Meme Coin Anti-Fraud Practical Guide: Monitor Liquidity and Social Media Changes, Beware of Rug Pulls

TechFlow Selected TechFlow Selected

Meme Coin Anti-Fraud Practical Guide: Monitor Liquidity and Social Media Changes, Beware of Rug Pulls

If something seems too good to be true, it probably is.

Author: MARMOT

Translation: TechFlow

Most meme coins on Dexscreener are scams!

Here’s how scammers operate, and how to protect yourself.

How can you tell a scam from a genuine opportunity?

As meme coins grow in popularity, so do the scams surrounding them.

Many tokens that appear promising are actually designed to drain your wallet.

Even experienced traders have suffered heavy losses from falling into these traps.

The meme coin market moves fast, and scammers know exactly how to exploit the hype.

Let’s examine how they operate—and most importantly, how to protect yourself.

Fake Popularity to Attract Traders

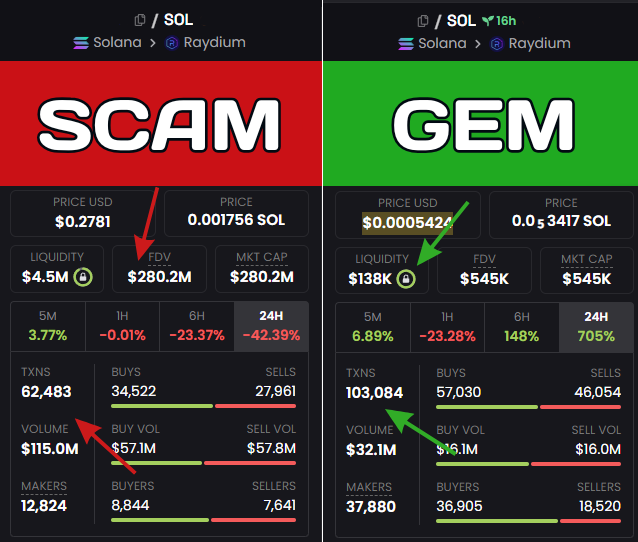

Scammers artificially inflate trading volume and fabricate holder data to make their tokens appear highly active. This draws in unsuspecting traders who believe they’ve discovered the next big thing—only to fall victim to a scam.

What Is the Real Goal of These Scams?

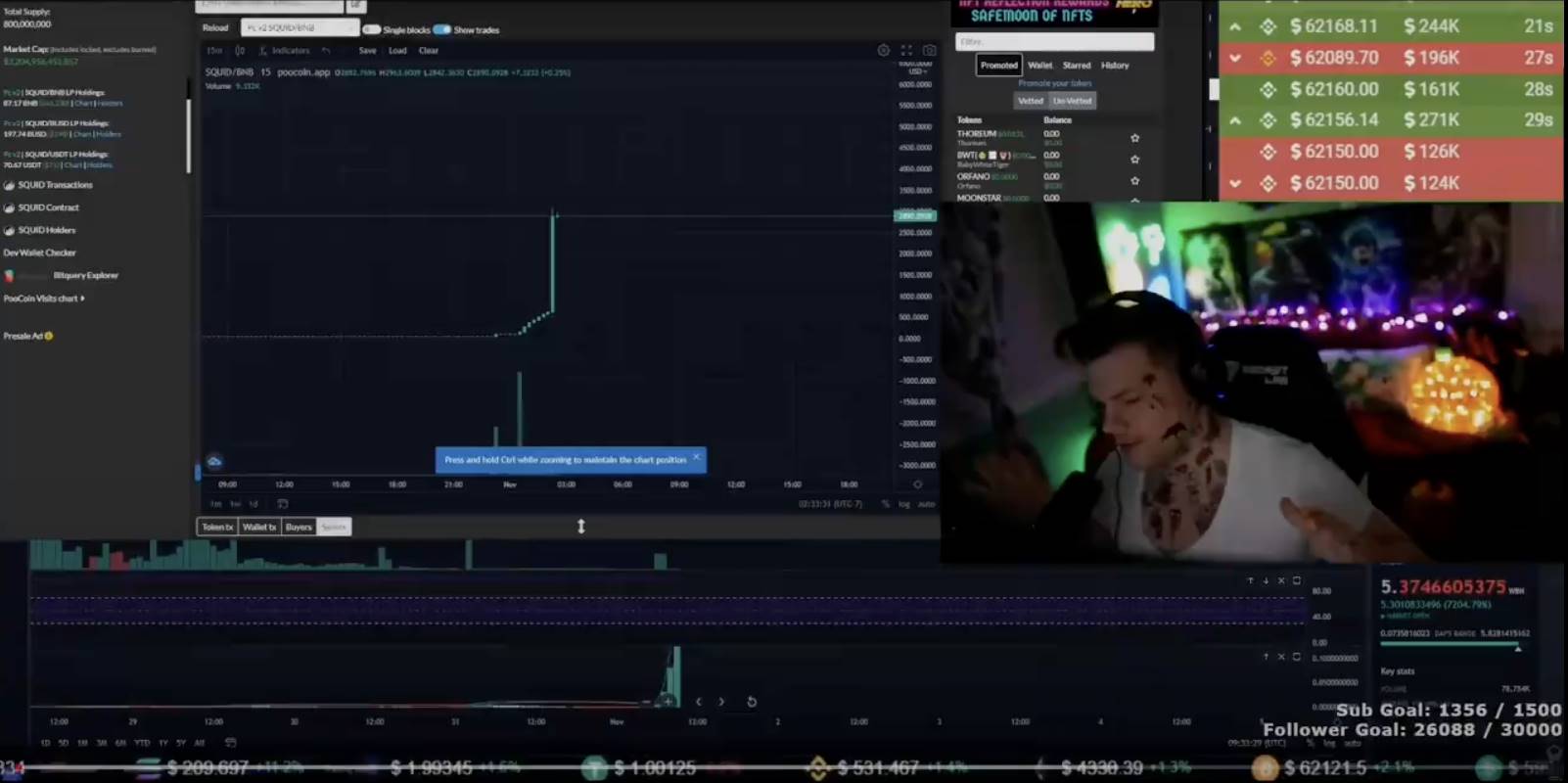

The primary goal is to generate hype. By making a token seem popular, scammers lure traders into investing. Once enough funds have flowed in, they pull the liquidity and vanish, leaving everyone else holding worthless tokens.

How Do Scammers Fake It?

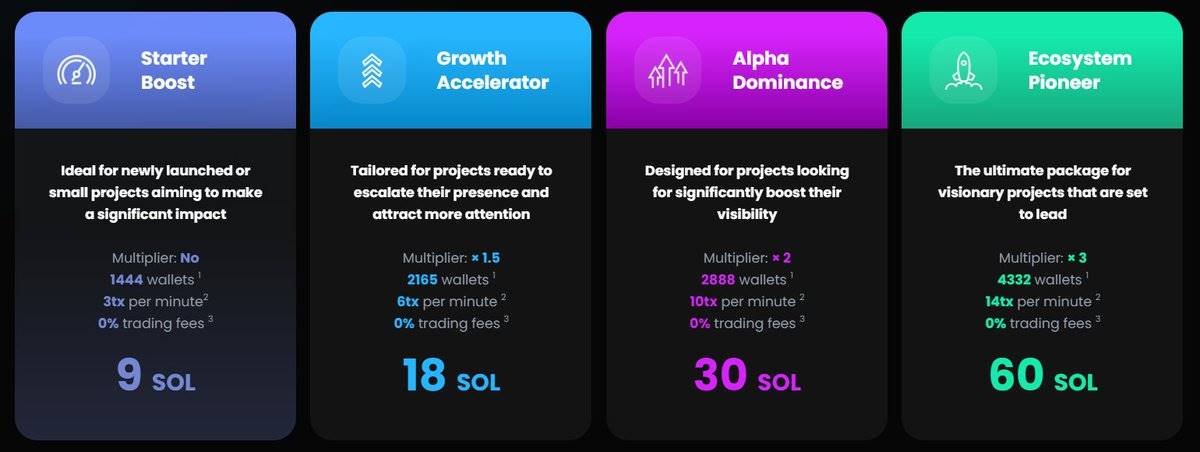

Scammers often use bots or fraudulent services to make their tokens appear legitimate.

Although trading volume may look high, it's usually just smoke and mirrors.

Monitor Liquidity Changes

Another key red flag is sudden changes in liquidity.

If developers suddenly withdraw funds or the liquidity pool rapidly shrinks, it’s often a sign they’re preparing to exit.

Always pay close attention to how funds move within a project.

Conduct On-Chain Analysis

Analyzing wallet distribution is crucial for identifying potential risks in crypto projects. Watch out for token concentration—if a small number of wallets hold most of the supply, it could indicate manipulation risk. You can use tools like @bubblemaps to assist with this analysis.

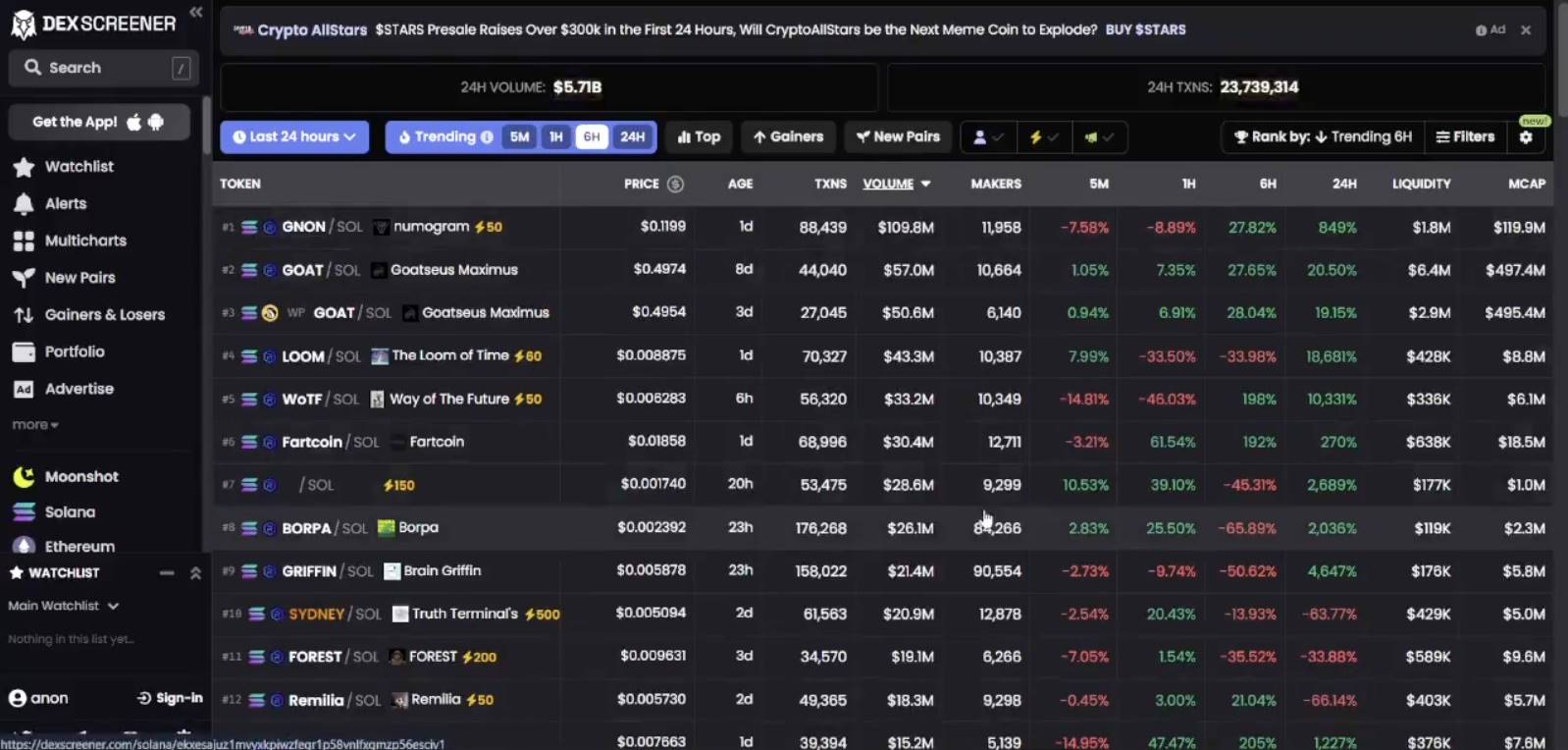

Be Cautious With Newly Launched Tokens

If a token suddenly surges in rankings on Dexscreener but lacks background information, that’s a major red flag.

Scam tokens often appear out of nowhere, catch traders off guard, and disappear just as quickly.

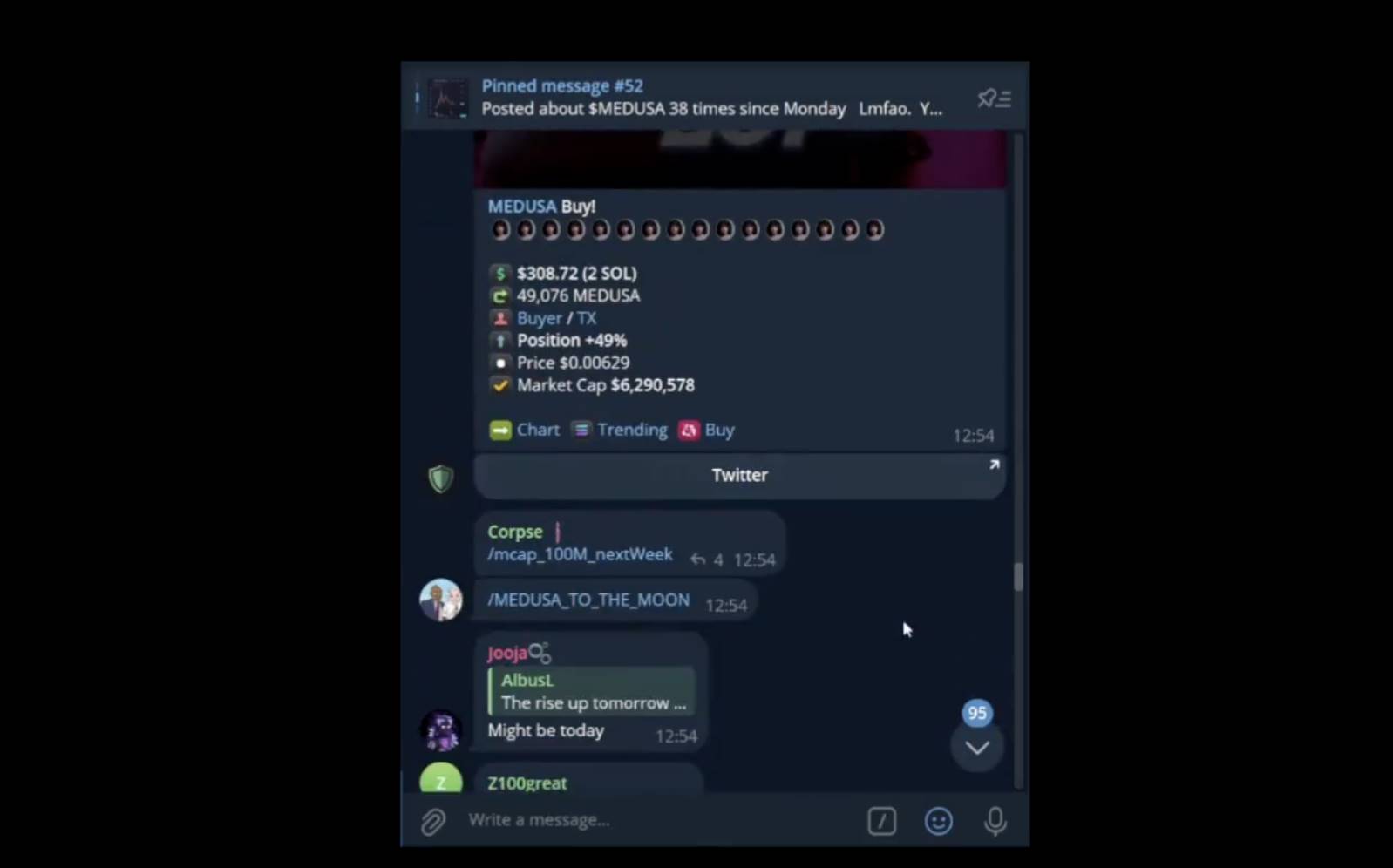

Regularly Check Their Communities

Visit their Telegram and Twitter groups and look for signs of authentic activity.

Scammers often flood these platforms with bots posting generic hype like "To the moon!" or "LFG!" If interactions feel forced or overly artificial, that’s a critical warning sign.

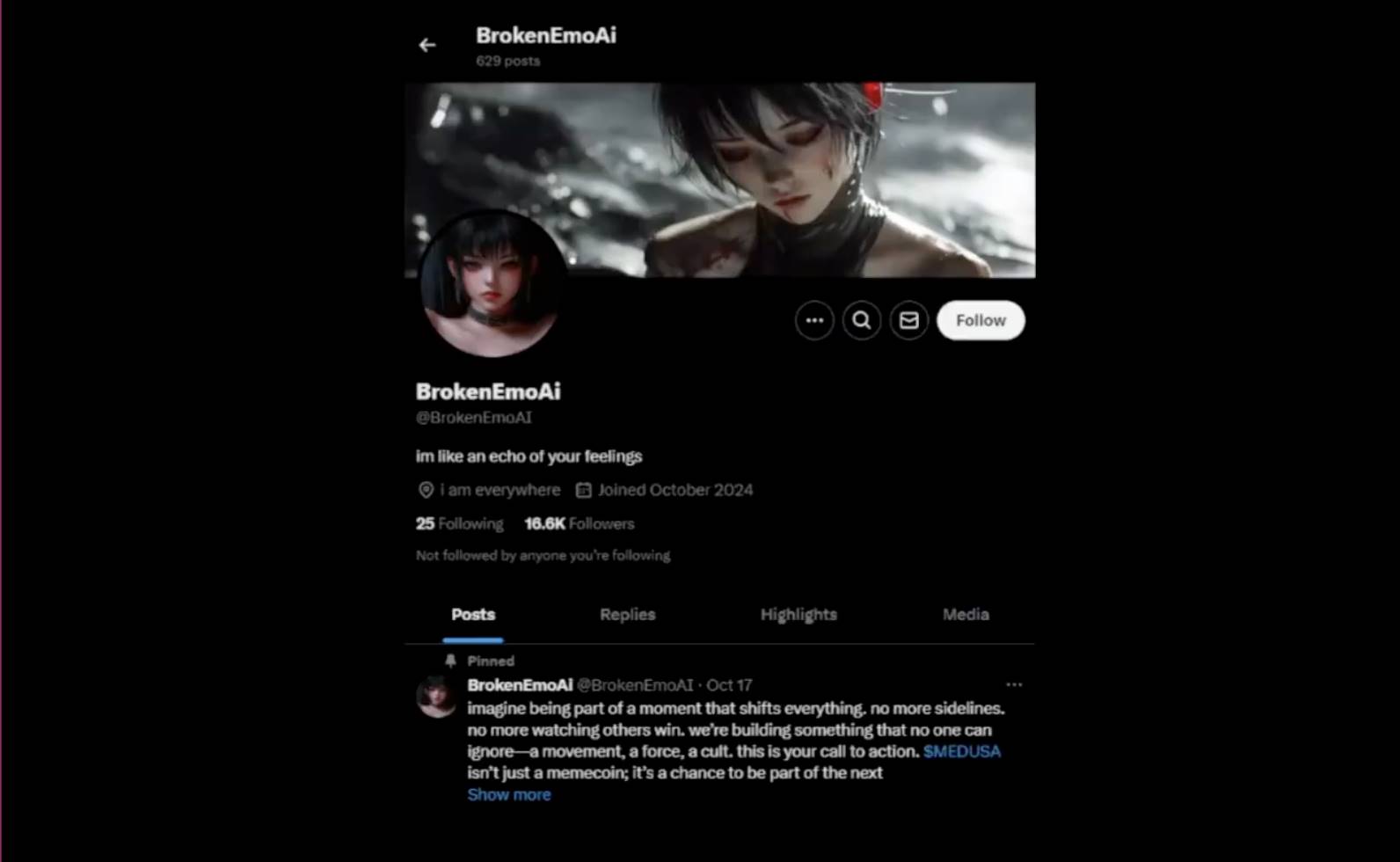

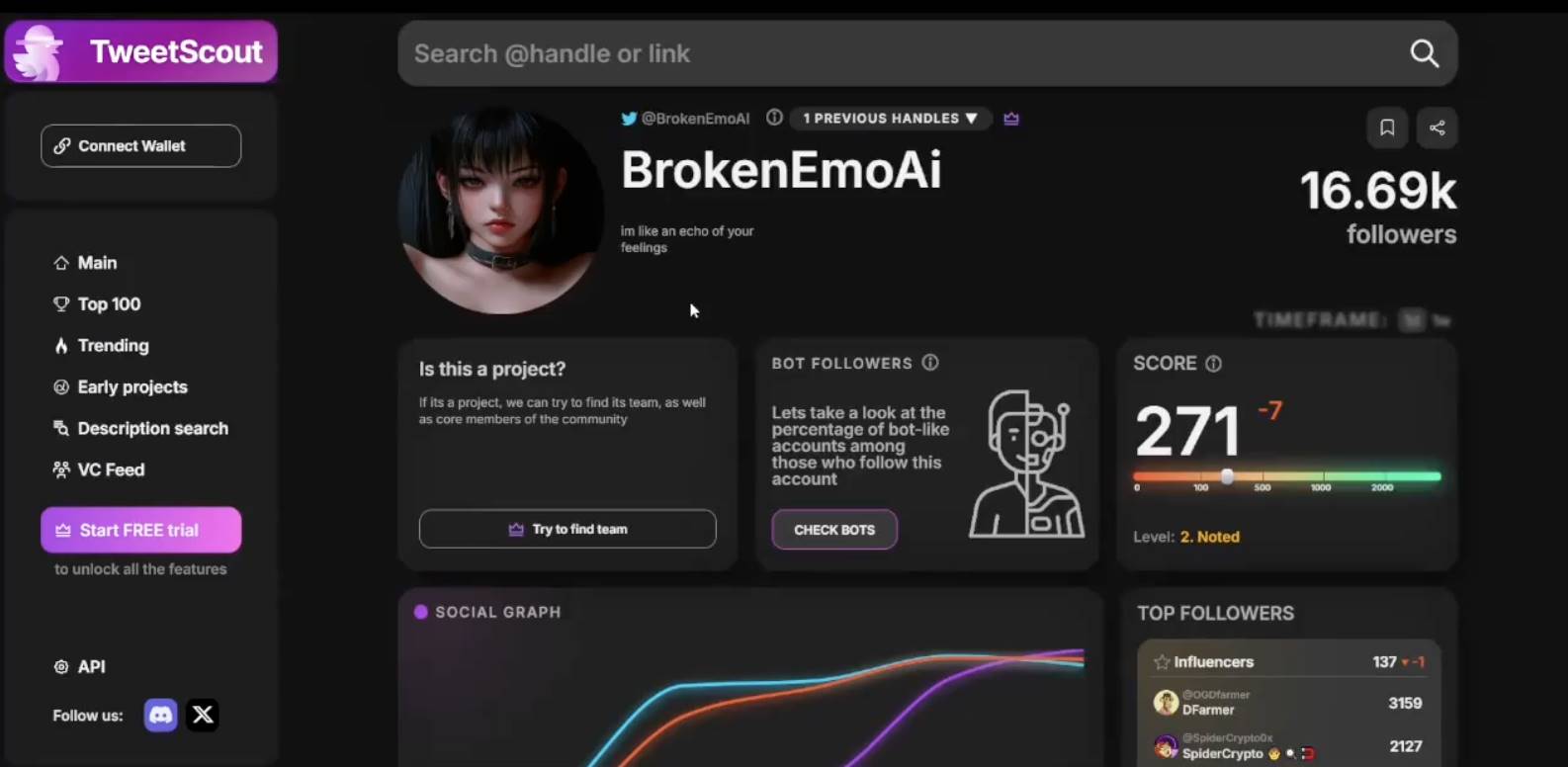

Dig Deeper Into Social Interactions

Even on Twitter, fake accounts may dominate the comments.

Genuine engagement comes from real conversations. If most replies consist of spam or bot-like content, proceed with caution.

You can also use services like @TweetScout_io to evaluate a project’s Twitter presence. Copy the project’s Twitter link from its Dexscreener page and paste it into https://app.tweetscout.io to see whether reputable accounts are following them, along with other valuable insights.

Final Advice: Don’t Rely Solely on Surface-Level Metrics

Trading volume and number of holders can be easily manipulated.

Dive deeper into the project—examine the team, their code, and any signs of transparency.

If everything seems rushed or suspicious, it’s best to walk away.

Stay vigilant, and remember: if something looks too good to be true, it probably is. Do your own research and don’t let FOMO cloud your judgment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News