From Frenzy to Rationality: The Maturation Path of Cryptocurrency Venture Capital

TechFlow Selected TechFlow Selected

From Frenzy to Rationality: The Maturation Path of Cryptocurrency Venture Capital

Unlike the previous cycle, this one will be built on commercial fundamentals rather than token mechanics.

Author: Thejaswini M A

Translation: Block unicorn

Introduction

I used to get excited about every crypto funding announcement.

Every seed round felt like major news. "Anonymous team raises $5 million for revolutionary DeFi protocol!"

I'd obsessively research founders, dive into their Discord, trying to understand what made the project special.

Fast forward to 2025. Another funding round hits my headlines. Series A. $36 million. Stablecoin payment infrastructure.

I categorize it under "enterprise blockchain solutions" and move on.

When did I become so... pragmatic?

For the first time since 2020, late-stage crypto venture deals have surpassed early-stage ones.

65% versus 35%.

Read that again.

An industry built on pre-seed fundraising, anonymous teams building DeFi protocols in garages, innovating from scratch.

Now? Series A and beyond are driving capital flows.

What changed?

Everything. And yet, nothing.

Crypto venture capital

Suit-wearing VCs. Due diligence stretching from minutes to months.

Regulatory compliance. Institutional adoption.

Professional pitch decks instead of anonymous Discord messages.

KYC processes. Legal teams. Revenue models that actually make sense.

Companies like Conduit raised $36 million for "unified on-chain payments." Beam raised $7 million for "stablecoin-based payment services."

These are infrastructure projects. B2B solutions. Enterprise-grade platforms.

Boring, profitable, scalable businesses.

Crypto VC headlines love big numbers, so let's start with facts:

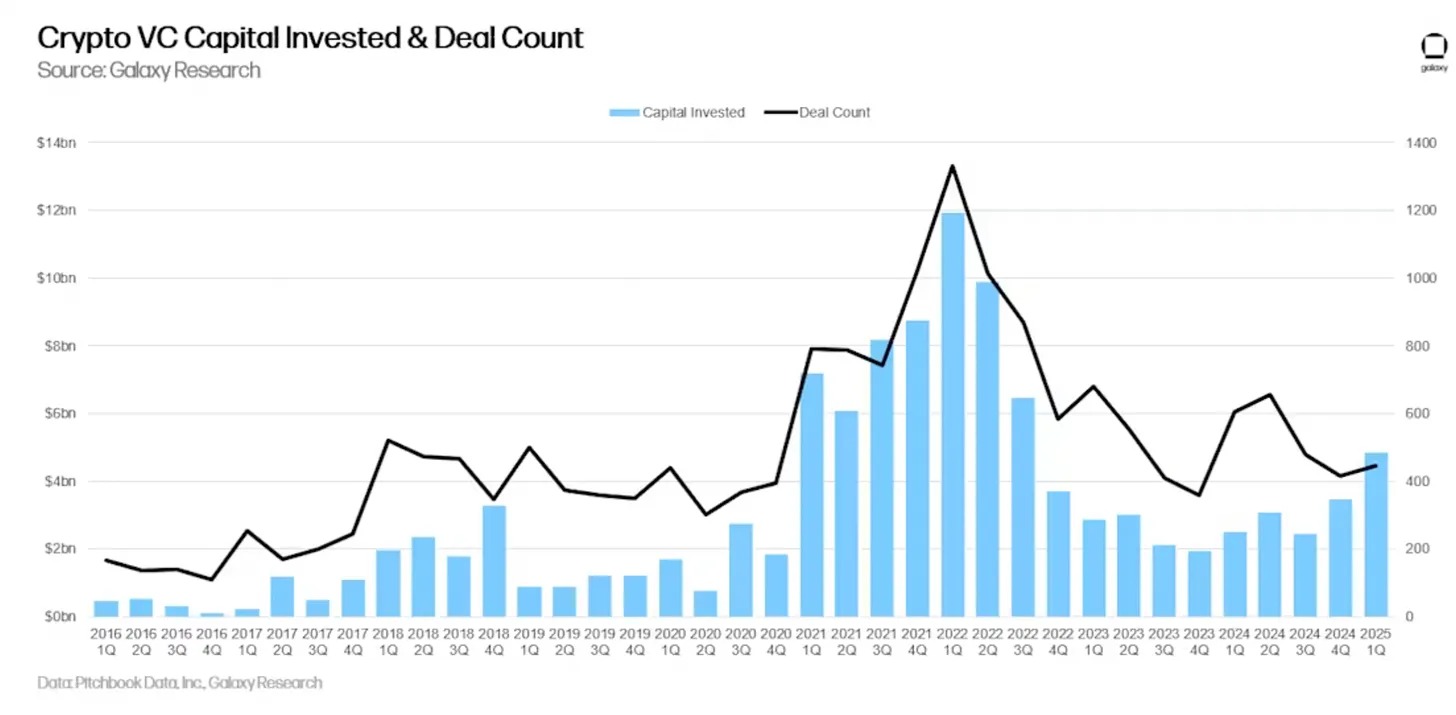

Q1 2025: 446 deals totaling $4.9 billion (40% quarter-on-quarter growth).

Year-to-date: $7.7 billion raised, putting 2025 on track for $18 billion.

But here's the catch: MGX (Abu Dhabi’s sovereign fund) wrote Binance a $2 billion check.

This perfectly reflects the current VC landscape—few massive deals skewing the data while the broader ecosystem remains muted.

The correlation between Bitcoin price and VC activity—which held reliably for years—broke in 2023 and hasn’t recovered.

Bitcoin hits new highs, but VC activity stays flat. It turns out institutions don’t need to fund risky startups for crypto exposure when they can just buy Bitcoin ETFs.

Reality Check for Venture Capital

Crypto venture funding has dropped 70% from its 2022 peak of $23 billion, falling to just $6 billion in 2024.

Deal count plummeted from 941 in Q1 2022 to only 182 in Q1 2025.

But here’s what should terrify every founder claiming to be the "next big thing"—of the 7,650 companies that raised seed rounds since 2017, only 17% made it to Series A.

And merely 1% reached Series C.

This is the maturation of crypto venture capital—and it will be painful for those who thought the feast would last forever.

Category Rotation

The hot narratives of 2021–2022—gaming, NFTs, DAOs—have virtually disappeared from VC interest.

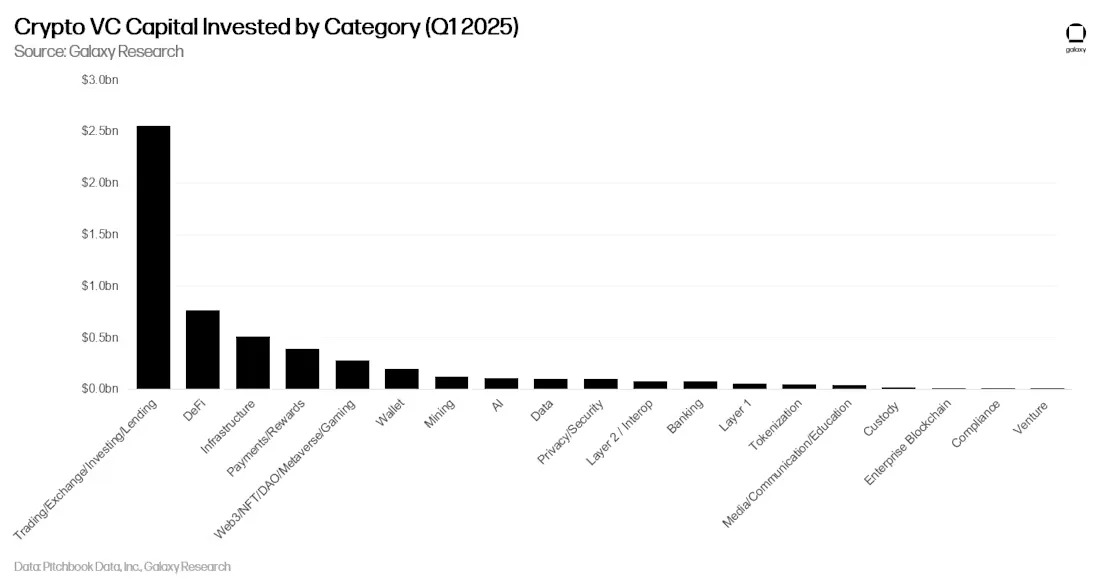

In Q1 2025, companies building transactions and infrastructure captured most venture capital. DeFi protocols raised $763 million. Meanwhile, the once-dominant Web3/NFT/DAO/gaming category has slid to fourth place in capital allocation.

This shows VCs finally prioritizing revenue-generating businesses over narrative-driven speculation.

Infrastructure that actually powers crypto transactions gets funded.

Applications people actually use get funded.

Protocols generating real fees get funded.

Everything else will increasingly starve for capital.

Artificial intelligence has also emerged as a major competitor for VC dollars.

Why bet on crypto gaming when you can back AI applications with clearer revenue paths? The opportunity cost of investing in crypto-native apps has sharply turned against projects unable to demonstrate immediate utility.

Graduation Crisis

Let’s extract the most sobering statistic from the data: the graduation rate from seed to Series A in crypto is 17%.

This means five out of every six companies raising seed funding never secure meaningful follow-on financing.

By comparison, around 25–30% of seed-funded companies in traditional tech reach Series A—you’re beginning to see the severity.

The success metrics in crypto have always been fundamentally flawed.

Why? Because for years, the playbook was simple: raise venture capital, build something that looks innovative, launch a token, and let retail investors provide exit liquidity. VCs didn’t need their portfolio companies to graduate through funding stages—the public markets offered a bailout.

That safety net is gone. Most tokens issued in 2024 trade at a fraction of their initial valuations. EigenLayer’s EIGEN launched with a $6.5 billion fully diluted valuation and has since dropped 80%. Only a handful of projects generate over $1 million in monthly revenue.

When the path to token listing ends, true graduation rates emerge. And they aren’t pretty. So what happens now? VCs are asking the same questions traditional investors have asked for decades: “How do you make money?” and “When will you be profitable?” Revolutionary concepts, apparently, in the world of crypto.

Centralization Takeover

While deal counts have dropped sharply, deal sizes tell an interesting story. Since 2022, the median seed round size has grown significantly—even as fewer companies overall raise capital.

This indicates an industry consolidating around fewer, larger bets. The era of “spray and pray” seed investing is over.

The message to founders is clear: if you're not in the inner circle, you probably won't get funded. If you haven’t secured backing from top-tier funds, your chances of raising follow-on capital drop dramatically.

This centralization isn’t limited to funding alone.

Data shows that 44% of A16z portfolio companies receive participation from A16z in subsequent rounds.

For Blockchain Capital, the figure is 25%. The best funds aren’t just picking winners—they’re actively ensuring their portfolio companies continue to access capital.

Our View

We’ve all witnessed the shift—from “revolutionary DeFi protocols” to “enterprise blockchain solutions.”

Honestly? I’m conflicted.

Part of me misses the chaos. The wild swings. Anonymous teams using Discord nicknames raising millions for ideas that sound like fever dreams.

There was purity in that madness. Just builders and believers betting on a future traditional finance couldn’t even imagine.

But another part of me—the part that’s watched too many promising projects fail due to weak fundamentals—knows this correction was inevitable.

For years, crypto venture capital operated in a fundamentally broken way. Startups could raise millions on whitepapers alone, launch tokens to retail for liquidity, and call it a success regardless of whether they built anything users actually wanted.

The result? An ecosystem optimized for hype cycles rather than value creation.

Now, the industry is undergoing a long-overdue shift from speculation to substance.

The market is finally applying performance standards that should have existed from day one. When only 17% of seed-funded companies reach Series A—that’s market efficiency catching up to an industry once artificially propped up by overblown narratives.

This brings both challenges and opportunities. For founders accustomed to raising based on token potential rather than business fundamentals, the new reality is brutal. You now need users, revenue, and a clear path to profitability.

But for those building real businesses that solve actual problems, the environment has never been better. Less competition for capital. More focused investors. Clearer success metrics.

"Tourist money" has left, leaving behind the substantial capital real startups need. The institutional investors remaining aren’t looking for the next “meme coin” or speculative infrastructure plays.

The founders and investors who survive this transition will build the infrastructure for crypto’s next chapter. Unlike the last cycle, this one will be built on business fundamentals—not token mechanics.

The gold rush is over. The mining operation has just begun.

Even though I said I miss the chaos? This is exactly what crypto needed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News