Interview with Delphi Labs: The Death of OG Memes, AI Hype Cycles, and BTC Dominance

TechFlow Selected TechFlow Selected

Interview with Delphi Labs: The Death of OG Memes, AI Hype Cycles, and BTC Dominance

Over 50% of revenue in the crypto sector comes from Solana applications, and when Solana generates 80% of the industry's revenue, it's hard not to believe it has the potential to surpass ETH.

Compiled by: Yuliya, PANews

In the volatile crypto market, accurately grasping trends and opportunities is crucial. As one of the most influential research firms in the industry, Delphi Digital is renowned for its in-depth market analysis and precise investment insights, with its reports becoming essential decision-making references for institutional investors.

In the latest episode of the Hivemind podcast, core members of Delphi engaged in a deep discussion on the outlook for the 2025 crypto market. Host Jose (Head of Delphi Labs), Ceteris Paribus (Head of Institutional Research), Duncan (small-cap investment expert), and Jason (Market Lead for Research) explored hot topics including the evolution of AI narratives, Bitcoin L2 ecosystems, and the return of infrastructure value. PANews has compiled and translated this podcast into written form.

*Note: The podcast was recorded on January 16, which differs significantly from current market data and trending sectors.

Market Observations

Ceteris:

The market volatility over these past few weeks has been extremely intense. Looking back, after the FOMC meeting at the end of December last year, the market saw a sell-off. Bitcoin had reached nearly $100,000, but within just a few hours dropped below $90,000.

My main view is that this market fluctuation hasn’t changed fundamentals. For example, during previous downturns, Bitcoin still performed best, while many DeFi projects and OG Memes remained relatively inactive. This shows that market interest hasn’t fundamentally shifted. Projects leading the rebound—such as Virtuals and frameworks related to ai16z—are still those that stood out at the bottom.

In summary, I believe this market movement reflects both macro factors—like CPI data and policy rumors—and technical corrections. Price charts for many tokens have looked extremely "wild" over recent weeks, and such extreme price action naturally triggers pullbacks and liquidations.

Jason:

Much of the volatility relates to market positioning. For instance, news last week about the DOJ planning to sell $6 billion worth of Bitcoin now appears possibly false or exaggerated. As Trump’s inauguration approaches, if they haven’t taken action by now, it could actually be a bullish signal.

From my perspective, last week’s macro data came in better than expected, potentially raising near-term targets. However, the more the market rallies ahead of major events, the greater the chance of a “sell-the-news” scenario. Just like when Trump takes office next Monday, if Bitcoin continues rising beforehand, I’d be concerned about a short-term pullback—similar to what happened around ETF approvals.

On the other hand, Trump may, like in 2016, issue a series of executive orders immediately upon taking office, some targeting crypto. Given the relatively small liquidity in the crypto market, he could influence it even more significantly than traditional financial markets.

Ceteris:

I’ve noticed Trump’s youngest son and his circle are actively involved in crypto, suggesting he might see Bitcoin’s price as a “stock market indicator” for younger generations. While this needs verification, given his children’s involvement, it seems plausible. If he starts talking about being the first “crypto president” or “Bitcoin president,” he indeed has many ways to advance the crypto space.

Jose:

Trump has many levers to support crypto development. Clearly, we saw a massive rally post-election, and the market is now digesting that move. Future market direction will largely depend on Trump’s actual policies toward crypto and how officials he appoints impact broader macro markets—for example, Scott Bessent as Treasury Secretary.

The dip before Trump’s election felt like a solid buying opportunity. There’s a simple logic here: he can easily implement policies beneficial to crypto. Washington is now advancing a crypto bill; the industry has evolved from being ignored or disliked to having a “Crypto Bowl” and an upcoming crypto advisory committee. So there’s no need to overthink—it’s clear Trump is bullish on crypto. Of course, there’s also a chance he does nothing, and politicians failing to deliver isn’t rare—especially Trump, who isn’t the most trustworthy. But pushing crypto aligns with his interests, so I remain quite bullish.

The AI Bubble

Jose:

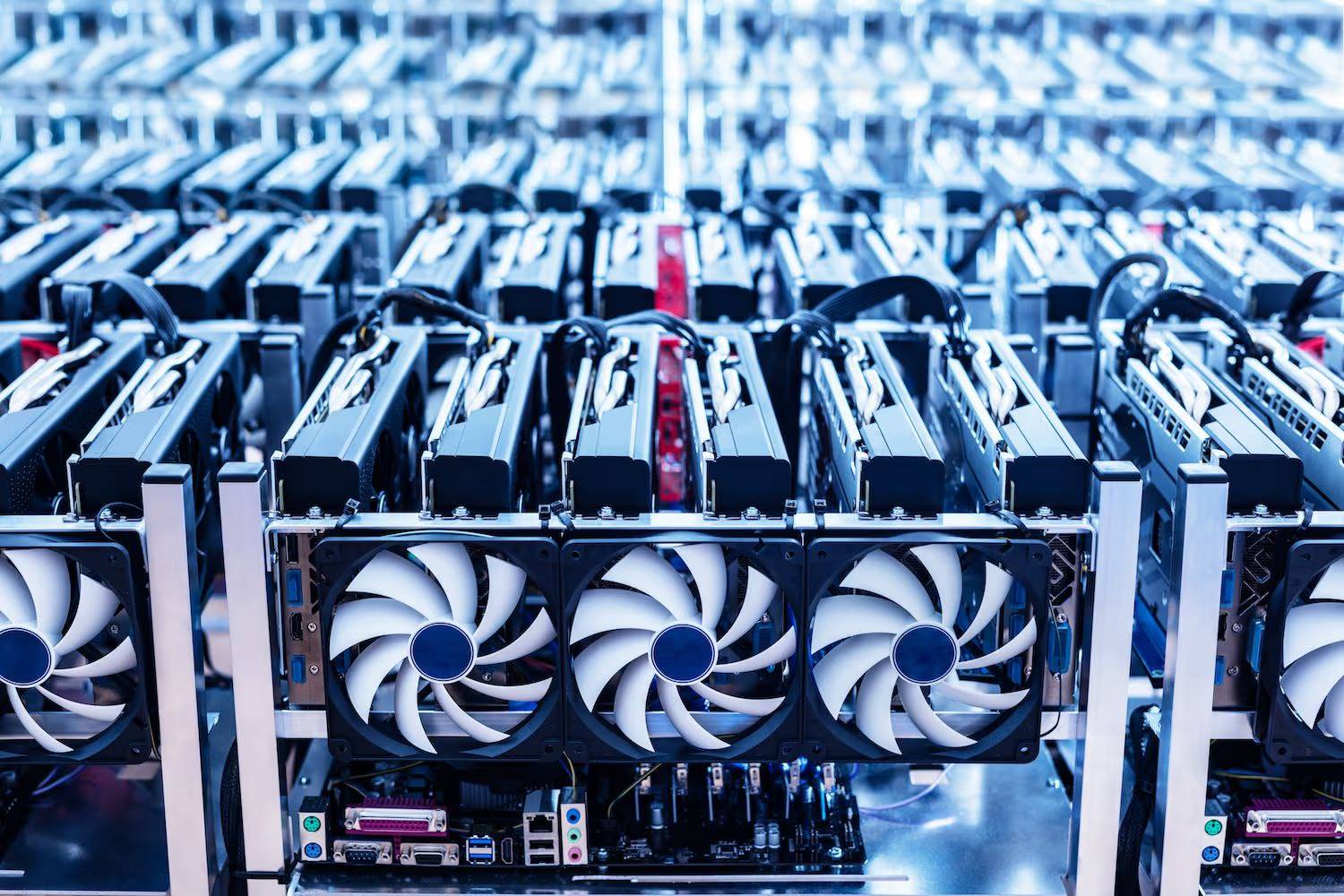

Actually, during this downturn, I bought quite a bit of tokens tied to AI frameworks. In my view, AI itself will be the biggest narrative in 2025. My overall take is that we might achieve AGI (Artificial General Intelligence) by 2025. The capital expenditures by hyperscale tech companies are staggering—Microsoft alone plans to spend $80 billion, with others funneling nearly all their free cash flow into building computing infrastructure for training AI models. Progress in 2025 could be faster than in 2024.

To me, AGI means AI reaching or surpassing human-level performance across multiple domains, with some autonomy to perform tasks for users. Simply put, it’s like having a PhD-level research assistant or investment analyst.

Right now, only a few people in Silicon Valley and the tech world truly grasp how transformative AI will be, but over the coming years, the global awareness will grow. I believe this will become one of the largest bubbles in financial history, because AI fundamentals are strong, and the story built around it is highly compelling. Never before has a technology at such an early stage had such robust fundamentals—like OpenAI’s revenue or future income potential from code-assistant tools.

Despite strong fundamentals, humans tend to get overly excited about new things, causing cyclical swings. I don’t think the big AI bubble has truly arrived yet, but it’s almost inevitable. Even assuming crypto-based AI projects have zero fundamentals, I believe capital flows alone could drive the market. Consider how ordinary investors can participate in the AI narrative: The “MAG7” (Microsoft, Apple, Google, etc.) are expensive but not unaffordable; however, investing in big tech stocks rarely leads to life-changing wealth. Stock picking feels like a rigged game to many, and venture capital remains inaccessible to 99.9% of people. That leaves betting on crypto AI projects.

I think sectors like Agentic currently have a market cap of about $1 billion, with the entire crypto AI market around $5 billion. As we’ve forecasted, this scale will only keep growing.

Ceteris:

My strategy has always been “act first, analyze later.” Right now, the priority is exposure to trending areas, then identifying which projects emerge as valuable players. At the same time, I’m betting on the growth of the sector as a whole. However, last week’s market reminded us that volatility here is extreme. Some projects’ prices could drop 50% in two days—a level of rotation likely to repeat over the next year. So I won’t hold AI tokens all year long; instead, I’ll adjust dynamically based on market movements.

Currently, the leaders are Virtuals and ai16z, but I don’t believe they have insurmountable moats.

Virtuals’ strength lies in its built-in token value capture—users must pay in Virtuals tokens to launch agents, providing stable cash flow.

Ai16z relies more on broad framework adoption, but currently lacks a clear monetization model.

Ultimately, dominance comes down to platform appeal—specifically, whether it attracts more developers and users. Notably, this is the first time we’re seeing reduced user concern about the underlying chain. Many agent functions run off-chain, with chains mainly supporting token trading or liquidity. So users care more about platform functionality and convenience than which chain it runs on.

The Moat of Agent Tokens

Jason:

I think the main moat right now is attractiveness—being a Launchpad. That’s where value capture happens. A Launchpad’s value depends on how much attention and users it draws, and whether users perceive its fees as reasonable. This is why Binance can charge 3%–10% of a project’s token supply for its Launch Pool, and why Virtuals has proven capable too. But this moat is fragile, and competition could be fierce.

The market will experience brutal capital rotations, making it hard to keep up. I hope over time different platforms will emerge, allowing for risk diversification. Take TAO, for example—it was initially the dominant choice, but as better alternatives emerged, its position weakened. Current leaders like Virtuals and ai16z will likely face the same fate. Today, they’re the primary bets on this narrative, but better solutions and new narratives will arise in AI. When that happens, smart investors will continuously rebalance portfolios. This is more of a trading play than a long-term hold.

Ceteris:

Personally, I haven’t found any team whose long-term prospects inspire full confidence. Some say you should invest in “mining tools” or infrastructure, but whether these tools remain effective—even by year-end—is uncertain.

Duncan:

For example, Pump.Fun has a strong edge in the Launchpad space, but I doubt Virtuals can maintain its lead long-term.

Ceteris:

From what I’ve learned, Virtuals’ actual tech stack isn’t particularly strong. Its popularity stems more from ease of launching agents. For instance, one team initially launched an agent via Virtuals but recently switched to the Eliza framework. While the agent remains part of Virtuals’ ecosystem and pairs with Virtuals on Base, the core tech has moved to Eliza.

Jose:

This kind of shift isn’t uncommon. Some who were originally bullish on Virtuals tried the product and switched to ai16z’s framework, turning less optimistic. I think this pattern will repeat. For Virtuals and other AI tokens, uncertainty about the future remains high. Still, they’re seen as credible options now, so large amounts of capital are flowing in, driving short-term gains.

Also, from conversations with industry insiders, I’ve found many remain skeptical of the AI narrative and haven’t invested. This suggests significant latent capital could enter the market. While current AI projects are seen as the only viable buys now, future projects with stronger long-term value and deeper moats could outperform.

Jason:

On the technical side, my team is deeply analyzing these platforms and their trade-offs. Larry’s point—that crypto AI agent frameworks have almost no technical edge, and big tech could replicate them in weeks—may be correct, but it doesn’t mean much given big tech’s vast resources. Still, I agree with the current reality: these projects are the only seemingly credible investment options, so capital is flooding in.

The Decline of OG Memes

Jose:

I think AI is essentially a bigger meme than WIF. It’s easier to tell stories around and get excited about, especially since it has some fundamental potential. I believe that in 2025, not just meme coins, but most crypto capital will shift toward AI. The shift in meme coin markets may be more direct—AI agent memes offer larger narratives than traditional memes.

Jason:

I mostly agree. It’s not necessarily that AI is inherently better than memes, but rather that the market is tired of traditional memes. People have played FROG, WIF, BONK, etc., for over a year. Making money is fun, but most want to invest in something with at least some real value or a path to value.

That doesn’t mean I must buy into that. When the market clearly signals where attention is focused, you can hold both views simultaneously. That’s key to being a good tactical trader—not what you believe or wish were true, but what the market tells you.

For most of 2024, the market signaled a preference for meme coins—whether due to lack of new users, chasing patterns from prior cycles, or poor regulatory conditions. But starting mid-November, the market clearly favored AI.

I think some OG meme coins might still perform well, but the March wave of meme coins is probably dead. Honestly, I think most meme coins and these agent projects will eventually fail. Someone should tell Coinbase’s listing team—the meme coin era is over. But looking at DOGE’s chart, I don’t think it’s peaked yet.

I see DOGE as a good benchmark for the overall meme coin market. The meta-narrative has clearly shifted—easy money is now in agents and AI. That doesn’t mean all meme coins are doomed, just that they won’t be the sole focus for investment like last year.

Now that Trump is returning, people may feel more comfortable investing in crypto, so I might consider DeFi coins or projects like Ethena. With pro-crypto and pro-AI figures in the White House, maybe I should buy all AI coins—there could be positive catalysts ahead.

Duncan:

Long-term, aside from a few projects like Bitcoin or DOGE that have achieved escape velocity and mindshare, any project without real business backing will likely trend toward zero—especially considering the pace at which new projects are launched today.

Return of Fundamentals

Ceteris:

I agree that projects without fundamental backing are unlikely to sustain long-term. I believe we’re entering a new era in infrastructure—without a long-term revenue story, sustainability is difficult. We’re already seeing more attention going to projects that generate real revenue, such as certain L1s and infrastructure projects.

According to the latest Blockworks data, over 50% of revenue in crypto now comes from Solana applications. (Of course, not all revenue goes directly to Solana—Jito takes a small cut, but this isn’t included in the stats; most flows directly to stakers.) Specifically:

Solana: 56.8%

Ethereum: 17.9%

Base: 8.7%

BNB: 4%

Arbitrum: 1%

If Solana reaches 80% of these metrics by year-end, it would be hard not to believe it could surpass ETH. Two key indicators matter:

Application-generated revenue, aka “on-chain GDP”

R-value, the most objective measure of economic value creation on a chain

When Solana generates 80% of the industry’s revenue, softer arguments like “Ethereum has more developers” or “Ethereum is more decentralized” become far less relevant.

Duncan:

I agree. We’ve seen bubbles in infrastructure tokens, high-FDV low-circulating tokens, and meme coins. The market is moving toward balance—base assets generating real revenue will find price support, while meme coins or overvalued infrastructure tokens will struggle to find a floor due to lack of revenue.

Jose:

I should note these metrics have limitations. For example, revenue mainly counts DEXs and on-chain money markets. And with new mechanisms like Pump.Fun emerging, revenue distribution patterns may shift.

Ceteris:

Regarding app-specific sequencing, I think crypto researchers may be overhyping it. Many assume apps will capture 100% of on-chain economic value, but that’s not realistic. There’s synergy between apps, L1s, and validators requiring some form of value sharing. While L1s currently take 100%, that won’t last. Even if L1s eventually take 30% and apps 70%, as chains scale and more apps join, the model remains highly favorable for L1s.

I prefer app-specific sequencing over app chains because it maintains shared state. But there are trade-offs—each new mechanism introduces new centralization risks. UniChain is the first project to implement pure app sequencing from day one, so I’m watching it closely.

People often say build an app chain to capture full economic value, but look at the GDP chart—most profitable apps are on Ethereum. Some argue they should spin off, but that contradicts what fundamentals show: the most profitable apps are on Solana—why leave just to capture slightly more revenue?

This ignores the trade-offs of independent chains. Pump works well on Solana. In a perfect long-term world, being a standalone chain might be better, but right now it benefits from Solana’s capital pools and shared state.

We’ve seen bubbles in infrastructure tokens, high-FDV low-circulating tokens, and meme coins—now AI may be next. While AI’s overall potential is huge, as time passes, the market will rebalance. Projects with real revenue will find buyers at certain price levels, while meme coins or overvalued infrastructure tokens will struggle to establish bottoms due to lack of earnings, relying only on subjective metrics.

The market is maturing—a positive sign. Overhyped infrastructure tokens, high-FDV low-circulating tokens, and meme coins are losing momentum, while investors increasingly focus on projects with real businesses and sound fundamentals.

Duncan:

If there were a chain abstraction wallet with excellent user experience, would differences between chains become less important?

Ceteris:

My view is that it really comes down to UX, not shared state. However, chain abstraction can’t fully eliminate differences between chains, as cross-chain operations inevitably introduce latency when switching between different state machines, leading to performance degradation.

For example, portfolio tracking tools like Lighthouse.one represent chain abstraction—they aggregate user assets across chains and display them in one interface, very convenient. But when cross-chain interaction is needed—switching between different state machines—performance always suffers. So while chain abstraction improves UX, technically it can’t fully replace shared state.

The Next Generation of L2s and L3s

Jose:

On L2 development, I think they performed well last year. No single unified token to invest in, and ETH didn’t directly benefit, but from a product standpoint, they succeeded. Total Value Locked (TVL) on L2s doubled from $22 billion to $40 billion. That said, a large portion of Base’s TVL comes from Coinbase customer deposits—more like a centralized exchange doing accounting on its proprietary blockchain.

Looking ahead, I’m bullish on Solana and L2s. I expect at least one major financial institution to announce its own L2 by 2025. Institutions like BlackRock might place tokenized securities on L2s, gaining flexibility and overcoming some limitations of traditional blockchains. This “private blockchain” model may spark decentralization debates, but if securities are to go on-chain, this is the more practical path.

Ceteris:

Only three L2s currently have TPS higher than Ethereum—an incredible fact. Ethereum’s throughput is limited to about 12 TPS. We’re seeing winner-takes-all dynamics—strength breeds strength. Low TPS among other L2s stems from lack of demand, not technical limits. I expect Mega ETH to perform well, but its funding may come from existing L2s. Currently, only about 2.5% of ETH is bridged to L2s.

Ceteris:

I’m also bullish on application-layer developments, especially AI agent-related projects. These are somewhat infrastructural but distinct. As I said earlier, people are starting to care less whether a project is built on BSC or Solana—that’s a positive trend.

It’s interesting—many once believed Solana wouldn’t succeed, arguing tech didn’t matter, which always seemed odd to me. Now it’s clear tech matters—entire industries are shifting toward high-performance systems. My conclusion: we now have no excuse not to build great applications.

Bitcoin Dominance

Duncan:

With the regulatory environment gradually easing, will we see an altcoin season, or will Bitcoin’s dominance continue rising?

Looking at BTC.D (Bitcoin dominance) data, it’s been steadily rising since 2022. It was 40% in 2022, peaked at 61% shortly after the election, and now sits around 58%. We did see a small altcoin rally from November to early December, somewhat similar to March.

The key question: Is this the new normal? Like in March, when Bitcoin formed a temporary top around $72,000, then traded sideways between $60,000–$70,000 while alts broadly declined. Or will this be a stronger cycle bringing new capital and enabling alts to outperform?

Jose:

I think even if BTC dominance holds steady, some small-cap tokens can still perform strongly. In 2021 and 2022, when Bitcoin topped, we saw wild altcoin rallies. But this March, after Bitcoin hit new highs, most alts suffered during Bitcoin’s consolidation. Traditionally this should’ve been altcoin season—but things changed.

I think the traditional concept of “altseason” may be outdated. Instead, projects with strong fundamentals and clear narratives will shine, while others stagnate.

Jason:

Predicting BTC dominance peaks is essentially forecasting the ETH/BTC ratio, as it’s mostly a two-horse race. Though XRP and BNB are now also prominent. Theoretically, if the entire AI sector surges 10x, it could slightly dent BTC dominance.

From that angle, I think Bitcoin may still outperform Ethereum this year, especially with favorable executive orders. It’s a bold call, but I made a similar prediction last year and it came true. Still, the gap may be narrower this year, as improved regulation and a crypto-friendly president benefit ETH—evident in ETF fund flows.

Six months ago, I expected BTC dominance to reach 66%–68%, but now it seems unlikely. If Bitcoin hits $125,000–$150,000, I think BTC dominance might return to 62%–63% before declining.

Duncan:

Notably, BTC dominance was 73% in January 2021, then fell to 40%. By comparison, the recent November–December move dipped only from 61% to 55%—a swing roughly one-eighth to one-tenth the magnitude of 2021.

Feasibility of Bitcoin L2s

Jose:

I think Bitcoin L2s could be a dark horse in 2025. Historically, Bitcoin holders rarely used their BTC for anything—peak WBTC usage was only about 6% of total supply. Adoption of existing multisig L2s has been low, but in 2025 we may see real ZK L2s launch on Bitcoin, such as Citrea or Alpen Labs.

This could have massive implications. Bitcoin holders prioritize security, and the market size is enormous. Bitcoin L2s offer scalability and programmability. On Ethereum L1, smart contracts are native, but on Bitcoin L1, almost nothing is possible. So the change from Bitcoin L2s is far more transformative—not just greater scalability, but programmability. Even if just 1–2% of Bitcoin flows into L2 ecosystems, it could multiply L2 TVL several times over.

Ceteris:

I’m excited about Bitcoin rollups. I never believed claims that “Bitcoin holders don’t want DeFi” or “don’t want to use their BTC for anything”—that’s always seemed absurd. Sure, loud voices on Twitter may never do it, but this is a $2+ trillion asset—many will want to use it, even just for on-chain loans, without needing wrapped versions.

Currently, a trusted bridge is required, but if OP_CAT passes, trustless bridging via ZK proofs becomes possible. OP_CAT has been running on Bitcoin testnet for about a year—some say it could go live in 2025. This feature existed early in the protocol but was removed due to a critical bug, which no longer exists.

I think Starkware’s Starknet could be a dark horse for Bitcoin L2s. Once OP_CAT passes, they could begin submitting proofs to Bitcoin. This space is vibrant and only benefits Bitcoin. Even without using Bitcoin as DA (data availability), simply submitting proofs to Bitcoin has value.

Even if just 2.5% of Bitcoin holders use these services, that’s a $50 billion market. And it’s not just existing holders—people may buy Bitcoin specifically to use these services.

Jose:

I think we’ll see non-custodial solutions this year. It’s worth writing a new report updating all Bitcoin L2 developments, as our last one is nearly a year old. If Bitcoin L2s truly take off, it could put significant pressure on Ethereum.

Currently, about 10,000 BTC are in existing Bitcoin L2s, like wBTC. I think this number could grow tenfold, especially if it’s not multisig-based. Bitcoin holders genuinely care about this—many of these L2s may eventually shift to EVM. If there’s a ZK bridge or a highly reliable codebase (like Aave or Morpho) allowing Bitcoin deposits to borrow USDC or perform Maker-style CDP operations, I believe such solutions will find a market.

Jason:

Financially, the demand for lending exists. BlockFi once did a lot in deposits. Now that Bitcoin ETFs are live, and traditional finance offers custody, will they also offer credit solutions? Will more people adopt crypto-native solutions, or choose platforms like JP Morgan—centralized but with more safeguards and recourse if things go wrong?

I think the main future demand for Bitcoin may come from non-crypto-native markets. Currently, about $3.2 billion worth of Bitcoin is in L2-like states across chains like Ethereum, Arbitrum, Base, and Solana. This data is fascinating, though most aren’t truly “secure” solutions—except Lightning Network. But if real secure solutions emerge, this figure could rise dramatically.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News