DeepSeek earns 4.09 million daily, but "large-factory alternatives" remain mired in losses

TechFlow Selected TechFlow Selected

DeepSeek earns 4.09 million daily, but "large-factory alternatives" remain mired in losses

If we view large AI models with a developmental perspective, we can see that, like earlier technologies such as the internet and mobile apps, they face challenges of unclear commercialization upon initial emergence.

Author: Wu Zi

Image source: Generated by Wujie AI

The wildly popular DeepSeek has already pioneered a closed commercial loop.

Image source: DeepSeek

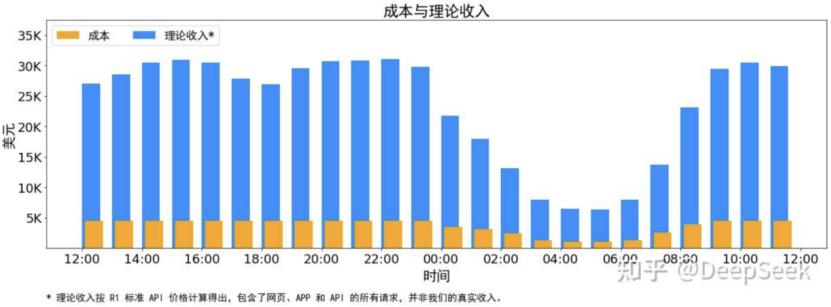

On March 1, 2025, DeepSeek published a technical article stating that from 24:00 on February 27 to 24:00 on February 28, with GPU rental costs calculated at $2 per hour, the platform's average daily cost was $87,072 (approximately RMB 630,000); based on token input/output pricing under R1 rates, the platform’s single-day revenue reached $562,027 (approximately RMB 4.09 million), generating a net profit of $474,955 (around RMB 3.46 million), achieving an impressive cost-profit margin of 545%.

However, it should be noted that the financial data presented by DeepSeek is highly simplified and idealized, significantly deviating from the complexities of real-world operations. DeepSeek admits that due to V3’s lower pricing, only partial services being charged, and discounts during off-peak hours, the company's actual income is far less than reported.

Image source: WeChat

Possibly inspired by the immense commercial potential embedded in DeepSeek’s large model, numerous tech companies have recently been aggressively promoting their own products integrated with DeepSeek. For instance, on February 16, Baidu Search officially announced full integration with both DeepSeek and its latest version of the Wenxin large model for deep search capabilities. On February 27, Tencent's new product "Yuanbao" was launched within the life services section of WeChat.

In reality, the explosive popularity of DeepSeek cannot mask the awkward truth that AI large models still face limited commercialization capabilities. Since ChatGPT sparked the large model wave in November 2022, AI large models have yet to find ideal commercial applications, leaving most AI model companies deeply mired in losses.

Consumer-facing (C-end) products struggle to charge users directly and require continuous investment in marketing, making commercialization particularly challenging for C-end AI model products.

A possible commercial path lies in AI-powered search monetization.

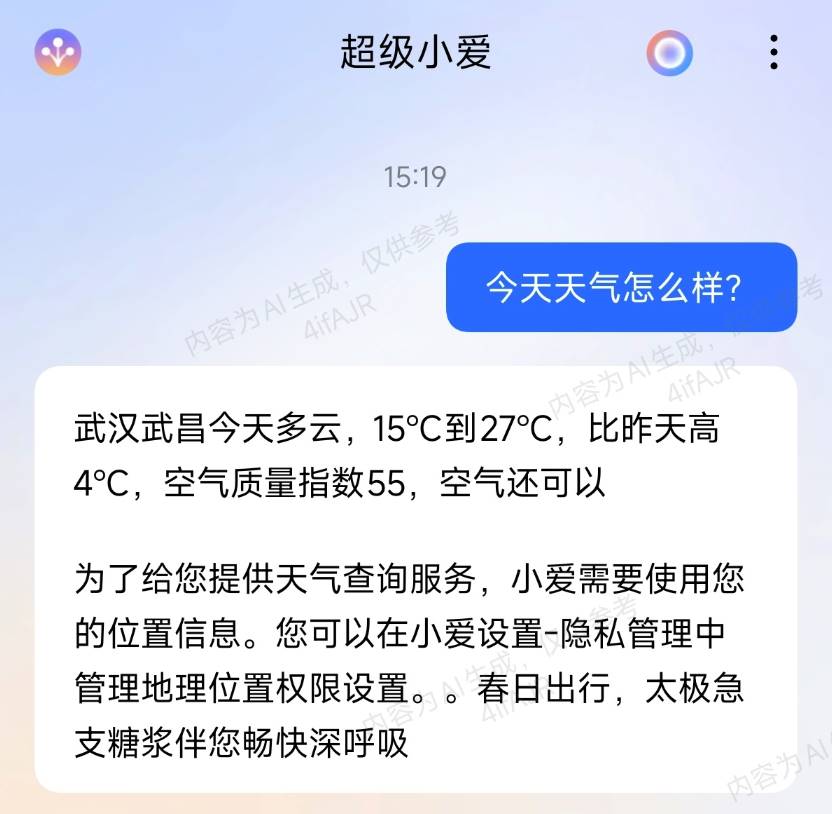

For example, recently some netizens noticed that Xiaomi’s Super Xiaoai, when answering the question “What’s the weather like today?”, included commercial advertisements at the end of its response.

Image source: Weibo

On February 25, 2025, Moonshot AI underwent a business registration update, adding “Internet information service for pharmaceuticals,” suggesting preparations for launching medical advertising on Kimi.

Baidu stated during its Q4 2024 earnings call: “We expect our advertising revenue to gradually increase, driven by our efforts to monetize the results of our AI transformation.”

However, because AI search delivers highly singular results, the highest-paying advertisers may not necessarily offer the best solutions. In fact, due to the need to balance high marketing expenses, advertiser-provided solutions might lack cost-effectiveness or even harm consumer interests. After consulting people around us, DuoJiao Spicy found that many remain cautious about ads in AI search, concerned that incorporating ads could compromise fairness and objectivity.

Another commercial avenue involves tech companies acting as “water sellers,” generating revenue by providing AI infrastructure to enterprise (B-end) clients. For example, on February 20, iFlytek launched two fully domesticated AI infrastructure systems—the Spark DeepSeek Tower All-in-One Machine and the Spark DeepSeek All-in-One Machine—dedicated to delivering efficient and reliable large model deployment solutions for downstream customers.

Nonetheless, not all tech companies possess the technological depth required to sustain the “water seller” narrative. Drawing lessons from the PC and mobile internet eras, if AI large models are to achieve a closed commercial loop, they must go beyond incremental innovation along existing business lines and instead deeply understand user needs, creating entirely new interaction paradigms and transaction scenarios.

The recent surge of DeepSeek across the tech industry is certainly due to its open-source philosophy—fully open-sourcing its technology—but this success also hinges on its more efficient inference and lower operational costs. Official data shows that DeepSeek-R1’s inference cost is merely 17% of GPT-4 Turbo’s.

After going open-source, tech enterprises no longer need to spend heavily building proprietary closed models. By simply integrating DeepSeek-R1, they can access top-tier AI large model capabilities at low cost—naturally earning enthusiastic adoption.

That said, while DeepSeek’s inference costs are very low, they are not entirely free. As downstream user numbers grow, many companies unable to close their own commercial loops are falling into a “scale trap.”

Image source: Liang Bin’s Weibo

On February 14, 2025, Liang Bin, Chairman and CEO of Beijing Bayou Technology Co., Ltd., posted on social media that running a full-capacity consumer-facing DeepSeek service using AMD MI300X chips to deliver 100 billion tokens daily would incur monthly costs of approximately 360 million yuan ($50 million).

An AI industry practitioner told DuoJiao Spicy: “Unlike traditional internet businesses where marginal costs decrease with scale, current AI products see costs rise proportionally with computational load—‘the better the product performs, the higher the subsequent costs.’”

Given that most products integrating DeepSeek haven’t expanded their revenue channels, the majority of companies’ AI-related businesses are actually sinking deeper into losses.

For example, the WeChat public account “Consensus Crusher” revealed that to support WeChat’s AI search function, Tencent ordered an additional 100,000–200,000 H20 GPUs, amounting to hardware expenditures as high as $2 billion.

Precisely because upstream costs are exceptionally high and AI search results are confined within the WeChat ecosystem—with limited monetization potential—WeChat still hasn't opened AI search to all users to date.

Against this backdrop, Tencent is now actively promoting Yuanbao, its AI assistant powered by full-capacity DeepSeek and capable of web-wide searches.

Thanks to heavy traffic acquisition campaigns across platforms such as WeChat, Bilibili, and Zhihu, on February 22, Tencent Yuanbao surpassed Doupeng in single-day downloads, ranking second among free apps on China’s App Store.

Likewise, recognizing the vast commercial imagination tied to AI large model technologies, in 2024, 360 began doubling down on AI initiatives, launching products including 360 AI Search, the 360 Children’s Watch A9 AI Hongyi Edition, and various AI assistants.

Image source: 360's Financial Report for the First Three Quarters of 2024

Unfortunately, due to extremely high R&D and operational costs associated with AI technologies and the inability to effectively generate downstream revenues, 360’s financial performance has continued to deteriorate. The financial report shows that in the first three quarters of 2024, 360’s operating costs reached 2.608 billion yuan, surging 31.92% year-on-year. During the same period, 360’s revenue was 5.609 billion yuan, down 16.76% year-on-year, with a net loss of 579 million yuan.

In stark contrast to consumer-facing internet companies struggling to close the commercial loop in AI large model ventures, upstream players such as chip manufacturers and cloud service providers—the so-called “water sellers”—are seeing steadily improving financial results.

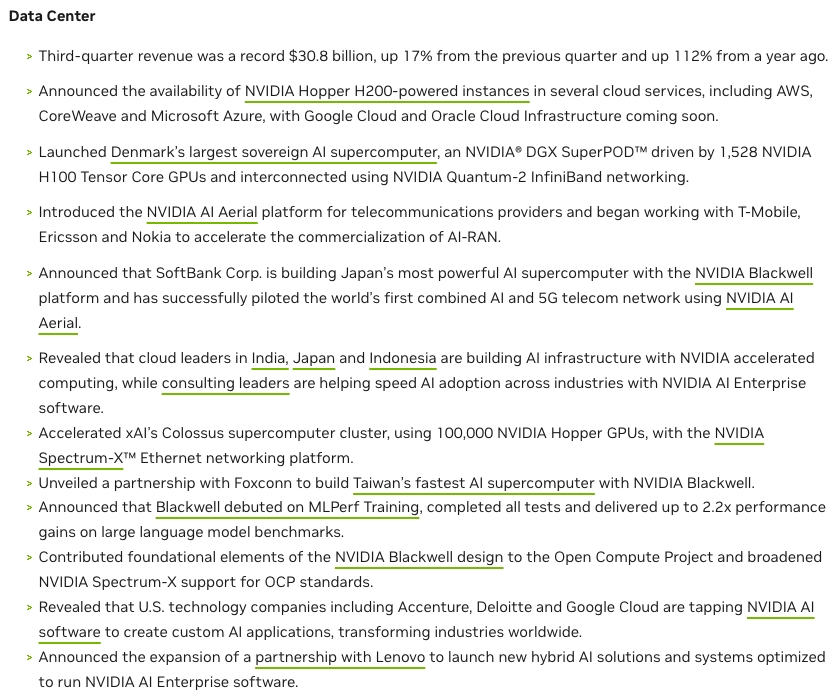

Image source: NVIDIA’s Q3 FY2025 Earnings Report

NVIDIA, for example, reported record-breaking figures in Q3 of fiscal year 2025: data center business revenue reached $30.8 billion, up 112% year-over-year, setting a new high. As a result, NVIDIA’s net profit hit $19.309 billion, growing 109% year-on-year, with gross margins reaching 74.6%, up 0.6 percentage points.

The primary reason? “NVIDIA’s AI chips are unmatched in performance and highly irreplaceable,” enabling them to command premium prices from downstream customers amid the booming AI industry.

Louis Navellier, founder of market research firm Navellier & Associates, said: “Regardless of how NVIDIA’s financials perform, I won’t sell my shares—it’s the first stock I’ve ever seen with such strong monopolistic power and influence.”

It’s not just NVIDIA at the top of the pyramid—relatively downstream cloud providers like Alibaba Cloud and Baidu Cloud are also emerging from losses thanks to AI-driven growth.

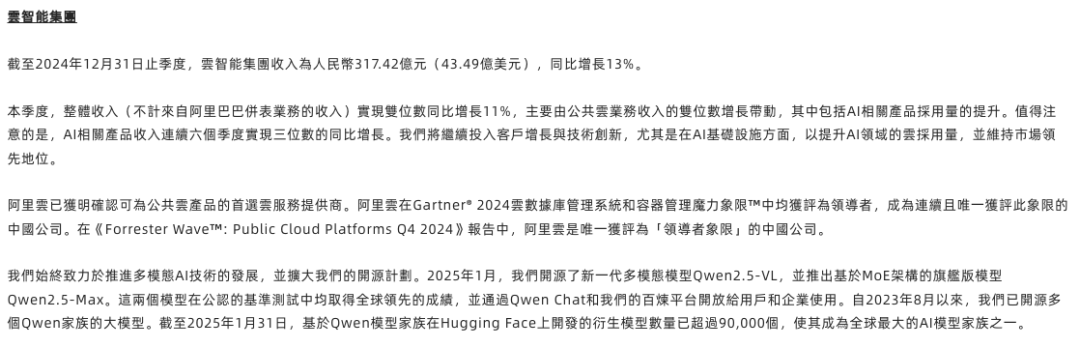

Image source: Alibaba’s Q3 FY2025 Earnings Report

Alibaba’s Q3 FY2025 earnings report reveals that Alibaba Cloud generated revenue of 31.742 billion yuan, up 13% year-on-year, with adjusted EBITA reaching 3.138 billion yuan, increasing 33% year-on-year, primarily driven by “growth in public cloud revenue fueled by AI-related products.”

Recently, Morgan Stanley noted in a research report that since Q4 2024, Baidu Cloud’s profitability and margins have improved, a trend expected to continue. In Q1 2025, Baidu Cloud’s revenue is projected to grow 20% year-on-year.

Given the promising outlook of AI technology, Alibaba Cloud is ramping up investments in AI. On February 24, 2025, Eddie Wu, CEO of Alibaba Group, announced that over the next three years, Alibaba will invest more than 380 billion yuan in cloud and AI hardware infrastructure—exceeding the total investment of the past decade.

Wu stated: “The AI boom has far exceeded expectations. The domestic tech industry is still in its early stages, with enormous potential. Alibaba will spare no effort to accelerate cloud and AI hardware infrastructure development and drive ecosystem-wide progress.”

As Xiaopeng Motors Chairman He Xiaopeng put it: “No one makes money from language large models except NVIDIA—or maybe Microsoft, though even Microsoft isn’t strictly profitable; OpenAI raises funds rather than earns profits, same with Xiao Chuan.” Reviewing the commercialization journey of the AI large model industry, DuoJiao Spicy finds a clear disparity in commercial progress between upstream and downstream companies: the closer to end-users, the harder it is to make money.

Because AI large model technology has become a major trend in the tech sector, many downstream companies are rushing to adopt related technologies. Upstream chip makers and cloud service providers—the “water sellers”—whose computing infrastructure is in high demand, have already achieved commercial closure by selling compute power to downstream clients.

While many downstream To-C companies have integrated AI large models into core products, they have failed to expand revenue streams simultaneously and must bear massive operational costs—leading most to operate at a loss, essentially “losing money for exposure.”

For upstream “water sellers,” achieving early commercial closure is indeed fortunate. However, healthy supply chain operations depend on positive cash flow throughout the value chain. Until downstream AI model companies achieve commercial viability, the upstream “water sellers” remain built on shaky ground—a tree without roots.

Since AI large models hold significant advantages in information retrieval—not only generating content but also emphasizing semantic understanding and personalized recommendations—and given that traditional search engines have proven monetizable, many internet companies are doubling down on AI search, hoping to break through commercially via search functionality.

Mingsheng Securities stated in a research report: “AI search is poised to become the first commercially viable C-end super app—‘the first ray of light’ in large model monetization.”

Hence, internet giants like 360, Baidu, and iFlytek, as well as newer entrants like Moonshot AI, Zhipu AI, and Mitra Tech, are all entering the AI search arena.

Image source: AI Product Rankings

Evidence shows that AI search products, having tapped into genuine user needs, have indeed become pioneers in AI application deployment. Among the top 20 websites listed in the January 2025 AI Product Rankings, three were AI search tools: New Bing, Nano AI Search, and Perplexity AI. In the domestic overall rankings, four spots went to AI search products: Nano AI Search, Mitra AI Search, Zhihu ZhiDa, and C-Know.

A prime example is Nano AI Search. As a veteran in the internet space, 360 entered the search market back in 2012 with a general search service aiming to challenge Baidu’s dominance. However, due to limited search capabilities and brand recognition, 360’s search business never gained traction.

With AI technology maturing, 360 decisively doubled down on AI search, launching Nano AI Search—which has now become an industry leader. According to the AI Product Rankings – Domestic Edition, in January 2025, Nano AI Search recorded 308 million web visits, ranking first.

Parallel to expanding market influence, AI search companies are experimenting with monetization. After analysis, DuoJiao Spicy identifies three main commercial directions currently pursued by AI search firms: subscriptions, advertising, and API sales.

Perplexity AI, one of the earliest players in AI search, chose subscription as its initial monetization model. Users seeking more professional search queries, custom AI models, or file analysis must subscribe to the Pro version at $20 per month.

According to The Information, Perplexity AI is expected to have 550,000 premium subscribers in 2025, generating annualized revenue of $127 million. Even so, the company remains unprofitable. Its official blog states: “The current subscription fee of $20/month or $200/year is insufficient to support our ambitious goals and growing revenue-sharing commitments with publishers.”

Yang Zhiyun, founder of Moonshot AI, believes: “Charging by user count cannot scale with increased product value creation—subscriptions aren’t the final business model.”

Considering even Western markets struggle to turn a profit through subscriptions despite stronger user payment habits, in China, where consumers lack a culture of paying for digital services, AI search products naturally face even greater challenges in closing the commercial loop via subscription models.

Image source: Perplexity AI

Consequently, in November 2024, Perplexity AI launched an ad strategy. When users search questions, sponsored ads appear in the “Follow-up Questions” section at the bottom of the results page.

In fact, many Chinese AI search companies are now targeting ad-based monetization.

However, unlike traditional search engines that return vast amounts of content in ranked order—allowing paid placements atop results for users to choose freely—AI search consolidates information and delivers highly precise answers. If vendors overly prioritize monetization, conflicts with user interests become inevitable.

For instance, if a user searches for medical advice, placing expensive ads from Putian-style hospitals in the results could easily trigger another “Wei Zexi incident.”

This is precisely why internet companies hesitate to push AI search advertising into deeper commercial waters. At the end of 2024, Zhou Hongyi, founder of 360 Group, admitted: “Actually, doing AI search is quite painful for us—we’re undergoing self-disruption, and temporarily there’s nowhere suitable to place ads.”

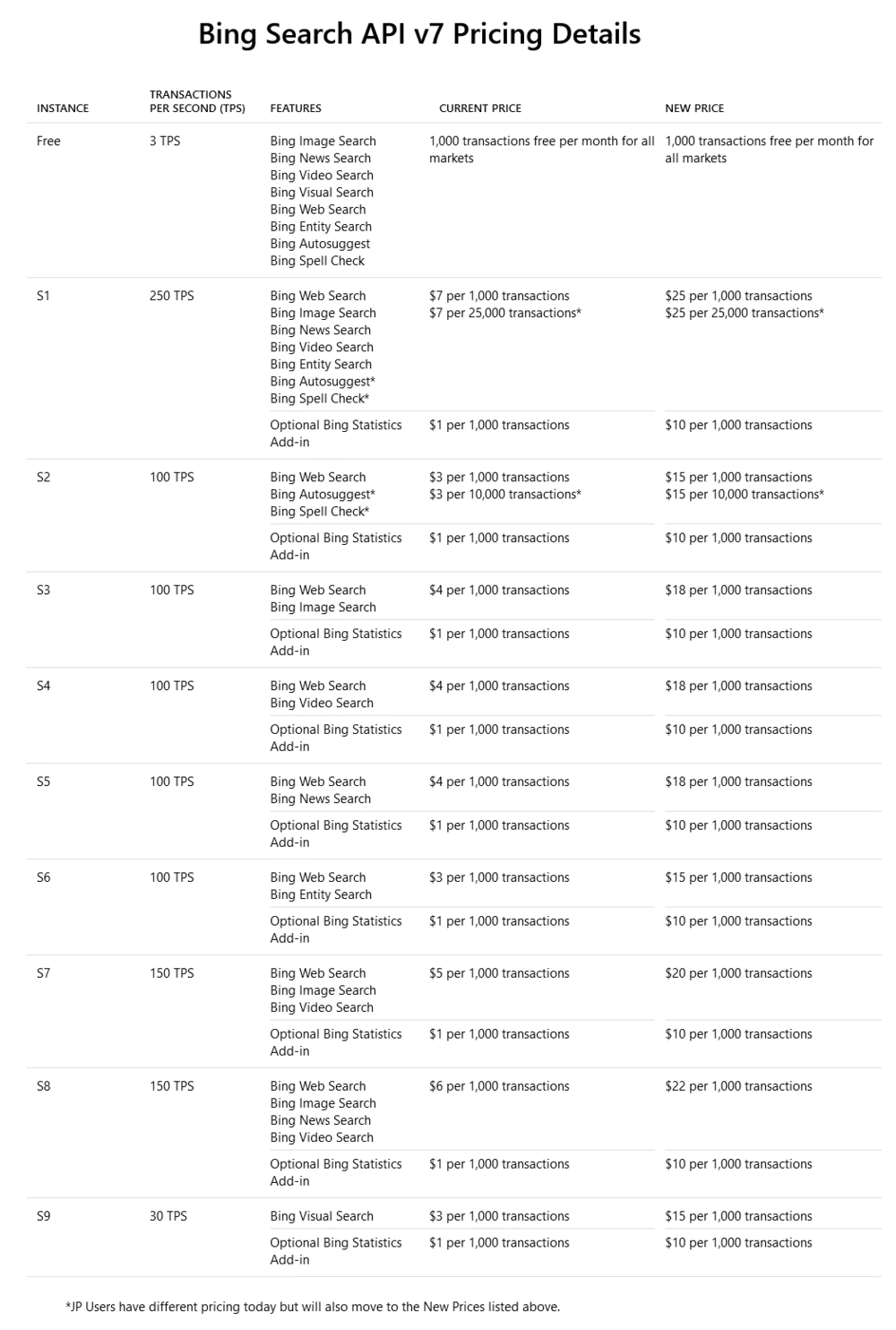

Besides consumer-facing models like subscriptions and ads, AI search can also monetize by selling APIs to B-end clients. For example, Bing offers the Bing Search API to enterprises, allowing them to integrate search functionality into their own platforms.

Image source: Bing

However, due to the high cost of AI large models, the usage price of Bing Search API is not low. In May 2023, Microsoft raised Bing Search API pricing: the ChatGPT-enabled Bing API costs $28 per thousand calls for fewer than one million requests per day, and $200 per thousand calls for over one million requests per day. Microsoft explained: “The new pricing model more accurately reflects Bing’s ongoing technological investments to improve search.”

Due to excessive usage costs, in April 2023, Brave Search severed all connections with Bing API, opting instead to use its own index and planning to launch its own Brave Search API.

Given that DeepSeek is now open-source, any organization can freely integrate it, making it difficult for AI search providers to convince technically capable downstream clients to pay higher fees for proprietary APIs.

In May 2024, Wang Xiaochuan, founder and CEO of Baichuan AI, stated: “API revenue and large model revenue themselves aren’t the most attractive business models—they aren’t what we should chase or emulate.”

In summary, due to fundamental differences in user needs, technical approaches, and output presentation compared to traditional search engines, the three current commercial paths for AI search—subscriptions, advertising, and API sales—all face considerable challenges. It will be difficult for these companies to quickly emerge as dominant search giants in the AI era.

Indeed, the commercialization difficulties faced by AI large models are not unique. In the early days of PC and mobile internet, many internet companies encountered similar hurdles.

Taking Tencent as an example, according to Wu Xiaobo’s book *The Tencent Story*, by the end of 1999, OICQ had over one million registered users. But with enormous daily operating costs and no clear path to monetization, Tencent’s bank balance once dropped to just 10,000 yuan, nearing collapse. Desperate, founder Pony Ma attempted to sell the company for 3 million yuan.

Yet after approaching multiple companies, no deal was finalized. Most valued Tencent based only on tangible assets, offering mere hundreds of thousands of yuan. Lin Jun, author of *Fifteen Boiling Years*, recalled: “OICQ might have looked like a fast-growing project, but nobody in the world knew how it could make money.”

The rest, as they say, is history. Based on a novel IM interaction model, QQ created the online chat scenario, later expanding into advertising, QQ Show, and QQ Games—eventually turning Tencent into a cash-generating powerhouse.

He Xiaopeng believes: “After an interaction revolution comes a shift in usage scenarios—this process brings enormous commercial opportunities.” Products like QQ, Didi, and Meituan succeeded in the PC and mobile internet eras by introducing new interaction methods and transaction scenarios, boosting efficiency, creating greater user value, and ultimately closing the commercial loop.

Unlike the transition from PC to mobile internet—which mainly changed content delivery formats—AI large models may involve entirely new interaction carriers, methods, and scenarios, potentially leading to commercial models vastly different from traditional internet paradigms.

Regarding AI’s commercial prospects in the automotive sector, He Xiaopeng expressed optimism: “If L4 autonomy is achieved, it will dramatically increase vehicle software or ecosystem revenue. For example, your car automatically washing itself becomes one ecosystem revenue stream; automatic parking, a second; automatic charging, a third.”

Of course, smart vehicles represent just one vertical application of AI. Beyond that, AI holds even broader possibilities. Meta’s Chief Scientist Yann LeCun believes that as technology matures, AI glasses may integrate AI Agent functions, enabling users to manage daily tasks through a single pair of glasses, greatly enhancing work efficiency, creativity, and productivity.

During this evolution, AI glasses may experience their “iPhone moment,” and AI technology could unlock entirely new commercial models alongside expanding application scenarios—such as shopping, navigation, and immersive video viewing via AI glasses.

Clearly, adopting a forward-looking perspective on AI large models reveals that, much like earlier internet and mobile app technologies, they initially face ambiguous commercialization challenges upon debut.

The good news is that user needs are constant. With major internet players and startups actively innovating in functionality and interaction design based on real user demands, once novel usage scenarios are discovered, AI large models may finally achieve a closed commercial loop.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News