A long-anticipated overtaking, BGB surges over 20% in a single day

TechFlow Selected TechFlow Selected

A long-anticipated overtaking, BGB surges over 20% in a single day

Platforms and users are destined to mutually empower each other; platforms that genuinely benefit users will naturally be propelled to the forefront by the users themselves.

Author: MartinTalk

"A day in crypto feels like a year in the real world" — crypto enthusiasts often use this phrase to describe the fast-paced changes in the cryptocurrency market. With each bull and bear cycle, the CEX market landscape undergoes another reshuffle, allowing those who adapt to thrive.

The wheels of fate are turning once again, and a new trio格局 is quietly taking shape, with Bitget gradually emerging as a key player at the table. Backed by rapidly growing platform operations, Bitget’s native token BGB has delivered outstanding performance, achieving a year-to-date gain of 391%, outperforming both BTC and ETH.

As BTC successfully breaks through the $100,000 mark, cryptocurrencies have once again become a mainstream focus. For leading platforms such as Binance, OKX, and Bitget, attracting new users and expanding their user base has become the core battleground in this new round of competition.

1. The Narrative Returns to Platform Tokens: BGB Dominates Across the Board This Year

Recently, the platform token sector has been buzzing, drawing renewed market attention.

On December 4th, BNB—the long-dormant Binance platform token—began a sharp rally, nearly reaching $800 and hitting an all-time high with a single-day surge exceeding 20%, quickly becoming headline news across the industry.

Bitget's platform token BGB has also proven formidable, dominating price gain charts for several consecutive days since December 4th with a cumulative increase of over 70%. BGB’s price surged past $2.80, reaching a circulating market cap of $3.9 billion.

In fact, platform tokens were largely overlooked this year, as market narratives focused on short-lived trends like Meme coins. However, when surveying the broader crypto market, only platform tokens truly possess fundamental value. After all, in today’s market, the most profitable business model remains “selling shovels”—charging users fees for trading services. Exchanges are quintessential examples of this model, and thus their native tokens naturally rise in value alongside them.

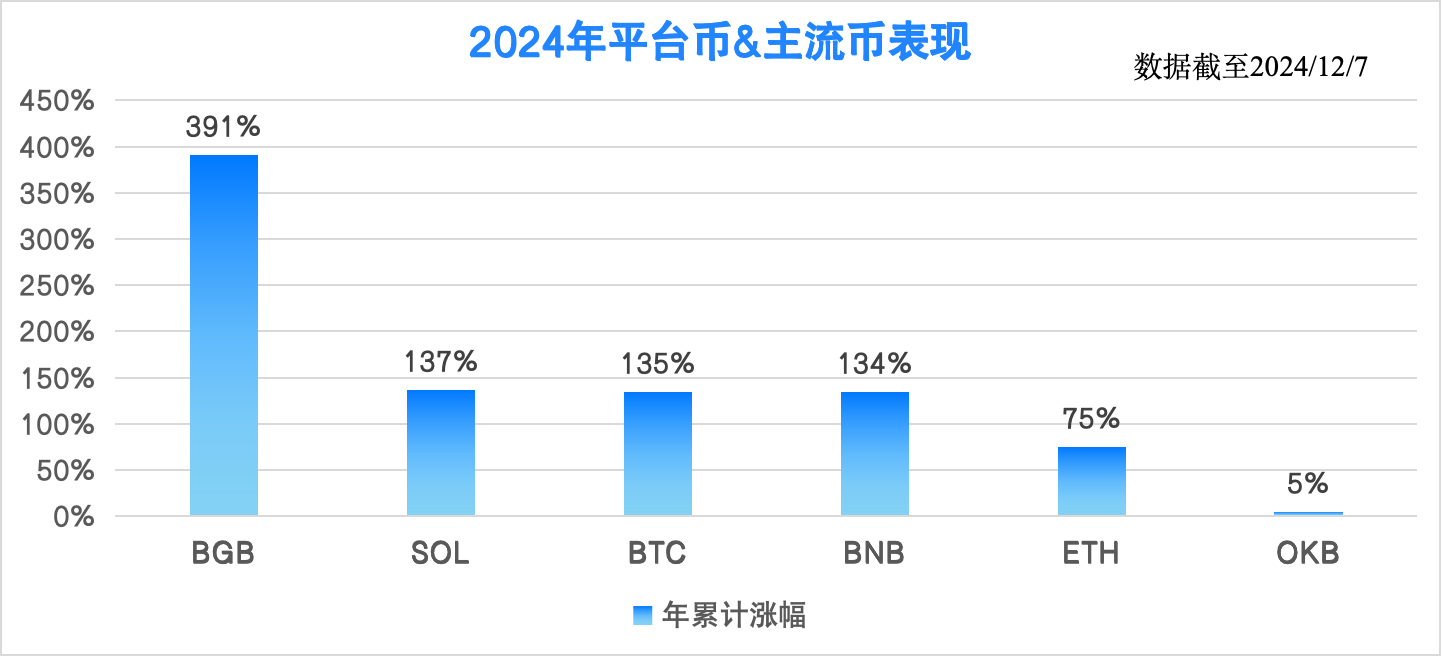

Therefore, fundamentally backed platform tokens are poised to become the next major narrative in the crypto market. How can investors identify the best alpha assets among these platform tokens? By comparing the three major platform tokens against BTC, ETH, and SOL, we may find the answer, as shown below:

Data shows that among major CEX platform tokens this year, BGB achieved the highest year-to-date gain at 391%, surpassing BNB (up 134%) and OKB (up 5%). Moreover, BGB’s gains also exceeded those of SOL (up 137%), BTC (up 135%), and ETH (up 75%).

Additionally, while BGB’s circulating market cap stands at $3.9 billion, it still has significant room to grow compared to BNB’s $106.7 billion. For crypto users, holding BGB and growing alongside Bitget could yield even greater excess returns in the future.

BGB’s market recognition is also driven by Bitget’s continuous empowerment initiatives, including Launchpad access, Launchpool new-coin mining, VIP experiences, fee discounts, preferential pricing for major cryptocurrencies, additional wealth management yields, and free withdrawals—offering multiple tangible benefits.

Among these, BGB-powered new token subscriptions stand out as a key wealth-generation feature, with high frequency and high returns being the most prominent highlights. Data indicates that over the past two months, Bitget Launchpool launched an average of three projects per month, with ARP in the BGB pool consistently above 40% and peaking at 170%, as illustrated below:

Looking ahead, Bitget plans to complete BGB’s final missing piece—buyback and burn mechanisms. Bitget CEO Gracy Chen stated: "In the future, Bitget will consider implementing a BGB buyback and burn program, further enhancing BGB’s ‘golden shovel’ attributes."

2. Business Flywheel Growth: The Value Behind BGB

A CEX’s true moat lies in its operational strength, which also serves as the foundation supporting its platform token. Since the start of this bull market in October 2023, Bitget has achieved leapfrog development. According to Bitget’s Q3 Transparency Report, its registered user base has surpassed 45 million—up 400% year-on-year.

Derivatives trading, Bitget’s original core offering, has made another significant leap in market share this year.

Data from Coinglass shows that among the top three centralized exchanges by 24-hour Bitcoin futures trading volume, Bitget ranks second with $11.77 billion. In Ethereum futures trading volume, the top three are Binance, Bitget, and OKX, with Bitget recording $5.99 billion in 24-hour volume—second only to Binance.

Regarding this achievement, Bitget CEO Gracy Chen noted that recent metrics—including trading volume, open interest, and daily active users—have all reached record highs, nearly doubling previous peaks.

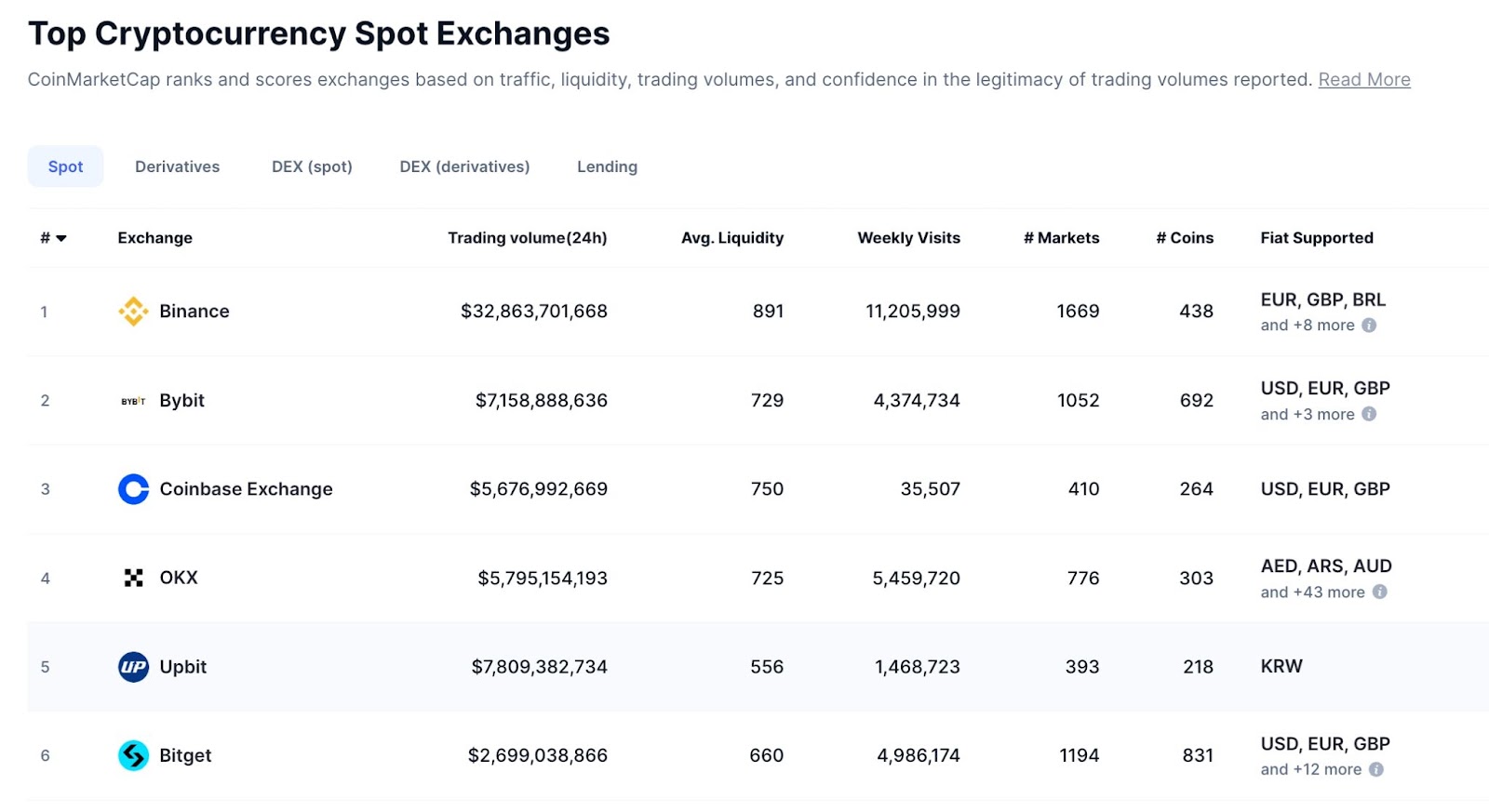

Many crypto users highly value Bitget’s derivatives trading experience. According to CoinMarketCap data on weekly visits to global crypto CEXs, Binance leads with 11.2 million weekly visits, followed by OKX (5.45 million) and Bitget (4.98 million).

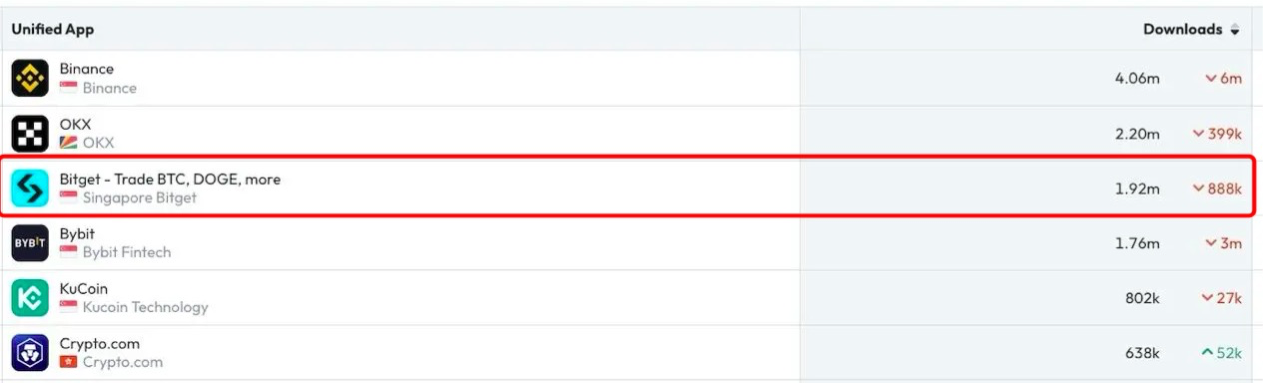

Beyond retaining existing users, Bitget has also become one of the top choices for new entrants. According to Data.ai, Bitget’s app was downloaded 1.92 million times in October, ranking third globally among CEX apps—just behind Binance and OKX.

Now, after six years of steady growth, Bitget has emerged as an industry leader, gaining increasing recognition from users worldwide.

3. Innovation Remains Bitget’s Core DNA

Over the past few years, the CEX landscape has repeatedly shifted, leaving behind conservative players who failed to keep pace. Bitget’s ability to break through in a fiercely competitive market stems directly from its unwavering commitment to innovation—a core part of its DNA.

This year, Bitget turned its focus toward innovative asset categories: Meme coins. Through a collaboration with Nansen to refine its token discovery strategy, Bitget leverages on-chain data and community insights to provide traders with an advanced toolkit for identifying promising tokens.

Since April, Bitget has listed 240 new tokens, making it one of the most active exchanges for early token launches. Most of these listings were first-time offerings, creating a strong listing effect that helped users capture excess returns—and deepening user affection for Bitget. Some notable initial listings include:

Beyond new token listings, Bitget innovatively introduced “pre-market trading” this year to attract early movers, allowing users to buy or sell designated tokens ahead of official listing to boost potential gains. According to its Q3 report, Bitget launched pre-market trading for 12 popular tokens including CATI, MOCA, HMSTR, DOGS, and ZKL, attracting 53,800 early traders with a total trading volume of $23 million.

Bitget CEO Gracy Chen once wrote in an open letter: “Bitget still has a long journey ahead. Think Big, Think Long.”

Platforms and users are destined to uplift each other. A platform that genuinely delivers value to its users will naturally be elevated to the forefront by those users themselves.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News