How meme coin culture is transforming the cryptocurrency market?

TechFlow Selected TechFlow Selected

How meme coin culture is transforming the cryptocurrency market?

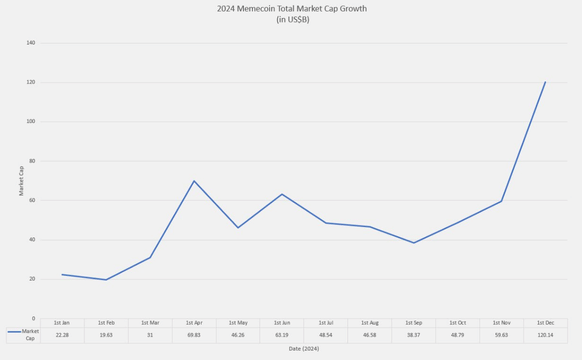

Memecoin achieved explosive growth from $20 billion to $120 billion in 2024.

Author: DWF Labs

Translation: Baihua Blockchain

The convergence of financial nihilism and cryptocurrency has completely reshaped the digital asset landscape, creating a new paradigm—one in which memes are not just communication tools but powerful financial instruments. This evolution marks a significant shift in how value is created, perceived, and transferred within modern digital society.

The rise of memecoins exhibits characteristics fundamentally distinct from traditional financial assets, reflecting a unique intersection of social dynamics, technological innovation, and market psychology. What began as satirical commentary on cryptocurrency—exemplified by Dogecoin—has evolved into a mature market sector attracting substantial capital inflows and institutional attention. This transformation reflects how younger generations are embracing new approaches and attitudes toward investment, wealth creation, and community building in the digital age.

The memecoin phenomenon transcends mere speculation, emerging as a novel form of social coordination and value creation. These tokens serve not only as vehicles for community expression, digital identity, and shared cultural experiences but also challenge conventional notions of intrinsic value and fundamental asset analysis. They demonstrate that in the digital economy, community consensus and social capital can be as powerful as traditional financial metrics.

In 2024, the memecoin sector demonstrated remarkable growth, expanding its total market capitalization from approximately $20 billion in January to over $120 billion by December—an increase of 500%.

Memecoin Total Market Cap Growth in 2024 (in billions USD). Source: CoinMarketCap, DWF Ventures

1. Foundation Building

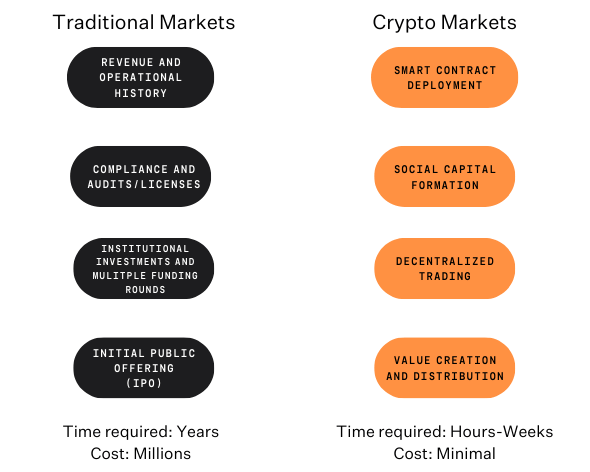

Traditional initial public offerings require companies to have a substantial operating history, consistent revenue growth, and strong financial controls. The process typically involves multiple funding rounds, complex regulatory filings, and high professional service fees, often taking years and costing millions of pounds. These inherent frictions act both as quality control mechanisms and barriers to innovation—particularly for creative projects challenging established business models.

The emergence of blockchain technology has fundamentally disrupted this paradigm by introducing permissionless, programmable models of value creation. Smart contracts effectively replace many functions traditionally performed by financial intermediaries and regulatory gatekeepers. This technological innovation drastically reduces the time and cost required to launch tradable assets, democratizing access to capital markets in unprecedented ways.

This reduction in friction has given rise to a new form of value creation that prioritizes community engagement and narrative strength over traditional financial indicators. Projects can now rapidly test ideas in the market, with success determined by community adoption rather than institutional approval. This environment is especially favorable for meme-driven initiatives, where shared cultural understanding and active participation generate powerful network effects.

Value Creation in Crypto vs. Traditional Markets. Source: DWF Ventures

The efficiency of crypto market infrastructure establishes a new paradigm for digital asset creation and distribution. Rapid iteration cycles and reduced friction in value creation make markets across various domains more dynamic and flexible.

The shift from traditional capital markets to crypto-native value creation represents a fundamental transformation, redefining how ideas are funded and scaled. Historically, the path to public investment followed rigid institutional frameworks designed to protect investors—but also limited access to capital.

This change provides fertile ground for meme culture to thrive.

2. The Meme Lifecycle

The transformation in digital asset value creation has spawned a new model where community-driven growth and social capital are primary drivers of success. Barriers that once separated creators from markets have disappeared, replaced by decentralized mechanisms enabling rapid deployment and community formation.

This shift is particularly evident in the memecoin space, where the fusion of social dynamics and financial markets creates unprecedented opportunities for value generation.

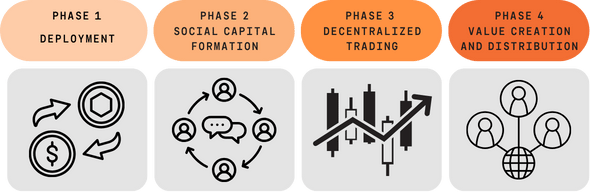

To understand this new paradigm, it's essential to examine how projects evolve from initial concepts to mainstream trends—propelled by social media and community momentum before ultimately becoming financialized. This lifecycle reflects how modern digital communities coordinate and capture value.

The memecoin creation lifecycle begins with technological accessibility.

Four Stages of the Memecoin Creation Lifecycle. Source: DWF Ventures

1) Stage One: Deployment

A memecoin’s journey starts when creators use platforms like pump.fun or gra.fun. These tools simplify what were once highly technical processes into user-friendly experiences. The platform handles complexities such as contract deployment, smart contract verification, and initial liquidity provision. Processes that previously took weeks of development and significant capital can now be completed in under an hour with minimal upfront investment, dramatically lowering the barrier to entry for creators in the digital economy.

2) Stage Two: Social Capital Formation

After token deployment, the focus shifts to community building. Creators typically establish presence across multiple social platforms:

-

Twitter/X: The primary channel for narrative development and public engagement.

-

Telegram groups: Platforms for community coordination and real-time communication.

-

Discord channels: Structured spaces for deeper community interaction and technical discussions.

This multi-platform strategy ensures broad reach while maintaining centralized community development. As the community grows, three distinct yet interconnected forms of capital emerge and reinforce each other:

-

Social capital: Measured through community engagement metrics, influencer adoption, and network effect growth.

3) Stage Three: Decentralized Trading

Optimized liquidity deployment and automated market makers (AMMs) provide a trading market for the token, enabling free exchange among participants.

Trading tools complement social media by helping sustain growth through trend detection and sentiment analysis, forming a feedback loop that reinforces both social and financial capital.

4) Stage Four: Value Creation and Distribution

When community members actively contribute to value creation, the ecosystem becomes self-sustaining:

-

Community-driven marketing replaces traditional paid advertising.

-

Creator- and user-generated content maintains community vitality and attracts new participants.

This lifecycle represents a fundamental departure from traditional token issuance, which heavily relied on initial capital and institutional backing. In today’s memecoin ecosystem, community participation and social capital drive value creation—enabled by widespread technology access and streamlined deployment processes.

The key innovation lies in these platforms democratizing not only token creation but the entire value creation process, making it transparent and accessible so communities can build and capture value in ways previously reserved for well-funded institutions.

3. The Meme Ecosystem: More Than Just Images

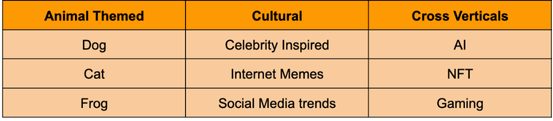

The memecoin ecosystem has diversified into distinct categories, generating value around various social themes and trends—and delivering significant financial returns.

Types of Memecoins. Source: DWF Ventures

The coexistence of different memecoin subcategories and their ability to deliver strong returns indicate that the market can support multiple narratives simultaneously—from pure meme plays to utility-enhanced tokens.

Established projects like DOGE and SHIB have proven the viability of meme-based assets, while newer entrants like WIF show continued market demand for well-crafted, thematic projects.

One of the most notable developments is the emergence of cross-domain tokens that combine the viral nature of memes with practical utility. For example, AI-themed memecoins merge cultural resonance with the transformative potential of artificial intelligence, creating more sophisticated value propositions that attract both retail and institutional participants.

This convergence signals important maturation within the space: memecoins are no longer just cultural phenomena—they have become laboratories for experimenting with novel forms of value creation, merging social collaboration with real-world use cases.

4. Conclusion

The memecoin phenomenon is not merely a fleeting market trend; it signifies a fundamental shift in how value is created, recognized, and distributed in the digital economy. While individual trends may come and go, the underlying structure of rapid tokenization and community-driven value creation appears to have become a permanent feature of the cryptocurrency landscape.

The sector’s growth from $20 billion to $120 billion in 2024 demonstrates that this is not a flash-in-the-pan occurrence but the emergence of a new asset class. This expansion reflects market recognition of social capital as a legitimate source of value in the digital age. The increasingly sophisticated infrastructure surrounding memecoins—from automated market makers to community governance tools—further solidifies their position as a lasting component of the crypto ecosystem.

This represents not just a new vertical market, but a fundamental innovation in how societies collaborate around shared goals and distribute value. Looking ahead, continued evolution in this space may yield new insights into how digital communities create and capture value in increasingly complex ways.

For market participants, the challenge lies in preserving the unique creativity and community-driven essence of memecoins while building sustainable structures that support long-term growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News