Cobo | The DeepSeek Moment for RWA is Approaching: A Comprehensive Analysis of Development Trends, Implementation Pathways, and Institutional Best Practices

TechFlow Selected TechFlow Selected

Cobo | The DeepSeek Moment for RWA is Approaching: A Comprehensive Analysis of Development Trends, Implementation Pathways, and Institutional Best Practices

"Every asset—every stock, bond, and fund—can be tokenized, which will bring an investment revolution."

This article is based on the keynote speech delivered by Cobo's Lily Z. King at a RWA event hosted by Junhe Law Firm in Hong Kong on June 10, 2025, for multiple brokerage firms, fund stablecoin institutions, and family offices, titled "Real-World Asset Practices in an Uncertain World."

“Every asset—every stock, bond, and fund—can be tokenized, ushering in an investment revolution.” This statement comes from Larry Fink, Chairman and CEO of BlackRock. Larry Fink’s vision of universal tokenization not only describes a technological possibility but also signals a profound transformation within finance. The context—when, where, and under what circumstances Larry Fink made this statement—is even more significant than the words themselves. This quote appeared in BlackRock’s annual letter to investors dated March 31, 2025. Yet, in last year’s letter, terms like stablecoins, RWA, tokenization, and digital assets—the most popular buzzwords in today’s market—were entirely absent, with only Bitcoin ETFs mentioned as related to digital assets. This year, however, the entire letter champions how tokenization can democratize finance.

Why are so many industry leaders, including Larry Fink, focusing on real-world assets (RWA) right now? Some say it’s because DeFi yields on-chain have declined, pushing investors to seek returns from real-world sources. Others argue that RWA is currently the only hot trend—any project or stock associated with it sees price increases. There was also an RWA boom during 2017–2018, then known as ICOs—a mere passing fad. Still others ask: Why analyze so much? If you’re not doing RWA, you might soon lose your job!

We may still need to clearly understand the origins and trajectory of this current RWA wave to make informed decisions over the next 6–12 months—ensuring RWA truly takes off in Asia and secures a competitive position in the coming era of global finance.

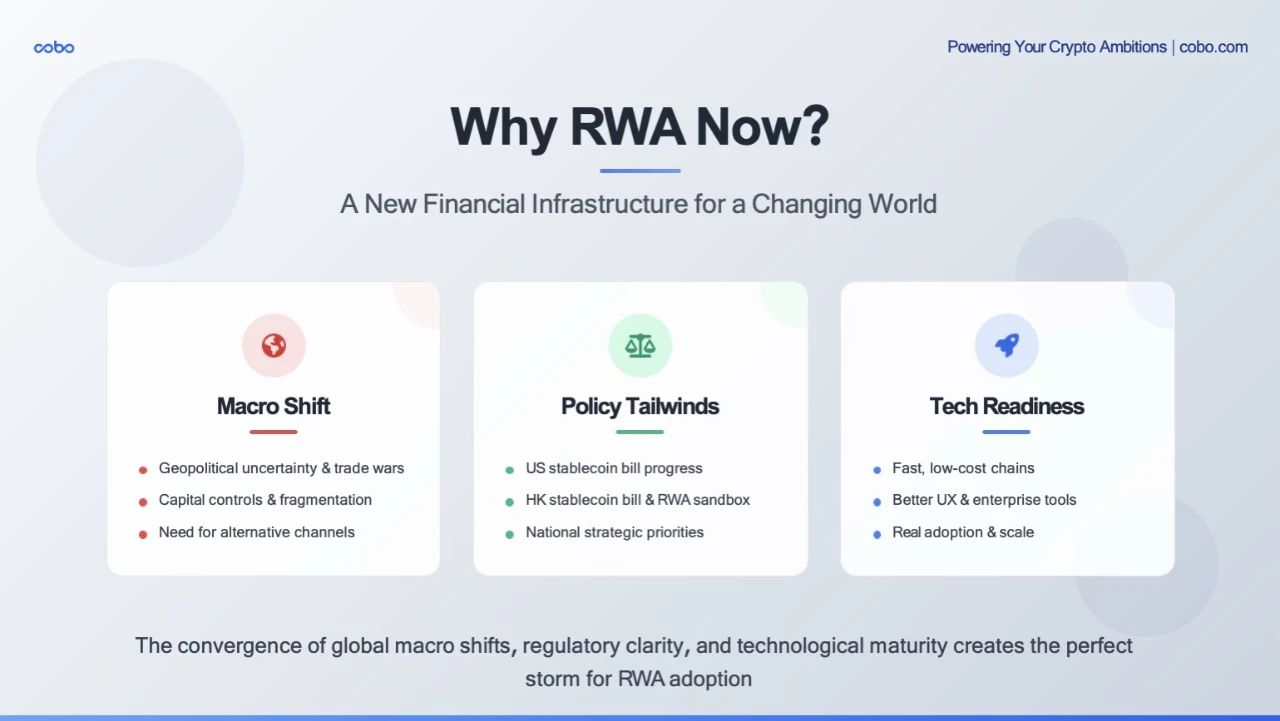

Today, the world is undergoing a macro-level transformation. For the first time in decades, we live in an environment marked by geopolitical uncertainty, trade wars, capital controls, and a fragmented—even weaponized—global financial system. While the U.S. dollar remains strong, countries are actively seeking risk hedging strategies, and cross-border capital flows are facing increasingly strict oversight.

Under these conditions, global capital naturally seeks faster, cheaper, and more open channels for movement. At the same time, digital asset policies are catching up rapidly. Bipartisan efforts in the United States are advancing regulatory frameworks for stablecoins and tokenization. In Asia, tokenization is no longer a niche experiment—digital assets have become part of national strategy. Finally, technical infrastructure is maturing. Over the past 12 to 18 months, we’ve seen remarkable progress: near-zero transaction fees on chains like Tron, Solana, Base, and various Layer 2s; sub-second final settlement times for stablecoin transactions; and rapidly improving user experiences for digital wallets—including gas abstraction, one-click approvals, and institutional-grade custodial services offering bank-like usability.

So why is Larry Fink talking about RWA now? Not because the hype cycle has arrived, but because the world needs it more than ever before—a way and a vision to efficiently, compliantly, and globally connect traditional finance with the future of finance.

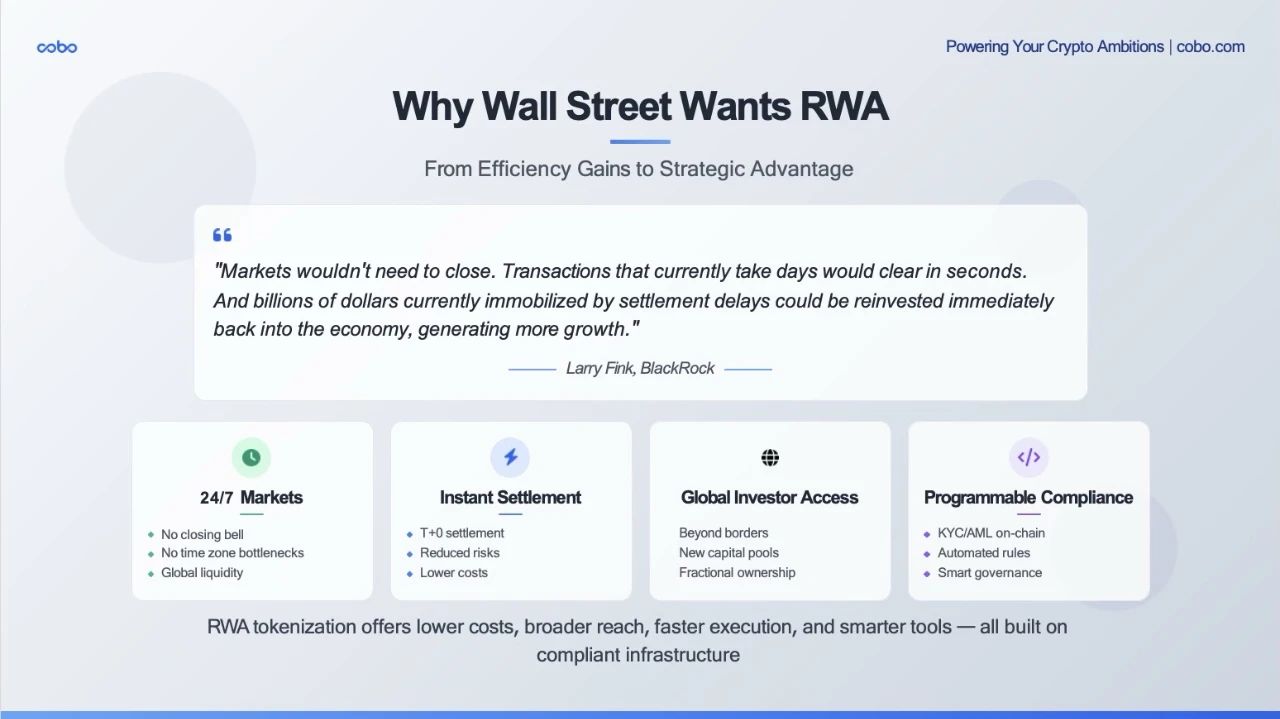

In Larry Fink’s view, Wall Street needs cost reduction and efficiency gains. Simply put, real-world assets (RWA) can make markets faster, leaner, and more global—without disrupting existing rules. Wall Street isn’t pursuing crypto for crypto’s sake, but to improve the infrastructure of existing capital markets.

First is the efficiency challenge. Traditional financial instruments such as bonds and private credit suffer from slow and expensive settlement cycles, along with cumbersome operational processes. By contrast, once RWAs are brought on-chain, they enable:

-

Instant settlement—T+0 instead of T+2 or longer.

-

24/7 liquidity—no market closures or time zone limitations.

-

Built-in auditability—ledgers are real-time and publicly transparent.

Major institutions recognize this potential for cost savings and efficiency and are moving quickly. Giants like BlackRock and Franklin Templeton have launched large-scale tokenized U.S. Treasury funds on blockchain, enabling on-chain settlements and daily yield payments via smart contracts. These are no longer experiments—they represent functioning components of new financial infrastructure.

Second is the accessibility challenge. Tokenized assets can reach investor groups inaccessible through traditional channels—especially those in emerging markets or non-traditional investor segments. For example:

-

Tokenized Treasuries issued by Ondo, Matrixdock, and Plume are being purchased by DAOs, crypto treasuries, and stablecoin holders in Asia, Latin America, and Africa—groups whose KYC profiles traditional brokers may never reach, despite their demand for stable-yield, high-credit-quality assets.

-

Real estate tokenization projects in the UAE and the U.S. have enabled fractional ownership and globally distributed access within compliance thresholds—something impossible before tokenization.

RWA doesn’t just reduce friction—it expands markets.

Finally, there’s programmability. This is where tokenized assets fundamentally gain superior power: embedding commercial logic directly into the asset itself:

-

Compliant transfer rules

-

Embedded yield distribution

-

Automatic rebalancing

-

Even embedded governance rights

Cantor Fitzgerald (where the current U.S. Secretary of Commerce previously served as CEO, and which maintains deep ties with Tether) recently partnered with Maple Finance to launch a $2 billion Bitcoin-collateralized lending arrangement—using smart contracts to automate parts of loan structuring and risk monitoring. This marks the beginning of a broader shift: financial products aren't just digitized—they're becoming intelligent. They can be traded globally, designed with compliance built-in, and instantly integrated into any digital portfolio.

With RWA gaining momentum, concrete market data reveals whether it remains a marginal experiment or is approaching mainstream adoption.

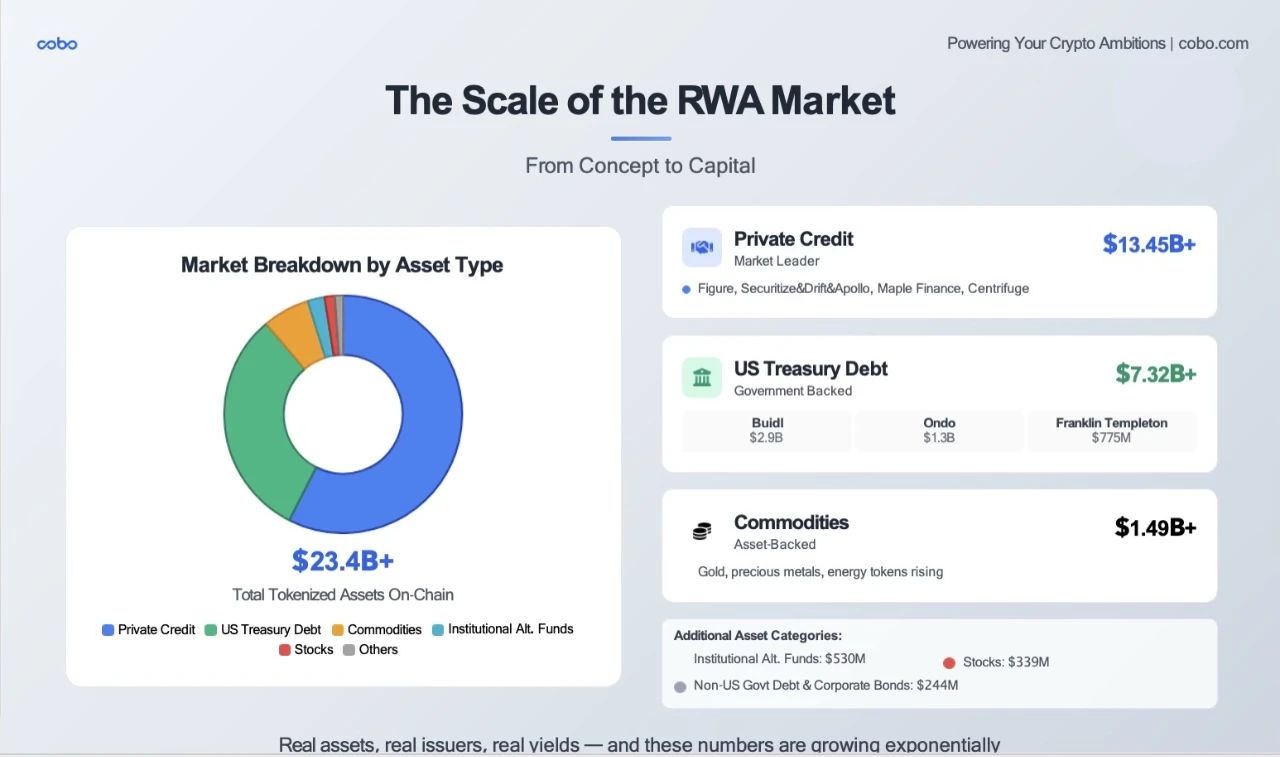

As of June 9, the total value of tokenized real-world assets (RWA) on public blockchains has reached nearly $23.4 billion. This figure represents only traceable on-chain assets, including U.S. Treasuries, corporate credit, real estate, various funds, and even commodities. The $23.4 billion represents about 10% of the stablecoin market and 0.7% of the entire crypto market—ranking among the top 10 or 11 largest tokens by market cap.

Further analysis yields several key observations:

💳 Private credit surpasses Treasury scale

-

Figure’s flagship product leads with $12 billion (home equity lines, investor mortgages, cash-out refinancings). From origination to inter-institutional transfer, Figure leverages the Provenance blockchain (Cosmos) to move institutional home loans onto-chain, completing ownership/rights transfers and settlements on-chain. Each loan is minted as a digital eNote and registered on a digital asset registry system, replacing MERS registration and manual custodial verification. This gives each loan an on-chain identity, enabling instant sale, pledge, or securitization. Already, 90–95% of Figure’s existing loan portfolio exists as on-chain eNotes. This process eliminates paper notes, MERS fees, and manual checks, reducing friction costs by over 100 basis points per loan and cutting funding disbursement time from weeks to days.

-

Securitize, in partnership with Drift Protocol, has brought Apollo’s $1 billion diversified credit fund on-chain.

-

To date, Maple Finance has facilitated over $2.5 billion in tokenized loans.

-

Centrifuge is providing real-world credit pools to DeFi protocols such as Aave and Maker.

🏦 Tokenized Treasuries become mainstream

-

BlackRock’s BUIDL fund: $2.9 billion in total AUM, leading the pack.

-

Ondo: $1.3 billion; Franklin Templeton’s BENJI fund: ~$775 million in tokenized assets.

-

Matrixdock and Superstate have pushed this category above $7 billion in size.

These are not crypto-native experiments, but mainstream financial institutions using blockchain as infrastructure to settle and distribute government bonds.

🏢 Commodity futures tokens were an earlier attempt than Treasury tokens, giving them some first-mover advantage.

🏢 Fund-based RWAs, including real estate funds, are catching up fast.

-

In the UAE, MAG Group (one of Dubai’s largest developers), MultiBank (the largest financial derivatives trader), and Mavryk (a blockchain tech company) announced a $3 billion collaboration to bring luxury properties on-chain.

-

Platforms like RealT and Parcl in the U.S. are enabling retail investors to buy fractional shares of income-generating real estate—with earnings paid directly to wallets.

These tokenized assets are income-producing, tradable, and legally binding—making them particularly attractive in today’s market environment. They offer yield, low volatility, and accessibility to stablecoin holders, DAOs, and fintech treasury managers alike.

Taken together, our analysis leads to a clear conclusion: tokenized RWA is no longer just a concept—it is already a market: real assets, real issuers, real yields, and numbers growing at a compound rate.

Let’s examine some specific, real-world RWA projects, particularly practices in Hong Kong and across Asia: five representative cases spanning traditional banks to tech companies, gold to new energy, pilots to full operations.

1. HSBC Gold Token

-

A classic example of a traditional bank entering the RWA space

-

Key Insight: HSBC chose a private chain, focused on retail customers, avoiding complex secondary markets

-

Strategic Implication: Banks prioritize compliance and risk control over maximizing liquidity

-

What It Shows: Traditional financial institutions may initially opt for closed ecosystems when testing the waters

2. Langxin Group × AntChain (New Energy EV Charging Stations)

-

Represents China’s exploration of RWA in “new infrastructure” sectors

-

Funding Scale: RMB 100 million demonstrates institutional recognition of physical asset tokenization

-

Key Point: Still in sandbox phase, indicating cautious regulatory advancement

-

Investor Composition: Domestic and international institutions plus family offices, showing cross-border capital interest

3. GCL-Power’s Solar Farm RWA

-

Larger Scale: Over RMB 200 million, highlighting green energy assets’ appeal

-

ESG Angle: Green power assets align with global ESG investment trends

-

Circulation Design: Still in design phase, showing that complex assets require further technological and legal innovation

4. UBS × OSL Tokenized Warrants

-

International Bank Pilot: UBS’s participation as a Swiss banking giant carries major significance

-

B2B Model: Targeted issuance to OSL, focusing on process validation rather than scale

-

Technical Validation: Emphasis on proving the technical feasibility of tokenized warrants

5. China Asset Management Hong Kong Digital Currency Fund

-

Most Transparent Case: Built on Ethereum’s public chain, fully auditable on-chain data

-

Retail-Oriented: Held by 800 addresses, genuinely targeting ordinary investors

-

Compliance Balance: Balances KYC requirements with on-chain transparency

From these five projects, several keywords emerge: private chains, institutional and targeted retail, pilot—not scale. Covering Hong Kong, mainland China, and international contexts, they reflect a diverse landscape. Specifically, Hong Kong is relatively open and supportive of innovation; mainland projects proceed cautiously within sandboxes; global players actively test the waters. The main challenge today remains liquidity: most projects face insufficient secondary market depth, representing the current bottleneck for RWA.

Compared to Hong Kong’s largely experimental stage, let’s now look at five leading global RWA projects operating at scale—representing best-in-class practices today.

1. BUIDL – BlackRock’s Flagship Product

-

Scale Leader: $2.9 billion, far ahead of other tokenized Treasury products

-

Institution-Focused: Only 75 holding addresses, yet monthly trading volume reaches $620 million

-

Key Insight: Average holdings of nearly $40 million per address demonstrate massive institutional demand

-

Strategy: BlackRock prioritizes quality over quantity, serving large institutions exclusively

2. BENJI – Franklin Templeton’s Retail Experiment

-

Most Interesting Data: 577 addresses, but only $20 in 30-day trading volume

-

Retail-Oriented: Truly targets everyday investors

-

Liquidity Challenge: Almost no secondary trading—holders appear to be “buy-and-hold”; perhaps not strangers, but familiar individuals.

-

Market Insight: Retail investors may care more about yield than liquidity

3. OUSG – Ondo Finance’s Institutional Product

-

Balanced Strategy: $690 million in size, 70 addresses, $14 million in trading volume

-

Institutional Efficiency: Though smaller than BUIDL, shows higher relative trading activity

-

Clear Positioning: Targets U.S. accredited investors, avoiding retail regulatory complexity

4. USTB – Compliance-Driven Product

-

Moderate Size: $640 million, 67 addresses

-

High Activity: $63 million in 30-day trading volume indicates solid liquidity

-

Dual Compliance: Serves both U.S. accredited and qualified investors, with strictest compliance standards

5. USDY – Global Breakthrough

-

Biggest Finding: 15,487 addresses! A truly “mass-market” product

-

Global Strategy: Specifically serves non-U.S. investors, sidestepping U.S. regulatory complexity

-

Democratized Investment: Average holding of ~$40,000 per address—true financial inclusion achieved

Analysis of international projects reveals core insights and trends: investor type determines product design. Institutional products typically have few large holders, high unit value, low-frequency trades; retail products involve many small holders, small units, and long-term holding; global products succeed by leveraging geographic differentiation to avoid regulatory complexity.

Combining insights from Hong Kong and global RWA projects, we draw four conclusions:

-

No one-size-fits-all model: Institutional and retail markets require completely different product designs;

-

Regulation is the biggest divider: Performance differences between U.S. and non-U.S. investor products are stark, with U.S. professional investors showing clear liquidity advantages;

-

Liquidity remains a challenge: Even the most successful products show limited secondary market activity;

-

Scaling requires focus: Either go deep (large institutional deals) or go broad (retail adoption).

All this data and analysis reveal an important truth: successful RWA products must find their own liquidity and unique product-market fit.

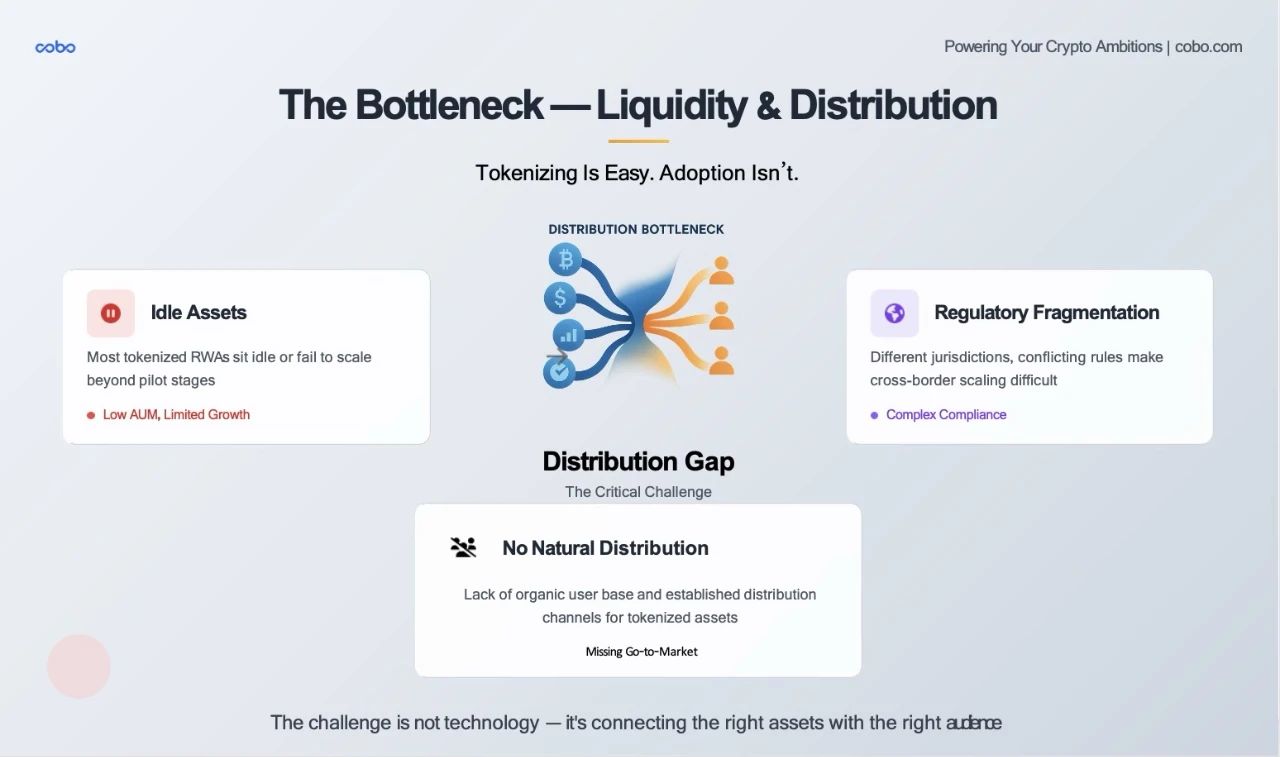

Tokenizing RWA is easy—but distribution is hard. Anyone can mint a token representing a property or a U.S. Treasury bill. The real challenge lies in how to deliver these tokens at scale, compliantly, and continuously to the right buyers.

Beyond the leading RWA projects we’ve seen, dozens of tokenized Treasury products already exist on-chain, many offering attractive yields—yet most manage less than a few million dollars in AUM. Why? Because they aren’t integrated into DeFi protocols, listed on regulated exchanges, or easily accessible to institutional buyers without customized onboarding.

The value of tokenized assets depends directly on how easily they can be exited. Currently, apart from a few pools like Maple or Centrifuge, secondary market liquidity for RWA is extremely weak. One reason is that RWA lacks anything resembling Nasdaq—or even a proper bond market. This leads to opaque pricing, limiting institutional participation.

Lastly, fragmented regulation across jurisdictions remains a major obstacle. Different regions have varying views on whether tokens qualify as securities, how custody should work, and who can hold them. This slows down cross-border scaling of RWA—especially in Asia, where progress is particularly sluggish.

Thus, while RWA asset quality improves and infrastructure strengthens, the “last mile” remains unconnected: matching tokenized assets with the right capital, building liquidity, and enabling RWA to fulfill its true potential.

This is the current challenge—and greatest opportunity—for the RWA industry.

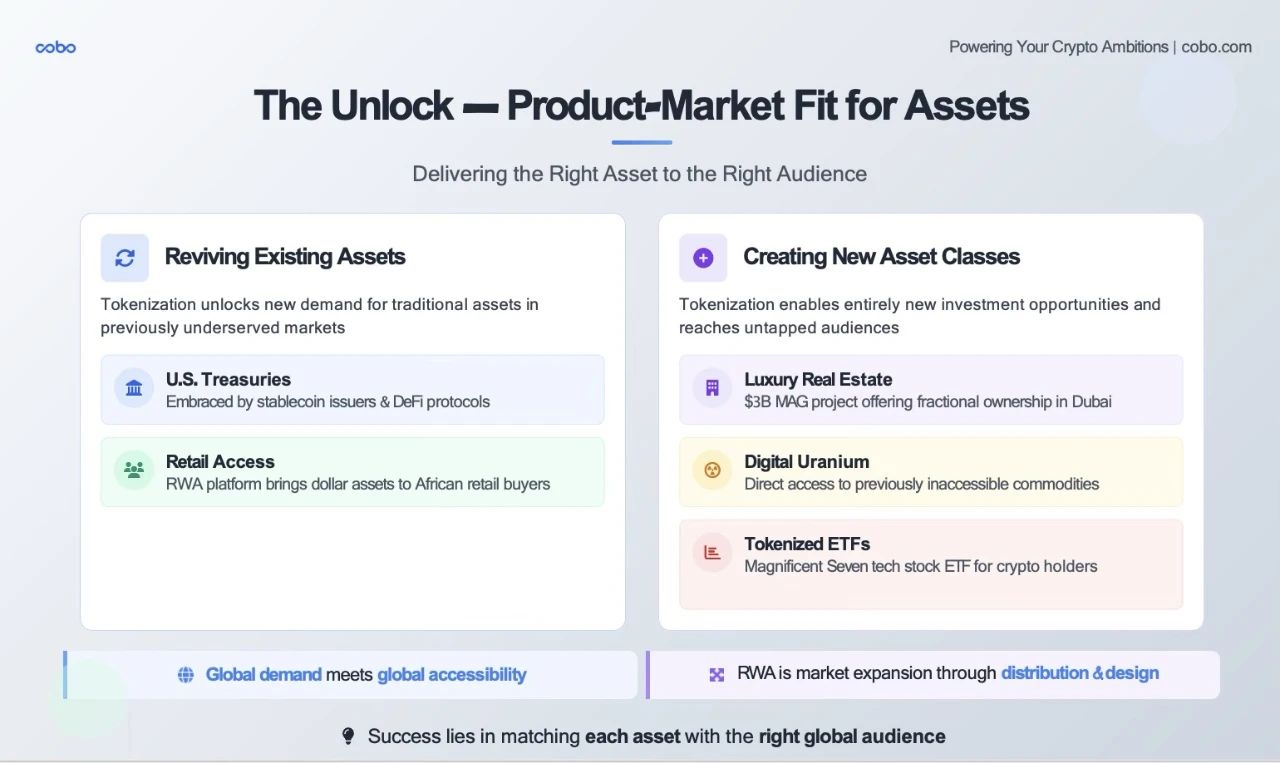

Solving the liquidity puzzle requires more than better infrastructure—it demands true product-market fit. It’s not merely about placing old assets onto new blockchain rails. The core question is: Who truly needs this asset? If the asset becomes easier to access, which new markets can it serve? If U.S. stocks could trade 24x7, and more brokers could trade digital assets, would there still be demand for tokenized ETFs and equities?

Tokenization enables two powerful outcomes: finding new demand for existing assets that have stalled in traditional markets, and creating entirely new investable assets delivered in novel ways to previously excluded investors.

Reviving Demand: The current popularity of U.S. Treasuries in RWA exemplifies this. In traditional finance, the Treasury market is crowded and losing appeal. But in the crypto world and emerging markets, they’ve found renewed relevance: stablecoin issuers on-chain use tokenized Treasuries to generate yield. Blockchain platforms designed specifically for RWA now sell U.S. Treasuries directly to retail investors in Africa, giving them access to dollar-denominated, yield-bearing assets unavailable at local banks. Here, tokenization does more than digitize—it matches assets with a global, underserved audience hungry for safety and yield.

Creating New Investable Assets: When tokenization creates new assets, the opportunities become even more exciting.

Case 1: Luxury real estate in Dubai. Dubai’s property prices have impressed overseas investors in recent years. But how many can actually enter this market? Do you need to fly to Dubai? Find a reliable agent—who may not even be available during working hours? Traditionally, this market is closed—opaque, high-barrier, difficult for foreigners. Now, through tokenization, projects like the $3 billion MAG initiative are opening fractional ownership of premium properties to global buyers—with compliance, yield, and liquidity pathways built-in. Could Shanghai residents’ post-pandemic spree buying homes in Japan be replicated here in Dubai? This isn’t just financial inclusion—it’s market expansion.

Case 2: Commodities like uranium. Most retail investors have never touched uranium—it’s too complex, restricted, and niche. But through “digital uranium,” a new tokenized instrument, investors can now directly back a critical resource powering the global nuclear transition. A brand-new asset, delivered to a brand-new audience, made investable through tokenization.

Case 3: Re-packaged equities. When crypto markets slump, tokenized ETFs tracking the Nasdaq’s Magnificent Seven offer traders a way to earn real-world yields without exiting crypto. In other words, tokenization makes assets follow the money—not the other way around.

Case 4: Private credit. As traditional market spreads tighten, lenders hesitate. Platforms like Maple and Goldfinch use tokenization to fund SME loans in underbanked regions, while allowing global DeFi users to earn yields from real-world cash flows.

So the bigger picture for RWA looks like this: tokenization isn’t just repackaging old financial tools—it’s about redefining what can be an asset and delivering it to those who value it most. This is what product-market fit looks like in the on-chain era: global demand meeting global accessibility, new assets meeting new liquidity, with effective matching at the center.

These new audiences—including institutional investors, fintech treasury teams, and crypto-native investors—span two worlds. Some come from traditional finance, others from DeFi. For RWA to achieve mass adoption, the only path forward is building bridges between them. Think of it this way: Traditional Finance (TradFi) brings assets—credibility, compliance, and scale; Decentralized Finance (DeFi) brings distribution—24/7 access, smart contract automation, and global liquidity. The opportunity lies in securely, compliantly, and programmatically connecting the two.

This isn’t theoretical—it’s happening now: Ondo Finance brings BlackRock’s tokenized Treasuries on-chain and integrates them into DeFi vaults; Centrifuge converts off-chain credit into on-chain assets usable by protocols like MakerDAO and Aave; Maple and Goldfinch allow institutional lenders to tap global yield-seeking capital via DeFi channels. These examples show the sparks that fly when traditional financial assets meet DeFi liquidity.

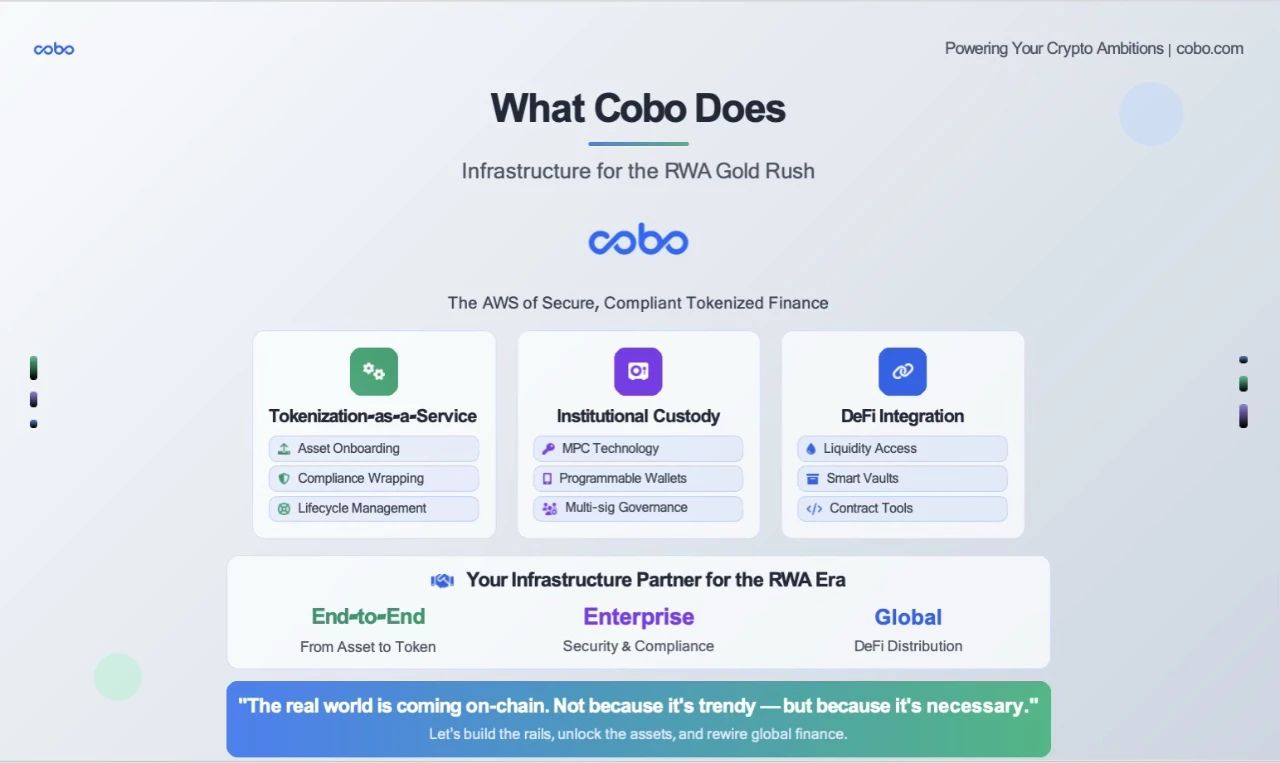

Having understood the strategic opportunity and confirmed the direction, we now need the right tools to participate in this RWA boom. This is where Cobo comes in: Cobo provides end-to-end infrastructure for tokenized assets. Whether you’re an asset issuer, fund manager, or securities firm, Cobo helps you securely and compliantly bring real-world assets on-chain.

Specifically, here’s how we do it:

🛠️ Tokenization-as-a-Service

-

We help you connect assets such as Treasuries, credit, and real estate to our platform and wrap them via smart contracts.

-

You choose the blockchain, compliance framework, and access permissions.

-

We handle the technology, legal structure, and full lifecycle management.

🔐 Institutional-Grade Custody

-

Cobo is a regulated, qualified custodian.

-

Our MPC (Multi-Party Computation) wallet stack delivers security, automation, and full control—no seed phrases, eliminating single points of failure.

-

We support whitelisted transfers, timelock vaults, multisig governance—everything you need to keep tokenized assets secure.

🌉 DeFi Integration

-

We don’t just wrap your assets—we provide tools for distribution and interaction.

-

Whether you want to integrate with Aave, offer staking services, or create liquidity pools—we provide the institutional wallets (like Web3 and MPC wallets) needed to interact directly with blockchains.

Think of Cobo as the middleware layer between traditional assets and on-chain liquidity. From asset onboarding to custody, from compliance management to role-based authorization and blockchain interaction under risk controls, Cobo is your infrastructure partner to build and scale in this new market.

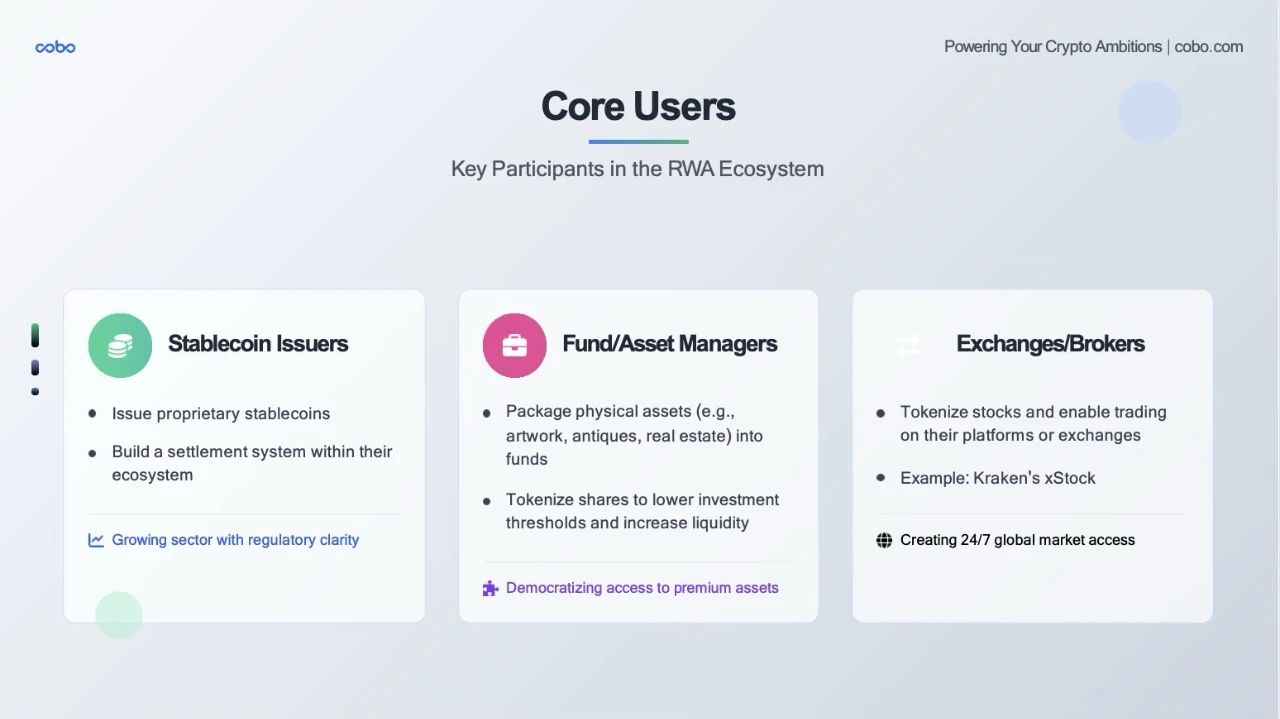

Our RWA Engine serves all stablecoin issuers, asset managers, and exchange-like institutions.

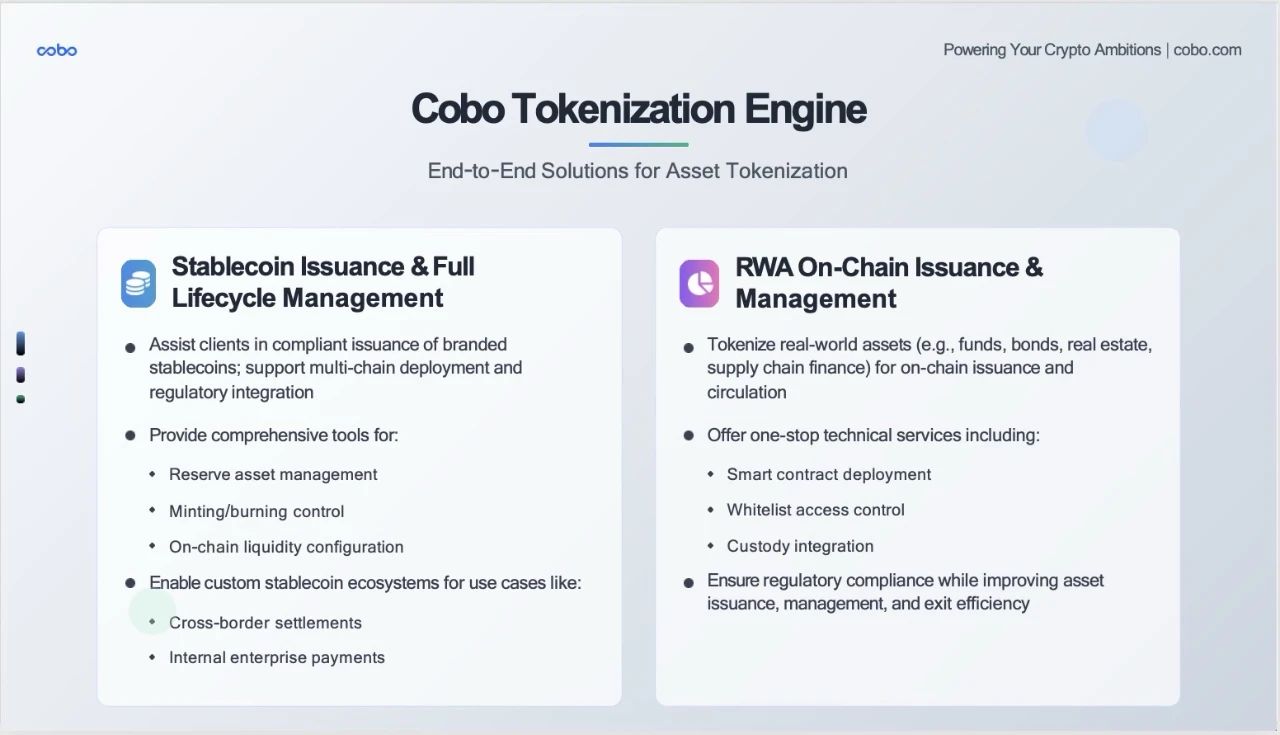

Cobo Tokenization Engine is our core technological platform built for the RWA era. We don’t just offer isolated tools—we’ve built two complete end-to-end solutions covering the two most critical tracks in tokenization.

Left: Stablecoin Issuance & Full Lifecycle Management

Through client engagements, we’ve found many institutions want to issue their own branded stablecoins but face three major challenges:

-

High technical barriers: Smart contract development, multi-chain deployment

-

Regulatory complexity: Varying requirements across jurisdictions

-

Operational difficulty: Reserve management, liquidity configuration

Cobo’s Solution

We offer more than tools—we deliver a full ecosystem:

-

Compliant Issuance: Help clients issue branded stablecoins under local regulatory requirements

-

Multi-Chain Deployment: One system supporting Ethereum, BSC, Polygon, and other major blockchains

-

Comprehensive Toolkit:

-

Reserve Asset Management: Real-time monitoring, automated reporting

-

Mint/Burn Control: Precise supply management

-

On-Chain Liquidity Configuration: Deep integration with major DEXs and CEXs

-

Use Case Examples

-

Cross-Border Settlement: Enterprises can issue their own stablecoins for international trade settlements

-

Internal Corporate Payments: Large conglomerates can use them for internal transfers and employee payroll

Right: RWA On-Chain Issuance & Management

The data we reviewed earlier—BUIDL’s $2.9 billion, China Asset Management’s $120 million—shows the vast potential of the RWA market. But to scale sustainably, industrial-grade infrastructure is required. We offer RWA issuers a true “move-in ready” solution:

-

Smart Contract Deployment: Audited, modular contract templates

-

Whitelist Access Control: Granular permission management tailored to regulatory needs

-

Custody Integration: Seamless connection with our custody, MPC wallets, and Hong Kong trust partners

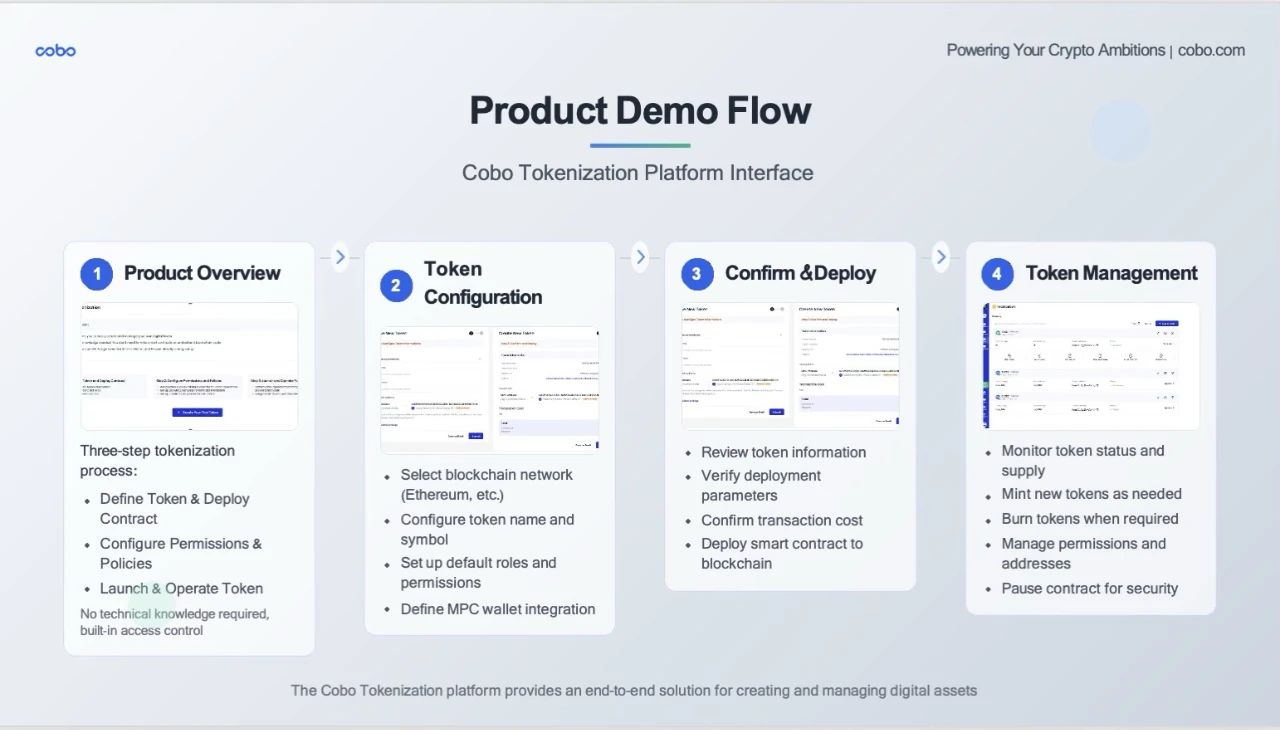

Here we show the actual user interface and workflow of our tokenization platform.

Step 1: Product Review

This is the first screen users see.

• Clear Three-Step Process: Define token & deploy contract, configure permissions & policies, launch & operate token

• No Technical Knowledge Required: Interface explicitly states “no technical expertise needed”

• One-Click Start: Lowers entry barrier

Step 2: Token Configuration

Shows the actual configuration interface:

• Blockchain Selection: Users can choose different blockchains like Ethereum mainnet

• Token Basics: Name, symbol, and other essential fields

• Security Setup: Integrated MPC wallet ensures asset security

• Customization Options: Meets individual client needs

Step 3: Confirm & Deploy

Critical confirmation step:

• Parameter Review: All settings clearly displayed

• Transparent Cost: Deployment fee clearly shown ($0.99)

• MPC Wallet Display: Highlights our core security technology

• Final Check: Gives users a last review opportunity

Step 4: Token Management

Post-deployment management interface:

• Multi-Token Support: Manage multiple token projects simultaneously

• Status Monitoring: Clear display of Success, Processing, Failed statuses

• Rich Features: Mint, burn, permission management, contract pause—all essential functions

• Detailed Data: Total supply, individual holdings, contract address, and other key info

Today we’ve covered a lot—from market trends to technical architecture, from case studies to product demos. Let me conclude with three key takeaways:

First: The Inevitability—Tokenization is irreversible;

Second: The Motivation—RWA isn’t pursued because blockchain is cool or tokenization trendy. It’s driven by the limitations of traditional finance—geographic borders, time constraints, high costs, complex processes—problems that must be solved;

Third: The Call to Action. Asset Issuers must bring high-quality real-world assets; Technology Providers must deliver reliable infrastructure (this is our role); Investors must provide liquidity and trust; Regulators must provide compliant frameworks.

This window won’t stay open forever. Early participants will reap the greatest rewards—not just financially, but in shaping the future of finance.

About Cobo

Cobo is a trusted leader in digital asset custody and wallet technology, offering a one-stop wallet technology platform that enables institutions and developers to easily build, automate, and securely scale their digital asset businesses.

Founded in 2017 by blockchain pioneers and headquartered in Singapore, Cobo is trusted by over 500 leading digital asset firms worldwide, safeguarding billions of dollars in assets. Today, Cobo offers the industry’s only platform integrating four distinct digital asset wallet technologies: custodial wallets, MPC wallets, smart contract wallets, and exchange wallets. Committed to the highest standards of security and regulatory compliance, Cobo maintains a zero-breach record and holds ISO 27001, SOC2 (Type 1 and Type 2) certifications, and licenses across multiple jurisdictions. Recognized for industry-leading innovation, Cobo has been honored by authoritative bodies including Hedgeweek and Global Custodian.

Learn more at: www.cobo.com.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News