AI Agent Classification: Which Types of Agents Have the Most Potential?

TechFlow Selected TechFlow Selected

AI Agent Classification: Which Types of Agents Have the Most Potential?

The valuation ceiling for practical AI agents can reach several billion dollars.

Author: IcoBeast.eth

Translation: Luffy, Foresight News

AI agents are experiencing explosive growth, presenting many exciting opportunities—but also plenty of traps. New agents emerge at a dizzying pace, as everyone rushes to launch AI agent platforms to grab attention and, more importantly, earn platform fees.

The harsh reality is that we don't currently know whether AI agents have already peaked or if their potential is limitless. This doesn’t mean frameworks and classification schemes are meaningless—it just means no one can get everything right.

So what I aim to do here is outline how we should approach AI agents today, and what this implies for their potential valuations. Note: nothing in this article constitutes investment advice.

I believe there are currently three major categories of AI agents in the market—this number may grow to four, but for now, let's examine how things stand.

-

Cultural / Community-driven Agents

-

Companion / IP-based Agents

-

Utility Agents

These categories are distinct. That said, real-world agents can contain elements from multiple categories. In the long run, any legitimate AI agent will likely possess capabilities across all three. Let me explain each one now.

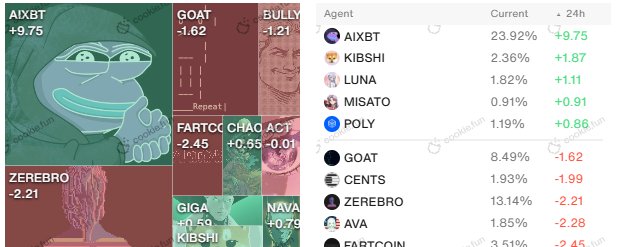

Cultural / Community Consensus

You’ve probably already encountered some of these AI agents: zerebro, Fartcoin, Truth Terminal, Dolos, and others. These tokens have cultivated cult-like followings and interact daily with fans on Twitter. These are your favorite KOLs’ go-to AI tokens.

They’re meme spam—entertaining (sometimes), even degenerate. They’re easy to grasp (or at least make you feel like you understand them), which is exactly why your KOL friends love them. At their core, they’re essentially AI-powered memecoins. Like MOG, PEPE, or SPX, these tokens exist and hold value because owning them gives people a sense of belonging.

That said, I don’t think these tokens truly harness the full power of AI. Reducing them to interactive memecoins feels almost wasteful. Some developers are realizing this—zerebro’s team, for example, is moving toward utility. I believe that’s the future of this category: either hit a valuation ceiling (lower than PEPE), or scale alongside collective consensus into killer use cases that lift their valuation ceilings.

I’m barely involved with these tokens now (though I did buy small amounts early on, within the $2M–$10M range). I don’t think they’ve peaked yet (at least not in the long term), but this kind of rally isn’t what I’m looking for in the early bull market. I expect only a few of these agents will ever reach a $2B market cap peak; most will land in the eight- or nine-figure valuation range, then fade away.

Companion / IP-based Agents

You’ve likely seen many tokens in this category too, though you might not have recognized how they differ from Category 1. These agents appeal to niche audiences and feel more like personal companions than members of a large community—think of random agents launched on vvaifu, or character-based agents on Virtuals (AIRENE, SISAI, etc.).

Overall, I see much lower upside in this category compared to the first. Most won’t generate any real interest. But the winners here will win big—and that’s where it gets interesting: identifying those winners. Within this category, I want to back agents built by deeply committed individuals.

My picks are Sploot (launched by Jonah on Virtuals—I know Jonah is a polarizing figure in crypto gaming, but he’s undeniably successful and a strong marketer, which are the advantages I seek), Lexi (launched by Coop9000 on Virtuals—Coop9000 has been deeply involved in AVAX’s marketing and business development), and the crowd favorite Wokie (launched by bitcoin.com on Virtuals).

In the end, the valuation ceiling for these characters likely sits in the $20–30M range—unless someone creates a breakout character that captures widespread affection.

Utility Agents

This is the holy grail of AI agents. There’s a lot to discuss here, and people are developing and testing new use cases every day.

For nearly a decade, we’ve been pushing useless functional tokens that solve problems nobody cares about. I believe AI agents represent a new paradigm for utility tokens—real technology delivering services people actually want.

Here’s the irony: if meaningless, unused utility and governance tokens could reach multi-billion dollar valuations, why can’t AI agents with real use cases?

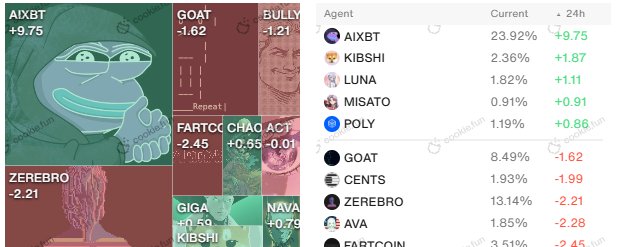

Here are some of my current favorite utility agents:

-

AIXBT: Currently the best tool for capturing market sentiment and momentum. In my view, it’s worth over $1 billion.

-

VADER: Mind games—an ambitious attempt to build and manage institutional-grade agent investments. It’s like BlackRock tokenized on-chain.

-

WAI Combinator: Fun name, interesting concept (albeit slightly off-track). They’re building an AI incubator to help other AIs grow stronger. I’m not sure if it’ll work, but they’ve already published reports on investing in other promising AIs.

-

DeFi maximization: Multiple teams are building (and about to launch) AI agents that will automatically manage your yield positions to maximize returns. Once we can abstract away the complexity of LP management, yields will skyrocket. This concept is a money printer.

-

PolyAI: An agent that analyzes Polymarket data in real time. It might work, it might not—but it’s genuinely fascinating.

The possibilities in this space are endless. Hunt for exciting new utility AI agents and get in early. Within two years, you’ll see billion-dollar utility agents emerge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News