Why has this cycle been so difficult, and what should I do?

TechFlow Selected TechFlow Selected

Why has this cycle been so difficult, and what should I do?

Control the downside risk, and the upside will take care of itself.

Author: Aylo

Translation: TechFlow

First, this cycle is genuinely tough—don’t let anyone pretend otherwise.

But the reality is that every cycle gets harder than the last. You're competing against a larger pool of participants, who are increasingly sophisticated, and ultimately, there are more losers.

If you didn't hold mostly BTC or SOL during the bear market, you probably didn't make money—and may even be tearing your hair out.

I would have struggled too if I weren’t measuring returns in SOL. Yes, we do have some big individual winners, but I suspect if you speculated heavily on these assets, you might end up giving back a portion—or even a large part—of your gains. Especially because people don’t typically walk away after one big win.

They say “the cycle still has time,” assume prices will keep rising, and that’s how they give their profits back. The truth that “play stupid games, win stupid prizes” never expires. Sometimes, it just takes longer for this dynamic to play out among traders and gamblers.

So why is this cycle so difficult?

PTSD (Post-Traumatic Stress Disorder)

We’ve had two major examples where large altcoins dropped 90–95%. Add to that the collapses of Luna and FTX, which triggered industry-wide contagion and likely pushed asset prices lower than they otherwise would have gone.

Many big players were wiped out, and we haven’t seen the return of crypto lending platforms this cycle. This PTSD runs deep among crypto natives. Especially in the altcoin markets, the mindset that “everything is a scam” has become mainstream.

In previous cycles, the belief that “this technology is the future” was more widespread, but now it's either a minority view or coexists with “everything is a scam.” No one wants to hold anything long-term because no one wants to lose most of their portfolio again.

This has created a “max jeet cycle.” This sentiment is amplified on Crypto Twitter, as participants constantly search for the top of the cycle.

This psychological impact extends beyond trading—it affects the entire ecosystem’s approach to building and investing. Projects now face higher scrutiny and trust thresholds have multiplied. This has both positive and negative sides: while it helps filter out obvious scams, it also makes it harder for legitimate projects to gain attention.

Innovation

Innovation continues and infrastructure keeps improving, but we’re no longer seeing jaw-dropping 0-to-1 breakthroughs like DeFi.

This makes arguments like “crypto hasn’t progressed” easier to accept, fueling more narratives such as “crypto has achieved nothing.”

The innovation landscape has shifted from revolutionary leaps to incremental improvements. While this is a natural evolution for any technology, it poses challenges for a narrative-driven market.

We also still lack breakout applications—the kind needed to bring hundreds of millions of users on-chain.

Regulation

The corrupt U.S. Securities and Exchange Commission (SEC) has caused chaos. It has hindered industry progress and blocked areas like DeFi from achieving product-market fit (PMF) with broader audiences.

It also prevents all governance tokens from delivering value to holders, thus reinforcing the narrative that “these tokens are useless”—which, to some extent, is true. The SEC drove developers away (see Andre Cronje’s account of how the SEC pushed him out), blocked traditional finance (TradFi) from engaging with the space, and ultimately forced the industry to rely on venture capital funding. This led to poor supply and price discovery dynamics, with value captured by a small few.

However, we’re now seeing some positive shifts, such as Echo, Legion, and more public sales.

Financial Nihilism

All the above factors have made financial nihilism a significant force in this cycle.

The combination of “useless governance tokens” and the high FDV (fully diluted valuation), low float dynamics caused by the SEC has pushed many crypto natives toward memecoins in search of “fairer” opportunities. And indeed, in today’s society—where asset prices soar while wages fail to keep up with endless fiat devaluation—young people feel compelled to gamble to improve their station. Hence, the memecoin lottery is attractive. Lotteries are appealing because they offer hope.

Since gambling has product-market fit (PMF) in crypto—and we now have better technology for it (e.g., Solana and Pump.fun)—the number of token launches has exploded. High demand for ultra-high-risk gambling creates corresponding supply.

The “trenches” have always been part of crypto, but in this cycle, it has become a widely recognized term. This nihilistic attitude manifests in multiple ways:

-

The rise and mainstreaming of “Degen” culture

-

Shortened investment timeframes

-

Greater focus on short-term trading over long-term investing

-

Normalization of extreme leverage and risk-taking

-

Indifferent attitude toward fundamental analysis

Past Cycle Lessons Have Become Obstacles

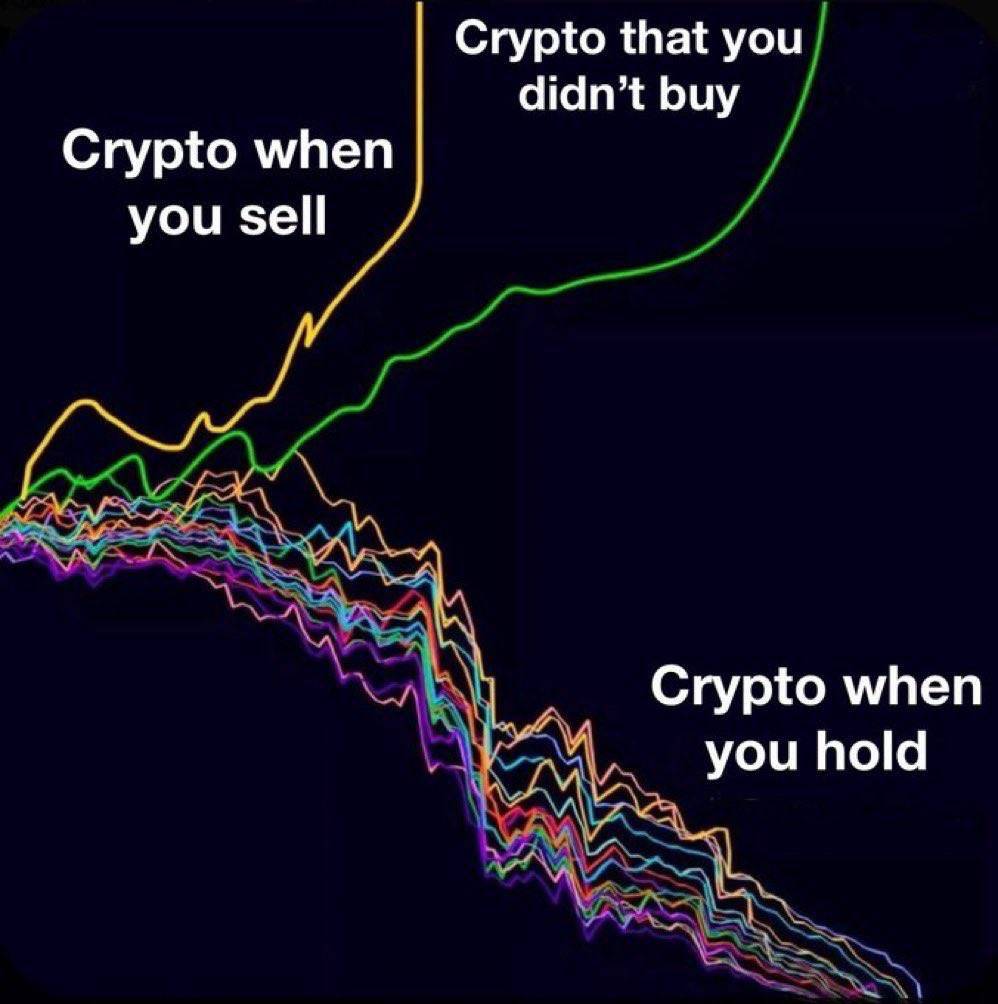

Previous cycles taught people they could buy altcoins during bear markets and eventually outperform BTC.

Few people are skilled traders, so this was the best path for most. Overall, even the worst altcoins had a chance.

But this cycle favors traders, not holders. Traders even captured the largest gains of this cycle through HYPE airdrops. Narratives in this cycle don’t last long, and compelling ones are rare. With more sophisticated players who are better at efficiently extracting value, mini-altcoin bubbles haven’t been particularly large.

The first hype cycle around AI agents is an example. This may have been the first time people felt “this is the new thing we’ve been waiting for.” But it’s still early, and long-term winners may not have emerged yet.

Bitcoin Has New Buyers; Altcoins Mostly Don’t

The divergence between Bitcoin and other assets has never been clearer. Bitcoin has unlocked demand from traditional finance. For the first time, it has an incredible source of new passive demand—central banks are even discussing adding it to their balance sheets.

Altcoins face a tougher battle against Bitcoin than ever before, which makes sense given Bitcoin’s very clear target: the market cap of gold.

Altcoins simply don’t have new buyers. Some retail investors return when Bitcoin hits new highs (though they often buy XRP 💀), but overall, new retail inflows are insufficient, and crypto’s reputation remains poor.

Ethereum’s Shifting Role

The decline in Bitcoin dominance was largely due to Ethereum’s market cap growth. Many used Ethereum’s rise as a signal for the start of “alt season,” but this heuristic failed this cycle because Ethereum underperformed on fundamentals.

Many traders and investors struggle to accept that Ethereum failed to boost risk appetite. In fact, it has repeatedly acted to end mini-alt seasons—opposite to past behavior.

Despite evidence that certain narratives and sectors can thrive without Ethereum moving, many traders still believe Ethereum must rally before a true alt season can begin.

What Should You Do?

So, what should you do from here?

Work hard—or work smarter. I still believe fundamentals will matter in the long run, but you must truly understand the projects you back and how they can actually outperform Bitcoin. Right now, only a few candidates meet this bar.

Look for projects with:

-

Clear revenue models

-

Real product-market fit (PMF)

-

Sustainable tokenomics

-

Strong narratives that complement fundamentals (I believe AI and RWA qualify)

I think projects with stronger fundamentals and PMF are finally positioned for their tokens to accrue value, thanks to regulatory unlocking in the U.S.—making them lower-risk options. Protocols that generate revenue are now poised to shine. This marks a significant shift from the dominant “greater fool theory” prevalent in many token models previously.

If your strategy is “wait for retail to enter, then sell,” I think you’ll run into trouble. The market has evolved beyond purely retail-driven cycles, and sophisticated players will likely front-run such obvious strategies.

You can choose to become a better trader, develop your edge, and focus on more short-term trades, as this market does offer consistent short-term opportunities. On-chain trading can yield higher multiples, but it’s also more brutal on the downside.

For most people without a clear edge, a “barbell portfolio” remains the best choice: allocate 70–80% to BTC and SOL, and reserve a smaller portion for more speculative bets. Regularly rebalance to maintain these ratios.

You need to assess how much time you can realistically dedicate to crypto and adjust your strategy accordingly.

If you’re a regular person with a day job, competing against kids sitting 16 hours a day won’t work. The old strategy of passively holding underperforming altcoins and waiting for your turn no longer works in this cycle.

Another approach is to combine different strategies: build a portfolio anchored in solid assets, then look for opportunities like airdrop farming (harder now, but low-risk chances remain), identify emerging ecosystems early (e.g., HyperLiquid, Movement, Berachain), or specialize deeply in a specific niche.

I still believe the altcoin market will grow this year. Conditions are in place—we remain tied to global liquidity—but only a few sectors and fewer altcoins will meaningfully outperform BTC and SOL. Faster altcoin rotation will persist.

If we see some wild monetary expansion, we might get something closer to a traditional alt season, but I think that’s less likely than we’d hope. Even then, most altcoins would only deliver market-average returns. We still have many important altcoins launching this year, and liquidity will continue to be diluted.

It’s not easy, but here’s some hope: I’ve never seen someone who spent years seriously engaged in crypto fail to make meaningful money.

This asset class still holds enormous opportunity, and there are plenty of reasons to remain optimistic about its growth.

In the end, I don’t know more than anyone else—I’m just adapting to what I observe in this cycle.

One more point: we are not in the early stages of the cycle. That much is clear. The bull market has been ongoing for a long time—regardless of whether you’ve made money or not.

“Control the downside, and the upside will take care of itself.”

This timeless quote will always ring true.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News