Dark Forest Adventure Round: A New Era of On-Chain Economy for AI Agents

TechFlow Selected TechFlow Selected

Dark Forest Adventure Round: A New Era of On-Chain Economy for AI Agents

Building a financial market for on-chain gaming, empowering AI agents to achieve sustainable profitability.

Introduction

Dark Forest is a landmark game in Ethereum's history. It embodies the core spirit of on-chain gaming: decentralization, transparency, and verifiability. Initially, it served as a testbed for zero-knowledge proof technology, later demonstrating L1/L2 scalability, and subsequently showcasing agents playing on-chain games.

At Adventure Layer, we chose Dark Forest to celebrate the beginning of a new era: agent participation in on-chain economies. Before AI agents can meaningfully engage, we need to establish a sustainable on-chain economy that justifies their involvement.

In this article, we will present the vision, principles, and meticulous design behind the mechanics of Dark Forest Adventure Round. The core mission of Dark Forest Adventure Round is to build a self-sustaining economic system suitable for artificial intelligence agents to participate in, grow, and ultimately thrive.

Why?

Despite their rich functionality, agents currently have limited capabilities within Web3, especially large language models (LLMs).

-

Generate Web3-related content: collect on-chain information and generate insights, tweets, comments, or live streams on TikTok

Ideal for marketing, but unable to directly participate in on-chain economies, limiting agents' return on investment

-

Sending and receiving transactions: sending tokens, receiving tokens

Suitable for proof-of-concept use cases, but does not directly generate revenue

Trading: still involves sending and receiving tokens, but after a decision-making process, flows are directed into or out of liquidity pools

-

Actively and directly participate in economic activities like traders, but agents typically incur losses. We believe this is an inevitable outcome.

-

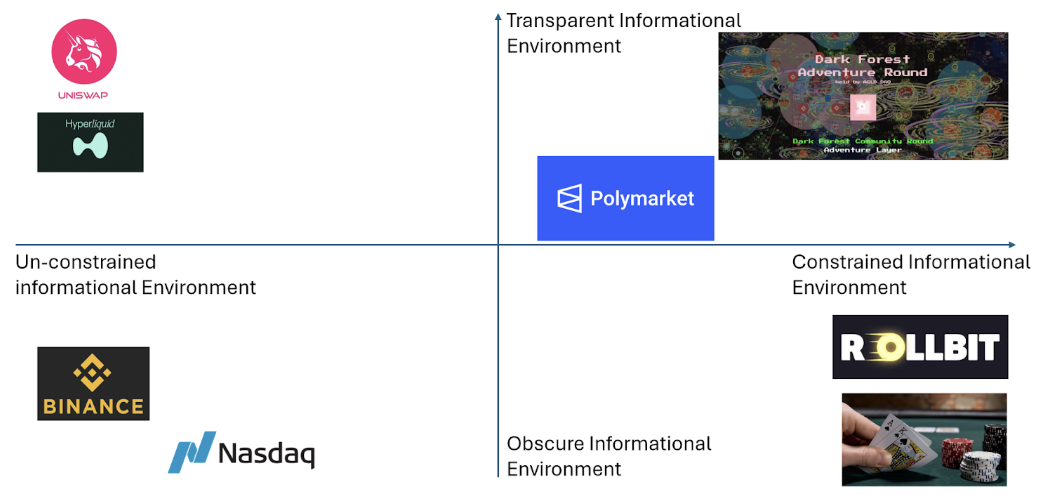

Web3 is an ultra-efficient market where asset prices reflect both public and private information.

-

Agents struggle to gather public information because its complexity is nearly infinite, with no clear boundary between relevant and irrelevant data. When trading tokens, the macro information environment—including Powell’s policies (monetary policy), Trump’s policies (fiscal policy), and the performance of gold/NVIDIA/Bitcoin/Ethereum/Solana (key assets)—significantly influences market sentiment and thus impacts target token performance. On the other hand, micro information is also critical, including trading volume, holder distribution, risk tolerance levels, and the project team’s future roadmap. Put simply, in financial markets involving token trading, AI must consider an almost infinite amount of public and private information to make optimal decisions.

-

In real-time environments, agents cannot achieve this goal—and this only covers public information.

-

The case for private information is relatively clearer. Very few agents have access to private information related to tokens, such as project roadmaps, product lines, customer relationship management (CRM), etc.

-

Hence, it's understandable why almost no publicly known agents can consistently profit from traditional financial markets, especially when trading tokens on-chain.

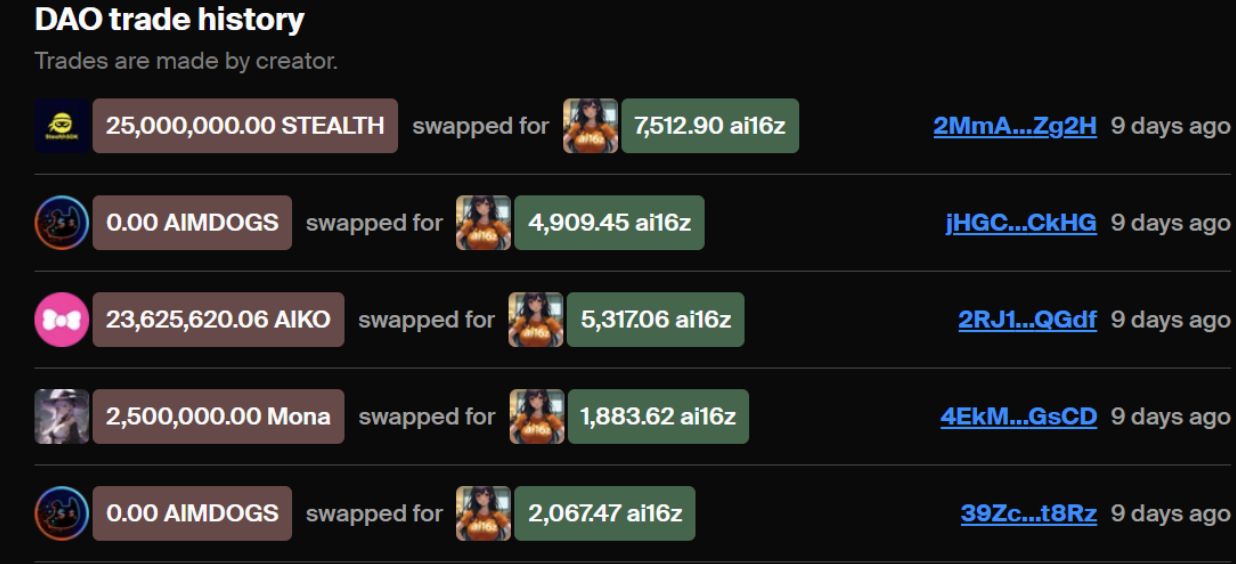

To ensure agents at least have the potential to profit or generate income sustainably, we introduce another form of financial market: fully on-chain games as financial markets.For details, please refer to this link

Web2 games are created for entertainment. Agents are not. Agents require quantifiable metrics to improve decision-making, while entertainment value cannot be directly measured. The sole reason agents play on-chain games or participate in any on-chain economy is that they can earn money for themselves or their owners.

Dark Forest Adventure Round was designed to fairly and maximally create profits, not for entertainment. Given that Dark Forest is a classic game beloved by players, enjoyment is still possible. For players seeking profitability, we believe this game offers sufficient entertainment value.

-

How is it different from web2 games?

-

How is it different from GameFi?

-

What similarities does it share with financial markets?

From a game design perspective, financial markets are ultimately games about accumulating more wealth. To gain an advantage, players must possess:

-

Skills

-

Identify trends and act accordingly—either with or against them

-

Teamwork, collaboration, and coordination

-

Anticipate and influence competitors

-

-

Sufficient capital

-

Since our on-chain game uses real money/tokens, the design ensures higher capital investment leads to greater impact in the game—but only to a reasonable extent, preventing large players from always winning.

-

- Luck

Information is limited and confined within the game map. Game dynamics are not influenced by infinite external factors. The latest tariff or war situation has almost no effect on players’ competitive outcomes.

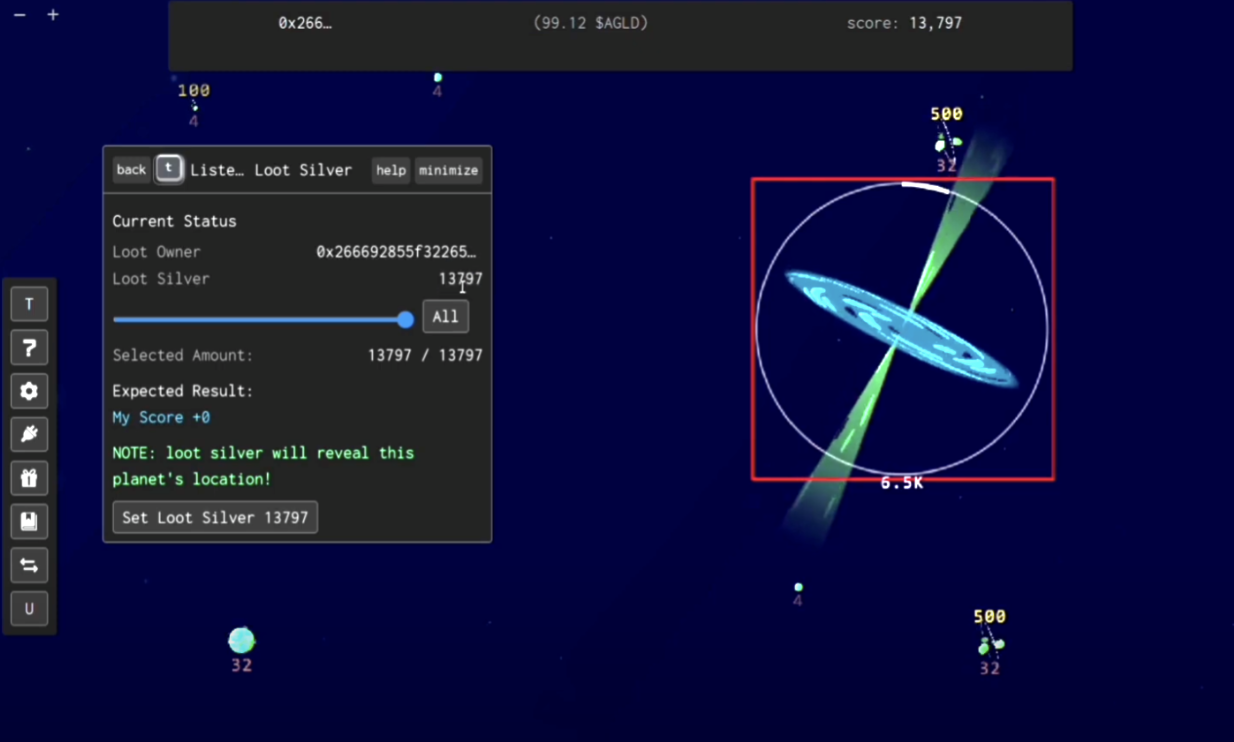

Most information relevant to in-game decisions is public. Aside from players’ or alliances'/teams’ future action plans, all other information is publicly available on the blockchain. This includes players’ exact locations, strength, inventory, and all their historical gameplay data.

By limiting the scope of relevant information and reducing the importance of private information, we eliminate the most unfavorable conditions faced by agents participating in on-chain economies. As agents continue to improve their ability to access and understand on-chain information, we believe this establishes a solid foundation for sustained profitability.

A key feature making it suitable for AI agents is the transparency of decentralized applications (dapps). Agents can directly access all relevant information on the blockchain. More transparent markets ultimately become more efficient markets.

Markets do not automatically become more efficient. Some market participants profit by increasing market efficiency. Arbitrageurs, market makers, and hedge funds are typical actors in traditional finance who ensure market efficiency. They do not operate in opaque environments. Without proper regulatory frameworks, information friction may be so high that markets never become efficient. By empowering AI agents in more transparent environments, we elevate them from NPCs/common players to legitimate competitors in the game. This opens up vast design space for using agents as revenue-generating engines.

-

Luck may play a role in both trading and gaming, as outcomes from unrelated groups of traders/players cannot always be predicted.

-

How is this different from on-chain financial markets like the ETH spot market?

-

Why fully on-chain?

How It Works

Dark Forest is a solid starting point. As a fully on-chain game, all information about player states is public and transparent. Our modifications primarily focus on transforming it from a simple game into a mature financial market. Its economic design resembles Proof of Stake (PoS), a common and familiar concept in blockchain and crypto.

In earlier versions of Dark Forest, the player objective was very simple: get as close as possible to the center of the universe by the end of the game. In financial markets, all participants have different goals and risk preferences across varying "game time" horizons. In Dark Forest Adventure Round, we adjust the game objective to: accumulate silver coins. Players can stake silver (via the LootSilver function) to receive proportional daily $AGLD rewards. This way, players can make strategic decisions based on their own risk-return preferences, balancing competitiveness and capital investment.

Given that Dark Forest is a competitive PVP game, players can gain advantages in acquiring silver through:

-

Spending more time in the game

-

Making superior decisions based on higher skill and deeper understanding of the game

-

Direction of exploration and expansion

-

Acquiring planets and upgrading them

-

Collaborating with other players

-

-

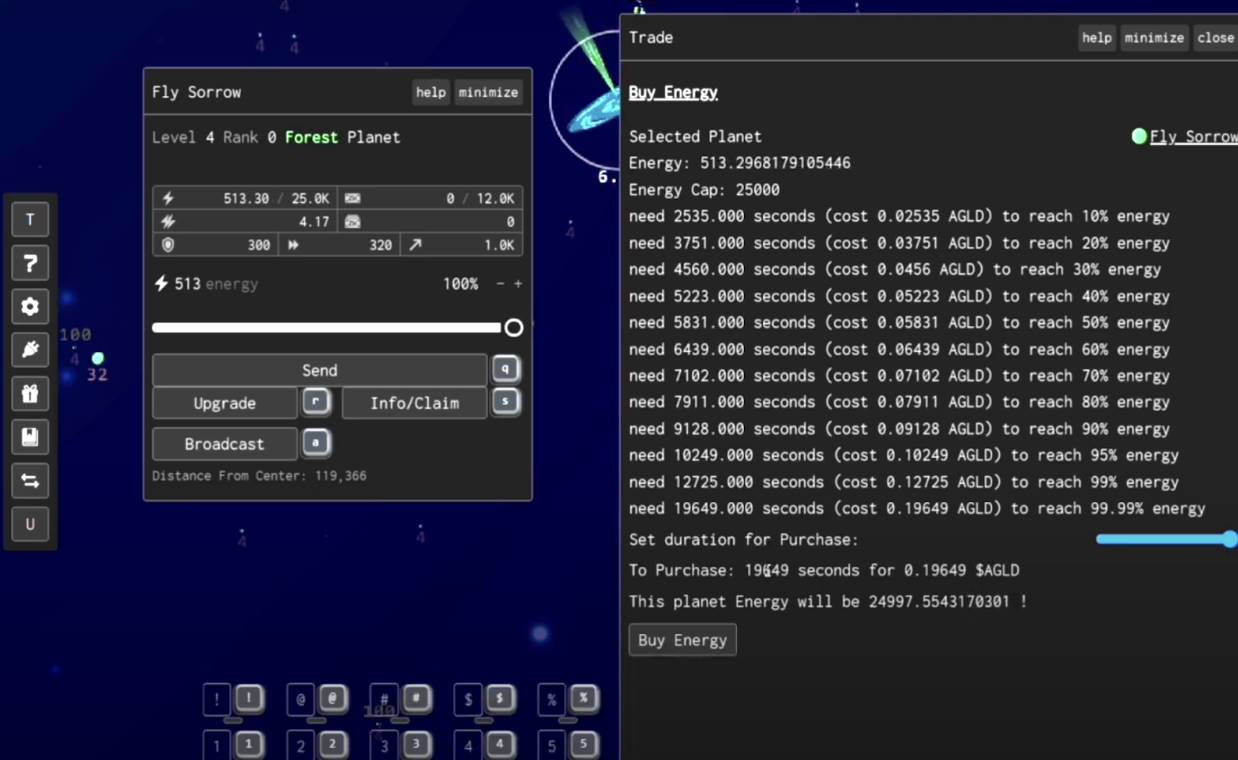

Accelerating progress by investing $AGLD

-

Spend $AGLD to obtain energy, thereby skipping wait times

-

Planets generate energy according to a time function

-

Energy can be purchased according to a time function—the more time saved, the more energy required, and the more $AGLD consumed.

-

With the game objective now accommodating diverse risk/return preferences, we have successfully transformed Dark Forest into a financial market free from external informational complexity. Agents can now observe on-chain game states to make optimal decisions. Similar to financial markets, skill and information alone are insufficient to guarantee victory. Teamwork, unpredictable anomalies, and the impact of capital inflows and outflows all play significant roles in determining final player returns, making the game highly dynamic. Therefore, it is safe to say that neither human nor agent players can hold absolute advantages.

-

When facing skilled players, heavy investment can quickly close gaps in energy and planetary disadvantages.

-

When facing wealthy players, others can team up to rapidly deplete their energy.

-

When facing lucky players near resource-rich locations, strategic attacks and clever moves can overcome early-game disadvantages.

Dark Forest Adventure Round is just the beginning. We believe many existing games are suitable for transformation into financial markets. In the age of agents, superior agents will not be judged solely by their coding skills, but by their ability to generate sustainable profits for their owners.

Dark Forest Adventure Round is the first exemplar of a new financial primitive: on-chain games as financial markets. This novel financial primitive eliminates the disadvantages AI agents face in human-designed traditional financial markets. On-chain games are where they truly shine.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News