Data review of TRUMP large holders' positions over the past three months: 86.9% of large holders have exited, with some facing unrealized losses exceeding $30 million

TechFlow Selected TechFlow Selected

Data review of TRUMP large holders' positions over the past three months: 86.9% of large holders have exited, with some facing unrealized losses exceeding $30 million

Three months have passed—how are the big players faring now?

Author: Frank, PANews

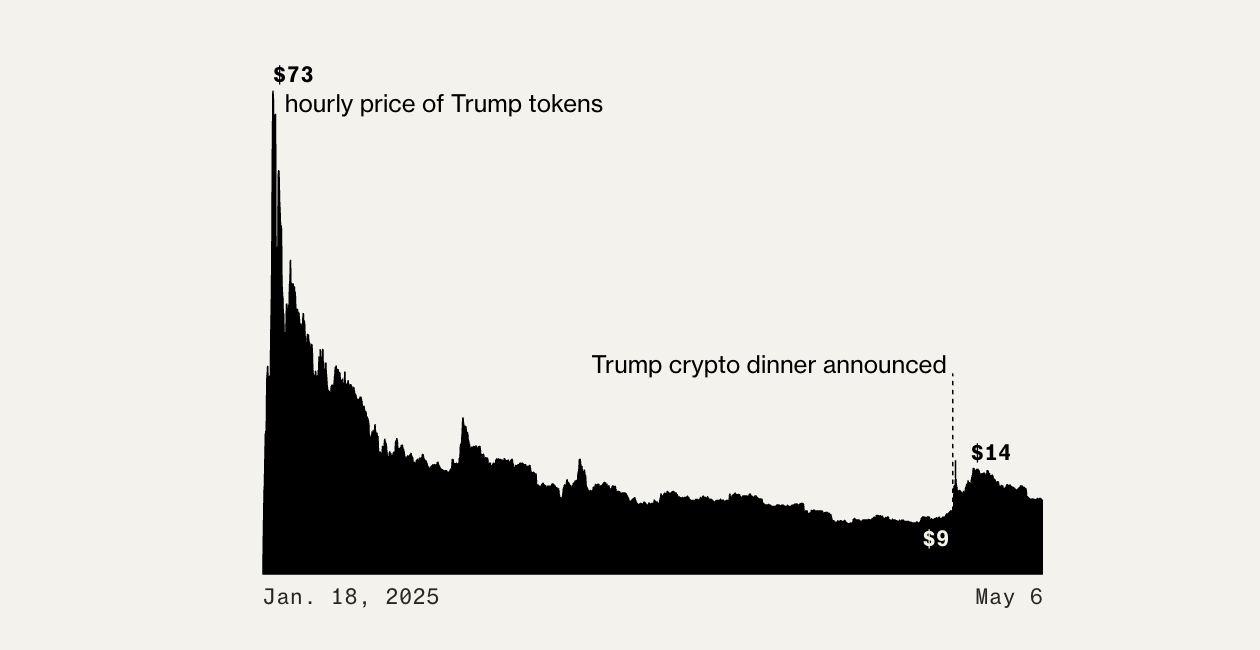

As the pinnacle of celebrity tokens, the launch of TRUMP token triggered extreme market FOMO and attracted numerous large holders. However, as the entire MEME market cooled down and insider team scandals emerged one after another, TRUMP's price plummeted from its peak of $75 to a low of $7.20, a decline exceeding 90%. On April 18, 4% of TRUMP tokens were unlocked, with the market expecting this to intensify panic and trigger further declines. On the other hand, on April 20, news spread that Trump planned to host a dinner for TRUMP token holders. Amidst this mix of positive and negative developments, the TRUMP token appears to have stopped falling and begun rebounding.

Three months have passed. How are the large holders faring now? What new changes have occurred in the distribution of TRUMP tokens?

Large Holders Can't Withstand the Crash—86.9% Have Already Exited

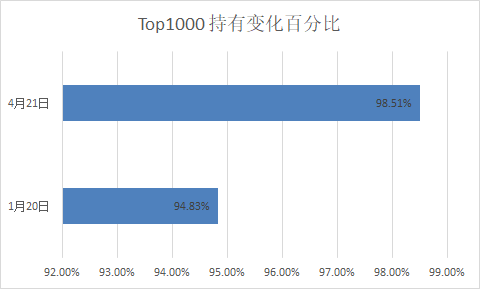

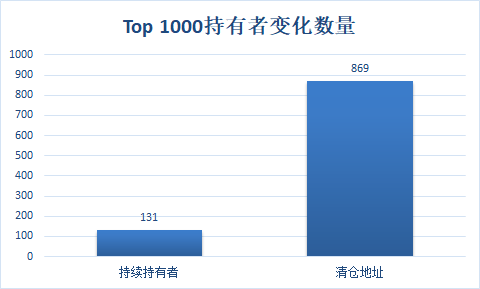

Compared to overall data, the turnover among TRUMP's large holders has been extremely frequent over the past three months. Compared to January 20, 86.9% of the top 1,000 holders chose to exit their positions, collectively selling 48 million tokens—accounting for 24% of the total circulating supply.

Data as of April 21 shows that the top 1,000 addresses hold approximately 98.51% of all TRUMP tokens, up 3.68 percentage points from 95.83% on January 20. These figures indicate significant token turnover and suggest that during the downturn, holdings have become more concentrated.

Among newly emerged large holder addresses over the past three months, Robinhood stands out as an exchange that significantly increased its holdings, adding 1.44% of the token supply. Additionally, U.S.-focused exchange addresses such as Crypto.com and Meteora also saw notable increases in holdings. Among individual large holders, many entered during late January at TRUMP’s price peak, remain stuck in loss-making positions, and continue averaging down—though overall losses remain severe. In terms of token holdings, these addresses purchased 12.2% of the total supply after January 20.

Among continuously holding large addresses, the project development address accumulated about 1.38 million additional tokens. However, most of these were transferred back and consolidated from smaller associated accounts rather than acquired through market purchases.

Regarding exiting addresses, according to PANews’ observations, many top-tier large holders began buying around January 18 and exited by February 1 or earlier—most realizing substantial profits.

Overall, early-profit-making large holders of TRUMP have largely already exited. The current large holders mostly consist of those who entered repeatedly at high prices after January 20 and remain trapped. Yet, judging by trading behavior, many large holders still appear optimistic about TRUMP’s future and continue accumulating.

One Made $25 Million and Exited, Another Lost $33.66 Million

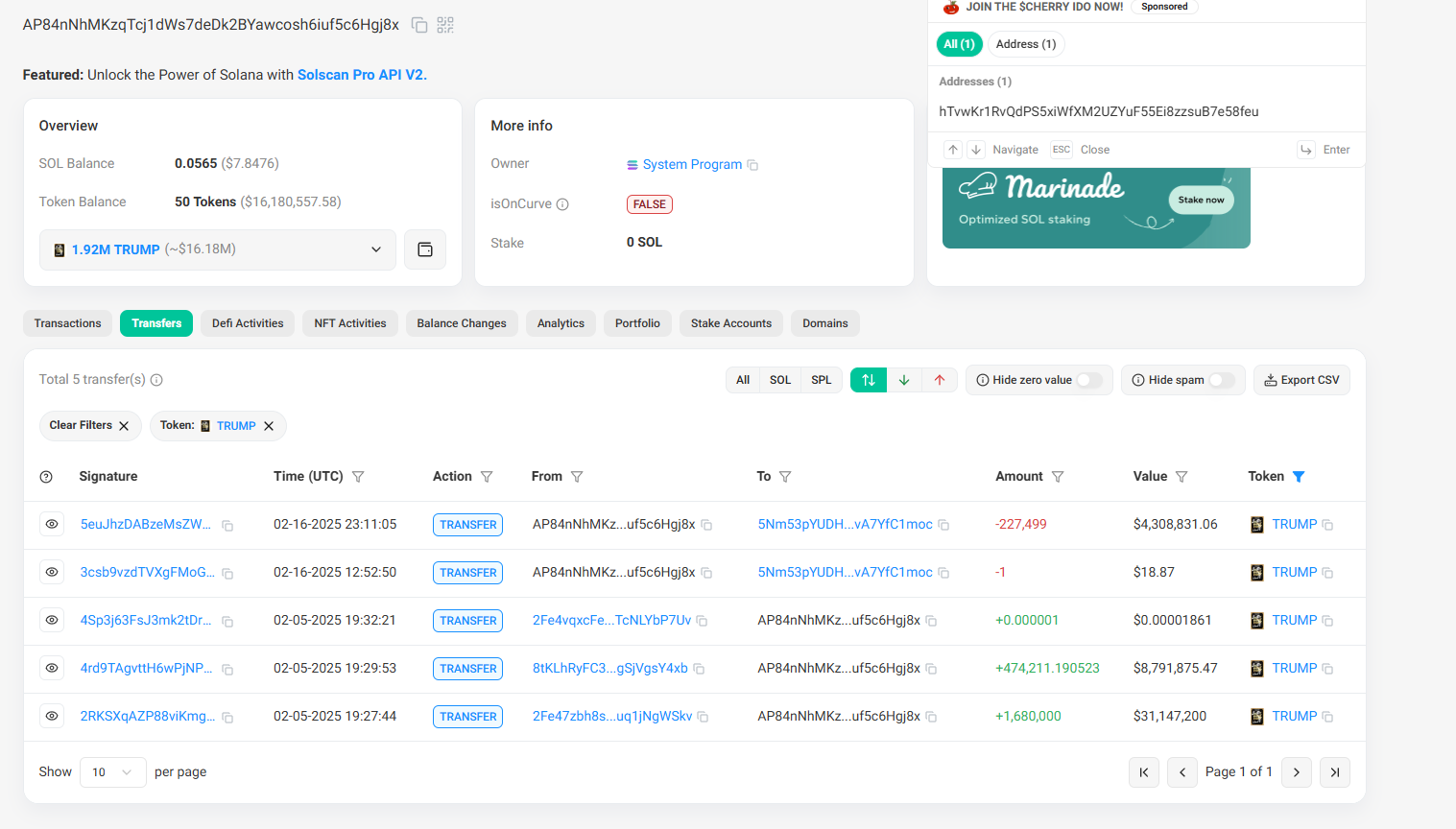

Among large holders who have fully exited, the most profitable is the address 2Fe47zbh8svDNGNehFy1NY8bsjQNtomvKFuq1jNgWSkv (hereinafter "2Fe47"). This address received 25 million TRUMP tokens from the founding address before TRUMP was listed, immediately sold them on the market upon listing, then received another 27 million from founding address 5e2qR and sold those as well—generating over $112 million in total proceeds. Finally, it returned remaining tokens to founding address 5e2qR. Data from January 20 showed this address held over 1 million tokens; it now holds zero. Judging by its transaction pattern, this address is suspected to belong to the TRUMP project team.

Another large holder, 3AWDTDGZiW8joyfA52LKL7GUWLoKBCBUBLUE5JoWgBCu, began aggressively buying shortly after TRUMP’s launch on January 18, spending $78.55 million in total and eventually selling for $103 million—profiting $25.17 million. However, its last entry occurred between January 25 and 27, when the user believed TRUMP had hit bottom and invested $12.78 million. By February 2, seeing no floor to the decline, the user fully exited, selling for $9.23 million. Nonetheless, overall, this address achieved substantial gains from TRUMP trading.

Another large holder began aggressively purchasing TRUMP tokens from various exchanges around January 20, spending $45.73 million to buy 1.11 million tokens at an average cost of about $41. On February 7, they sold 300,000 tokens at $17.60 and still hold 810,000 tokens—suffering an unrealized loss of approximately $33.66 million, representing a 73% loss. This is the single largest loss among new large holders.

Similarly, the user behind address 6qgBGeZgPyxdobeHhcNtAqVe927zodpiuoufhwGN8BhP followed a similar strategy, starting to accumulate via several linked addresses from mid-January, spending $16.67 million in total. They currently still hold $6 million worth of tokens, with losses exceeding $10 million.

The extreme volatility of the TRUMP token resembles a real-life crypto “reality show,” showcasing both get-rich-quick myths amid MEME coin speculation and the brutal realities of high-leverage gambling. From early whales executing precise profit-taking exits to later buyers sinking into quicksand, winners and losers in this game have been clearly separated by the market. Although Trump’s “dinner利好” temporarily injected momentum for a rebound, the shadows of highly concentrated holdings and suspected manipulation by the project team linger. While TRUMP may appear to be catching its breath after negative catalysts played out, its fate remains tightly bound to the resonance between celebrity influence and market sentiment. For retail investors, this roller-coaster ride serves as a stark risk education lesson: even in the battlefield of MEME coins backed by “top-tier influencers,” the glamour may merely be a sophisticated disguise for capital harvesting.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News