A New Landscape in This Bull Market: Legacy Coins' Comeback, Inflation Trap, and Generational Shifts Among Retail Investors

TechFlow Selected TechFlow Selected

A New Landscape in This Bull Market: Legacy Coins' Comeback, Inflation Trap, and Generational Shifts Among Retail Investors

New capital inflows, not just fund rotation; retail investors are returning, but with different focuses.

Author: Stacy Muur

Translation: TechFlow

We’ve finally entered a bull market, but it has also exposed some weaknesses in the economic reality of Web3.

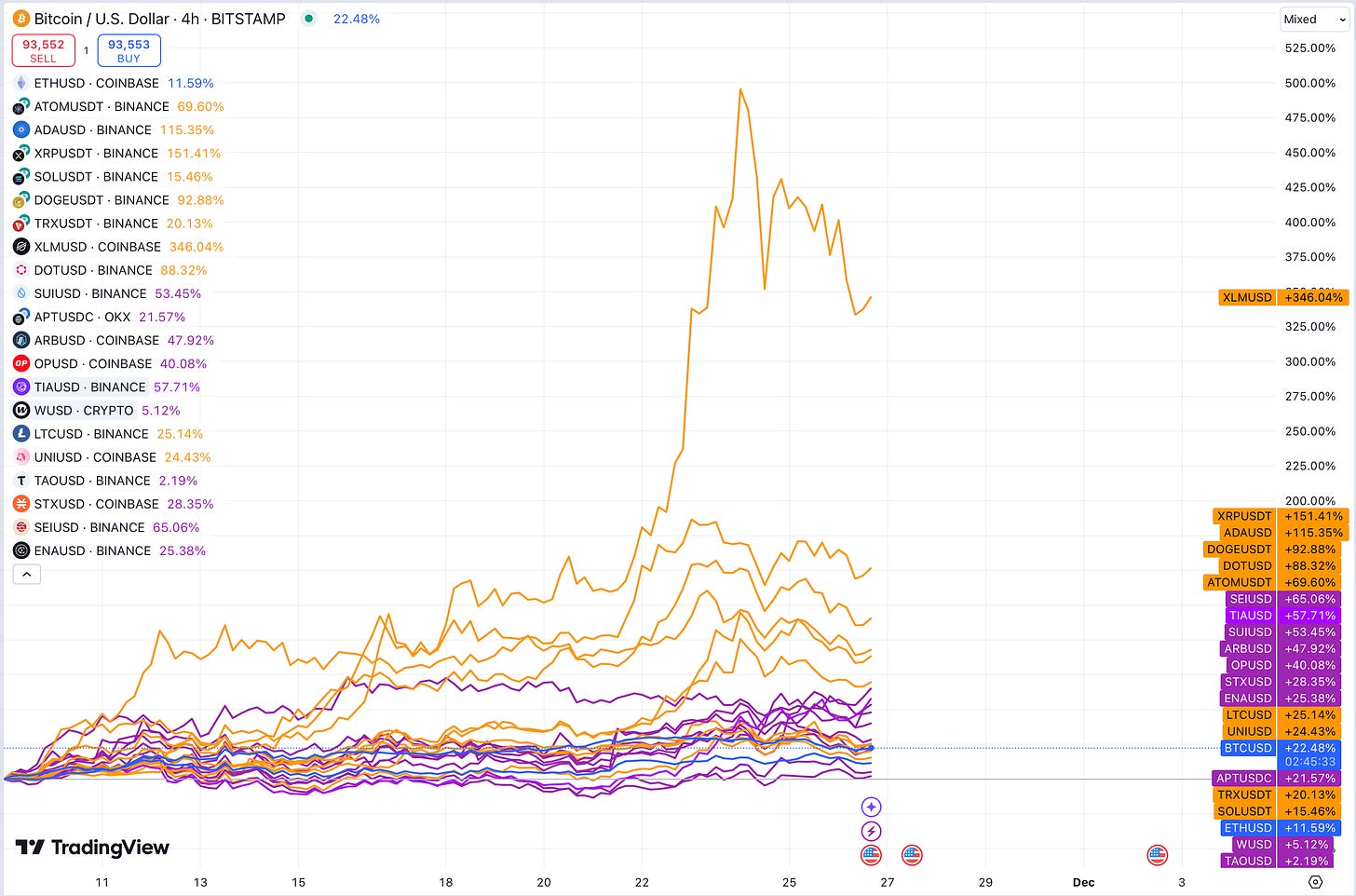

For market participants who have been optimizing their portfolios over the past few years, this bull run feels somewhat “frugal.” Many newer tokens are underperforming, while established ones like $XRP, $ADA, $DOT, and $ATOM are delivering impressive returns.

Background: Performance Comparison Between Old and New Tokens

Historically, newer altcoins (tokens less than two years post-TGE—Token Generation Event) have consistently outperformed older projects across various timeframes. However, this bull market tells a different story: legacy projects such as $XLM, $XRP, $ADA, $DOT, and $ATOM have taken center stage, while new tokens remain lackluster.

Next, we’ll explore the underlying causes, implications, and what this means for the future.

Understanding the Shift: Key Insights

-

New capital inflows, not internal rotation

The broad-based rally in legacy altcoins suggests this trend isn’t driven by capital rotating within the crypto market. Instead, it’s more likely that fresh capital is entering—particularly from retail investors returning to the market.

-

Retail return, but with shifting focus

Signs of retail comeback are clear—from rising rankings of the Coinbase app to increased viewership of crypto-related YouTube content. Yet contrary to expectations that retail would flood into high-risk memecoins, funds appear to be flowing toward mature projects from the previous cycle. This may indicate that today’s retail investors are older, more risk-averse, or simply more familiar with well-known altcoins from the last bull run.

-

Familiarity and trust as deciding factors

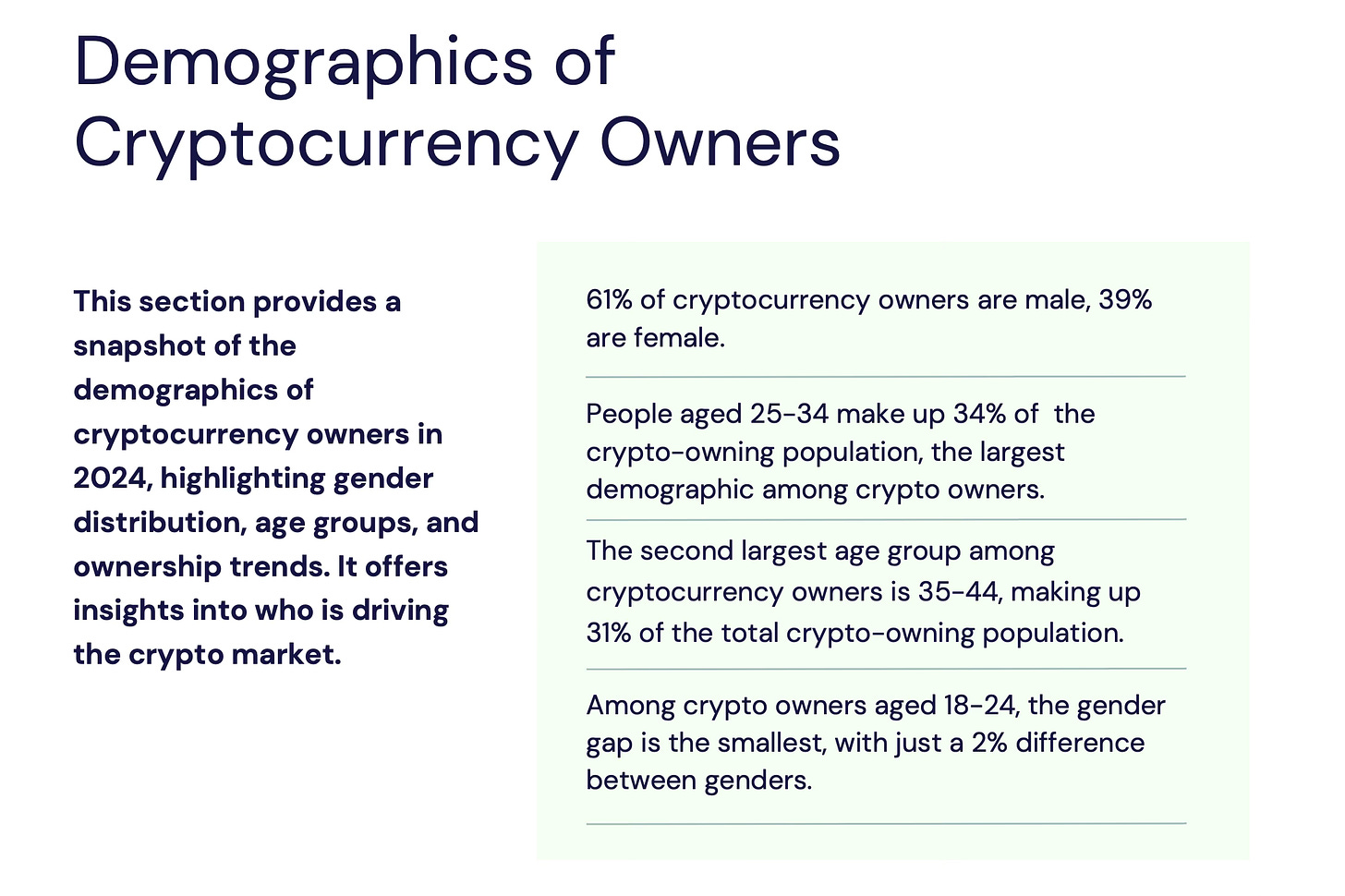

The top-performing legacy altcoins in this cycle were all stars during the last bull market. This suggests returning retail investors are likely aged between 25 and 45, with prior experience in crypto. They may lack understanding of newer narratives like DePIN (Decentralized Physical Infrastructure Networks), RWA (Real World Assets), or AI, leading them to favor familiar names.

-

Generational differences at play

Meanwhile, Gen Z investors—who often discover crypto through TikTok or meme-driven content—tend to have less disposable income. This could explain why, despite the return of retail, memecoin markets haven’t seen significant capital inflows.

-

Inflation effects

Another key reason for the poor performance of new altcoins is inflation. Older tokens generally have a higher percentage of circulating supply, meaning new capital isn't diluted by ongoing token emissions.

If these trends interest you, the evolving market dynamics are worth watching closely. Will the rise of legacy coins reshape the Web3 economy? How should new projects respond to these challenges? Only time will tell.

Below, we’ll focus on two critical factors influencing market behavior in this bull cycle: inflation and retail demographics.

Inflation: The Silent Killer Eroding Crypto Gains

The current bull market brings optimism, but also reveals an uncomfortable truth: inflation is quietly eroding investor returns. For anyone aiming to profit in this cycle, understanding how inflation impacts asset value is crucial.

Let’s look at real-world examples:

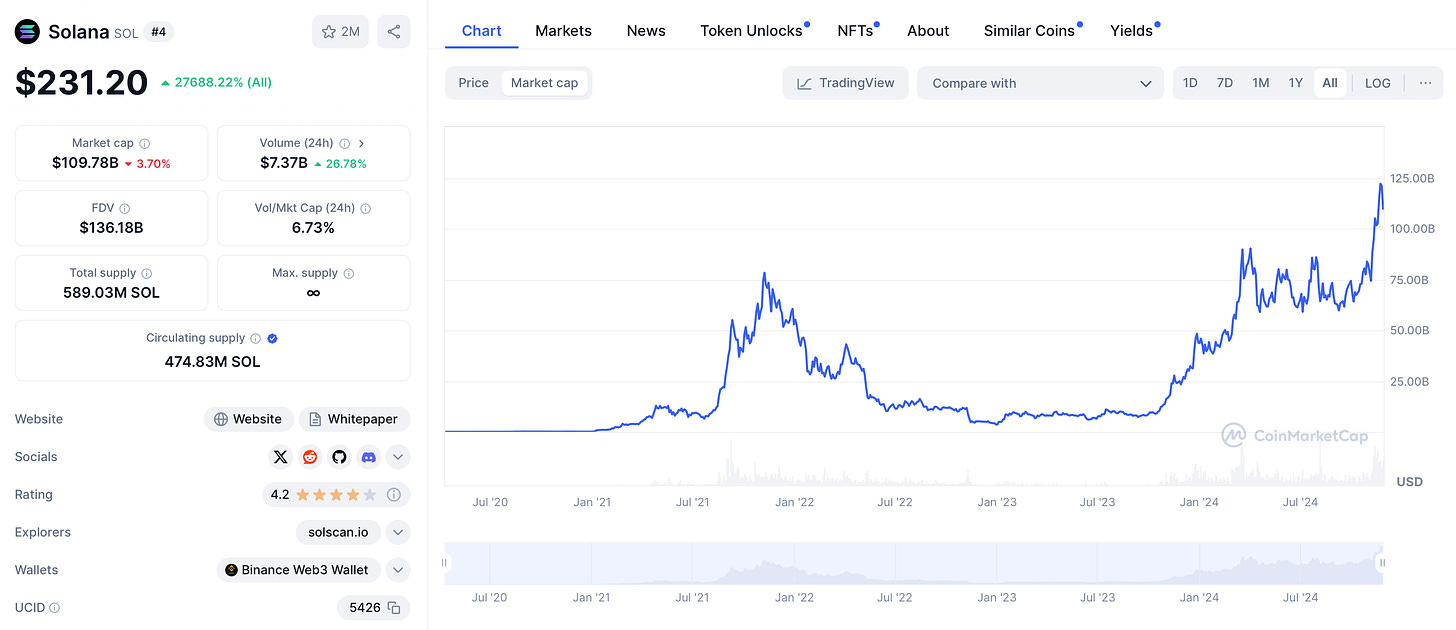

In 2021, $SOL reached $258 with a market cap of $75 billion. Today, it trades at the same price—$258—but now has a market cap of $122 billion. Why? Increased circulating supply. As supply expands, each token’s value gets diluted by inflation, requiring a much larger market cap just to maintain the same price level.

More cases like this:

-

$TAO: Market cap has surpassed its all-time high (ATH) of $4.6 billion, yet price hasn’t reached new highs.

-

$ENA: Current market cap (~$1.84B) near ATH ($2.12B), but price dropped from $1.49 to $0.64.

-

$ARB: ATH market cap was $4.6B in March; now down to $3.8B. Price fell from $2.1 to $0.8.

-

$SEI: ATH market cap was $2.8B, recently at $2.25B; price down from $1.03 to $0.53.

This is just the tip of the iceberg. In reality, many tokens face similar issues.

Even as the "altseason" appears to be underway, inflation continues to silently undermine potential gains. With growing circulating supplies, maintaining or increasing token prices demands ever more capital inflow. For assets with high inflation rates, investors must fight an uphill battle—even in a bull market.

How to Counter Inflation Risks

To better protect your gains during this bull market, consider these strategies:

-

Study Tokenomics: Before investing, analyze a project’s inflation rate and token distribution plan. Prioritize those with slower supply growth or low inflation.

-

Diversify wisely: Favor projects with capped total supply or hard limits on inflation, such as Bitcoin (BTC).

-

Assess real returns: Factor in inflation when calculating investment returns and adjust your profit expectations accordingly.

Inflation isn’t just a macroeconomic term—it’s the “silent killer” of crypto profits. Understanding and effectively managing its impact will be one of the keys to success in this bull market.

TikTok vs. CoinMarketCap

If you’re reading this, you’re likely a seasoned investor who has lived through both bull and bear markets. You’ve probably researched new protocols, participated in airdrop farming, and explored emerging investment themes. By contrast, the average retail investor entering now—driven by election optimism or Bitcoin nearing $100K—is fundamentally different in background and mindset.

To truly understand the behavior of these new retail investors, recall your own early days in crypto. Back then, you might have had only a centralized exchange (CEX) account filled with unfamiliar token tickers.

I believe today’s new retail entrants can be broadly categorized into three groups:

-

Gen Z: Likely drawn to memecoins via TikTok hype—often highly speculative and volatile assets.

-

Gen X: May have had some crypto exposure during the last bull run.

-

Gen Y: Attracted by democratized stock trading in recent years, now possibly turning attention to crypto.

Recently, I’ve studied Gen Z investment psychology in depth. Compared to other generations, they show distinct differences in risk attitude and behavior patterns. The following descriptions likely apply to typical Gen Z investors. If you're part of Gen Z and feel this doesn’t describe you, you might be the exception.

For Gen Z, taking risks and suffering losses is often unappealing. They prefer low-risk activities like completing Galxe quests, playing Hamster Kombat, or participating in airdrop farming. These require time—not money—making them far more attractive.

Trading, however, is a different beast. When Gen Z discovers the bull market through TikTok, it may initially seem like an exciting adventure. But after experiencing volatility-induced losses, they quickly confront harsh realities.

Gen Y, on the other hand, behaves differently. If they become interested in crypto, it’s likely because they already have trading experience in equities and a clearer grasp of investment risks. As a result, they’re less likely to chase high-risk memecoins.

Gen Y tends to open CoinMarketCap, browse token lists, study charts, and make data-driven decisions. They also typically have more disposable income than Gen Z, enabling more rational and stable investment choices.

Conclusion

The above reflects my observations on current retail investor behavior, which largely align with recent market trends. Of course, this doesn’t mean my analysis is 100% accurate or the only possible interpretation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News