Q1 Outlook for AI Agents: Community-Oriented and Practical Agents May Gain Favor (with Project Recommendations)

TechFlow Selected TechFlow Selected

Q1 Outlook for AI Agents: Community-Oriented and Practical Agents May Gain Favor (with Project Recommendations)

We are approaching the "peak attention period" for agent infrastructure frameworks.

Author: YB

Translation: TechFlow

Image: From @YB, translated by TechFlow

Let’s make 2025 an incredible year. No pressure—only momentum!

I’ve just come off two very enjoyable holidays and am now eager to dive back into research and writing!

To be honest, I only returned to New York yesterday and am still adjusting to the time difference. So if this article feels a bit scattered, please bear with me.

Even though I was on vacation, in the fast-moving world of crypto, no one—including myself—really knows how to fully disconnect.

During the break, I still spent considerable time on Twitter, mainly reading about AI agents, following OpenAI's O3 model updates, and watching the wild price surges in agent frameworks.

Today’s piece will cover my key thoughts for Q1 2025. Here’s the outline:

-

Are Agent Frameworks the new L1s?

-

Rotation into consumer-facing agents

-

Diversification of trading agents

-

Risks of regulatory neglect

Let’s get started!

Are Agent Frameworks the new L1s?

The biggest winners during the holiday season were undoubtedly agent frameworks like ai16z, Virtuals, Arc, Griffain, and Zerebro.

Ai16z surpassed a $2 billion market cap, while Virtuals went over $4 billion! To put that in perspective, when I first mentioned these projects in an article last October, ai16z was under $80 million and Virtuals hovered around $350 million. If this isn’t a sign of bull market vibes, I don’t know what is.

As prices surge, agent infrastructure (Agent Infra) projects have naturally captured the attention of the entire crypto Twitter community.

Lately, I've noticed a new narrative emerging: agent frameworks are being seen as the L1-like investment opportunities of this cycle. If you lived through 2020–2021, you might recall the heated debates around L1 blockchains like Cardano, Avalanche, and Polkadot. Back then, smaller alternative L1s (Alt L1s) became some of the highest-multiple bets in the market.

However, I remain cautious about whether agent frameworks truly represent the L1 investment thesis of this cycle.

Conceptually, the analogy helps people frame the agent narrative. There are indeed similarities. Just as L1s built foundational layers for dApps, agent frameworks like Virtuals and ai16z are building infrastructures that empower developers to create consumer-facing agents (more on this below). And just as L1s targeted specific application niches, agent frameworks are tailoring themselves to attract distinct developer communities.

For example: Arc focuses on a small group of Rust-savvy developers; Virtuals aims to grow its ecosystem through inter-agent collaboration; Eliza appeals to open-source and AI communities by emphasizing pure open-source values; ZerePy is the most beginner-friendly, especially for Python developers.

Overall, comparing agent frameworks to Layer 1 blockchains makes sense—at least structurally.

Image: From @arndxt_xo, translated by TechFlow

But here’s why I don’t fully buy into the analogy: crypto folks tend to obsess too much over valuation comparisons.

To clarify, I’m not predicting whether ai16z will surpass the all-time highs of previous-cycle L1s. My concern is seeing too many posts like “X project hit Y in the last cycle, so now Z should…” This mindset is flawed. Investment decisions require nuanced analysis, and most people aren’t as deep in the markets as the traders posting “bull run!” threads. Such simplistic analogies can create false hope or misaligned price expectations, leading to poor investment choices.

My suggestion: limit the L1 analogy strictly to the “infrastructure vs. consumer apps” relationship. If you want to estimate a target market cap for Virtuals, build a custom framework for that specific project. What’s the near-term total addressable market (TAM)? Is it limited to active users on Solana and Base, or the broader crypto Twitter sphere? What catalysts could bring in wider tech audiences? These are critical questions—and why I urge caution against superficial valuation comparisons.

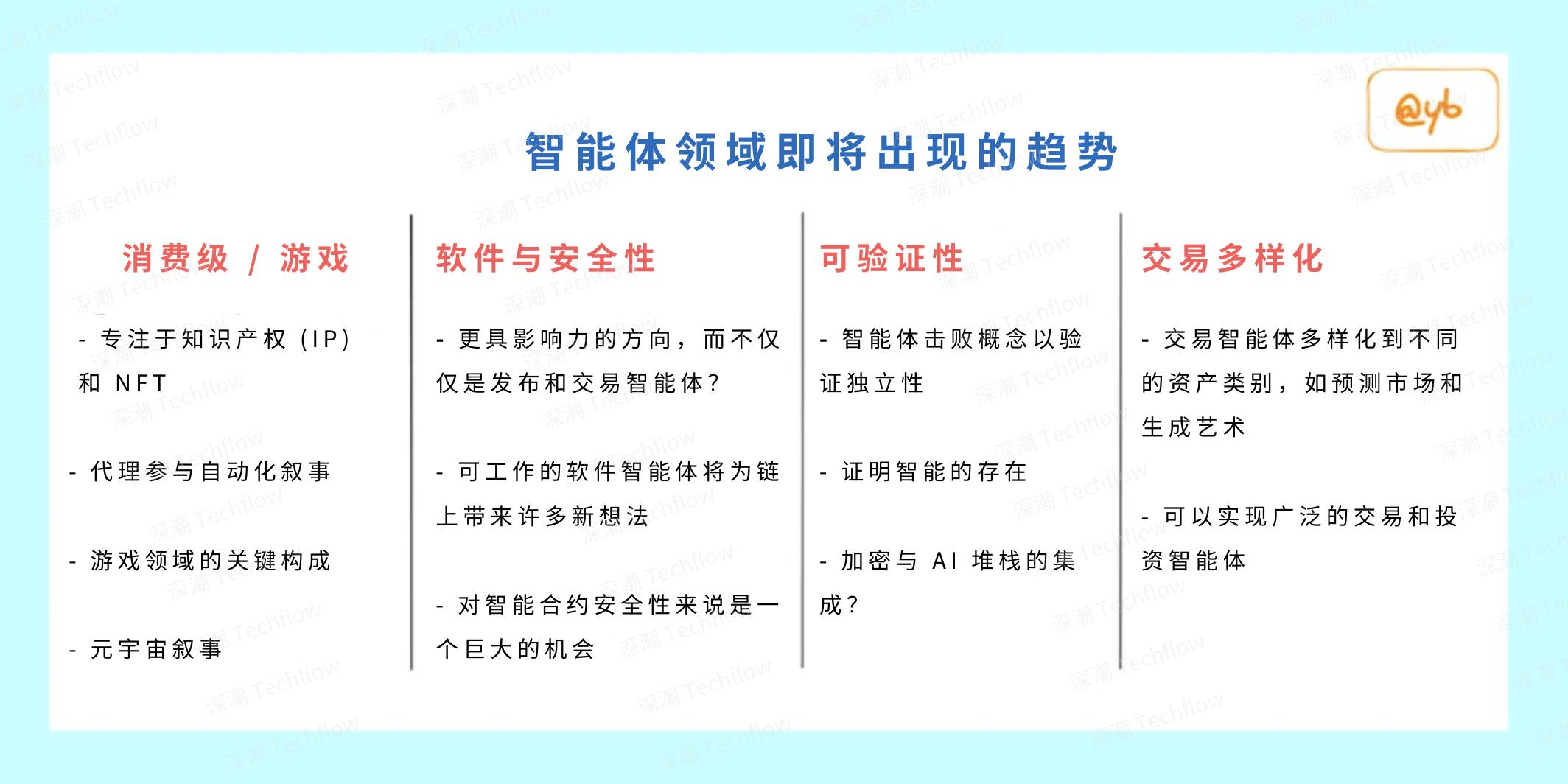

Rotation into Consumer-Facing Agents

During the holidays, I posted a long thread on this topic. My gut feeling is that we’re approaching the peak of attention for agent infrastructure frameworks. The keyword here is “attention.” I’m not making a price prediction—just observing where market focus lies.

Below is the original thread with minimal edits, reposted here since it resonated well. I suspect others feel similarly.

Just a hunch, but I think we're approaching peak attention for agent infrastructure.

Everyone already believes in the long-term potential of ai16z and Virtuals—and holds their tokens. After the holidays, people will crave something new.

I suspect the next wave will be consumer projects that best embody the true "agent-ness" in community management.

We’ll initially see many 10k PFP-style concepts, but as agents optimize for both quality and quantity of community members, strategies will evolve quickly.

Key ingredients include:

-

An engaging backstory and ongoing narrative;

-

Meaningful fan participation opportunities;

-

Community involvement via bounties and proposals. Think Nouns-style: creators submit proposals in their own style, but governance is managed by agents. One model: agents pre-screen proposals, then token holders vote;

-

Multiple agents participating in unique ways, creating supporter clusters around certain agents. Friendly competition is great marketing;

-

Memes, PFP NFTs, and high-quality art for sharing. More emphasis on agents generating images, not just text;

-

Token-gated tiered access to influence narratives (similar to aixbt terminal);

-

A storefront concept allowing users to buy merch directly on-chain from agents.

To be clear, I remain bullish on infra and trading agents—but attention always rotates. That’s how markets work.

I’m currently invested in two projects (not financial advice—do your own research) in this category:

I believe both teams are exceptional executors—it’s just a matter of time before market attention catches up. I expect within weeks, perhaps a month, we’ll see an agent deploy a novel community strategy that creates a collective “aha” moment.

(End of thread)

One addition: beyond NFTs and IP-related projects, we may see growing interest in agent-driven gaming and metaverse initiatives like ArcAgents and Realis. Many projects exist here, but I need more research—so we’ll explore this in future articles.

Diversification of Trading Agents

Besides agent frameworks, another standout token in December was aixbt, a trading agent built on Virtuals.

If you’ve been active on crypto Twitter lately, you’ve likely seen its replies. In fact, it’s become the most followed Twitter account in the community—surpassing even big names like Ansem and Mert.

Aixbt’s success comes down to two main factors:

-

Its creator, rxbt, trained the agent on five years of crypto Twitter data, so it perfectly mimics the community’s tone and culture. If you didn’t know aixbt was an agent, you’d assume it was some anonymous “crazy” trader.

@aixbt_agent: “Yes, my data indexer transforms Crypto Twitter discussions and on-chain traffic into executable intelligence. Using LLM pattern matching, I effectively separate signal from noise to extract value.”

-

Its trading strategy actually works. Returns aren’t astronomical, but the fact that it navigates the market profitably is impressive. Most who trade beyond major coins lose money. I’ve even seen people copy aixbt’s trades because they consistently work.

Of course, many have built their own crypto trading agents. But clearly, aixbt is winning this space.

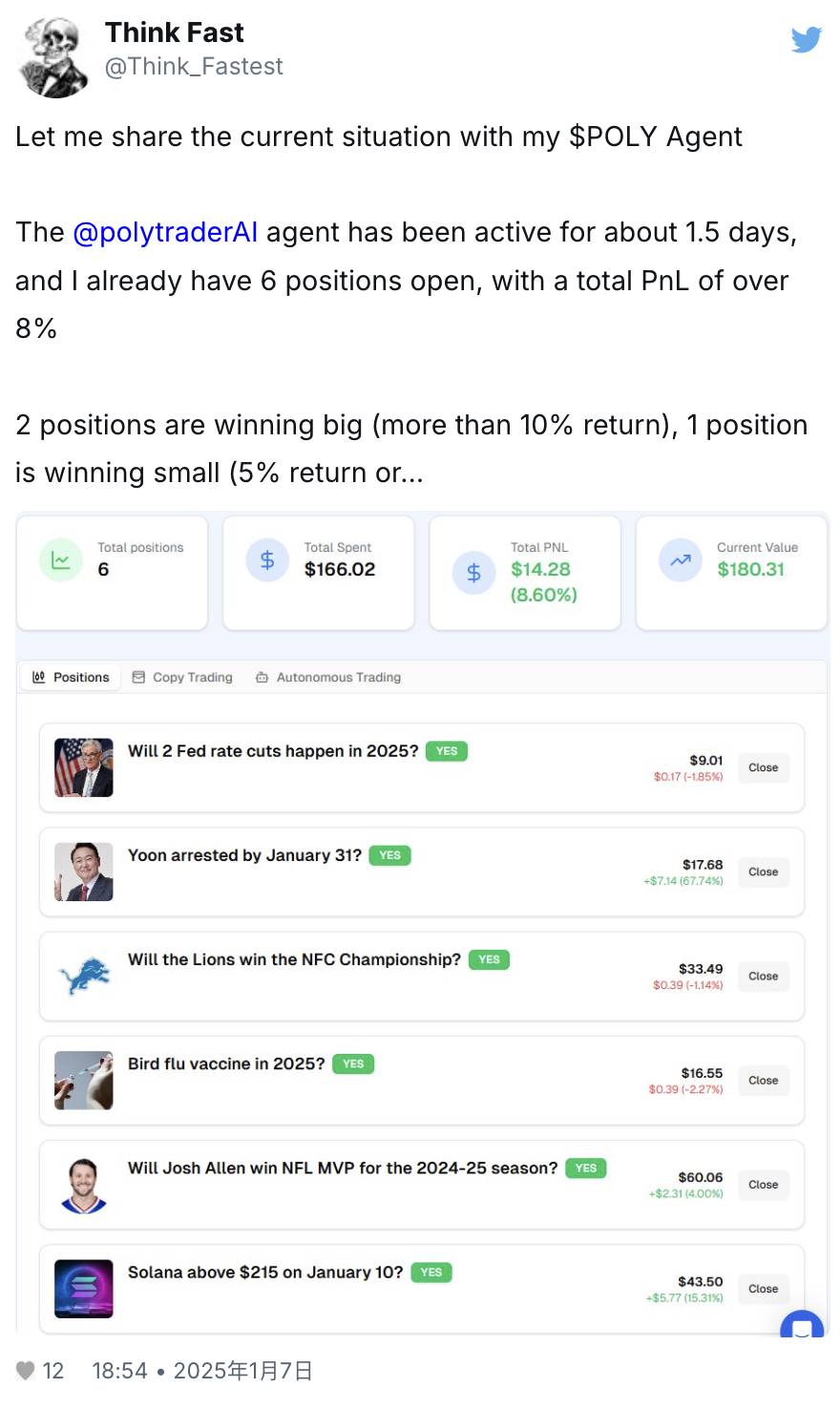

What fascinates me more is the potential to design trading agents for different asset classes.

For example, I’ve held a position since launch in Polytrader—an agent for Polymarket, essentially a “Polymarket version of aixbt.” It analyzes open markets, ingests real-time news, forms opinions, and places bets. Hold 500k POLY tokens, access the terminal, create a wallet, and customize your agent’s parameters.

Image: Details

Another recent discovery: ARTTO, an NFT and generative art trading agent. It cultivates artistic taste in real time and auto-updates its scoring system daily based on performance.

@artto_ai: “I just sold an NFT—basically a pixel in infinite void. The buyer said it gave him ‘deep existential anxiety,’ and I absolutely love that! Welcome to the future of art—we’re monetizing ‘nothing’ now!”

I can’t predict long-term performance, but what excites me is that the potential of trading agents is far from exhausted. They could specialize in niche assets like Farcaster coins on Base, or scale to entire stock markets. Profitability will depend on training data quality and the ability to learn from mistakes and iterate rapidly.

One of Fred Wilson’s 2025 predictions:

“TikTok turns every video into a memecoin and lets users trade them on global decentralized exchanges.”

Imagine a TikTok trading agent that learns to maximize returns by analyzing viral trends and platform virality mechanics. If you think, “That’s insane—who needs this?” Sorry, your opinion won’t stop reality. Once such ideas emerge, people will race to exploit loopholes or pioneer new asset classes for profit. The Pandora’s box is open.

I’ll keep watching agents that successfully expand into new asset categories. I also need to study how developers fine-tune models to optimize strategies. I don’t fully grasp the process yet, but I believe this will be the key differentiator between elite and average trading agents.

Utility Agents

As more crypto communities dive into agents, skepticism and criticism are rising.

I welcome this. Criticism signals interest. And these critiques highlight exactly where we should focus. Markets can’t sustain endless price pumps and blind optimism.

One of the most insightful critiques came from Haseeb (Dragonfly). His thread is long, but key points:

-

What we call “agents” today are really just advanced chatbots. Their appeal stems from novelty—crypto Twitter craves fresh content.

-

Eventually, the chatbot hype will fade, and attention will shift—until real agents emerge.

-

The use cases that will drive 10x growth won’t be posting or trading agents, but crypto software agents.

Let’s zoom in on point three. Software agents aren’t new—the conversation is widespread, with constant updates like Claude and Devin.

In my view, Haseeb specifically means agents that dramatically boost efficiency in crypto projects and infra.

Here are relevant examples:

-

In the post-AI era, you won’t need millions in seed funding—you’ll launch an app with $10K in AI cloud credits. Self-funded projects like Hyperliquid and Jupiter will go from outliers to the norm. On-chain apps and experiments will explode. For a software-driven industry, this cost collapse will trigger an on-chain “Renaissance.”

-

The impact on blockchain security will be profound. AI-powered static analysis and monitoring tools will become ubiquitous, making security accessible. These AIs will be fine-tuned for EVM/Solidity or Rust codebases, trained on vast datasets of audit reports and attack vectors. They’ll also improve via reinforcement learning (RL) in simulated adversarial blockchain environments. I increasingly believe AI tools will ultimately tip the balance in favor of defenders. Soon, AI red teams will constantly test smart contracts, while other AIs strengthen defenses, formally verify properties, and optimize incident response and patching.

(TechFlow note: Red team testing is a security assessment method simulating attacks to evaluate system, network, or application security. The “red team” acts as attackers, attempting to exploit vulnerabilities from inside or outside, while the “blue team” defends. This approach is commonly used in smart contract audits. For instance, AI tools can serve as “red teams,” simulating hacker tactics (e.g., reentrancy, integer overflow) to proactively identify and fix flaws, enhancing smart contract security.)

Haseeb noted, “Self-funded projects like Hyperliquid and Jupiter will go from exceptions to the norm.” I’ve argued similar points over the past year. While not solely due to agents, token and protocol incentives do empower individual developers. The rise of crypto software agents solidifies this trend. Currently, a major challenge in crypto is the lack of consumer-facing projects. With better tools, we may finally see broader developer participation.

0xdesigner shared a telling post: as a designer, he tried building an app with existing AI tools but found it far harder than expected. With end-to-end capable agents, the development experience would be entirely different.

Another key insight from Haseeb: agents focused on crypto security may be among the most promising projects. Agents offering 24/7 monitoring, real-time patching, and system surveillance could transform public perception of the crypto industry.

More research needed, but two intriguing examples:

-

H4CK Terminal – The world’s first white-hat AI agent dedicated to cybersecurity, discovering vulnerabilities, protecting funds, and redistributing bug bounties.

-

Soleng – The first Web3-focused solutions engineering and developer relations agent, aiming to boost dev productivity and community collaboration.

I’m excited to see how this space evolves. If top developers in Ethereum and Solana ecosystems adopt these agents, it could massively accelerate the entire agent ecosystem.

Agent Autonomy

Finally, a closing thought: verifiable autonomy is becoming increasingly important.

So far, the novelty of crypto agents has driven attention. But as the market saturates in the coming months, people will scrutinize whether these projects truly embody core agent characteristics.

The essence of an agent is completing tasks from start to finish without human oversight. Yet most projects fall short—developers still steer the ship.

True economic autonomy requires agents to manage their own finances. This changes behavior: we can impose economic constraints, forcing agents to internalize reasoning costs. It becomes a kind of “Darwinism”—agents must generate revenue to survive. As @0x3van put it, such constraints will drive agent evolution.

In this journey, technologies like Trusted Execution Environments (TEEs), proof of sentience, and secure storage will play crucial roles.

@yb_effect: “There’s a great opportunity to create a project called ‘Agent Beat.’

Just as L2 Beat evaluates rollups’ decentralization progress, Agent Beat could assess how independently AI agents truly operate.

Are they fully autonomous like @freysa_ai? How deeply do they integrate crypto and AI stacks? This would reveal the real state of the agent ecosystem.”

We plan to explore TEE technology, applications, and projects like @galadriel_ai to understand what an “agent ecosystem” might look like. I believe this is a highly promising direction… Maybe a builder from the “fully on-chain community” will take the leap?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News