Ethena 2025 Roadmap Full Text: Integration and Mutual Success

TechFlow Selected TechFlow Selected

Ethena 2025 Roadmap Full Text: Integration and Mutual Success

In 2025, we will disrupt the financial system at a scale far beyond what it is today.

Author: G | Ethena, Founder of Ethena

Translation: 0xresearcher

In May, I outlined Ethena’s final roadmap for 2024—describing our vision to create the most important product in crypto: internet money—and drive convergence between DeFi, CeFi, and TradFi in terms of capital flows and interest rates.

Looking back, what we’re most proud of is the resilience demonstrated during a six-month market downturn. We faced many skeptics eager to see us fail, but also had those who stood firmly by our side. For that, I’m deeply grateful.

I know it wasn’t easy to support Ethena early on. It required taking on unique risks, understanding novel concepts, and placing trust—believing we could deliver on our promises.

But this is exactly what innovation, challenging the status quo, and advancing the industry are all about.

The team and I thank you for your trust. We feel honored and are working day and night to build better products to repay that confidence.

Just days after Luna collapsed, I left my job and founded Ethena. A few months after the FTX collapse, I assembled the team.

We persevered through the bear market of 2023 and doubled down during the past six months of market stagnation, scaling Ethena’s core product and ecosystem ambitions tenfold.

This article details our goals for 2025 and covers the following topics:

-

Summary of key Ethena metrics in 2024;

-

Ethena entering traditional finance with its customized product sUSDe;

-

Why sUSDe is the logical next step for traditional finance after ETFs?

-

Macro tailwinds from looser rate environments for USDe;

-

The current state and future of the crypto dollar landscape;

-

Ethena building a Telegram-based savings and payments app for one billion users;

-

Ethena Network ecosystem applications and new chains;

Ethena 2024 Recap:

-

Became the third-largest dollar-denominated asset in the space within ten months, reaching $6 billion in supply

-

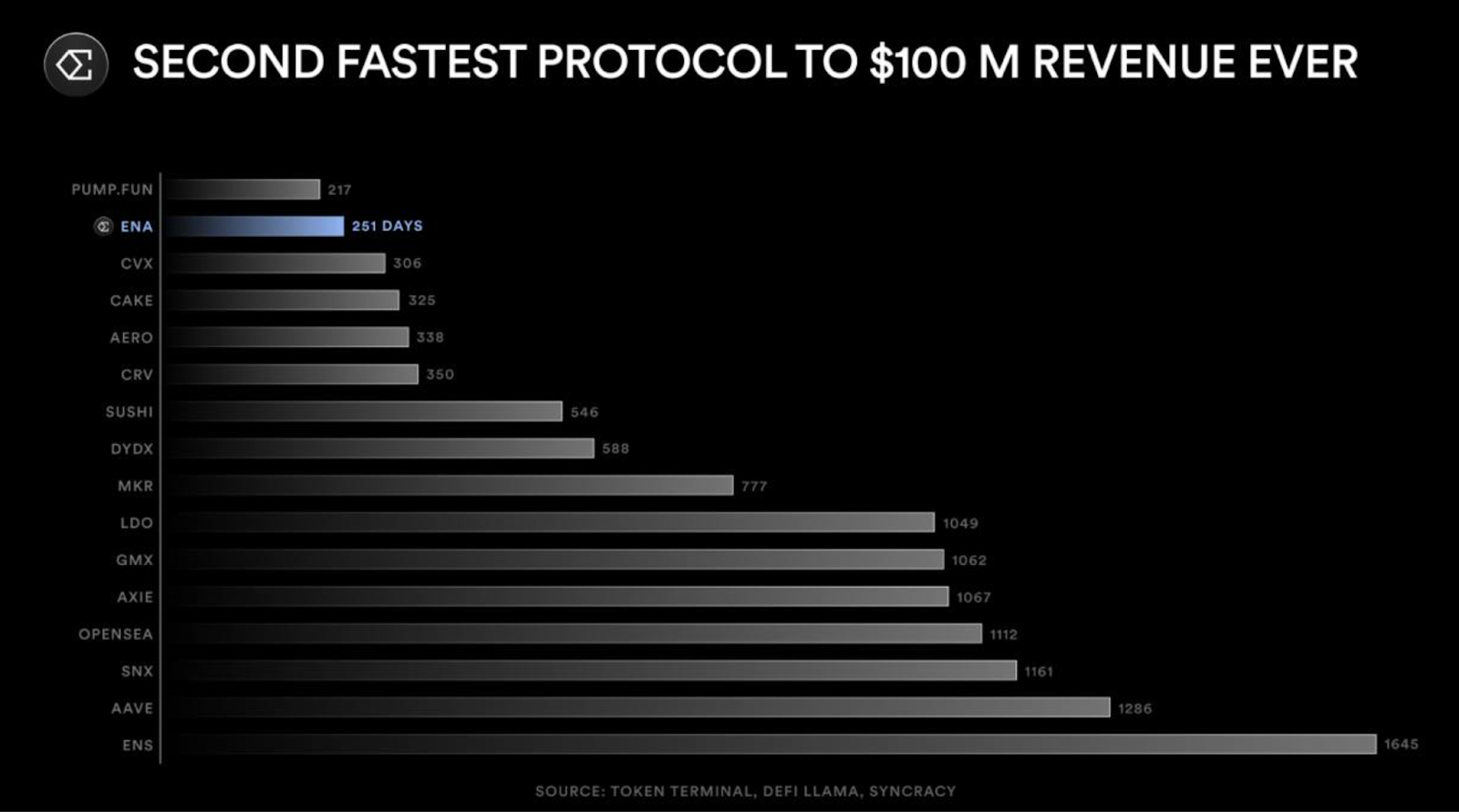

Fastest dollar asset in history to reach $5 billion

-

Generated over $1.2 billion in annualized revenue last month

-

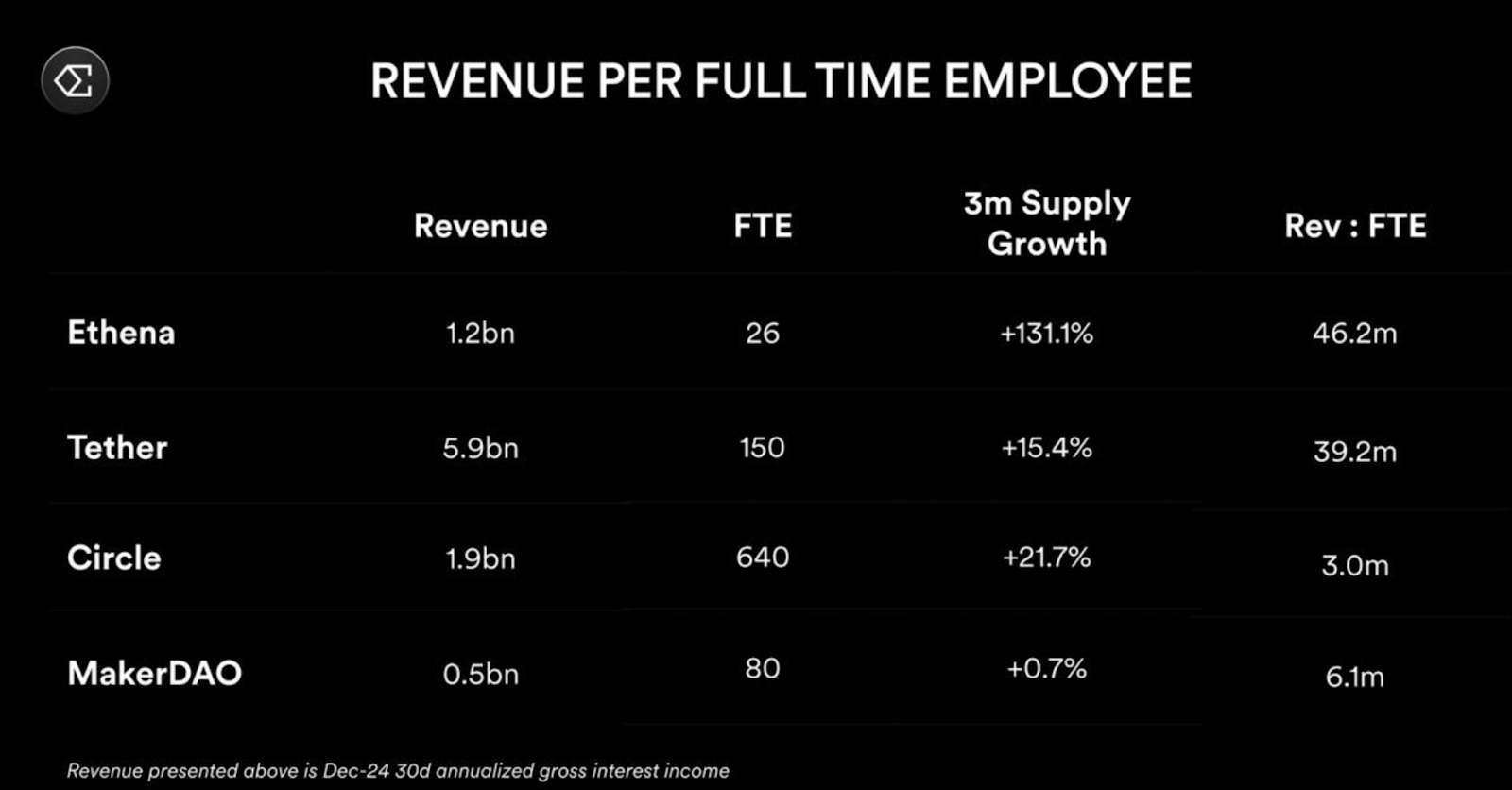

Second-fastest crypto startup ever to reach $100 million in revenue, behind only pump.fun

-

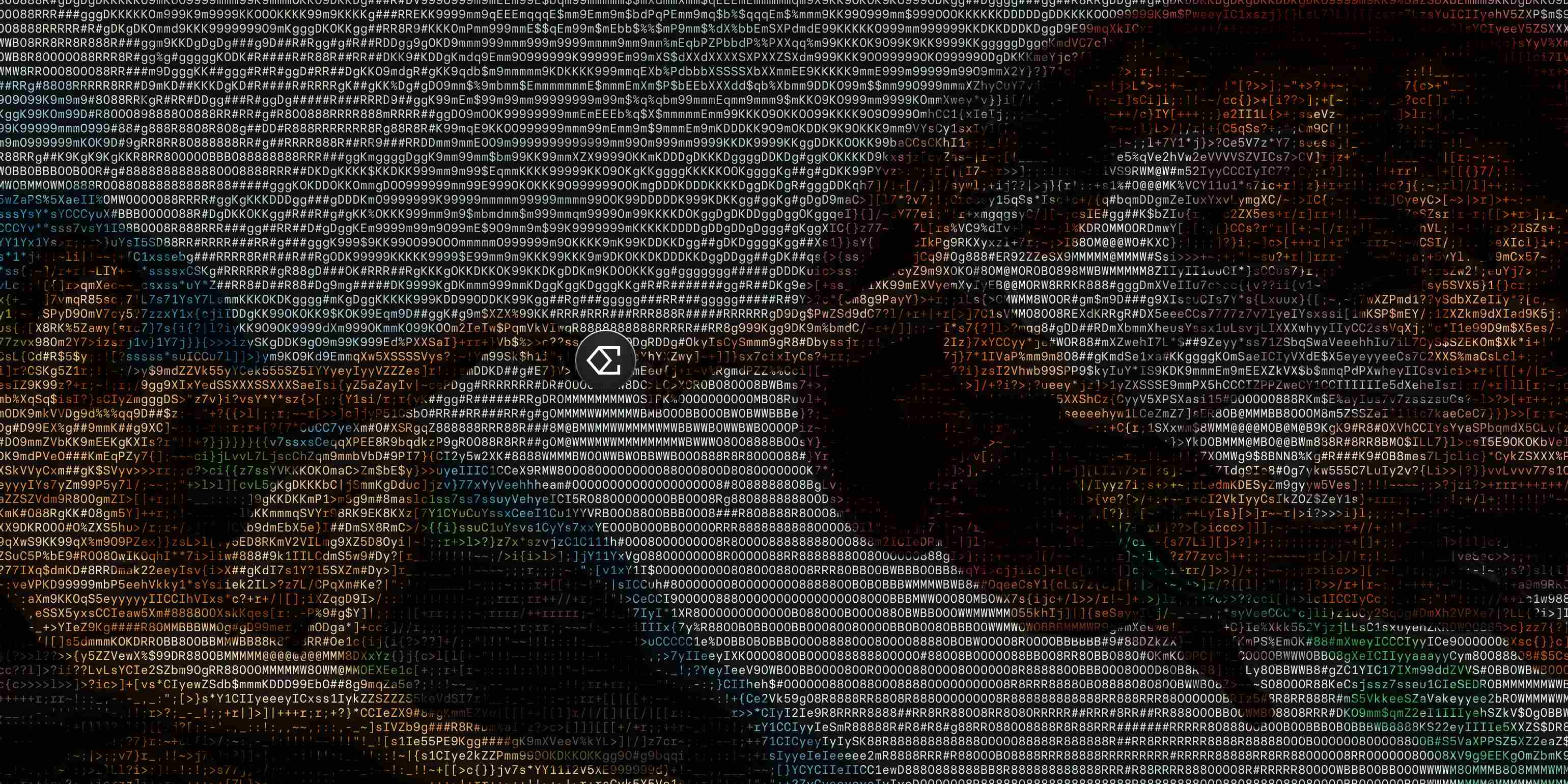

Became the highest per-capita revenue protocol in the space in December

What initially drew me to DeFi protocols was:

-

Financial services can scale at the marginal cost of software

-

Capital can move freely across borders at internet speed

This gives us the ability to create the most profitable entity on Earth—at nearly zero cost.

For this goal, Ethena has only existed for one year.

Revenue run rate per employee in December

Ethena is the second-fastest startup in history to reach $100 million in revenue

Ethena officially launched in February 2024. With a current USDe supply of approximately $6 billion, it's one of the fastest-growing applications in cryptocurrency history. Just one year after launch, USDe ranks behind only USDT and USDC, which have operated for nearly a decade.

Fastest dollar-denominated assets to reach $5 billion in history

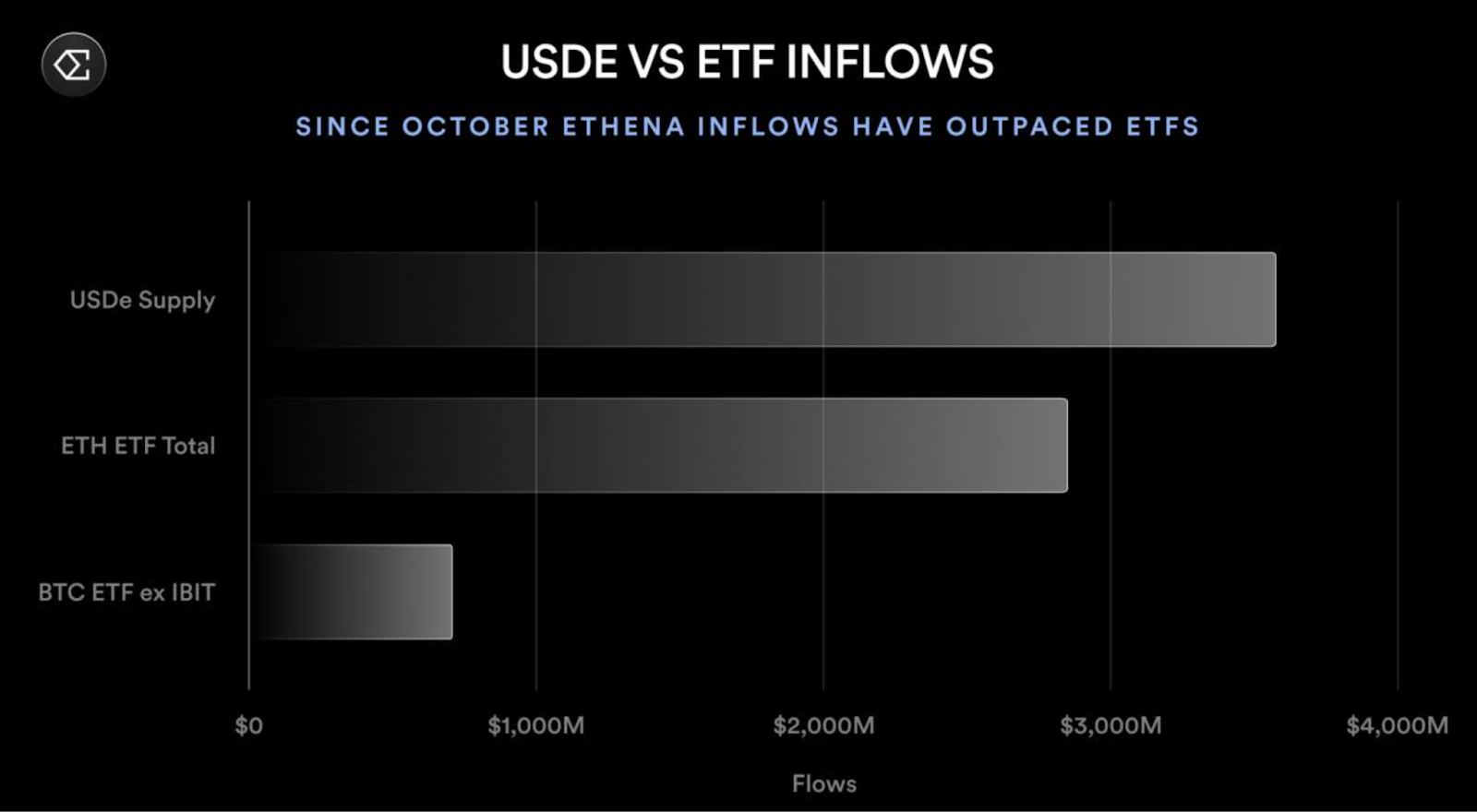

Excluding USDT and USDC, Ethena captured 85% of all on-chain dollar asset growth in 2024. In recent weeks, nominal dollar inflows into USDe have exceeded the total growth of even the most successful ETFs in history.

Since October 1st, USDe inflows have surpassed combined ETH and BTC (excluding IBIT) ETFs

In DeFi, Ethena has become a foundational component for other financial applications. Over 50% of Pendle’s total value locked (TVL) comes from Ethena; Sky derives around 25% of its revenue (over $100 million) from Ethena; approximately 30% of Morpho’s TVL stems from Ethena assets; Ethena’s listing on Aave was the fastest-growing asset in 2024, surpassing $1.2 billion in three weeks; most EVM-based perpetual exchanges now support USDe as collateral.

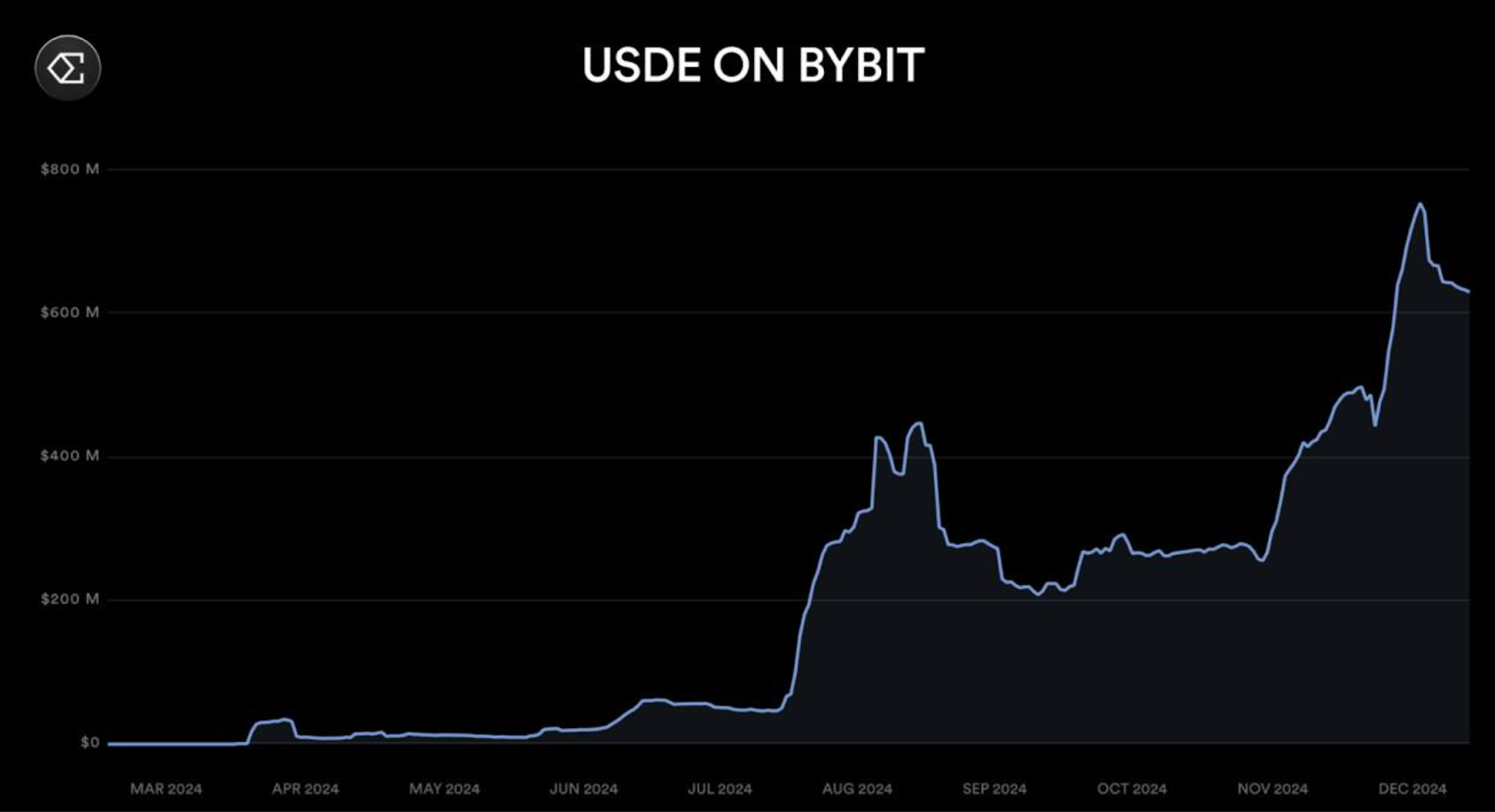

Ethena is also among the first on-chain products to enter the CeFi market, primarily as margin collateral for derivatives trading. USDe is now listed on roughly 60% of centralized exchange markets, with only two major exchanges remaining. Within weeks, USDe surpassed USDC in balance on Bybit—a strong signal of product-market fit.

USDe surpassed USDC balances on Bybit in under a month

USDtb was also launched last month, backed by BlackRock’s BUIDL treasury fund. For end users, the product functions like any standard stablecoin, but it's designed specifically to share yield with distribution partners such as centralized exchanges, incentivizing platform adoption. We will announce exchange integrations throughout January, enabling institutions to offer full-stack dollar products via Ethena’s infrastructure.

Finally, we're seeing decentralized and on-chain stablecoins begin adopting hybrid models using USDe and real-world assets (RWA) to back their offerings. Ethena now provides backend infrastructure, offering dual-product solutions—Sky, Frax, and Usual are already incorporating Ethena’s products into theirs.

Yet, these achievements pale in comparison to the transformation ahead.

Ethena’s next phase of growth will be driven by entry into traditional finance.

The infrastructure is ready, the regulatory path for the product in traditional finance is clear, and the opportunity dwarfs anything we’ve seen in crypto so far.

Entering Traditional Finance: Convergence and Mutual Benefit

Note: Target distribution platforms listed above are for reference only; not all institutions are current partners

The fixed income market is the world’s largest liquid investment category, exceeding $190 trillion in size. Most asset managers, sovereign wealth funds, pension funds, and insurance capital are invested in fixed income products. The entire cryptocurrency market cap is still smaller than Australia’s debt capital market—despite Australia representing less than 0.5% of the global population.

The most critical financial instrument globally for saving and preserving value is the U.S. dollar and its yield. It sounds simple, but demand for this product vastly exceeds the combined size of the entire crypto market—including Bitcoin.

This is why, after ETFs, dollar-denominated savings products are the logical next step for institutional players. The futures market is currently the only large enough segment in crypto capable of meeting their dollar needs.

Ethena is now ready to deliver this product.

sUSDe for Traditional Finance — iUSDe

Ethena will launch a new product, iUSDe, next month—aimed at bringing sUSDe to traditional finance through a regulated vehicle.

iUSDe is identical to sUSDe, except for an additional wrapper contract that imposes simple transfer restrictions at the token level, making it easier for traditional finance entities to hold and use.

This includes partnering to offer independent special-purpose vehicles (SPVs) managed by regulated investment managers, allowing investors to subscribe to shares in the SPV—enabling traditional institutions to participate without exposure to crypto-native systems.

We will announce our first batch of iUSDe distribution partners in traditional finance this month.

The focus for Q1 2025 will be collaborating with traditional finance distribution partners to bring iUSDe to their clients across the spectrum:

-

Asset management firms

-

Private equity funds

-

Exchange-traded products

-

Private investment trusts

-

Prime brokers

By bridging to traditional finance, institutions can access dollar funding at SOFR +100–200 bps spreads. Capital will flow into Ethena at unprecedented scale until the return spread of the sUSDe protocol narrows toward the risk-free rate.

In this scenario, Ethena acts as an interest rate arbitrage tool, driving capital and rate convergence between DeFi, CeFi, and traditional finance.

Traditional finance will price iUSDe relative to the risk-free rate, while USDe supply adjusts based on shifts in native crypto rates—acting as the balancing variable connecting traditional finance and internet finance.

Based on current market conditions, we estimate incremental capacity for over $10 billion in iUSDe from these capital pools.

Why iUSDe Appeals to Traditional Finance

What makes Ethena’s iUSDe unique:

-

It combines the only two scalable forms of native crypto yield that generate real returns at the billion-dollar level.

-

Its returns exhibit weak negative correlation with traditional financial rates.

-

Its underlying assets are held in custody and insurable by traditional financial institutions.

Integrating the only two scalable sources of native crypto yield into a single dollar-denominated product gives traditional asset allocators a simple way to capture and harvest excess returns from crypto via a single asset.

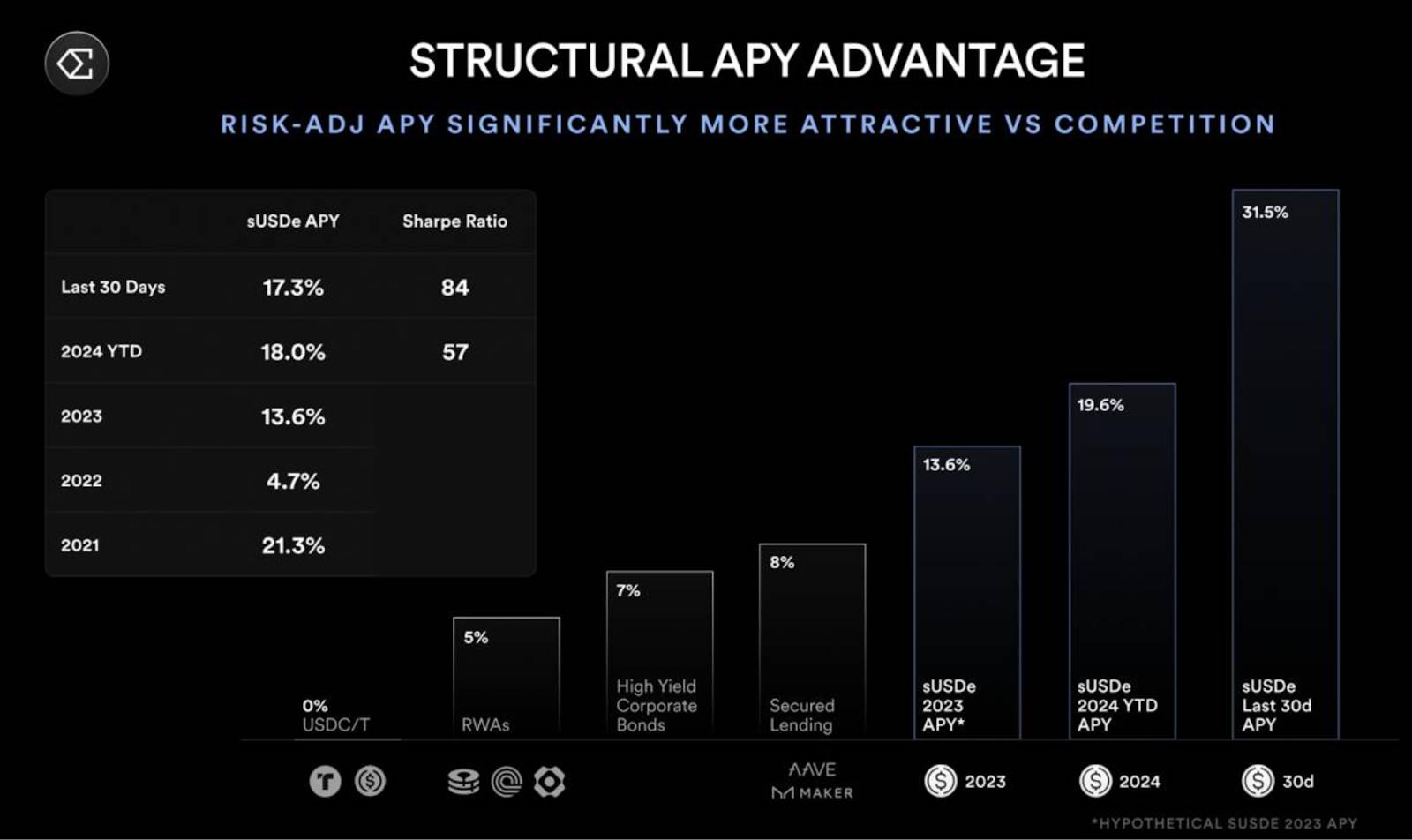

Highest risk-adjusted dollar returns in crypto

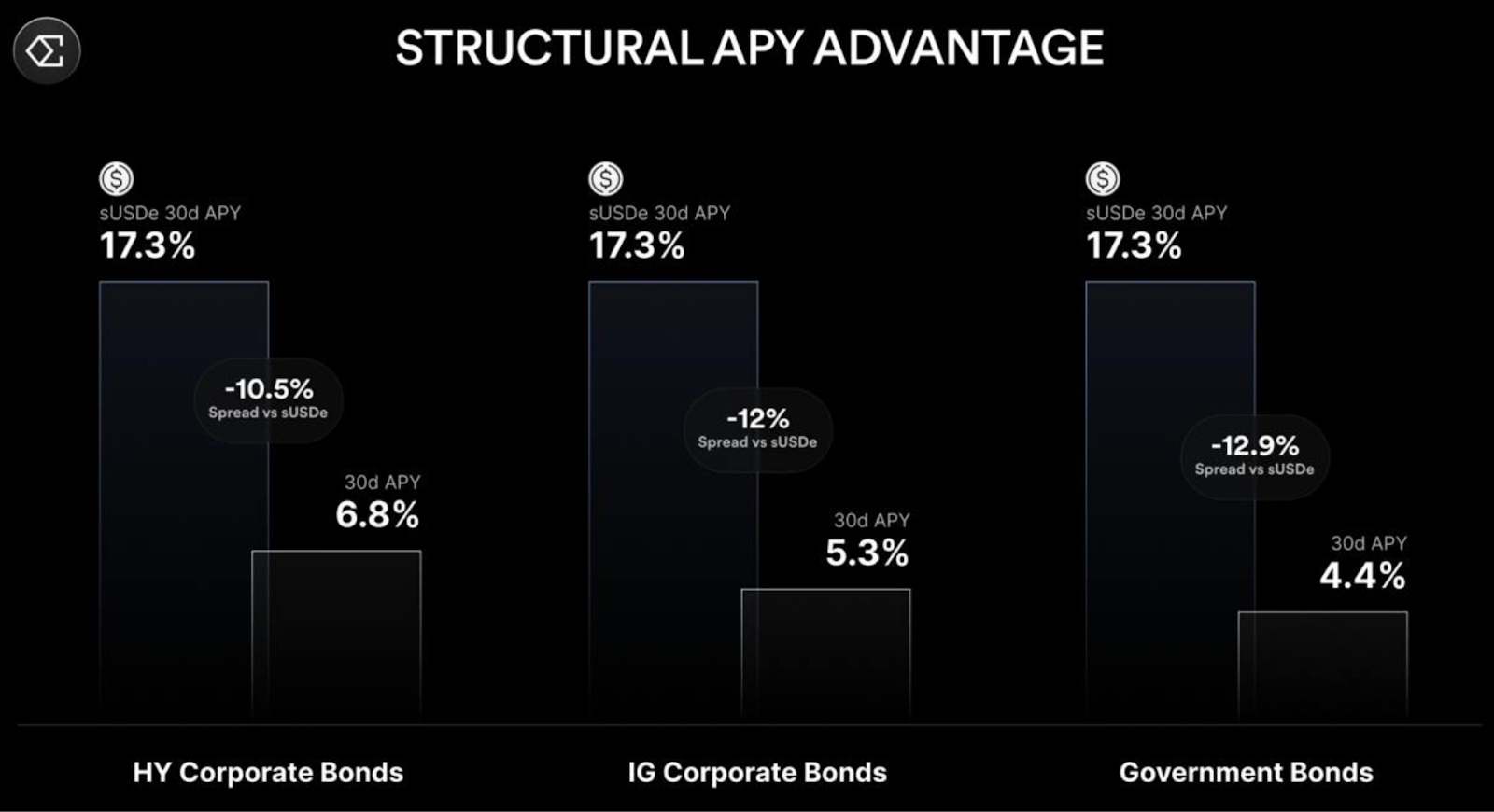

When compared against existing traditional fixed-income portfolios, unleveraged dollar returns from Ethena’s iUSDe reached ~20% annually last year—an unheard-of figure before. As rates decline, iUSDe becomes an increasingly attractive alternative.

sUSDe vs. traditional fixed income products

The basis trade in crypto remains underappreciated. It is undoubtedly the largest potential cashflow source in the entire sector. Since Ethena’s launch, the basis has grown over threefold. Crucially, it’s now large enough to attract serious attention from traditional finance as a viable opportunity.

Total open interest stands at $110 billion, with an annualized basis of ~20%, generating ~$10 billion in annual cashflow for Ethena—nearly ten times that of the entire ETH liquid staking market.

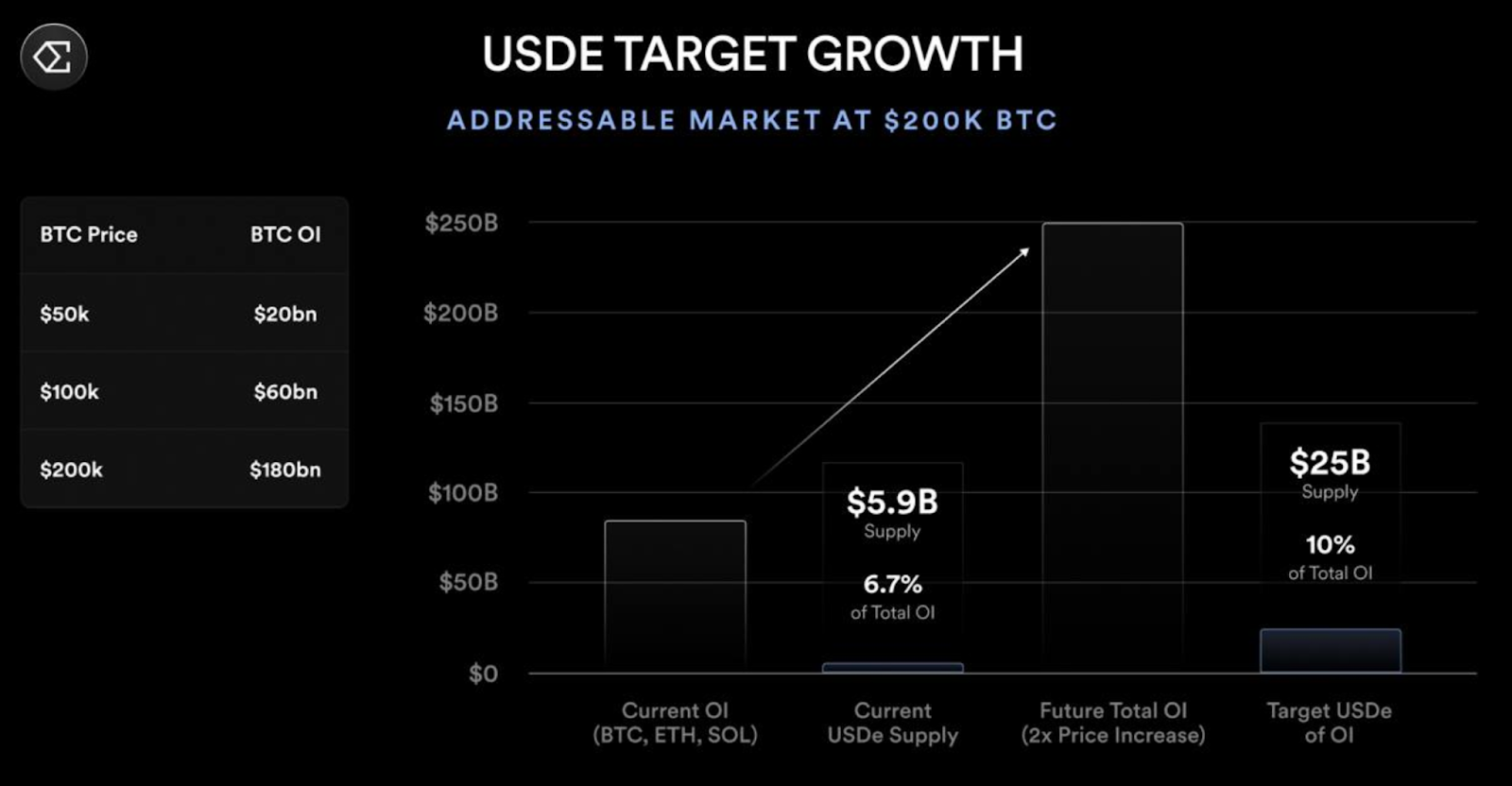

Ethena currently holds about 7% of open interest. At a $200,000 Bitcoin price, capturing just 10% of open interest would bring USDe supply to $25 billion.

The path forward is clear. Now it’s time to execute and deliver this product to traditional markets.

With growing Bitcoin open interest and market share, USDe targets a $25 billion supply

Macro Rate Tailwinds and Negative Correlation:

The most compelling feature of sUSDe for traditional finance is its negative correlation with real interest rates. Almost no other debt product in traditional finance offers this.

This is intuitive: as real rates continue to fall, speculative activity in crypto accelerates, and long-term demand for leverage increases—pushing up funding rates and ultimately boosting the yield harvested by Ethena.

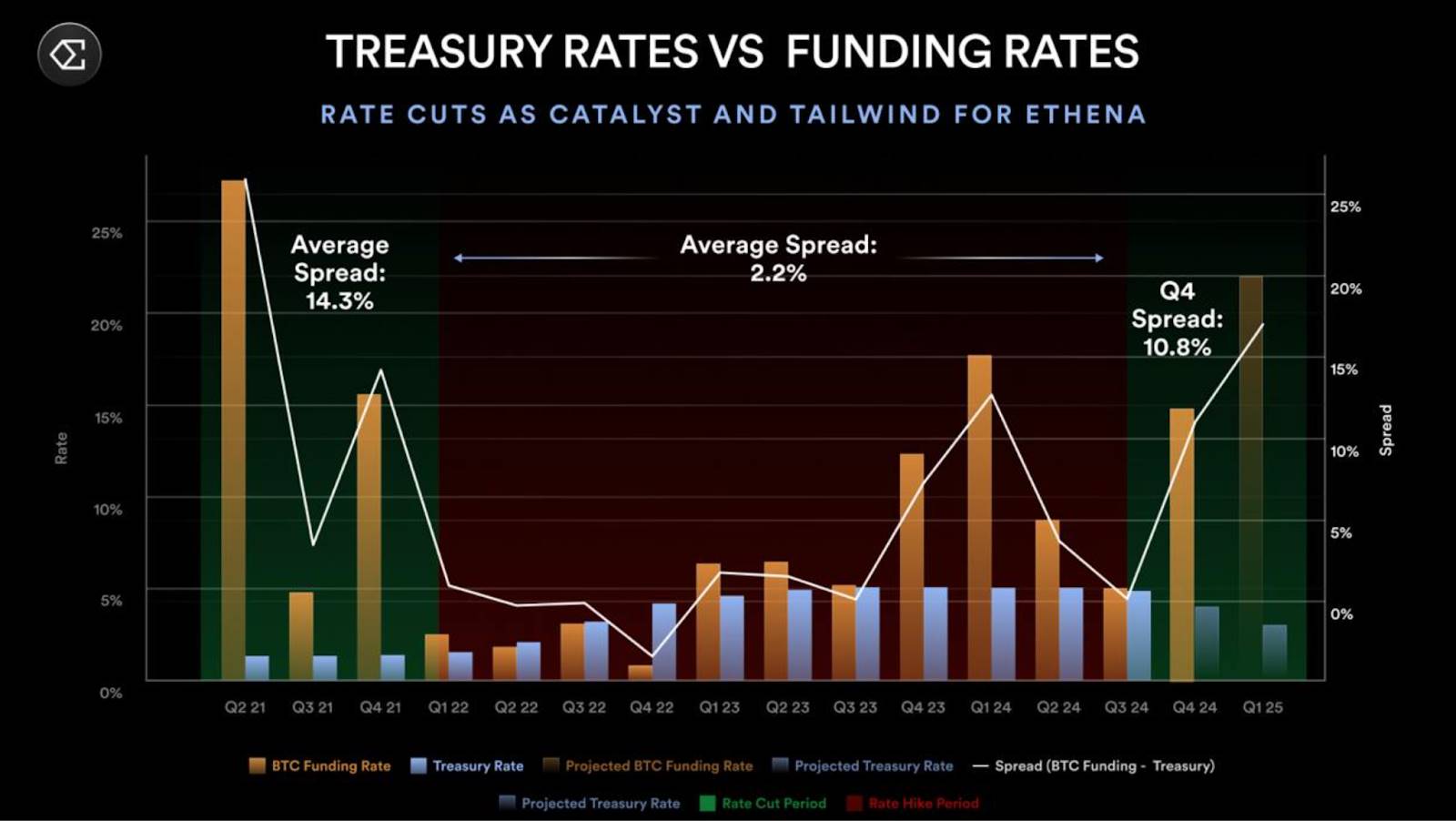

We observed this during the ZIRP era of 2020/21, when funding spreads exceeded 15%. This phenomenon began reappearing again in Q4 2024.

Rate cuts driving sUSDe growth

Recently, we've seen the exact response: a ~75 bps rate cut drove funding rates from ~8% to over 20%—a shift occurring over just a few months in the last quarter. With a looser monetary cycle expected next year, this trend is set to continue.

Compounding Effects of Rate Cuts

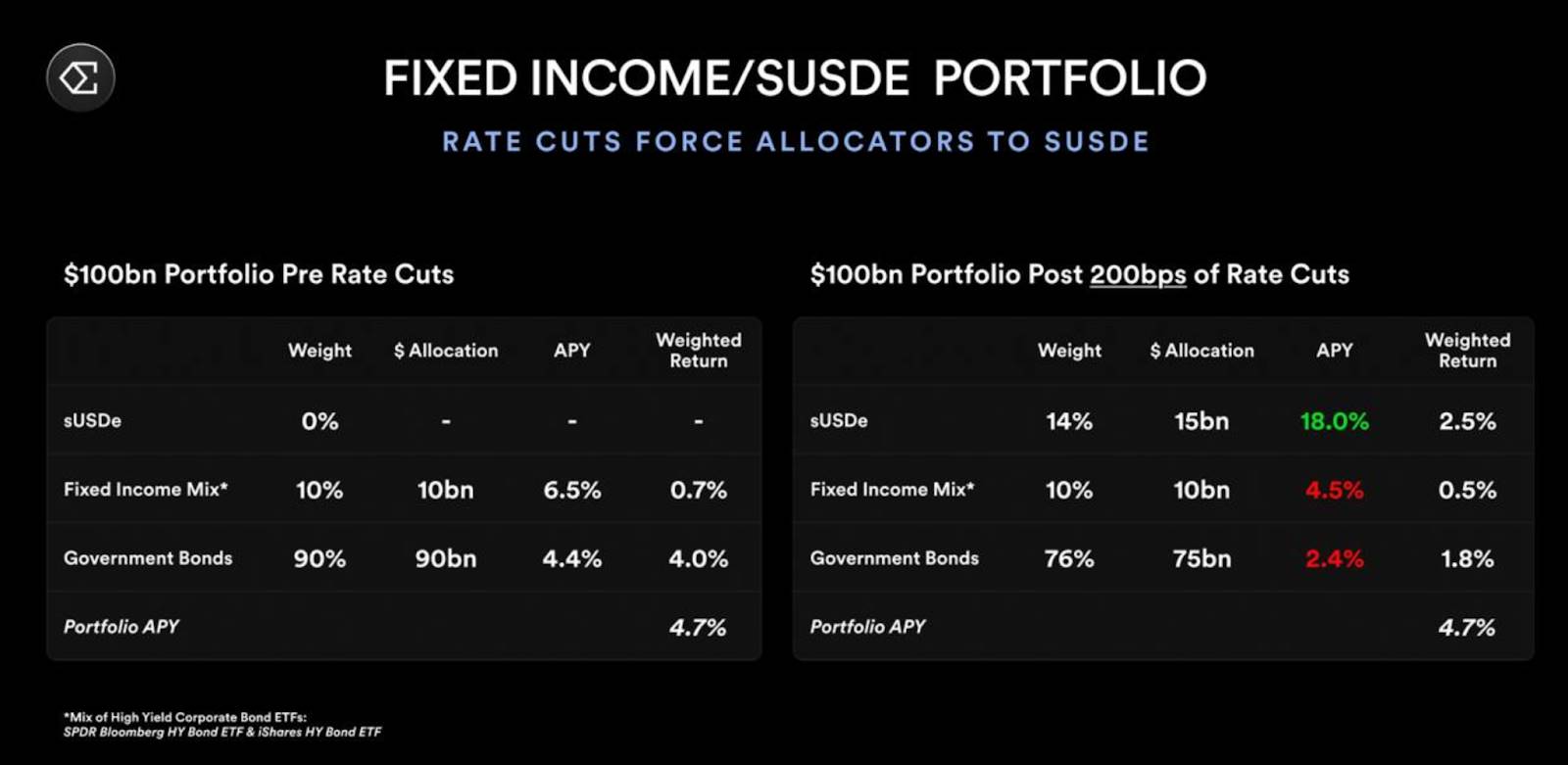

Rate cuts clearly produce compounding effects for Ethena’s growth and fundamentals. Lower rates not only expand stablecoin demand but also make Ethena more attractive on a risk-adjusted basis as RWA benchmark yields fall—offsetting declining real yields in traditional fixed income.

Simple Example:

For a $100 billion fixed income portfolio, a 200 bps decline in rates would require adding ~$15 billion in sUSDe to maintain the same blended portfolio return.

Illustrative impact of sUSDe on a $100 billion fixed income portfolio

A superior risk-adjusted dollar return powered by native crypto yield is the type of product capable of redirecting billions from legacy finance to internet-native systems.

Ethena will be the bridge for this shift.

This transition will happen in Q1 2025.

The Future of the Crypto Dollar Landscape:

Current crypto dollar landscape

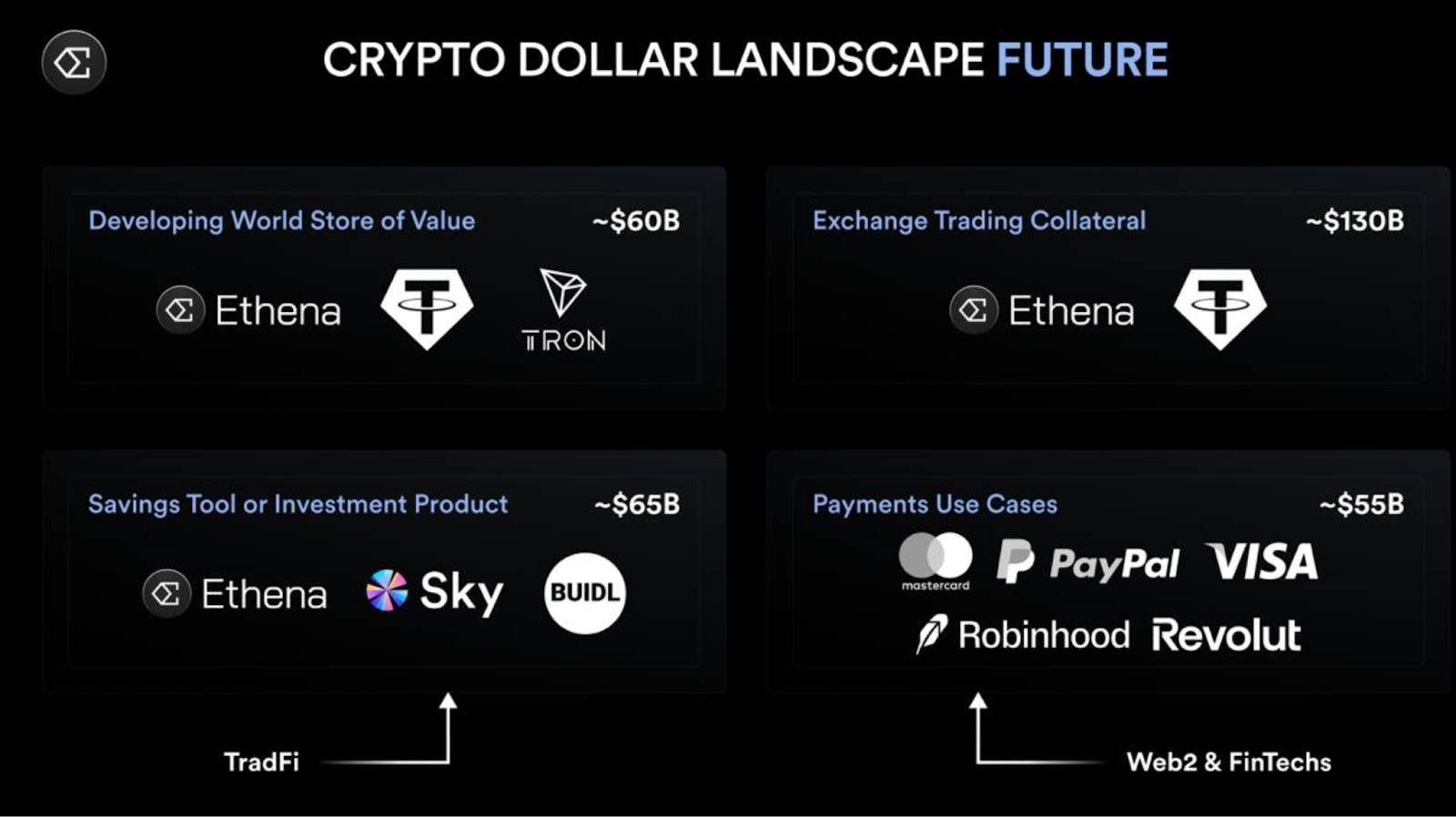

The present and future of crypto dollars will look vastly different.

Today, stablecoin use cases fall into roughly four categories:

-

Trading and collateral: Dominated by Tether, with USDT as the quote currency for most spot and perpetual pairs (~$125B market). Ethena has already surpassed USDC as derivative collateral on the second-largest exchange.

-

Store of value in emerging markets: Providing dollar access to individuals outside the U.S. banking system, dominated by Tether on Tron (~$60B market).

-

Savings or investment vehicles: Currently led by Ethena and Sky, with minimal participation from traditional finance (~$15B market).

-

Payments: Nearly non-existent today; PYUSD and USDC show some presence but lack meaningful integration with legacy payment systems (<$5B market).

In summary, Tether dominates the two largest current use cases: trading and store of value in developing economies.

Future crypto dollar landscape

However, I believe the landscape will dramatically shift with the entry of two new players:

-

Traditional finance entering the savings/investment use case

-

Fintech and Web2 companies entering the payments use case

While these two segments are currently the smallest, they offer the greatest growth potential.

Although Ethena has achieved product-market fit in the two most popular use cases today, I believe the entry of traditional finance into savings and fintech/Web2 into payments will bring over $50 billion in net new dollar inflows to the market within the next two years.

sUSDe will be the primary beneficiary of the former.

As for the latter, we plan to address the payments and savings use case by building dedicated apps within Telegram and the TON ecosystem—not by directly competing in the payments company space.

A Product for One Billion Users:

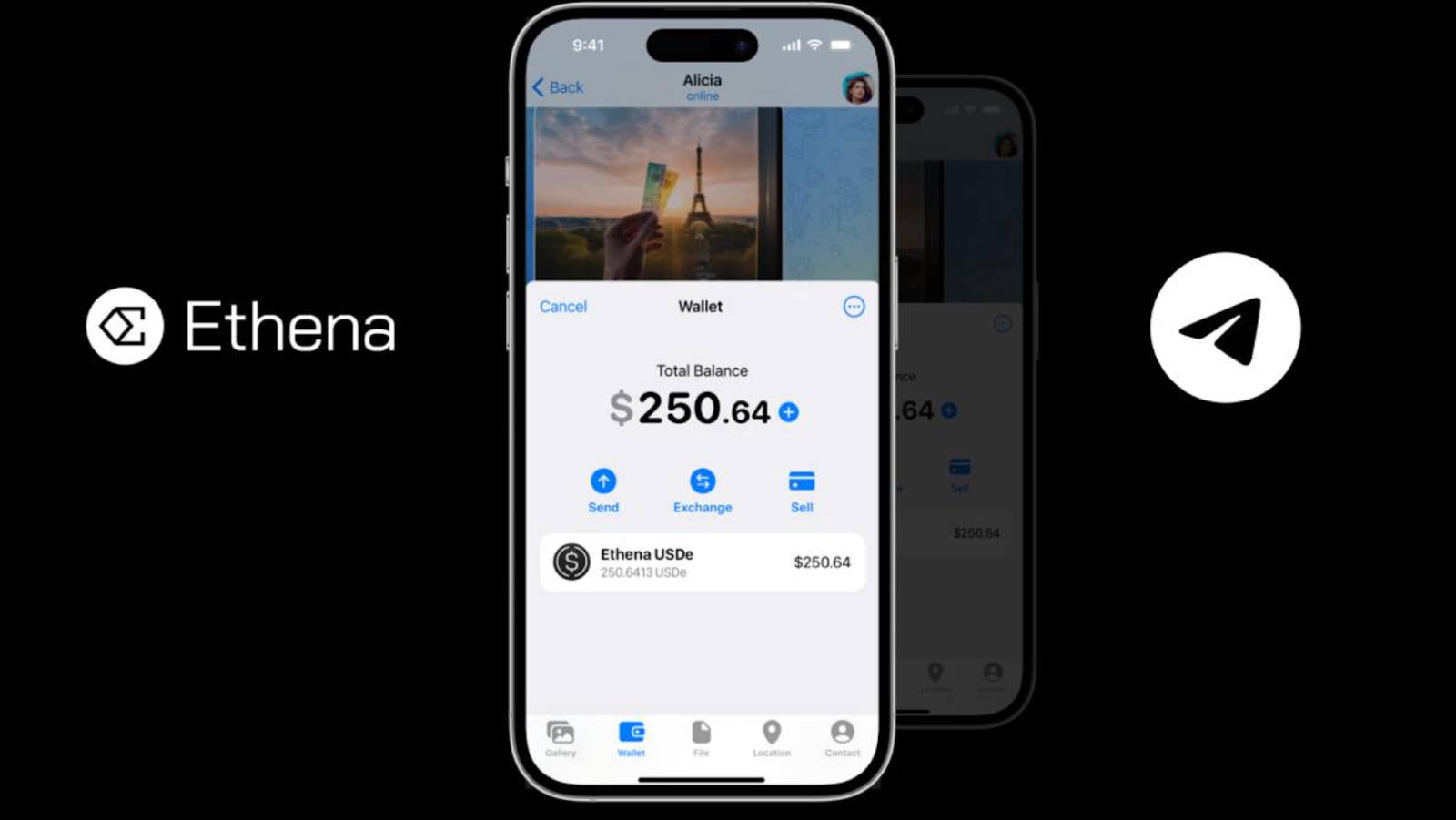

sUSDe application within Telegram

In 2025, we’ll launch a dedicated in-app sUSDe experience on Telegram, allowing users to transfer, spend, and save in a mobile digital banking-like interface.

Payments will integrate directly with Apple Pay, enabling seamless switching between earning yield on sUSDe and direct mobile payments from the phone.

Yield-bearing dollars are the world’s most important savings and wealth preservation asset—and I believe the only crypto product besides Bitcoin capable of reaching one billion people.

With access to Telegram’s 900+ million users, we have a distribution platform to bring this product to the world.

Our shared goal is to provide one billion people with a payments and savings product as easy to use as sending a message.

Ethena Network Ecosystem:

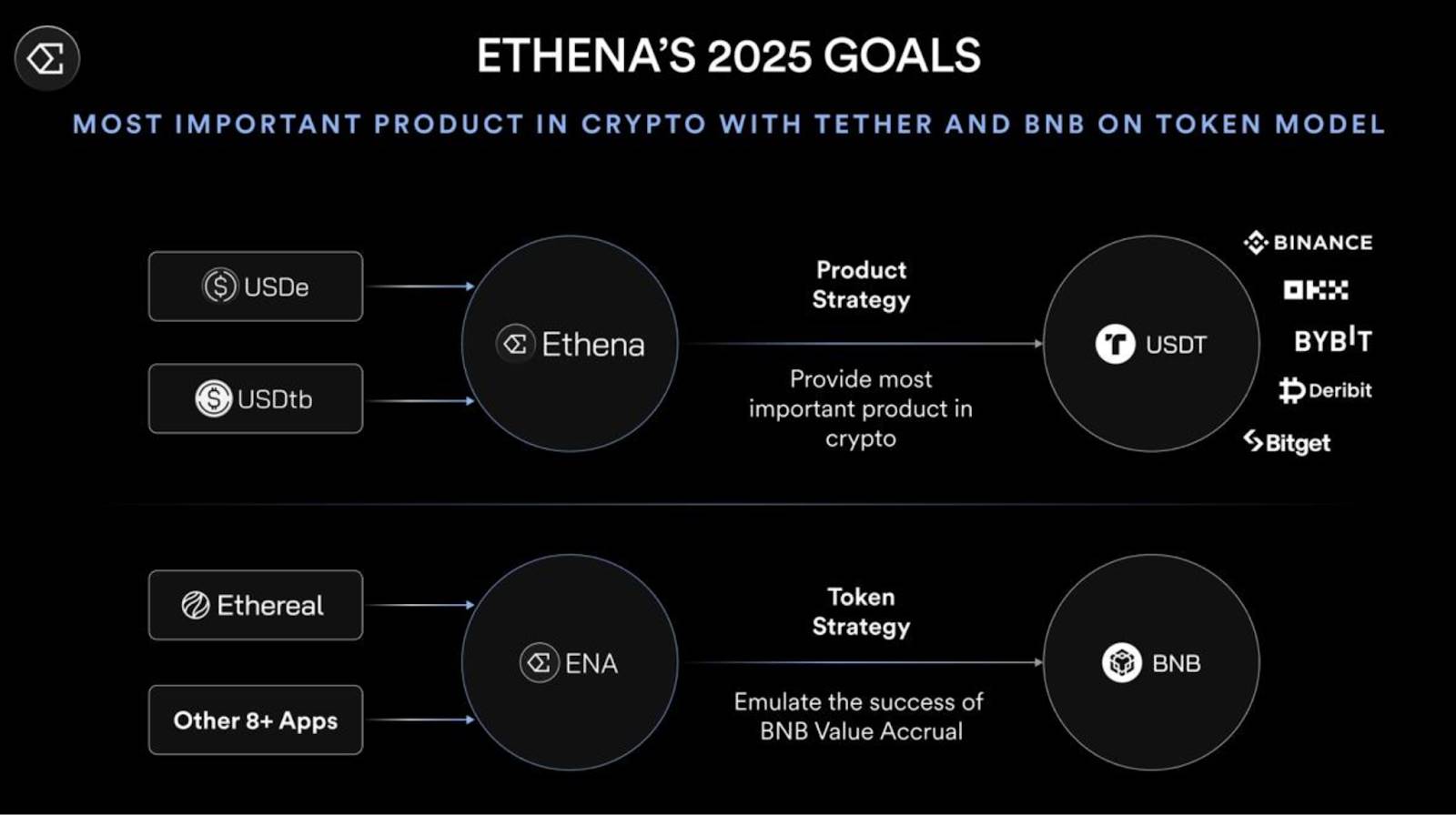

Ethena’s core product goal is simple: alongside Tether, make USDe and USDtb the most essential products in crypto.

Product and token strategy tightly integrated through ecosystem applications

Beyond these core products, Ethena will continue evolving from a single-asset issuer into a platform empowering top developers to innovate in on-chain finance.

As part of building an sUSDe-based ecosystem, sENA is designed to accrue value through a BNB-like token model, where ecosystem applications reserve a portion of their token supply to airdrop to sENA holders.

Dollars will remain the backbone of on-chain capital flows—not just for settlement and payments, but across all core DeFi primitives: trading, lending, derivatives, and leverage.

Every dollar-related DeFi protocol today can be rebuilt around Ethena, achieving better economic outcomes by default.

sUSDe unlocks new possibilities in this cycle—fixed-rate lending, leveraged strategies in money markets, and reward-bearing derivative collateral. Yet the full scope of what can be built on sUSDe remains to be seen.

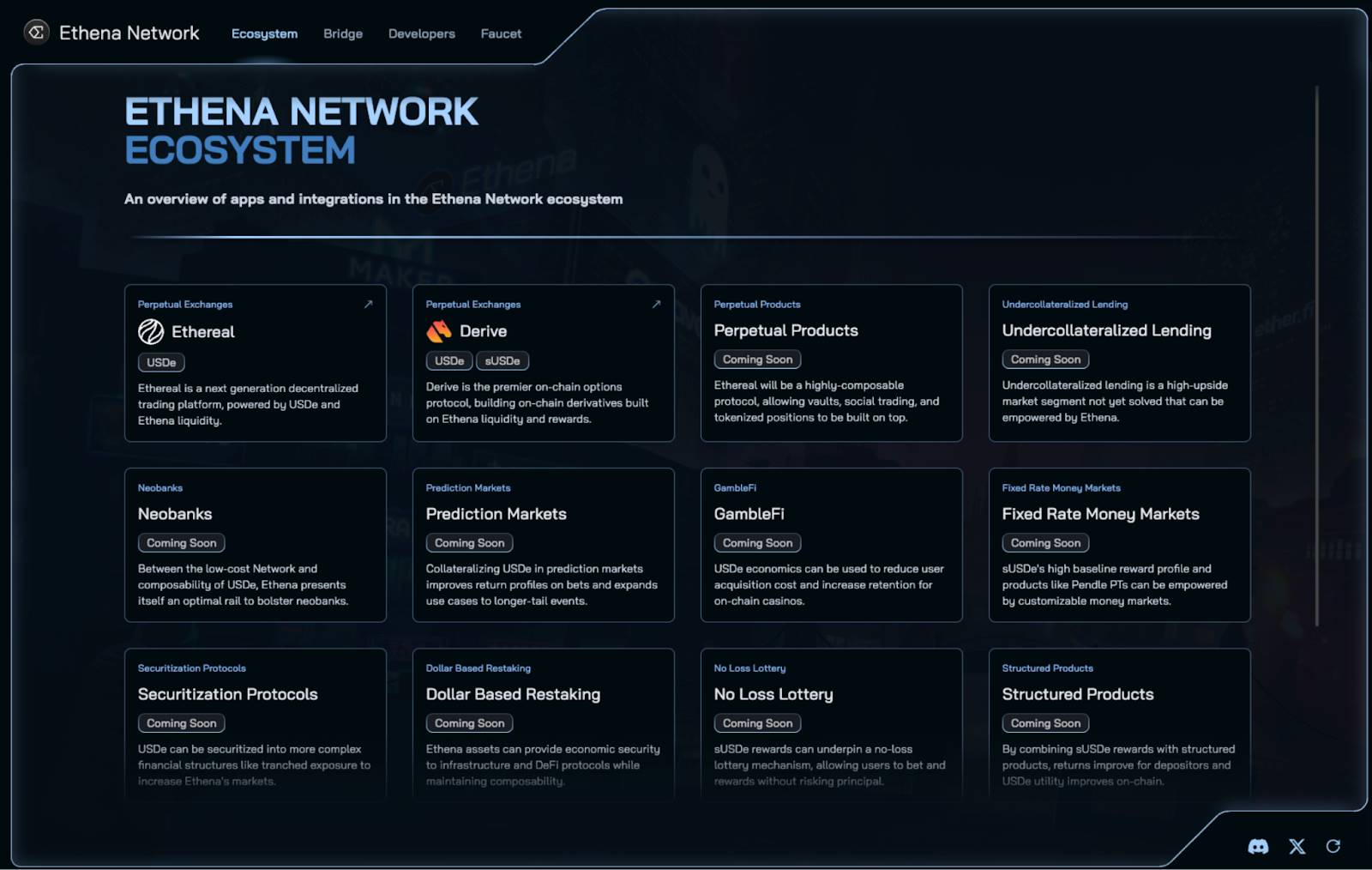

Ethena Network is our initiative to directly support innovative protocols building on Ethena’s sUSDe, aligning success through the ENA token.

Two announced applications:

-

Ethereal: A perpetual and spot exchange on a dedicated app chain, with order books fully denominated in sUSDe and native rewards. Ethena will provide liquidity and hedging support.

-

Derive: The largest on-chain options and structured products protocol, with sUSDe as the core collateral asset.

Ethereal will open its testnet next month, and Derive plans to launch its token in the coming two weeks.

These are just the first examples of a broader DeFi ecosystem built on sUSDe, with more applications launching in Q1 2025.

Full chain details will be released alongside Ethereal’s mainnet launch in Q1.

Ethena Network applications

Thank you again for your support in 2024. Without our users and those who believed in our vision from the start, Ethena would be nothing.

2024 was the year we launched our first real product—we laid the foundation and positioned ourselves to meet macroeconomic tailwinds.

In 2025, we will disrupt the financial system at a scale far beyond what we’ve seen so far.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News