Global tariff tensions eased, US CPI and PPI data below expectations, market uncertainty increases|Hotcoin Research

TechFlow Selected TechFlow Selected

Global tariff tensions eased, US CPI and PPI data below expectations, market uncertainty increases|Hotcoin Research

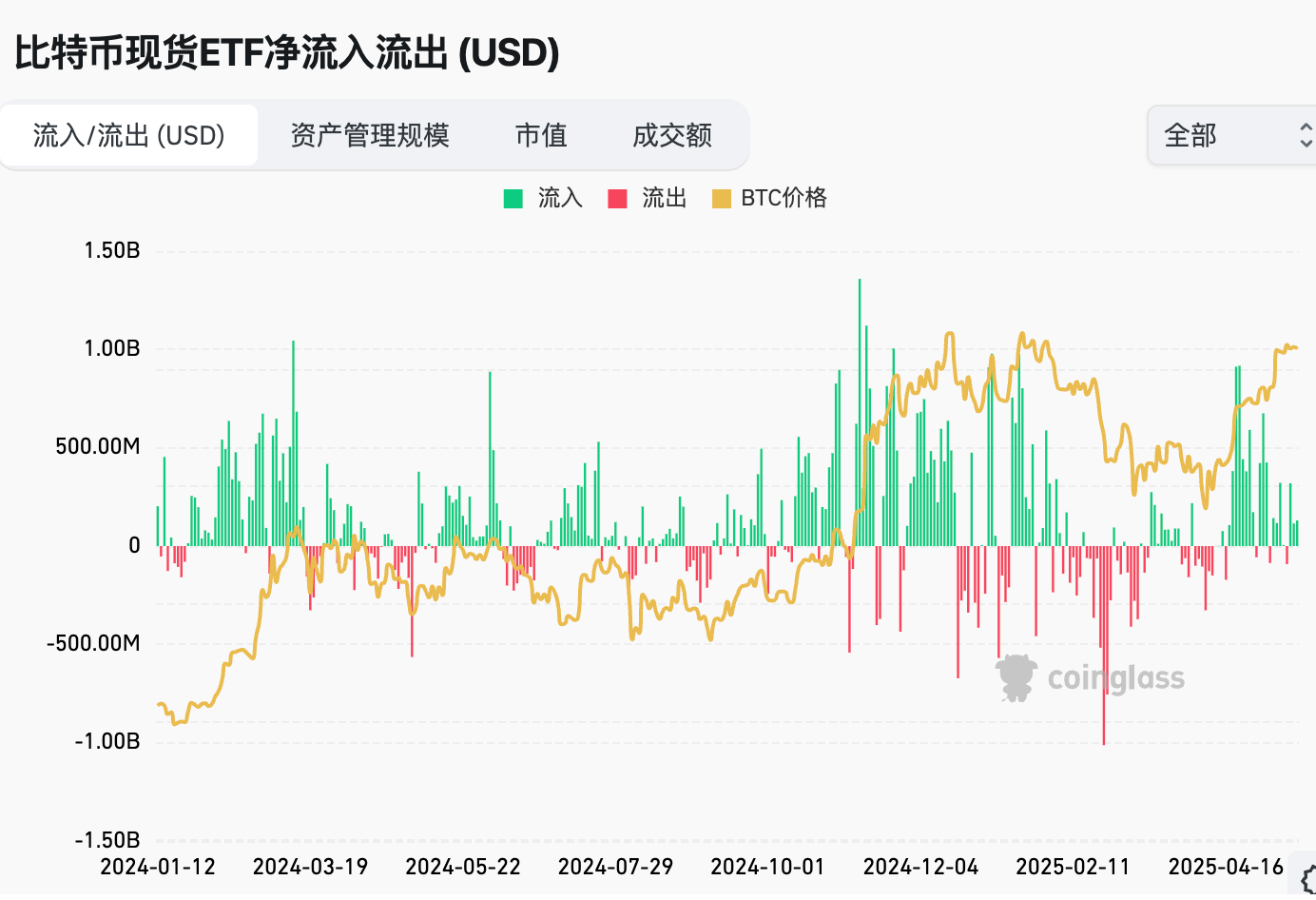

This week, stablecoins saw continued small-scale issuance, with large inflows into U.S. spot Bitcoin ETFs and small inflows into Ethereum ETFs.

Author: Hotcoin Research

Cryptocurrency Market Performance

The current total cryptocurrency market capitalization stands at $3.34 trillion, with BTC accounting for 61.55% ($2.06 trillion). The stablecoin market cap is $242.5 billion, up 0.12% over the past seven days, of which USDT accounts for 62.4%.

This week, BTC prices have been range-bound, currently trading at $103,628; ETH has shown an upward trend, currently at $2,599.

Among the top 200 projects on CoinMarketCap, a minority rose while most declined: WIF gained 44.8% over 7 days, RAY rose 19.4%, ETHFI surged 114.52%, and NXPC increased by 75.9%.

This week, net inflows into U.S. spot Bitcoin ETFs were $607.8 million; net inflows into U.S. spot Ethereum ETFs were $41.8 million.

The "Fear & Greed Index" on May 16 was 69 (lower than last week), reflecting a "greedy" sentiment throughout the week.

Market Outlook:

This week, stablecoins saw continued small-scale issuance, U.S. spot Bitcoin ETFs experienced significant inflows, and spot Ethereum ETFs saw modest inflows. Global trade tensions eased, and U.S. April CPI and PPI data came in below expectations. BTC has hovered around $103,000, with some altcoins showing slight gains. Notably, the new project Launchcoin surged 2,650% over seven days, indicating ongoing short-term profit opportunities. Investors may focus on Hotcoin's new coin rankings. Greed sentiment has slightly cooled compared to last week. The probability of a 25-basis-point rate cut by the Federal Reserve in June is only 6.7%, lower than last week, making a June cut unlikely—investors should now look toward July. Despite positive macroeconomic fundamentals, market uncertainty remains high without fresh liquidity. We remain bullish on the long-term outlook for 2025. However, summer months often bring liquidity shortages, so investors are advised to consider partial profit-taking at this stage.

Understanding the Present

Weekly Recap

-

On May 11, Defillama founder 0xngmi announced on X that a hacker had compromised one address within Lido’s oracle multisig, stealing 1.4 ETH before being detected. 0xngmi suggested placing small “canary” amounts in multisig wallets to serve as early warning systems for breaches;

-

On May 12, the White House announced that the U.S. reached a trade agreement with China in Geneva;

-

On May 13, S&P Dow Jones Indices announced that Coinbase (COIN.O) would be added to the S&P 500 index, replacing Discover Financial. Coinbase will become the first pure-play crypto company in the index, with its stock rising 9.5% in after-hours trading;

-

On May 13, market reports indicated that Trump-affiliated Truth Social denied rumors about launching a meme coin;

-

On May 13, SEC Chair Paul Atkins unveiled his vision for crypto regulation, signaling a more favorable stance toward digital assets;

-

On May 13, blockchain cloud services firm Nirvana Labs completed a $6 million seed extension round led by Jump Crypto and Crucible Capital, with participation from RW3 Ventures, Castle Island, and Hash3 VC;

-

On May 14, AI agent platform Virtuals Protocol announced on social media that its VIRTUAL staking feature is live. By locking VIRTUAL, users receive veVIRTUAL—the vote-escrowed version—representing long-term alignment, deeper protocol utility, and future governance rights;

-

On May 14, TheBlock reported that the U.S. SEC delayed its decision on BlackRock’s iShares Bitcoin Trust physical redemption mechanism, requesting public comment. The current cash redemption model requires custodians to sell BTC before returning cash to investors. Analysts noted that approval of physical redemptions would enhance ETF efficiency. Additionally, Grayscale’s Litecoin and Solana trust proposals were postponed, while 21Shares’ Dogecoin ETF entered the public comment phase;

-

On May 14, eToro, an online brokerage offering crypto and stock trading and a competitor to Robinhood, raised approximately $310 million in its U.S. IPO;

-

On May 14, the Ethereum Foundation announced the launch of its "Trillion Dollar" security initiative—a comprehensive ecosystem-wide plan to enhance Ethereum's security and support global adoption of on-chain systems. The plan consists of three parts: "Full-stack Security Mapping," "Targeted Focus Areas," and "Security Awareness Upgrade";

-

On May 15, CoinMarketCap officially launched its launchpad platform, CMC Launch, with the first project being Aster ($AST), a decentralized perpetual trading platform;

-

On May 15, U.S. lawmakers stated that Trump’s involvement in crypto complicates legislation, but the Stablecoin and Market Structure Act still has a chance to pass before August;

-

On May 16, Coinbase faced a dual blow during trading hours: an "SEC investigation" and a "user data breach" by hackers.

Macroeconomics

-

On May 13, the U.S. April unadjusted YoY CPI was 2.3%, below the expected 2.40% and prior 2.40%;

-

On May 15, the U.S. April PPI YoY was 2.4%, below the 2.5% forecast, with the previous figure revised from 2.70% to 3.4%. This marks the third consecutive monthly decline in PPI, reaching its lowest level since September last year;

-

On May 15, market reports indicated that the U.S. Securities and Exchange Commission decided to delay its decision on 21SHARES' spot Polkadot (DOT) ETF application;

-

On May 16, according to CoinPost, Japanese listed company Remixpoint announced the purchase of an additional 32.83 BTC, increasing its total holdings to 648.82 BTC, valued at approximately 9.91 billion JPY;

-

On May 16, according to CME's "Fed Watch": the probability of the Fed holding rates steady in June is 93.3%, while the chance of a 25-basis-point cut is 6.7%.

ETFs

Data shows that between May 12 and May 16, net inflows into U.S. spot Bitcoin ETFs totaled $607.8 million. As of May 16, GBTC (Grayscale) has seen cumulative outflows of $22.944 billion, currently holding $19.635 billion in assets, while IBIT (BlackRock) holds $65.435 billion. The total market cap of U.S. spot Bitcoin ETFs is $125.131 billion.

Net inflows into U.S. spot Ethereum ETFs: $41.8 million.

Looking Ahead

Upcoming Events

-

Bitcoin 2025 will take place in Las Vegas, USA, from May 27 to 29;

-

NFT NYC 2026 will be held in New York, USA, from June 23 to 25, 2025.

Project Updates

- DeFi Development approved a 1-for-7 stock split; shareholders will receive six additional shares on May 19, and if approved by Nasdaq, trading will resume under the adjusted structure on May 20.

Key Events

- On May 20, the Reserve Bank of Australia will announce its interest rate decision.

Token Unlocks

-

Pyth Network (PYTH) will unlock 2.13 billion tokens on May 19, worth approximately $399 million, representing 58.62% of circulating supply;

-

Pixels (PIXEL) will unlock 89.37 million tokens on May 19, worth about $4.94 million, or 1.79% of circulating supply;

-

Polyhedra (ZKJ) will unlock 15.5 million tokens on May 19, worth approximately $31.9 million, or 1.55% of circulating supply;

-

Pyth Network (PYTH) will unlock 2.83 billion tokens on May 20, worth about $472 million, or 28.33% of circulating supply;

-

Bittensor (TAO) will unlock 216,000 tokens on May 21, worth approximately $95.47 million, or 1.03% of circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We offer a three-pillar service framework of "trend analysis + value discovery + real-time monitoring," delivering deep industry trend analysis, multidimensional assessment of promising projects, and round-the-clock market volatility tracking. Through our bi-weekly strategy livestreams "Top Coins Selection" and daily news digest "Blockchain Today," we provide precise market interpretations and actionable strategies for investors at all levels. Leveraging cutting-edge data analytics models and extensive industry networks, we empower novice investors to build foundational knowledge and help institutional clients capture alpha, together seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News