Chain on Numbers: Polymarket's October Betting Volume Surpasses $1.3 Billion, Zora Weekly Active Users Exceed 100,000

TechFlow Selected TechFlow Selected

Chain on Numbers: Polymarket's October Betting Volume Surpasses $1.3 Billion, Zora Weekly Active Users Exceed 100,000

Polymarket accounts for 85% of the total locked value in the crypto prediction market.

Author: OurNetwork

Translation: TechFlow

On-Chain Culture

Polymarket | Karate Combat | MetaDAO | Zora

Polymarket

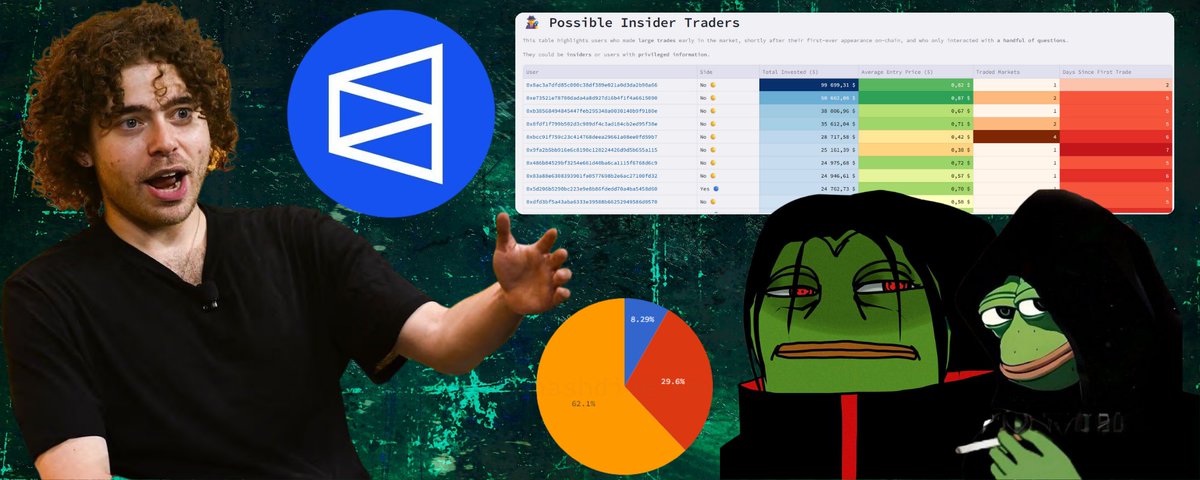

Polymarket surpassed $1.3 billion in monthly wagers in October 2024, with total value locked (TVL) reaching $221 million

-

Polymarket is a Polygon-based decentralized platform for betting on real-world events. On October 20, 2024, the platform achieved a significant milestone, surpassing its previous all-time high of $533 million in volume set in September—reaching a new record of $1.3 billion this month, marking an impressive 2.5x growth. Additionally, Polymarket now accounts for 85% of the total value locked in crypto prediction markets. To date, the platform has recorded $3.5 billion in total trading volume and 17.7 million bets placed.

-

Even before the month ended, Polymarket set a new record, creating 109,427 Safes—a form of smart account—as of October 22. These smart accounts currently hold $48.2 million in non-platform assets, readily available for potential use in platform transactions—marking a record high in user acquisition and suggesting continued growth in platform usage.

-

U.S. election markets dominate trading on Polymarket, but non-election-related markets are growing steadily, reaching weekly volumes of $20 million. Over 40,000 non-election traders participate weekly, indicating Polymarket’s potential to sustain millions in wagers year-round, beyond just seasonal events.

-

Trading highlight: On October 5, someone placed a $1.69 million bet on the market asking "Will Trump launch a coin before the election?"transaction.

Karate Combat

Winnie Lau | Website | Dashboard

Karate Combat's fan engagement coalition surged during the recent KC50 event, with over 386,000 token holders and 109,000 participants; the new UP Layer 2 blockchain will expand Up Only Gaming

-

Karate Combat is a crypto-native professional kickboxing league governed by $KARATE holders. KC events, produced using Unreal Engine and focused on knockout moments, are streamed via TV and social media. Fans can earn tokens by predicting match outcomes through Up Only Gaming, which KC refers to as its "software stack." During the recent KC50 event held at the Permissionless crypto conference in Salt Lake City, 109,000 unique players participated, wagering approximately $5.5 million worth of 8.9 billion $KARATE tokens. Earlier this year, KC44 had only 40,000 participants—showing a significant increase in engagement. The past four events each attracted over 90,000 players, peaking at 118,000.

-

Karate Combat’s mobile-first platform offers seamless key management, league governance, NFT display, token voting, and easy onboarding. 99% of users engage via mobile devices, and fans can predict fight outcomes to win shares of prize pools—90% of rewards go to users, while the remaining 10% go to athletes.

-

Given the success of Up Only Gaming, Karate will launch UP L2, enabling partners (such as other sports leagues) to deploy similar apps for free. The $UP token will be launched simultaneously, with 30% distributed to $KARATE holders through staking. Over 100,000 users on the KC mobile platform can discover new applications through tasks.

-

Trading highlight: KC47 was the most participatory event in KC history, with 117,833 participants placing predictions on match outcomes—users collectively wagered over 4.1 billion $KARATE tokens. The total prize pool was 169 million $KARATE, exceeding $100,000 at October 22 prices. Each match has its own prize pool, with 90% of rewards going to correct predictors and 10% to fighters. Winners receive a share of total tokens based on unique voting and payout ratios. In the first match, winner Rafael received 68% of 616M $KARATE.

MetaDAO

MetaDAO launches prediction market grant program, interest exceeds funding amount by threefold

-

MetaDAO is an experimental governance platform built on Solana that implements economist Robin Hanson's futarchy model, making decisions through prediction markets instead of token staking votes. This approach aims to improve decision quality and offer unique protection for projects and token holders. Their new grant program has already attracted more than triple the funding amount in market interest.

-

The project is approaching its one-year anniversary with strong user retention. MetaDAO uses its own futarchy platform for governance. Activity peaks often coincide with controversial proposals—for example, the August proposal “Should we release Futard.io?” ultimately failed to pass.

-

Futarchy-as-a-Service (“FaaS”) has enabled 34 trade proposals. Derivatives protocol Drift has joined discussions, and liquid staking protocol Jito is actively considering integrating it into governance as part of its NCN grant program.

Zora

Ricardo de Arruda | Website | Dashboard

Zora’s AMM-driven secondary market stabilizes protocol user growth, but creation originations decline

-

Since introducing its AMM-driven secondary market, Zora Network has consistently maintained over 100,000 weekly active users—compared to pre-update levels of 20,000–30,000 per week.

-

However, creators’ motivation to launch new collections has declined since the introduction of the secondary market—previously, over 70% of NFT collections created across all EVM chains originated from the Zora protocol, but by October, this dropped to around 30%.

-

As seen in the previous charts, Zora’s activity has significantly shifted since the launch of the secondary market. Given that secondary market volume is now more than twice that of the primary market, this shift is understandable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News