CPI Approaches, with Institutional Funds Providing Support—Can BTC Bulls Remain Unscathed?

TechFlow Selected TechFlow Selected

CPI Approaches, with Institutional Funds Providing Support—Can BTC Bulls Remain Unscathed?

Analysts such as Doctor Profit believe the recent sideways consolidation is just a brief pause, and Bitcoin's price is highly likely to突破 $125,000.

By BitpushNews

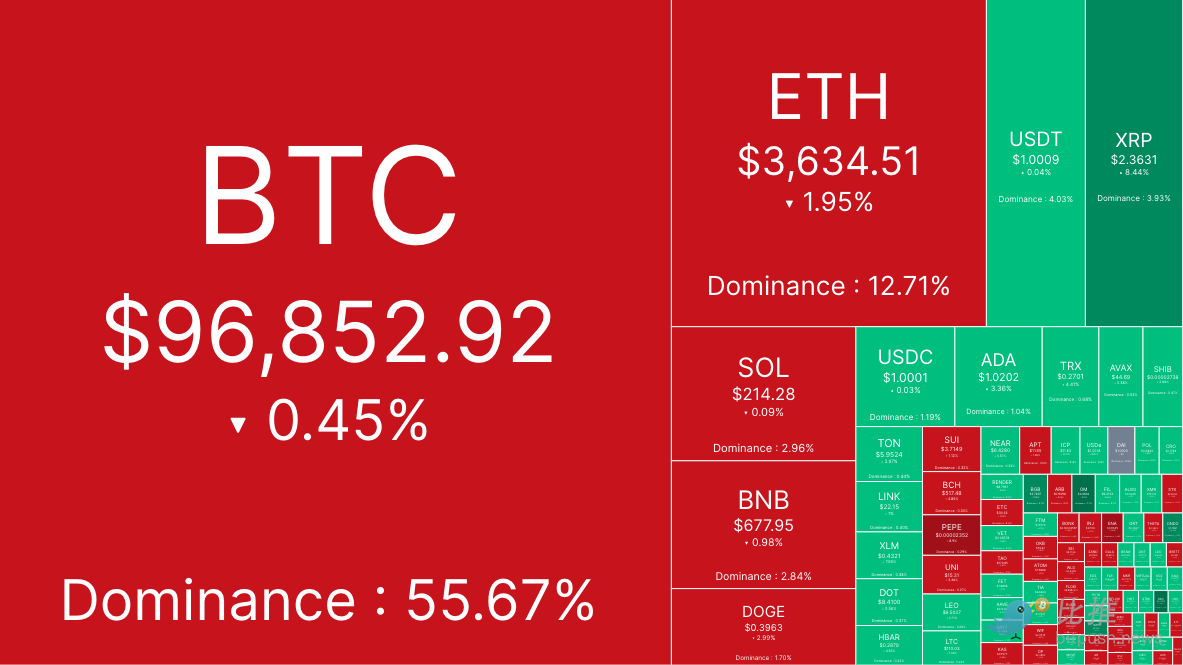

Crypto markets continued to adjust on Tuesday.

Data from Beiin shows BTC down 0.45% over the past 24 hours, holding above $96,000 at the time of writing. Most altcoins declined, though among established coins, XRP rose逆势, gaining nearly 8% in 24 hours.

Ruslan Lienkha, Market Head at Youholder, said the broader market pullback may reflect anticipation of inflation data due Wednesday. "Markets expect inflation to rise slightly. However, if CPI comes in higher than expected, it could intensify the ongoing correction across financial markets. In that case, the timing and likelihood of Fed rate cuts will become a key focus heading into the new year," he said.

"Market lacks confidence"

Skew, a well-known trader on X, commented: "Looks like bulls are exiting here / taking profits. Further confirming that $97,700–$98,000 is a critical level for buyers to break even. This typically suggests the market currently lacks confidence until price strengthens further."

More Crypto Online, a crypto technical analysis team, warned that after touching $94,000 the previous day, another local low might form. Their latest post on X stated: "There's still a chance for another low. After forming that low, the white wave d could retest $100,000 again."

Bitcoin ETFs remain unaffected by BTC price volatility

Data from Farside Investors shows daily net inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) consistently reaching millions of dollars, with total inflows nearing $500 million on December 9 alone.

Trading firm QCP Capital wrote in its latest market update on Telegram: "Bitcoin absorbed a $1.5 billion liquidation hit during long unwinding, plunging $3,000 before rebounding from the key $95,000 support level. Currently, the pair is consolidating around $97,000–$98,000, with altcoins following closely. However, spot BTC and ETH ETFs have been impressive, posting net inflows for eight consecutive days and eleven consecutive days respectively."

Where is the market headed next?

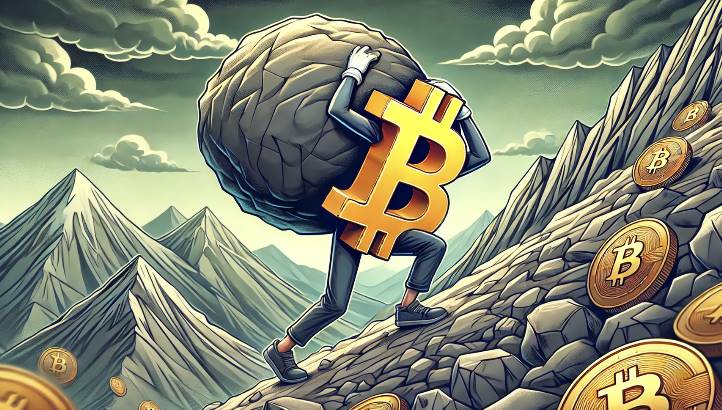

Current market sentiment suggests Bitcoin’s upward trajectory is far from over. Analysts like Doctor Profit believe the recent sideways consolidation is merely a brief pause, with Bitcoin likely to target levels between $125,000 and $135,000.

Historical data indicates clear cycles in Bitcoin’s price movements. In previous major bull runs, Bitcoin has repeatedly experienced 20%-30% corrections before strongly rebounding to reach new highs.

As for altcoins, Michaël van de Poppe believes they are about to emerge from their longest bear market. He thinks altcoins appear poised for a significant rally amid expectations of a weaker dollar and increased liquidity.

A chart published by Kaizen shows that if compared to December 2020, when altcoins dropped 30% before entering a three-month rebound phase with gains exceeding 400%, the recent 25% decline in altcoins could be a precursor to explosive growth if history repeats itself.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News