Can BGB Replicate BNB's Valuation Miracle After 30 Million Tokens Are Burned?

TechFlow Selected TechFlow Selected

Can BGB Replicate BNB's Valuation Miracle After 30 Million Tokens Are Burned?

Price is not just expectation, but the realization of structure.

Author: WhiteRunner

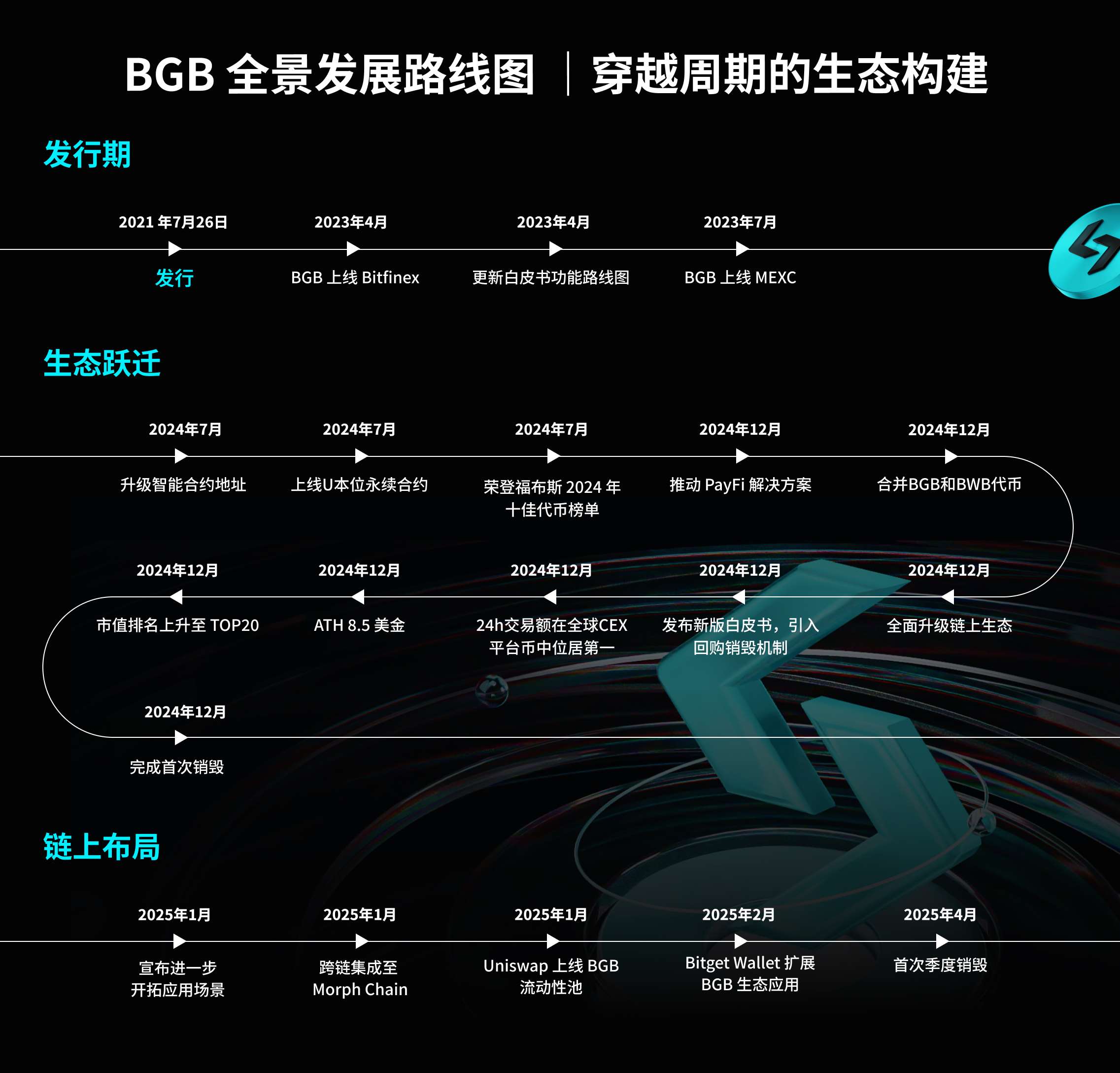

In Q1 2025, Bitget announced the burning of 30 million BGB tokens, representing 2.5% of the total supply. This move has reignited market interest in deflationary mechanisms for exchange tokens.

This burn ratio is relatively high among major exchange tokens—for comparison, BNB’s previous single burns were around 1%. It also marks Bitget's accelerated progress toward a structured deflationary path for BGB. This article analyzes the rhythm and rationale behind this latest burn, examining Bitget’s deflationary mechanism design and real-world BGB use cases to unpack the underlying supply-demand dynamics.

1. A 30 Million Token Burn: Faster Pace, Greater Intensity

According to Bitget’s official announcement, the quarterly burn totaled 30 million BGB, or 2.5% of the current 1.2 billion total supply—significantly higher than most other exchange token burns.

The burn was based on gas fees generated from Bitget’s on-chain products during Q1, executed as part of its scheduled quarterly deflation plan. All burn transactions have been recorded on-chain and are publicly verifiable.

Prior to this, Bitget burned 800 million BGB held by its team, locking the total supply at 1.2 billion and achieving 100% full circulation. This means no reserved or future-released tokens remain, further strengthening market perceptions of scarcity.

2. Mechanism Design Behind the Burn Rhythm

Bitget’s approach to BGB deflation is not a one-off “occasional burn,” but rather a shift since 2025 into a mechanized, fixed-cycle burning phase.

Currently, BGB burns come from two sources: fees generated through on-chain usage and fixed-amount burns, together forming the basis of each quarter’s total burn.

As disclosed by Bitget, starting in 2025, each quarter the platform will calculate the burn amount based on total gas fees generated by user activity within the Bitget Wallet ecosystem.

The core logic is: higher on-chain usage → wider BGB adoption → more BGB burned.

This ties token destruction directly to user behavior and actual platform activity, creating an elastic mechanism. After each quarter, Bitget publishes the burn results and records the transaction on-chain, enabling users to verify it independently via blockchain explorers.

In addition, Bitget conducts fixed-amount burns, effectively using platform funds to support deflation—a form of value management for its exchange token.

While similar in concept to the burn models of established tokens like BNB and OKB, BGB’s mechanism does not rely on a single revenue stream. Its scope is broader, and its schedule more frequent (quarterly vs. semi-annual or irregular).

Overall, the key features of the BGB burn mechanism are:

● Stable source: Based on actual on-chain usage;

● Fixed cycle: Executed every quarter, enhancing predictability;

● Transparent: Results are auditable and transactions are on-chain;

● Tied to platform growth: The mechanism is grounded in business metrics, avoiding “mechanical deflation” disconnected from real operations.

These design elements embed supply control within product functionality and user behavior, making it self-sustaining rather than reliant solely on platform promises.

3. Actual Supply Tightening, Clear Path Forward

Beyond entering a regular quarterly burn cycle, Bitget made a pivotal move at the end of 2024—permanently burning 800 million BGB previously held by its team. This reduced the total BGB supply from the originally planned 2 billion to 1.2 billion, with an explicit statement that “BGB has now achieved 100% full circulation, with no locked or reserved portions remaining.”

This action has multiple implications:

1. Eliminating Future Supply Pressure

Previously, the market expected the 800 million BGB held by Bitget’s team to be gradually unlocked over multiple tranches across several years. That pool represented a long-term potential supply overhang that could influence future price expectations.

Now, these tokens have been permanently removed from circulation. Such a “preemptive clearance” is rare among exchange token projects and removes lingering uncertainty for long-term holders.

2. Capped Supply, Transparent Structure

Post-burn, BGB’s total supply is capped at 1.2 billion, all fully circulating. Compared to other exchange tokens that still maintain team allocations, foundation reserves, or locked portions, BGB’s supply structure is now clearer and easier to assess.

In other words, the current circulating supply reflects the true state of supply and demand—there is no risk of sudden large-scale token releases in the future.

3. Addressing Concerns Over “Platform Control”

At a time when crypto users are increasingly concerned about whether exchange tokens are “centrally controlled” or if large holdings remain off-market, Bitget’s decision to completely relinquish its own stake sends a strong signal: the platform will rely on mechanisms, not manual manipulation, to support the token’s value structure.

This move has drawn industry attention. By “voluntarily giving up control levers,” Bitget positions BGB as fully market-driven—an indication of growing transparency in exchange token governance. For many observers, this “team exit, mechanism takeover” strategy aligns better with the crypto community’s current expectations around decentralization and openness.

4. Beyond Deflation: Expanding Use Cases

Unlike some exchange tokens that rely purely on burns for deflation, BGB’s deflationary model also includes a “staking + usage” dual-binding mechanism: when users employ BGB within platform products, they automatically trigger staking or locking actions, thereby continuously reducing circulating supply.

This creates a self-reinforcing loop: user usage → BGB staked → reduced market circulation → stronger deflation expectations. Currently, this loop operates across two main dimensions: platform product participation and on-chain utility integration.

1. Platform Participation Products: Sharing Rewards, Earning Yield

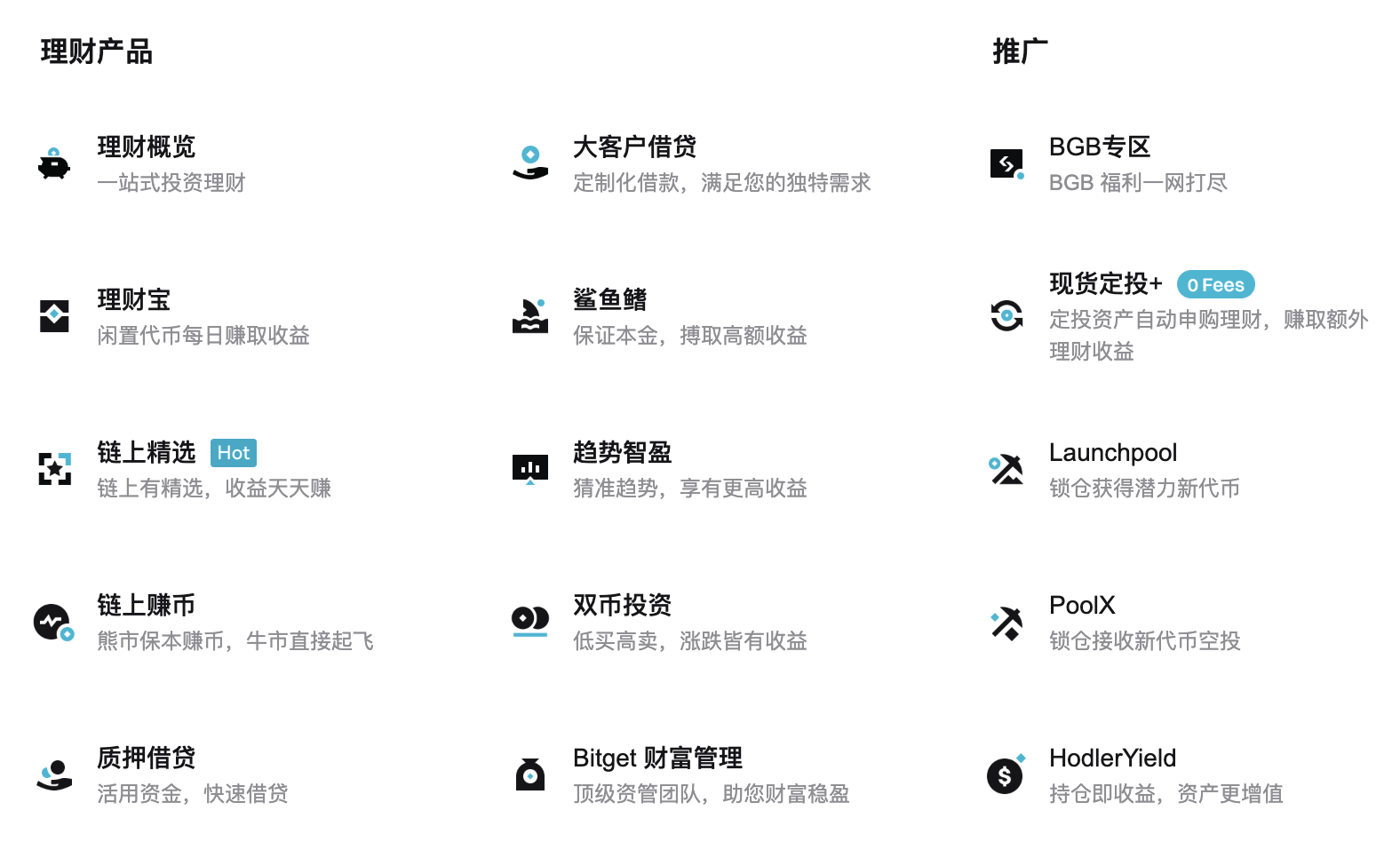

As Bitget’s core platform asset, BGB is deeply integrated into various products, including but not limited to:

● Launchpad: Users stake BGB to gain eligibility for new project launches;

● Launchpool: Staking BGB allows users to receive airdrops of new tokens, a common route for launching popular projects;

● PoolX: Users stake BGB to participate in multi-asset yield strategies combining short-term high returns with trending on-chain assets;

● Wealth Management Zone: BGB-based yield products incorporating hot assets or structured strategies to further increase capital efficiency.

A common feature of these products is that participation requires staking, often with fixed terms or advance subscription requirements—making their impact on BGB lockup particularly pronounced during periods of high market activity.

2. On-Chain Ecosystem Expansion: From CeFi to DeFi

BGB’s utility is also expanding into the broader on-chain ecosystem, primarily through Bitget Wallet and the Morph chain. Current applications include:

● BGB Staking: Users can stake BGB directly on the Morph chain to earn ~5% annual yield, used for future ecosystem incentives or participation;

● Gas Payment: BGB can now be used to pay gas fees across multiple chains via Bitget Wallet, lowering cross-chain and currency-swapping barriers;

● Future Use Cases: Bitget plans to explore additional functions such as on-chain governance, identity binding, and priority access rights (e.g., NFT minting, DAO voting), further broadening BGB’s functional scope in Web3 environments.

This evolution signifies that BGB is becoming more than just an exchange token—it is emerging as a universal utility token within Bitget’s on-chain ecosystem, bridging centralized financial products with native decentralized finance behaviors.

Overall, BGB spans multiple scenarios—from CeFi wealth products to DeFi on-chain interactions. Compared to pure burn-driven deflation, this usage-based deflation model is more sustainable, enhances user engagement, and fosters stable, organic demand.

5. Predictable Deflation, Maturing Utility

In summary, BGB’s current deflationary logic is no longer isolated burn events, but a comprehensive framework combining mechanized supply reduction, application integration, and predictable timing.

This framework consists of at least three layers:

1. Clear and Institutionalized Deflation Mechanism

– Quarterly burns tied to on-chain usage and platform profits, enabling adaptive adjustment;

– Core team holdings fully burned by end of 2024, fixing total supply at 1.2 billion—supply side is now closed;

– All burn records published and verified on-chain, ensuring transparency and building long-term trust.

2. Gradually Expanding Use Cases, Creating Internal Loops

– BGB enables participation in Launch series products, wealth management, and yield strategies;

– On-chain uses include staking and gas payments, with future expansion into governance, NFTs, and identity;

– User “usage” naturally leads to “locking,” indirectly reducing circulating supply.

3. Value Proposition Evolving Toward “Utility-Driven Platform Asset”

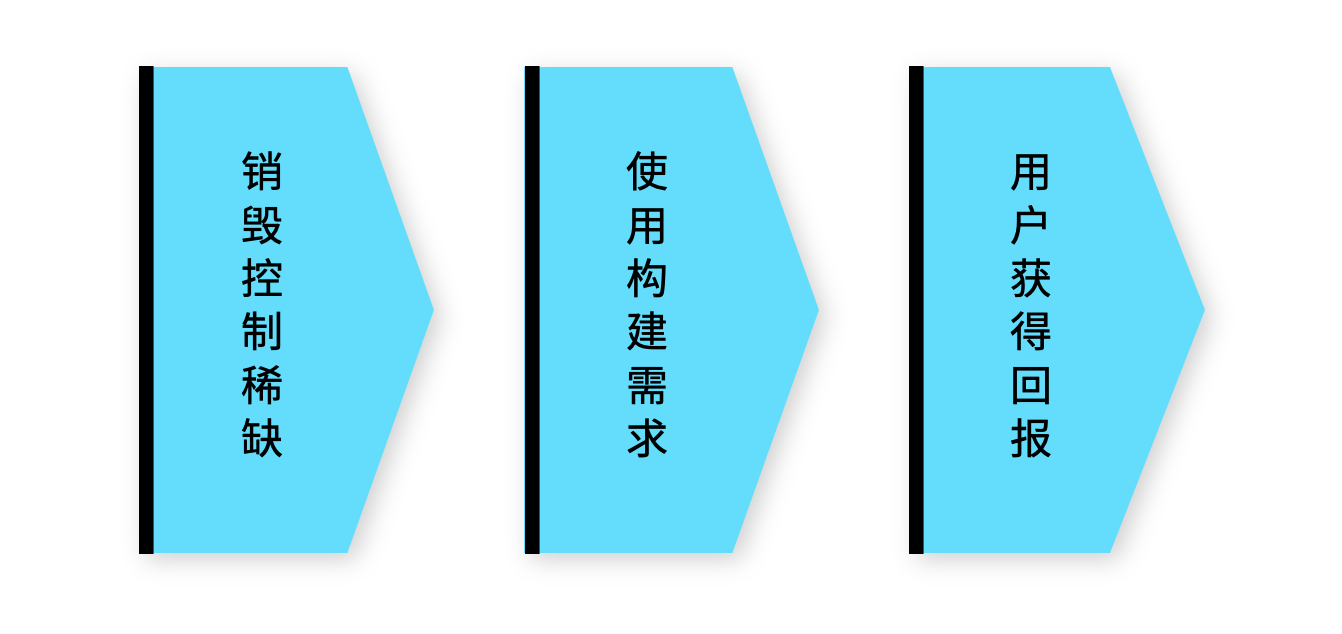

– Historically, many exchange tokens faced criticism for “burn-only, no real use.” BGB now follows a utility-first model: scarcity via burns → demand via usage → returns for users.

BGB has evolved from a simple “fee discount token” into a core asset within Bitget’s ecosystem. This trajectory ensures ongoing utility not only within CeFi platforms but also in wallet services, staking rewards, and project participation—establishing tangible roles across diverse contexts.

Epilogue: Price Is Not Just Expectation—It’s Structural Realization

Looking back at BGB’s price performance over the past three years:

● 2022 peak: $0.2387

● 2023 peak: $0.6950

● 2024 reached an all-time high: $8.50

Each surge corresponded to the execution of strategic milestones: 2022 marked the start of exchange growth; 2023 saw product ecosystem expansion; 2024 featured the launch of the deflationary mechanism and the team token burn.

So where could BGB go in 2025?

Considering current platform scale, BGB’s market cap positioning, and structural factors, a reasonable target range may be $15–$20, with some aggressive models projecting up to $30.

This isn’t speculation—it reflects a “structural revaluation” driven by the convergence of sustained trading volume growth, consistent quarterly burns, and continuous expansion of on-chain use cases.

In other words, BGB’s price upside is shifting from “betting on hype” to “waiting for delivery.”

For token holders, the key question is no longer “how much can it rise?” but rather “is it already on a structural growth path?” Given the current mechanisms, ecosystem development, and rising trading activity, BGB appears to possess the characteristics of an asset with downside support and upside anchoring.

Among all assets, those truly worth watching long-term are always ones that have built solid value foundations—but whose prices have yet to fully reflect that value.

Right now, BGB stands precisely at that inflection point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News