Compute Labs plans to tokenize GPU devices, with stablecoin annual yields potentially reaching 30%

TechFlow Selected TechFlow Selected

Compute Labs plans to tokenize GPU devices, with stablecoin annual yields potentially reaching 30%

Compute Labs has launched a token offering fractional ownership of industrial-grade NVIDIA H200 GPUs, each priced at approximately $30,000.

Author: Ian Allison

Translation: TechFlow

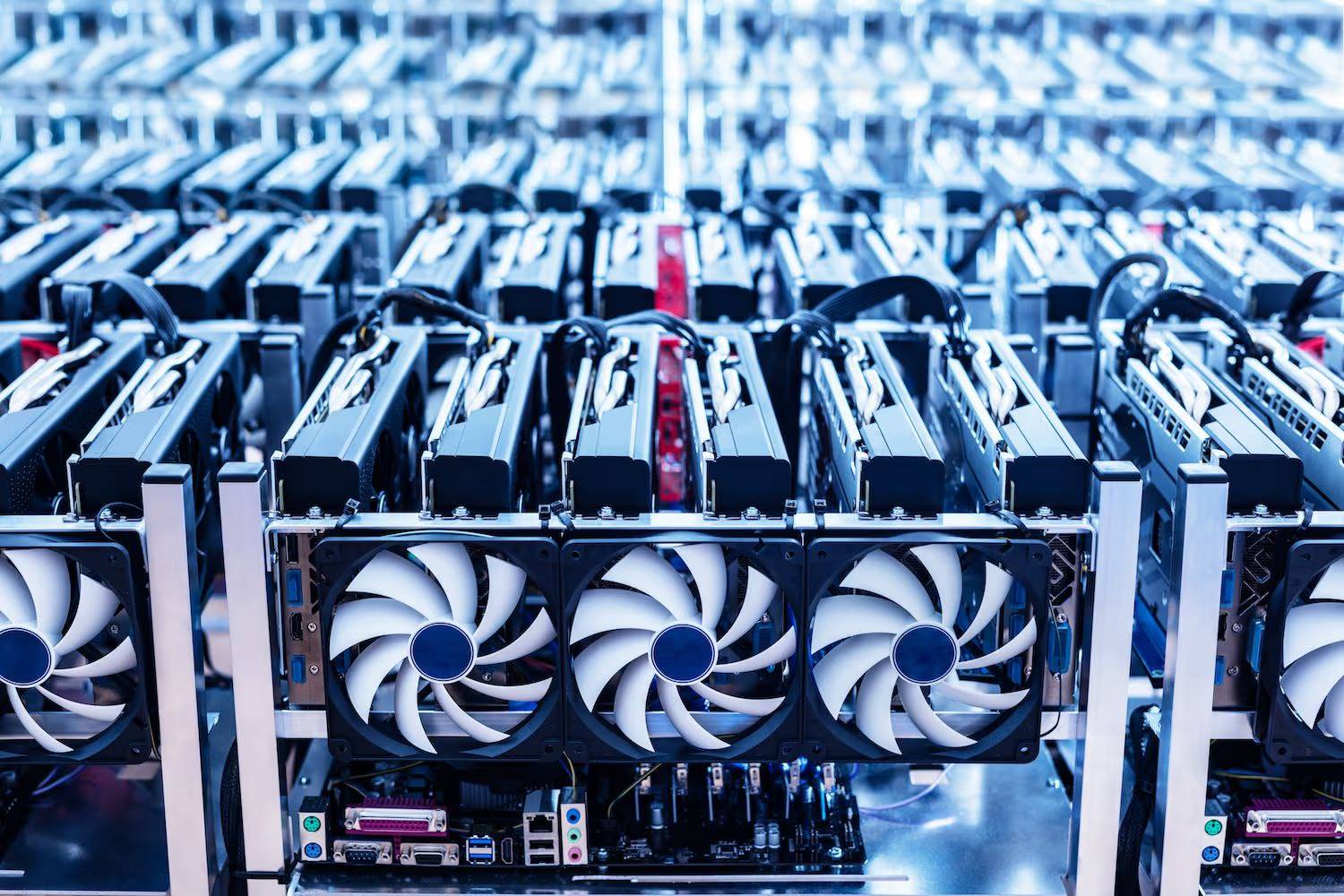

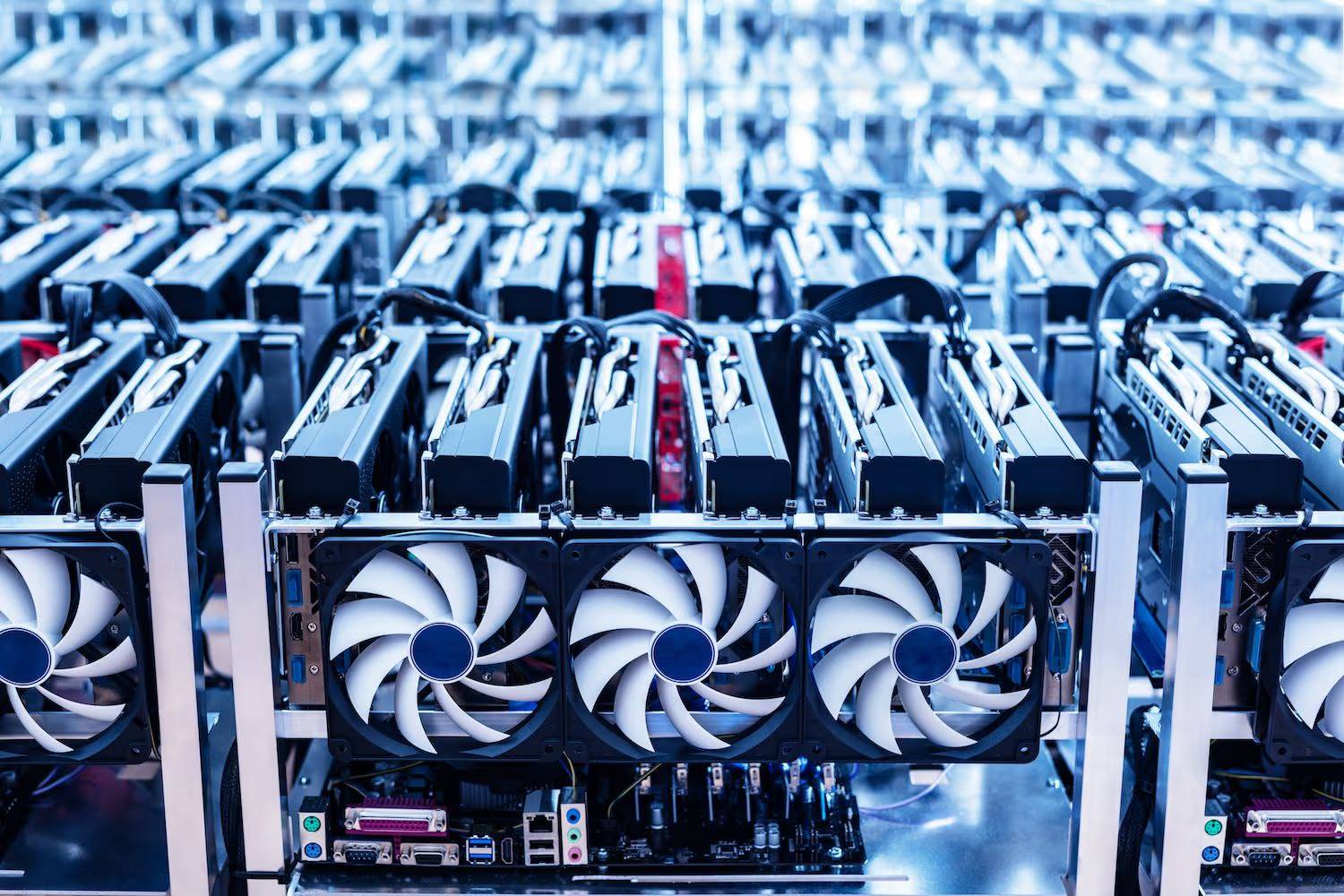

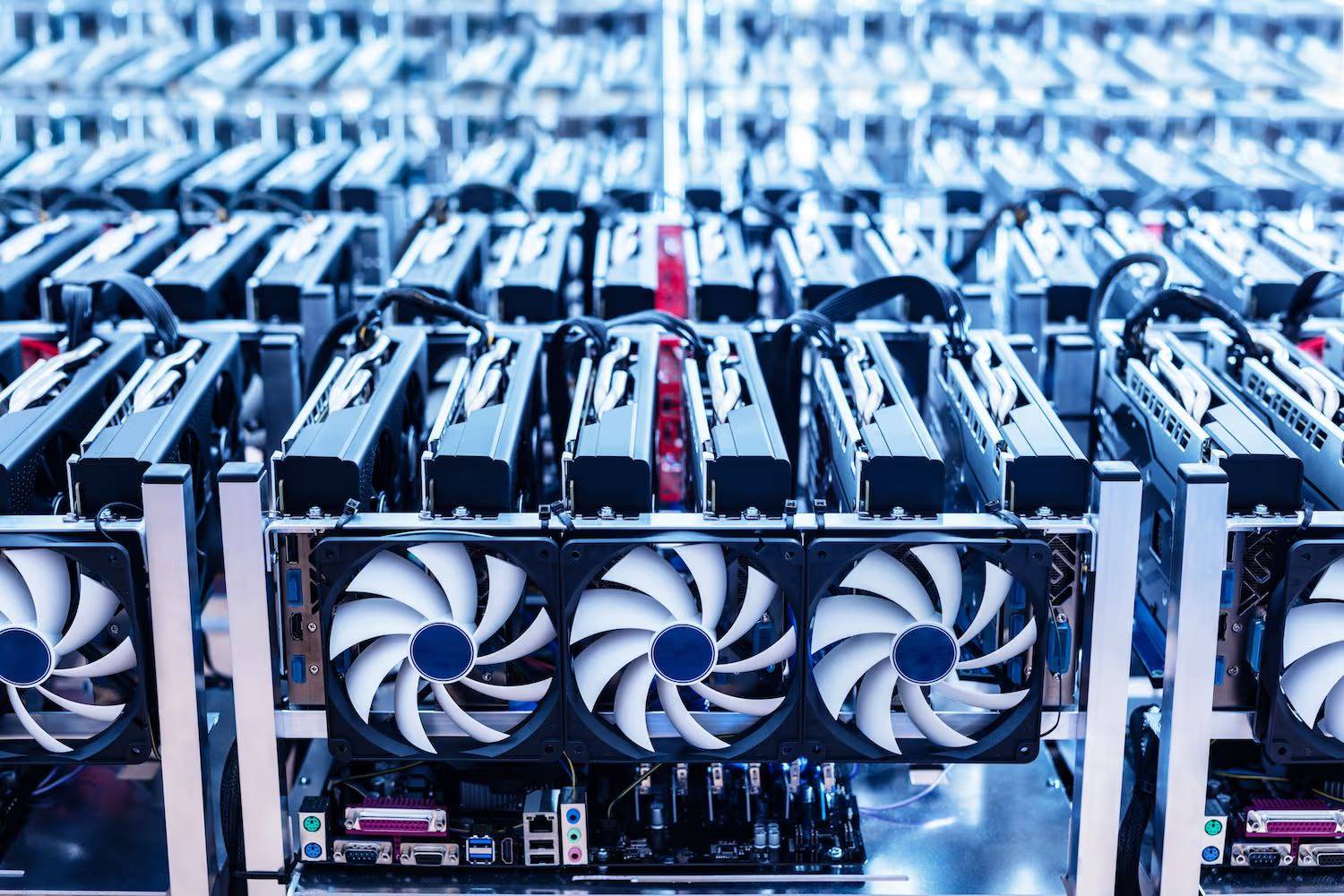

Computer processor (Shutterstock)

Key Takeaways:

-

The first $1 million "public treasury" is projected to yield an annualized return of approximately 30%, based on existing enterprise GPU leasing agreements.

-

Initial funding will be managed by InfraHub Compute, the investment arm of NexGen Cloud.

Compute Labs, a startup converting industrial-grade GPUs that power AI data centers into revenue-generating fractional tokens, is partnering with enterprise AI cloud provider NexGen Cloud to launch a $1 million ownership distribution program for its “public treasury.”

Currently, capabilities and profitability in AI infrastructure are largely concentrated among hyperscalers like AWS or well-funded venture-backed firms. Compute Labs aims to change that by offering investors direct exposure to the earning potential of enterprise hardware—such as individual NVIDIA H200 GPUs, which cost around $30,000 each—through its tokenized model.

"For investors, this pilot project offers the first opportunity to earn stablecoin yields directly from real-time AI compute, without managing hardware or relying on overvalued public equities," said Compute Labs.

Europe-based NexGen, focused on delivering AI computing capacity to clients, raised $45 million earlier this year. The initial funding for this collaboration will be handled by its investment division, InfraHub Compute.

How It Works

According to the press release, funds raised will be used by InfraHub to purchase GPUs, which will then be fractionalized for use by investors and customers.

The first "treasury" has already raised $1 million from investors. This initial treasury will be equipped with top-tier NVIDIA GPUs currently used for “AI training and inference.” Based on existing enterprise GPU leasing contracts, the expected annualized yield—paid in USDC—could exceed 30%.

Nikolay Filichkin, Chief Commercial Officer at Compute Labs, told CoinDesk the target customers include data center operators with spare server space who want to add incremental compute capacity—akin to “mom-and-pop shops” within the data center industry.

"When data centers utilize investor-owned GPUs, Compute Labs manages them through our protocol and balance sheet, leasing the GPUs out. After deducting costs such as hosting and energy, net revenues are returned to investors who own fractional shares of the GPU compute," Filichkin said.

The GPUs will be tokenized and held in treasuries, then offered to individual investors in increments of a few hundred dollars. NFTs are also used to differentiate types of tokenized GPU hardware investments.

Compute Labs is backed by institutions including Protocol Labs, OKX Ventures, CMS Holdings, and Amber Group. The company applies a standardized 10% fixed fee structure across tokenization, asset management, and yield management.

Youlian Tzanev, co-founder and Chief Strategy Officer at NexGen Cloud, said: "This model assigns tangible, tradable value to every GPU cycle, connecting supply, demand, and pricing directly while removing speculative behavior from investor participation—making the AI market more rational."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News