Analyzing the market potential and unique advantages of AI16Z and ELIZA

TechFlow Selected TechFlow Selected

Analyzing the market potential and unique advantages of AI16Z and ELIZA

This article explores how AI16Z and ELIZA are standing out in the rapidly evolving fields of AI and cryptocurrency.

Author: Greythorn

Market Opportunity

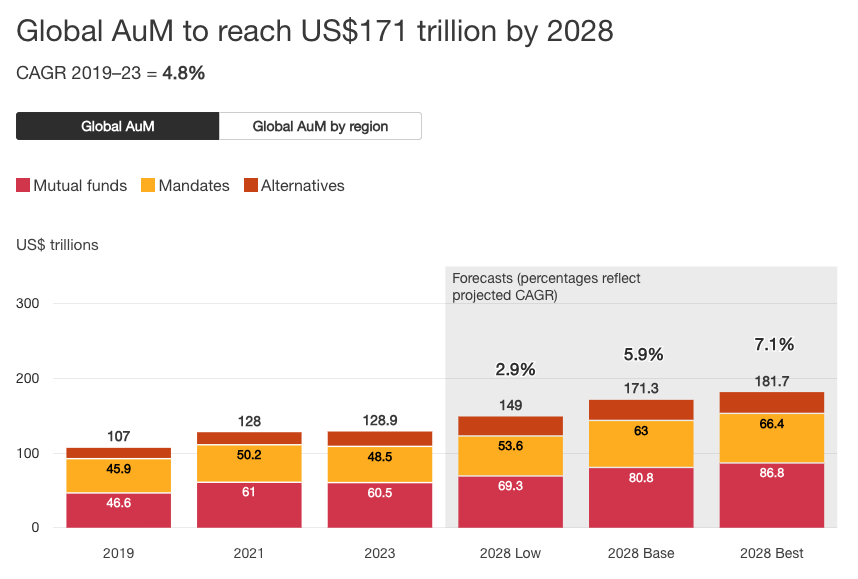

The global asset management industry is growing rapidly, with assets under management (AUM) reaching $120 trillion by the end of 2023 and projected to reach $171 trillion by 2028. However, growth brings challenges, as the rise of low-cost passive funds intensifies competition, forcing traditional managers to innovate and improve efficiency.

Source: pwc research

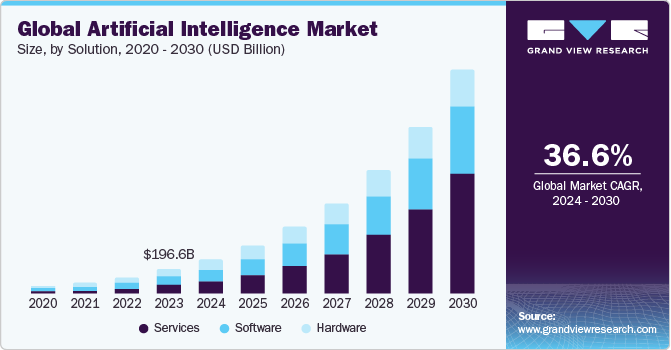

Meanwhile, the global AI market is expected to exceed $1.8 trillion by 2030, reshaping industries by streamlining processes and creating new opportunities. In the crypto space, AI-powered solutions are emerging prominently, managing liquidity and Web3 tokenomics. This opens the door for projects like AI16Z and ELIZA to effectively deploy intelligent agents.

Source: Grand View Research

This article explores how AI16Z and ELIZA stand out in the fast-evolving AI and crypto landscape, covering their operations, market potential, and unique advantages.

Inside the Projects

AI16Z: Redefining Venture Capital

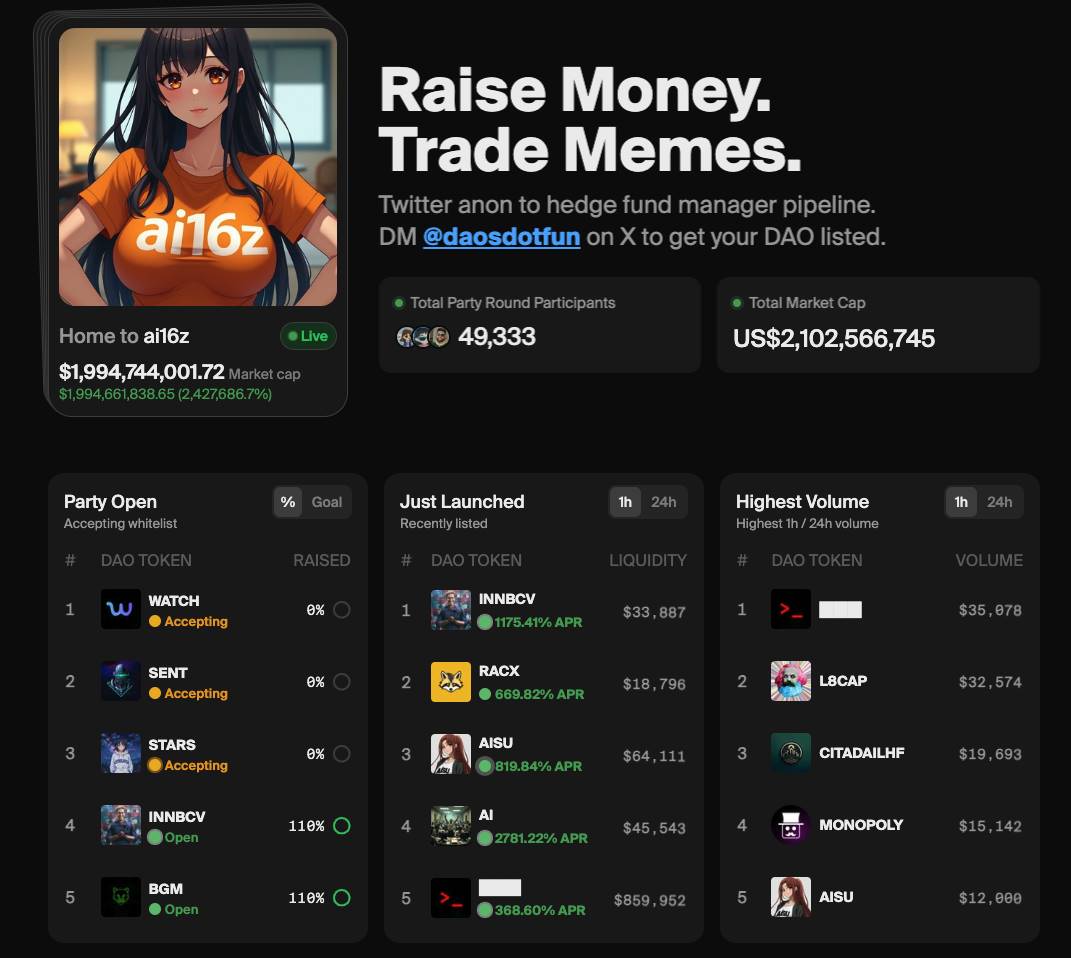

AI16Z emerges as an AI-driven venture capital fund that blends AI analytics with community insights, challenging norms in traditional investing. The fund raised 420.69 SOL through an initial token offering on DAOS.FUN in October 2024. Today, it manages over $25 million in assets, with a market cap exceeding $2 billion—demonstrating its ability to attract capital and attention in an increasingly competitive market.

Source: AI16Z

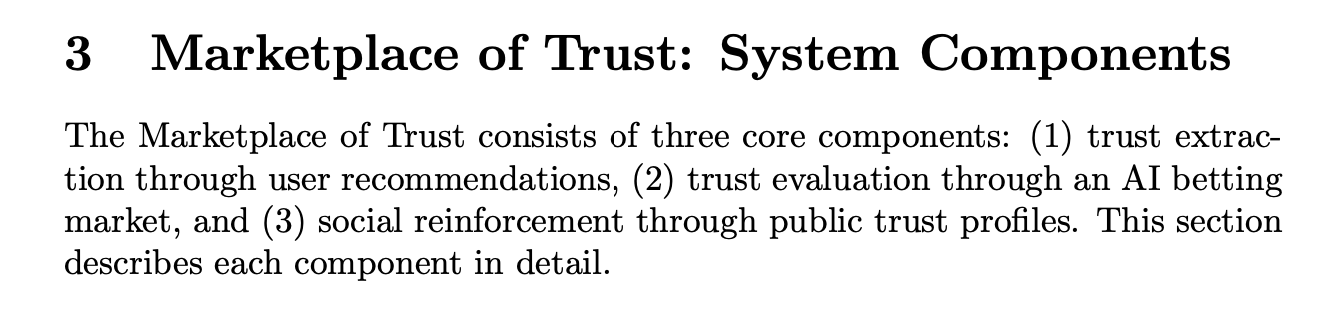

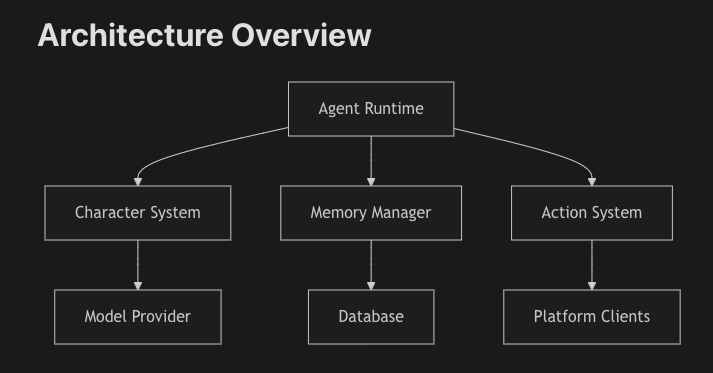

At the heart of AI16Z’s success lies the ELIZA framework, a multi-agent simulation platform that combines AI-driven analysis with input from decentralized communities. This infrastructure uses a trust market to filter reliable signals from vast data streams, including DAO proposals, social media activity, and Telegram discussions. By assigning trust scores, the system ensures investment decisions are based on credible intelligence rather than noise.

Source: AI16Z Whitepaper

AI16Z redefines venture capital by focusing on assets influenced by internet virality—such as cryptocurrencies, meme coins, and NFTs. The fund leverages AI to analyze these speculative markets and execute trades, ensuring liquidity amid market volatility.

What Sets AI16Z Apart

● AI-Powered Decision-Making: The fund’s autonomous agent Marc AIndreessen combines advanced AI with human-like intuition to optimize trading in meme-driven markets, echoing the legacy of a16z.

● Where Meme Culture Meets Venture Capital: AI16Z aligns with internet culture, emphasizing the growing influence of memes in Web3 and crypto markets.

● Transparent DAO: Through its DAO on DAOS.FUN, token holders participate in governance within a fully automated and transparent system.

How AI16Z Works

● Fundraising: The DAO conducts a one-week token sale at a fixed price to raise capital.

● Trading & Investment: After fundraising, creators invest in Solana-based protocols, using AI to make optimal trading decisions.

● Performance & Token Pricing: Tokens trade on a virtual AMM, with prices tied to fund performance; downside risk is limited to the initial fundraising amount.

● Maturity & Payout: Upon maturity, profits are distributed in SOL. Token holders can burn tokens to claim assets or sell them based on fund performance.

Source: Daos.fun

Decoding ELIZA: The Framework Transforming AI and Web3

The ELIZA framework powers AI16Z by enabling the creation and management of autonomous AI agents optimized for diverse markets. As AI agents transform industries, ELIZA stands out by providing efficient tools to build and deploy these agents.

● Autonomous Applications: ELIZA’s modular design supports rapid prototyping for use cases in gaming, trading, customer service, engagement, and more.

● Mass Customization: Its character file system enables tailored experiences for niche markets such as AI-driven social interactions, DeFi, and entertainment.

Source: Eliza Documentation

AI agents designed for blockchain ecosystems represent a promising niche, and ELIZA bridges this gap by enabling agents to securely interact with smart contracts, execute transactions, and autonomously manage tasks. As the concept of tokenized AI agents grows, ELIZA provides the infrastructure for projects to issue tokens linked to agent performance or utility.

Key Features and Use Cases of ELIZA:

Open-Source AI Ecosystem

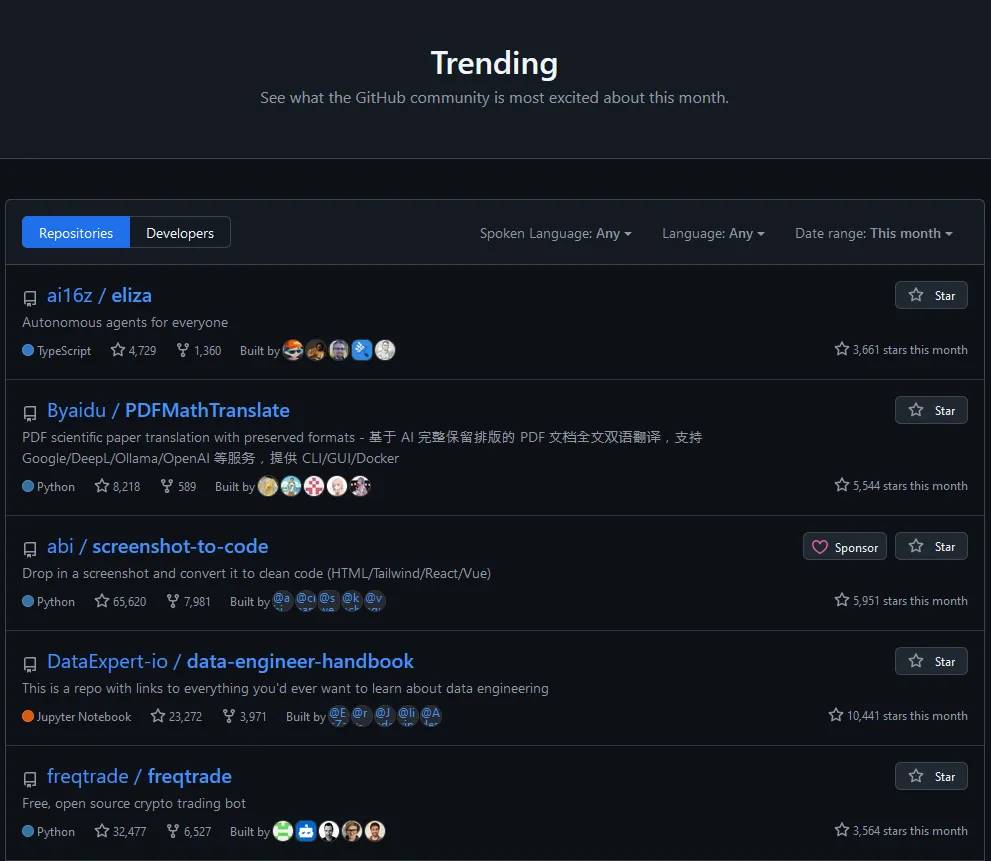

The rise of open-source frameworks demonstrates the power of community-driven development. ELIZA’s development model leverages this approach, driving rapid innovation and adoption.

● Community Contributions: A growing library of plugins and tools built by contributors enhances ELIZA’s functionality and appeal.

● Developer Adoption: With thousands of contributors already involved, ELIZA is becoming the go-to platform for building AI agents, accelerating its network effects.

ELIZA’s adoption is surging, with thousands of developers contributing to its GitHub and Discord communities. Its plugin ecosystem grows daily, fueled by the ai16z Creator Fund, which rewards innovation and builds momentum for the platform’s future.

Source: elizaos.com

Agents in Action

ELIZA’s framework empowers the following agents:

● Marc AIndreessen: A trading-focused AI that uses ELIZA’s trust engine for secure and autonomous decision-making.

● Degen Spartan AI: A bold, meme-savvy agent with strong social influence and plans for deeper ecosystem integration.

● The Swarm: A vision for decentralized AI collaboration where agents work transparently and collectively across the ecosystem.

Creator Fund

The Creator Fund marks a milestone in ai16z’s mission to grow the ELIZA framework ecosystem. This community-driven initiative supports developers and creators, made possible by Elijah donating 11% of his ai16z tokens—a testament to his commitment to innovation and long-term alignment with the project’s vision.

Source: Elizaos.github

Distributed via vesting contracts, the fund offers steady rewards to creators upon achieving milestones, allowing them to focus on impactful work without short-term pressures. By attracting talent, reducing token dump risks, and strengthening the ecosystem, the fund paves the way for sustained growth and adoption.

Additionally, they are exploring OTC deals to enhance liquidity and support tokenomics. Details on grants and funded projects will be announced soon, marking a new era for the ELIZA community.

Team & Partnerships

Eliza Labs was founded by Shaw, a key figure in the AI agent space deeply rooted in open-source communities. He is known for pioneering work on Project 89 with Parzival, which developed some of the first AI agents capable of adaptive, context-aware interactions.

Source: Google

Having operated anonymously for years, Shaw focused on building technology rather than personal recognition, cultivating strong relationships within the open-source community. His commitment to transparency and innovation has positioned Eliza Labs as a leader at the intersection of AI and Web3 trends.

Recently, Eliza Labs partnered with Stanford University’s Future of Digital Currency Initiative (FDCI) to explore how autonomous AI agents can revolutionize digital currency systems. The collaboration, set to launch in early 2025, will focus on developing trust frameworks, multi-agent economic systems, and decentralized governance protocols for AI agents.

In addition, Eliza Labs is collaborating with ARC to accelerate progress toward Artificial General Intelligence (AGI). This partnership combines ARC’s expertise in behavioral learning with Eliza’s framework to drive innovation in gaming, simulation, and robotics. Key initiatives include access to ARC’s SDK, enhancing behavior models with large language models (LLMs), and building advanced simulation environments.

Source: @ARCagents

Eliza is also rapidly becoming a critical framework for AI innovation, integrated into various projects including a collaboration with Ash, a renowned three.js developer known for creating cutting-edge browser-based game engines. Together, they are conducting a deep Eliza integration on Hyperfy, enabling AI agents to exist and interact within immersive 3D worlds.

Tokenomics

The $AI16Z token is the cornerstone of its ecosystem, integrating governance, incentives, and value creation. Token holders shape strategy through the DAO, while AI agents using the $ELIZA framework contribute revenue or tokens, creating a stable value flow. When the fund matures in October 2025, SOL profits will be distributed—holders can burn tokens to redeem assets or sell via a bonding curve, ensuring value and liquidity.

AI16Z has a fixed token supply of 1.1 billion, fully circulating, with a current market cap of $2 billion. The DAO governs the supply, ensuring no new tokens are minted without approval. Allocation prioritizes development, liquidity, and contributor rewards, with a structured unlock schedule designed to maintain stability and prevent supply shocks.

Source: Shaw on X

AI16Z benefits from several monetization avenues:

● Agent Contributions: AI agents on ELIZA contribute a portion of their tokens to the DAO.

● Service Fees: Platforms using ELIZA, such as community launchpads, pay fees to deploy AI agents.

● Enterprise Solutions: As ELIZA gains traction, its open framework attracts enterprises seeking automation and AI-driven workflows.

Participation in the ai16z DAO is voluntary, with projects contributing part of their token supply. On Vvaifu, a prominent launchpad, launching an AI agent via the ELIZA framework requires a payment of 1.5 SOL and 5% of the agent’s token supply.

Competitors

The convergence of AI and blockchain is sparking a wave of innovation, with projects like AI16z, Griffain, Arc, and Virtuals leading the charge. These projects focus on developing or funding ecosystems where AI agents can be created and monetized. While all aim to advance this space, their differing approaches and applications define their competitive positioning.

AI16z adopts a venture capital model, investing in high-potential AI agents and concepts across domains. It strengthens its ability to shape AI agent infrastructure by leveraging frameworks like ELIZA and open-source strategies. By driving community-led development, AI16z accelerates adoption and innovation, though reliance on external contributions can sometimes slow iteration cycles.

Griffain targets the DeFi space, using Solana’s speed to automate financial operations via AI agents. Meanwhile, Arc focuses on its open-source framework called Rig, designed to build portable, modular, and lightweight AI agents in Rust, whereas ELIZA emphasizes scalable foundational AI model infrastructure.

Virtuals takes a slightly different approach with a dedicated AI agent launchpad and has positioned itself as a market leader and early mover.

Among them, AI16z stands out due to its financial and strategic impact, accelerating the growth of its AI-focused portfolio. Its use of ELIZA as an open-source framework further solidifies its position, enabling rapid prototyping and widespread adoption of AI agent technology.

While larger projects like AI16z and Virtuals benefit from greater market caps and mature ecosystems, smaller players like Arc or Swarms offer higher return potential due to lower market caps and adoption levels, presenting asymmetric opportunities for investors. Ultimately, choosing among these projects depends on individual risk preferences. Regardless of which project becomes the leader, the AI and blockchain space is poised for significant growth, creating abundant opportunities for innovation and adoption.

Bullish Fundamentals

● AI16Z has rapidly gained momentum, achieving significant AUM growth within months, reflecting strong investor confidence in its innovative approach. The token’s rapid price appreciation, with a market cap surpassing $2 billion, also highlights strong demand and growing investor interest.

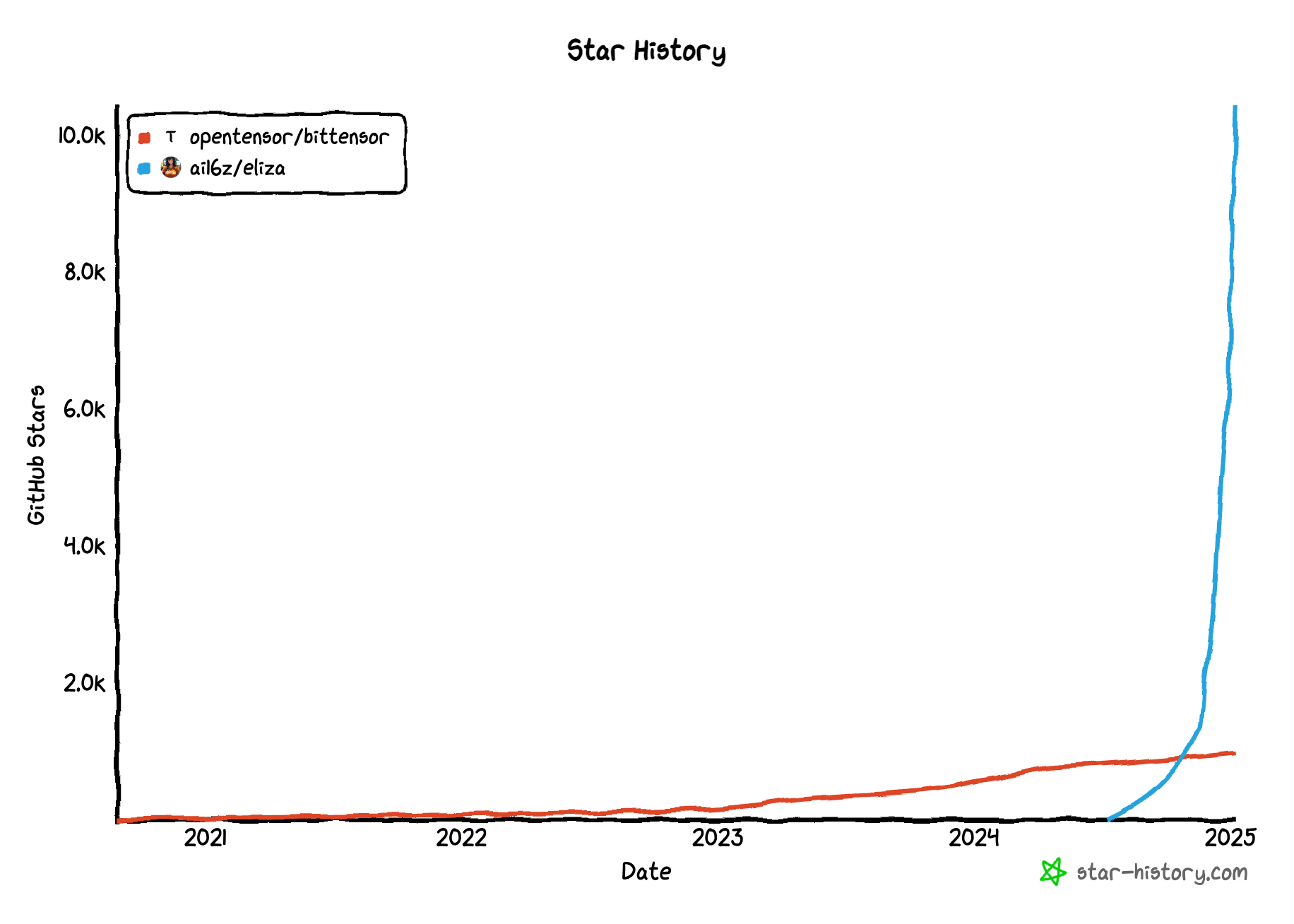

● ELIZA’s developer base is expanding quickly, becoming the #1 trending GitHub repository, with engagement far exceeding competitors like Bittensor. Its plugin ecosystem grows daily, driven by the ai16z Creator Fund, which incentivizes innovation and builds momentum for the platform’s future.

Source: Github repositories

Source: GitHub Star History

● AI16Z’s innovative tokenomics ensure continuous value accrual. It generates revenue through agent contributions, launchpad fees, and adoption, tying token value directly to ecosystem success. The decentralized DAO model also allows token holders to actively shape AI16Z’s direction while sharing in profits, aligning incentives within the community.

● AI16Z’s FDV positions it between emerging players and market leaders, offering significant growth potential backed by solid fundamentals and a growing community. ELIZA’s modular framework enables rapid prototyping, customization, and cross-platform integration, empowering developers to create versatile AI agents for diverse applications.

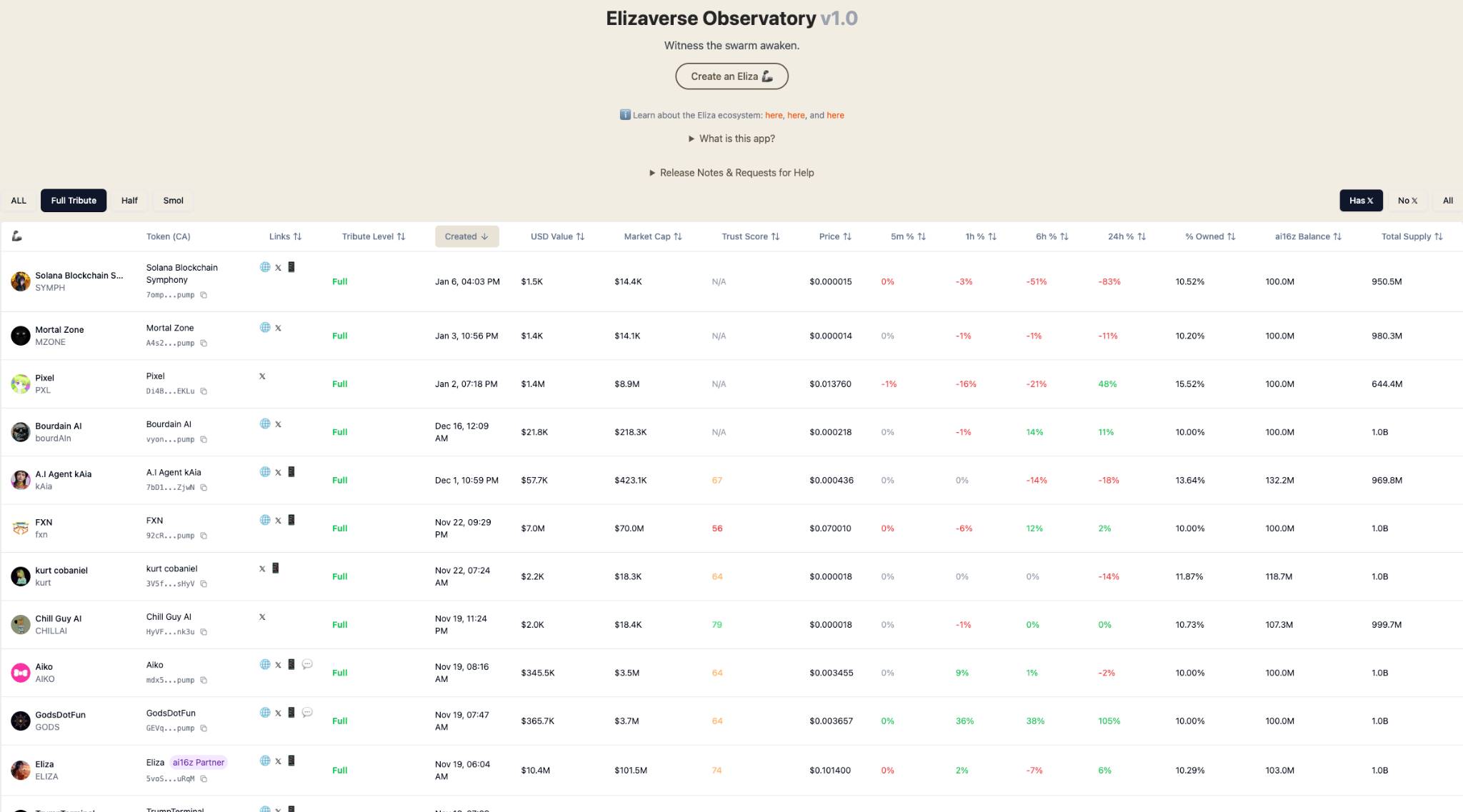

Source: Elizaverse Observatory

● ELIZA’s vision for a decentralized “AI swarm” aims to create a collaborative network of agents across ecosystems, positioning the project as a leader in AI-driven Web3 innovation.

● With the anticipated official ELIZA agent launchpad expected to enforce token contributions at the smart contract level, further ecosystem growth and value accrual may follow.

Bearish Fundamentals

● Extreme volatility in the meme coin/AI agent market poses risks for AI16Z’s investments, as rapid price swings could lead to significant losses if trading strategies fail to adapt quickly. This also raises questions about the project’s resilience during market downturns.

● While ELIZA’s open-source framework fosters innovation, sustaining community interest and contributions long-term may be challenging, especially if incentives weaken or competing projects gain market share.

● Monetizing open-source frameworks like ELIZA relies on voluntary contributions to AI16Z. While many projects donate a portion of their tokens, not all will choose to align with AI16Z, potentially posing challenges in capturing long-term value and establishing sustainable revenue streams.

● If AI16Z fails to scale or maintain its competitive edge, better-funded and more structured projects like Virtuals could overshadow it.

● Regulatory uncertainty surrounding AI agents and crypto markets may affect adoption and operational flexibility, posing risks to the project’s long-term growth.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News