Prediction Markets' Trust Crisis: When the "Truth Engine" Begins to Lie, How Can We Build More Reliable Forecasting Systems?

TechFlow Selected TechFlow Selected

Prediction Markets' Trust Crisis: When the "Truth Engine" Begins to Lie, How Can We Build More Reliable Forecasting Systems?

Prediction markets are being given a higher status, seen as "truth engines."

Author: michaellwy

Translation: TechFlow

The potential of prediction markets has been widely recognized, yet some critical issues remain unresolved. This article analyzes recent controversies—particularly the challenges in dispute resolution—to reveal the current obstacles facing prediction markets. For developers, this presents a massive opportunity: prediction markets are still in their early stages of development, and whoever solves these core problems could lead the next wave of innovation.

Introduction

Prediction markets are tools that aggregate information through financial incentives. By allowing traders to stake money on their judgments, prediction markets drive prices toward probabilities reflecting collective wisdom. When functioning properly, they often produce more accurate forecasts than traditional methods.

This strength was clearly demonstrated during the 2024 U.S. presidential election. Polymarket outperformed conventional polls and successfully predicted Trump's victory.

As Polymarket’s credibility grows, mainstream media have begun treating it as a legitimate data source. Even traditionally skeptical outlets like Bloomberg now cite its odds, and search engines such as Perplexity display its predictions. Traditional news organizations increasingly reference its results.

Vitalik Buterin, Ethereum’s co-founder, also supports prediction markets. He stated: "Prediction markets and community annotations are becoming two major social epistemic technologies of the 2020s."

However, despite their promise, decentralized “truth verification” mechanisms face significant challenges. A recent controversy on Polymarket over whether the U.S. government would shut down exposed key design flaws, offering important lessons for decentralized dispute resolution.

This article will analyze this controversy in detail, explore design vulnerabilities in dispute resolution mechanisms, and propose improvements.

How Does Polymarket Work?

Polymarket operates similarly to a traditional exchange, except users trade probabilities rather than assets. For example, in the market asking “Will Bitcoin hit $100K in 2024?”, traders can buy or sell positions dynamically between 0% and 100%.

Suppose you believe Bitcoin will reach $100K in 2024 and purchase $100 worth of “Yes” shares at 47 cents each. If correct, you receive $212 (calculated as 100 / 0.47), effectively the inverse of your purchase price. This dynamic trading allows participants to adjust positions based on new information, providing real-time insights from collective intelligence.

Polymarket's mechanism is built on the Conditional Token Framework. Here’s an illustrative case:

-

Assume the total pool for the Bitcoin prediction market is $1,000:

-

Alice believes Bitcoin will hit $100K and buys $200 worth of “Yes” shares at 20 cents;

-

Bob believes it won’t and buys $800 worth of “No” shares at 80 cents;

-

-

The system matches these orders because they sum to $1,000 (i.e., 100%);

-

The system receives 1,000 USDC and mints 1,000 pairs of “Yes/No” tokens:

-

Alice receives 1,000 “Yes” tokens (each valued at 20¢);

-

Bob receives 1,000 “No” tokens (each valued at 80¢).

-

-

By year-end 2024, winners redeem each token for $1:

-

If Bitcoin hits $100K, Alice turns her $200 into $1,000 (5x return), while Bob’s tokens become worthless;

-

If not, the outcome reverses—Bob profits and Alice’s tokens expire worthless.

-

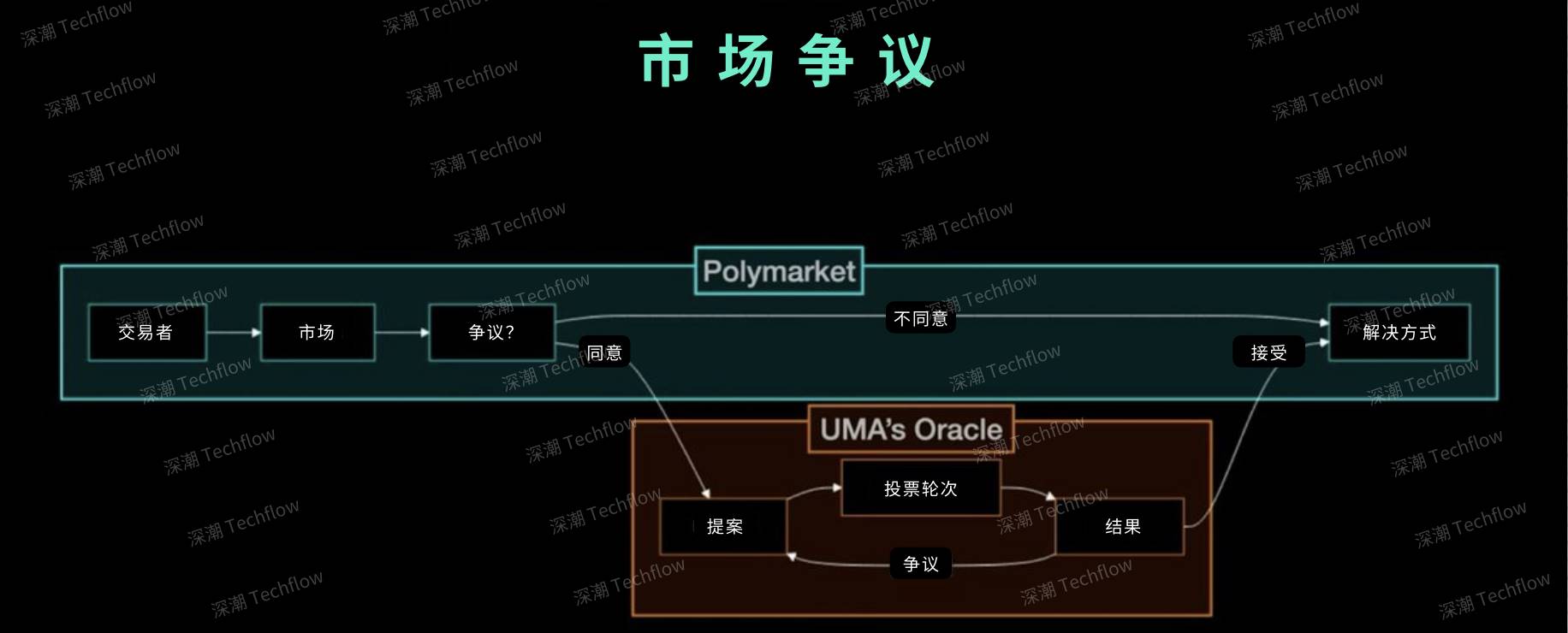

All trades on Polymarket are executed automatically via the Polygon network. Market outcomes are determined by social consensus. In case of disputes, the UMA protocol—an optimistic oracle system—steps in to verify and finalize results.

Here’s how UMA works:

-

Any user can trigger a vote if there's disagreement about a market outcome;

-

UMA token holders vote on the result;

-

Voting power scales with the number of UMA tokens held;

-

Winning voters are rewarded; losing voters are penalized.

Original image by michaellwy, translated by TechFlow

For a detailed explanation, see the official UMA video. Additionally, reports from ASXN and Shoal Research offer deeper analyses of UMA’s mechanics.

The U.S. Government Shutdown Controversy

Prediction markets have proven powerful in forecasting event outcomes, and their success in the 2024 U.S. election further enhanced their credibility.

But what happens when the system itself fails? The recent controversy around the U.S. government shutdown revealed critical weaknesses in current prediction market designs.

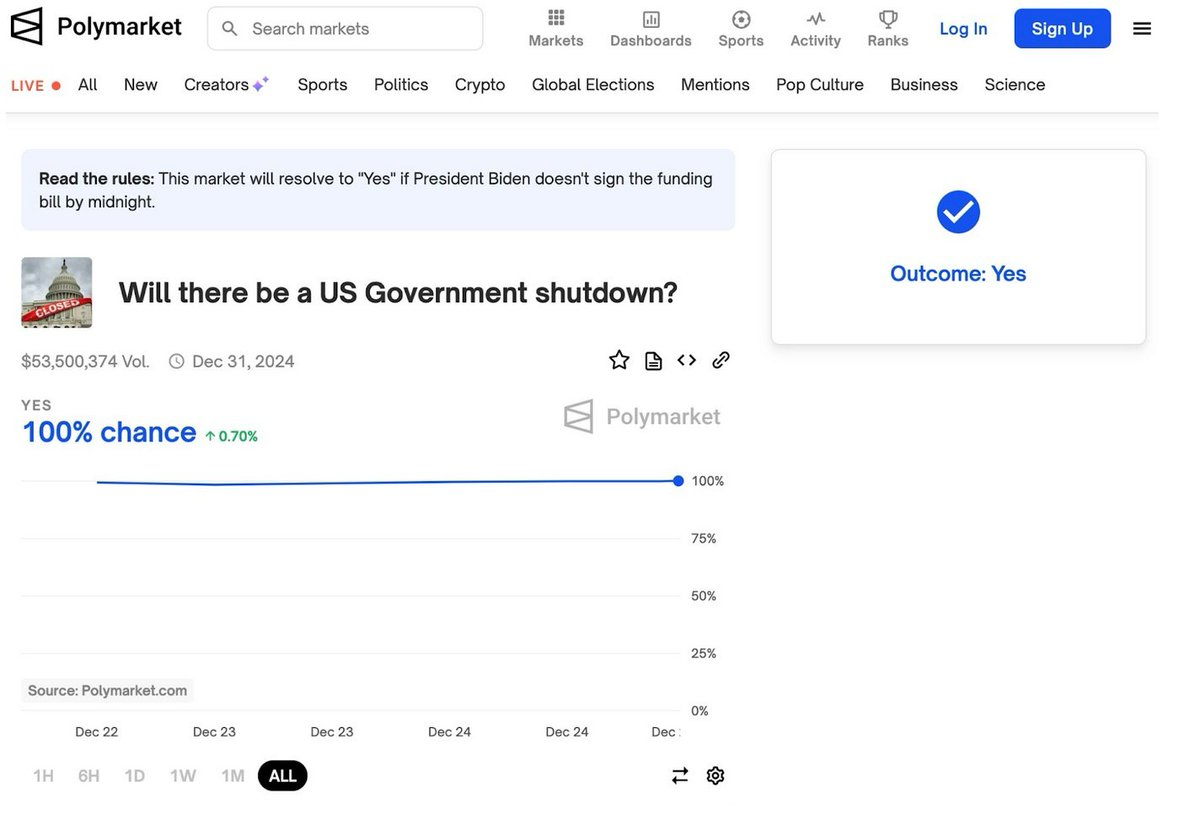

Polymarket created a market predicting whether the U.S. government would shut down between August 30 and December 31, 2024. Initially, the market appeared straightforward. Despite President Biden signing a funding bill (H.R. 10545, the American Relief Act) and successfully avoiding a shutdown, with all major media outlets—regardless of political leaning—confirming no federal interruption occurred, the market still showed a 99% probability of shutdown near expiry and ultimately resolved as “Yes.”

This controversial outcome stemmed from Polymarket modifying the rules mid-market. Specifically, after substantial trading had already taken place, the platform added a new “rule clarification” introducing a previously non-existent deadline: midnight on December 20, 2024. This change directly caused the disconnect between market resolution and reality.

What should have been a simple binary market turned into a debate about market manipulation and flawed design.

Timeline of Events

-

6 PM EST, December 20: The probability of “Yes” (government shutdown) dropped to 20%, down from 70%. This reflected traders’ expectations that the Senate would pass H.R.10545 to avoid a shutdown.

Polymarket official tweet: Probability of government shutdown drops to just 20%. Funding bill expected to pass.

-

Later that day: Polymarket added a banner on the market interface stating that if Biden failed to sign the bill before midnight, the market would resolve as “Yes.” Immediately afterward, the “Yes” probability surged to 98%, as traders bet the Senate wouldn't finish in time for Biden to sign.

- If President Biden does not sign the funding bill before midnight, the market resolves as “Yes.”

-

Market comment section reaction: Heated debates erupted. Holders of “No” shares were confused by the sudden spike and pointed out that all news sources reported the Senate was close to passing the bill to prevent a shutdown.

-

December 21, 00:38: The Senate passed the funding bill.

-

December 21 morning: Biden officially signed the bill into law. Major media unanimously confirmed the shutdown had been avoided.

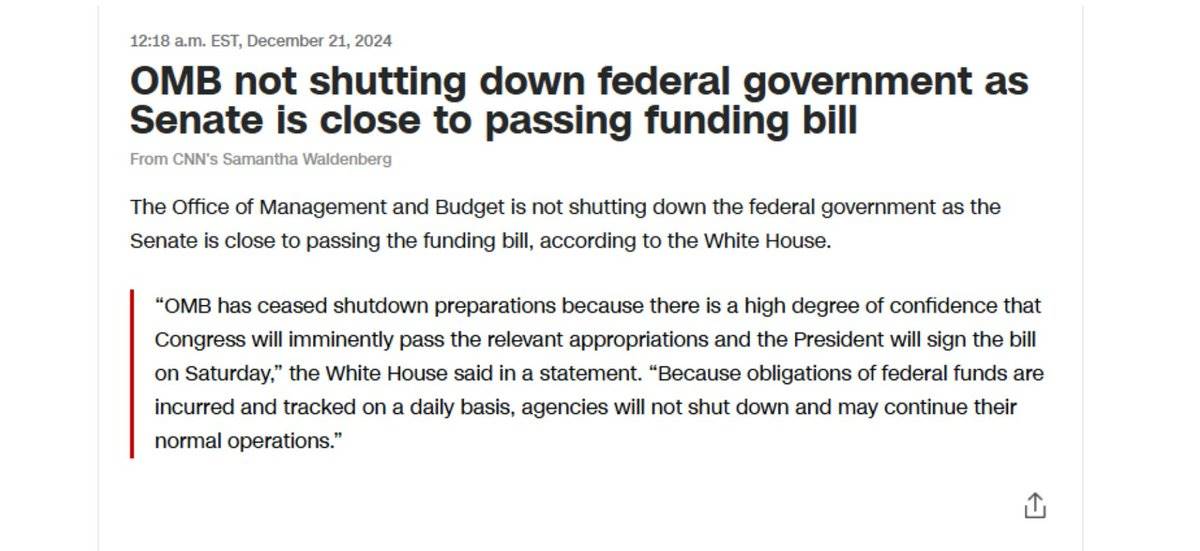

Senate nearing passage of funding bill, OMB will not shut down federal government.

According to the White House, the Office of Management and Budget (OMB) will not shut down the federal government, as the Senate nears passage of the funding bill.

In a statement, the White House said: "Given Congress is set to pass the appropriations bill and the President will sign it on Saturday, OMB has halted shutdown preparations."

"Since federal spending obligations are incurred and tracked daily, agencies will not close and may continue normal operations."

Why did the market resolve as “Yes” despite no actual government shutdown?

Despite no shutdown occurring, the market resolved as “Yes.” To understand this, we must closely examine the original market rules.

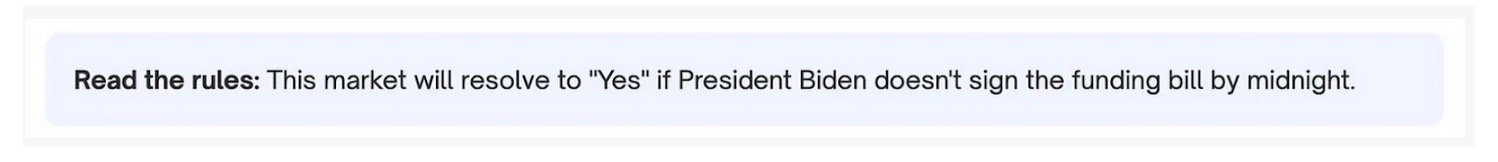

Text in image:

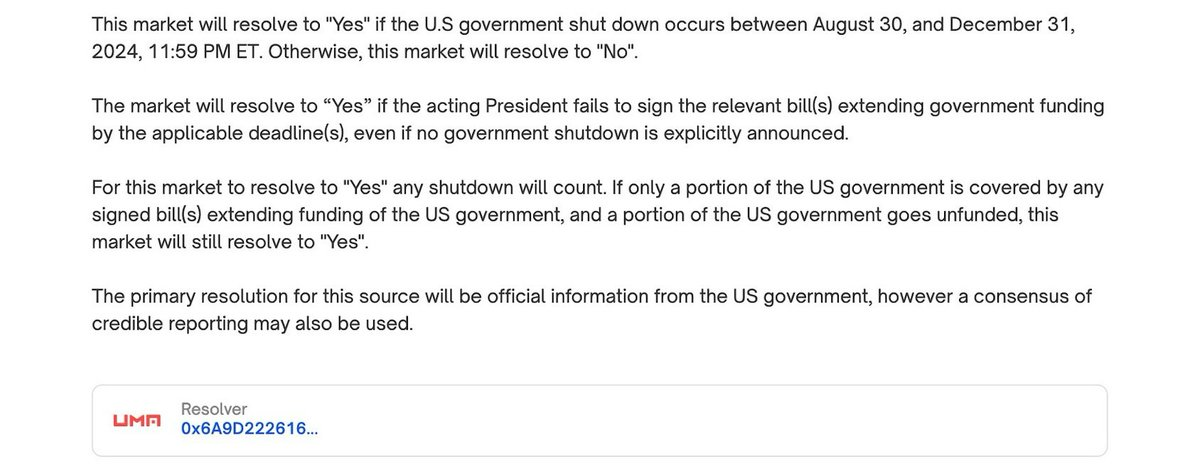

If the U.S. government shuts down between August 30, 2024, and 11:59 PM ET on December 31, 2024, this market resolves as “Yes.” Otherwise, it resolves as “No.”

If the acting president fails to sign legislation extending government funding before the applicable deadline, even without an official announcement of a shutdown, this market resolves as “Yes.”

This market resolves as “Yes” regardless of the form of shutdown. For example, if only some U.S. government departments receive extended funding while others do not, this market still resolves as “Yes.”

The primary basis for resolution will be official U.S. government information, but credible media consensus may also be referenced when necessary.

Rule Analysis:

-

Point 1 – Simple enough: observe whether a shutdown occurs within the specified period (note: end date is December 31, 2024).

-

Point 2 – This is the crux of the controversy. “Yes” holders argue that according to market rules, the president must sign the relevant bill before the applicable deadline. They claim midnight on December 20 qualifies as such a deadline, and since it wasn’t met, the market should resolve as “Yes” (we’ll discuss this further below).

-

Point 3 – Covers partial department shutdowns, less relevant here, so not discussed in depth.

-

Point 4 – States that official U.S. government information will be the main basis, though credible media consensus may also be considered.

“Yes” camp argument:

-

Polymarket added a banner explicitly stating midnight on December 20 was the deadline.

-

The platform later released “additional context” reinforcing this rule.

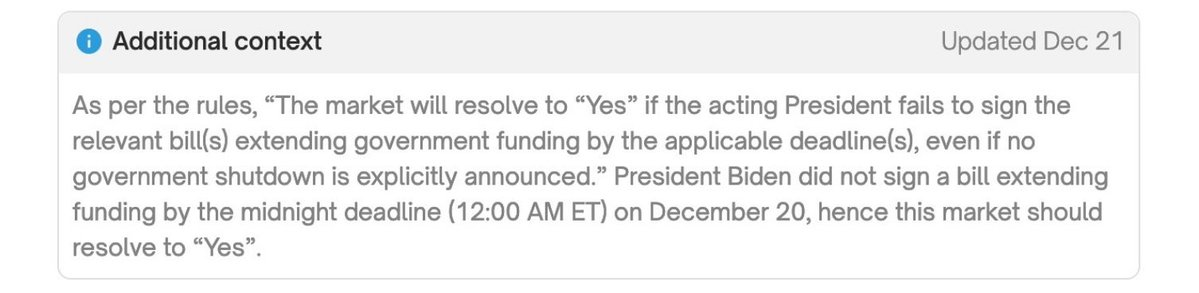

Additional Context

Per the rules: "If the acting president fails to sign the legislation extending government funding before the applicable deadline (12:00 AM ET on December 20, 2024), even without an official declaration of government closure, the market resolves as 'Yes'."

President Biden failed to sign the extension bill before midnight on December 20. Therefore, the market should resolve as “Yes.”

-

Because Biden didn’t sign before midnight, per the rules, the market should automatically resolve as “Yes.”

-

They argue the rule is binding, even if no actual shutdown occurred.

“No” camp argument:

-

Timing issue:

-

The original market timeframe was August to December 31, 2024. The midnight deadline on December 20 emphasized by the “Yes” side was not explicitly written in the rules—only “the applicable deadline” was mentioned.

-

Federal funding operates on a day-to-day basis, so the actual deadline should be 11:59 PM on December 21.

-

The banner declaring the “midnight deadline” remained visible on December 21, which defies logic since the interpretation standard had already expired.

-

-

Actual situation:

-

The White House Senior Deputy Press Secretary confirmed: "Given confidence the bill would pass, OMB had ceased shutdown preparations."

-

Normally, missing a deadline would cause a shutdown. But since none occurred, it implies no critical deadline was actually missed.

-

Finally, a separate Polymarket market asking “Will the House and Senate pass the funding bill by midnight?” correctly resolved as “No.” The key point is that missing a procedural deadline doesn’t equate to a government shutdown—this conflates process with outcome. That’s why two separate pages existed: the spirit of the markets was different.

The core tension here isn’t merely interpretive—it’s about whether prediction markets should prioritize technical rule interpretations over real-world outcomes they’re meant to predict. When a market resolves “Yes” on a government shutdown that objectively never happened, the truth-seeking mechanism breaks down.

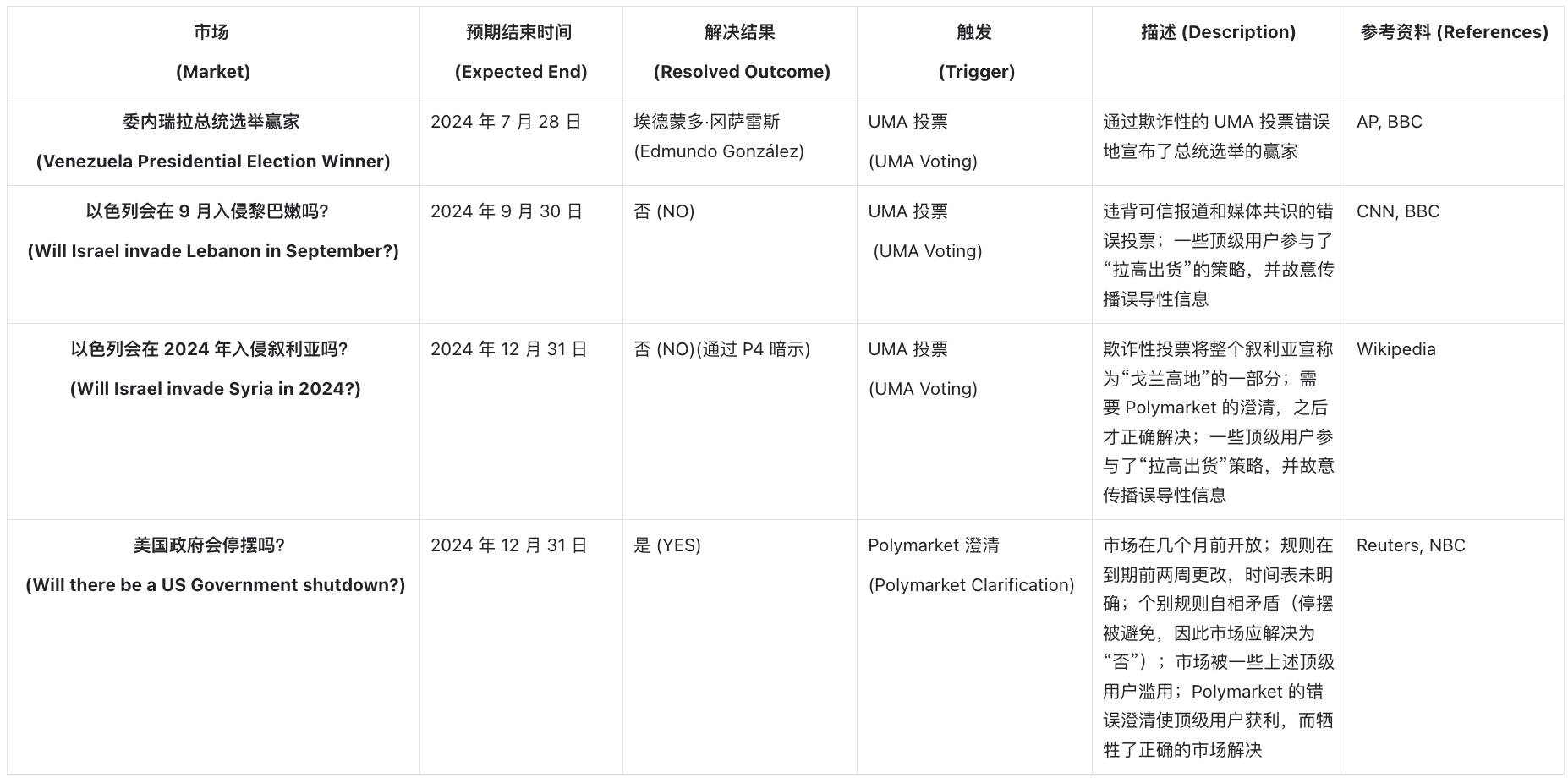

Similar controversies are not rare

One might dismiss this as an isolated incident due to poorly drafted rules. But similar disputes are common. A watchdog site called Polymarketfraud (forgive the provocative name) documents numerous cases where market resolutions contradict reality.

The Venezuelan presidential election winner market is particularly striking. Nicolás Maduro is currently Venezuela’s president, yet the market resolved that opposition candidate Edmundo González won the recent election.

Frank Muci explores this in greater depth in his article. Here’s a brief summary:

-

The market rules clearly stated: “The primary basis for resolution is official Venezuelan information, but credible media consensus may also be used.”

-

Official results declared Maduro the winner:

-

First announcement: 51.20000% vs 42.20000%

-

Second announcement: 51.9500% vs 43.1800% (Such precise decimal figures, especially ending in multiple zeros, raise suspicion of fabricated data.)

-

Exit poll data indicated the opposition led by over 20%.

-

UMA token holders—the final arbiters in dispute resolution—were heavily lobbied to ignore Venezuela’s official sources and instead accept credible media reports of election fraud.

-

Ultimately, UMA holders voted to override the primary resolution source stated in Polymarket’s rules, ruling González the winner—even though Maduro remains in power.

This contradictory decision-making reveals a problem. In the U.S. government shutdown case, UMA voters strictly followed a technical rule—a late-added clause about the midnight deadline—ignoring the fact that all media consistently reported no shutdown occurred. Yet in the Venezuela election, they did the exact opposite: overturning the primary information source in favor of media consensus on election fraud.

Fraudulent Markets

(Source)

This list continues to grow, and research into other markets is ongoing. It’s reasonable to assume countless (new) users lost significant funds across these markets, while certain top users profited handsomely. While no concrete evidence exists, there’s reason to suspect these accounts may have coordinated behavior and/or possessed insider knowledge during UMA voting processes and/or Polymarket clarifications.

Furthermore, the rules for the “Will there be a US Government shutdown?” market appear suspiciously misleading, failing to clearly state which deadlines are valid for resolution. Yet all signs suggest the market should resolve as “YES,” given a shutdown did occur before 2025.

Polymarket should consider refunding users affected by these fraudulent markets and/or adopting 50/50 resolutions where applicable. Without action, this trend of controversial markets will persist—enriching a few large users while harming many newcomers. This may be something the U.S. Commodity Futures Trading Commission (CFTC) and/or Federal Bureau of Investigation (FBI) should promptly investigate.

Another case involves the Israel-Hezbollah ceasefire market. Despite reliable reports indicating military actions continued, the market still resolved as “Yes.” A YouTube video titled "Gaming Prediction Markets: A $40 Million Lesson" details this incident.

Additionally, Lou Kerner proposed an intriguing theory in his article about potential issues in U.S. election markets. Though he calls it a “conspiracy theory,” his analysis suggests Polymarket’s presidential election market may structurally favor Trump.

His scenario goes like this: If Trump loses, he might, like in 2020, refuse to concede, claim voter fraud, and challenge the results. Thus, even if Kamala Harris actually wins, the market might not resolve in her favor.

This creates a “heads I win, tails I don’t lose” situation for Trump supporters. If Trump wins, bettors profit directly. If he loses but contests the outcome, market resolution could be delayed or altered through UMA token holder votes.

Problems Identified

First, the issue of rule manipulation. When platforms can arbitrarily add clarifications, the oracle becomes meaningless. In the shutdown case, posting a new banner caused odds to surge to “Yes” and effectively changed the effective deadline from December 31 to December 20, 2024.

This raises further questions about resolution criteria. When rules conflict, which takes precedence? Although the primary resolution standard clearly cited news sources and credible reporting—with a deadline of December 31—the market ultimately relied on a newly added clarification about midnight on December 20. This inconsistency in rule hierarchy severely undermines market credibility.

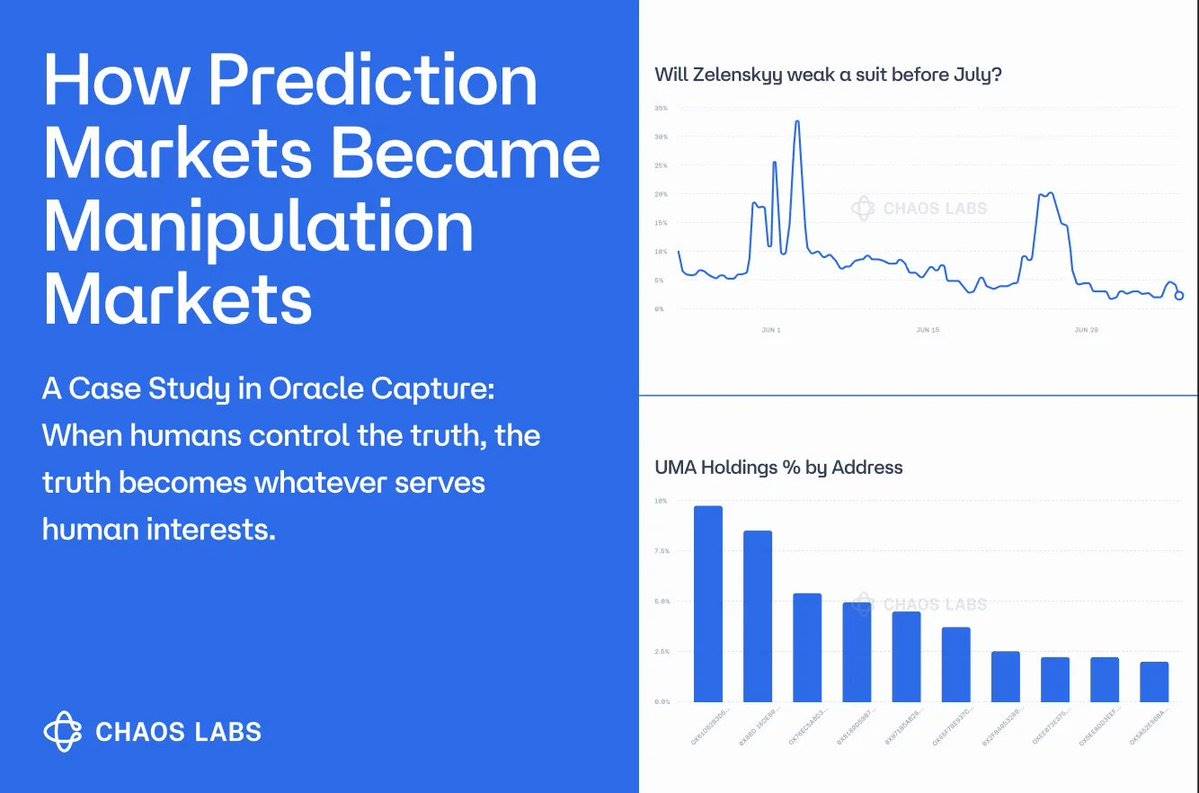

Another structural challenge lies in the relationship between UMA holders and Polymarket’s resolution system. Since UMA token holders can both trade and vote, strong alignment of interests emerges between large traders and oracle voters.

Although Polymarket and UMA are supposed to act as independent checks on each other, in practice, UMA is Polymarket’s sole oracle provider. This reminds me of a scene in *The Big Short*, where a ratings agency employee admits they must give AAA ratings—or banks will go to competitors. When a system’s success depends on pleasing powerful participants, independence becomes impossible.

Dispute Resolution: The Fatal Flaw of Prediction Markets

The core value of prediction markets lies in their ability to accurately determine facts. No matter how polished the UI, sophisticated the trading engine, or deep the liquidity—if they cannot reliably decide who wins a bet, everything else is meaningless. Polymarket currently relies on UMA’s oracle system to resolve disputes, but this mechanism may harbor latent vulnerabilities.

Overview of UMA’s Mechanism:

-

When a market outcome is disputed, any user can trigger a vote.

-

UMA token holders vote on the result according to the rules.

-

Voting power depends on the number of UMA tokens held.

-

Winning voters are rewarded; losing voters are penalized.

In a blog post on Dirt Roads, Luca Prosperi introduced a concept called “Corruption Value Multiple (CVM)” to measure the risk exposure of prediction markets. Here’s his analysis:

-

Currently, the total open betting value on Polymarket is approximately $300 million, while UMA’s total market cap is only $220 million.

-

Controlling half of UMA’s tokens would cost about $110 million.

-

This means every $1 spent to control UMA could influence $1.36 in bets.

However, actual risks may be higher due to:

-

Actual UMA voting participation is typically only ~20%, far below 100%.

-

Market rules are often ambiguous, leaving gray areas for dispute resolution.

-

Voters may be influenced by narratives or interested parties.

-

The cost to influence outcomes may be much lower than the theoretical $110 million.

This means traders who believe they can manipulate oracle decisions may artificially inflate market prices far beyond true probabilities.

These issues reflect the complexity of prediction market design. While there’s no “one-size-fits-all” solution, improving dispute resolution is undoubtedly one of the most pressing challenges. Inconsistent resolutions erode user trust and ultimately divert markets from their original purpose.

Paths Forward: Improving Dispute Resolution

Fix market rules—no post-hoc modifications. Once a market launches, its rules should be locked. Terms should not allow any form of “supplementary explanations” or “retroactive clarifications.” Original rules must serve as the sole reference. During disputes, oracles should strictly adhere to these foundational rules, unaffected by platform-added content.

Establish rule hierarchies with on-chain records. Market rules need clear priority structures. For instance, when conflicts arise, which rule prevails? Primary standards (e.g., credible media consensus) should clearly override secondary mechanisms. These hierarchies should be recorded on-chain at market creation, forming an immutable chain of evidence to ensure transparency and authority.

Reputation-based validation systems. Beyond token-weighted voting, markets could introduce a council system based on reputation. Composed of respected industry experts, members would stake their professional reputations when adjudicating outcomes. This adds expertise and accountability to the verification process.

Inter-subjective fork mechanism. Inspired by Eigenlayer’s innovation, this mechanism handles clear errors identifiable by human consensus. During major disputes, the community can split the oracle or protocol tokens into two versions, each supporting a different interpretation. The market then determines which version retains value. Those backing incorrect interpretations suffer economic penalties as their tokens lose value—effectively deterring manipulation.

AI agents as independent arbitrators. To reduce manipulation risks from economically motivated token holders, specialized AI agents could be developed solely for resolving market outcomes. Unlike humans who may vote based on personal stakes, AI agents can be designed to be fully neutral, analyzing evidence impartially to deliver fairer resolutions. This significantly enhances market credibility and efficiency while minimizing human interference.

Conclusion

To clarify, this article isn’t intended as a targeted critique of Polymarket. However, as the largest (and frankly, the only practically influential) player in crypto prediction markets today, it serves as the best case study for understanding systemic industry challenges.

Why do these issues matter? If we view prediction markets merely as speculative platforms where traders bet on outcomes, their flaws are relatively contained. Yes, some people may lose money—but ultimately, it’s just another casino.

Yet prediction markets are being positioned as something greater: engines of truth—objective tools capable of cutting through noise and bias to reveal the real probabilities of future events.

This is precisely why the government shutdown case raised alarms. When a market confidently predicts and verifies a government shutdown that never actually happened, it shows how these so-called “truth engines” can generate false realities disconnected from facts. The danger isn’t limited to individual financial losses; the greater risk is that our “objective verification systems” could be exploited by those with capital and motive to manipulate public perception.

As prediction markets grow in influence, their structural weaknesses become everyone’s problem. If we fail to fix these fundamental flaws, we risk turning prediction markets into powerful tools for distorting truth—not discovering it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News