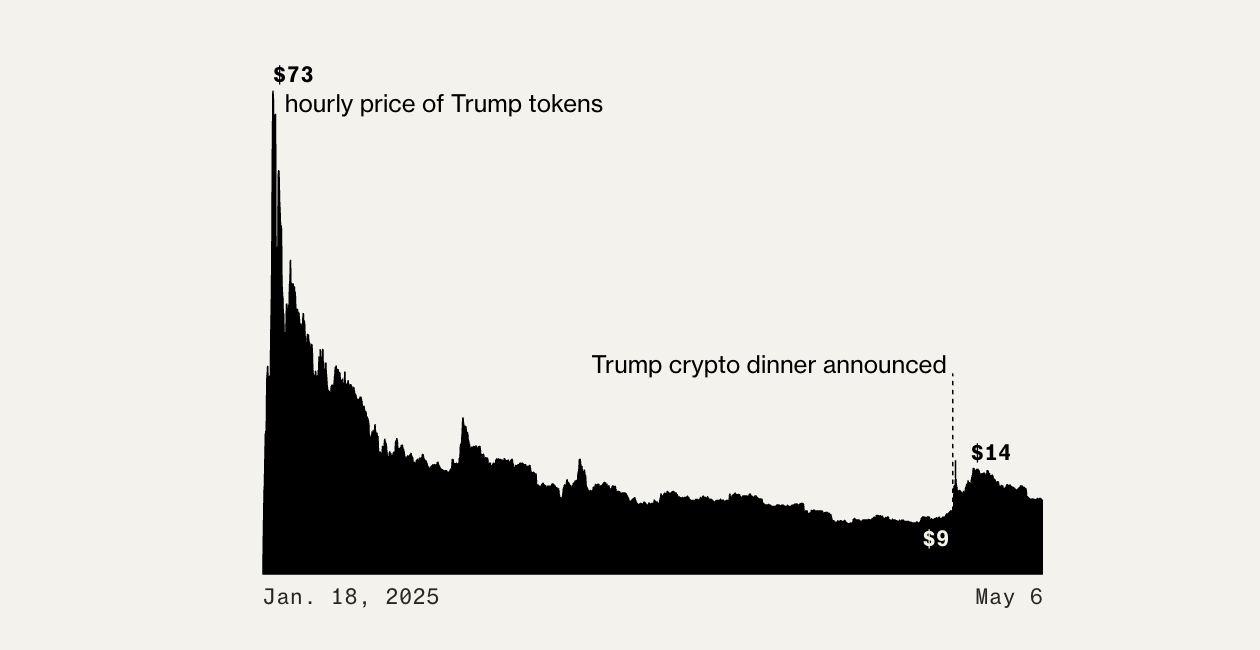

On January 18, Donald Trump shocked everyone by announcing the launch of his official memecoin on Solana, named $TRUMP. Initially mistaken for a hack, the announcement was soon confirmed as genuine. $TRUMP quickly became a “liquidity black hole,” with its fully diluted valuation (FDV) surging from $1 billion to nearly $30 billion within 12 hours, as traders dumped other memecoins to chase $TRUMP. Despite extremely unfair token distribution (80% allocated to insiders), $TRUMP reached an FDV of $75 billion on January 19, largely fueled by short covering.

Later that evening on January 19, the $MELANIA token launched, causing $TRUMP to drop -50% within three hours and triggering a broad market selloff. $BTC fell below $100k, and $SOL dropped from nearly $300 earlier in the day to $230. $MELANIA’s FDV briefly spiked to $13 billion but collapsed within a day to under $400 million.

By the end of January, both $TRUMP and $MELANIA continued to decline ($TRUMP from $48 to $21, $MELANIA from $4 to $1.5). Given their poor tokenomics, I do not recommend holding these tokens.

$XRP Reaches New ATH and the "American-Themed Token" Narrative

On January 16, a New York Post article suggested Trump might consider establishing a strategic reserve composed of American “digital tokens.” Though clearly unrealistic, this idea sparked a wave of interest in “American-themed tokens” such as $XRP, $HBAR, and $XLM. Fueled by this narrative, both XRP and HBAR hit new cycle highs, with $XRP reaching $3.4, implying an FDV of $340 billion.

Since then, XRP’s price peaks have gradually declined. Nevertheless, in terms of market strength—especially considering its market size—XRP remains one of the best-performing tokens. Still, I believe its upside potential is now very limited.

$SOL Hits New ATH at $295

During the $TRUMP memecoin event, the biggest winner was undoubtedly Solana and its ecosystem. $SOL surged after the token launch, hitting a new all-time high (ATH) of $295. Additionally, SOLETH (Solana’s price ratio against ETH) reached a new high of 0.09. Although $SOL pulled back to $230 by month-end, the Solana ecosystem remains one of the most dynamic areas. Other standout ecosystem tokens include DEX tokens $JUP and $RAY.

For Jupiter, Solana’s DEX aggregator, January was a significant month. As one of the most widely used apps on Solana, Jupiter launched its second round of airdrops (remember to claim if you’re eligible!), announced the acquisition of Moonshot (a mobile app enabling seamless purchases of Solana-based memecoins), and declared that 50% of collected fees would be returned to $JUP holders—an announcement that further boosted confidence in $JUP.

SUI Hits New High of $54B FDV Before Trend Reversal

Since early August, $SUI had shown strong momentum, continuing into early January and reaching a new all-time high (ATH) FDV of $54 billion. However, the rally began to weaken afterward. On January 20, $SUI broke below its 50-day moving average (50D), a level it had held since September, signaling a potential trend reversal. The following days confirmed this bearish shift, culminating in a late-month selloff on January 27 where $SUI briefly touched $3.5.

$FARTCOIN: The Strongest Memecoin of the Month

Among memecoins in January, $FARTCOIN was the strongest performer. When the $TRUMP launch caused other memecoins to crash, $FARTCOIN rebounded the fastest. Its strength was further demonstrated in subsequent days, with its market cap surging from $1.5B to a peak of $2.75B just before the inauguration. As a “high-volatility token,” $FARTCOIN exhibited extreme price swings, amplifying every move. Currently, its market cap has fallen sharply from its peak to around $700M, a -75% decline.

VINE and JELLYJELLY: The Start of a New Trend?

The founder of Vine (a predecessor to TikTok) launched a memecoin called $VINE. The token quickly attracted massive trading volume, briefly spiking to nearly $500M in market cap before crashing to $100M and then rebounding to $400M. Behind $VINE’s surge was a speculative narrative: rumors that Twitter might integrate Vine into its platform, fueled by calls from Rus and hints from former Twitter employees. However, I consider this possibility extremely unlikely, suggesting the market may be chasing a false narrative—one that even Rus himself probably doesn’t believe.

The launch of VINE may mark the beginning of a new trend: traditional Web2 founders or companies issuing memecoins to raise funds and draw public attention to their products. For example, a few days ago, the co-founder of Venmo launched a memecoin called JELLYJELLY, allegedly linked to his Jelly Jelly app. The token’s market cap reached $250M within hours but has since steadily declined, now down -90% from its peak.

Murad Series Tokens Hit New Highs

Two key tokens in the Murad series, $SPX and $GIGA, saw strong rebounds in January. $GIGA hit a new ATH close to $1 billion in market cap, while $SPX broke above the $1 billion resistance level and peaked at $1.75 billion after the $TRUMP launch.

Although both $SPX and $GIGA have significantly pulled back from their peaks, their corrections have been much milder compared to most memecoins, showing relative resilience.

AI Agents and Memecoins Crash

In January, most memecoins performed poorly. For example, $WIF dropped from $2.2 to $1, and $POPCAT fell from $1 to $0.32. Many popular memecoins from recent months saw losses exceeding -90%, including GOAT, PNUT, CHILLGUY, NEIRO, MOODENG, and FWOG. It could be said that the entire memecoin market was nearly wiped out.

AI tokens also endured a difficult month, with declines similar to memecoins. The AI agent sector peaked in early January (e.g., VIRTUAL reached a $5B market cap, AI16Z hit $2.5B), after which performance weakened steadily. Although some AI tokens briefly reached highs later, such as $ARC ($600M), $GRIFFAIN ($600M), $AVA ($320M), and $PIPPIN ($300M), overall, AI tokens became one of the worst-performing categories this month.

List of Best-Performing Tokens

Top-Performing Large-Cap Tokens in January:

-

XRP: +46%

-

RAY: +45%

-

OM: +39%

-

LDO: +32%

-

JUP: +27%

-

LINK: +26%

-

XLM: +25%

-

LTC: +24%

-

XMR: +24%

-

SOL: +22%

-

HBAR: +14%

-

HYPE: +12%

-

ONDO: +11%

-

AAVE: +8%

Notable Small-Cap Tokens in January:

-

XCN: x14

-

TOSHI: +720%

-

DEEP: +175%

-

GT: +43%

-

SPX: +38%

-

KCS: +33%

-

CULT: +27%

-

MOCHI: +317%

-

BENJI: +178%

-

DOGINME: +171%

-

USA: $15M → $320M → $20M

-

UFD: $60M → $400M (peak)

-

MUSKIT: $10M → $400M → $25M

-

MLG: $3M → $160M (peak)

-

LLM: $1M → $120M (peak)

-

BUTTHOLE: $1M → $120M (peak)

-

ALON: $1M → $250M → $6M

-

PIPPIN: $7M → $320M (peak)

-

SWARMS: $80M → $600M → $60M

-

BUZZ: $20M → $180M (peak)

-

ANON: $15M → $300M (peak)

-

AVA: $50M → $320M (peak)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News