Macro Monthly Report: Weaker CPI Outlook for the US in the Second Half of the Year, Signaling Potential New Investment Opportunities

TechFlow Selected TechFlow Selected

Macro Monthly Report: Weaker CPI Outlook for the US in the Second Half of the Year, Signaling Potential New Investment Opportunities

The major global economies are still facing significant uncertainty.

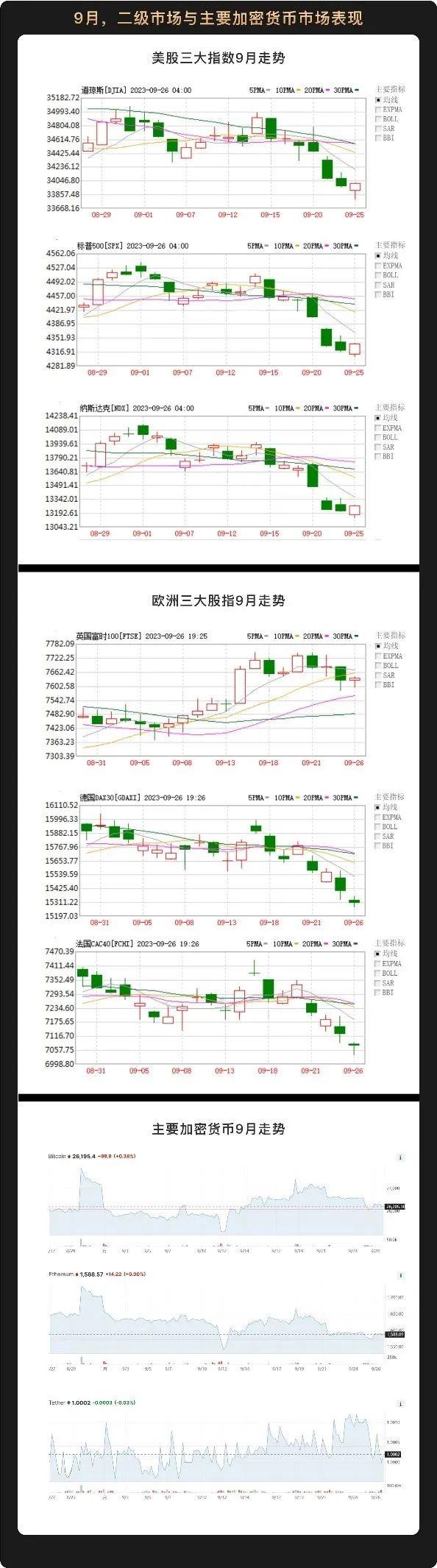

In September, major global stock markets—including the three U.S. equity indices, European, and Asia-Pacific markets—generally showed a sideways consolidation trend. After reaching their peaks on September 1, all three major U.S. indices declined. Meanwhile, Europe's three main stock indices followed divergent paths. The UK's FTSE index first fell then rose during September, ending with a slight overall gain; Germany's DAX30 and France's CAC40 briefly rallied but ultimately displayed narrow-range consolidation.

Regarding cryptocurrencies, the crypto market remained in a prolonged period of low-level consolidation in September. Major digital assets such as Bitcoin and Ethereum performed steadily, with prices fluctuating within a narrow range. During TOKEN2049 2023 in Singapore, industry veterans pointed out that periods of consolidation at lower levels present good opportunities for launching new crypto projects, urging investors to stay alert for emerging investment opportunities.

On September 20 local time, the Federal Reserve announced it would maintain the federal funds rate target range between 5.25% and 5.50%, in line with market expectations. In fact, since the end of July, U.S. commercial bank credit volume has turned negative. Year-on-year growth rates for real estate loans and consumer loans have shown clear downward trends, while outstanding balances in commercial and industrial loans have begun shrinking.

With commercial bank lending declining, both production and consumption demand in the market are cooling. Analysts broadly expect that the U.S. CPI will continue its downward trajectory in the second half of the year. WealthBee believes that slower economic growth in Europe and the U.S. remains highly likely, and monetary policy will remain at elevated interest rates for some time. Under these conditions, sustained high inflation or further price increases are unlikely. As a key factor in disinflation, rental prices in the U.S. housing market have started to decline month-on-month, returning to pre-pandemic median levels. Over the remaining months of 2023, rent-driven disinflation is expected to persist, contributing to a volatile downward trend in U.S. CPI.

Notably, in the short term, U.S. inflation has rebounded slightly due to rising global oil prices, higher energy commodity prices, and increasing labor costs. However, core inflation continues to follow a year-on-year downward trend. In the long run, rising energy prices lack sufficient underlying market demand support, particularly in an environment where U.S. commercial bank credit expansion is clearly slowing.

Continuing August’s strong performance, U.S. Treasuries maintained strength this month. The yield on the 10-year U.S. Treasury note surpassed 4.5%, hitting a new high not seen since 2007, while the two-year Treasury yield nearly stabilized at 5.1%. Even newly issued bonds offered exceptionally high yields. The reissued $13 billion 20-year U.S. Treasury bond recorded a record-high bid-to-cover yield of 4.592%, just below the pre-auction trading level of 4.595% at 1 p.m. Eastern Time. Bank of America interest rate strategists suggest the 10-year Treasury yield could reach 4.75%, setting another new record.

While Treasury yields remained strong, U.S. equities and other major global stock markets entered a phase of sideways adjustment. On September 1, the three major U.S. indices reached their peak before entering a period of volatile trading, trending downward overall. On September 21, when Powell announced a pause in rate hikes, all three indices recorded their largest single-day declines of the month: Nasdaq dropped -1.83%, S&P 500 fell -1.64%, and the Dow Jones declined -1.08%. With a pause in rate hikes already widely anticipated by the market, the absence of any positive surprise made the subsequent volatility a reasonable outcome.

Not only U.S. stocks, but other national equity markets that posted significant gains in the first half of the year have also recently experienced corrections. Most are now undergoing consolidation near their highs. Japan's Nikkei 225 has been fluctuating at elevated levels since peaking in June, India's SENSEX has formed a double-top pattern, and major European stock markets have already been range-bound for several months.

Looking back at the first half of the year, the strong performance of U.S. equities was evident to all. Before the U.S. stock market hit its annual peak on July 19, mainstream investment institutions generally believed that the market had entered a "mini bull market." During this process, all optimistic expectations were already priced into the market. Long-term bull markets require solid macroeconomic fundamentals as support. The direction of major markets in the U.S., Europe, and Asia-Pacific in the second half of the year will depend on how national policy measures unfold.

Currently, major global economies still face considerable uncertainties. Particularly in the U.S. and European markets, no new consensus expectations have emerged, nor has there been a visible turning point in economic fundamentals. As a result, sideways movement has become the only viable path for secondary markets and cryptocurrency markets. A prolonged period of consolidation or bottoming-out is inherently challenging. Investors should carefully manage their positions and mindset, seize investment opportunities, and patiently await the emergence of a new market narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News