Plume Network: How to Bring the Real World into Crypto?

TechFlow Selected TechFlow Selected

Plume Network: How to Bring the Real World into Crypto?

As a full-stack L1 blockchain, Plume's dedicated RWA chain focuses on bringing RWAs on-chain to the RWAfi ecosystem.

Author: Four Pillars

Key Takeaways

• Real-world assets (RWAs) such as commodities, bonds, and equities—representing over $100 trillion in market value—present massive growth potential for the next phase of crypto. Institutional asset managers like BlackRock, Franklin Templeton, KKR, and Hamilton Lane are launching tokenized RWA funds to capture this vast market.

• As a full-stack L1 blockchain, Plume’s dedicated RWA chain focuses on bringing RWAs onchain into an RWAfi ecosystem. The platform simplifies tokenization, liquidity management, and listing processes for RWA projects by integrating core functions like custody services and KYC/KYB verification into a single solution. Plume’s vision for RWAfi extends far beyond simple tokenization.

• By building a complete onchain ecosystem and RWA community, Plume unlocks new use cases—from traditional assets to abstract concepts like GPU price indices and economic indicators—blurring the lines between the real world and the crypto economy.

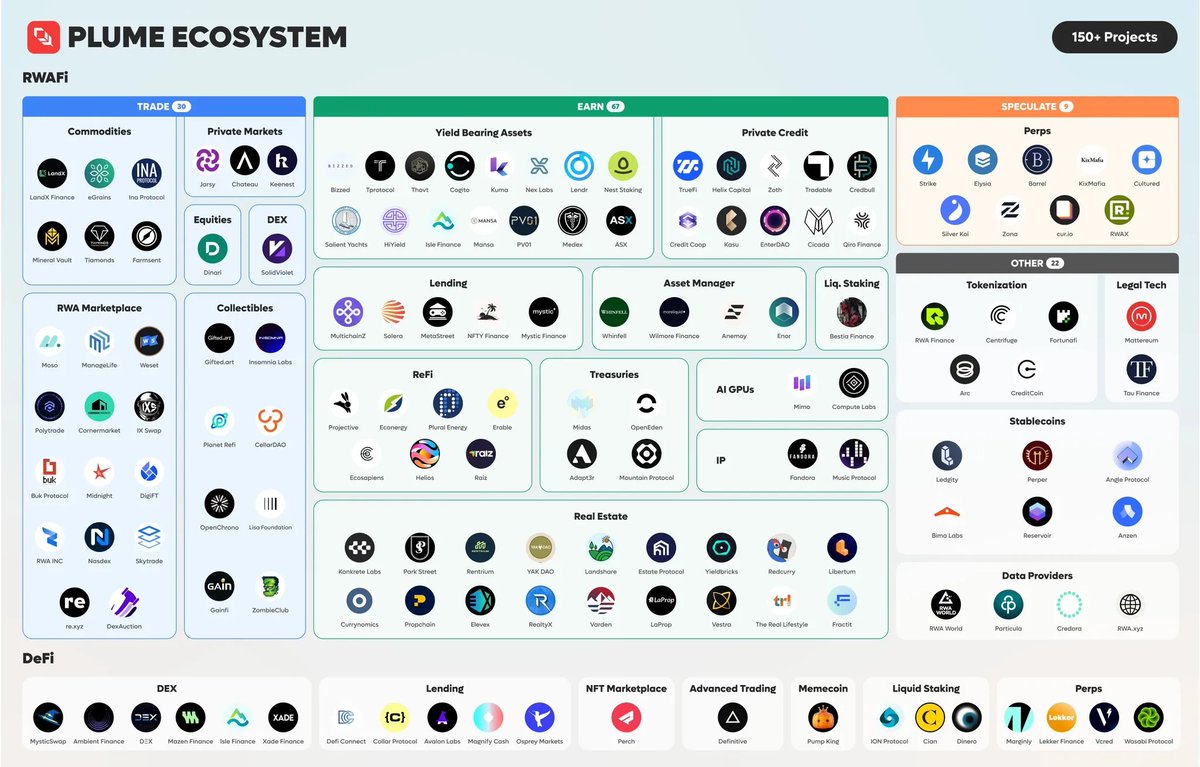

• Over 180 teams are already building on the thriving Plume ecosystem, including specialized lending protocols, perpetual contracts, real estate platforms, and even hotel booking services. This diverse application range demonstrates how the platform transforms our interaction with RWAs, treating them as practical products and useful services.

1. Background – The Rise of Onchain RWA Markets

1.1 The Potential of RWA in Crypto Markets

Real-world assets (RWAs) represent the next major opportunity in crypto—and for good reason: their market scale is staggering. While the entire cryptocurrency market currently stands at $3–4 trillion, individual sectors such as commodities, bonds, and equities each control markets exceeding $100 trillion. This immense size underscores the transformative potential of bringing RWAs onchain.

Within the crypto ecosystem, the tokenized RWA market continues to grow and has become one of the industry's greatest success stories. Stablecoins are the leading example of RWAs, processing a staggering $10 trillion in onchain transactions in 2023 alone. Tether, one of the largest issuers, minted over $130 billion in stablecoins in the first half of 2024 alone and generated $5.2 billion in profit. In the protocol space, MakerDAO generated over $27 billion in revenue over the past 12 months, accounting for 40% of all DeFi protocol revenue on Ethereum.

Meanwhile, protocols like Ondo, Ethena, and Frax are accelerating the transition of traditional assets onto blockchains. Yet despite these remarkable achievements, we have only scratched the surface of RWA’s vast potential.

Source: rwa.xyz

The trend toward tokenization is undeniable. Coinbase analysis shows that Fortune 100 companies launching onchain initiatives in Q1 2024 increased by 39% year-over-year. While stablecoins remain the primary driver of tokenization growth, interest in tokenizing off-chain assets like U.S. Treasuries is rapidly rising. Since early 2023, total value locked (TVL) in tokenized assets—excluding stablecoins—has more than doubled to $3 billion, clearly signaling where the market is headed.

Source: The Fortune 500 Moving Onchain

As technology matures and its advantages become increasingly clear, the momentum behind tokenization appears unstoppable. The next-generation financial systems being built today will naturally incorporate key features of tokenized assets: 24/7 availability, global instant settlement, broader market access, seamless interoperability through shared infrastructure, and customizable transparency. These benefits provide financial institutions with a foundation to enhance operational efficiency, increase liquidity, and create new revenue opportunities through innovative applications.

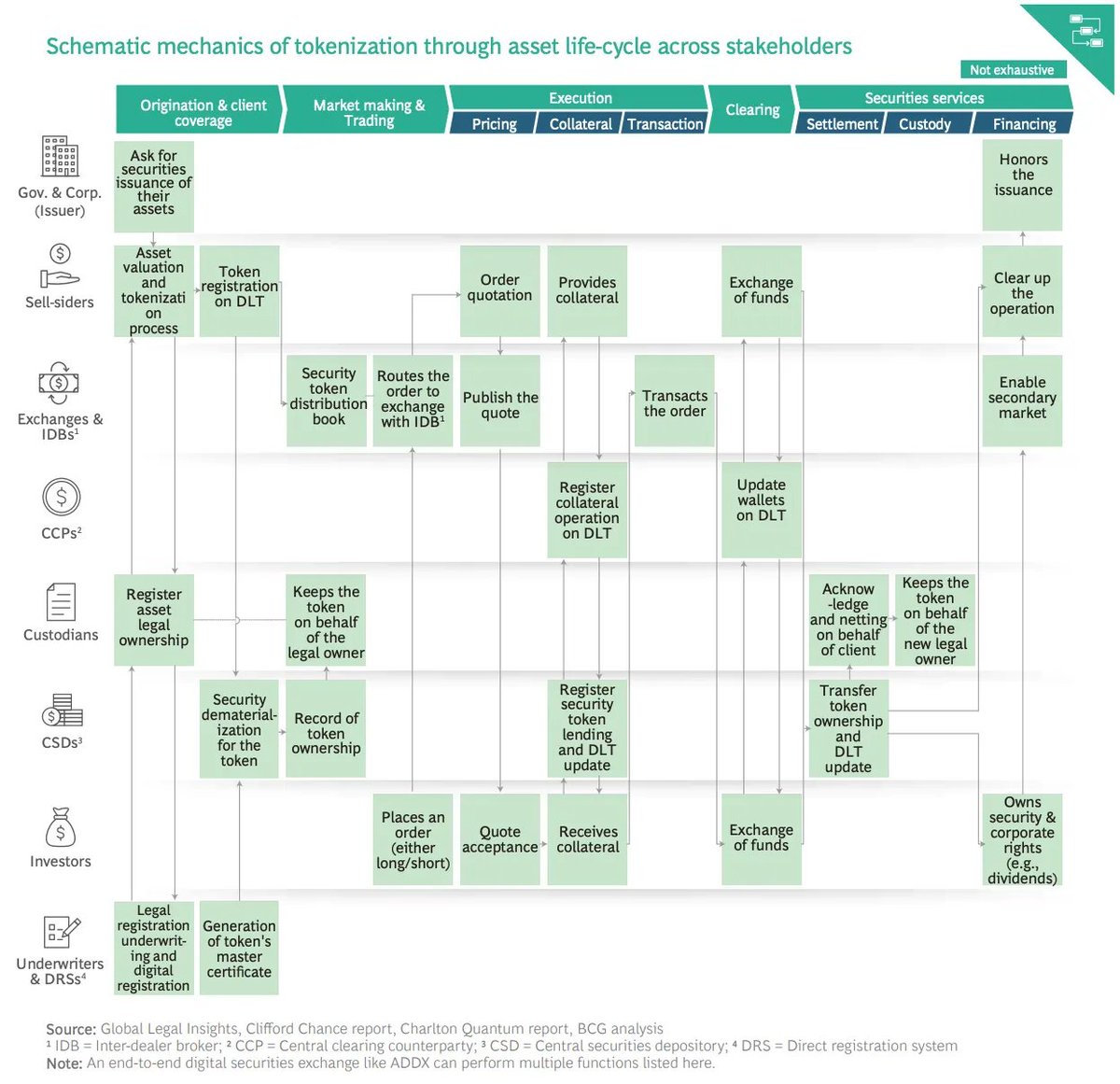

1.2 Growing Competition in Tokenization

We are already witnessing the industry shift toward tokenization. Traditional finance giants like BlackRock, WisdomTree, and Franklin Templeton are increasing deposits into onchain tokenized funds, while Web3-native projects such as Ondo, Superstate, and Maple Finance are accelerating adoption of tokenized money market funds. In a recent interview, BlackRock CEO Larry Fink emphasized this trend, stating: "We believe tokenization of financial assets is the direction of the next stage of evolution. Every stock, every bond will exist on a common blockchain."

Source: Tokenization: The Future of Commodities

Major protocols are not overlooking this opportunity either. Both large and small players are racing to capture market share in this expansive space:

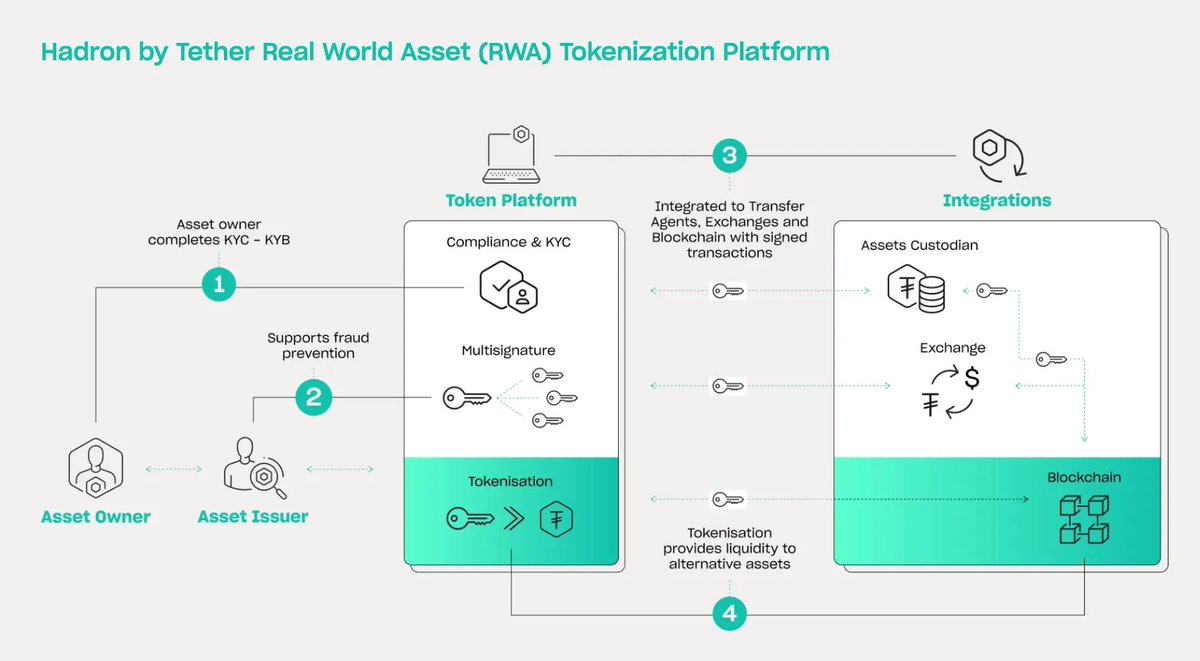

• Tether, the issuer of USDT—the largest stablecoin—is expanding into broader asset tokenization through its "Hadron" platform. The platform offers comprehensive services for token issuance and management, including KYC/AML, risk management, and secondary market monitoring. It particularly focuses on helping nations and enterprises leverage alternative financing opportunities.

• Ripple announced the launch of the first tokenized money market fund on the XRP Ledger (XRPL). Partnering with UK-based Archax and abrdn, the project aims to tokenize a portion of a £3.8 billion liquid fund and plans to bring more asset managers’ real-world assets onto XRPL.

• Aptos is developing "Aptos Ascend," an institutional-grade digital asset management platform. Built on Microsoft Azure technology and combining SK Telecom’s Web3 wallet infrastructure with Brevan Howard’s financial market expertise, the platform aims to help institutions efficiently manage digital assets, expand tokenized asset liquidity globally, and maintain compliance.

2. Plume Enabling RWAfi

2.1 Plume Network: A Blockchain Built for RWA

Plume Network is a full-stack architecture and ecosystem designed specifically for the integration and utilization of onchain RWAs. Its standout feature is the native integration of tokenization workflows and compliance mechanisms directly into the blockchain architecture, enabling RWA holders and institutional investors to leverage onchain systems without needing deep technical expertise or building complex infrastructure.

This L1 RWA chain is engineered to withstand attacks that general-purpose blockchains cannot handle—especially when trillions of dollars in RWA assets move onchain. By introducing a new security model called Proof-of-Representation, the tokenized RWA itself becomes part of the blockchain’s security mechanism, directly tying network security to asset value.

Source: Relevance of onchain asset tokenization in "crypto winter"

The current onchain RWA market faces a classic chicken-and-egg problem. Market participants are stuck in a deadlock: liquidity providers hesitate without strong asset offerings, while asset issuers are unwilling to tokenize without guaranteed market depth. This self-reinforcing cycle poses a significant barrier to market growth. Plume breaks this impasse by decomposing the tokenization process into manageable components and offering integrated management solutions, thereby laying the groundwork for RWA projects to effectively enter the market and experiment with different models.

Bringing real-world assets (RWAs) onchain still faces multiple hurdles. Service providers must navigate regulatory uncertainty, complex access control, technical implementation challenges, custody issues, licensing requirements across jurisdictions, and market fragmentation. For instance, real estate tokenization platform RealtyX reported that “out of three years spent building services, two were dedicated to establishing onchain service providers and workflows.” This complicated service delivery process leads to prolonged implementation timelines, limiting the realization of RWA market potential.

Source: Plume

To address these challenges, Plume integrates over 50 distinct functionalities into a unified platform purpose-built for RWA tokenization. These include essential legal and administrative functions required for onchain RWA tokenization—such as custody services, on/off-ramps, and KYC/KYB compliance systems. Rather than enforcing a fixed or predetermined framework, Plume offers these functions as configurable modules, allowing projects to select and implement only what they need. These modules are tightly integrated to ensure efficient data flow across the system.

Plume Arc is the core of the network—a comprehensive infrastructure solution for service providers looking to register RWAs onchain. Through a streamlined tokenization process, Plume Arc drastically reduces the time and resources needed for asset issuance. Service providers can leverage Plume Network’s compliance tools and asset management capabilities to significantly lower technical complexity and legal uncertainty, enabling them to focus more on operating RWA-based services.

Plume’s architecture lowers the barriers to entry that have hindered RWA adoption. By handling underlying infrastructure needs, Plume allows teams to concentrate on core business development, helping attract high-quality liquidity providers and asset suppliers to fuel market expansion.

2.2 RWAfi: Blurring the Line Between Real World and Onchain

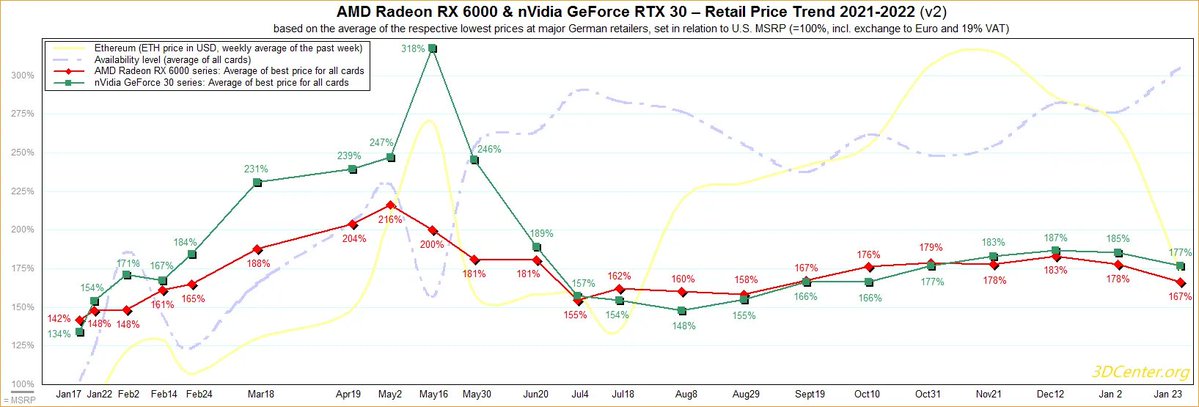

Source: 3DCenter.org

RWAs are seen as a potential catalyst for the next phase of growth in the onchain economy. By bringing off-chain assets into blockchain systems, they vastly expand the types of assets that can participate in the crypto ecosystem. This isn’t just about adding new asset classes—it’s about creating direct links to the real world, enabling simultaneous expansion in market value and user base.

Take the tokenization of the GPU market as an example. Fluctuations in GPU prices are closely tied to demand from AI model training and Bitcoin mining. Traditionally, investors could only gain exposure indirectly—by purchasing stocks like NVIDIA or Bitcoin. On Plume’s RWA market, however, a GPU price index can be brought directly onchain, allowing traders to invest in or hedge against GPU price movements directly.

The concept of tokenization extends beyond tangible assets. Plume also brings abstract economic indicators into the investment realm. Users can invest in or hedge macroeconomic metrics via Plume’s platform—from national and city-level GDP growth rates and unemployment data to climate change indicators. This framework breaks down the boundaries between traditional finance, crypto markets, and real-world economic activity, offering entirely new market structures and modes of economic interaction.

Source: DeFi's Permissionless Composability is Supercharging Innovation

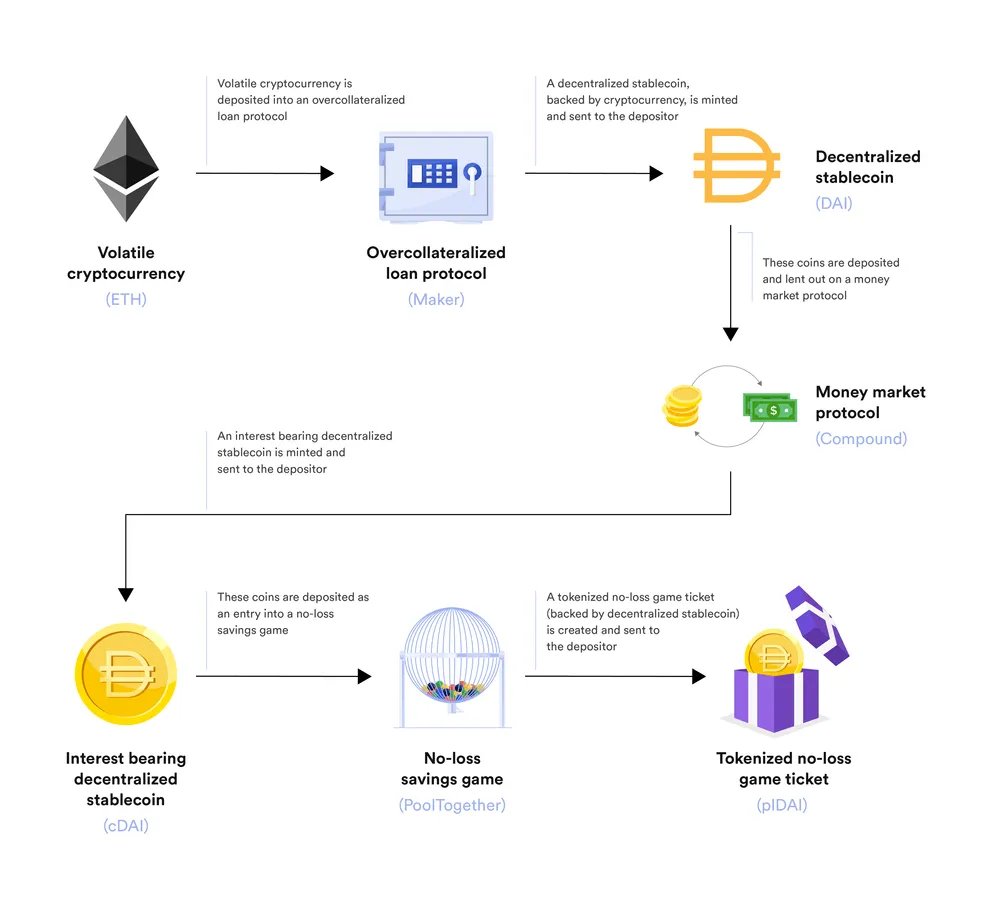

Most RWA projects primarily focus on the basic task of registering off-chain assets on blockchain systems. Plume goes further by introducing the concept of RWAfi—an onchain ecosystem built around RWAs. The true power of an onchain ecosystem lies in its composability and permissionless nature. DeFi’s growth wasn’t driven by individual protocol success, but by multiple protocols interconnecting to form a larger ecosystem.

The same principle applies to RWAs—its true potential comes not just from registering assets onchain, but from creating an ecosystem where these assets can be traded, generate yield, serve as loan collateral, and interact with various protocols. For example, tokenized real estate can be used as collateral for loans, and investors can build diversified global portfolios through a single protocol. Plume’s vision is to enable this innovative model through RWAfi.

Source: Plume Network

Plume maintains a diverse ecosystem offering various services to unlock the potential of RWAfi. Users can earn returns through multiple channels—such as staking with actual farms to receive 20% annualized stablecoin and token rewards, trading sports cards and Pokémon cards onchain, or making leveraged investments in Jordan sneakers or political events.

The Plume ecosystem currently hosts over 180 projects across various domains, including RWA-dedicated lending protocols, RWA-focused perpetual futures DEXs, real estate and stock tokenization protocols, collectibles marketplaces, and consumer applications like hotel booking services. The Plume ecosystem is not merely about moving traditional financial assets onchain—it’s about creating entirely new market opportunities for assets that were previously illiquid or hard to access.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News