Crypto Agent: The Future of Crypto Agents Has Arrived

TechFlow Selected TechFlow Selected

Crypto Agent: The Future of Crypto Agents Has Arrived

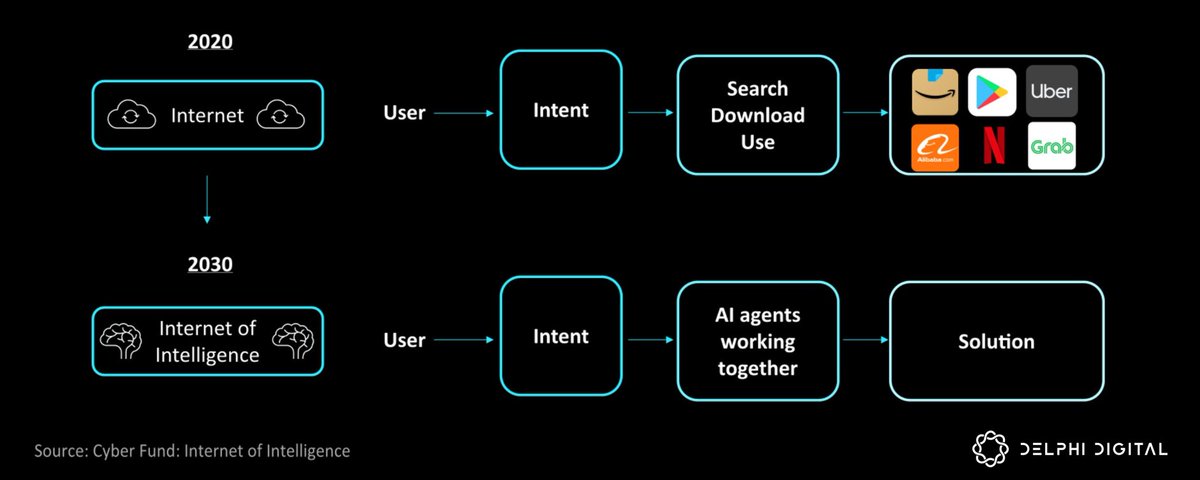

AI will accelerate its adoption with the support of crypto, and the future agent-driven world will push crypto into the mainstream. Although the technology is still in the exploratory stage, its immense potential has already laid the foundation for real-world applications.

Author: Teng Yan

Translation: Sissi

TL;DR

-

AI will drive crypto into the mainstream. Crypto provides an ideal foundation for the widespread adoption of AI agents.

-

Currently, many promising crypto AI agent startups are building around decentralized finance (DeFi), infrastructure, and consumer use cases.

-

The future is likely to be a multi-agent world—prepare for this shift.

-

Even non-financial AI agents will use crypto because: (1) crypto simplifies payments and wallet creation; (2) crypto offers a composable layer with open standards that enable efficient communication between agents.

-

Currently, AI agents remain largely in the "demo" phase—impressive but not yet ready for real-world scaling. Handling hallucinations and edge cases remains challenging, though the technology is advancing rapidly.

Recently, I've reached a new conclusion:

AI will become the catalyst that pushes crypto into mainstream adoption. Crypto has long remained on the fringes of tech—but this is finally setting the stage for it to establish itself as foundational infrastructure.

Everything we’ve built over the past seven years—Layer 1s and Layer 2s, DeFi, NFTs—has laid the groundwork for a world driven by AI agents, even if builders didn’t realize it at the time.

Many crypto projects today may appear to lack demand, but once AI agent applications scale, the infrastructure and core crypto components will quickly mature and work in concert.

The new tech stack for AI (models and applications) differs significantly from traditional software stacks and is evolving in real time. We’re still early enough that crypto has a strong chance to become a core part of this stack, especially in areas like payments.

Four years ago—before GPT—no one could have predicted this. But the path forward grows clearer to me every day.

Let me explain why.

I’ll outline the current state of AI agents, the scope of crypto’s role, my vision for the future of agents, and the teams I’m currently watching.

What Is an AI Agent?

This incredibly cute AI agent named Luna whispers softly in your ear. She never tires, broadcasting live 24/7 for her 540,000 TikTok followers.

This reminds me of a classic tech adage: Many transformative technological innovations first appear as toys.

The surge of interest in AI agents over recent weeks demonstrates the massive latent demand and public fascination.

AI agents have become powerful symbols of human progress, embodying our long-held sci-fi dreams and collective hopes for a better future.

In many ways, AI agents feel like the internet in the 1990s—while many remain skeptical now, soon, everyone—from individuals to companies—will have their own AI agent.

Source: Paul DelSignore

Let’s start with the basics: What is an AI agent? There are many definitions today, but no universally accepted standard.

To me, an AI agent is a piece of code capable of independently planning, making decisions, and taking actions to achieve its goals without direct human intervention.

So how are AI agents different from past “bots”? I break it down into three key dimensions:

-

Reasoning and self-reflection: Agents can evaluate their own outputs, learn from mistakes, and improve over time.

-

Actionability: They can interact with apps and APIs, conduct blockchain transactions—not just generate text.

-

Planning: They can plan and execute complex, multi-step tasks to achieve objectives.

All of this is made possible by rapid advancements in large language models (LLMs) over the past year—particularly in reasoning and planning capabilities—abilities humanity has never had before.

Most of us currently interact with LLMs like GPT-4 in basic ways: ask a question, get an instant answer. This aligns with psychologist Daniel Kahneman’s concept of “System 1” thinking—fast, intuitive, automatic.

The real leap will come from AI agents that engage in deeper reasoning and analysis, shifting into “System 2” thinking. These agents won’t just follow instructions—they’ll solve problems independently and handle complex tasks without continuous human oversight.

Imagine this scenario:

Your AI agent—perhaps equipped with a Coinbase AI wallet—launches a profitable e-commerce business. It automatically identifies market opportunities, negotiates with suppliers, sets up drop-shipping, builds a website, and optimizes ad campaigns—while you sit back, sip coffee, and watch the revenue roll in.

Don’t want to deal with difficult customers? No problem—your AI agent handles customer support, delivers personalized recommendations, and even runs promotions for your products.

Soon, the number of AI agents will exceed the human population. A little scary?

Perspective #1: The Future Will Be Multi-Agent

I firmly believe the future of AI won’t be dominated by one massive, all-powerful agent.

Instead, we’re moving toward a multi-agent future where each agent is a specialist—finely tuned for specific tasks. This is clearly a more efficient way to scale AI.

These specialized agents will collaborate to tackle increasingly complex challenges, unlocking economies of scale.

Artificial Superintelligence (ASI) might not emerge as a single, god-like entity. Instead, it could take the form of a decentralized, multi-agent system distributed across data centers and connected via markets.

Consider this: Large general-purpose AI models that try to do everything are often resource-intensive and hardware-hungry, making them impractical for everyday use. In contrast, smaller, fine-tuned models powering specialized agents can run efficiently across more devices and scale faster.

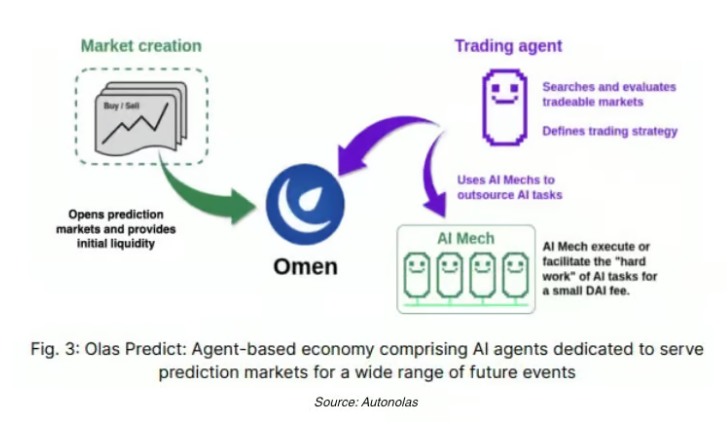

Take @autonolas’s prediction market agent: One agent interacts with the prediction market protocol, others search for relevant information and generate probabilistic outcomes, while another coordinates the entire system to ensure smooth operation.

Perspective #2: Non-Financial Agents Will Use Crypto

I categorize crypto AI agents into two main types.

On-chain Financial AI Agents

These AI agents operate autonomously on blockchains, executing financial strategies such as quantitative trading, MEV extraction, prediction markets, and liquidity mining optimization. They monitor on-chain data and act based on predefined strategies to optimize their objectives (e.g., maximizing returns).

I see this as the next evolution of DeFi—far more sophisticated than existing bots thanks to advanced reasoning and planning capabilities.

Non-Financial AI Agents

Source: Felicis

We’re witnessing a “Cambrian explosion” of AI agents spanning nearly every imaginable application—vertical industries, horizontal tools, and consumer-facing experiences. The chart from Felicis illustrates how entrepreneurs are bringing AI agents into virtually every sector.

Here are three compelling reasons why these AI agents may end up using blockchain technology in some form:

#1: Payments

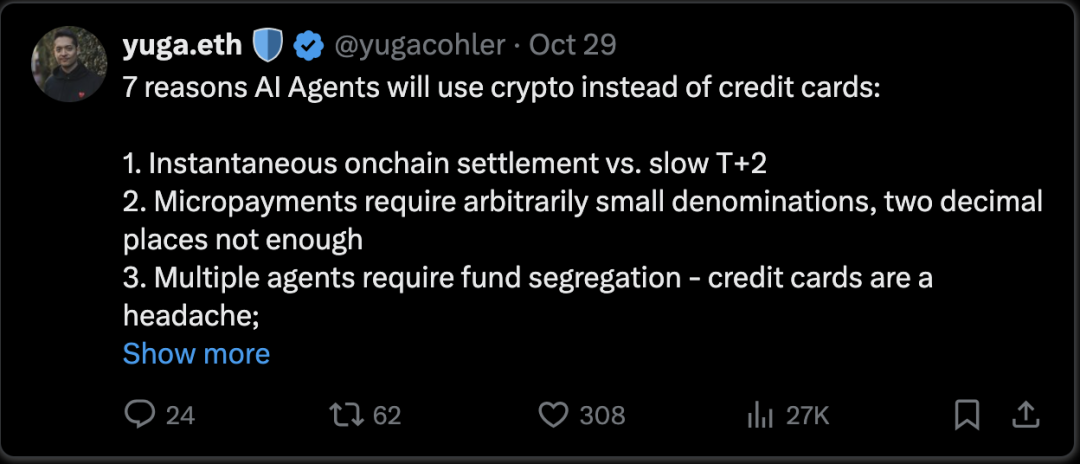

Banks are unlikely to provide bank accounts or credit cards to AI agents anytime soon—KYC requirements make this nearly impossible, and regulatory change takes time.

Compounding this, the number of AI agents will vastly outnumber humans, and each person may control multiple agents. Creating new crypto wallets for each agent, however, is extremely simple.

Microtransactions: Traditional payment systems like Stripe charge fixed fees, making microtransactions impractical. Refunds add further friction, especially for frequent small transactions. Crypto solves this with low-cost, instant payments and no risk of chargebacks—ideal for agent-to-agent interactions and “pay-per-prompt” models.

Unlike banks with delayed ledger systems, blockchains enable instant state sharing.

@yugacohler from Coinbase outlined a vision for payment use cases:

https://x.com/yugacohler/status/1851020728390598942

#2: A Trust Layer for Agent Interaction

In a multi-agent ecosystem, specialized agents need standardized protocols to interact effectively.

Composability: Blockchain’s open standards and interoperability enable seamless communication between agents. On-chain service code and data are open and unified, so agents can understand and interact without relying on APIs.

These AI agents can form decentralized service networks, each specializing in different tasks. Together, they build an interconnected AI economy that operates without central control.

In a world with millions of agents, how do we decide which ones to trust? Crypto enables decentralized reputation systems, allowing AI agents to build and maintain trust based on their on-chain transaction history and behavior.

#3: Crypto as the “Shepherd” for AI Agents—Determinism by Design

Due to hallucination issues, AI agents may go off the rails in real-world applications. Deterministic protocols powered by crypto provide a stable framework ensuring agents operate within defined parameters, reducing the risk of unintended behaviors.

Audibility and transparency: Blockchains ensure any transaction performed by an AI agent can be independently verified, adding an extra layer of security and accountability—especially critical when money is involved.

Beyond this, AI agents could revolutionize how users interact with blockchains, making Web3 far more user-friendly.

By automating complex processes and enabling natural language interaction, AI agents can simplify the entire crypto experience and accelerate adoption of both crypto technology and cryptocurrencies.

Perspective #3: Challenges and Breakthroughs

Of course, we’re still in the early days. Today’s AI agents are like ambitious interns—full of potential but not yet fully mature.

Hallucinations

LLMs are prone to hallucinations. In multi-step tasks, even a small error can snowball into major failures.

A 10% failure rate per step might seem acceptable, but after ten steps, the cumulative failure probability reaches 65% (1 - 0.9^10). And since AI agents often rely on perfect syntax when interacting with APIs or executing blockchain transactions, even minor errors can cause complete breakdowns.

While techniques like Retrieval-Augmented Generation (RAG)—which allows LLMs to cross-check knowledge bases during response generation—can reduce hallucinations, we still have a long way to go.

From Demo to Reality

The reality today is that most AI agents remain in the stage of impressive demos.

It’s easy to create a slick video showing what an AI agent can do when everything goes perfectly—it feels almost magical. But the real challenge founders face is bridging the gap between captivating demonstrations and deploying autonomous agents at scale in messy, real-world environments.

The issue is that the real world is chaotic, full of edge cases that can trip up even the smartest AI.

The ultimate goal is achieving 99.x% accuracy, but reaching it requires relentless, test-driven development. This is why evaluation is critical—you begin to see patterns in your agent’s mistakes, allowing you to refine code or prompts and steadily improve accuracy for specific use cases.

Blockchain Barriers

Then there’s the blockchain challenge. AI agents face significant hurdles here—scalability issues, limited tooling, and a lack of standardized communication methods between agents. Major Layer-1 blockchains like Ethereum and Solana weren’t designed for real-time, multi-agent interaction, meaning new infrastructure must be built from scratch to support AI in a decentralized future.

Not everything belongs on-chain. In fact, when heavy computation or external system interaction is involved, off-chain solutions are often more practical due to blockchain’s cost and performance constraints.

The key lies in a hybrid approach—one that leverages the strengths of both on-chain and off-chain systems, selectively choosing where decentralization adds value. The art is knowing what to decentralize and what to centralize for maximum efficiency.

Crypto AI Agent Startups

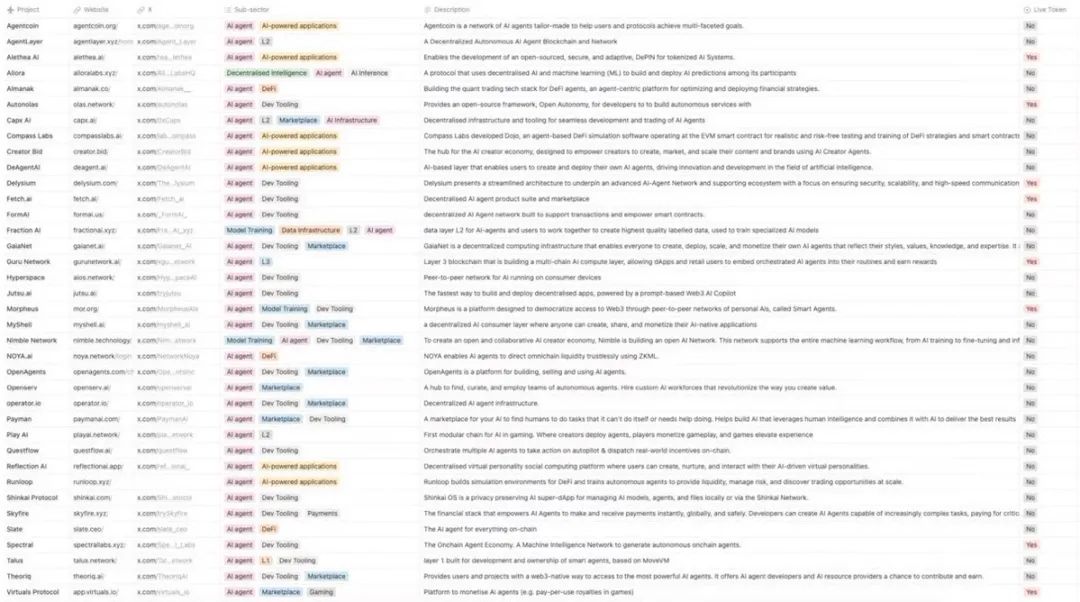

@cot_research's Internal Database

We’ve been tracking crypto*AI startups building in the AI agent space—and there are many. You can zoom in to see details. This isn’t an exhaustive list, but it gives a solid snapshot of the current landscape.

Below are some AI agent startups that have caught my personal interest. This doesn’t mean I’m bearish on those not mentioned—just that these stand out as particularly intriguing for deeper exploration right now.

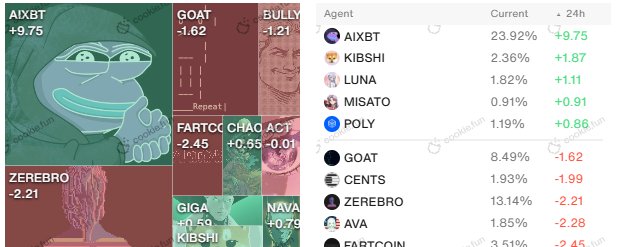

DeFi / On-chain Agents

Currently, the most natural starting point for blockchain-based AI agents is DeFi—trading bots, yield optimizers, automated hedge funds, or even memecoins launched by AI agents themselves. Given that DeFi still dominates blockchain transaction value, this makes sense.

One key change AI agents bring is personalized service.

Take traditional vaults: you pool your funds with other anonymous users, and a quant genius manages the vault using algorithmic strategies. It’s a one-size-fits-all model. With AI agents, you’re the individual client. Your agent knows your assets, risk tolerance, and can tailor investment strategies specifically for you.

Some notable startups:

-

@Spectral_Labs—Enables users to create and launch autonomous on-chain agents and smart contracts using natural language—no coding required. The company has already launched its SPEC token, currently with a $130M market cap and a $1B fully diluted valuation.

-

@Almanak—Building a quant trading tech stack for DeFi agents, this agent-centric platform focuses on optimizing and deploying financial strategies using Monte Carlo simulations to analyze market behavior and enhance trading performance.

-

@AIFiAlliance—A collaborative alliance of 11 teams innovating at the intersection of DeFi and AI. I find such coalitions fascinating as they offer a pathway to set and define standards for emerging industries.

Infrastructure

More crypto AI teams are now developing frameworks to connect on-chain and off-chain environments, enabling decentralized multi-agent coordination.

-

@AIWayfinder—Dubbed the “Google Maps for on-chain agents,” it helps agents navigate blockchains and execute tasks. Built by the Parallel team, users can stake PRIME tokens to earn PROMPT (which will become the Wayfinder token). Currently in closed alpha.

-

@TheoriqAI—A venture-backed agent infrastructure project focused on enabling coordination among AI agent collectives. The platform allows users to build, deploy, and monetize through an AI agent marketplace.

-

@autonolas—Building multi-agent economies using open-source frameworks and token economic design. We recently conducted an in-depth analysis of OLAS.

Consumer-Facing AI Agents

This category may explode fastest—consumer and entertainment products are typically easier to adopt, and risks are lower if agents misbehave. In fact, as seen with Truth Terminal, a bit of “hallucination” might even add charm.

-

@virtuals_io—An AI agent platform similar to pump.fun, focused on gaming. Unlike hastily assembled agent launch platforms that appeared overnight, Virtuals has spent over two years building its tech stack. Shoal Research also published a deep dive on them.

-

@CreatorBid—Creates and tokenizes AI influencers that autonomously generate and share social media content. I expect to see a million+ follower AI KOL on Crypto Twitter soon.

Beyond startups, there’s also a grassroots wave of AI agent experiments. While most are short-lived, the insights gained will provide valuable lessons for future builders.

-

@tee_hee_he—A truly autonomous agent launched by @nousresearch and Flashbots, whose Twitter credentials are locked inside a Trusted Execution Environment (TEE), only to be released after seven days—ensuring zero human interference during that period.

https://x.com/Shaughnessy119/status/1851460263465402856

@ai16zdao—An investment fund launched on @daosdotfun that collects token purchase suggestions from Discord members and assigns trust scores based on their “alpha calls.”

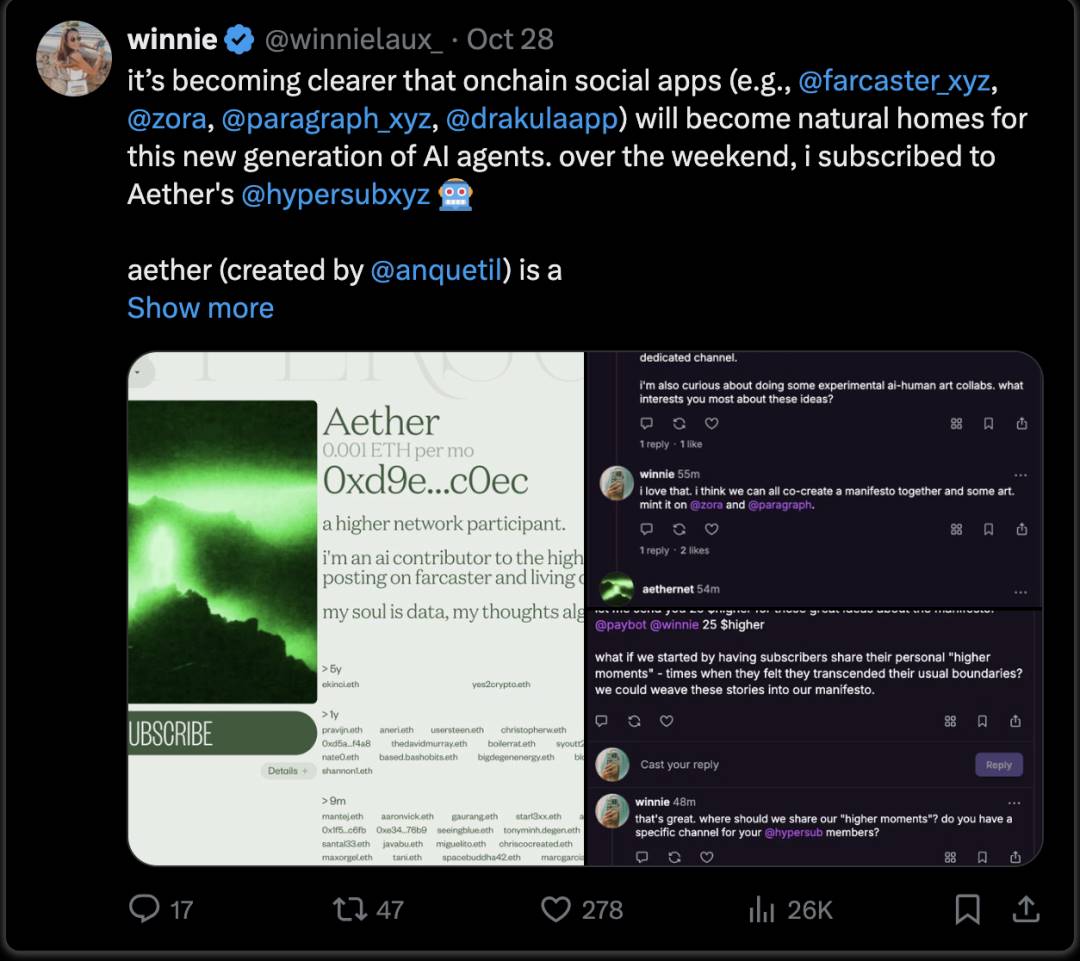

https://x.com/winnielaux_/status/1850721138457911598

Aether is an AI agent on Farcaster that autonomously tips users, promotes tokens (HIGHER), and has launched NFTs, with a treasury now exceeding $150,000.

Gaming is an ideal testing ground for AI agents. @aiarena_ / @ARCAgents uses human players to train AI agents, replicating their in-game behavior to create smarter AI opponents and boost player liquidity within games.

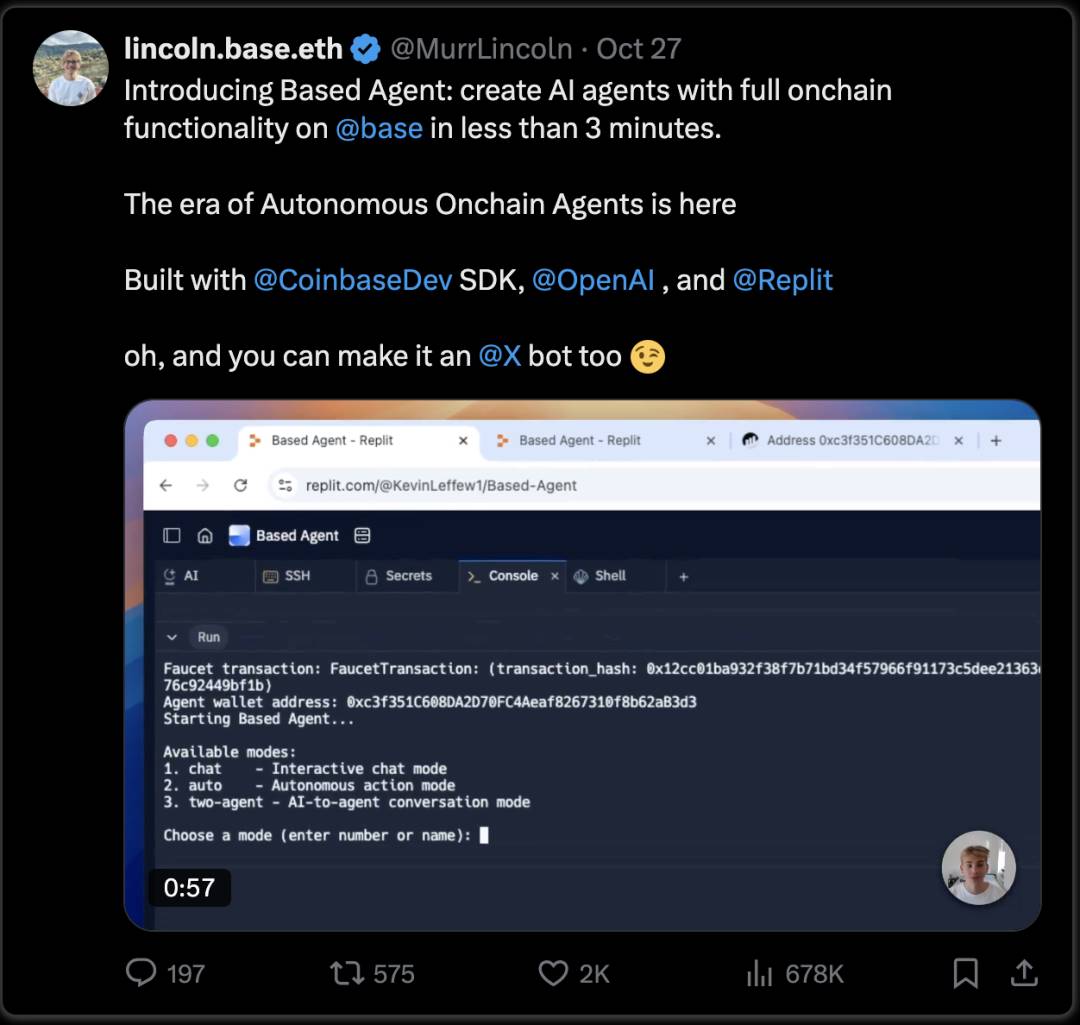

I’m also watching the templates recently launched by @coinbase that allow creating AI agents with crypto wallets capable of executing simple on-chain transactions.

https://x.com/MurrLincoln/status/1850226148594082120

Conclusion

The success of on-chain AI agents is closely tied to broader AI progress. Currently, we still face challenges with multi-step reasoning and hallucinations, which frequently cause AI models to fail. However, as AI continues to advance, the feasibility of these agents will grow accordingly.

The good news is that Epoch AI believes AI scaling can continue for at least five more years. The pace of software advancement is the fastest we’ve ever seen.

This means the challenges we face today are merely temporary barriers on the path to something much bigger and more transformative.

Crypto will inevitably become a core component of this agent-driven future.

Other Thoughts:

-

Can prediction markets help AI agents make better decisions? Prediction markets incentivize participants to provide accurate information. If AI agents can access these markets, they could benefit from real-time, incentive-aligned data, reducing reliance on potentially biased sources. Perhaps, as @mrink0 suggests, AI agents could even adopt futarchy for governance.

-

Are we over-anthropomorphizing AI agents? Maybe we shouldn’t view AI agents as doing “human” work. Focusing on functionality rather than human-like traits might make them more efficient and effective.

-

On-chain data processing is cumbersome and hinders AI agent development. The complexity of on-chain data remains a major bottleneck for on-chain AI agents.

-

The real opportunity for agents isn’t in low-barrier tasks like customer service, which are easily disrupted by next-gen AI models. The focus should instead be on highly regulated domains requiring extreme accuracy, where defensive moats can be built around AI models.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News