OneKey secures Series B funding at $150 million valuation, backed by YZi Labs and Coinbase

TechFlow Selected TechFlow Selected

OneKey secures Series B funding at $150 million valuation, backed by YZi Labs and Coinbase

OneKey has a higher mind share among Chinese users than all other similar products, making it the most recognized hardware wallet currently.

OneKey is taking its first step into the unicorn club of the Web3 crypto space.

Over the past three years, this open-source cryptocurrency hardware wallet (cold wallet) company has seen an 11-fold increase in user assets stored and DeFi scale managed, while product sales have grown at a rate of nearly 300% year-on-year.

OneKey has announced the completion of its Series B funding round, achieving a valuation of $150 million. The round was led by YZi Labs (formerly Binance Labs), marking their largest investment to date in the hardware wallet sector. Previous supporters include top-tier venture capital firms such as Dragonfly, Ribbit Capital, and Coinbase Ventures.

This six-year-old startup with 60 employees is known for its open-source code, strong security reputation, and low-key, pragmatic ethos. Its products have been widely adopted across major exchanges and well-known blockchain projects.

"From day one, OneKey has been fully open source. We have confidence in our code, and so does the community."

— Yishi Wang, Founder and CEO of OneKey

Hardcore Security for Asset Protection

For newcomers to crypto, whether using Bitcoin, Ethereum, Tron, or Solana, managing private keys remains a painful challenge.

Many users rely on browser extension wallets that generate private keys in connected environments. Others avoid key management altogether by keeping funds on large centralized exchanges like Binance. But if you truly want control over your private keys and wish to isolate risks from network attacks, malware infections, and backdoor vulnerabilities, then choosing an audited, trusted open-source hardware or cold wallet becomes essential.

Earlier this year, a popular "airdrop farming multi-browser" tool was exposed for silently updating its code, resulting in widespread private key theft affecting both individual users and farming studios. Fortunately, many studios had used OneKey hardware wallets—physical isolation of private keys combined with manual confirmation allowed them to escape unharmed.

According to WeChat Index statistics, OneKey holds higher brand awareness among Chinese-speaking users than any other similar product, making it the most recognized hardware wallet today. It is also the only hardware wallet co-branded and officially adopted by leading exchanges including Binance, OKX, Bybit, and Bitget.

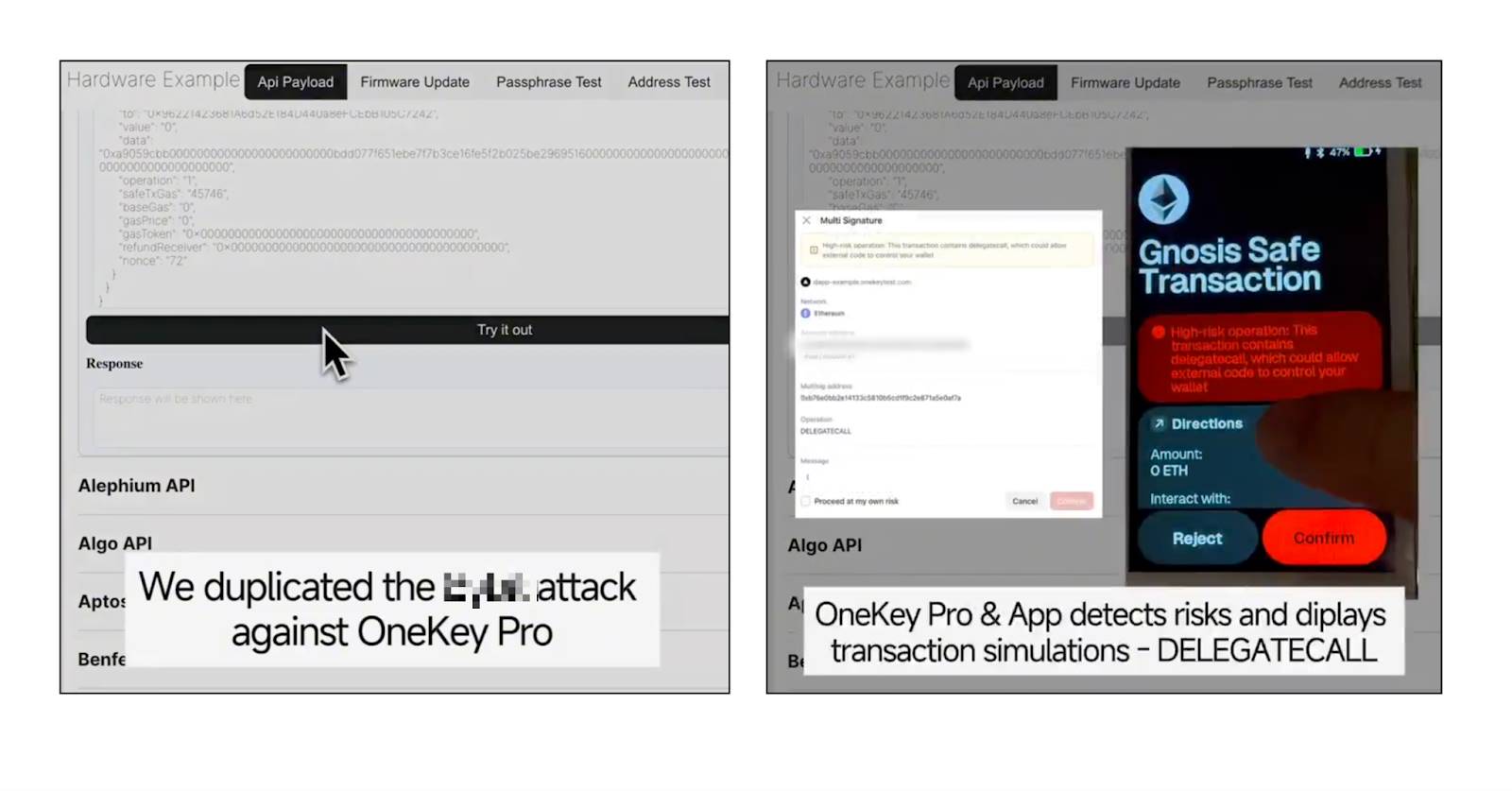

During an offline event for security experts, OneKey’s technical team demonstrated their robust security capabilities. At the time, a major exchange suffered a hack resulting in over $1.5 billion stolen—due to their hardware wallet's inability to parse complex Safe contract calls, which were displayed only as an indecipherable string of codes on the device, ultimately leading to operator error in authorization.

If OneKey devices had been used, the transaction would have been correctly parsed, clearly showing the call structure along with risk warnings. This capability stems from OneKey’s sustained, high-level investment in contract parsing and interaction security within both hardware and software wallets.

A typical hardware wallet costs just over $100. No one wants to pay a steep “tuition fee” for security. When weighing purchase cost against potential catastrophic losses, the choice of a hardware wallet is obvious.

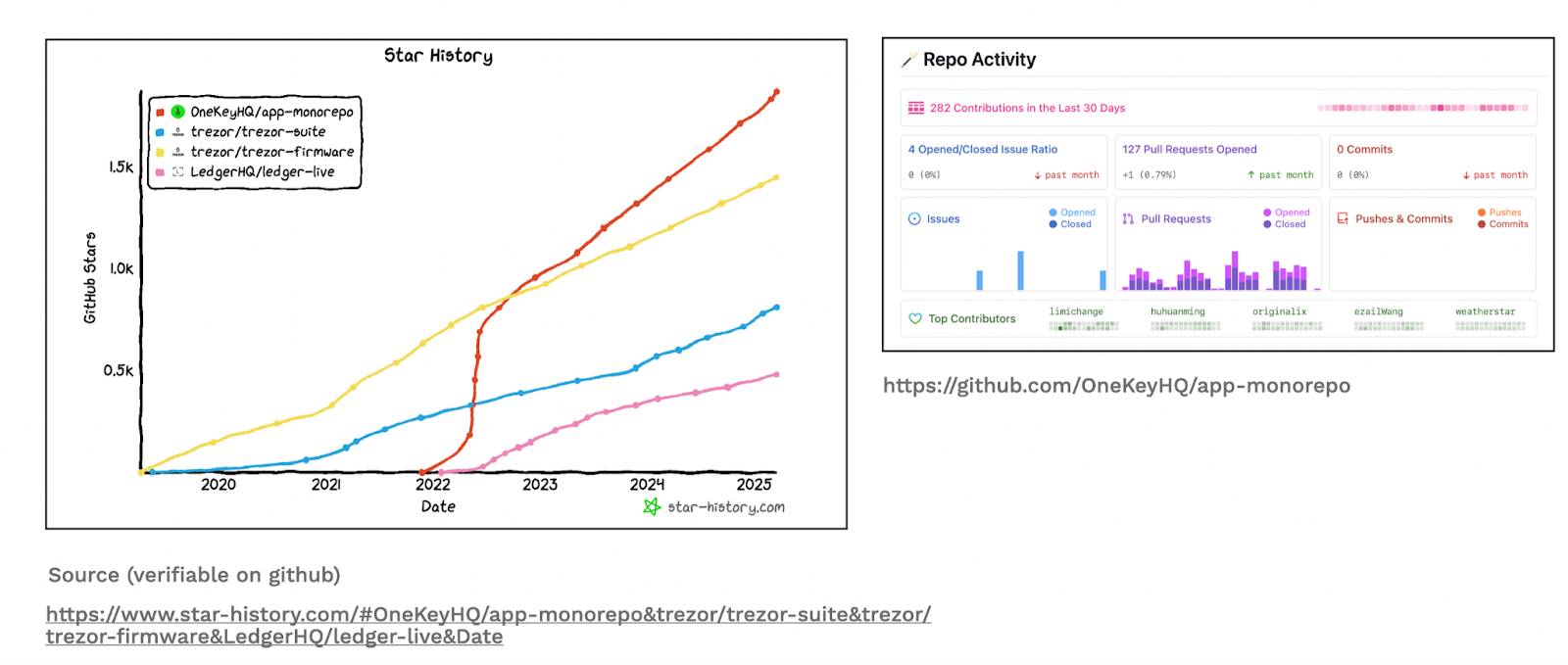

In the open-source realm, OneKey maintains exceptional activity levels—its GitHub repositories process issues and pull requests faster than many renowned software companies. Community members can review and reproduce the entire codebase and firmware compilation process at any time, providing unprecedented transparency and auditability for users and security researchers alike.

Unlike many industry competitors who use closed-source designs, OneKey achieves full openness—from hardware and底层 firmware to UI. OneKey believes true security arises from complete transparency.

Outlasting Cycles and Pushing Boundaries

The company has achieved notable success in Asian markets and now aims ambitiously toward global expansion.

In the hallway of Hong Kong’s JW Marriott Hotel, Yishi Wang is rushing between sessions at an annual Web3 event. As he walks briskly, he tells an investor: “Our team spans mainland China, Hong Kong, Japan, South Korea, Dubai, Italy, and more, with a distribution network across multiple global economies. If we were just a remote Web3 software team, our path would be straightforward—but we’re a fintech hardware company managing complex supply chains and technological integration. That presents immense challenges.”

Yet these complexities also form moats. The core team remains confident. Niq Chen, OneKey’s Chief Growth Officer, is an early NFT enthusiast and prominent collector. Having lived through two crypto bull-market bubbles, this Gen-Z leader deeply understands: “What’s truly worth building are long-term impactful and valuable products and companies—doing challenging things with exceptional people.”

Currently, OneKey’s growth in German-speaking regions far exceeds other markets. Users from Germany, Austria, and Switzerland provide daily feedback via social channels and email. In response, the team quickly rolled out native German support.

In Brazil, performance has similarly exceeded expectations. Investigation revealed that early adoption by influential figures in local crypto communities sparked organic recommendations, triggering viral spread—and attracting local distributors and even OTC physical stores to proactively join and promote the product.

Mildred, OneKey’s Head of Sales, said: “This gave us great insight. When we deliver strong product value, solve real needs, and satisfy customers, overseas markets can grow organically.”

[Featured live endorsements from influencers at Binance Blockchain Week in Dubai]

On technology and talent, Yishi expresses a consistently forward-thinking stance on social media. He publicly stated he cannot accept engineers in 2025 who don’t efficiently and securely use AI-assisted coding—a remark that sparked controversy. Still, he firmly upholds high standards for technical talent.

He openly expresses his desire for brilliant minds and high individual output: “Team size and density of smart people determine organizational models—ours is fundamentally different from traditional big tech. I think DeepSeek’s team deserves an average salary of $1.5 million per person; their RPE (Revenue Per Employee) is an order of magnitude higher than Pinduoduo’s.” To Yishi, AI dramatically boosts individual productivity—same tools, vastly different outcomes. “The AI era has rewritten the efficiency model. Hiring based on old standards will only get you outdated people.”

Team members come from ByteDance, DJI, OPPO, and other leading firms. They’ve established an internal security lab called OneKey Anzen, dedicated to testing and cracking existing hardware wallets on the market for research purposes.

Over the past six months, amid crypto market turbulence, many entrepreneurs worry macroeconomic downturns and systemic financial collapse could severely hinder the crypto space. Yishi acknowledges that under such cycles, blind expansion and unstructured hiring must be avoided. “We might be one of the world’s companies with the highest asset volume managed per employee,” he paused. “Every crypto cycle sees players exit—but we remain. Without patience, you can’t build the iPhone of crypto.”

“I’ve gathered a group of crazy people who truly understand crypto, hardware, and security—people constantly pushing boundaries, relentlessly self-criticizing—not chasing KPIs, but building what we believe is right.”

[Photo of OneKey CTO, CEO, and COO with CZ]

[Cavin, OneKey Eco Lead, sharing security practices at an event]

Raising the Ceiling: Secure On-Chain Wealth Management

After launching the Morpho USDC demand product in the OneKey Earn module, subscription amounts surpassed $62 million within a short period.

“We’ve almost become the Zhaoshang Jin Kuizhi for whale DeFi users,” Yishi remarked. In his view, there are only two ways to achieve significant gains in crypto: issuing assets, or participating in asset circulation by offering irreplaceable services—like exchanges and wallets.

As users accumulate substantial positions on-chain, DeFi whales are increasingly approaching OneKey, seeking to earn yield while maintaining self-custody via hardware wallets. In response, OneKey built the Earn module, emphasizing non-custodial design—acting solely as a secure gateway—focusing on delivering safe DeFi experiences through both hardware and software wallets.

But this is just the beginning. Yishi believes on-chain DeFi wealth management holds even greater potential:

Capturing protocol incentives and layer-1 rewards is only step one. Future plans include structured products. Take Pendle, for example—its PT/YT model separates yield rights from principal rights, catering to users with different time preferences. However, current order books suffer from inefficiency, systematically mispricing tokens.

He envisions creating baskets of LP pools matched to various time preferences, improving liquidity allocation and overall market efficiency. The Lego-like composability of DeFi offers unprecedented freedom. By combining permissionless, secure self-custody with advanced financial engineering, we can offer users flexible, efficient, and deep investment tools—something traditional finance simply cannot replicate.

Yishi once wrote in Slack: “If you keep staring at competitors, you’ll forget what users actually need. For a company, the most important thing is always making the right decisions—not decorating shit. Wasting energy on trivialities gets you nowhere. Success isn’t earned by sheer effort alone.”

[A golden frog given by Ribbit Capital sits on Yishi’s desk in Hong Kong—their signature gift to portfolio companies]

The Hardcore Financial Security Tech Story Continues

OneKey hasn’t rushed to seize flashy narratives. Instead, it chooses to focus on perfecting the most fundamental, least glamorous aspects. In an industry driven by rapid change and hype, this slow, steady approach may not be intoxicating—but it’s rare and valuable.

As stated in their YZi Labs Twitter announcement: OneKey adheres to values of focus, integrity, and excellence. On the journey to build the most powerful, secure, and user-friendly open-source hardware wallet, they continue to explore deeply—with no end in sight.

OneKey Official Overview

Founded in 2019, OneKey is one of the world’s best-selling and most secure open-source hardware and cold wallet brands.

Its hardcore commitment to full open-source principles from day one has earned the trust of users managing hundreds of millions in assets. All hardware and software code has passed security audits by SlowMist and Offside Labs and is fully open-sourced on GitHub for public scrutiny. OneKey has received funding and adoption support from top-tier investors including YZi Labs, Coinbase, and Dragonfly.

$99 entry-level hardware + free app = enterprise-grade, $100M-level security solution. OneKey’s vision is to open-source and permissionlessly democratize institutional-grade, end-to-end secure self-custody technology for every crypto citizen.

OneKey Products:

Classic 1S / 1S Pure: Best-selling ultra-thin credit-card-style entry-level cold wallet.

OneKey Pro: Features air-gapped QR code signing, encrypted fingerprint verification, and wireless charging, delivering premium true wireless security protection.

All hardware wallets come standard with EAL6+—the industry’s highest-grade secure chip—plus anti-theft self-destruct technology, supporting nearly all blockchains.

OneKey App: Supports 60+ blockchains (including Bitcoin, Ethereum, BNB Chain, Tron, Solana, XRP, Cardano, etc.), handles multiple asset types including NFTs, and works across mobile, desktop, browser extensions, and web interfaces—seamlessly connecting to the Web3 ecosystem. Offers advanced security features such as phishing detection for websites and contracts, and simulation analysis of signature results.

OneKey official website: https://onekey.so/

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News