Bitget Research: After CPI came in lower than expected, Bitcoin rose above $58,000. The Fed is likely to announce an interest rate cut next week, with significant market volatility expected.

TechFlow Selected TechFlow Selected

Bitget Research: After CPI came in lower than expected, Bitcoin rose above $58,000. The Fed is likely to announce an interest rate cut next week, with significant market volatility expected.

Over the past 24 hours, several new trending cryptocurrencies and topics have emerged in the market, and they could very well be the next wealth-building opportunities.

Author: Bitget Research

Summary

Yesterday's CPI data came in below expectations, with the market largely stabilizing after declines. The Federal Reserve will announce its interest rate decision next week, which is expected to trigger significant market volatility. Key highlights:

-

The most wealth-generating sectors are: DeFi blue chips (PENDLE, AAVE);

-

Most-searched tokens & topics by users: Fractal Bitcoin, Polymarket, DOGS;

-

Potential airdrop opportunities: Polymarket, Solayer;

Data cutoff time: September 12, 2024, 4:00 AM (UTC+0)

1. Market Environment

Yesterday’s CPI release was lower than expected, making a 25-basis-point rate cut highly likely. Major crypto assets have halted their downward trend and shown slight recovery. Market participants are now awaiting the Federal Reserve's upcoming interest rate decision meeting. The first rate cut following an extended period of high rates is expected to significantly impact markets, likely leading to elevated volatility next week.

Regarding ETFs, Bitcoin ETFs saw a net outflow of $43 million yesterday, while Ethereum ETFs recorded a net outflow of $5 million. This reflects ongoing cautious sentiment among market participants, as sustained net inflows or outflows have not materialized.

In the broader crypto ecosystem, the launch of the fractal Bitcoin project caused a sharp spike in network hashrate, sparking widespread industry discussion and attention. Investors are advised to closely monitor the project’s future developments.

2. Wealth-Generating Sectors

1) Sector Movement: DeFi Blue Chips (AAVE, PENDLE)

Main Reasons:

The DeFi blue-chip sector has demonstrated strong resilience, primarily because these projects continue to play crucial roles within the ecosystem during market fluctuations. Through consistent development and operations, their protocol metrics remain robust. AAVE has recently achieved record-high user activity and steady revenue growth. Pendle’s strategic focus on major LSDs has proven effective, and its further expansion into BTCFi is expected to drive substantial future revenue growth.

Price Performance:

AAVE and PENDLE have risen 13.5% and 28.1%, respectively, over the past 7 days.

Factors Influencing Future Trends:

-

Total Value Locked (TVL): Cash flow generation for these protocols largely depends on asset scale. As TVL increases, protocol earnings rise correspondingly, supporting stronger token price performance.

-

Product Updates: AAVE recently upgraded its tokenomics by introducing a buyback mechanism. This move may inspire similar actions across other DeFi projects. Monitoring product updates in the DeFi space is recommended, as positive announcements often create trading opportunities.

2) Sectors to Watch Going Forward: Solana Meme Assets (BEER, WIF, POPCAT)

Main Reasons:

The rebound in SOL price has eased panic sentiment within its ecosystem, with liquidity showing temporary improvement, driving broader gains across Solana-based assets.

Specific Token List:

-

BEER: A meme coin on the Solana network. On-chain data shows clear signs of capital inflow, increasing volatility and speculative interest, suggesting potential for continued upside.

-

WIF: Another Solana-based meme coin, recently listed on Robinhood. When SOL rises, top-tier Solana meme coins like WIF typically experience amplified gains.

-

POPCAT: A core meme coin on Solana with consistently high trading volume. It has surged over 50x year-to-date, maintaining relatively stable price action.

3. User Search Trends

1) Popular Dapp

Fractal Bitcoin

Fractal Bitcoin is a project focused on Bitcoin network scaling, aiming to enhance blockchain scalability. It uses PoW consensus with SHA256d hashing—similar to BTC—and supports mainnet switching via Unisat Wallet. Network validation requires ASIC mining hardware. The network currently operates at 260 EH/s, supported by major mining pools such as Antpool, F2Pool, and Spiderpool. Ecosystem projects like CAT20 are gaining traction and media attention. With strong community interest, it warrants continued monitoring.

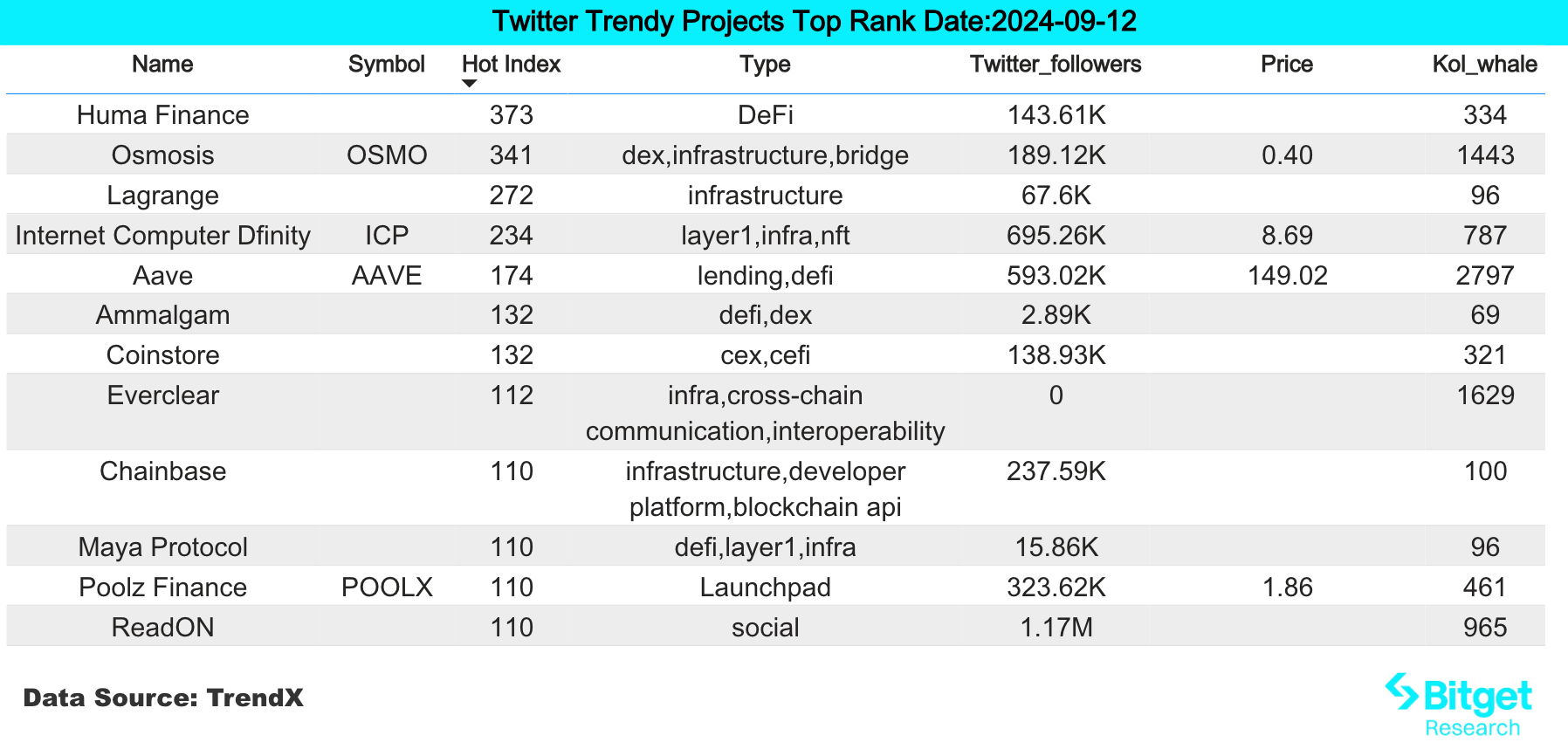

2) Twitter

AAVE (Token)

This week, Aave announced the deployment of a dedicated ether.fi weETH market on-chain, enabling users to borrow stablecoins using weETH as collateral. DeFi projects on Ethereum, including AAVE and UNI, performed well in secondary markets this week. On-chain data reveals large whales gradually accumulating positions in AAVE and UNI. Notably, an address linked to Vitalik Buterin deposited 950 ETH and 2.28 million USDC into Aave within the past 24 hours, signaling support for the platform. AAVE has performed strongly in secondary markets, rising over 50% in the past month with stable momentum—worth continued observation.

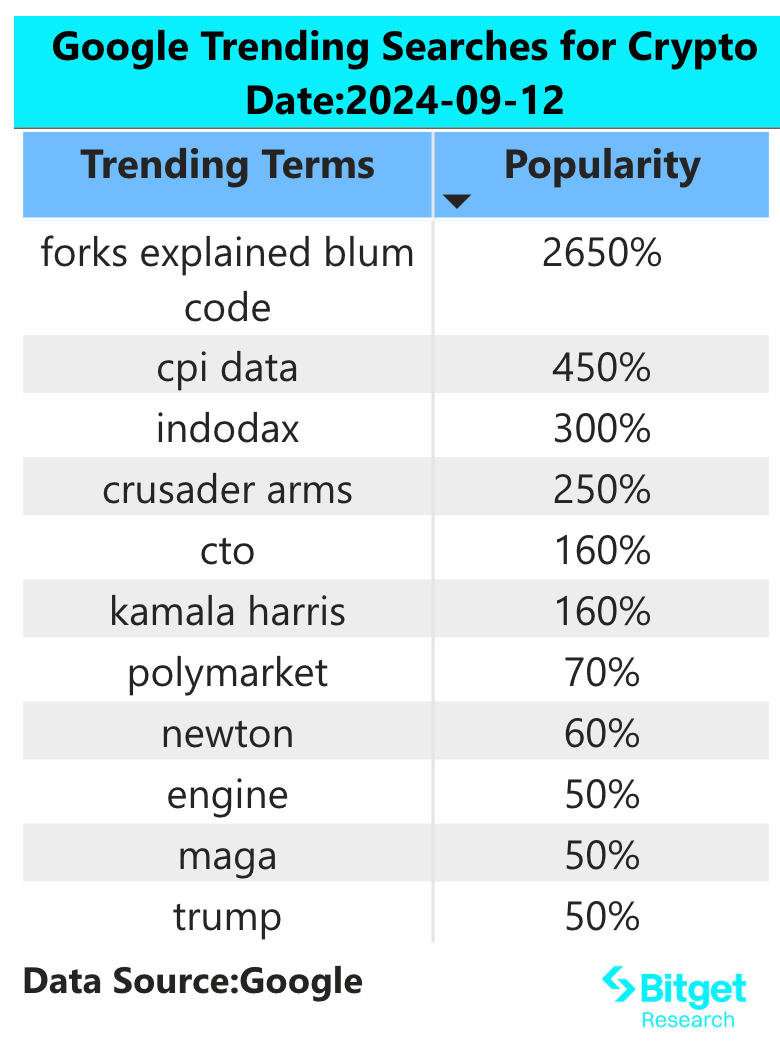

3) Google Search & Regional Trends

Global Overview:

Polymarket:

Polymarket is a prediction market platform where events are community-proposed, allowing users to place predictions and earn rewards if correct. Yesterday’s presidential debate between Trump and Harris led to shifts in perceived odds—Harris’ performance was viewed as superior, causing her chances of winning to surpass Trump’s on Polymarket. Given Trump’s reputation as a crypto-friendly candidate, tracking Polymarket data could provide valuable market signals.

Regional Search Trends:

(1) Telegram bots have become primary points of interest in Africa and CIS regions, with trending projects including Dogs and Blum. Countries showing notable search interest include Russia, Vietnam, and Ukraine.

(2) In Western Europe and North America, search trends are more dispersed but center around fundamentally strong or early-stage projects such as XRP, AKT, INJ, Glass, and KAS.

4. Potential Airdrop Opportunities

Polymarket

Polymarket is a prediction market platform where all events are initiated by the community. Users can participate in predictions and earn rewards for accurate outcomes.

The centralized prediction market platform Polymarket has raised a total of $70 million across two funding rounds. The latest round, a $40 million Series B in 2023, was led by Founders Fund, following a $25 million Series A in 2022.

How to Participate: While no official airdrop details have been released, community speculation suggests users should register an account, connect a wallet, deposit USDC via the Polygon network, and actively engage in predictions to increase eligibility for potential airdrops.

Solayer

Solayer is building a restaking network on Solana, leveraging economic security and high-performance execution to serve as decentralized cloud infrastructure. It enables application developers to achieve higher levels of consensus customization and dedicated blockspace.

In July 2024, Solayer announced the completion of a builder-focused funding round, with undisclosed amounts. Backers include Binance Labs, Anatoly Yakovenko (co-founder of Solana Labs), Rooter (founder of Solend), and Richard Wu (co-founder of Tensor).

How to Participate: Users can stake SOL or supported SOL LSTs (jitoSOL, mSOL, bSOL, INF) to earn积分 (points) per epoch. The mainnet is live—staking SOL yields sSOL and accumulates platform积分.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News