YZi Labs' latest investment in digital assets: The invisible force behind a $4 trillion RWA empire

TechFlow Selected TechFlow Selected

YZi Labs' latest investment in digital assets: The invisible force behind a $4 trillion RWA empire

With over $400 million in cumulative funding and processing more than $4 trillion in tokenized RWAs, how has Canton become the "behind-the-scenes blockchain" for institutional finance?

By KarenZ, Foresight News

Originally published on July 1

Updated July 4: YZi Labs announced investment in Digital Asset.

On June 24, Digital Asset, a developer of the privacy-focused blockchain Canton, completed a $135 million Series E round led by DRW Venture Capital and Tradeweb Markets. The investor lineup includes heavyweight players from both traditional finance and crypto, such as BNP Paribas, Circle Ventures, Citadel Securities, DTCC (Depository Trust & Clearing Corporation), Virtu Financial, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, and Virtu Financial.

Digital Asset stated that the funds will accelerate the deployment of institutional and decentralized finance on the Canton Network and its integration with real-world assets (RWA), further solidifying its widespread application across diverse asset classes including bonds, money market funds, alternative funds, commodities, repurchase agreements (repos), mortgages, life insurance, and annuities.

Notably, Digital Asset has been operating for 11 years and has raised over $400 million in total funding. So what exactly are Digital Asset and the Canton Network? What are their core technological features? Why have they attracted attention and adoption from multiple traditional financial institutions? What is the background of the core team? And how is Canton progressing now—where is it headed in the future?

Company Positioning and Timeline

Founded in 2014 and headquartered in New York, Digital Asset aims to unlock the potential of cryptocurrency and the ongoing convergence between decentralized finance and traditional finance. Its core products include the Canton Network and the DAML smart contract language, which together form an enterprise-grade blockchain infrastructure. Digital Asset has raised over $400 million in total funding.

The Canton Network is an open-source, privacy-preserving Layer 1 blockchain designed specifically for financial institutions and enterprise applications. Using the DAML language and Canton protocol, Canton enables cross-application interoperability, supports atomic transactions across subnets, and combines privacy protection, independent scalability, and compliance.

Below is a timeline of Digital Asset’s development over the past 11 years:

Source: Digital Asset official website

Team Background

The leadership team at Digital Asset brings deep expertise in finance, technology, and blockchain.

Co-founder and CEO Yuval Rooz: Prior to founding Digital Asset, Yuval Rooz managed the electronic algorithmic trading division at DRW, later joined DRW Investment Group, and served as a trader and developer at Citadel. He is also a board member and treasurer of the Global Synchronizer Foundation. Notably, Yuval Rooz was a member of the U.S. Commodity Futures Trading Commission (CFTC)’s Global Markets Advisory Committee, Subcommittee on Digital Asset Markets.

Co-founder Don Wilson: Don Wilson founded diversified trading firm DRW in 1992 and led its growth into a global organization with over 2,000 employees, expanding into areas including crypto assets (via Cumberland), real estate investment (Convexity), venture capital (DRW VC), and carbon financing solutions (Artemeter).

Co-founder and Head of Network Strategy Eric Saraniecki: Before joining Digital Asset, Eric built a trading platform focused on illiquid commodity markets at DRW Trading and co-founded Cumberland Mining.

Co-founder and Chief Operating Officer Shaul Kfir: Previously served as CTO at two startups in Tel Aviv and has a research background in cryptography.

Chief Technology Officer Ratko Veprek: Co-inventor of the DAML language, joined Digital Asset in 2016 after its acquisition of Elevence, and served as Engineering Director for Canton before being promoted to CTO.

Canton Network: Three-Dimensional Breakthroughs in Privacy, Scalability, and Compliance

The Canton Network is a global blockchain network designed specifically for financial institutions, featuring built-in privacy capabilities. It connects multiple independent applications built using Digital Asset’s smart contract language Daml, bridging traditional finance and DeFi by enabling real-time synchronization of assets, data, and cash across different applications. At the same time, Canton allows each application provider to define its own rules for privacy, scalability, permissions, and governance.

The Canton Network positions itself as a “network of networks,” aiming to provide decentralized infrastructure better suited for financial institutions and enterprise applications.

Technical Foundations:

Daml Language: A functional smart contract language with built-in permission management and modular design, supporting cross-application workflow composition.

Canton Protocol: Implements the Daml ledger model, coordinating transaction ordering through synchronization domains and enabling atomic transactions across multiple subnets.

Core Features:

1. Privacy and Selective Transparency

-

Data is confidential by default via the Daml smart contract language, visible only to authorized parties, meeting financial institutions' privacy requirements.

-

Supports "sub-transaction privacy," where different participants can only view transaction parts relevant to them.

2. Independent Scalability

-

Applications do not compete for global resources and can scale independently, avoiding network congestion caused by high load from a single application.

-

Uses sharding techniques; each participant stores only the portion of the ledger relevant to them, improving overall network throughput.

3. Flexible Governance, Interoperability, and Composability

-

Application providers can customize governance rules, permissions, and fee structures while supporting atomic transactions across subnets.

-

Connects heterogeneous networks via "Synchronization Domains," similar to the open architecture of the internet.

4. Proof-of-Stakeholder Consensus with Built-in Privacy

Canton employs a layered "Proof-of-Stakeholder" consensus protocol (comprising transaction validation and ordering layers). The first phase uses a two-phase commit protocol, replicating contracts to relevant stakeholders who validate transactions in parallel. The second phase is the ordering protocol, which timestamps transactions. This ordering protocol runs on a Byzantine Fault Tolerant (BFT) algorithm, ensuring deterministic transaction processing and agreement among nodes on transaction order and state.

5. Compliance-by-Design

Supports data storage and pruning to comply with regulations like the EU’s General Data Protection Regulation (GDPR), while cryptographic commitments ensure immutability of historical data and retain critical audit trails.

Canton Global Synchronizer and Canton Coin

As previously mentioned, blockchain applications on the Canton Network can use the Global Synchronizer to enable atomic transactions across sovereign blockchains without sacrificing privacy or control. The Global Synchronizer is a decentralized and transparently governed interoperability service within the Canton Network, designed to meet the financial industry's need for unified infrastructure to connect systems, drive liquidity, and unlock the full potential of tokenized assets.

In July 2024, the Linux Foundation established the Global Synchronizer Foundation (GSF) to coordinate governance of the Global Synchronizer and lead ecosystem development. Other GSF members include Digital Asset, Broadridge, Cumberland SV, and SBI Digital Asset Holdings. Additionally, Hyperledger Foundation—an open collaboration project hosted by the Linux Foundation—launched a new lab called Splice, allowing anyone on the Canton Network to launch their own version of a synchronizer to meet specific interoperability needs.

To further promote adoption and utility of the Global Synchronizer, organizations running decentralized services voted to introduce a native utility token named Canton Coin. Canton Coin incentivizes application builders, users, and infrastructure providers to use the Global Synchronizer and rewards cross-application connectivity.

Canton Coin uses a unique "Burn-and-Mint Equilibrium" mechanism to dynamically adjust token supply based on actual network demand. The core principles are:

-

Users burn Canton Coin to pay fees, reducing circulating supply.

-

Service providers (e.g., validators, app providers) can only mint new tokens by delivering useful functions to the network, increasing supply.

-

The long-term goal is to balance the amount burned and minted (stabilizing at 2.5 billion annually), maintaining token value stability.

It’s important to note that validators and super validators (a validator plus a Canton Synchronizer node participating in the Global Synchronizer) earn the right to mint Canton Coin by operating nodes and securing the network. Early super validators receive a higher proportion of token allocations to encourage network launch. Application providers can earn Canton Coin by serving users—“Featured Apps” (selected via super validator voting) can enjoy up to 100x the burned amount in minting rewards (an early-stage ecosystem incentive), while non-featured apps can mint at most 80% of the fees collected.

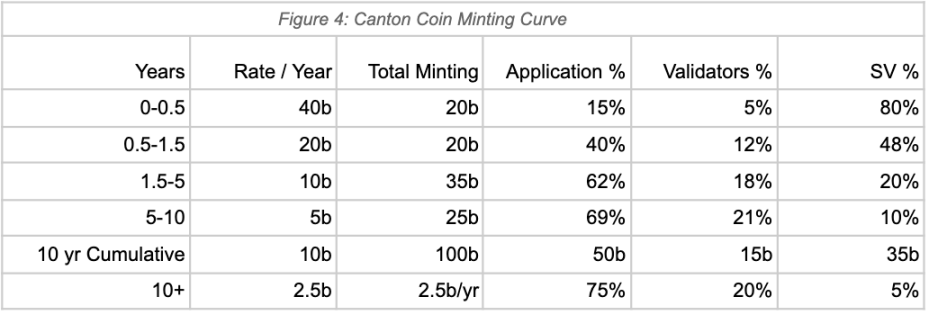

Canton Coin launches fairly, with no pre-mine or private sale. Over the first 10 years following the Global Synchronizer’s launch, a total of 100 billion Canton Coins will be minted, split equally between infrastructure providers (50%) and application providers (50%). After ten years, annual issuance drops to 2.5 billion and gradually shifts toward application providers. The economic model dynamically adjusts supply to ensure long-term token value stability.

Source:Canton Coin Whitepaper

From Pilots to Processing $4 Trillion in RWAs

Canton is suitable for high-privacy, high-concurrency scenarios like finance and has successfully supported the tokenization and trading of various asset types, including bonds, money market funds, and repurchase agreements.

When Canton was first unveiled in May 2023, its initial participants included 3Homes, ASX, BNP Paribas, Broadridge, Capgemini, Cboe Global Markets, Cumberland, Deloitte, Deutsche Börse Group, Digital Asset, DRW, Eleox, EquiLend, FinClear, Gambyl, Goldman Sachs, IntellectEU, Liberty City Ventures, Microsoft, Moody’s, Paxos, Right Pedal LendOS, S&P Global, SBI Digital Asset Holdings, The Digital Dollar Project, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia.

In March 2024, Canton completed a comprehensive blockchain pilot. The pilot provided distributed ledger applications for asset tokenization, fund registration, digital cash, repo transactions, securities lending, and margin management—all interoperable via the Canton Network testnet. The project brought together 15 asset managers, 13 banks, 4 custodians, 3 exchanges, and 1 financial market infrastructure provider. BNY Mellon, Broadridge, DRW, EquiLend, Goldman Sachs, Oliver Wyman, and Paxos provided market expertise throughout the working group. Other participants included abrdn, Baymarkets, BNP Paribas, BOK Financial, Cboe Global Markets, Commerzbank, DTCC, Fiùtur, Generali Investments, Harvest Fund Management, IEX, Nomura Securities, Northern Trust, Pirum, Standard Chartered, State Street, Visa, Wellington Management, with Deloitte as observer and Microsoft as supporting partner.

According to Digital Asset, since the mainnet launch one year ago, the Canton Network ecosystem has grown to over 400 participants, with tokenized RWA volume exceeding $4 trillion and monthly transaction volume reaching $2 trillion.

Additionally, according to the latest RedStone report, more than half of all digital bond issuances since 2022 have been executed via Canton-based applications. HSBC Orion, Goldman Sachs’ digital asset platform GS DAP, BNP Paribas’ Neobonds, and Broadridge’s DLR are all built on Canton technology. In January this year, Circle, upon acquiring Hashnote—the issuer of USYC incubated by Cumberland Labs—announced plans to offer native USDC support on the Canton Network, enabling private transactions and the use of USDC and USYC within TradFi markets.

Summary

The Canton Network fills a gap left by existing public blockchains by combining smart contract functionality with strong privacy features, offering a viable solution for bringing traditional assets on-chain. Through its "selective decentralization" design, Canton enables financial institutions to tokenize assets while retaining control. This architecture makes it an ideal springboard for traditional financial institutions undergoing digital transformation. For institutions seeking digitization but constrained by rigid legacy systems, Canton offers a gradual path toward on-chain integration and could become a pivotal bridge connecting traditional finance and decentralized finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News