Bloomberg: TRUMP coin dominated by foreign buyers, dinner promotion raises regulatory concerns

TechFlow Selected TechFlow Selected

Bloomberg: TRUMP coin dominated by foreign buyers, dinner promotion raises regulatory concerns

The user named "Sun" ranked first on the banquet leaderboard.

By Leonardo Nicoletti, Anthony Cormier, David Kocieniewski

Translated by Luffy, Foresight News

More than half of the largest holders of the Trump meme coin are from foreign exchanges that claim to prohibit U.S. users, suggesting many buyers are based outside the United States.

Trump is a cryptocurrency promoted by President Trump just days before his inauguration. Following an unprecedented promotional campaign, sales of the Trump token have surged over the past two weeks: more than 200 of the largest token holders will be invited to a dinner on May 22 at Trump's Virginia golf club, while the top 25 holders will qualify for an exclusive pre-dinner reception and a "VIP" tour as described on the Trump token website.

Now, Bloomberg analysis shows that among the top 25 holders registered on the website leaderboard, all but six used overseas exchanges that claim not to accept U.S. residents. Among the top 220 holders on the leaderboard, at least 56% used similar offshore platforms. The widespread presence of these potential foreign buyers echoes ethical concerns raised by Democratic lawmakers in Congress about selling access to the president through token promotions. It also raises questions about how participants in the dinner promotion will be vetted, given that their public identities are tied only to usernames composed of a few letters.

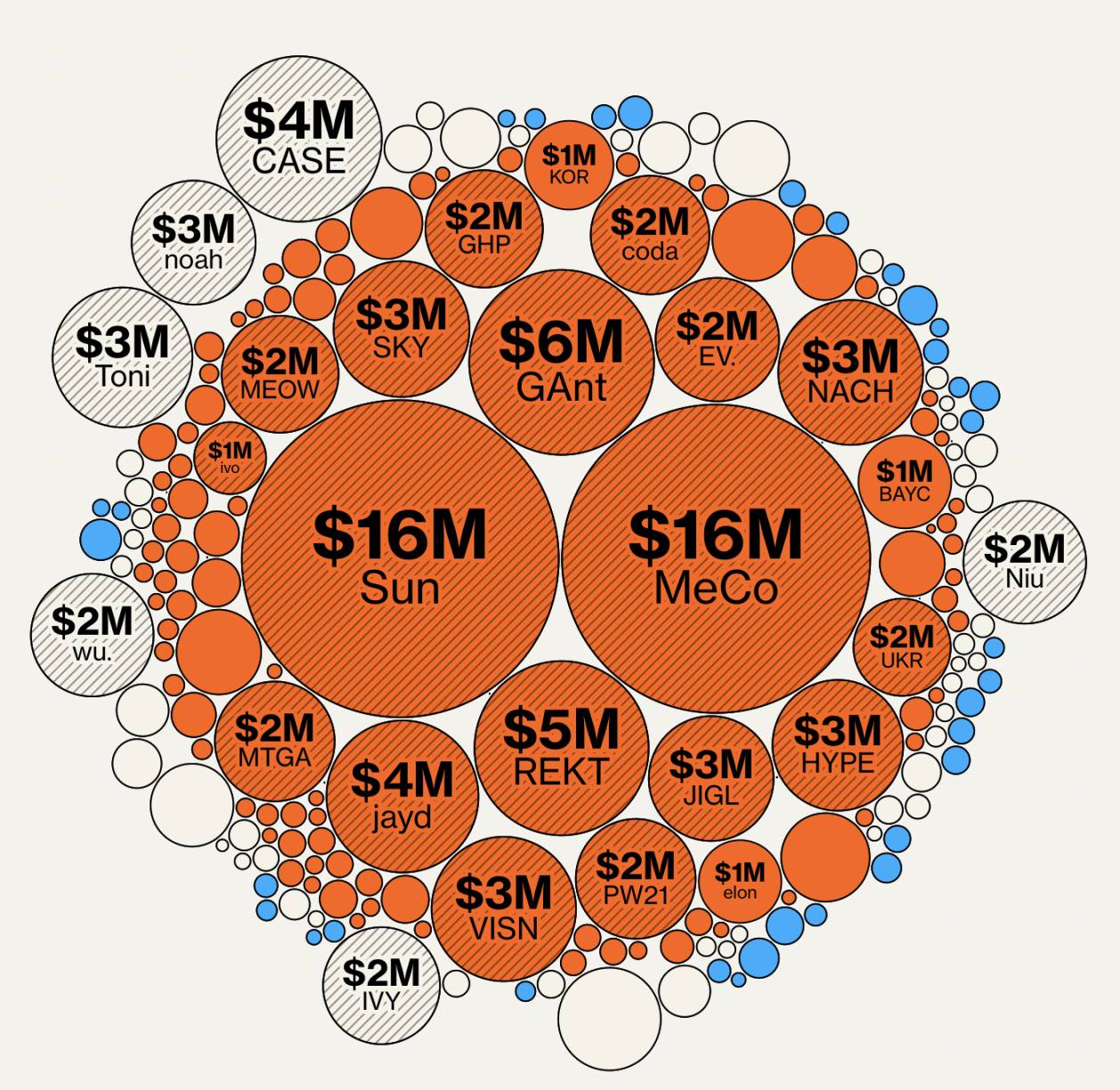

Most major holders of the Trump token may be outside the U.S.

The current value of tokens held by the 220 cryptocurrency wallets registered on the TRUMP leaderboard (by the likely location of wallet holders). 76% of the token value held in the top 220 wallets may belong to foreign owners, as these wallets use exchanges inaccessible to U.S. residents.

Source: Bloomberg analysis of SolScan data.

(Note: Data as of 10 a.m. Eastern Time on May 5. Usernames are those listed on the TRUMP token website, set by wallet holders when registering for the dinner promotion. One wallet still in the top 25 on the leaderboard site is not shown here, as it sold nearly all its holdings on May 3.)

In the fine print on the website, organizers state that participants must pass background checks. The site says: "We will also review your wallet for KYC and compliance purposes. You will be dining with the President of the United States!" But the site does not explain how such reviews will be conducted.

The promoters of the TRUMP token did not respond to requests for comment, nor did White House officials.

To appear on the dinner leaderboard, buyers of the TRUMP coin must register on its website, which ranks them based on the number of tokens held and holding duration. Many large holders have not yet registered. However, another Bloomberg analysis of all the biggest buyers—regardless of whether they are on the leaderboard—shows that even within this broader group, more than half came from foreign exchanges.

It's possible some U.S. buyers found ways to bypass restrictions and use foreign exchanges, such as using virtual private networks (VPNs) to hide U.S. IP addresses. Most exchanges say they take measures like collecting user information to prevent such circumvention. The three foreign exchanges most commonly used by major TRUMP token holders to fund accounts or buy TRUMP coins are Binance, Bybit, and OKX—all of which impose restrictions on U.S. users. Bloomberg’s analysis found that six holders on the TRUMP token leaderboard made purchases on OKX before the platform launched a U.S.-based exchange on April 15. An OKX spokesperson said the company previously did not allow U.S. residents to make purchases. Representatives from Binance and Bybit did not respond to requests for comment.

Two of these three exchanges have previously violated U.S. laws. In November 2023, Binance pleaded guilty to violating federal anti-money laundering and sanctions laws due to weak internal controls and paid over $4 billion to the U.S. In February, OKX admitted to breaching anti-money laundering rules and paid over $420 million.

This is not the first time that crypto projects linked to Trump have attracted significant foreign investment.

Sun Yuchen, a Hong Kong-based crypto entrepreneur, became an advisor to World Liberty Financial—a different crypto project promoted by the Trump family—after announcing he had purchased tens of millions of dollars worth of its WLF tokens. At the time, Sun said he did not expect any benefits from Trump in return for his investment. According to Bloomberg’s analysis of cryptocurrency wallet transactions, Sun may also be a major holder of the TRUMP token.

Sun Yuchen, founder of blockchain platform Tron, in Hong Kong on May 8, 2020

Source: Bloomberg

World Liberty is promoting a stablecoin. Zach Witkoff, one of the company’s founders and son of Trump’s Middle East envoy, announced at a meeting Thursday that the stablecoin would facilitate a transaction between Binance and an investment firm founded by the Abu Dhabi government. Executives at World Liberty did not respond to requests for comment.

Tony Carrk, executive director of the nonprofit Accountable.US, said: “Congress should require the president to disclose those secretly paying tribute to him, to assess whether the public interest has been compromised.” The organization has created an online “Trump Accountability War Room.” Accountable.US found that at least 14 of the top 50 WLF token holders also used cryptocurrency services inaccessible to Americans. Bloomberg’s analysis identified an additional eight such wallets. World Liberty disclosed in November that its initial $300 million offering was primarily sold overseas.

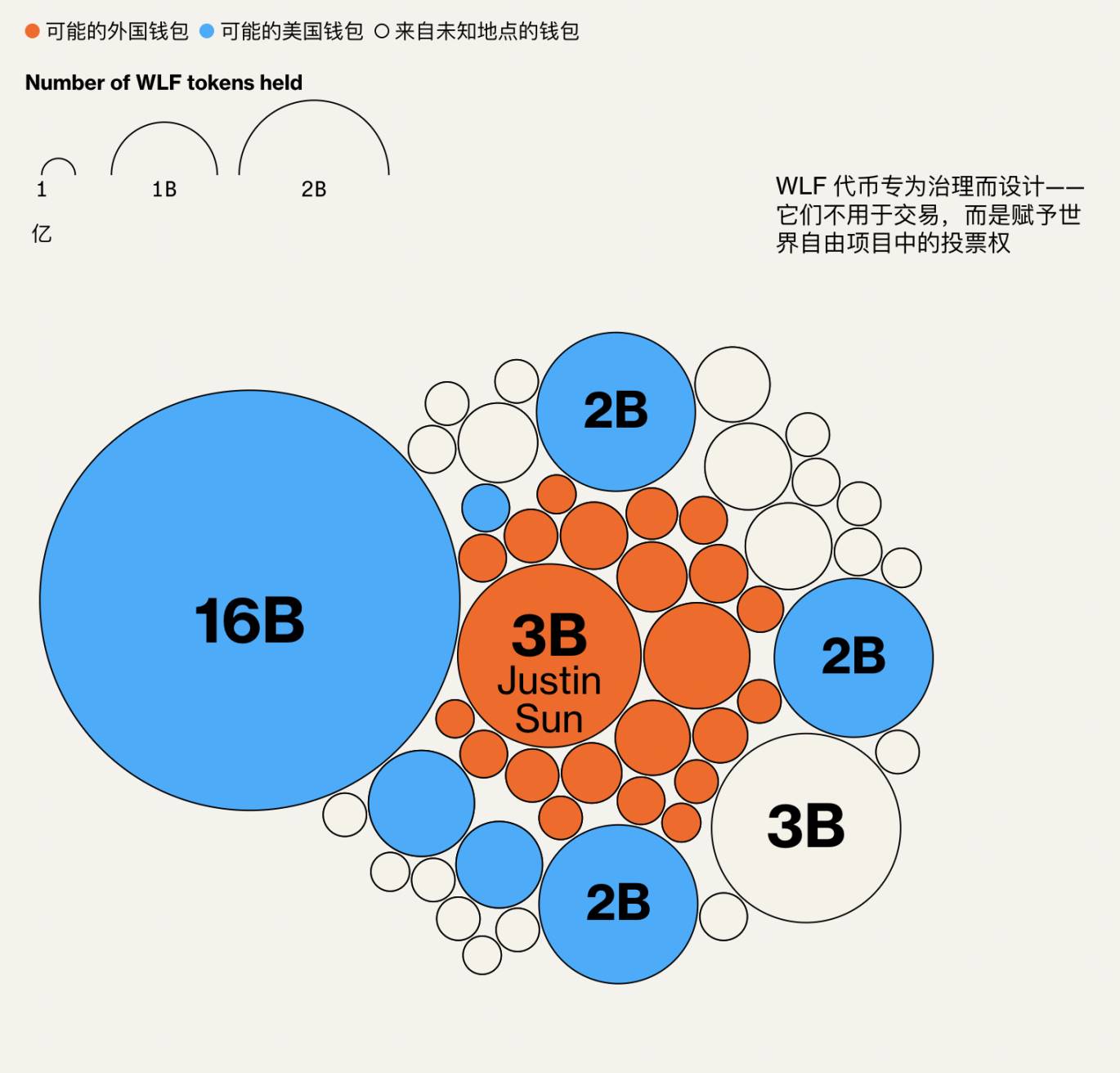

Many top WLF token holders are located abroad

Holdings of the 50 wallets with the most WLF tokens (by the likely location of wallet holders)

Source: Accountable.US, Bloomberg analysis of Etherscan data

Note: Data as of 6:45 p.m. Eastern Time on April 30

Trump, who once called bitcoin a “scam against the dollar,” has deepened his involvement in crypto while his administration begins dismantling regulatory and enforcement teams responsible for overseeing these digital assets. For example, shortly after taking office, SEC staff tasked with investigating cryptocurrencies were reassigned, and many of their cases were put on hold. In April, the U.S. Department of Justice disbanded its cryptocurrency task force.

Last month, Democratic Senators Adam Schiff and Elizabeth Warren urged the U.S. Office of Government Ethics to investigate the Trump token dinner promotion in a letter. They said the May 22 event poses “serious risks that President Trump and other officials may engage in corruption by selling access to the presidency to individuals or entities, while personally benefiting the president and his family.”

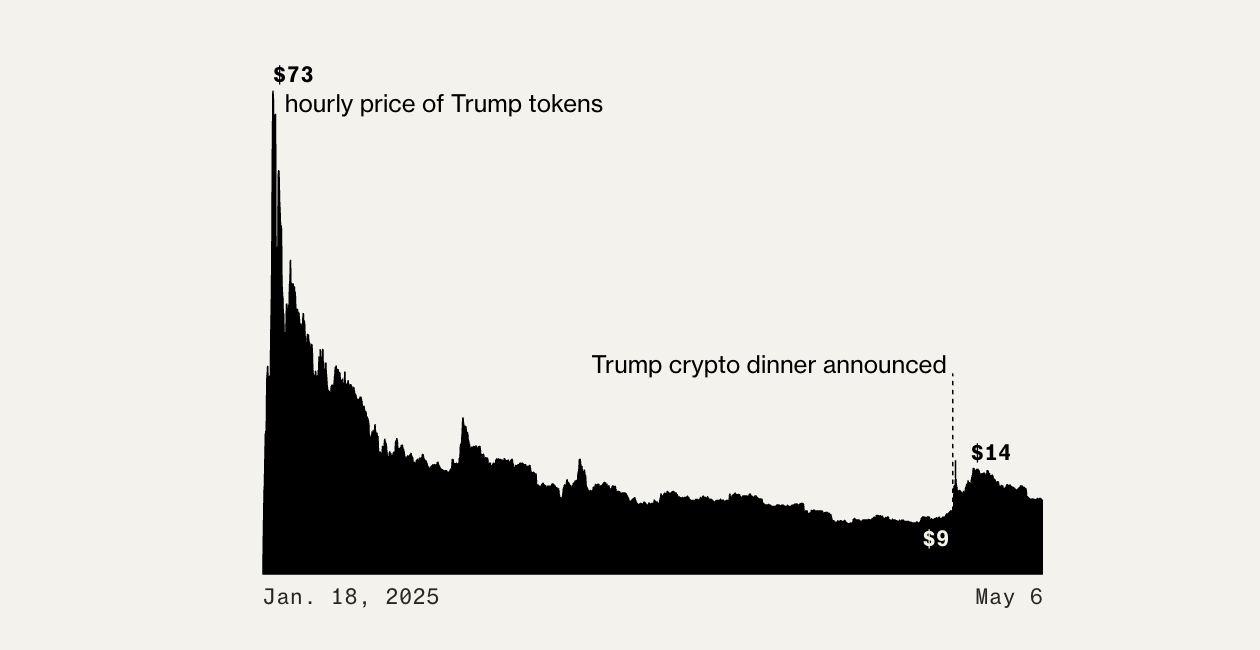

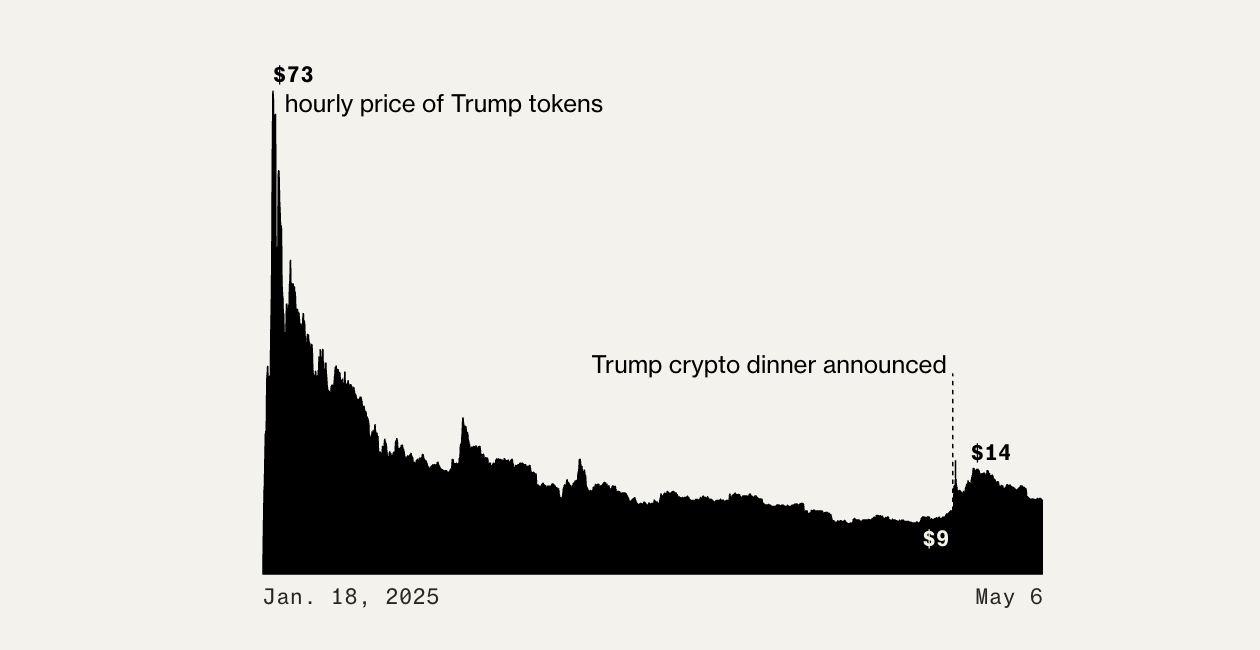

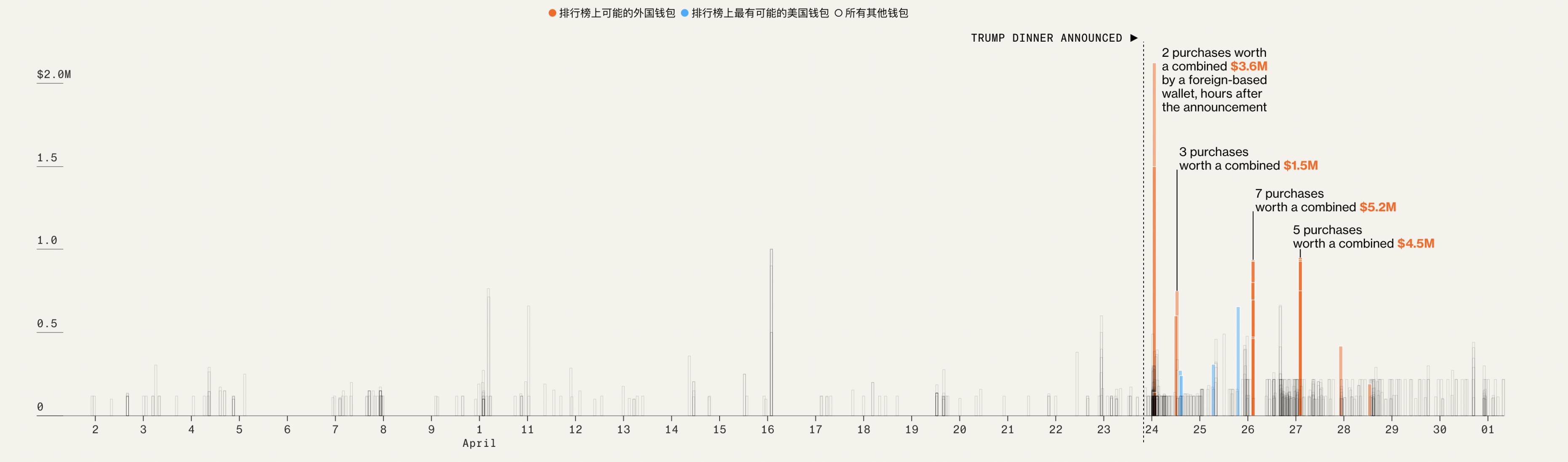

The Trump family benefits from the rise in the TRUMP token price, as a company under their control holds a large amount of the token. Although the Trump family cannot sell any tokens for a period per the token issuance terms, price fluctuations still impact their paper wealth. The announcement of the April 23 dinner caused the token price to jump from around $9 to about $14, triggering 436 new transactions exceeding $100,000 each over the next five days, with the largest trades involving accounts interacting with exchanges not operating in the U.S.

Major foreign purchases followed the dinner announcement

Purchases of TRUMP tokens exceeding $100,000 in April

Source: Dune; Bloomberg analysis of SolScan data

Note: Data as of May 1

To qualify for dinner with Trump, token holders must register a “self-custody” wallet—one fully controlled by the holder rather than a third-party exchange.

Bloomberg analyzed transactions of the top 220 wallets on the dinner leaderboard as of May 5 to determine whether their holders might be based abroad. A separate analysis examined all self-custody wallets holding enough Trump tokens as of April 30 to qualify for the top 220. Many of the largest wallets are not listed on the dinner leaderboard, suggesting they haven’t registered yet or that their time-weighted holdings differ significantly from current balances. Some may be strategically delaying registration.

While it’s difficult to identify the people behind these accounts, there are already public clues for some. In recent days, entities on the leaderboard have been swapping positions, with at least one boasting online. The wallet labeled “MeCo” belongs to an entity called “Memecore,” which describes itself as “an EVM-compatible L1 multichain cross-staking mainnet secured by a Meme Proof mechanism.”

The company said on X: “We’re not just aiming to top the TRUMP leaderboard—we want to conquer the entire meme coin space.” Memecore asks users to send their TRUMP tokens to it to boost rankings. The company says tokens will be returned later with rewards.

Cherry Hsu, Memecore’s chief business development officer, said in a statement on Telegram: “Currently, the meme coin space is seen as stagnant. We want to challenge that notion. By participating in this event, we aim to show that the meme coin sector is rising again.”

According to Bloomberg’s analysis of blockchain data, the leader that Memecore is chasing on the leaderboard chose the username “Sun” and used a wallet belonging to HTX, which is associated with Sun Yuchen. Sun himself has publicly acknowledged buying World Liberty Financial tokens but has not yet confirmed whether he owns the leading wallet on the leaderboard. He did not respond to requests for comment.

The wallet marked “Sun” began accumulating tokens worth a total of $17.9 million when the Trump token was first launched in January. Since the Trump dinner promotion was announced, it has bought another $4.5 million worth of tokens.

In 2023, the U.S. Securities and Exchange Commission sued Sun Yuchen, alleging he collaborated with companies he owned and controlled to orchestrate the issuance and sale of unregistered securities. Sun’s lawyers denied the allegations, calling the regulator’s claims “overreaching and meritless.” In February, after Sun spent at least $75 million purchasing World Liberty Financial tokens, the SEC paused its lawsuit, stating that exploring potential resolutions served the interests of both parties.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News