Galaxy Q3 Crypto Venture Investment Report Key Insights: Investment down 20% QoQ, L1 projects raised the most funds

TechFlow Selected TechFlow Selected

Galaxy Q3 Crypto Venture Investment Report Key Insights: Investment down 20% QoQ, L1 projects raised the most funds

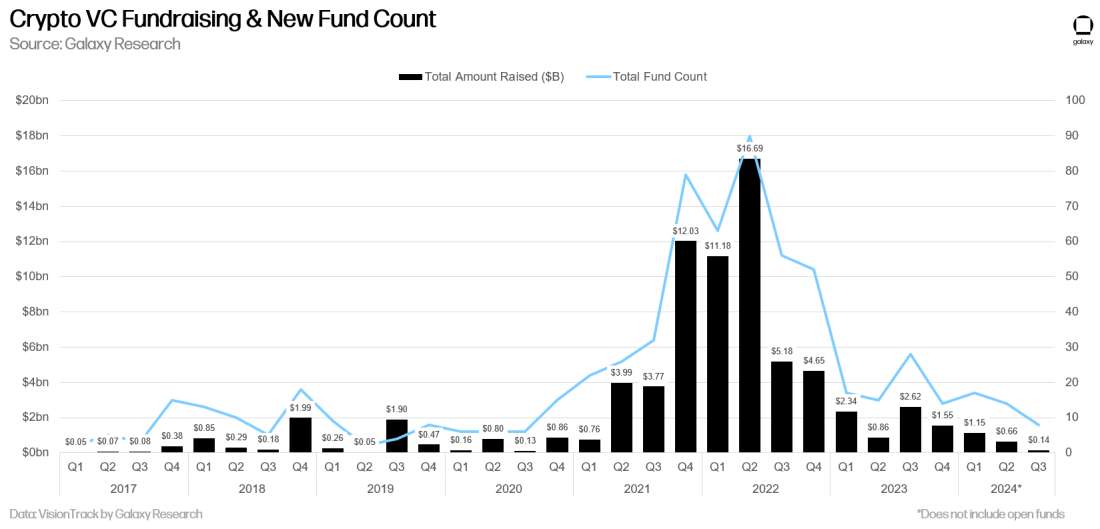

On the fundraising front, investor interest remains weak, with only eight new funds raising $140 million in the third quarter of 2024.

Authors: Alex Thorn & Gabe Parker

Translation: TechFlow

Introduction

Since March, Bitcoin’s price has traded within a tight range, while other major cryptocurrencies have failed to reclaim prior all-time highs, contributing to subdued venture capital activity in 2024. The "barbell market"—with Bitcoin leading on one end and meme coins showing high activity on the other—combined with limited interest from traditional investors and generalist venture funds, has made the crypto venture landscape relatively quiet this year. However, opportunities remain, particularly for experienced crypto-native managers who continue to lead deal activity. With potential rate cuts and a possibly easing regulatory environment, venture investment could accelerate in Q4 and into Q1 2025. Our quarterly report analyzes two sides of venture capital—investments by VC funds into crypto startups, and institutional allocations into those venture funds—drawing on public filings, data providers like PitchBook, and Galaxy Research’s proprietary VisionTrack fund performance database.

Key Takeaways

-

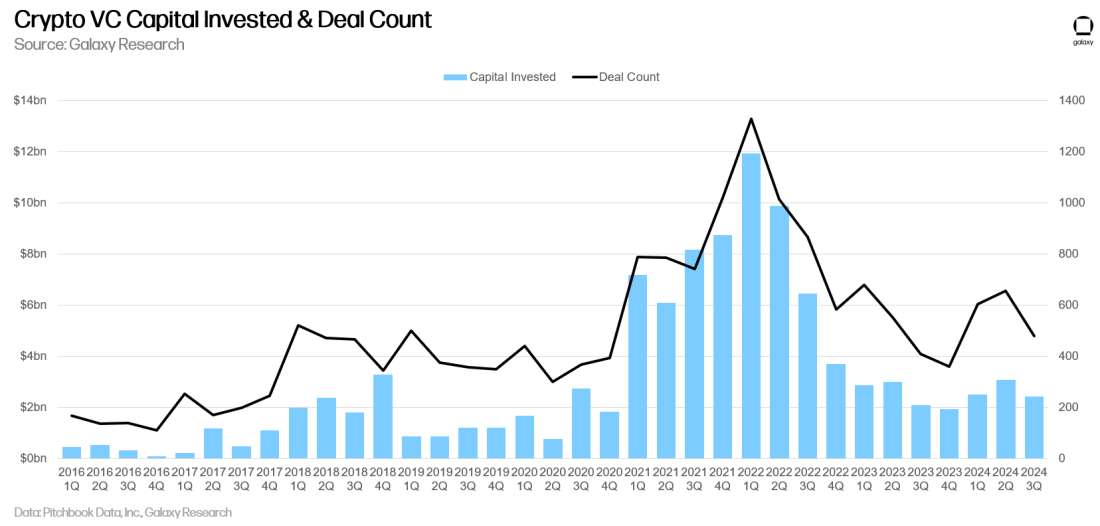

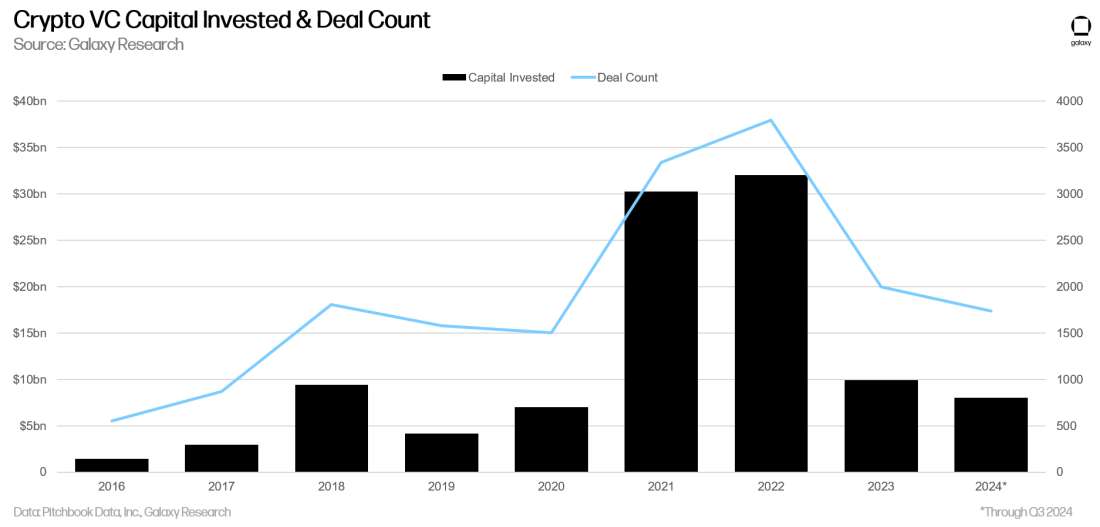

In Q3 2024, venture capital invested $2.4 billion into crypto startups, down 20% quarter-over-quarter, across 478 deals, a 17% decrease from the previous quarter.

-

Venture capitalists have already deployed $8 billion into crypto startups in the first three quarters of 2024, putting full-year investment on track to match or slightly exceed 2023 levels.

-

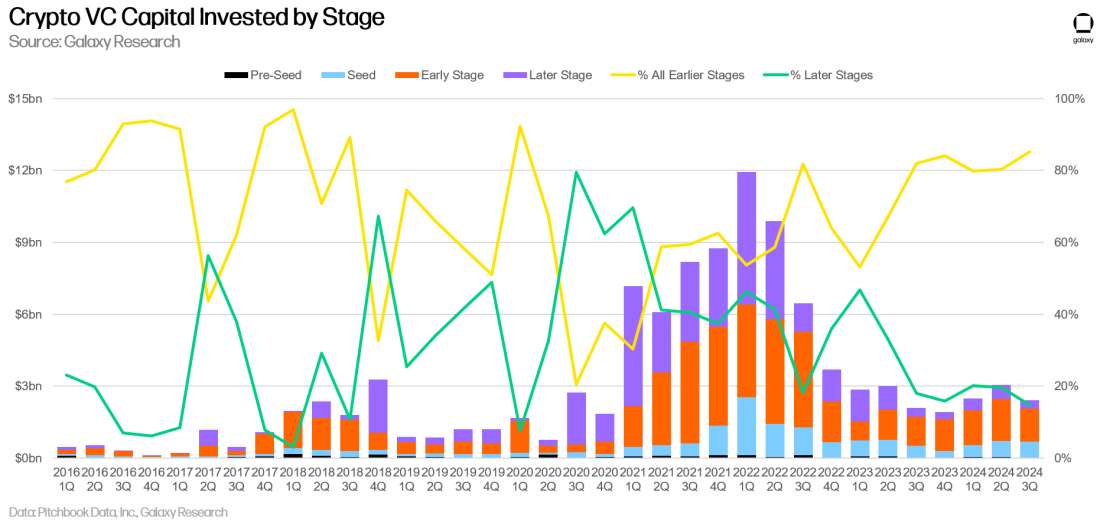

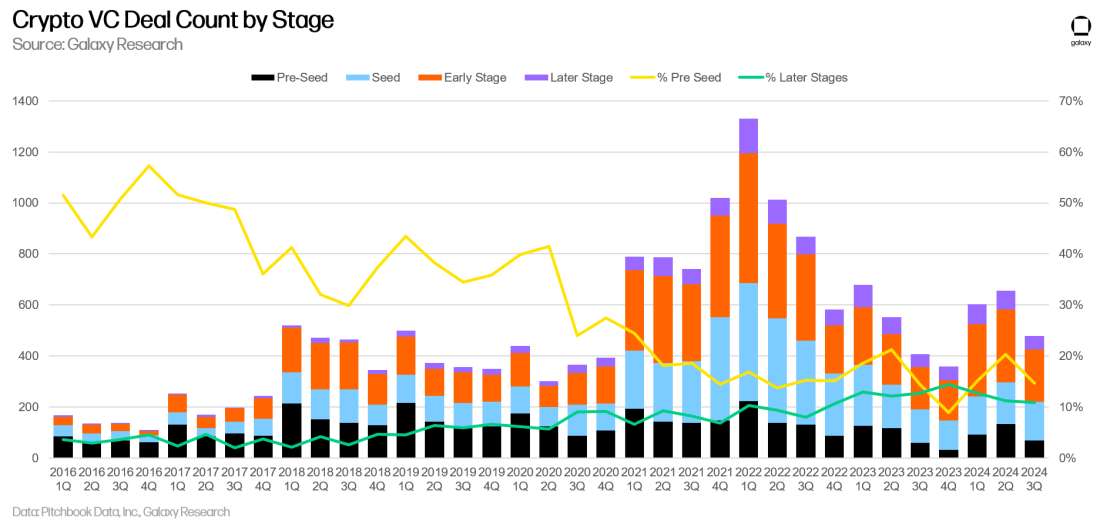

Early-stage deals attracted the majority of funding (85%), while late-stage deals accounted for only 15%—the lowest level since Q1 2020.

-

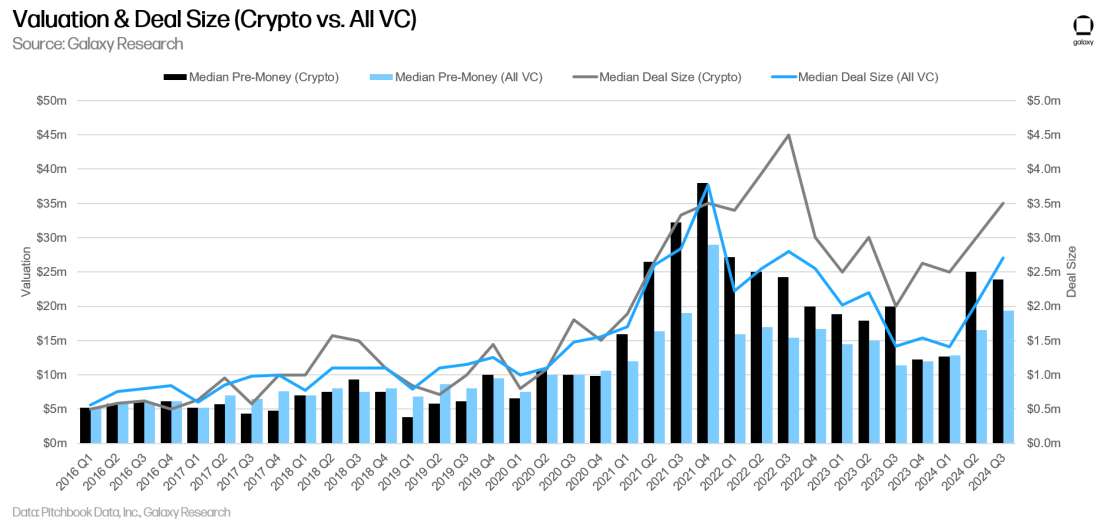

Median valuations for crypto deals rose in both Q2 and Q3, outpacing valuation growth across the broader venture industry. The median pre-money valuation in Q3 2024 was $23.8 million, slightly below Q2’s $25 million.

-

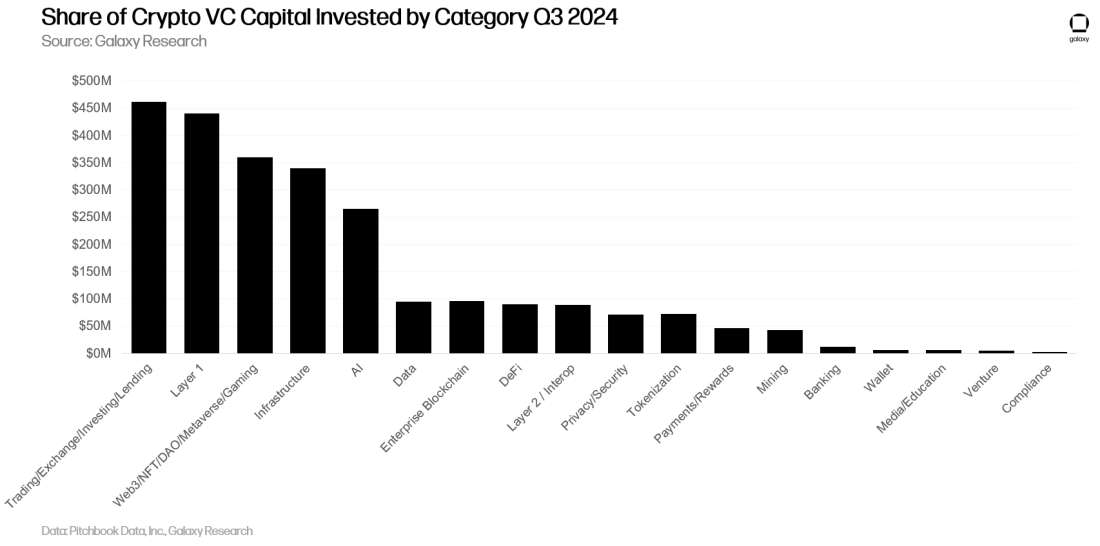

Layer 1 projects and companies raised the most capital, followed by cryptocurrency exchanges and infrastructure firms. Most deals involved infrastructure, gaming, and DeFi projects.

-

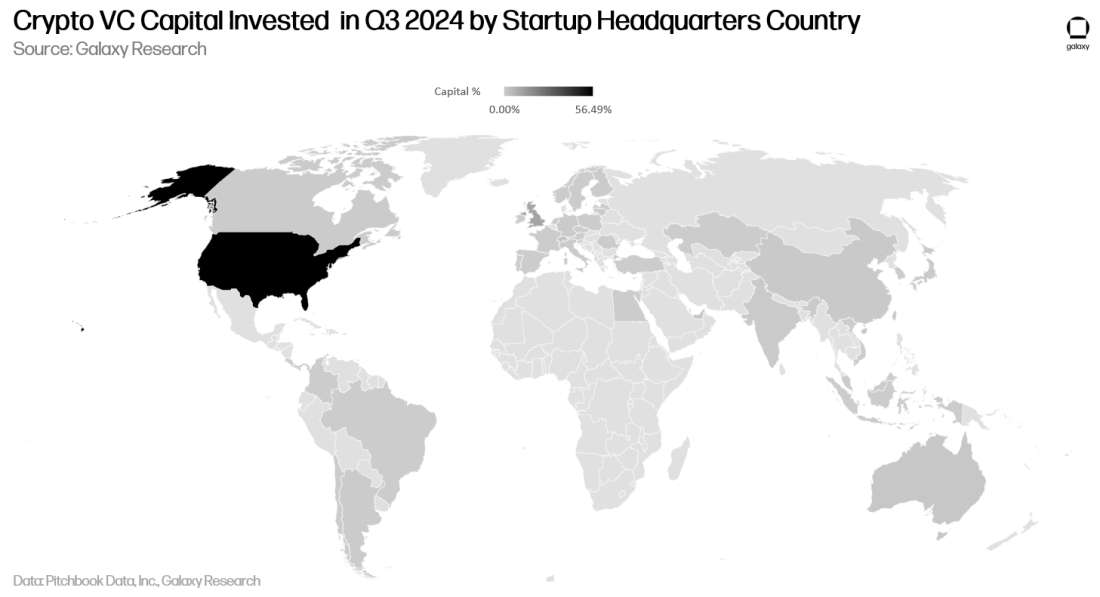

The U.S. continues to dominate crypto venture investment, with 56% of capital and 44% of deals involving U.S.-based companies.

-

Fundraising sentiment remains weak, with only eight new funds raising $140 million in Q3 2024.

-

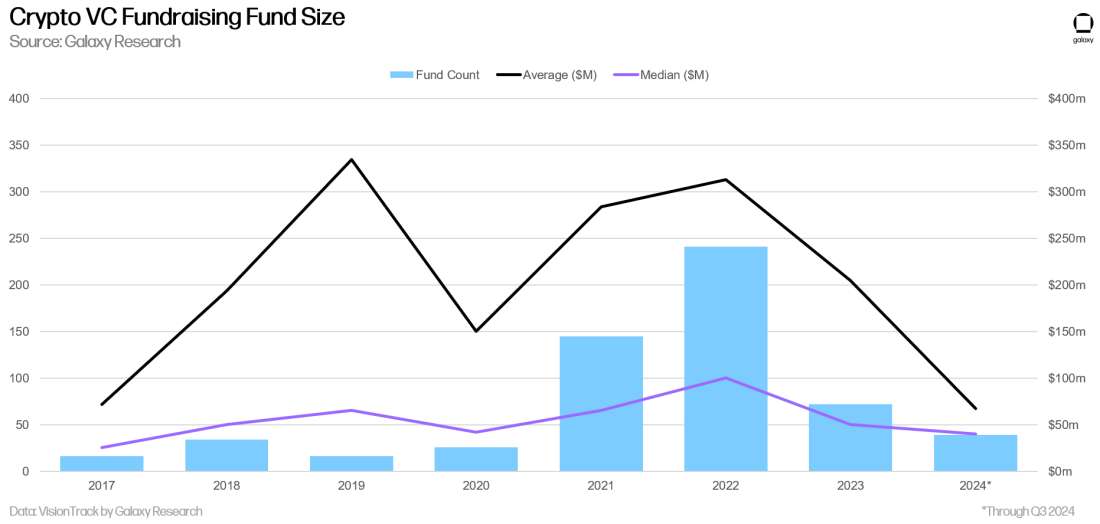

The median size of newly launched crypto venture funds continues to decline. In 2024, the median ($40 million) and average ($67 million) fund sizes are the lowest since we began tracking data in 2017.

Venture Investment

Deal Count and Investment Capital

In Q3 2024, venture capitalists invested $2.4 billion into crypto- and blockchain-focused startups, a 20% decline quarter-over-quarter, completing 478 deals—a 17% decrease from the prior quarter.

2024 is on pace to meet or slightly exceed 2023 levels.

Investment Capital and Bitcoin Price

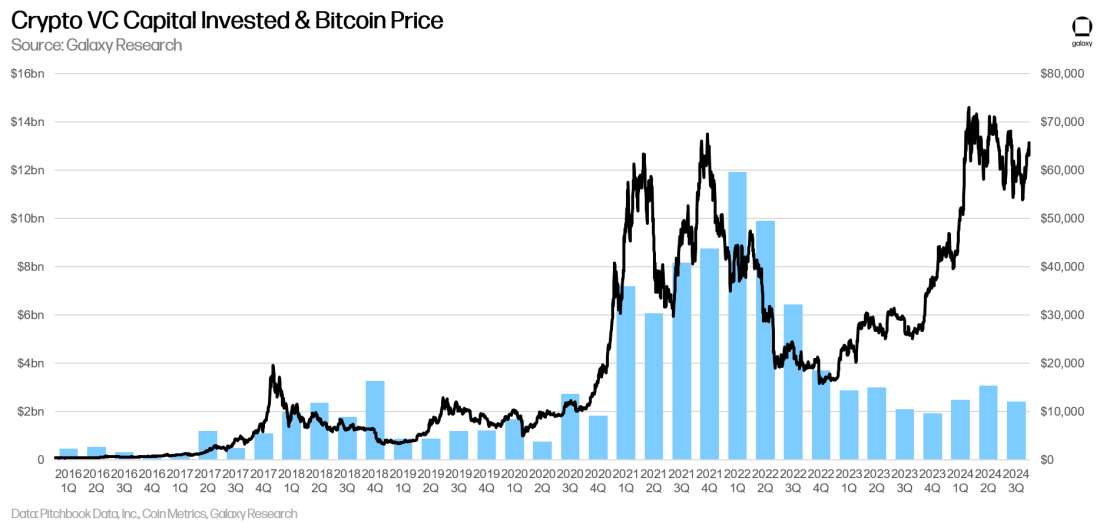

The long-standing correlation between Bitcoin prices and investment capital into crypto startups has broken down. Since January 2023, Bitcoin has risen significantly while venture activity has struggled to keep pace. Weak investor appetite in both crypto and broader venture capital, combined with market preference for Bitcoin over many of the 2021-era themes, helps explain this divergence.

Investment by Stage

In Q3 2024, 85% of venture capital went to early-stage companies, while late-stage companies received only 15%. Crypto-focused funds may still have dry powder from large fundraises years ago and, due to close ties with entrepreneurs, are better positioned to identify new opportunities amid renewed market enthusiasm.

In terms of deal volume, Pre-seed stage transactions saw a slight decline but remain healthy compared to previous cycles.

Valuations and Deal Sizes

In 2023, valuations for venture-backed crypto companies dropped sharply, reaching their lowest point since Q4 2020 in the final quarter. However, as Bitcoin hit new highs, valuations and deal sizes began recovering in Q2 2024. Valuations in Q2 and Q3 reached their highest levels since 2022. The rise in deal sizes and valuations mirrored broader VC trends, but the rebound was more pronounced in crypto. The median pre-money valuation in Q3 was $23 million, with an average deal size of $3.5 million.

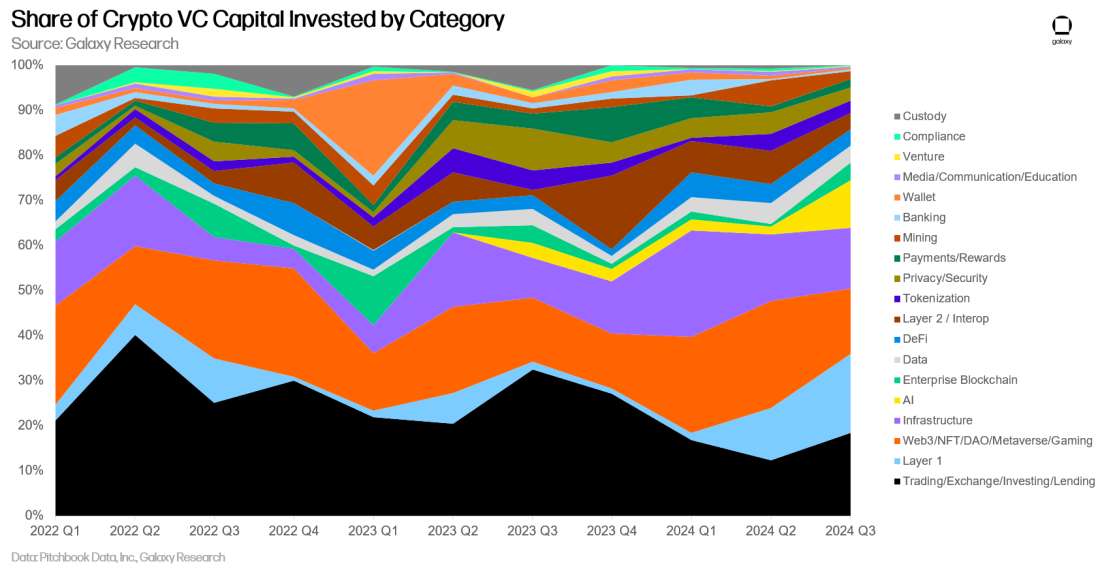

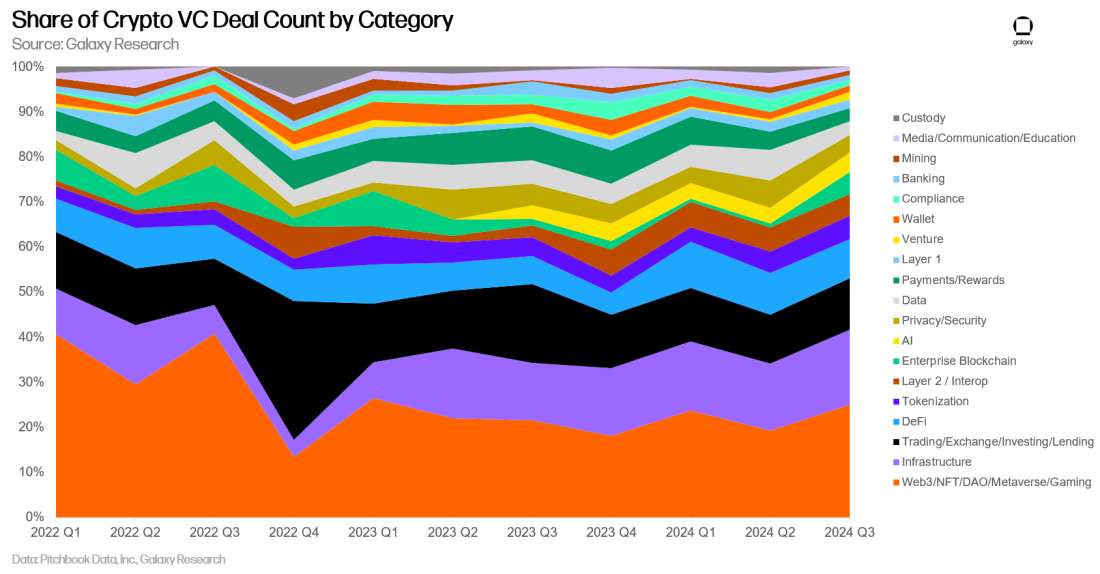

Investment by Category

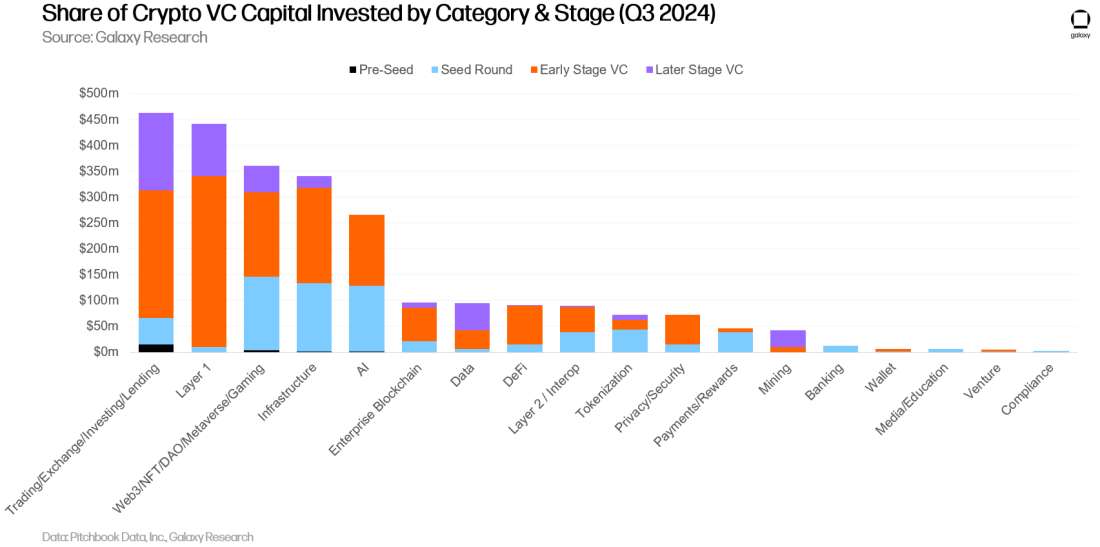

In Q3 2024, companies and projects in the “trading/exchange/investment/lending” category raised the most venture capital, accounting for 18.43% of total funding ($462.3 million). Cryptospherex and Figure Markets were the largest deals in this category, raising $200 million and $73.3 million respectively.

Crypto startups focused on AI services saw a fivefold quarter-over-quarter increase in venture funding during Q3 2024. Sentient, CeTi, and Sahara AI contributed significantly to AI-related crypto investments, raising $85 million, $60 million, and $43 million respectively. Venture funding for trading/exchange/investment/lending and Layer 1 crypto projects also grew by 50%. In contrast, Web3/NFT/DAO/metaverse/gaming projects saw a 39% decline in funding—the largest drop among all categories.

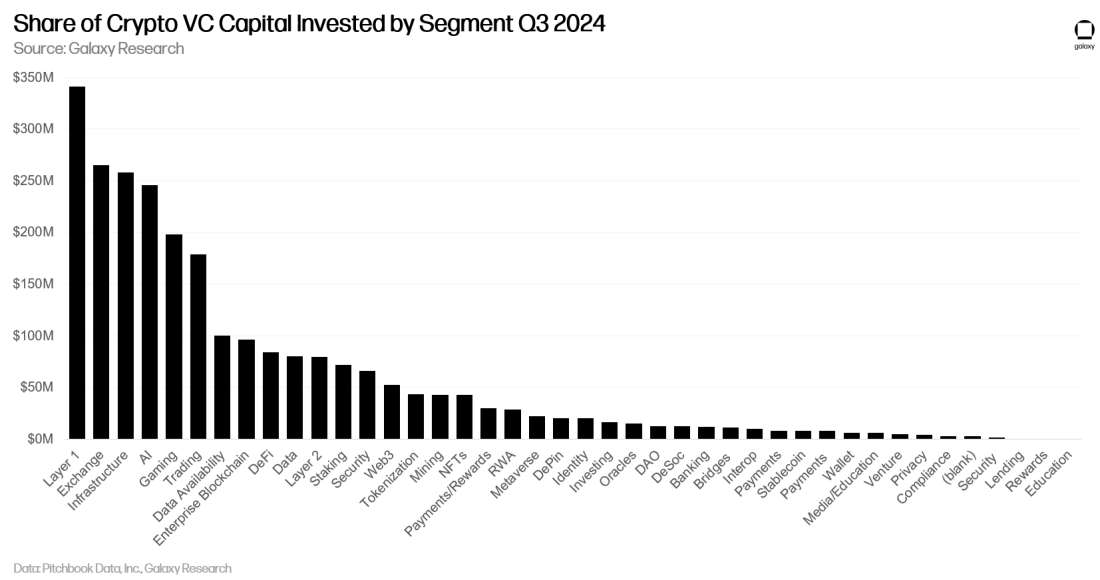

Breaking down larger categories further, Layer 1 blockchain projects captured the largest share of venture capital in Q3 2024 at 13.6%, totaling $341 million. Within the Layer 1 category, Exochain and Story Protocol were the top two deals, raising $183 million collectively—representing 54% of total Layer 1 venture funding that quarter. Crypto exchanges and infrastructure companies followed, raising $265.4 million and $258 million respectively.

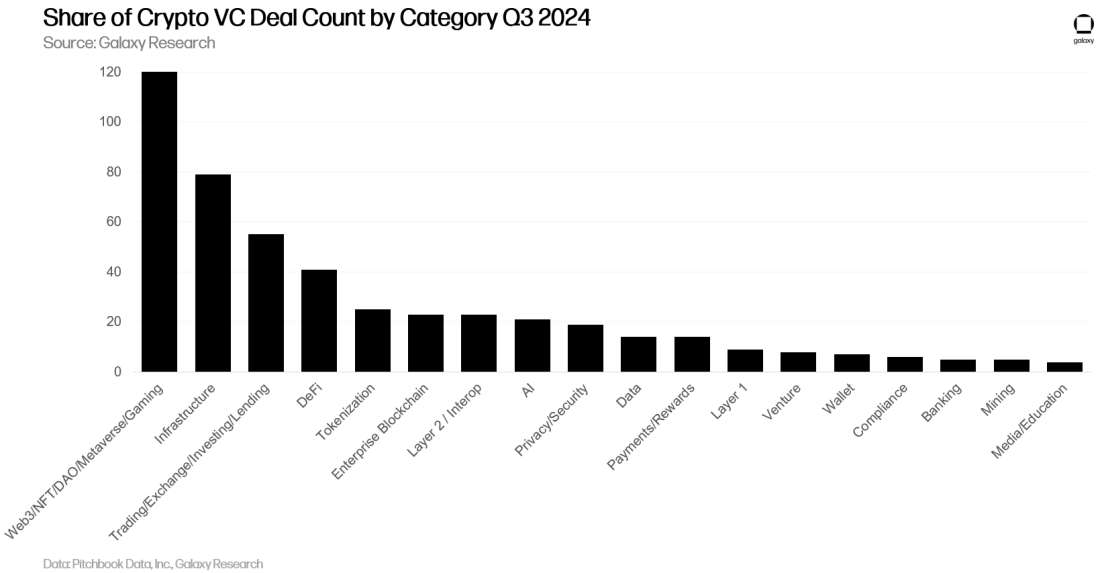

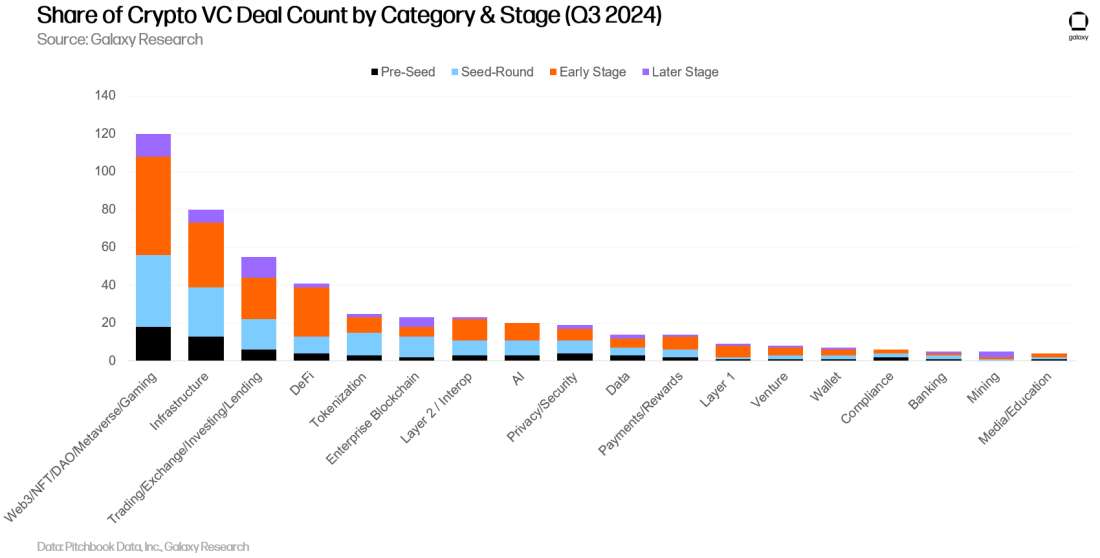

In terms of deal count, Web3/NFT/DAO/metaverse/gaming led with 25% of all deals (120 total), a 30% increase quarter-over-quarter, including 48 gaming-specific deals. The largest gaming deal in Q3 2024 was Firefly Blockchain raising $50 million in its Series B round.

Crypto infrastructure projects ranked second in deal volume with 16.5% (79 deals), up 12% quarter-over-quarter. Trading/exchange/investment/lending products came third with 11.5% (55 deals). Notably, crypto companies focused on media/education and data businesses saw the sharpest declines in deal volume, down 73% and 57% respectively.

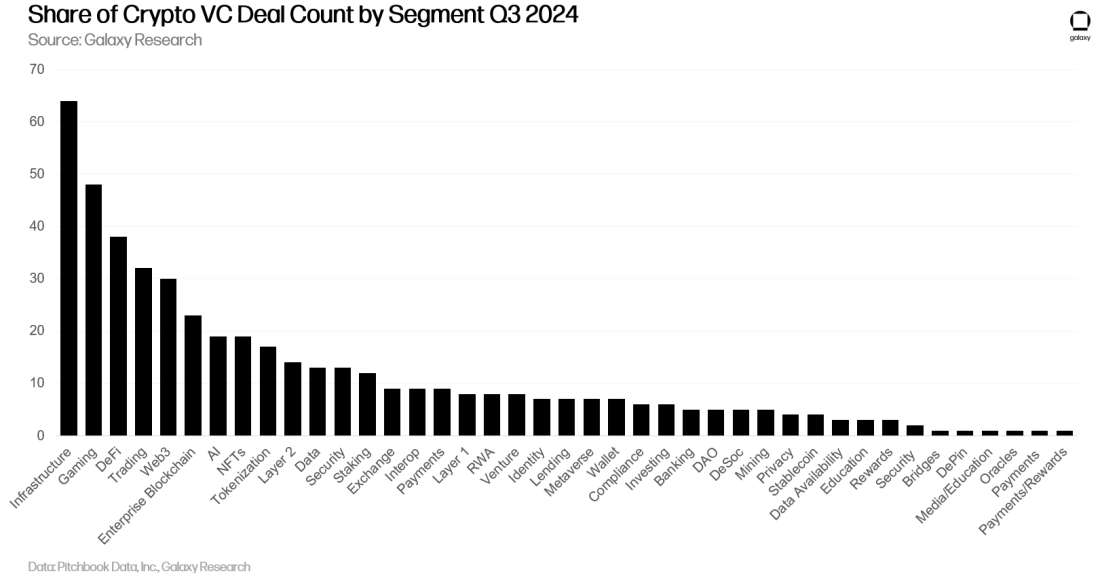

When breaking down broader categories, infrastructure-focused projects had the highest number of individual deals (64). Gaming and DeFi-related crypto companies followed, completing 48 and 38 deals respectively in Q3 2024.

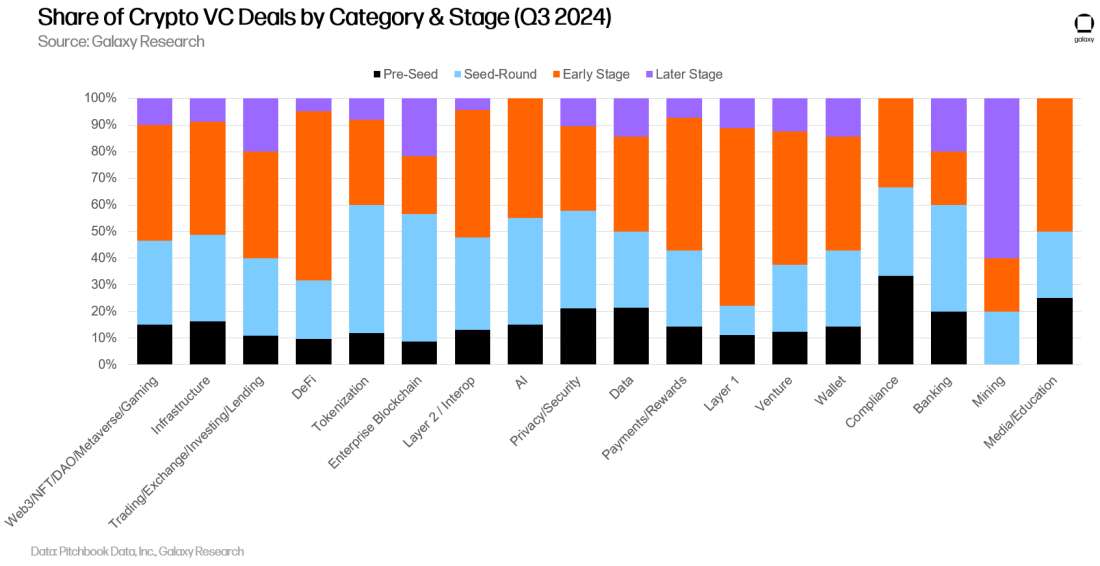

Investment by Stage and Category

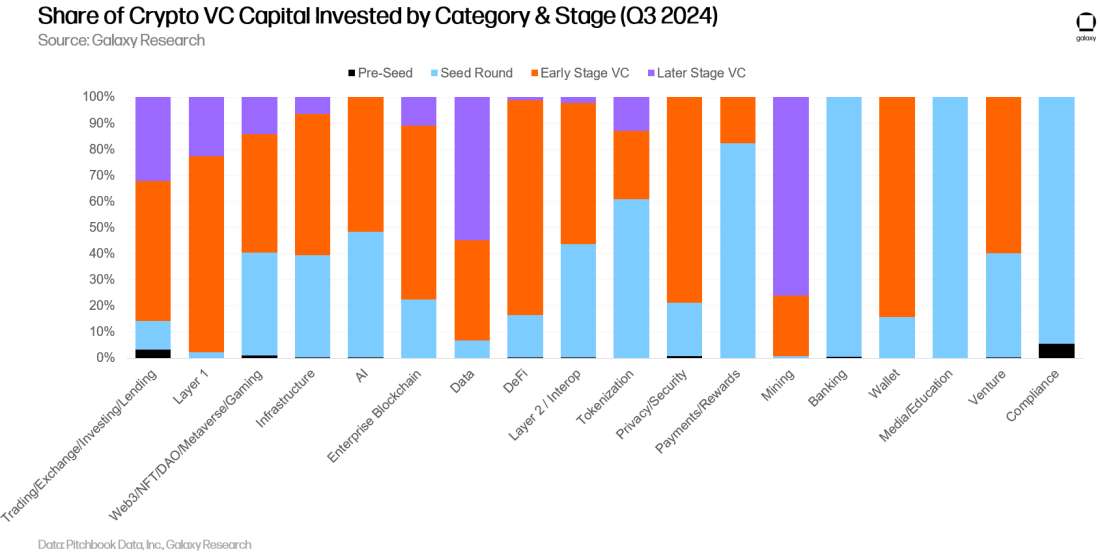

Breaking down investment capital and deal counts by category and stage provides clearer insight into which types of companies are raising funds. In Q3 2024, most capital directed toward Layer 1, enterprise blockchain, and DeFi went to early-stage companies and projects. In contrast, mining-related ventures saw a higher proportion of late-stage funding.

Analyzing capital distribution across stages within each category reveals the relative maturity of various investment opportunities.

Similar to Q2 2024, a large portion of deals completed in Q3 involved early-stage companies. Total dollar volume for late-stage crypto venture deals remained flat compared to Q2 2024.

Examining the share of deals by stage within each category offers insights into the developmental lifecycle of investable sectors.

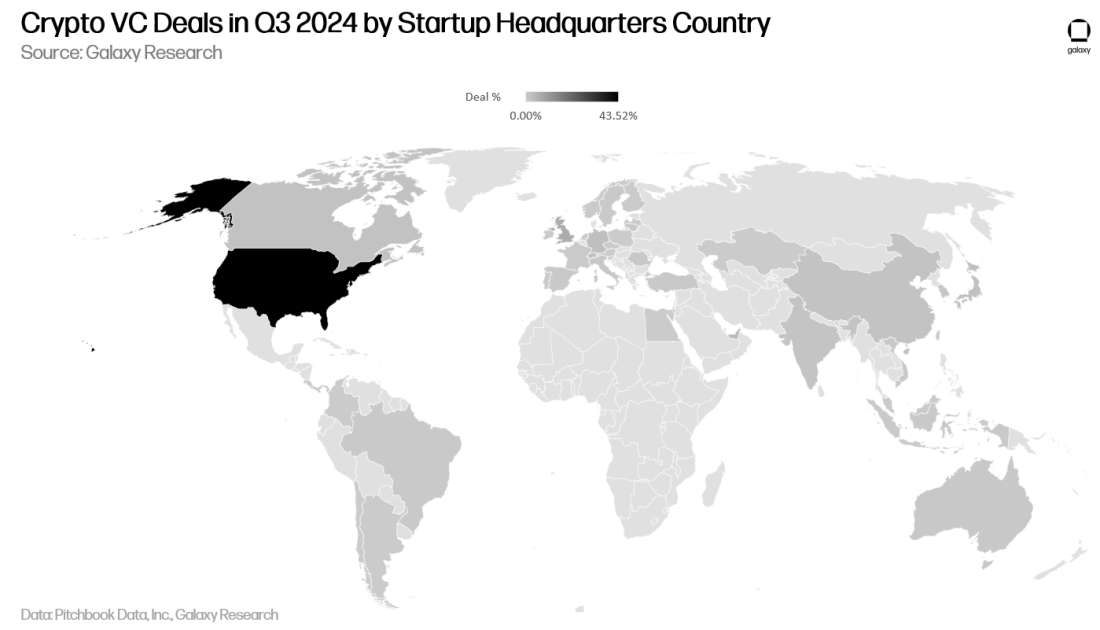

Geographic Distribution of Investment

In Q3 2024, 43.5% of deals involved companies headquartered in the U.S. Singapore ranked second with 8.7%, followed by the UK at 6.8%, UAE at 3.8%, and Switzerland at 3%.

U.S.-based companies received 56% of venture investment, up 5% from the previous quarter. The UK accounted for 11%, Singapore 7%, and Hong Kong 4%.

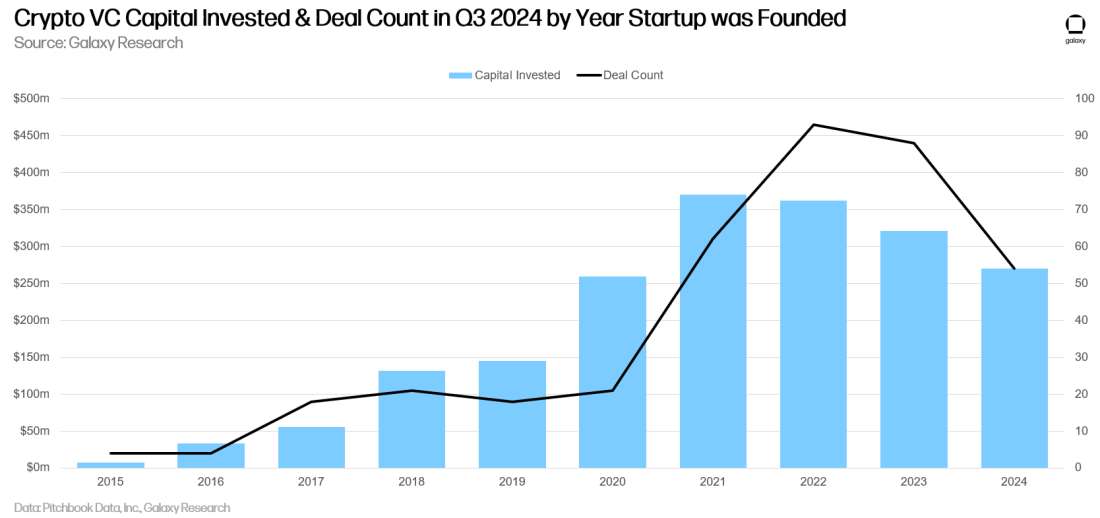

Investment by Year of Incorporation

Companies and projects founded in 2021 raised the most capital, while those founded in 2022 completed the most deals.

Venture Fundraising

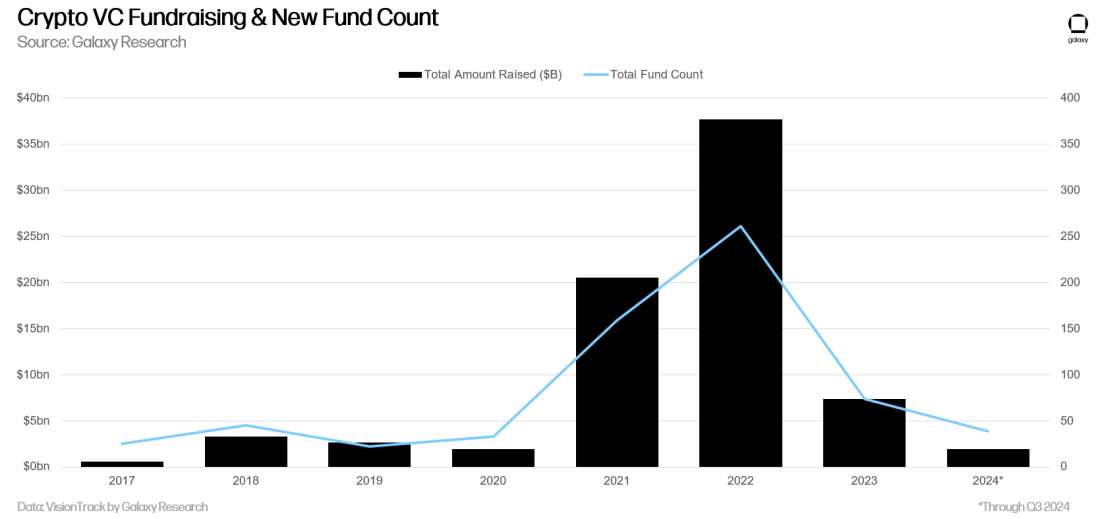

Fundraising for crypto venture funds remains challenging. The macro environment in 2022 and 2023, along with volatility in crypto markets, caused some investors to pull back from crypto venture investing compared to the aggressive stance seen in 2021 and early 2022. At the start of 2024, investors widely expected significant rate cuts during the year, but these only began materializing gradually in the second half. Since Q3 2023, total capital allocated to venture funds has steadily declined, and the number of new funds raised in Q3 2024 was the lowest since Q3 2020.

On an annualized basis, 2024 could become the weakest year for crypto venture fundraising since 2020, with only 39 new funds raising $1.95 billion—far below the boom years of 2021–2022.

Declining allocator interest has reduced the number of smaller crypto venture funds being raised, pushing median and average fund sizes in 2024 (through Q3) to their lowest levels since 2017.

Conclusion

-

Market sentiment and activity remain far below bull market levels. While liquid crypto asset markets have recovered significantly since late 2022 and early 2023, venture investment activity remains well below previous bull market highs. During the 2017 and 2021 bull runs, venture activity closely tracked liquid crypto prices. Over the past two years, however, venture activity has remained muted despite partial market recovery. Contributing factors include a “barbell market,” where Bitcoin (and its new ETFs) dominates center stage, while fringe activity comes largely from memecoins that struggle to raise capital and face uncertain longevity.

-

Early-stage deals continue to lead the way. Despite broader challenges, strong interest in early-stage deals bodes well for the long-term health of the crypto ecosystem. While late-stage companies face fundraising difficulties, entrepreneurs are still finding backers for innovative ideas. Projects focused on building Layer 1s, scaling solutions, gaming, and infrastructure are performing well even in tough fundraising conditions.

-

Bitcoin ETFs may pressure funds and startups. High-profile investments by U.S. institutions—such as pensions, endowments, and hedge funds—into spot Bitcoin ETFs suggest a preference for gaining exposure through large, liquid instruments rather than early-stage venture investments. Although interest in the newly launched spot Ethereum ETF has been muted so far, increased demand for other crypto sectors like DeFi and Web3 could divert capital away from venture and into Ethereum ETFs.

-

Fund managers continue to face a difficult environment, though some newly formed small funds are beginning to see fundraising success. The number of new funds and capital allocated to them in Q3 reached the lowest level in four years (since Q3 2020). With fewer and smaller new funds launching, and generalist investors and allocators remaining inactive, late-stage companies may continue to struggle. If U.S. digital asset regulations meaningfully ease after the November 5 presidential election, late-stage companies might consider public markets as an alternative path.

-

The U.S. continues to dominate the crypto startup ecosystem. Despite a complex and often unfriendly regulatory environment, U.S.-headquartered companies and projects account for the majority of deals and investment. If the U.S. aims to remain a center for technological innovation, policymakers should recognize how their actions—or inaction—impact the crypto and blockchain ecosystem. There may be positive developments ahead, as former President Donald Trump and current Vice President Kamala Harris have expressed stances ranging from strongly supportive to moderately favorable toward the industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News