Analyze BGB investment opportunities and price trends, potentially reaching $31.66 within the year

TechFlow Selected TechFlow Selected

Analyze BGB investment opportunities and price trends, potentially reaching $31.66 within the year

This article will review the development history of platform tokens and recent market performance data of BGB, helping readers analyze the logic behind BGB's price increase, as well as its future trend and potential investment opportunities.

Author: Crypto Frontline (Brother Tang)

Recently, Bitget's native token BGB has surged逆势 against the broader market trend, with gains so striking that several of my chat groups have been filled with regrets from those who didn't buy in. On December 27, Bitget announced it would burn over $5 billion worth of BGB. Driven by this news, BGB hit an all-time high (ATH) of $8.49 on that day, briefly pushing its market cap past the $10 billion mark.

On December 30, Bitget announced the successful burning of 800 million BGB tokens—representing 40% of the total supply and valued at over $5 billion—reducing its market cap to approximately $8.9 billion. This burn was part of a plan outlined in a newly released white paper, which includes both this initial burn and a quarterly buyback-and-burn program. Going forward, 20% of profits from Bitget’s exchange and wallet operations will be used to repurchase and destroy BGB, fulfilling its commitment to a deflationary model—a move that further boosts market sentiment.

These actions and market reactions have made BGB a major focal point in the crypto industry recently, drawing widespread attention. This article reviews the evolution of exchange tokens and analyzes recent BGB market data to help readers understand the logic behind its price surge, assess its future trajectory, and evaluate potential investment opportunities.

1. The Symbiotic Evolution of CEXs and Exchange Tokens

In the complex ecosystem of cryptocurrency, centralized exchanges (CEXs) and their native tokens evolve like a rising spiral—mutually reinforcing and advancing together. As core hubs for crypto trading, CEXs provide efficient and convenient trading environments, attracting massive capital flows and transaction volumes. During their development, CEXs have introduced innovative financial products to attract more users, giving rise to exchange tokens.

Initially, exchange tokens were primarily used within exchanges—for example, to pay or discount trading fees. As markets matured, these tokens gained diverse functionalities. Users can now use them to participate in platform activities such as voting for new listings or subscribing to high-potential projects. In listing votes, holders can vote based on their token balance; if a project gets listed, they may receive rewards—increasing user engagement in governance while offering additional returns. Some tokens have also entered the DeFi space, enabling services like lending and staking.

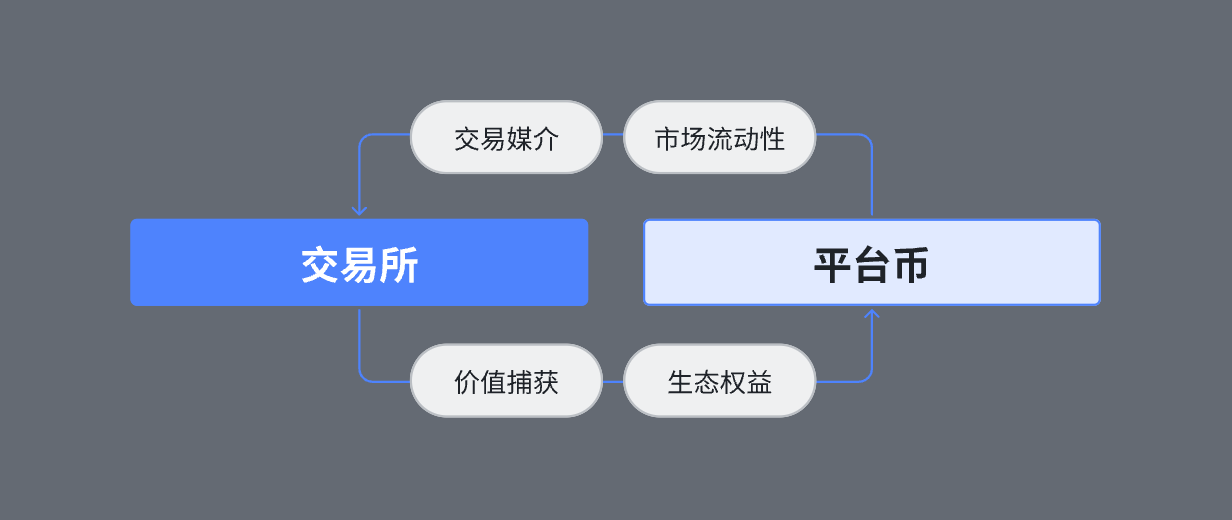

The core value of exchange tokens can be summarized as follows:

1. Transaction Medium: Exchange tokens are widely used for paying trading fees, often with tiered discounts. This creates stable demand within the exchange ecosystem, highlighting their role as a transaction medium.

2. Ecosystem Rights: These tokens serve as key credentials for deep participation in the exchange ecosystem, granting access to benefits such as early participation in promising projects and voting rights.

3. Value Capture: As exchanges expand their business, user base, and market share, their profitability and influence grow—allowing token holders to share in the economic upside of the platform’s growth.

4. Market Liquidity: High liquidity enables effective price discovery and plays a crucial role in resource allocation and risk pricing across the market.

It is clear that CEXs and exchange tokens are interdependent and mutually reinforcing. The growth of CEXs provides real-world utility and solid value backing for tokens, while token innovation enhances exchange competitiveness and user stickiness.

However, this journey hasn’t been smooth. There have been multiple incidents where CEXs suffered hacker attacks due to security flaws, leading to significant losses of user assets and sharp declines in token prices. Such events have served as wake-up calls for the entire industry and remind investors of the risks associated with exchange tokens.

2. The Rise of BGB and Bitget

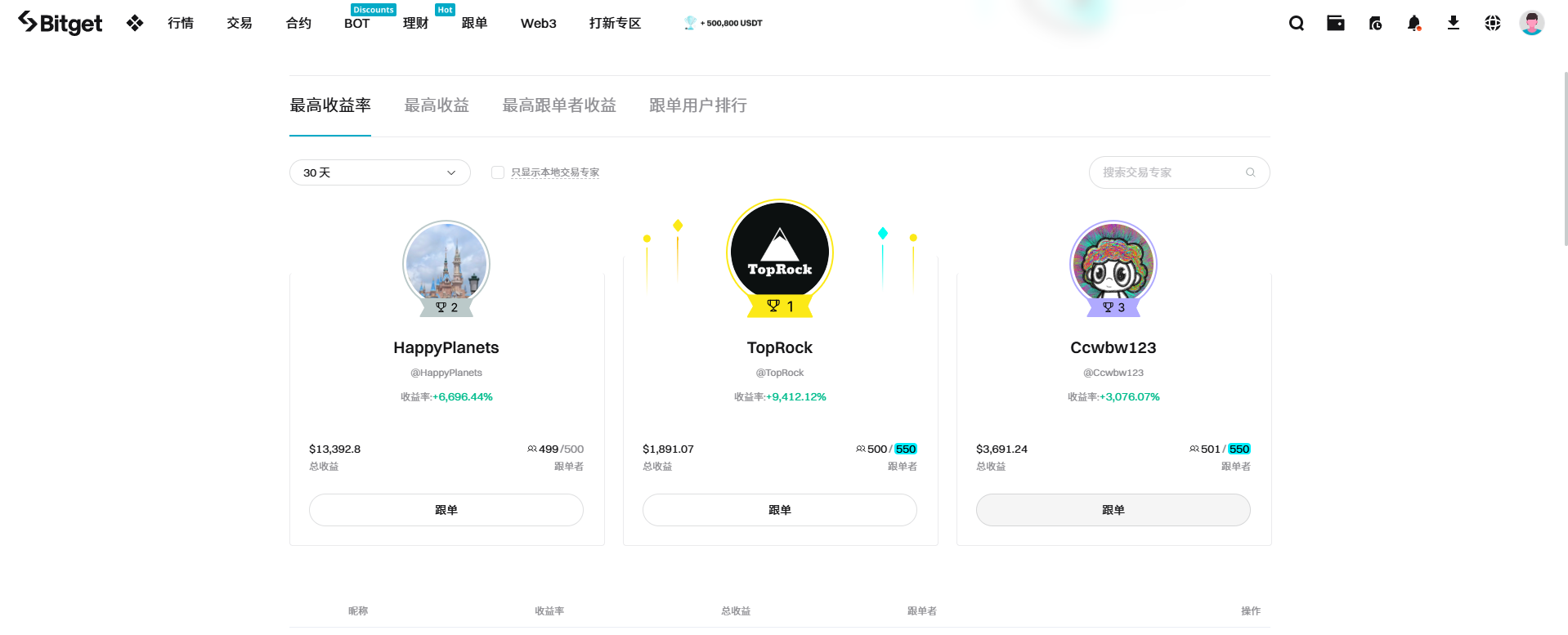

This section introduces BGB and Bitget. Founded in 2018, Bitget is a cryptocurrency derivatives exchange offering spot, derivatives, and copy trading. After initial exploration, Bitget paused spot trading in 2019 to focus on launching USDT-margined contracts, turning profitable shortly after. In 2020, it pioneered copy trading—significantly lowering the barrier to entry by allowing novice investors to follow strategies of professional traders—drawing large numbers of new users. From then on, “product innovation” became Bitget’s foundation.

Over the following years, Bitget evolved from a derivatives-focused exchange into a comprehensive platform. Starting in 2022, Bitget expanded its team and prioritized operations and growth, establishing KOL channels in East Asia and replicating this strategy across Asia, Europe, and Latin America. Its user base grew rapidly—from 300,000 in early 2021 to 20.2 million by the end of 2023.

In 2024, Bitget focused on globalization, compliance, and Web3 on-chain access, appointing senior executives aligned with these goals: COO Vugar Usi Zade, with extensive international market experience; CLO Hon Ng, overseeing legal and regulatory affairs; and CEO Gracy Chen, previously an investor in BitKeep.

Today, Bitget employs over 1,500 people, serves more than 45 million users across 150+ countries and regions, and averages over $10 billion in daily trading volume. It is the world’s largest crypto copy-trading platform and ranks fourth globally among cryptocurrency exchanges by overall market share.

BGB, Bitget’s native token, has evolved significantly since its inception. Launched on July 29, 2021, BGB initially served to offset trading fees. As Bitget’s ecosystem matured, its use cases expanded to include LaunchPad project subscriptions, LaunchPool mining, and more.

On Bitget’s LaunchPad, BGB holders gain priority in subscribing to new project tokens—offering early access to high-growth opportunities. In LaunchPool, users stake BGB to earn shares of new token distributions—effectively receiving dividends. Additionally, BGB plays a role in Bitget’s governance, incentivizing active participation and boosting trading activity, thereby strengthening user-platform interaction and loyalty.

Price-wise, after Bitget relaunched its spot product and introduced BGB in 2021, the broader market turned bearish. Yet despite this, BGB rose steadily thanks to Bitget’s rapid product rollouts and brand expansion. After each new high, BGB typically corrected around 30%, then resumed climbing with average rallies of 250%. By the end of 2022, it stabilized around $0.20. From 2023 to 2024, as the market shifted from bear to bull, and Bitget launched Bitget Wallet and expanded into regions like the Middle East, BGB climbed again to a new high of $1.486 before a minor pullback. In December, BGB began surging sharply, reaching a peak of $8.49 on December 26—spurred by the announcement that BGB would merge with BWB (Bitget Wallet Token)—before settling around $6.

Regarding BGB’s buyback and burn mechanism, 800 million tokens held by the core team were burned on December 30. Starting in 2025, a quarterly burn program will begin, using 20% of profits from Bitget’s exchange and wallet operations to repurchase and destroy BGB, with full transparency. The circulating supply of BGB has already dropped from 2 billion to 1.2 billion. This demonstrates Bitget’s commitment to its deflationary model and determination to accelerate ecosystem development.

Exchange tokens possess two core attributes: asset and utility. The former reflects the exchange’s value, while the latter acts like a "loyalty points" system. Within Bitget’s ecosystem, BGB represents the exchange’s market value and integrates across various products and services. Acting as an operational loyalty point connecting exchanges, project teams, and users, BGB leverages B-side incentives to help retain C-side users and their assets. Through its “golden shovel” characteristics—rewarding users via profit-sharing—it establishes predictable returns for users, creating a virtuous cycle from asset retention to asset growth, while helping B-side partners gain early liquidity and users, co-building the ecosystem.

3. BGB vs. Major Exchange Tokens

In the crypto market, major exchange tokens like BNB and OKB, backed by their respective platforms, offer diversified rights and services, drive ecosystem development, and continuously innovate to strengthen their market positions.

First, here's a comparison of major CEXs:

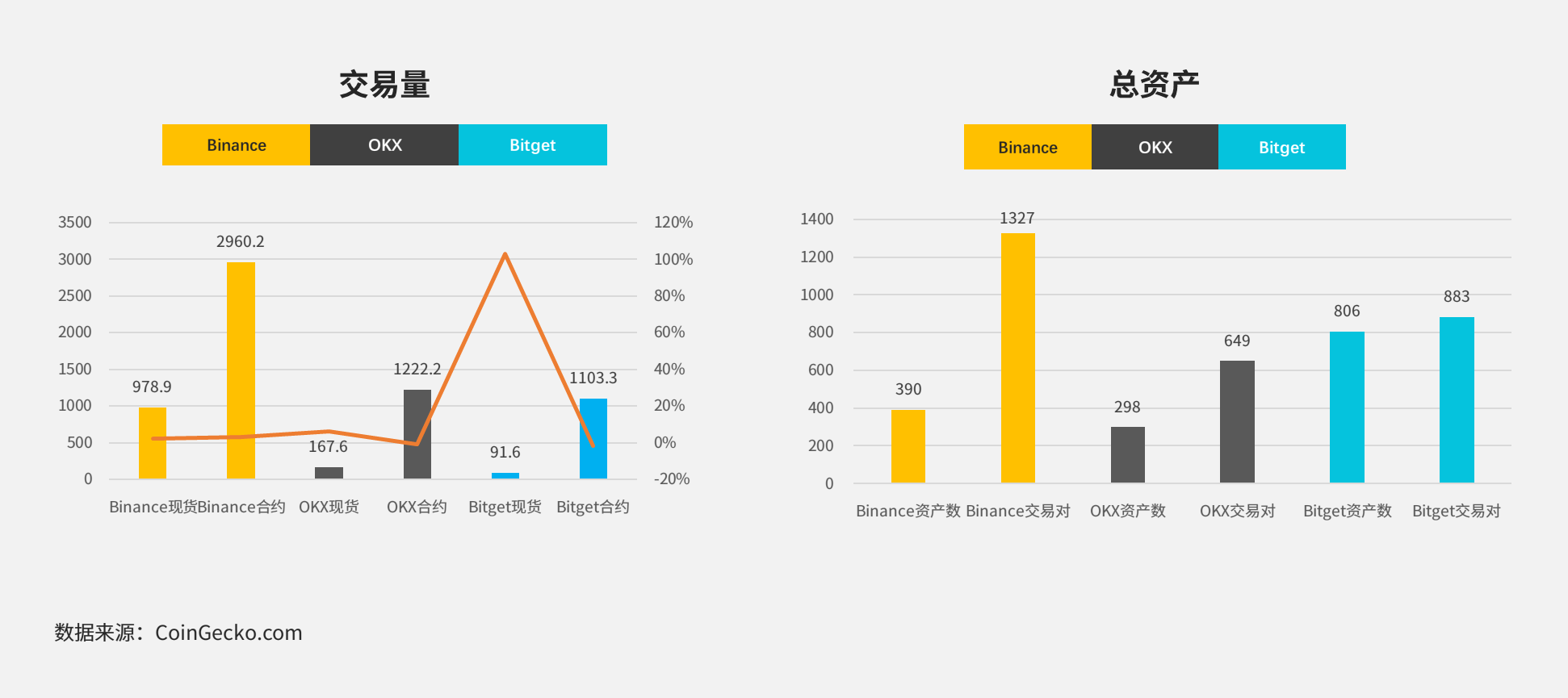

- The chart shows that most exchanges saw little change in monthly trading volume, except Bitget, whose spot trading volume increased 102.7% MoM—an exceptionally strong performance closely tied to its strategic moves and BGB’s price surge in December, reflecting strong market recognition.

- In terms of available assets, Binance and Bitget offer rich selections with numerous trading pairs. Altcoins, especially those centered around platform tokens, account for over 45% of total assets—indicating high-quality offerings and strong user holding intent.

Next, a comparison of major exchange tokens:

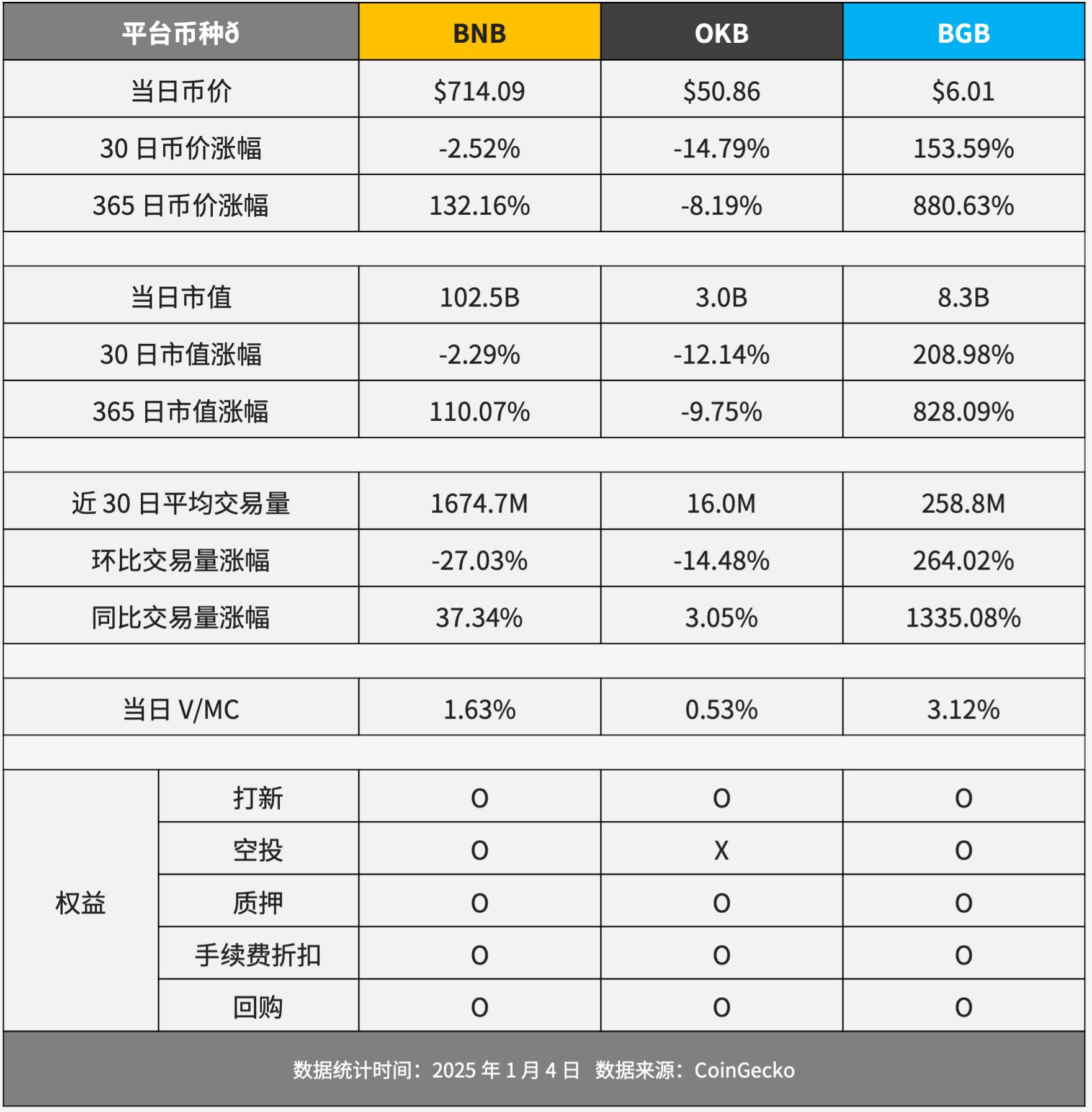

- In price and market cap, BGB leads clearly: +153.59% in the last 30 days, +880.63% over the past year; market cap up 208.98% (30-day) and 828.09% (yearly). Both metrics far exceed BNB and OKB, signaling strong market confidence.

- Daily trading volume: BGB trails BNB but surpasses OKB. More notably, BGB’s trading volume rose 264.02% MoM and 1,335.08% YoY—outpacing other exchange tokens. High turnover indicates strong liquidity, enhancing price discovery and providing fairer valuations. It also means higher fee income for Bitget, funding tech upgrades, security, and new ventures.

- V/MC ratio: OKB is below 1% at 0.53%; both BNB and BGB exceed 1%, with BGB as high as 3.12%. The V/MC ratio reflects valuation status—higher values suggest BGB may still be undervalued, with substantial upside potential.

- Utility: With the launch of its quarterly burn plan, BGB completes its final piece in value accrual. BNB has enhanced airdrop features in its new wallet. Both offer robust ecosystems. BGB offers more earning avenues through LaunchPad, LaunchPool, PoolX, and integration with Bitget Wallet and Morph’s on-chain ecosystem.

4. Drivers Behind BGB’s Current Rally

Next, let’s analyze the reasons behind BGB’s recent price surge—assessing whether it is fundamentally supported, identifying bullish and bearish factors, and evaluating remaining profit potential.

I believe the following factors support BGB’s price:

- Ongoing Product Innovation: From pioneering USDT-margined contracts and copy trading to introducing Launchpad, LaunchPool, and PoolX, Bitget consistently drives user acquisition and engagement through innovative products. New users bring fresh capital and higher trading activity, which—combined with BGB-based asset management—deepens user stickiness and fuels demand and price appreciation.

- MCN-Style Differentiation and Global Channel Control: Bitget has built a global KOL network using an MCN-style approach. Copy trading resembles live commerce, leveraging KOLs to showcase its strengths in derivatives. Low barriers increase trading frequency and user retention. Rapid user growth across Asia, Europe, and Latin America further boosts BGB demand.

- Fulfillment of Deflationary Promises: By burning 40% of team-held tokens and launching a quarterly destruction plan, Bitget demonstrated long-term commitment and alleviated prior concerns about insider holdings. Increased scarcity directly contributes to price increases.

- Merging BGB and BWB: This move consolidates BGB as the central token, expanding its utility and incentive functions within the wallet ecosystem. It eliminates confusion for new users navigating two tokens and removes friction in participating in platform activities.

- Improved User Experience: Continuous enhancements—such as multilingual customer support and improved UI/UX—strengthen user loyalty, encouraging greater BGB holding and usage, thus supporting price growth.

Together, these adjustments form a powerful flywheel: improved UX combines with aggressive global user acquisition to create a positive feedback loop; meanwhile, BGB-integrated wealth tools activate and retain users, converting them into deeper participants. Rising demand for BGB pushes prices up, and higher prices attract even more new users.

5. Investment Opportunity Analysis for BGB

To assess BGB’s current investment feasibility, here’s a summary of bullish and bearish factors:

Bullish Factors:

- Strong Growth Momentum: Over the past month, BGB has shown exceptional price strength, outperforming mainstream tokens like BNB and OKB. Underlying Bitget excels in derivatives, gaining significant market share. According to Coinglass, Bitget ranks top three in 24-hour BTC and ETH futures trading volume.

- Rich Utility Features: BGB holders enjoy multiple benefits: Launchpad allocations, Launchpool mining, VIP perks, fee discounts, discounted access to major coins, extra yield on savings, and free withdrawals. Notably, Launchpad offers high-frequency, high-return opportunities.

- Expanding Use Cases: Beyond gas fee payments, Bitget promotes BGB adoption in major public chains and DeFi ecosystems—enhancing on-chain liquidity, staking yields, and eligibility for partner token airdrops.

- Deflationary Mechanism: Bitget commits to maintaining BGB’s status and plans to allocate 20% of exchange and wallet revenues quarterly to buy back and burn BGB starting in 2025. The recent burn of 40% of team-held tokens reduces supply, potentially increasing value.

- PayFi Applications: BGB is actively expanding into payments, DeFi, and NFTs. Some merchants accept BGB as payment, and certain DeFi protocols integrate it as collateral. Products like Bitget Card and Bitget Pay allow users with sufficient BGB to unlock merchant discounts, cashback, lower fees, and broader service access.

- Relatively Low Valuation: As indicated by the V/MC ratio, BGB may still be undervalued compared to BNB and OKB, suggesting room for upward revaluation.

Bearish Factors:

- Shallow On-Chain Liquidity Pools: This could affect trade execution efficiency and price stability.

- Lower Market Cap: Compared to BNB, BGB’s smaller market cap makes it more volatile, with weaker market influence and liquidity.

- Potential Overheating: Recent price gains have been extremely rapid, possibly outpacing fundamentals. Signs of overheating suggest that a shift in market sentiment could trigger sharp corrections.

Overall, BGB’s strengths—strong price momentum, fast platform growth, active community, rich utilities, deflationary mechanics, and strategic moves in PayFi and on-chain development—present investment opportunities. However, weaknesses such as shallow on-chain pools and low market cap cannot be ignored, as they may lead to high volatility and reduced trading efficiency.

6. BGB Price Forecast for 2025

2025 brings more favorable conditions than previous years—Trump’s pro-crypto stance, global rate cuts increasing liquidity, and growing global acceptance of cryptocurrencies—making 2025, especially Q1, a likely breakout period.

Considering BGB’s ongoing burns and future deflationary mechanisms, its relatively undervalued market cap compared to BNB, stronger growth momentum than OKB, and more comprehensive ecosystem applications, BGB appears well-supported. In fact, BGB’s 2025 performance could surpass BNB’s performance last year.

For specific price projections, I take BGB’s current price of $6 as a baseline and estimate upside potential based on V/MC ratio, trading volume growth, and the deflationary model.

- Three key assumptions for annual forecasting: Current V/MC ratio is 3.12%; assume market correction toward the ideal 1%, settling at 2.5%; past 365-day trading volume growth was 1,335.08%; conservatively assume 250% growth in 2025; BGB circulation expected to decrease by 5% annually due to deflation.

- V/MC = Volume / Market Cap. If V/MC drops from 3.12% to 2.5% and volume grows 400%, market cap would rise to 4.38x current levels—recovering undervaluation.

- Using Market Cap = Price × Circulating Supply, with market cap increasing ~4.38x and supply decreasing 5% due to burns, price should reach ~4.61x current level.

- Add 10% weighting for value from products like LaunchPool, LaunchPad, PoolX, and expanded applications post-BGB/BWB merger in Bitget Wallet and Morph ecosystems. This raises price projection to 5.071x. Optimistic investor sentiment could push actual gains even higher.

- Short-term (Q1 2025) forecasts involve fewer variables. V/MC normalization and gradual supply reduction won’t yet have major impact. Only consider volume growth and immediate supply reduction from the first burn—suggesting a conservative ~1x price increase.

My final price forecast: Q1 2025 high of $12.34, with a yearly target of $31.66.

Investors should always consider personal risk tolerance and investment goals, closely monitor BGB’s progress in application expansion, on-chain development, and competitive positioning, weigh pros and cons carefully, and consider allocating modestly to a diversified portfolio—not over-concentrating—to mitigate potential risks.

The above analysis is based on publicly available information and reflects my personal review and outlook on BGB. I hope this provides valuable insights for investors. But remember: investment decisions must stem from thorough research and prudent judgment—never blindly follow trends. Stay alert to crypto market dynamics and industry developments to adjust your strategy timely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News