Binance Research CPI Index Analysis: Increased Likelihood of U.S. Rate Cut in September

TechFlow Selected TechFlow Selected

Binance Research CPI Index Analysis: Increased Likelihood of U.S. Rate Cut in September

The probability of a rate cut in September rose to over 80% after the data release.

Written by: TechFlow

In the crypto world, understanding macroeconomic data is a must for every retail investor.

Binance Research has just released its analysis of the recently announced CPI figures, presenting insights on the definition, impact, and future outlook of the CPI through a single chart.

TechFlow has compiled and translated the original chart.

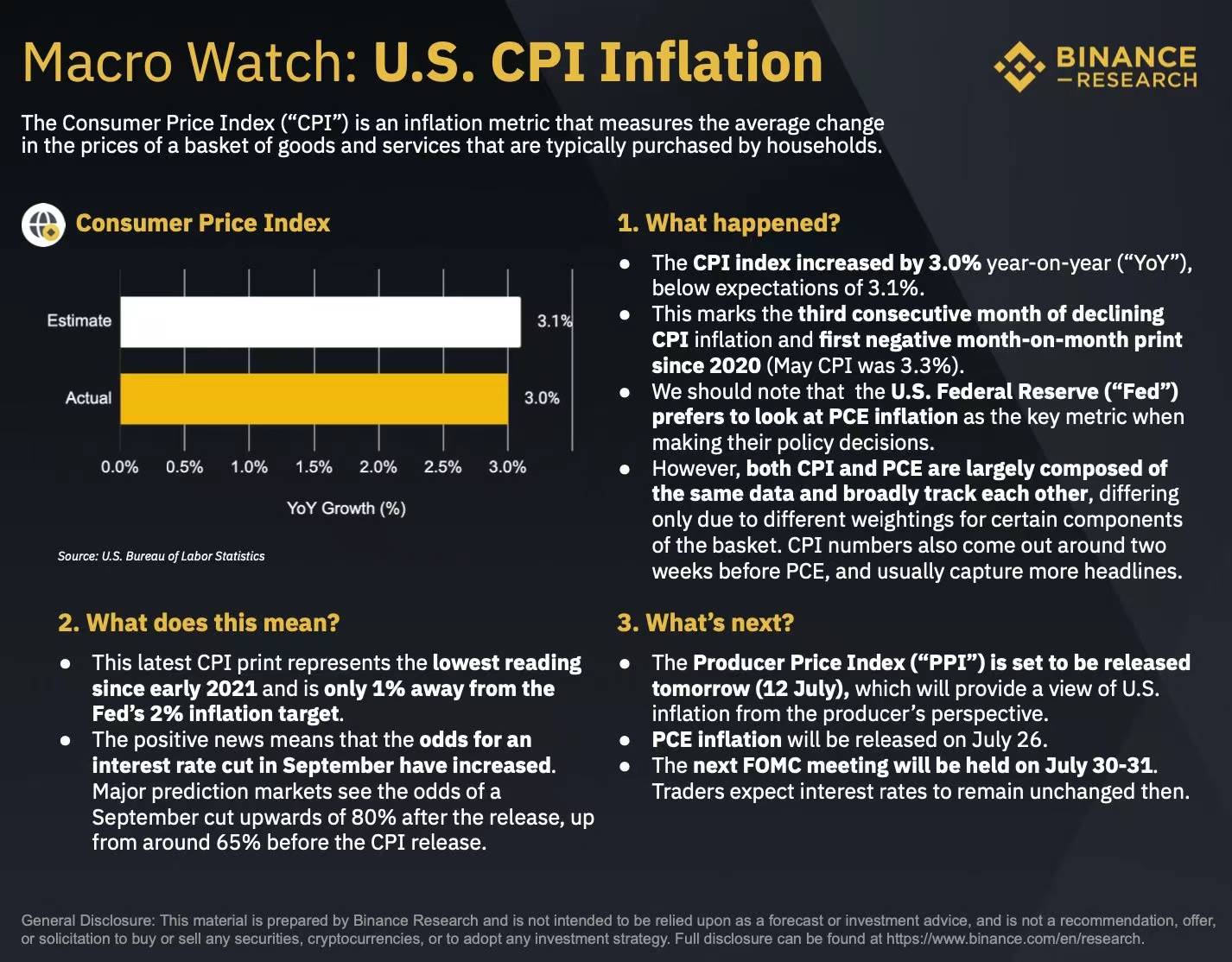

Macro Watch: U.S. Consumer Price Index (CPI) Inflation

The Consumer Price Index (CPI) is an inflation measure that tracks the average price changes in a basket of goods and services typically purchased by households.

-

What happened?

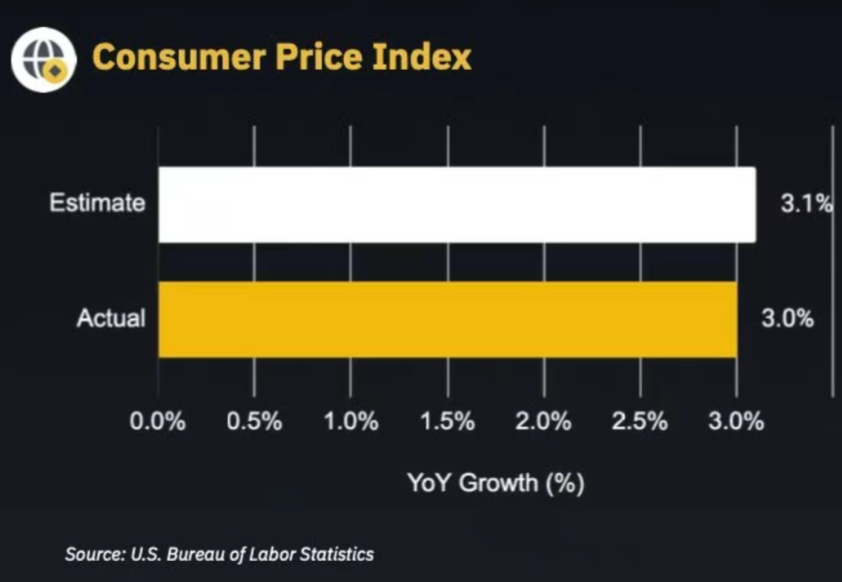

The CPI rose 3.0% year-on-year, slightly below the expected 3.1%.

This marks the third consecutive month of declining CPI inflation and the first negative monthly change since 2020 (May CPI was 3.3%).

It’s worth noting that the Federal Reserve (“the Fed”) tends to rely more on Personal Consumption Expenditures (PCE) inflation when making policy decisions.

However, CPI and PCE are largely composed of similar data and generally move in sync, differing only due to variations in the weightings of certain components in their respective baskets. CPI data is typically released about two weeks before PCE and often draws greater attention.

-

What does this mean?

The latest CPI reading is the lowest since early 2021, just 1 percentage point above the Fed's 2% inflation target.

This positive development increases the likelihood of a rate cut in September. Major prediction markets now assign over 80% probability to a September rate cut, up from around 65% prior to the CPI release.

-

What comes next?

The Producer Price Index (PPI) is scheduled for release tomorrow (July 12), offering an inflation perspective from the producer side.

PCE inflation will be released on July 26.

The next Federal Open Market Committee (FOMC) meeting will take place on July 30–31. Traders expect interest rates to remain unchanged at that time.

Source: U.S. Bureau of Labor Statistics

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News