Bitget Research: U.S. CPI data was released this Wednesday, triggering an intraday rebound; however, markets should remain cautious of further downside risks.

TechFlow Selected TechFlow Selected

Bitget Research: U.S. CPI data was released this Wednesday, triggering an intraday rebound; however, markets should remain cautious of further downside risks.

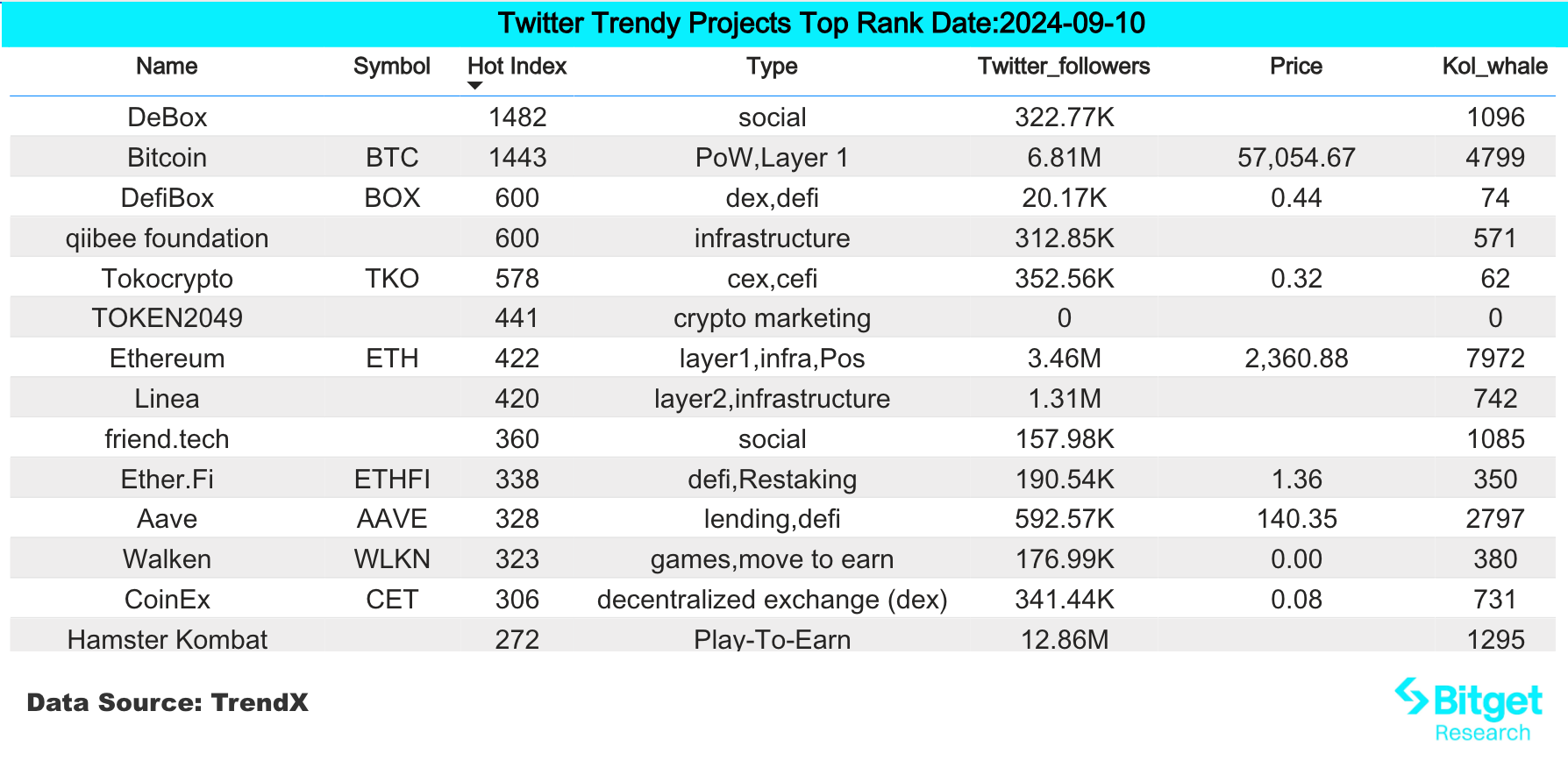

Over the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, which could very likely represent the next wealth-building opportunities.

Summary

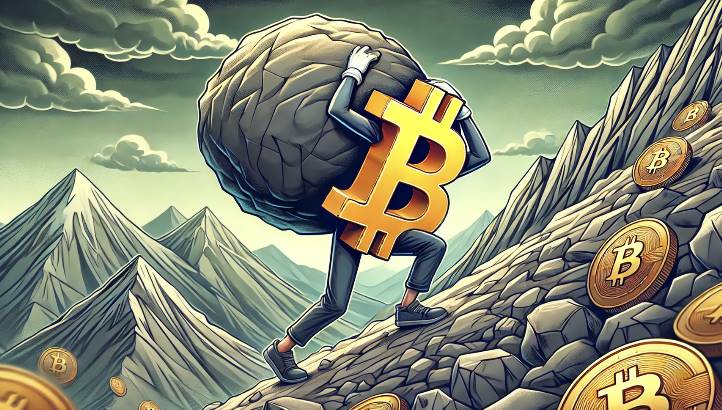

In the past 24 hours, BTC has seen a corrective rebound, rising by $2,000 within the day and currently oscillating around $56,500. Specifically:

-

The most wealth-generating sectors are: ETH DeFi sector, Solana Meme assets;

-

Trending tokens & topics among users: Catizen, AAVE, RPL, Fantom (renamed to Sonic);

-

Potential airdrop opportunities: DRiP, ODOS;

Data collection time: September 10, 2024, 04:00 UTC

I. Market Environment

In the past 24 hours, BTC price experienced a recovery rally, gaining $2,000 intraday and currently trading around $56,500. According to data from Alternative.me, the Fear & Greed Index has recovered to 33, still in the "fear" zone. Total open interest across markets rose by 3%, with BTC perpetual contracts entering negative funding rate territory, indicating relatively weak market liquidity. Over the past day, $128 million worth of positions were liquidated across all markets, including $94 million in long liquidations, which was the main driver behind BTC’s short-term price surge.

On the macro front, BTC ETFs saw net inflows for the first time in eight trading sessions, totaling $28.6 million. However, yesterday the SEC warned about risks associated with Bitcoin and Ethereum ETFs, labeling both BTC and ETH as highly speculative investments—developments that require ongoing monitoring. On Wednesday U.S. local time, August's CPI data will be released—the last major economic indicator before the Federal Reserve's mid-September rate decision. This could prompt risk-off behavior leading to further downside pressure on markets; investors should remain cautious.

II. Wealth-Generating Sectors

1) Sector Movement: ETH DeFi Sector (RPL, AAVE, BAL)

Main reasons:

-

Binance will launch 1–75x perpetual contracts for RPL, likely prompting other exchanges to follow suit;

-

Ongoing project updates: Balancer announced its v3 Hookathon is now live; Aave plans to roll out customized markets for EtherFi and Ethena on the Ethereum mainnet in the coming weeks;

Price performance: RPL, AAVE, and BAL rose 20.66%, 9.82%, and 17.94% respectively over the past 24 hours;

Factors affecting future trends:

-

TVL changes: Total Value Locked (TVL) is a key metric influencing ETH DeFi token prices. If project TVL continues to grow steadily, token prices may sustain upward momentum;

-

Product updates: Previously, AAVE updated its tokenomics to include a buyback mechanism. This move may inspire similar actions from other DeFi projects. It’s advisable to closely monitor product developments in the DeFi space, as positive announcements often create trading opportunities.

2) Sector to Watch: Solana Meme Assets (BEER, WIF, POPCAT)

Main reason:

-

Rising SOL price has eased panic sentiment across its ecosystem, showing temporary signs of improved liquidity, driving broader gains in ecosystem assets;

Specific tokens:

-

BEER: A meme coin on the Solana ecosystem. Contract data shows clear capital inflow, suggesting speculative money is entering, increasing volatility and potentially extending the uptrend;

-

WIF: Another Solana-based meme coin previously listed on Robinhood. When SOL rises, top-tier Solana meme coins like WIF tend to appreciate even faster;

-

POPCAT: A core meme coin on Solana, consistently maintaining high trading volume. Up over 50x year-to-date, it demonstrates relative price stability;

III. User Search Trends

1) Popular Dapp

Catizen:

According to Cointelegraph, Catizen has reached 800,000 paying users in six months, with an average revenue per paying user (ARPPU) of $33. Additionally, PLUTO Studio, the publisher behind Citizen, recently secured undisclosed investment from The Open Platform.

2) Twitter

AAVE:

Aave co-founder Stani stated on social media that customized markets for EtherFi and Ethena will launch on the Ethereum mainnet in the coming weeks. The protocol also plans to expand to ZKsync and Linea L2 networks.

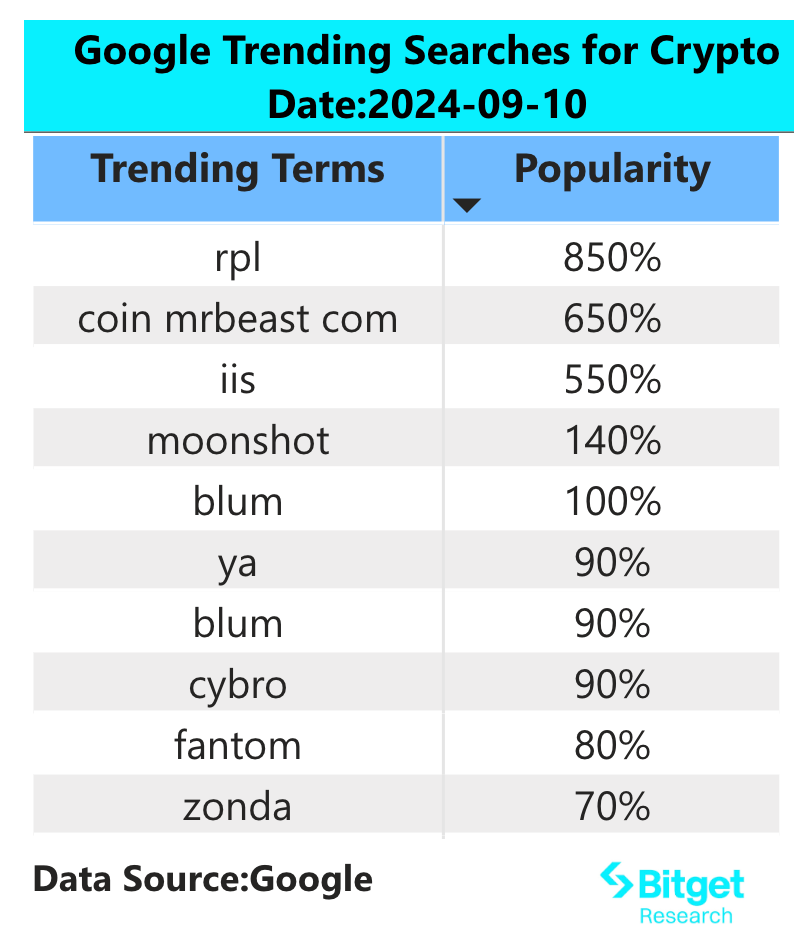

3) Google Search & Regional Trends

Globally:

RPL: Binance announced the listing of 1–75x perpetual contracts for RPL, causing a sharp short-term price increase.

Fantom: A few days ago, Sonic Labs (formerly Fantom) announced the launch of the Sonic testnet, allowing users to play Play-to-Earn games on the testnet soon.

By regional search trends:

(1) South Asia (India, Pakistan) shows interest in Blum. Southeast Asian countries have varied trends: TON, ETH, MATIC, and DOGS rank highest in Indonesia, Singapore, Malaysia, and the Philippines respectively.

(2) Search trends in Europe and North America are scattered: PEPE, DOGE, GRASS, and TRON appear in Germany; AIOZ, BONK, FLUX, and STX in Switzerland; RENDER, CVC, AMP, ONDO, QUBIC in Spain; KAS, TRX, JUP, MATIC in Italy.

IV. Potential Airdrop Opportunities

DRiP

A creator platform on Solana enabling artists and creators to distribute digital content such as art and music to fans. DRiP focuses on mainstream-friendly user experience and is expanding the types of content and experiences available to creators, including news, videos, and podcasts.

DRiP recently closed an $8 million seed round led by NFX, Coinbase Ventures, and Progression (a fund founded by former TikTok executives).

How to participate: DRiP features a system called "Droplets," where users can claim free drops every 6 hours. Regular logins, claiming Droplets, participating in platform activities, mini-games, and liking content may increase chances of qualifying for future airdrops.

ODOS

ODOS is a DEX aggregator that enables retail and institutional traders to benefit from incremental savings when swapping one or multiple crypto tokens into other assets.

At the end of August, ODOS completed its Series A funding round with participation from Uniswap Labs, CEIC, Curved Ventures, Orbs, Mantle, PAKA, and several angel investors. The funding amount was not disclosed.

How to participate: Use ODOS for cross-chain trades and try advanced swap functions—such as converting multiple input assets into multiple output assets in a single transaction—to increase eligibility for potential airdrops.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News