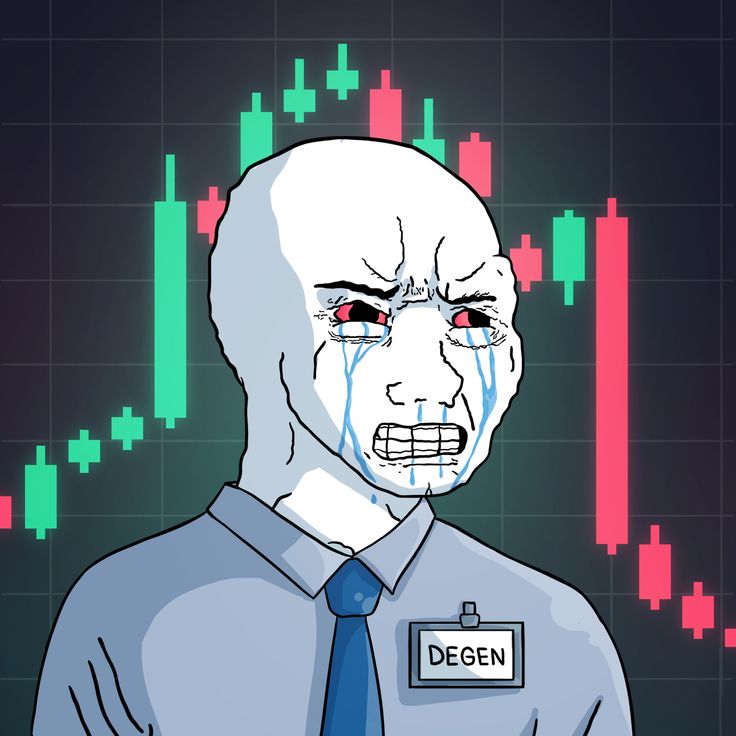

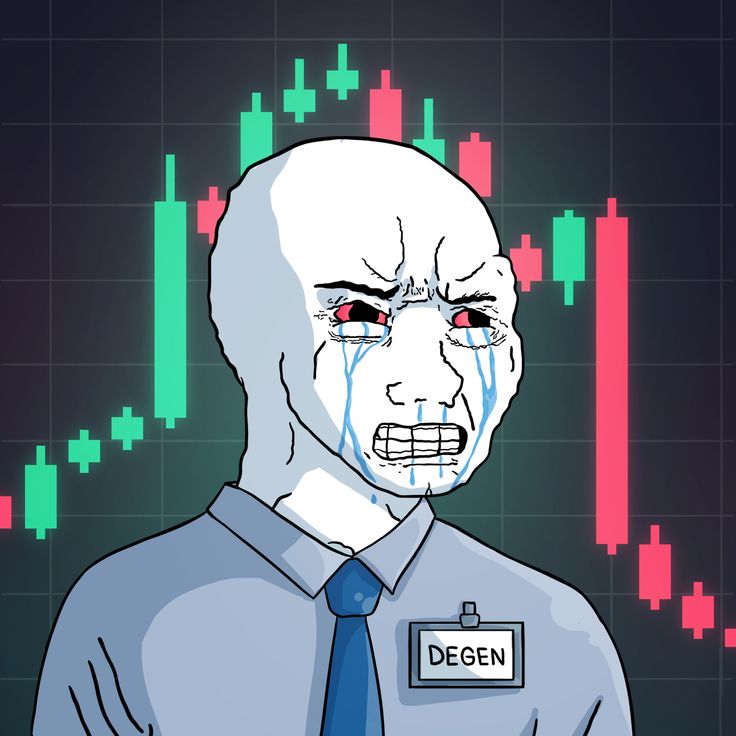

Crypto Morning Report: Crypto market flash crash, over $19 billion liquidated across the network in the past 12 hours

TechFlow Selected TechFlow Selected

Crypto Morning Report: Crypto market flash crash, over $19 billion liquidated across the network in the past 12 hours

After 519 and 312, there is now another date to be remembered.

Author: TechFlow

Yesterday's Market Dynamics

BTC dropped to $102,000 this morning, ETH fell to $3,435

HTX market data shows BTC dipped to $102,000 this morning and is now trading at $112,876; ETH fell to $3,435 and is currently at $3,867.

$19.076 billion liquidated across the network in the past 12 hours, long positions mainly hit

According to Coinglass data, total liquidations in the cryptocurrency market reached $19.076 billion over the past 12 hours, including $16.663 billion in longs and $2.413 billion in shorts.

Trump: Considering significantly raising tariffs on Chinese goods entering the U.S.

U.S. President Trump posted on social media, "One of the policies we are currently considering is significantly raising tariffs on Chinese products entering the United States. Many other countermeasures are also being seriously considered."

Fed Governor Waller: Open to a 25-basis-point rate cut at upcoming meeting

According to Jin10 News, Fed Governor Waller stated he is open to a 25-basis-point rate cut at the upcoming meeting. The Fed needs to cut rates but must proceed cautiously.

USDe severely de-pegged this morning; Ethena says minting and redemption remain normal, assets still over-collateralized

Around 5:30 AM today, Ethena’s USDe stablecoin experienced severe de-pegging. On Binance, the USDE/USDT price briefly dropped to $0.65 before recovering to normal levels.

Ethena Labs explained that USDe saw secondary market price fluctuations due to market volatility and cascading liquidations. They confirmed that USDe minting and redemption are functioning normally and assets remain over-collateralized. Due to liquidations causing perpetual contracts to trade below spot prices, Ethena accumulated additional unrealized PnL (uPNL) from short positions, which is now contributing to protocol revenue, making USDe even more over-collateralized than yesterday.

Binance: All services have returned to normal, monitoring situation closely

Binance announced on social media that all platform services have resumed normal operations and are gradually being restored. The team will continue to monitor developments closely to ensure smooth operations.

MetaMask announces multi-chain accounts launching by end of October

According to an official announcement, MetaMask will launch multi-chain accounts by the end of October, enabling users to group and manage EVM and non-EVM addresses and conduct transactions and track assets across both networks.

In existing MetaMask accounts, all EVM accounts will retain their names and addresses. Each EVM address will be grouped into a multi-chain account paired with a Solana address. If a user already has a Solana address, it will be paired with their EVM address to form a multi-chain account. If not, the system will generate a new Solana address for them. MetaMask's multi-chain accounts will also support other networks such as Bitcoin, Tron, and Monad.

Aster: Phase two airdrop eligibility checker now live, 153,932 wallets qualify

According to an official announcement, Aster has opened its phase two airdrop eligibility checker. A total of 153,932 wallets qualify. Eligible participants can claim starting October 14, with exact timing to be announced that day.

Four.meme denies Oracle partnership; Oracle has since deleted account, related token drops to zero

Crypto KOL AB Kuai.Dong revealed on social media that Four.meme officials stated the so-called "Oracle," a prediction market project on BNB Chain, is not a partner of Four.meme.

After the news broke, Oracle deleted its official Twitter account, and its associated token plummeted from a $3 million market cap to $160,000.

Goldman Sachs, Barclays among major global banks planning joint stablecoin project

Market sources report that major global banks are planning to jointly launch a stablecoin initiative. Consortium members include Santander, Bank of America, Barclays, BNP Paribas, Citibank, Deutsche Bank, Goldman Sachs Group, MUFG, TD Bank, and UBS Group.

Prediction market Kalshi raises $300 million at $5 billion valuation

According to The New York Times, prediction market platform KALSHI has raised $300 million at a $5 billion valuation.

HashKey considering IPO to raise up to $500 million

According to Zhitong Caijing, Hong Kong’s largest cryptocurrency exchange HashKey is considering an IPO to raise up to $500 million.

Market Update

Suggested Reading

The man behind Hyperliquid was an apprentice at Binance Labs incubator seven years ago

This article traces Hyperliquid founder Jeff Yan’s journey from learning at the Binance Labs incubator in 2018 to becoming a leading player in the decentralized exchange (DEX) space by 2025, showcasing his persistence and innovation. His earlier project Deaux failed to succeed, but its concepts and technical designs laid the foundation for Hyperliquid. By combining on-chain and off-chain systems, implementing a high-performance order book, and decentralized settlement, Hyperliquid achieved breakthroughs and capitalized on demand for decentralized trading after the FTX collapse. Jeff remains low-key, focusing on product optimization and user growth, using competition to drive industry progress.

Naval’s endorsement drives ZEC surge—what other privacy projects are worth watching?

This article analyzes how a single tweet from Naval Ravikant triggered a surge in Zcash (ZEC), exploring the current state and future potential of the privacy coin sector. Naval’s influence boosted overall sentiment in the privacy coin market, driving gains across multiple related projects. Meanwhile, ecosystems like Ethereum and Solana are also advancing privacy technologies, injecting new vitality into the privacy narrative.

This article discusses the development and future trends of the Decentralized Autonomous Trust (DAT) on Ethereum, focusing on Ethereum’s supercycle, DAT’s differentiated path, innovations in capital structure, and Ethereum’s central role in the global economy. Several industry leaders shared unique insights on the DAT industry from perspectives of corporate strategy, market positioning, and capital management, discussing the theoretical basis for DAT trading at a premium and potential future industry landscapes.

He Yi’s new essay: Becoming an entrepreneurial cultivator in the new era

This article focuses on the current state and development trends of the crypto industry, sharing the author’s experiences and reflections on entrepreneurship and the industry, including the growth journeys of Bitcoin and Binance, the importance of compliance, issues of user fairness, and views on the meme market. The article also highlights investment risks in crypto markets and calls for attention to long-term project value and ecosystem development.

Welcome to the golden age of asset bubbles

This article explores the current state of crypto asset bubbles and the behavioral drivers behind them, analyzing the speculative nature of memecoins, lack of intrinsic value, and phenomena of wealth transfer and gambling addiction. These bubbles typically feature rapid surges followed by swift collapses, attracting massive investor participation while also exposing ethical and societal issues within the financial sector.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News