Bitget Research: Bitcoin briefly drops below $65,000 as BGB continues to hit new highs

TechFlow Selected TechFlow Selected

Bitget Research: Bitcoin briefly drops below $65,000 as BGB continues to hit new highs

In the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, which could very well represent the next wealth-building opportunities.

Author: Bitget Research

Summary

The market declined broadly yesterday, with Bitcoin briefly falling below $65,000, and the total crypto market cap dropping 3.9% over the past 24 hours. Relatively speaking:

- High-performing wealth-generating sectors: Ethena (ENA), Proof-of-Work (POW) sector, Base ecosystem;

- Top user-searched tokens & topics: MomoAI, Ethena (ENA), Wormhole (W);

- Potential airdrop opportunities: xMetacene, XION;

Data collection time: April 3, 2024, 04:00 (UTC+0)

I. Market Environment

The market continued weakening yesterday, with Bitcoin briefly dipping below $65,000. The overall cryptocurrency market capitalization dropped by 3.9% in the past 24 hours. Spot Bitcoin ETFs saw a net inflow of $39.47 million yesterday; however, it's worth noting that Ark Invest & 21Shares' ETF ARKB recorded a net outflow of $346,000—the first such outflow since its launch. In addition to slowing ETF inflows, deteriorating expectations around interest rate cuts have also contributed to the pullback.

With rising pressure from high interest rates, increasing risks in commercial real estate, and ongoing skepticism about employment data, the Federal Reserve’s statements have failed to stabilize institutional sentiment. In the near term, market sentiment will likely remain sensitive to economic data releases, and continued volatility before Bitcoin’s halving in April cannot be ruled out.

II. Wealth-Generating Sectors

1) Sector Movement: Binance New Stock (ENA)

Main reason: Large outflows from spot Bitcoin ETFs may have weakened investor confidence in the broader market outlook. Meanwhile, Ethena (ENA), the 50th project on Binance’s new token mining program, attracted significant attention upon listing and delivered strong price performance. Its total market cap surpassed $1.1 billion, with a circulating market cap exceeding $110 million—rising steadily even amid a broad altcoin downturn.

Price movement: ENA surged 40% over the past 24 hours.

Factors influencing future performance:

- High expected returns from campaigns: Ethena announced the launch of its second-season campaign, “Shards,” on April 2. “Sats” will replace “Shards” to align with Ethena’s integration of BTC as a backing asset. This campaign will last five months. Users can deposit USDe to earn Sats. Early users will receive enhanced rewards—existing positions from Season 1 will earn 20% more Sats during Season 2.

- Strategic position in the stablecoin narrative: Algorithmic stablecoins like $DAI, $FRAX, and $UST experienced strong growth in previous cycles. In contrast, this cycle has not seen sustained breakout momentum for decentralized stablecoins, aside from brief surges in $LQTY and LSDFi. Ethena Labs enables staking of spot ETH via LSD protocols such as Lido, offering annual yields of 3%–5%. Additionally, users benefit from short-side funding rate income. Investors hold high expectations for Ethena to lead innovation across the stablecoin ecosystem.

2) Sector Movement: POW Sector (BCH, LTC)

Main reason: Amid broad altcoin declines, BCH and LTC held their ground at relatively high levels, demonstrating strength. BCH is particularly in focus as it approaches its halving event in just 11 hours.

Price movement: Over the past 24 hours, BCH traded between $600–$700, while LTC fluctuated between $100–$110.

Factors influencing future performance:

- Bitcoin correlation: POW tokens are highly correlated with BTC. When BTC rises, POW assets generally follow. Going forward, monitoring BTC’s support level after correction will be key. During rebounds, POW assets may outperform BTC, making them worthy of continued observation.

- Reduced post-halving selling pressure: BCH’s halving is now only 11 hours away. The current block reward is 6.25 BCH, which will drop to 3.125 BCH after halving. With only 219 blocks remaining, reduced issuance will lower sell-side pressure and increase mining costs, potentially supporting price stability.

3) Sector to Watch: Base Ecosystem

Main reason: The Base ecosystem’s TVL exceeds $3.2 billion. Continued capital inflows could directly influence the trajectory of meme coins on the chain. Internal ecosystem development on Degen Chain, progress in the SocialFi sector, and potential token launches related to Farcaster have all drawn significant attention to Base. Traders should closely monitor metrics such as ecosystem TVL and DEX trading volume. As fundamentals strengthen, highlighted assets may reach new highs.

Specific token list:

- DEGEN: The DEGEN token of Degen Chain has gained traction due to its low-cost Layer 3 blockchain built using Arbitrum Orbit and AnyTrust DA, with settlement on Base. By revitalizing the Farcaster ecosystem, DEGEN has acquired broader utility and compelling public chain narratives, driving up its valuation. Furthermore, DEGEN serves as a transactional token in social video apps like Drakula, establishing itself as one of the most active memecoins within the Base ecosystem and attracting growing user and investor interest. With Degen Chain’s rollout and increasing user adoption, DEGEN is poised to maintain upward momentum.

- AEVO: Aerodrome currently holds a total TVL of $538 million. It is a fork of OP’s leading protocol Velodrome Finance deployed on Base. Its native token AERO received major visibility when Coinbase listed it and when the Coinbase Ventures-led Base Ecosystem Fund invested in Aerodrome. These developments helped establish Aerodrome as one of the top DeFi protocols on Base within months. Long-term prospects remain positive. Investors may consider accumulating at lower prices, with the current pullback stabilizing around $1.

III. User Search Trends

1) Popular Dapp

MomoAI: A Telegram-based gaming product. Within just half a month, its user base surged to 500,000. On the booming Solana network, its number of active on-chain wallets quickly approached 100,000, placing it among the top three dapps in the Solana ecosystem. Both community engagement and daily active users remain exceptionally high.

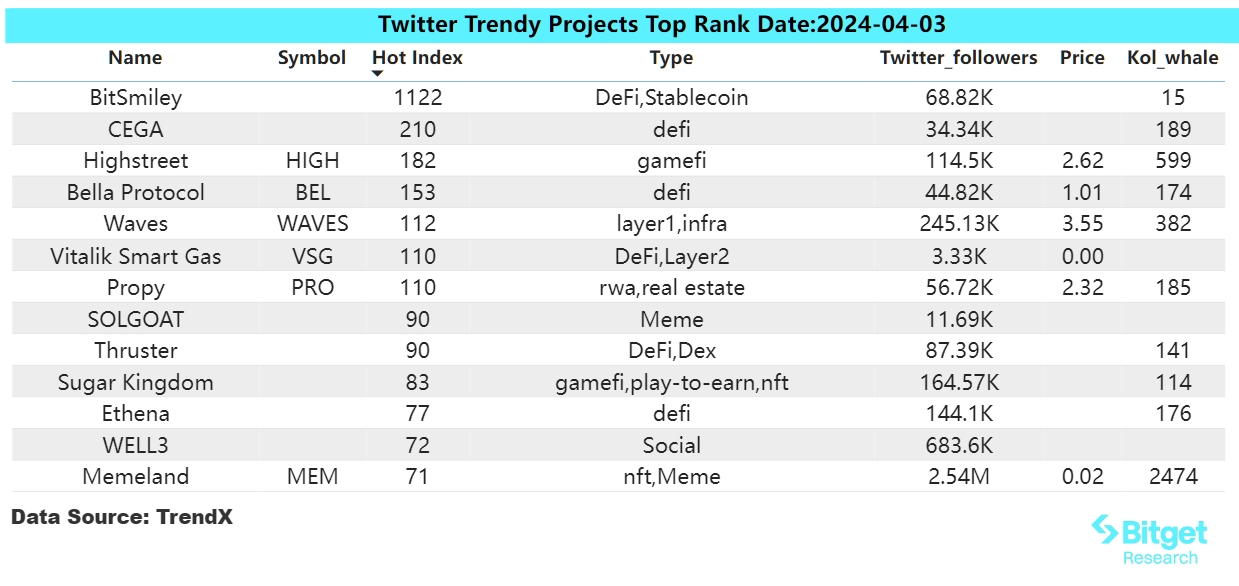

2) Twitter

Ethena (ENA):

Ethena is a synthetic dollar protocol built on Ethereum, aiming to provide a crypto-native solution for currency systems independent of traditional banking infrastructure. Its synthetic dollar, USDe, offers the first censorship-resistant, scalable, and stable crypto-native solution backed by delta-hedged staked Ethereum collateral. After concluding its Binance Launchpad sale, ENA’s price continued to rise. Smart money tracked approximately $4.13 million in inflows to ENA on the Ethereum network over the past 24 hours, indicating strong trading interest. Investors may consider participating in ENA or its competitor LQTY.

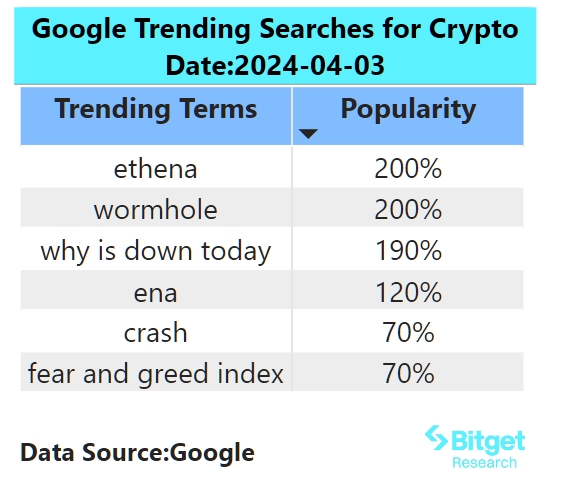

3) Google Search & Regional Trends

Global perspective:

Wormhole (W):

Wormhole is a general-purpose messaging protocol launched in October 2020, initially incubated and supported by Jump Crypto. Designed to enable developers to build natively cross-chain applications spanning multiple blockchains, it has evolved from an Ethereum-Solana bidirectional bridge into a multi-chain interoperability protocol. Its token launched an airdrop on April 3, with a total supply of 10 billion W tokens. Approximately 617 million W tokens (about 6.17% of total supply) were distributed to around 400,000 wallets. Currently trading at around $1.6 on Aevo, implying a fully diluted valuation of $16 billion, its short-term upside appears limited. Participation should be approached with caution.

Regional search trends:

(1) Strong interest in RWA topics in Asia:

RWA-related discussions have gained notable traction across Asia recently. At Hong Kong’s Web3 Carnival, a roundtable discussion was dedicated to “Real-World Assets (RWA).” Valuations for RWA projects are rising—Midas, an RWA project, recently raised $8.75 million in seed funding, nearly reaching the $10 million mark.

(2) CIS and parts of Europe show increased interest in BOME:

Darkfarms, founder of BOME, revealed on social media that the project is finalizing testing for a new feature. Users who input their Ethereum address and burn 888 BOME tokens will qualify for a whitelist, gaining eligibility to claim collectibles for free or through airdrops. Holders of BOME in these regions are particularly attentive to this update.

(3) Terms like “crypto bubble” and “crypto crash” reappeared in trending searches across Latin America and the Middle East following yesterday’s decline:

Impacted by large outflows from spot Bitcoin ETFs and the launch of Wormhole’s token, Bitcoin plunged from $69,000 to below $66,000 yesterday. More than $400 million in long positions were liquidated across the market, drawing attention from investors in Latin America and the Middle East.

IV. Potential Airdrop Opportunities

xMetacene (Million-dollar funding, high potential return)

MetaCene is a social gaming project similar to xpet. The team and investors are both high-profile. Alan Taam (Tan Qunzhao), CEO and founder of MetaCene, brings over 20 years of experience in the gaming industry, having served as Managing Director and President at Shanda Games. Chief Product Officer Cary Chen also has over two decades of industry experience, having led the development of multiple MMORPGs with millions of monthly active users and cumulative revenues exceeding $1 billion. The team is highly seasoned.

The project has raised $10 million in funding, led by Folius Ventures, with participation from Animoca Ventures, IGG, and others. Active gameplay may grant whitelist access and token rewards.

How to participate: 1) Download the Chrome extension: xMetaCene; 2) Log in via X (Twitter). Enter the referral code and complete simple tasks—follow, retweet, like, bind email, connect wallet, etc.; 3) Use crystals to upgrade your miner. After producing crystals, play the battle mode, defeat bosses, and share rewards from boss treasure chests to earn star honor points.

XION (Strong funding, cutting-edge concept)

XION is a blockchain featuring abstracted accounts. Its meta-accounts use signature-agnostic abstraction, allowing users to access XION applications seamlessly using familiar Web2 authentication methods like email or biometrics, alongside nearly any type of cryptographic signature scheme. Users don’t need to install wallets like MetaMask—though they’re still supported—making XION accessible to diverse user groups. Additionally, meta-accounts offer powerful features including cross-device synchronization, key rotation, multi-factor authentication, and account recovery.

XION recently closed a $25 million Series A funding round, co-led by Multicoin Capital, Animoca Brands, and Arrington Capital. Its testnet is now live, offering very high potential rewards.

How to participate: (1) Visit the official website and register with your email; (2) Claim $XION testnet tokens from the faucet, then stake them to receive a "Securooor" NFT; (3) Complete additional social tasks on Galxe—such as follows and recommendations—to earn OATs, which may serve as proof for future airdrops.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News