Dragonfly Managing Partner's 2025 Predictions: The AI Agent craze will continue, and stablecoin usage will experience explosive growth

TechFlow Selected TechFlow Selected

Dragonfly Managing Partner's 2025 Predictions: The AI Agent craze will continue, and stablecoin usage will experience explosive growth

In the future, truly autonomous agents might use cryptocurrency to pay each other.

Author: Haseeb >|<

Translation: TechFlow

These predictions will either make me look like a prophet or appear utterly clueless—but one thing is certain: my views are likely to upset quite a few “bagholders.”

I’ve divided my outlook into six parts: L1s and L2s, token distributions, stablecoins, regulation, “AI Agents,” and the intersection of crypto and AI.

Estimated reading time: ~9 minutes.

The Future of L1s and L2s

The line between L1s and L2s is blurring. Users no longer care about the distinction (if they ever did). Today’s blockchain landscape—comprising both L1s and L2s—is overcrowded, and consolidation is inevitable. The key determinant won’t be technical superiority, but rather unique market positioning and effective go-to-market (GTM) strategies that build user stickiness.

Despite strong momentum from SVM and Move-based chains, EVM’s market share will continue growing in 2025—driven by projects like @base, @monad_xyz, and @berachain. This growth won’t stem from compatibility alone, but from EVM and Solidity’s vast corpus of training data. In 2025, large language models (LLMs) will dominate application code generation, and EVM’s extensive library of battle-tested smart contracts will become a decisive advantage.

Solana’s low-latency performance will push more blockchains to optimize for speed. The industry will shift from competing on “transactions per second (TPS)” to competing on “latency.” Infrastructure like @doublezero and ultra-low-latency L2s (e.g., @megaeth_labs) will raise user expectations for Web2-like responsiveness. We’ll see rising trends in optimistic UIs, pre-confirmations, intent-based architectures, email-based signups, embedded browser wallets, and progressive security. Special thanks to @privy for pioneering many of these innovations.

@HyperliquidX has already demonstrated that app-specific chains are viable—especially when prioritizing user experience and seamless cross-chain interoperability. More projects will follow this model, while the idea of “one chain to rule them all” is now obsolete.

New Trends in Token Distribution

The era of massive airdrops via points programs is over. Two primary token distribution models will emerge:

-

Projects with clear core metrics (e.g., exchanges or lending protocols) will distribute tokens entirely based on points. They won’t mind being “farmed” or “gamed,” because token distribution functions as a rebate or discount mechanism tied to real usage. In this sense, those farming the airdrop are effectively genuine users.

-

Projects without clear core metrics (e.g., L1s and L2s) will increasingly turn to crowdfunding. Small airdrops may reward social contributions, but most tokens will be distributed through public sales. Vanity-driven airdrops are outdated—they don’t reach real users, but instead enrich professional airdrop farmers.

Additionally, memecoin market share will gradually be overtaken by “AI Agent”-themed tokens—a shift from “financial nihilism” to “financial over-optimism.”

The Stablecoin Explosion

Stablecoin adoption will explode in 2025, particularly among small and medium businesses (SMBs). Their use cases will extend beyond trading and speculation, with more companies using on-chain USD for instant settlements.

Banks are taking note: we’ll likely see a bank announce its own stablecoin by end of 2025 to avoid falling behind. However, under a Lutnick-led Commerce Department, Tether will retain its dominant market position.

Meanwhile, @ethena_labs is poised to attract significant capital, especially as Treasury yields decline over the next year. As opportunity costs fall, basis trade returns become increasingly attractive.

Regulation

In 2025, the U.S. is expected to pass stablecoin legislation, while broader market infrastructure reforms (i.e., FIT21) may be delayed. Stablecoin adoption will accelerate rapidly, but Wall Street’s integration of crypto, asset tokenization, and traditional finance (TradFi) progress could lag.

Under a Trump administration, Fortune 100 companies may aggressively roll out consumer-facing crypto services, while tech firms and startups exhibit higher risk tolerance. Trump’s inauguration could usher in a brief “regulatory vacuum”—a period of unclear rules and enforcement priorities—leading to a more permissive environment for crypto integration. During this window, we’re likely to see widespread adoption of crypto within Web2 platforms.

AI Agents

(This section is longer because my views may be controversial—please bear with me!)

The “AI Agent” hype will dominate 2025, but eventually fade. This isn’t the true long-term disruption from AI—it’s gaining attention in crypto Twitter (CT) due to its social nature.

Current “AI Agents” aren’t truly autonomous agents. They’re chatbots with attached memecoins, capable of little beyond posting on Twitter. Most are “Wizard of Oz” systems—humans operate behind the scenes to prevent failures. This won’t change soon; agent technology remains flawed even for Fortune 100 enterprises, which haven’t deployed agents in production. These bots are easily manipulated, may generate harmful content damaging brand reputation, or be hacked to drain resources. A true autonomous AI? Look at @freysa_ai—if an AI hasn’t been compromised, it’s probably because humans are secretly pulling the strings.

Still, I believe the trend will accelerate. Chatbots can indeed replace many internet personalities: they never sleep, maintain consistent messaging, and are far cheaper than humans. Plus, most influencers aren’t particularly original. Real-time information gathering and dissemination can already be algorithmically automated (e.g., @aixbt_agent).

Right now, these chatbots feel novel because the concept itself is striking—like seeing an elephant paint. The first time, you don’t care how good the painting is—the act is astonishing. But after a thousand repetitions, novelty wears off. That’s what happens when chatbot tech plateaus.

Take aixbt: it’s already great at aggregating project data. Next year, with next-gen agents, it might reduce hallucinations, offer deeper analysis, and generate more insightful takes. But for most users, these improvements may not feel dramatically different from today.

I expect this excitement and market enthusiasm to last throughout 2025—crypto tends to sustain interest in new trends longer than other industries. But by 2026, I foresee a turning point: chatbots become so common that users grow tired of them. Sentiment may reverse. When people see beloved human KOLs losing livelihoods to bots, a form of “class consciousness” could emerge. Users may begin favoring human creators—even if their content is less consistent or polished.

To adapt, future chatbots may conceal their AI identity, pretending to be human to capture attention. Instead of monetizing via memecoins, they might adopt human-like revenue models: sponsorships, affiliate links, and promoting their own tokens. Accusations of KOLs being bots could become common—and AI identity scandals might erupt. This space could get very messy, very weird.

Yet there’s a darker undercurrent. LLMs excel at text, but remain immature elsewhere. In crypto, the two easiest ways to monetize text skills are becoming an influencer—or a scammer. As tech advances, we may see an explosion of autonomous scam bots. Much like ransomware and cryptojacking post-2017, this could become a serious societal issue.

While chatbots may dominate 2025, AI’s long-term disruption won’t be social.

Nor will it be in trading. AI won’t give everyone a personal “trading agent” or mini hedge fund. AI does augment individual capability—but proportionally to capital, data, and infrastructure. Thus, we should expect AI to further empower large trading firms, which already possess superior resources. In short: big players will get better at making money. Moreover, AI will narrow the tech gap between firms, as all can access “cloud-based advanced quant tools.”

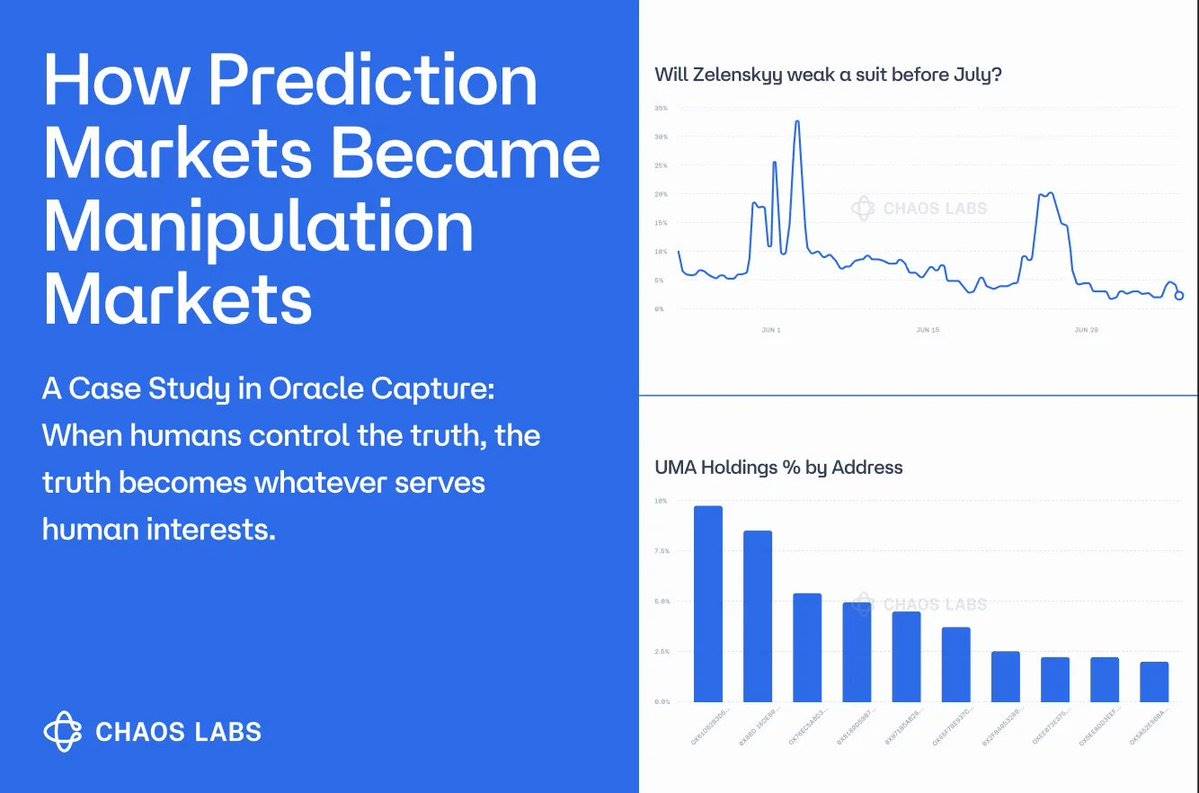

Over time, AI will make markets hyper-efficient—even niche ones. This leaves ordinary traders with almost no edge, even with custom AI assistants. The value of original research will plummet. Still, increased competition and liquidity could benefit average users—more opportunities, livelier markets. (For example, @Polymarket might achieve deep liquidity across all domains!)

If the future isn’t chatbots or trading bots, then what? Here’s my core thesis—rarely discussed today: the truly disruptive AI Agents will emerge in software engineering.

Why does this matter? Ask yourself: what’s our industry’s most critical input? What expensive bottleneck limits the creation of more apps, wallets, and better infrastructure? The answer is software. If AI Agents drastically lower software development costs, they’ll reshape the entire industry.

In the post-AI era, seed rounds may no longer require millions. For $10K in AI cloud costs, you could launch an app. Self-funded projects like Hyperliquid and Jupiter will shift from rare exceptions to the norm. On-chain application development and experimentation will explode. For a software-driven industry, this cost collapse will trigger an innovation wave across blockchain.

The impact on security will also be profound. AI-powered static analysis and monitoring tools will become ubiquitous, democratizing security. These AIs will be optimized for EVM/Solidity or Rust, trained on vast databases of audits and attack patterns, and improved via reinforcement learning (RL) in simulated adversarial blockchain environments. I’m increasingly convinced that, in security, AI tools will ultimately favor defenders over attackers. AIs will continuously “red-team” smart contracts, while others focus on hardening code, formally verifying properties, and improving incident response and patching.

Meanwhile, you can keep trading AI-themed memecoins—but the real agents will do far more than tweet and shill tokens. Their impact will run much deeper.

The Real Crypto x AI

So far, we’ve mostly discussed AI’s impact on crypto (the dominant direction), but crypto will also influence AI in return.

In the future, truly autonomous agents may transact with each other using cryptocurrency. Once stablecoin regulations loosen, this trend will intensify—even large AI-running corporations may prefer stablecoins over traditional bank accounts for inter-agent payments due to ease of use.

We’ll also see large-scale experiments around decentralized training and inference. Emerging projects like @exolabs, @NousResearch, and @PrimeIntellect will offer real alternatives to centralized training and proprietary models. @NEARProtocol is building a fully permissionless, trust-minimized AI stack from the ground up.

Another convergence point is user experience (UX). Post-AI wallets will undergo a revolution: an AI-powered wallet could automatically handle cross-chain bridging, optimize transaction paths, minimize fees, resolve interoperability issues or frontend bugs, and help users avoid obvious scams or rug pulls. Users won’t need to switch between wallets, change RPCs, or rebalance stablecoins—AI will do it all. This transformation may take until 2026 to mature, but once realized, how will it affect blockchain network effects? What happens when users no longer care—or even notice—which chain an app runs on?

This space is still early, but I’m excited for its potential and hope to see it explode soon. Long-term (say, mid-2026), I believe most of the market cap in the “AI x Crypto” space will concentrate here.

That’s all my predictions. I promised to finish this before hitting 100K followers—slightly late, but done before the new year!

Happy New Year, everyone! Hopefully by this time next year, I’ll have been replaced by an AI and officially “unemployed.”

Disclosure: These are my personal views, not those of Dragonfly. Dragonfly has invested in many of the projects mentioned. This is not financial advice—do your own research (DYOR). Whether I’m an AI? That’s for you to decide.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News