The story of BGB in one year is a turning point in the lives of many people

TechFlow Selected TechFlow Selected

The story of BGB in one year is a turning point in the lives of many people

Great products are all alike.

Author: TechFlow

The new world arrived like a dream—Bitget BGB!

Humans are creatures that need ritual—to mark certain dates as special and bid farewell to the past. The world grew increasingly volatile in 2024, and perhaps there’s always some ticker symbol that brings tears to your eyes. Beyond Bitcoin’s meteoric rise, few assets have offered ordinary people more opportunity than BGB. Memes are too chaotic; VC is too inefficient.

But BGB allows you to share in 1,400% price appreciation, enjoy double rewards from 15 tokens listing first on BG then on BN, and countless wealth management benefits—clearly emerging as a frontrunner.

One Year On, BGB Delivers a Perfect Score

The mindset of a diligent problem-solver fits perfectly with on-chain crypto battles, but it's the visionary's imagination that drives platform token valuations—from BNB reaching $800, to Hyperliquid’s DEX miracle, to BGB’s over 10x surge within a year.

At its core, crypto is about trading. Exchanges sit at the center of all interactions between projects and retail users. Whether centralized or decentralized (C/D EX), markets consistently favor platforms offering the best trading experience, and exchange and blockchain-native tokens remain among the strongest value propositions.

BGB as Bitget’s Platform Token: Retail Alpha Opportunity in 2024

Anyone navigating crypto dreams of becoming a whale.

For individuals, the initial capital accumulation phase—from zero to one—is the biggest hurdle toward sudden wealth. Seeking low-volatility, stable major blockchains, Super Apps, and exchange platform tokens is the most reliable investment strategy, paving the way for later nonlinear wealth growth.

At the beginning of 2024, many believed BGB at $0.5 was overvalued. By year-end, BGB approached $8.5, hitting an all-time high. With the bull market just beginning, this may only be a local optimum—markets will likely assign BGB a fairer valuation.

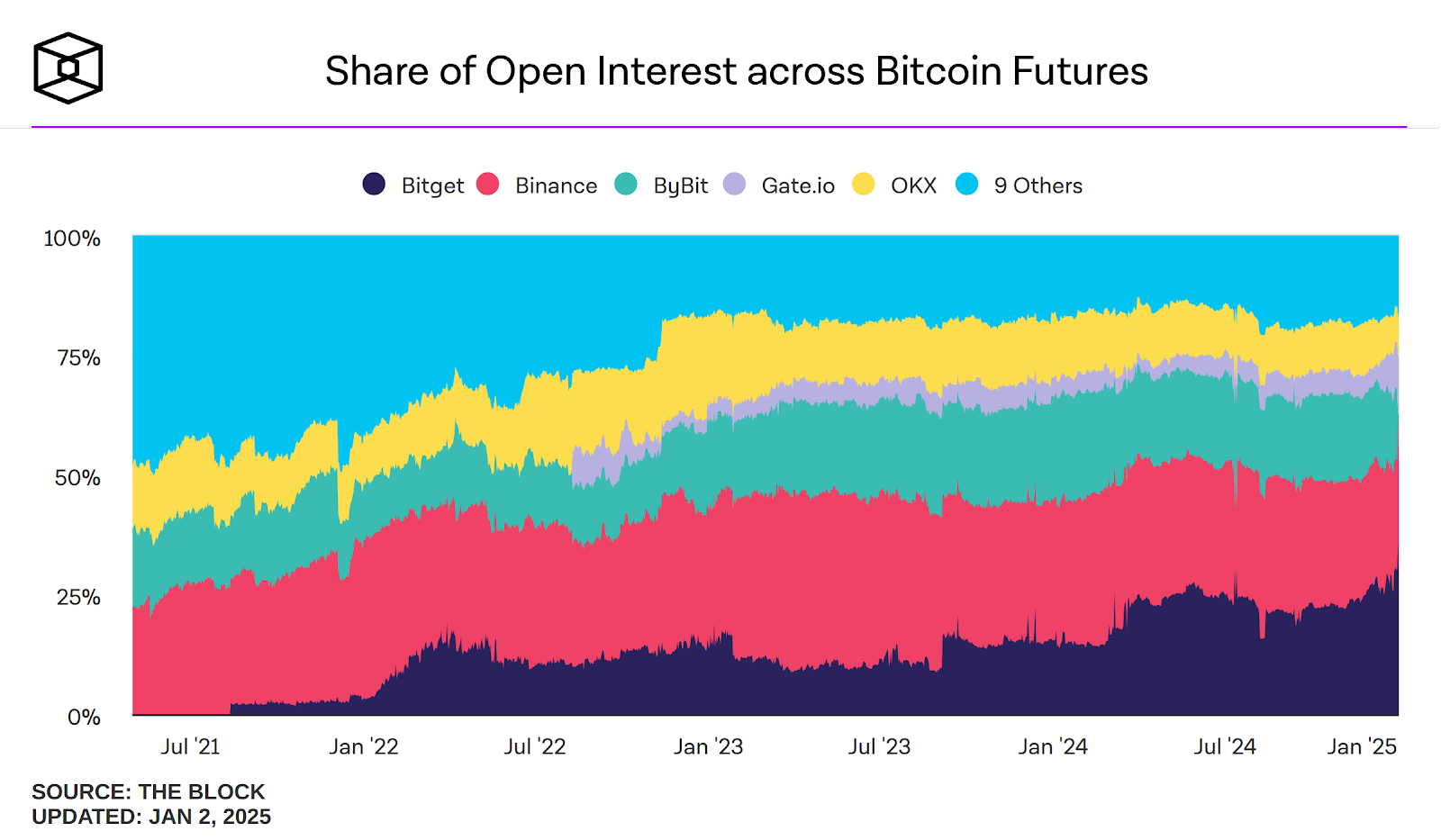

According to Defillama data, Bitget saw monthly inflows as high as $1.6 billion, topping all CEXs. In BTC futures alone,Bitget captured 35% market share—a rising star among crypto exchanges.

After six years, Bitget secured its position in 2024.

In 2025, surpassing emerging business models will naturally follow.

BGB represents an active choice—one that lets you share in the efforts of Bitget’s 1,700+ employees during its upward trajectory.

Bitget excels at asset discovery and issuance, whether through partnerships like Hyperliquid or by integrating Bitget Wallet’s token BWB. Empowering BGB remains Bitget’s consistent strategic focus.

-

Traffic is King:Crypto thrives on trends—projects and memes alike rely on momentum to skyrocket. With 45 million registered users and 21 projects discovered via Launchpool last year, Bitget has become the most frequently opened app in crypto, firmly anchoring itself at the center of traffic flow.

-

Deliver Real Returns:Price appreciation alone doesn’t justify a platform token. BGB now sits at the heart of Bitget’s operations. Holding BGB enables appreciation, wealth management, new token subscriptions, fee discounts, and profit sharing. Everything comes from Holders, everything for Holders—whether whale or retail, everyone is now part of the BGB family.

-

Sustain Token Value:Stronger yields and greater traffic ultimately reflect in token price. The biggest surprise at the end of 2024 wasn't BGB’s 10x gain, but that its trading volume nearly matched BNB’s—despite a 10x difference in market cap. That gap will be addressed in 2025.

Put simply, BGB sits at the core of a three-loop system—traffic → yield → price. Stable, low-volatility returns drive sustained price appreciation, laying the foundation for Bitget to outperform other CEXs/DEXs in 2024.

Beyond Passive Holding: BGB Beta Gains Linked by Bitget’s Continuous Empowerment

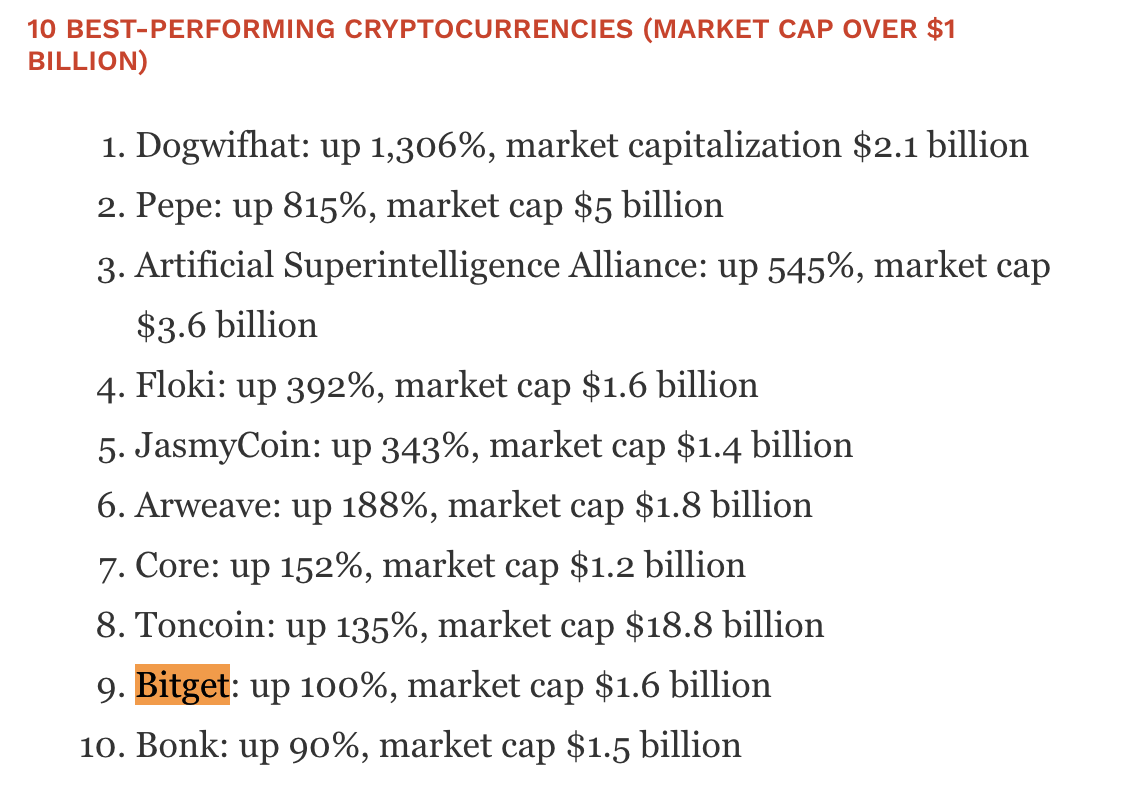

Every explosive move has roots. Mid-2024, Forbes listed BGB among the top 10 best-performing tokens under $1 billion market cap—four were Memes, three from Solana. BGB stood out as the only exchange token, a rare gem.

Compared to the emotional value of Memes, BGB delivers tangible utility.

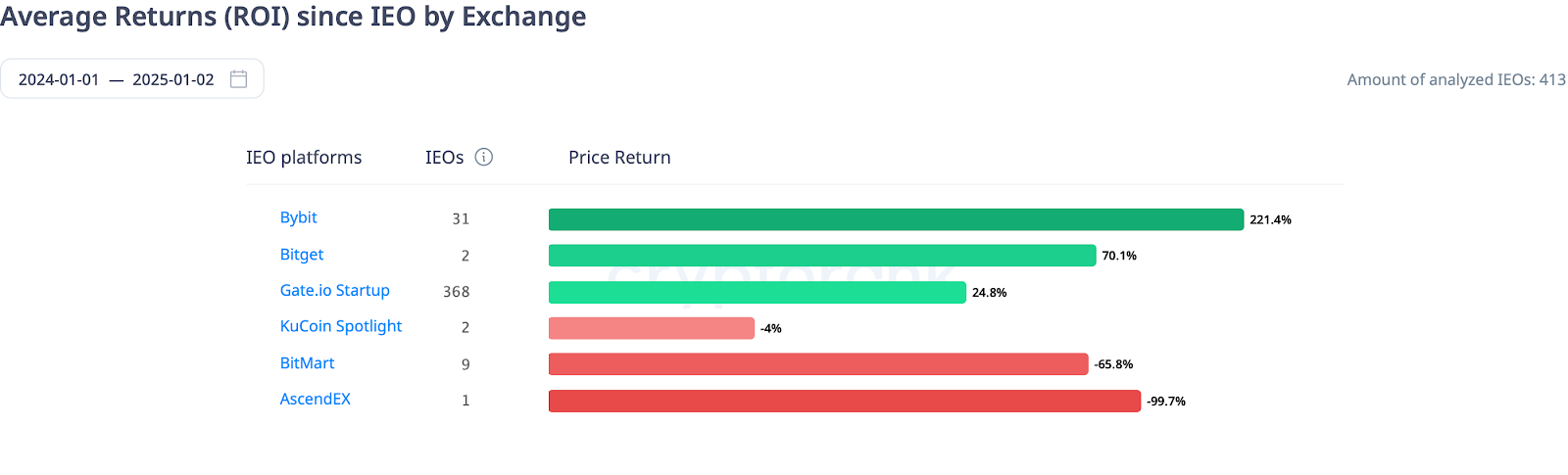

While BGB offers numerous benefits, we highlight the most critical: early access to new token launches. With both Launchpad and Launchpool, users can either directly purchase promising tokens using BGB or stake BGB to earn allocations.

Additionally, using BGB unlocks exclusive perks—such as 20% fee discounts—and innovative features like letting traders share 10% of copy-trading profits when holding BGB.

There’s also PoolX for round-the-clock mining, Wealth Management Vaults, free withdrawals, VIP tiers, and more. In short, if it exists elsewhere, BGB likely offers it. If it’s accessible on-chain, BGB connects to it—bridging centralized and decentralized worlds, capturing every hard-earned return.

Among these core utilities, new token access stands out—reflecting Bitget’s proven asset discovery strength.

Contrary to popular belief, Bitget once paused spot trading entirely—focusing solely on building derivatives expertise. When spot returned, it did so with remarkable ROI results.

2024 was a year of consolidating BGB’s multifaceted utilities. In 2025, BGB aims to transcend the label of “exchange token,” evolving into a real-world asset fluidly moving across on-chain, off-chain, Web2, and Web3 environments.

-

Versatile excellence: Bitget will deepen institutional and VIP services, building a more diversified user base;

-

Integrate with BTC, public chain, and DeFi ecosystems, expanding real transaction venues where BGB creates value;

-

Break down barriers between Bitget U Card and merchants, turning payments, stablecoins, and crypto into real spending power.

Ethereum is Money, while BGB is an asset—an asset transcending definitions of cryptocurrency or platform token. Let’s witness it together in 2025!

Serving the Ordinary: A Comeback Story in 2025

The history of platform tokens mirrors the evolution of trading venues—not just CEXs, but including DEXs. For example, dYdX proved on-chain perpetual contracts are viable, and Hyperliquid took it further. Like Bitget, Hyperliquid built its derivatives market first, then launched spot trading, placing Hype at the absolute center of its ecosystem.

Great products resemble each other, and Bitget has proven the reliability of its strategy over six years.

In 2024, Hyperliquid and Bitget emerged as twin stars in DEX and CEX realms. Hyperliquid’s airdrop created a broad base of holders—not rich, not poor, but full of expectation—more actively contributing liquidity. Its unique auction-based token model also attracted more projects to launch there first.

For comparison: Hyperliquid, leveraging decentralized tech and governance, serves 300,000 users and achieves $500,000 daily revenue. Bitget’s team of over 1,000 supports 45 million global users, generating $3 million daily through premium service.

Different approaches, same ambition—exchanges fundamentally aim to enhance asset issuance and pricing power. Hyperliquid offers up to 50x leverage; Bitget supports up to 125x. Despite differences, both share a common goal: creating wealth effects for their native token holders. We can even quantify this wealth effect.

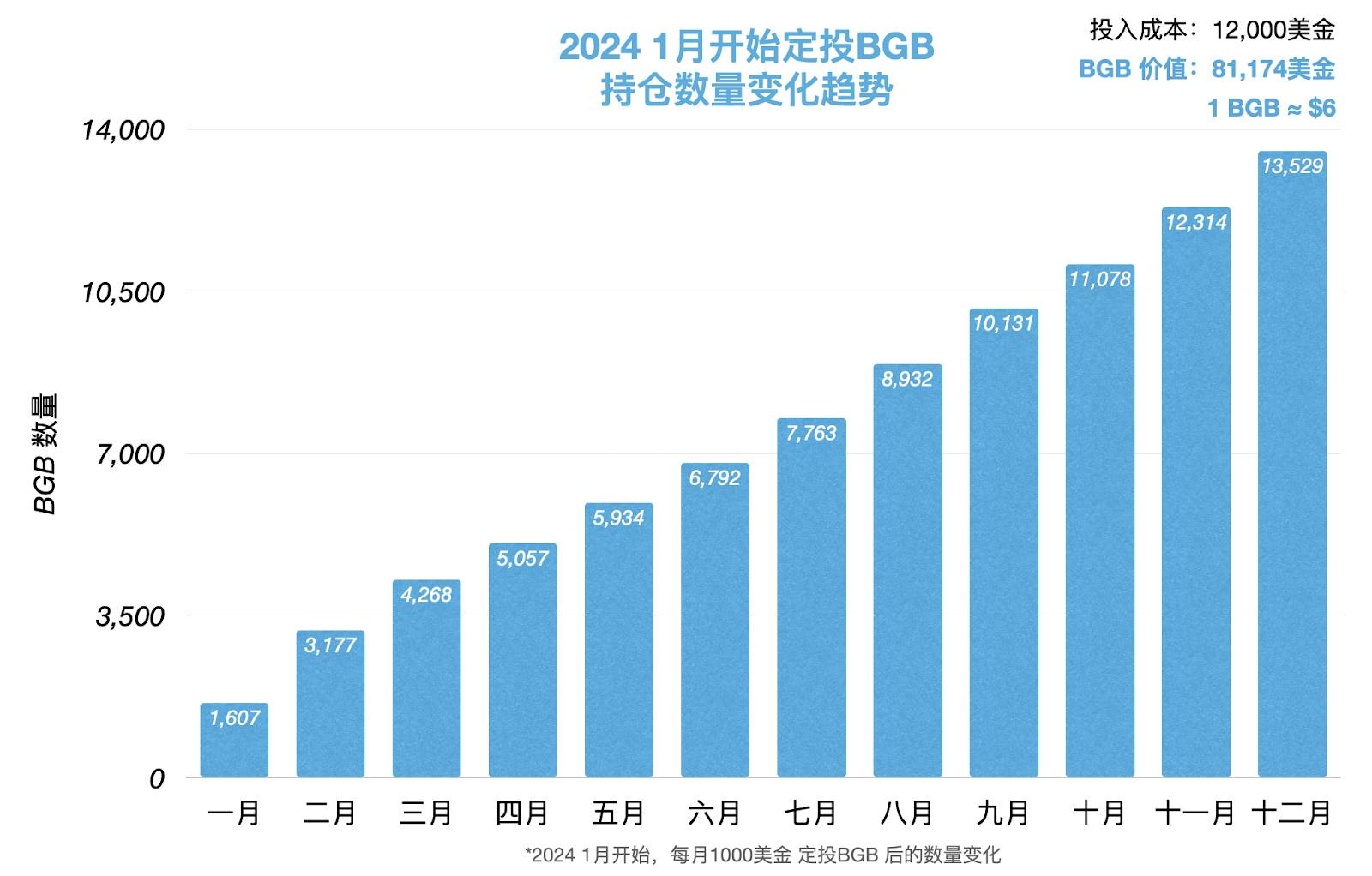

Imagine an average investor, Xiao G, deciding to dollar-cost average into crypto—after all, even the U.S. President openly supports Bitcoin. He considers BTC/ETH—solid assets, but too expensive. BGB better suits his situation.

Xiao G sets aside 100,000 RMB annually—about 10,000 RMB per month.

Assume Xiao G invests $1,000 monthly starting the year. As BGB’s price rises, each $1,000 buys fewer tokens—but the dollar-denominated holdings grow steadily. Combined with Launchpool rewards,by year-end he accumulates 13,529 BGB at a total cost of just $12,000. At December’s closing price of $6 per BGB, his portfolio is worth $81,174—a 6.7x return.

And note: this excludesthe 23 LaunchPool events and one LaunchPad benefit rolled out by Bitget in 2024. Including those, and reinvesting proceeds, adds $10,565.60 in pure passive income.

Conclusion

In 2025, BGB’s dividends will continue to overflow.

How short life feels—2024 marked the start of BGB’s integration with BWB, but that was merely an appetizer. The main course? BGB’s buyback mechanism launching, with 800 million tokens burned—worth $5 billion at market prices. Price support? Bitget means business.

A key trend in 2025 will be the convergence of DEX and CEX. BGB must now extend its empowerment beyond Bitget’s ecosystem, stepping out of its greenhouse to face broader storms.

For instance, after the merger announcement, BGB’s price surged rapidly, eventually breaking $8.5—the highest ever—with gains exceeding 30%. Tight coordination across internal ecosystems enhances market perception. Bitget Wallet boasts 60 million users; an eight-figure user base opens vast new possibilities for BGB.

Of course, pure buybacks may temporarily boost prices—market cap briefly exceeded $10 billion after the burn news, climbing to rank #16—yet prices dipped post-hype. Ultimately, long-term token value depends on real-world utility.

Today, Bitget stands unquestionably among the world’s top exchanges, and BGB has reached the forefront of platform tokens. Yet globally, how high can Bitget climb in 2025? That remains to be seen.

All is in motion. In 2025, let’s witness even fiercer competition unfold across platforms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News