BTC Continues to Break New All-Time Highs: ETF-Driven Momentum, Strong October Performance, and Analysis of Fed Policy Impact

TechFlow Selected TechFlow Selected

BTC Continues to Break New All-Time Highs: ETF-Driven Momentum, Strong October Performance, and Analysis of Fed Policy Impact

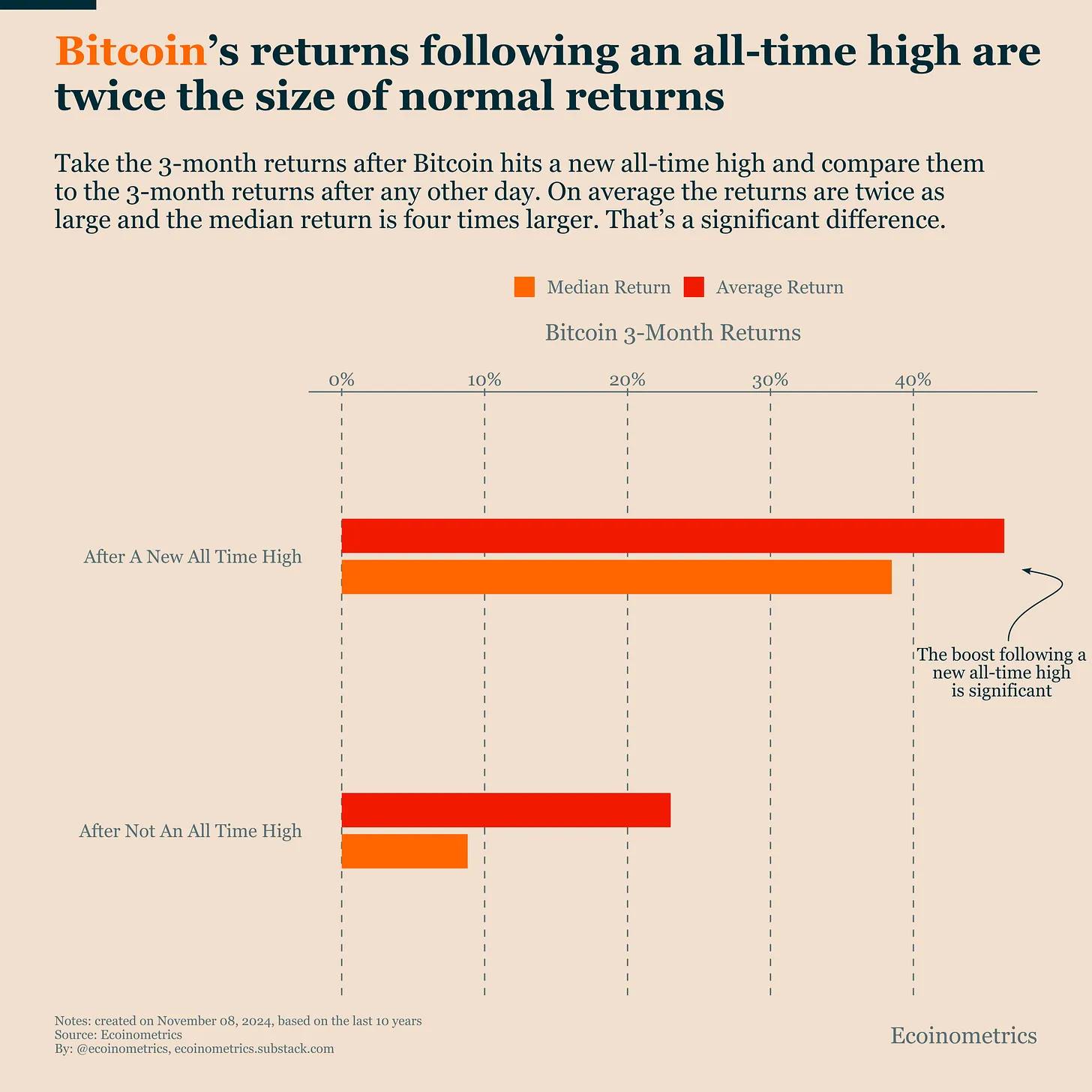

If Bitcoin's average return rate reaches 46% within three months after hitting a new high, Bitcoin could approach $100,000 by Q1 2025.

Author: Ecoinometrics

Translation: TechFlow

Today's topics include:

-

The driving force behind Bitcoin's new all-time high

-

Bitcoin's outperformance in October

-

Small rate cuts

Each topic comes with a brief explanation and a detailed chart. Let’s dive in.

The driving force behind Bitcoin's new all-time high

Bitcoin performed strongly during the U.S. election period. Not only did it successfully break through the $65,000 level, but it is now approaching a new all-time high. This positive momentum tends to reinforce itself.

Historical data allows us to make projections: within three months after reaching a new high, Bitcoin has delivered an average return of 46% and a median return of 39%.

This implies that if Bitcoin achieves its average return, it could approach $100,000 by the first quarter of 2025.

Achieving this target requires sufficient inflows into Bitcoin ETFs. Current trends are highly optimistic, so we should closely monitor this development.

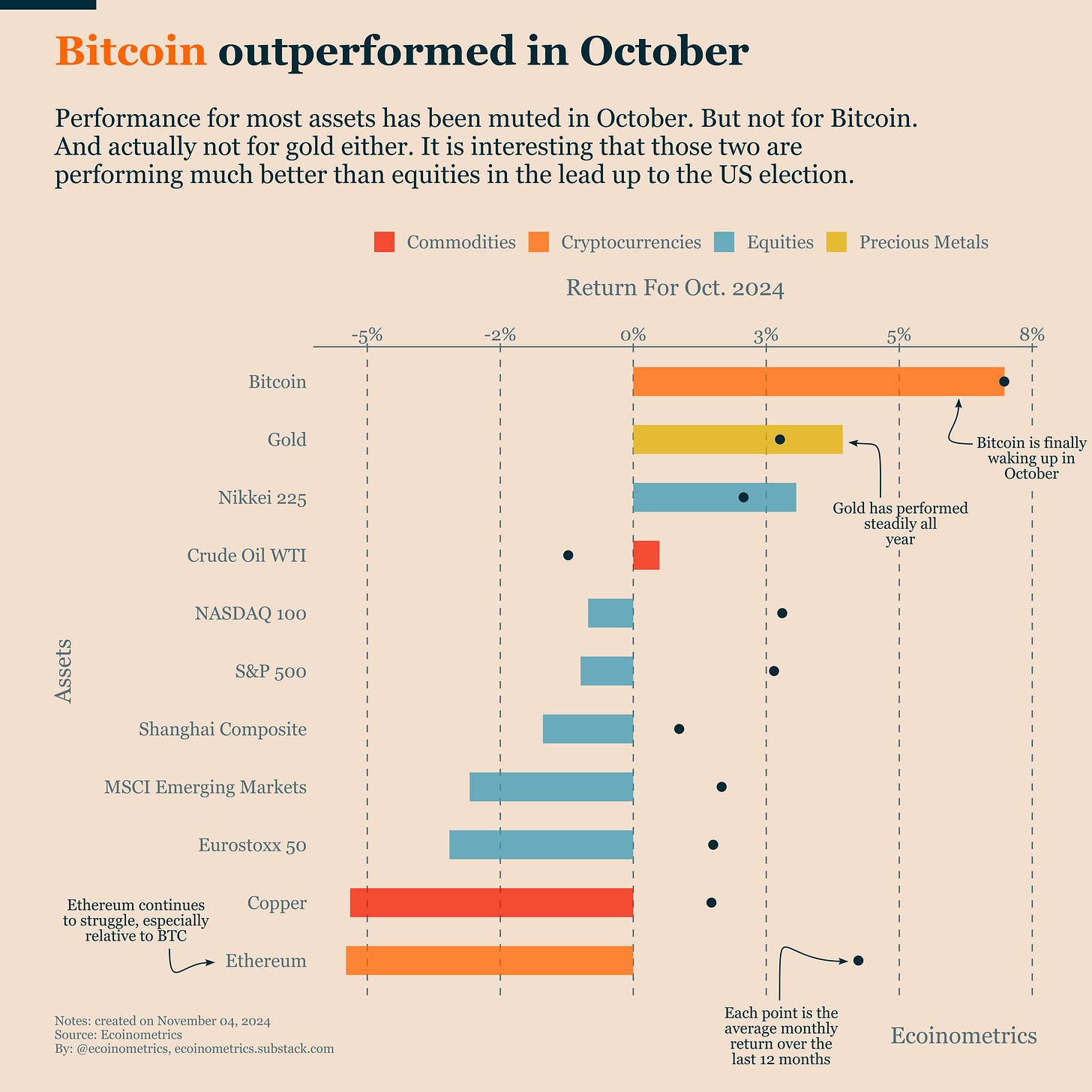

Bitcoin outperformed in October

In fact, even before the U.S. presidential election, Bitcoin was already performing exceptionally well.

In October, it was one of the few global assets to generate positive returns—alongside gold. This is not the first time we’ve highlighted this observation.

The strong performance of Bitcoin and gold over the past 12 months indicates that global macro investors are seriously concerned about the threat of dollar depreciation.

Unless the federal government suddenly adopts fiscal discipline, the trend in U.S. debt will remain unsustainable. At a certain tipping point, this debt will have to be monetized by the Federal Reserve.

This is no longer a question of "if," but "when."

Maintaining at least a portion of Bitcoin in your portfolio as a hedge is a strategy you cannot afford to ignore.

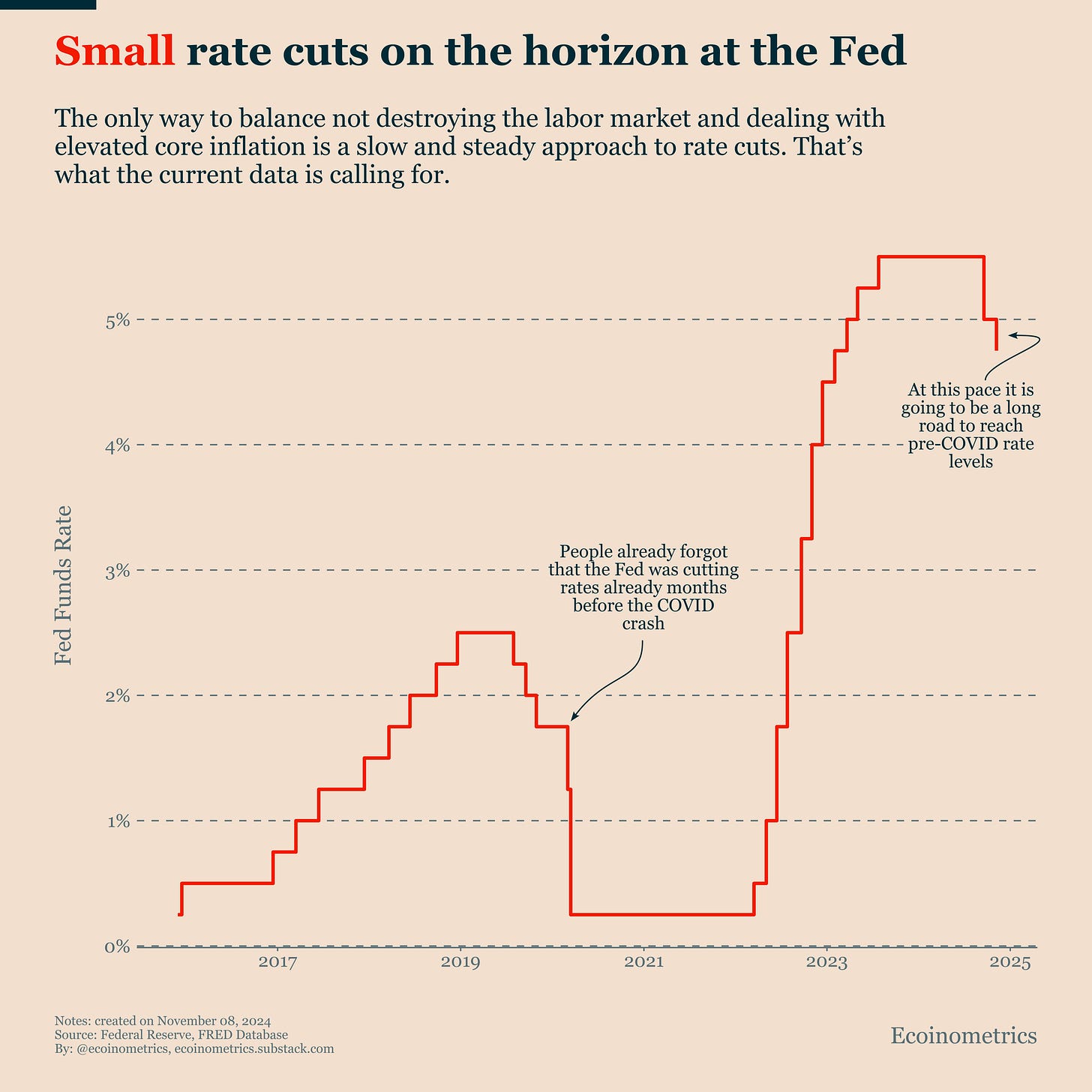

Small rate cuts

Regarding debt monetization, the Federal Reserve has not yet taken action.

The more immediate challenge facing the Fed right now is keeping core inflation under control without destabilizing the U.S. economy.

As we've discussed multiple times, current data shows:

-

No downward trend in core inflation

-

A stable labor market, with unemployment at historic lows

This means that a gradual and cautious approach involving small rate cuts over the coming months is the only reasonable path forward for the Fed.

This was precisely the focus of this week’s FOMC meeting. Meanwhile, the size of the Fed’s balance sheet continues to shrink.

This monetary policy won’t lead to rapid growth in money supply, but it isn't entirely negative for Bitcoin either.

Therefore, as long as Bitcoin’s upward momentum persists and ETF inflows continue, the Fed’s actions should not meaningfully impact Bitcoin in the short term.

That’s all for today. Hope you enjoyed it. Next week, we’ll bring you more insightful chart analysis.

Best regards.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News