Crypto Market Dips Again: Can NFP, CPI, and Fed Rate Cuts Bring a Turnaround?

TechFlow Selected TechFlow Selected

Crypto Market Dips Again: Can NFP, CPI, and Fed Rate Cuts Bring a Turnaround?

It will still take time for market liquidity to recover.

By 1912212.eth, Foresight News

The crypto market remains dull. BTC fell again today from around $58,000, dropping as low as $55,606. ETH also declined from near $2,500 to around $2,300. Altcoins broadly followed the downtrend amid weak overall market performance. According to CoinGlass data, total liquidations across the market reached $196 million in the past 24 hours, with $172 million coming from long positions.

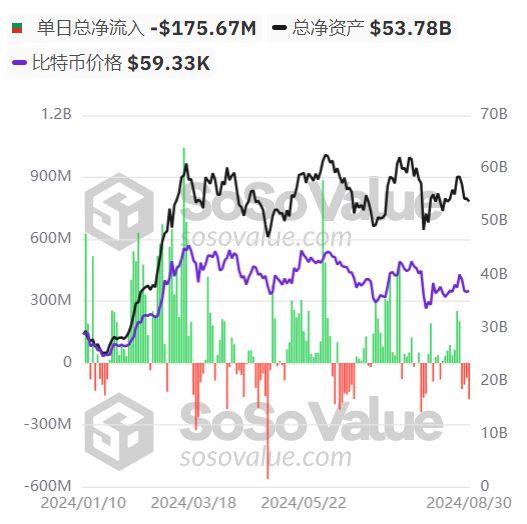

BTC spot ETFs have also shown poor performance, remaining in net outflow territory since August 27, when they recorded a significant outflow of $127 million.

If you bought altcoins after last October and haven't sold, you've likely given back all gains. If you purchased altcoins after March this year and are still holding, you're probably facing deep losses. The crypto market continues its gradual decline due to profit-taking and a lack of compelling narratives. Ultimately, market liquidity remains extremely tight.

With insufficient capital within the market, external funds may provide some relief. While crypto investors often risk overemphasizing macroeconomic factors at the expense of project-specific fundamentals, it's undeniable that macro conditions continue to significantly influence crypto price movements. A key example is the notable volatility in BTC and the broader market surrounding the release of non-farm payroll data, CPI figures, and Federal Reserve announcements.

Can these upcoming macroeconomic data releases spark a turnaround in the currently sluggish market?

Non-Farm Payrolls Data

On September 6, the final non-farm payroll report ahead of the Fed’s monthly meeting will be released. With the downward trend in inflation now confirmed, this employment data will undoubtedly be one of the most important indicators this week.

The July U.S. non-farm payrolls figure, released on August 2, came in at 114,000, below the expected 175,000. The weaker-than-expected number triggered widespread market concern, with some analysts warning of potential U.S. economic recession. This led to a week-long global market selloff, and as a risk asset, cryptocurrency was hit particularly hard.

BTC dropped for four consecutive days from around $65,000, briefly falling below $50,000 and reaching a low near $49,000, sparking significant panic across the market.

Recently, Swissquote analyst Ipek Ozkardeskaya noted in a report that if Friday’s U.S. non-farm payroll data exceeds expectations, the dollar could strengthen, dampening market expectations for the Fed to cut rates by at least 50 basis points this year.

According to Bloomberg surveys of economists, August job growth is projected between 100,000 and 208,000, with a median estimate of 163,000. The unemployment rate is expected to gradually decline to 4.2%. Morgan Stanley forecasts the August unemployment rate will drop to 4.2%, with non-farm payrolls rising to 185,000.

At a time when economic growth has become the sole focus of the market, these figures could significantly sway investor sentiment.

CPI Index

On September 11, another critical data point—the CPI index—will be released.

The U.S. July unadjusted YoY CPI, released on August 14, stood at 2.9%, marking the fourth consecutive monthly decline and the first time since March 2021 that it has returned to the "2 range," below the 3% market expectation. The core CPI, excluding food and energy, rose 3.2% YoY, also the fourth straight monthly decline and the lowest level since April 2021, in line with expectations.

This reading brought inflation closer to the Fed’s official target range, further reinforcing expectations for a rate cut in September.

Following the data release, BTC quickly surged to $61,800 before pulling back above $61,000. After briefly dipping near $57,700, it rallied strongly the following week to surpass $65,000.

Although significant progress has been made in fighting inflation over the past two to three years, risks remain. First, as major global central banks gradually enter easing cycles, the rebound in money supply growth poses upside inflationary pressure. Second, sticky components of inflation still carry upward risks. Third, geopolitical shocks could push up commodity prices.

Federal Reserve Meeting

On September 19, the Federal Reserve will officially announce its interest rate decision.

On August 23, Powell stated “the time has come” during the Jackson Hole Global Central Bank Symposium, sending the clearest signal yet of a September rate cut—an important turning point after two years of aggressive inflation fighting. Since July 2023, the Fed has maintained its benchmark rate at 5.25%-5.5%, the highest level in over two decades.

This decision will be influenced by the prior two data points. Currently, the market slightly favors a 25-basis-point cut, while a 50-basis-point cut is considered less likely.

Bond traders are pricing in approximately 100 basis points of rate cuts this year, implying a rate reduction at each Fed policy meeting from now through December, including potentially one large 50-basis-point cut.

Notably, a Fed rate cut does not necessarily trigger an immediate rally in crypto markets. When the Fed began its easing cycle in August 2019, BTC fell 4.89% that month and declined another 13.54% the following month, dropping from $12,000 to around $7,700, only beginning its upward trend after the March 2020 "Black Thursday" crash.

Summary

The crypto market remains in a dull phase. However, the coming weeks’ macroeconomic variables may significantly impact market liquidity. While recovery in market liquidity will take time, that turning point may not be far off.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News